MANAGEMENT ACCOUNTING

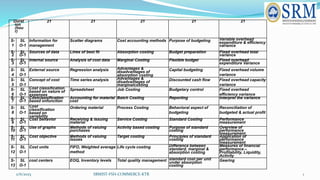

- 1. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 1 Durat ion (hou r) 21 21 21 21 21 S- 1 SL O-1 Information for management Scatter diagrams Cost accounting methods Purpose of budgeting Variable overhead expenditure & efficiency variance S- 2 SL O-1 Sources of data Lines of best fit Absorption costing Budget preparation Fixed overhead total variance S- 3 SL O-1 Internal source Analysis of cost data Marginal Costing Flexible budget Fixed overhead expenditure Variance S- 4 SL O-1 External source Regression analysis Advantages & disadvantages of absorption costing Capital budgeting Fixed overhead volume variance S- 5 SL O-1 Concept of cost Time series analysis Advantages & disadvantages of marginalcosting Discounted cash flow Fixed overhead capacity variance S- 6 SL O-1 Cost classification based on nature of expenses Spreadsheet Job Costing Budgetary control Fixed overhead efficiency variance S- 7 SL O-1 Costclassification based onfunction Accounting for material cost Batch Costing Reporting Interpret the variance S- 8 SL O-1 Cost classification based on variability Ordering material Process Costing Behavioral aspect of budgeting Reconciliation of budgeted & actual profit S- 9 SL O-1 Cost behavior Receiving & issuing material Service Costing Standard Costing Performance measurement S- 10 SL O-1 Use of graphs Methods of valuing purchases Activity based costing Purpose of standard costing Overview of performance measurement S- 11 SL O-1 Cost objective Methods of valuing issues Target costing Principles of standard costing Application of performance measurement S- 12 SL O-1 Cost units FIFO, Weighted average method Life cycle costing Difference between standard, marginal & absorption costing Measures of financial performance – Profitability, Liquidity, Activity S- 13 SL O-1 cost centers EOQ, Inventory levels Total quality management standard cost per unit under absorption costing Gearing

- 2. MARGINAL COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 2 Marginal costing is the accounting system in which variable costs are charged to cost units and fixed costs of the period are written off in full against the aggregate contribution. Note that variable costs are those which change as output changes - these are treated under marginal costing as costs of the product. IMPORTANT FORMULE 1. Marginal cost equation Contribution = Sales – Variable cost Contribution = Fixed cost + Profit 2. P/v Ratio Contribution/Sales * 100 Sales – Variable cost / Sales * 100 Change in profit / Change in sales * 100 (when profit / loss and sales of two periods are given )

- 3. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 3 3. Break- even point (B.E.P) 1. break even volume (units) Fixed cost/Contribution per unit (or) Break even sales / Selling price per unit 2. break even sales (in rupees) Fixed cost / p/v ratio (or) Break even volume * Selling price per unit 4. Margin of safety (MOS) MOS = Actual sales – Break even sales MOS in rupees = Profit / P/v ratio MOS in units = Profit / Contribution per unit 5. Required sales for given profit Required sales in units = Required profit + Fixed cost / Contribution per unit Required sales value in rupees = required profit + Fixed cost/ P/v ratio 6. Profit from given sales Profit = Contribution – Fixed cost Contribution = Given sales* P/v ratio

- 4. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 4 A Ltd has furnished the following details Fixed cost – Rs.80000 Variable cost per unit – Rs.4 Estimated sales – Rs.2,00,000 Selling price per unit – Rs.20 Compute the following 1. Contribution 2. P/V ratio 3. Break even point 4. Break even Sales 1.Contribution = sales-variable cost 20-4 = Rs.16 per unit 2. P/V ratio = Contribution / Sales * 100 16/20*100 = 80% 3. BEP = Fixed cost / Contribution per unit 80000/16 = 5000 units 4. Break even sales = Fixed cost / P/V ratio 80000 / 80% = Rs.1,00,000

- 5. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 5 Computation of BEP The fixed expenses of an industrial concern amount to Rs.1,80,000.Its variable cost per unit is Rs.29 and selling price is Rs.44 per unit. Calculate break even point

- 6. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 6 From the following information relating to Palani Bros Ltd, you are required to findout a. P/V ratio , b. Break even point, c. Margin of safety, d. Volume of sales to earn a profit of Rs.6,000 Total fixed costs 4500 Total variable costs 7500 Total sales 15000

- 7. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 7 Marginal cost and contribution statement Particulars Amount Sales 15000 Less: Variable cost 7500 Contribution 7500 Less : fixed cost 4500 Profit 3000 a. P/V ratio contribution / sales * 100 = 7500/15000*100 = 50% b.Break even point Fixed expenses / P/v ratio = 4500/50% = Rs.9000 c.Profit = Rs.3000 d. Margin of safety Sales- break even sales = 15000-9000 = Rs.6000 e. Sales to earn a profit of Rs.6000 Required sales = Fixed cost + Required profit/P/v ratio 4500+6000/50% = Rs.21,000

- 8. Marginal costing- When two consecutive periods figures are given 2/6/2023 SRMIST-FSH-COMMERCE-KTR 8 Year Sales (Rs) Profit(Rs) 2007 1,40,000 15,000 2008 1,60,000 20,000 Calculate 1. P/V ratio 2. BEP 3. Sales required to earn a profit of Rs.40,000 4. Fixed Expenses 5. Profit when sales are Rs.1,20,000

- 9. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 9 1. P/V ratio Change in profit / Change in sales * 100 Change in profit = 20000-15000 = 5000 Change in sales = 1,60,000-1,40,000 = 20,000 5000/20000*100 = 25% 2.BEP Fixed Expenses / P/v Ratio P/v ratio = 25% Fixed expenses = Contribution - Profit Contribution = sales*P/v ratio Using 2007 sales, contribution = 140000*25/100= 35000 Profit = 15000 (using 2007 profit) F.C = 35000-15000 = Rs.20,000 BEP = 20000/25*100 = Rs.80,000 3.Sales Required profit+Fixed cost/P/v ratio 40000+20000/25*100 = Rs.2,40,000 4. Fixed Expenses = Rs. 20,000 5. Profit Contribution – Fixed cost Contribution = sales*P/v ratio 1,20,000*25/100 = Rs.30,000 Fixed cost = Rs.20000 Profit = 30000 – 20000 = Rs.10000

- 10. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 10 Find out: 1. P/V ratio 2. BEP 3. Sales for a profit of Rs.40,000 4. Profit for sales of Rs.2,50,000 5. Margin of safety at a profit of profit of Rs.50,000 Year Sales (Rs) Profit(Rs) 1996 1,50,000 20,000 1997 1,70,000 25,000

- 11. Absorption Costing 2/6/2023 SRMIST-FSH-COMMERCE-KTR 11 The figures are extracted from the books of Vijay irons ltd for the year 1989 and 1990 whose capacity is 10,000 irons p.a. Direct material – Rs.3.50 Direct labor – 0.50 Fixed Overhead - Rs.2.00 Selling price – Rs.8.00 Production in 1989 was 10,000 units and in 1990 also it was 10,000 units. Sales was 8,000 units in 1989 and 12,000 units in 1990. Prepare cost statement assuming that the company uses Absorption costing Particulars 1989 1990 Units Per unit Rs) Total (Rs) Units Per unit Rs) Total (Rs) Direct material 10000 3.5 35000 10000 3.5 35000 Direct Labour 10000 0.5 5000 10000 0.5 5000 Prime Cost 10000 4 40000 10000 4 40000 Add: Fixed overhead 10000 2 20000 10000 2 20000 Cost of Production 10000 6 60000 10000 6 60000 Add : Opening stock nil nil nil 2000 6 12000 10000 6 60000 12000 6 72000 Less : Closing Stock 2000 6 12000 nil nil nil Cost of sales 8000 6 48000 12000 6 72000 Add : Profit 8000 2 16000 12000 2 24000 Sales 8000 8 64000 12000 8 96000

- 12. JOB COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 12 CIMA – It is a form of specific order costing in which costs are attributed to individuals jobs Job Costing Procedure 1. Customers Enquiry 2.Quotation for the job 3.Customer’s Order 4.Cost Accumulation 5.Completion of job 6.Profit Recognition Objectives of Job Costing 1. Ascertaining the cost of each job order, element, as accurately as feasible 2. Enabling preparation of overhead quotations and tenders through reliable estimates 3. Determination of suitable overhead recovery rates to absorb the overheads fully 4. Providing proper valuation of work-in0 progress at any given time 5. Establishing procedures for controlling and reducing costs over a period of time

- 13. Job Cost Sheet 2/6/2023 SRMIST-FSH-COMMERCE-KTR 13 Particulars Rs Rs Direct material xxx xxx Direct wages xxx xxx Production overhead xxx xxx Prime cost / Work/ Manufacturing Cost xxx xxx Office & distribution overheads xxx xxx Total cost xxx xxx Profit/Loss xxx xxx Selling price xxx xxx

- 14. JOB COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 14 The following data is available in respect of Job no 876 •Direct material- Rs.17000, Wages – 160 hours at Rs.50 per hour •Variable overhead incurred for all jobs – Rs.80000 for 2000 labour hours •Fixed overhead are observed at R.20 per hour Find the profit or loss from the job is billed for Rs.40000 Job cost sheet for job no 876 Particulars Rs Rs Direct materials 17000 Wages (160*50) 8000 Prime Cost 25000 Overheads Variable 80000/2000*160 6400 Fixed 160*20 3200 9600 Total Cost 34600 Profit (Balancing figure) 5400 Job Bill 40000

- 15. BATCH COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 15 Batch costing is another form of job costing. Under this method, homogeneous products are taken as cost unit. A batch consists of a specific number of products or units or articles. The number varies from one batch to another. Hence, batch cost is used to determine the cost per unit or article per unit. The Economic Batch Quantity is very similar to Economic order Quantity. But, there is only one difference ie Economic Batch Quantity is calculated to fix the level of production at minimum cost but Economic Order Quantity is calculated to fix the level for ordering the purchase of raw materials, stores and spares.

- 17. SERVICE COST / OPERATING COST 2/6/2023 SRMIST-FSH-COMMERCE-KTR 17 It is a method of costing designed to ascertain and control the costs of services.. It is unit costing as applied to the cost of services. The following are the some of the costs units normally used in different services Passenger transport Passenger-kilometer/mile Goods transport Ton-mile/ kilometer Hospitals (in-patients) Patient-bed-day Lodging Houses Room-day Cinema theaters Man-show Power generation Kilowatt-hour Road-lighting Per lamp post

- 18. Goods Transportation Costs 2/6/2023 SRMIST-FSH-COMMERCE-KTR 18 A truck starts from city ‘A’ with load of 8 tons. It unloads 2 tons in town ‘B’ and the balance 6 tons in Town ‘C’. In the return journey it carries 4 tons from town ‘C’ to the city directly. (a)Calulate – Absolute ton kms , Commercial ton kms Distance were as follows – city to town B 50 kms Town B to town C 40 kms Town C to city direct 70 kms (b) Ascertain the cost per commercial ton km, if total cost per trip is Rs.2,880 (round trip) © If arranged profit is 25% on the freightage, compute the charge per commercial ton km

- 19. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 19 (a) 1. Absolute ton kms = Distance travelled*Load carried (50*8)+(40*6)+(70*4) 400+240+280 = 920 ton kms 2. Commercial ton kms = Total distance travelled * Average load carried (50+40+70)* 8+6+4/3 160*6=960 commercial ton kms Cost per commercial ton km Total cost per round trip/Total commercial ton kms 2880/960 = Rs.3 per ton km c. charge per commercial ton km` Targeted profit is 25% on freightage or 1/3 on cost cost per commercial ton km = 3 Add : Targeted profit )3*1/3 = 1 Charge per commercial ton km = 4

- 20. Operating Costing Meaning and Definition Operating costing is a method of costing designed to ascertain and control the costs and services. Those industries or organizations which do not produce any product but render some service to customers can use this method. According to Wheldon, “Operating costing actually is unit costing as applied to the cost of services”. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 20

- 21. Operating Costing Whatever is the nature of services, it is essential to find out the cost of performing a service and relate the costs to appropriate cost units. The following are some of the cost units normally used in different services: (a) Passenger transport – Passenger – KM / mile (b) Goods transport – Ton – mile / KM (c) Hospitals (in – patient) – Patient – bed – day (d) Lodging Houses – Room day (e) Cinema theatres – Man – Show (f) Power generation – Kilowatt – hour (g) Road lighting – Per lamp post 2/6/2023 SRMIST-FSH-COMMERCE-KTR 21

- 22. Objectives of Transport costing: (a) Cost ascertainment (b) Price fixation (c) Quotations (d) Decisions data (e) Control over maintenance (f) Operational efficiency 2/6/2023 SRMIST-FSH-COMMERCE-KTR 22

- 23. Benefits of Operating costing Reliable prices Cost recovery Cost Control Policy decisions Logistics 2/6/2023 SRMIST-FSH-COMMERCE-KTR 23

- 24. Classification of Costs I.Fixed or Standing charges: These expenses are incurred whether the vehicles actually operate or not. They have to paid even when the vehicles are standing. They have no relationship with the miles or kilometres run by vehicles, but are mostly related to time. Eg., Garage rent, office exp, managers salary and road license etc., II. Semi-variable or Maintenance Charges: These are the expenses incurred to keep the vehicles in running condition. Eg., Repairs, replacement of tyres and tubes, overhauling charges etc., III. Operating Charges / Running Charges : These are expenses relating to the actual running of the vehicles. Diesel, Petrol. Note: (i) Drivers and conductors remuneration is a standing charges. If paid on monthly or weekly basis. It becomes a running charges if the payment is on the basis of trips made or distance covered. (ii) Depreciation of vehicles is a standing charges. If the life of the vehicles is estimated in number of years. It becomes a running charges if life of vehicles is estimated in terms of miles or kilometres. 3RD APRIL 2020 SRMIST-FSH-COMMERCE-KTR

- 25. Specimen 3RD APRIL 2020 SRMIST-FSH-COMMERCE-KTR

- 26. Exercise – 1- Running Distance Cost (or) Cost per Running km/mile 3RD APRIL 2020 SRMIST-FSH-COMMERCE-KTR

- 28. Exercise - 6 3RD APRIL 2020 SRMIST-FSH-COMMERCE-KTR

- 29. Solution - 6 3RD APRIL 2020 SRMIST-FSH-COMMERCE-KTR

- 30. ACTIVITY BASED COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 30 Activity-based costing (ABC) is a method of assigning overhead and indirect costs— such as salaries and utilities—to products and services. The ABC system of cost accounting is based on activities, which are considered any event, unit of work, or task with a specific goal. The activity-based costing (ABC) system is a method of accounting you can use to find the total cost of activities necessary to make a product. ... And, the activity-based costing process shows you which overhead costs you might be able to cut back on. For example, you make soap. PURPOSE OF ABC Activity-based costing provides a more accurate method of product/service costing, leading to more accurate pricing decisions. It increases understanding of overheads and cost drivers; and makes costly and non-value adding activities more visible, allowing managers to reduce or eliminate them

- 31. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 31 •Identify costly activities required to complete products. ... •Assign overhead costs to the activities identified in step 1. ... •Identify the cost driver for each activity. ... •Calculate a predetermined overhead rate for each activity. ... •Allocate overhead costs to products. STEPS INVOLVED IN ABC

- 32. PROCESS COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 32 Process costing is a method of costing used mainly in manufacturing where units are continuously mass-produced through one or more processes. ... The method used is to take the total cost of the process and average it over the units of production.

- 33. PROCESS COSTING PROBLEM- 1 2/6/2023 SRMIST-FSH-COMMERCE-KTR 33 Problem 1 Particulars Proces J Proces K Material 45000 15000 Labour 60000 25000 Chargeable expenses 5000 10000 Overhead 17000 on the basis of labour 12000 5000 Overhead Solution Process J a/c Particulars Amount Particulars Amount To Material 45000By process K a/c 122000 To Labour 60000 To Chargeable expenses 5000 To Overhead 12000 122000 122000 Process K a/c Particulars Amount Particulars Amount To Process J a/c(Transfer) 122000By Finished Stock 177000 To Material 15000 To Labour 25000 To Chargeable expenses 10000 To Overhead 5000 177000 177000 Labou r 60000 60+2 5 85 25000 17000*6 0/85 1200 0 17000*2 5/85 5000

- 34. PROCESS COSTING - PROBLEM 2 2/6/2023 SRMIST-FSH-COMMERCE-KTR 34 Problem 1 Particulars PROCESS A PROCESS B PROCESS C Material 10000 12000 20000 Labour 8000 10000 20000 Chargeable expenses 3000 5000 15000 Overhead 12000 on the basis of labour 10000 8000 9000 Overhead Labour 80008+10+20 38 10000 20000 12000*8/38 2526 12000*10/38 3158 12000*20/38 6316

- 35. PROCESS COSTING – PROBLEM 2 2/6/2023 SRMIST-FSH-COMMERCE-KTR 35 Solution Process A a/c Particulars Amount Particulars Amount To Material 10000By process B a/c 23526 To Labour 8000 To Chargeable expenses 3000 To Overhead 2526 23526 23526 Process B a/c Particulars Amount Particulars Amount To Process B a/c(Transfer) 23526By Process C a/c 53684 To Material 12000 To Labour 10000 To Chargeable expenses 5000 To Overhead 3158 53684 53684 Process B a/c Particulars Amount Particulars Amount To Process C a/c(Transfer) 53684By Finished Stock 115000 To Material 20000 To Labour 20000 To Chargeable expenses 15000 To Overhead 6316 115000 115000

- 36. TARGET COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 36 Target costing is not just a method of costing, but rather a management technique wherein prices are determined by market conditions, taking into account several factors, such as homogeneous products, level of competition, no/low switching costs for the end customer, etc. When these factors come into the picture, management wants to control the costs, as they have little or no control over the selling price. CIMA defines target cost as “a product cost estimate derived from a competitive market price.” Target Costing = Selling Price – Profit Margin

- 37. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 37 Key Features of Target Costing: The price of the product is determined by market conditions. The company is a price taker rather than a price maker. 1. The minimum required profit margin is already included in the target selling price. 2. It is part of management’s strategy to focus on cost reduction and effective cost management. 3. Product design, specifications, and customer expectations are already built-in while formulating the total selling price. 4. The difference between the current cost and the target cost is the “cost reduction,” which management wants to achieve. 5. A team is formed to integrate activities such as designing, purchasing, manufacturing, marketing, etc., to find and achieve the target cost.

- 39. LIFE CYCLE COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 39 The process of estimating how much money you will spend on an asset over the course of its useful life. Whole-life costing covers an asset's costs from the time you purchase it to the time you get rid of it. ... The cost to buy, use, and maintain a business asset adds up. 2. Characteristics of Life Cycle Costing: a. Product life cycle costing involves tracing of costs and revenues of a product over several calendar periods throughout its life cycle. b. Product life cycle costing traces research and design and development costs and total magnitude of these costs for each individual product and compared with product revenue. c. Each phase of the product life-cycle poses different threats and opportunities that may require different strategic actions.

- 40. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 40 BENEFITS OF LIFE CYCLE COSTING (i) It results in earlier action to generate revenue or lower costs than otherwise might be considered. There are a number of factors that need to be managed in order to maximise return in a product. (ii) Better decision should follow from a more accurate and realistic assessment of revenues and costs within a particular life cycle stage. (iii) It can promote long term rewarding in contrast to short term rewarding. (iv) It provides an overall framework for considering total incremental costs over the entire span of a product.

- 41. PROCESS OF LIFE CYCLE COSTING 2/6/2023 SRMIST-FSH-COMMERCE-KTR 41

- 42. TOTAL QUALITY MANAGEMENT 2/6/2023 SRMIST-FSH-COMMERCE-KTR 42 Total quality management (TQM) has been defined as an integrated organizational effort designed to improve quality at every level DEFINITION The process to produce a perfect product by a series of measures require an organized effort by the entire company to prevent or eliminate errors at every stage in production is called total quality management. According to international organization for standards defined tqm as, “TQM is a management approach for an organization, centered on quality, based on the participation of all its members and aiming at long-term success through customer satisfaction and benefits to all members of the organization and to the society Characteristics of TQM Committed management. Adopting and communicating about total quality management. Closer customer relations. Closer provider relations. Benchmarking. Increased training. Open organization Employee empowerment. Flexible production. Process improvements. Process measuring

- 43. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 43 Traditional approach and TQM Quality element Previous state TQM Definition Product-oriented Customer-oriented Priorities Second to service and cost First among equals of service and cost Decisions Short-term Long-term Emphasis Detection Prevention Errors Operations System Responsibility Quality Control Everyone Problem solving Managers Teams Manager’s role Plan, assign, control, and enforce Delegate, coach, facilitate, and mentor The three aspects of TQM Counting Customers Culture Tools, techniques, and training in their use for analyzing, understanding, and solving quality problems Quality for the customer as a driving force and central concern. Shared values and beliefs, expressed by leaders, that define and support quality Principles of tqm 1. Produce quality work the first time and every time. 2. Focus on the customer. 3. Have a strategic approach to improvement. 4. Improve continuously. 5. Encourage mutual respect and teamwork The key elements of the TQM Focus on the customer. Employee involvement Continuous improvement

- 44. 2/6/2023 SRMIST-FSH-COMMERCE-KTR 44 BENEFITS OF TQM: • Improved quality. • Employee participation. • Team work. • Working relationships. • Customer satisfaction. • Employee satisfaction. • Productivity. • Communication. • Profitability. • Market share. Advantages of tqm • Improves reputation- faults and problems are spotted and sorted quicker. • Higher employee morale- workers motivated by extra responsibility ,team work and involvement indecisions of tqm. • Lower cost. • Decrease waste as fewer defective products and no need for separate. Disadvantages of tqm • Initial introduction cost. • Benefits may not be seen for several years. • Workers may be resistant to change.