QNBFS Daily Market Report September 12, 2018

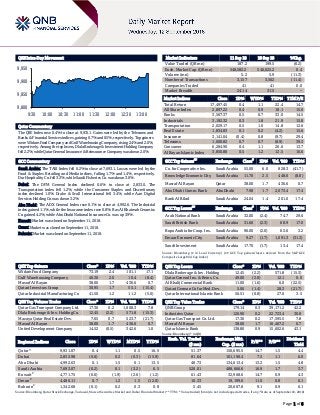

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.4% to close at 9,931.1. Gains were led by the Telecoms and Banks & Financial Services indices, gaining 0.7% and 0.5%, respectively. Top gainers were Widam Food Company and Gulf Warehousing Company, rising 2.4% and 2.0%, respectively. Among the top losers, Dlala Brokerage & Investment Holding Company fell 2.2%, while Qatar General Insurance & Reinsurance Company was down 2.0%. GCC Commentary Saudi Arabia: The TASI Index fell 0.2% to close at 7,693.1. Losses were led by the Food & Staples Retailing and Media indices, falling 1.7% and 1.4%, respectively. Dur Hospitality Co. fell 3.3%, while Saudi Fisheries Co. was down 3.0%. Dubai: The DFM General Index declined 0.6% to close at 2,833.0. The Transportation index fell 1.2%, while the Consumer Staples and Discretionary index declined 1.0%. Drake & Scull International fell 3.4%, while Aan Digital Services Holding Co. was down 3.2%. Abu Dhabi: The ADX General Index rose 0.1% to close at 4,992.6. The Industrial index gained 1.1%, while the Insurance index rose 0.8%. Ras Al Khaimah Ceramics Co. gained 4.2%, while Abu Dhabi National Insurance Co. was up 3.9%. Kuwait: Market was closed on September 11, 2018. Oman: Market was closed on September 11, 2018. Bahrain: Market was closed on September 11, 2018. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Widam Food Company 73.19 2.4 101.1 17.1 Gulf Warehousing Company 40.30 2.0 10.4 (8.4) Masraf Al Rayan 38.00 1.7 436.6 0.7 Qatari Investors Group 30.95 1.7 55.1 (15.4) Qatar Industrial Manufacturing Co 41.50 1.2 11.2 (5.0) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Company Ltd. 17.36 0.2 1,008.3 7.8 Dlala Brokerage & Inv. Holding Co. 12.45 (2.2) 571.8 (15.3) Mazaya Qatar Real Estate Dev. 7.05 0.7 523.7 (21.7) Masraf Al Rayan 38.00 1.7 436.6 0.7 United Development Company 14.52 (0.5) 342.6 1.0 Market Indicators 11 Sep 18 10 Sep 18 %Chg. Value Traded (QR mn) 187.2 199.5 (6.2) Exch. Market Cap. (QR mn) 548,582.2 546,625.2 0.4 Volume (mn) 5.2 5.9 (11.3) Number of Transactions 3,157 3,562 (11.4) Companies Traded 41 41 0.0 Market Breadth 24:14 31:5 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,497.45 0.4 1.1 22.4 14.7 All Share Index 2,897.22 0.4 0.9 18.1 15.0 Banks 3,567.37 0.5 0.7 33.0 14.5 Industrials 3,192.32 0.3 1.8 21.9 15.8 Transportation 2,029.17 0.5 1.0 14.8 12.6 Real Estate 1,834.83 0.1 0.2 (4.2) 15.6 Insurance 3,141.04 (0.4) 0.8 (9.7) 29.4 Telecoms 1,000.82 0.7 0.7 (8.9) 39.3 Consumer 6,284.90 0.4 1.1 26.6 13.7 Al Rayan Islamic Index 3,850.80 0.5 1.2 12.5 16.6 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Co. for Cooperative Ins. Saudi Arabia 55.00 6.0 828.3 (41.7) Knowledge Economic City Saudi Arabia 11.70 2.5 448.0 (8.8) Masraf Al Rayan Qatar 38.00 1.7 436.6 0.7 Abu Dhabi Comm. Bank Abu Dhabi 7.98 1.7 2,073.4 17.4 Bank Al Bilad Saudi Arabia 24.04 1.4 201.0 17.4 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Arab National Bank Saudi Arabia 32.00 (2.4) 74.7 29.6 Saudi British Bank Saudi Arabia 31.60 (2.3) 68.9 17.0 Bupa Arabia for Coop. Ins. Saudi Arabia 96.00 (2.0) 62.6 3.2 Emaar Economic City Saudi Arabia 9.27 (1.7) 1,091.3 (31.3) Saudi Investment Saudi Arabia 17.70 (1.7) 13.4 17.4 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding 12.45 (2.2) 571.8 (15.3) Qatar General Ins. & Reins. Co. 49.00 (2.0) 12.1 0.0 Al Khalij Commercial Bank 11.00 (1.6) 6.0 (22.5) Qatari German Co for Med. Dev. 5.06 (1.4) 28.3 (21.7) Qatar International Islamic Bank 56.51 (0.8) 27.6 3.5 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 179.14 0.3 39,171.2 42.2 Industries Qatar 126.90 0.2 22,723.4 30.8 Qatar Gas Transport Co. Ltd. 17.36 0.2 17,595.5 7.8 Masraf Al Rayan 38.00 1.7 16,467.2 0.7 Qatar Islamic Bank 138.80 0.9 15,602.6 43.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,931.07 0.4 1.1 0.5 16.5 51.37 150,695.5 14.7 1.5 4.4 Dubai 2,832.98 (0.6) 0.2 (0.3) (15.9) 81.64 101,190.4 7.5 1.1 6.0 Abu Dhabi 4,992.63 0.1 1.5 0.1 13.5 48.73 134,613.4 13.2 1.5 4.8 Saudi Arabia 7,693.07 (0.2) 0.1 (3.2) 6.5 526.01 488,666.6 16.9 1.7 3.7 Kuwait# 4,771.75 (0.6) (1.9) (2.6) (1.2) 61.43 32,968.6 14.7 0.9 4.3 Oman# 4,486.11 0.7 1.2 1.5 (12.0) 10.33 19,199.6 11.0 0.8 6.1 Bahrain# 1,342.68 (0.1) 0.2 0.3 0.8 5.45 20,607.8 9.1 0.9 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any; # Data as of September 10, 2018) 9,800 9,850 9,900 9,950 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.4% to close at 9,931.1. The Telecoms and Banks & Financial Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Widam Food Company and Gulf Warehousing Company were the top gainers, rising 2.4% and 2.0%, respectively. Among the top losers, Dlala Brokerage & Investment Holding Company fell 2.2%, while Qatar General Insurance & Reinsurance Company was down 2.0%. Volume of shares traded on Tuesday fell by 11.3% to 5.2mn from 5.9mn on Monday. Further, as compared to the 30-day moving average of 6.3mn, volume for the day was 17.4% lower. Qatar Gas Transport Company Limited and Dlala Brokerage & Investment Holding Company were the most active stocks, contributing 19.3% and 10.9% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/11 UK UK Office for National Statistics Employment Change 3M/3M July 3k 10k 42k 09/11 EU Eurostat Employment QoQ 2Q2018 0.4% – 0.4% 09/11 EU Eurostat Employment YoY 2Q2018 1.5% – 1.5% 09/11 Japan Bank of Japan Money Stock M3 YoY August 2.5% 2.6% 2.5% 09/11 Japan Bank of Japan Money Stock M2 YoY August 2.9% 3.0% 2.9% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar Qatar’s CPI inflation at 0.4% YoY in August – Qatar’s consumer prices index (CPI) inflation came in at 0.4% YoY in August 2018, mainly owing to higher expenses towards transport, health, clothing, furniture and education, according to the official data. The CPI-based cost of living was up a marginal 0.04% on monthly basis, amidst flat course in four sectors, the Ministry of Development Planning and Statistics data suggest. The International Monetary Fund, in its latest Article IV consultation with Qatar, viewed that inflation is expected to peak at 3.9% in 2018, before easing to 2.2% in the medium term, while a BMI report suggests Qatar’s inflation will average 2.6% this year. Transport, which has 14.59% weightage, saw its group index vault 8.4% YoY and 0.29% on a monthly basis. The sector has direct linkage to the dismantling of administered prices in petrol and diesel, which have witnessed sustained increase in the recent past as part of lessening the subsidies. (Gulf-Times.com) Al-Kaabi: Europe is a valued partner for Qatar oil and gas sector – Heads of mission of 17 European Union (EU) member countries visited Qatar Petroleum, for a meeting with its President and CEO, Saad Sherida Al-Kaabi and talks on enhancing cooperation in the field of energy. The meeting also included a review of EU-Qatar relations and energy developments in the region. Al-Kaabi welcomed the EU Heads of Mission and presented a historic overview of the strong relations that has bound Qatar with various EU member countries. He also highlighted the important work of European companies in all aspects of Qatar’s oil and gas industry. Al- Kaabi said, “We are proud of the important and valuable relations with the member countries of the European Union. Europe is a valued partner for Qatar and particularly in Qatar’s oil and gas sector, and we want to enhance that.” Discussions during the meeting covered a number of issues related to the local, regional and international developments related to the oil and gas industry. Speaking at the meeting, a number of EU Ambassadors applauded Qatar’s role in contributing to the security of energy supplies, be it for Europe or for the international markets. (Gulf-Times.com) Al-Shaibei: QIIK happy to be part of growing Qatar–UK business relations – Qatar International Islamic Bank (QIIK) is happy to be a part of the growing Qatar–UK bilateral relations, said the bank’s CEO, Abdulbasit Ahmad Al-Shaibei. He was speaking after receiving a delegation from the Cardiff Council at the bank headquarters. “We welcome the Cardiff delegation, and as you know, the relations between the State of Qatar and Britain are long, very well developed and economic cooperation in particular is strong and effective at all levels. At QIIK, we are happy to be a part of this,” Al-Shaibei said and hoped this would further get strengthened. (Gulf-Times.com) Sheikh Khalifa: Qatar, US chambers seek to boost trade exchange of both countries – Private sector leader Qatar Chamber and the US Chamber of Commerce are keen to strengthen relations between Qatar and the US by fostering more joint cooperation in various fields, Chairman Sheikh Khalifa bin Jassim Al-Thani said. He made the statement on the sidelines of a working dinner hosted by the Ministry of Economy and Commerce to welcome US Chamber of Commerce Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 28.28% 38.38% (18,925,971.33) Qatari Institutions 16.87% 24.00% (13,355,217.63) Qatari 45.15% 62.38% (32,281,188.96) GCC Individuals 0.28% 0.35% (141,646.95) GCC Institutions 0.40% 2.55% (4,035,237.48) GCC 0.68% 2.90% (4,176,884.43) Non-Qatari Individuals 8.40% 8.36% 78,955.40 Non-Qatari Institutions 45.78% 26.35% 36,379,117.99 Non-Qatari 54.18% 34.71% 36,458,073.39

- 3. Page 3 of 6 President and CEO Tom J Donohue and his accompanying delegation. Citing the US as one of Qatar’s “most important trading partners,” Sheikh Khalifa said Qatar-US trade exchange stood at “about $6bn” in 2017. “US exports are important to Qatar in terms of vehicles, electrical machinery, and iron and steel products, while US imports from Qatar are mostly petroleum oils and fertilizers,” Sheikh Khalifa said. He said the Qatar Investment Authority has allocated $45bn worth of investments in the US for 2015 to 2020, of which $10bn would be invested in the infrastructure sector. Qatari investments in the US are found in multiple sectors, including technology, media, entertainment, energy, and real estate, among others. “Many Qatari investors and businessmen also have many private investments in the US,” Sheikh Khalifa pointed out. (Gulf-Times.com) Qatar’s real estate business exceeds QR211mn – The trading volume of registered real estate between August 26 and August 30 at the Ministry of Justice’s real estate registration department stood at QR211,448,256. The department’s weekly report said that the trading included empty lands, residential units, multipurpose buildings, residential buildings and multipurpose empty lands. Most of the trading took place in Al Rayyan, Doha, Al Wakrah, Umm Salal, Al Khor, Al Daayen, Al Thakhira and Al Shamal. The trading volume of registered real estate between August 12 and August 16 was QR811,016,038. Furthermore, the real estate sector of Qatar has shown strong performance in July. The value of sold properties has jumped by about 224% in July this year compared previous month. Rising transactions in summer shows the robustness of Qatar’s real estate sector. The total value of sold properties reached around QR4.3bn in July, showing a whopping rise of around QR3bn compared to June. The value of sold properties stood at around QR1.33bn in June this year, according to the Ministry of Development Planning and Statistics data. (Gulf-Times.com, Peninsula Qatar) Turkish Souq targets five million products in 2019 – Qatar Post (Q-Post) has revealed that its e-commerce platform - Turkish Souq - will achieve the target of offering five million products by early next year. Launched early this year, the online shopping facility by Q-Post, will see the massive jump in the product range within a very short span of time, which will be offering nearly 25 times more items compared to the current level of 200,000 products available to the customers. The online shopping platform (turkishsouq.qa) provides easy access to Turkish products ranging from clothing, shoes, accessories, home furnishing, furniture and as well as vehicle parts and everything in-between, all at a flat delivery rate of QR50 by Q- Post. (Peninsula Qatar) International Record US job openings, quits rate boost wage growth outlook – US job openings increased to a record high in July, and more Americans voluntarily quit their jobs, pointing to sustained labor market strength and confidence that could soon spur faster wage growth. The Labor Department’s monthly Job Openings and Labor Turnover Survey, or JOLTS, released also suggested a further tightening in labor market conditions, with employers appearing to increasingly have trouble finding suitable workers. While the tightening labor market could boost wage gains, some economists warned that worker shortages could over time negatively impact economic growth. The JOLTS report cemented expectations the Federal Reserve will raise interest rates at its September 25-26 policy meeting. The Fed has raised rates twice this year. Job openings, a measure of labor demand, increased by 117,000 to a seasonally adjusted 6.9mn in July. That was the highest level since the series started in December 2000. The jobs openings rate was 4.4%, unchanged from the previous month and an all-time high first touched in April. The current level of job openings means there is a job for every one of the 6.2mn people, who were unemployed in August. Hiring was little changed at 5.7mn in July, keeping the hiring rate at 3.8% for a second straight month. (Reuters) UK’s pay growth beats forecasts as hiring levels off – British workers’ pay excluding bonuses picked up faster than expected during the three months to July to a rate that has not been beaten in three years, as businesses found it harder to hire staff, official figures showed. The Bank of England (BoE) has long forecast that a tighter labor market will lead to faster pay growth - albeit not at the rates seen before the financial crisis - and the latest data are likely to strengthen its focus on domestic inflation pressures. Both average weekly earnings excluding bonuses - the measure preferred by the BoE- and total pay grew at the top end of economists’ forecasts in a Reuters poll. Earnings excluding bonuses were 2.9% up on the year in the three months to July versus 2.7% in June, matching a peak seen in March. Pay has not risen faster since July 2015. Total earnings growth picked up to 2.6% from 2.4%. (Reuters) Eurozone’s employment maintains steady rise to new record in second quarter – Eurozone’s employment rose at the same rate in the second quarter as the first to a new record high, data showed. Employment in the 19 countries sharing the Eurozone increased by 0.4% QoQ and by 1.5% YoY, EU statistics office Eurostat stated. These were the same rates of change as in the first three months of 2018. It meant 158mn people in the Eurozone had a job in the April-June period, a record high. Employment has been steadily rising in the past five years, with about 9mn extra people in work. Estonia, Cyprus and Luxembourg recorded the highest quarterly rises, while decreases were seen in Latvia and Portugal. Employment growth in France was 0.1% in the quarter, in Germany 0.2% and in Italy 0.5%. (Reuters) Germany’s investor morale brightens unexpectedly in September – The mood among German investors brightened unexpectedly for the second month in a row in September, a survey showed, as concerns about an escalating tit-for-tat trade dispute faded into the background. The ZEW research institute stated its monthly survey showed economic sentiment among investors improved to -10.6 from -13.7 in August. This compared with the Reuters consensus forecast for a reading of - 14.0. A separate gauge measuring investors’ assessment of the economy’s current conditions rose to 76.0 from 72.6 in the previous month. The Reuters consensus forecast was for a reading of 72.0. (Reuters) France’s 2019 budget deficit to rise, but EU limit to be respected – France’s budget deficit will rise next year but stay below the European Union’s (EU) limit of 3% of economic output,

- 4. Page 4 of 6 according to figures given by Finance Ministry officials. Next year’s budget, which is due to be published at the end of this month, foresees the public deficit rising to 2.8% of gross domestic product next year after 2.6% this year, the ministry officials said. Respecting the EU deficit limit is the cornerstone of President Emmanuel Macron’s pro-European agenda after France flaunted the rules for a decade before his presidency. Most of the increase in the deficit next year is due to a long- expected, one-off effect of government plans to transform a payroll tax credit scheme into a permanent tax cut. The combined impact of the last rebate under the scheme for this year and the tax cut next year amounts to a tax break of more than 20bn Euros ($23.2bn) for companies in 2019. The overall deficit will remain lower than forecast in this year’s budget, which was based on projections for a shortfall of 2.8% in 2018 and 2.9% in 2019. The Finance Ministry forecasts that the economy will grow by 1.7% in both 2018 and 2019, unchanged from the estimates in this year’s budget. (Reuters) China’s auto sales drop again on trade war, economic gloom – China’s automobile sales fell for the second straight month in August as a weak macro economy and trade frictions with the US made consumers cautious about spending, an industry association said stated. Chinese auto sales dropped 3.8% in the month from a year earlier to 2.1mn vehicles, after a 4.0% fall in sales in July and an increase of 4.8% in June, the China Association of Automobile Manufacturers (CAAM) stated. China is the world’s largest auto market and a critical region for global carmakers, though regulators in the country have spooked some firms with a clamp-down on overcapacity in the sector and an aggressive push towards electric vehicles. (Reuters) Regional OPEC: Global oil demand may reach 98.83mn bpd in 2018 – The total global oil demand is anticipated to reach 98.83mn bpd in 2018, OPEC’s latest monthly bulletin showed. For 2019, OPEC forecasted world oil demand to grow by 1.43mn barrels per day (bpd), but some 20,000 bpd lower than OPEC’s July assessment. This was mainly due to weaker-than-expected oil demand data from Latin America and the Middle East in the second quarter of this year. Total world consumption is anticipated to reach 100.26mn bpd next year. The OECD (Organization for Economic Co-operation and Development) region will contribute positively to oil demand growth, rising by 0.27mn bpd YoY, yet with growth of 1.16mn bpd, non-OECD nations will account for the majority of expected growth. The demand for crude from 15 members of the OPEC has been revised down by 0.1mn bpd in August compared to the previous month to stand at around 32.9mn bpd. (Gulf-Times.com) Saudi Arabian Railway Company to increase cargo transport to 20mn tons by 2025 – Saudi Arabian Railway Company’s CEO, Bashar AlMalik said the railway network in the Kingdom has transported over 12.5mn tons during the past year and the company will increase the capacity of its services to be able to transport 20mn tons by 2025. Its transport services, he added, has positively affected the environment as it managed to reduce the use of trucks in the Kingdom by dropping 500,000 trucks off roads. He said the company has also transported 7mn tons of various mineral products since the start of this year until the end of August 2018, an increase of 20% compared to last year. Saudi Arabian Railway Company also broke a record in transferring phosphate as it has transferred 461,855 tons in August 2018 with an increase of 10,000 tons compared to the same period last year. (GulfBase.com) Asia buyers to receive more Saudi Arabian oil ahead of Iran sanctions – At least three North Asian buyers will receive extra supplies of oil from Saudi Arabia after the Kingdom cut its prices for most grades in October and as they look to cushion the impact on supply of US sanctions on Iran, according to sources. Buyers have asked to lift more Saudi Arabian oil than contracted volumes in October amid fears that the sanctions, to be imposed on Iran’s crude exports from November 4, will crimp supply during peak winter demand in Asia. Saudi Aramco will supply more oil to the buyers in October, with one to receive more Arab Light crude. (Reuters) SABIC signs MoU to build petrochemical complex in China – Saudi Basic Industries Corporation (SABIC) signed a memorandum of understanding (MoU) with China’s Fujian provincial government to build a petrochemical complex. SABIC is the third company to announce a large chemical investment in China over the past two months. SABIC did not give any details of the investment or a timeline in a brief release, saying this is part of the firm’s strategy to diversify its operations and strengthen its position in the world’s top petrochemicals market. (Reuters) Saudi Aramco to be in talks to buy fuel stations business – Saudi Aramco is in talks to acquire fuel stations company, Naft Services Company (NAFT), as part of a plan to launch its own retail operations in the country, according to sources. Saudi Aramco is also continuing with talks about a possible acquisition of Tas’helat Marketing Co., another Saudi Arabian service-station business, sources added. Saudi Aramco could consider buying both companies and merging them, or just one of them. No final decisions have been taken and the group may decide against making any acquisition, to focus instead on existing plans to start its own fuel-retail business from scratch. Saudi Aramco is planning to launch its own fuel retail unit in the first half of next year at the earliest, sources added. (Bloomberg) Saudi Arabia to set up real estate authority – The Saudi Arabian cabinet has given approval for converting the State Property Department into a general authority, which will be named General Real Estate Authority. This move will help enhance the efficiency of the Kingdom’s assets management, reported Argaam citing Yarob Al Thunayan, the Undersecretary of the Ministry of Finance for Communication and Information. Al Thunayan said, "The independence of the general real estate authority will give the entity more room for business development. Accordingly, it will directly or indirectly set up many new firms. The authority will also work closely with the private sector to develop the state’s assets. The new entity would be in charge of the state properties and would define the best investment opportunities, lay out policies and develop a related data base, in line with Saudi Vision 2030." (GulfBase.com) UAE’s banking system expands credit to 10 economic sectors – The UAE’s economic sectors have continued their growth since

- 5. Page 5 of 6 the start of the current year, according to a digital review of relevant indicators, which encouraged the banking system to fund the activities of various sectors that support the national economy. Statistics issued by the Central Bank of the UAE showed that ten vital economic sectors witnessed considerable growth, reflecting the overall rise of business activity since the start of 2018. The statistics also showed that the construction and real estate sector took the first position among the list of sectors, with its total funding reaching around AED306.6bn at the start of 2018, an increase of AED8.5bn compared to the end of 2017. The real estate sector is a leading sector that supports the national economy, making up 6.4% of the country’s non-oil GDP and whose overall value reached AED81.2bn in 2017, compared to AED79bn in 2016. (GulfBase.com) Dubai’s private sector activity picks up speed after the summer lull – Non-oil private sector in Dubai reported modest growth in output in August with the headline Dubai Economy Tracker Index (DET) gaining marginally to 55.2 from 54.9 in July. Overall output rose at a faster rate than in July, driven by ongoing projects, but new order growth slowed last month. The employment index eased to 50.4 in August, only slightly above the ‘no change’ level. The vast majority of firms surveyed (94%) reported no change in staffing levels in August. “The average DET year to date is 55.6, only slightly lower than the same period last year (56.5). This suggests to us that Dubai’s economy is probably growing a similar rate to 2017, or a touch slower. Preliminary estimates from the Dubai Statistics Centre put last year’s GDP growth at 2.8%; about half a percentage point slower than our forecast for 2018,” Khatija Haque, Head of Mena Research at Emirates NBD said. Producer price pressures eased in August, with the input cost index falling to just 51 from nearly 54 in July. However, average selling prices declined a fraction with some firms citing promotional activity. The selling prices have been in contraction for the last four months running, highlighting the lack of pricing power of firms and the competitive market environment. (GulfBase.com) DP World to issue new debt, buy back JAFZA Sukuk – Dubai- owned ports operator DP World plans to sell new Dollar, Euro and Pound-denominated securities to fund growth and the buyback of $650mn of Islamic bonds. The company offered to repurchase Sukuk due next year and issued by its Jebel Ali Free Zone (JAFZA) subsidiary to reduce its liabilities. To finance the transaction, DP World plans to issue a new 10-year Dollar Sukuk, plus a 30-year Dollar benchmark bond that’s subject to market conditions, and is also considering selling Euro and Pound securities, according to sources. DP World stated it will pay $1,032.50 for every $1,000 of bonds by principal value in the buyback offer, which opens September 12 and closes on September 17. (Gulf-Times.com) KAPP to soon complete five-year investment plan – Kuwait Authority for Partnership Projects (KAPP) has made final touches to its developmental projects for the next five years with investments estimated to be worth about KD40bn, reported by Al-Nahar daily. The authority explained that the number of such projects is about 60, which include projects on education, health, oil and infrastructure. Since partnership projects is part of the strategy of the state, the government is keen on enhancing the level of partnership between private and public sectors in order to ensure completion of important developmental projects including development of education via floating schools, institutes and private universities, as well as completion of major projects like the projects on metro, railway, energy, tourism and entertainment. (GulfBase.com) Oman seeks Japanese investment in Duqm SEZ – The Special Economic Zone Authority of Duqm (SEZAD) kicked off its road- show in Japanese capital, aimed at attracting Japanese investment to Oman’s biggest industrial and maritime hub overlooking the Arabian Sea. SEZAD’s Chairman, Yahya Bin Saeed Al Jabri said, “The strategic location and political stability of Oman makes it an economic and investment hub in the region, with Duqm abutting sea-lanes that serve markets in the Arabian Gulf, Asian and Africa.” (GulfBase.com)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as of September 10, 2018) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 50.0 75.0 100.0 125.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSE Index S&P Pan Arab S&P GCC (0.2%) 0.4% (0.6%) (0.1%) 0.7% 0.1% (0.6%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait# Bahrain# Oman# AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,198.58 0.2 0.2 (8.0) MSCI World Index 2,147.67 0.2 0.5 2.1 Silver/Ounce 14.14 (0.3) (0.2) (16.5) DJ Industrial 25,971.06 0.4 0.2 5.1 Crude Oil (Brent)/Barrel (FM Future) 79.06 2.2 2.9 18.2 S&P 500 2,887.89 0.4 0.6 8.0 Crude Oil (WTI)/Barrel (FM Future) 69.25 2.5 2.2 14.6 NASDAQ 100 7,972.47 0.6 0.9 15.5 Natural Gas (Henry Hub)/MMBtu 2.94 1.4 2.1 (4.9) STOXX 600 375.31 (0.2) 0.6 (7.0) LPG Propane (Arab Gulf)/Ton 107.13 1.3 1.8 8.2 DAX 11,970.27 (0.2) 0.3 (10.7) LPG Butane (Arab Gulf)/Ton 118.00 3.3 3.9 8.8 FTSE 100 7,273.54 (0.2) 0.6 (9.0) Euro 1.16 0.1 0.5 (3.3) CAC 40 5,283.79 0.2 0.8 (4.1) Yen 111.63 0.4 0.6 (0.9) Nikkei 22,664.69 0.9 1.0 0.4 GBP 1.30 0.1 0.9 (3.6) MSCI EM 1,003.33 (0.8) (1.9) (13.4) CHF 1.03 0.3 (0.3) 0.2 SHANGHAI SE Composite 2,664.80 (0.5) (1.8) (23.8) AUD 0.71 0.1 0.2 (8.8) HANG SENG 26,422.55 (0.7) (2.0) (12.1) USD Index 95.25 0.1 (0.1) 3.4 BSE SENSEX 37,413.13 (1.4) (3.3) (3.4) RUB 69.41 (1.6) (0.7) 20.5 Bovespa 74,656.51 (3.3) (2.6) (22.3) BRL 0.24 (1.6) (2.3) (20.2) RTS 1,055.90 1.2 0.5 (8.5) 79.8 77.7 77.1