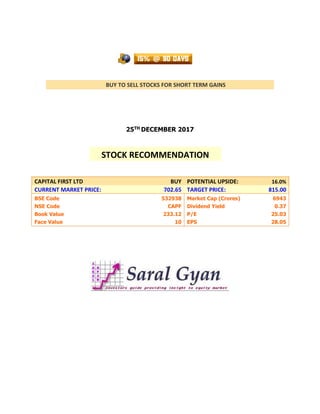

Saral Gyan - 15% @ 90 Days - Dec 2017

- 1. BUY TO SELL STOCKS FOR SHORT TERM GAINS 25TH DECEMBER 2017 CAPITAL FIRST LTD BUY POTENTIAL UPSIDE: 16.0% CURRENT MARKET PRICE: 702.65 TARGET PRICE: 815.00 BSE Code 532938 Market Cap (Crores) 6943 NSE Code CAPF Dividend Yield 0.37 Book Value 233.12 P/E 25.03 Face Value 10 EPS 28.05 STOCK RECOMMENDATION

- 2. 15% @ 90 DAYS – DECEMBER 2017 - 2 - SARAL GYAN CAPITAL SERVICES Comparative Chart (Last 1 Year) Returns: Capital First & Nifty: Nifty: 32.7% Capital First: 37.1% Stock Resistance and Support: 1st Resistance – 750 1st Support – 665 2nd Resistance – 790 2nd Support – 630

- 3. 15% @ 90 DAYS – DECEMBER 2017 - 3 - SARAL GYAN CAPITAL SERVICES Financials at a Glance: Quarterly Results of Capital First Ltd (Rs. In Crores) Particulars Sep 2017 Jun 2017 Mar 2017 Dec 2016 Audited / UnAudited UnAudited UnAudited UnAudited UnAudited Net Sales 844.03 783.74 727.28 707.65 Other Operating Income -- -- 1.8 9.67 Total Income From Operations 844.03 783.74 729.09 717.31 Consumption of Raw Materials -- -- -- -- Purchase of Traded Goods -- -- -- -- Increase/Decrease in Stocks -- -- -- -- Power & Fuel -- -- -- -- Employees Cost 74.91 67.28 55.26 63.29 Depreciation 6.65 5.71 5.18 3.77 R & D Expenses -- -- -- -- Provisions And Contingencies -- -- 117.78 122.41 Other Expenses 354.92 335.64 178.8 142.87 Other Income 10.35 11 5.14 0.25 P/L Before Int., Excpt. Items & Tax 417.89 386.11 377.21 385.23 Interest 311.09 294.31 271.41 300.15 P/L Before Excpt. Items & Tax 106.8 91.79 105.8 85.08 Exceptional Items -- -- -- -- P/L Before Tax 106.8 91.79 105.8 85.08 Tax 35.87 31.52 36.56 29.35 P/L After Tax 70.93 60.28 69.24 55.73 Prior Year Adjustments -- -- -- -- Net Profit/(Loss) 70.93 60.28 69.24 55.73 Equity Share Capital 97.73 97.73 97.42 97.38 EPS 7.26 6.18 7.11 6.07 No Of Shares with Public 6,26,38,992 6,25,39,822 3,79,36,467 3,78,92,717 Public Share Holding (%) 64.03 64.00 38.94 38.91

- 4. 15% @ 90 DAYS – DECEMBER 2017 - 4 - SARAL GYAN CAPITAL SERVICES Basis of Recommendation: i) Technical Analysis Disclaimer: Important Notice: Saral Gyan Capital Services is an Independent Equity Research Company. © SARAL GYAN CAPITAL SERVICES This Service is provided on an "As Is" basis by Saral Gyan Capital Services. Saral Gyan Capital Services and its affiliates disclaim any warranty of any kind, imputed by the laws of any jurisdiction, whether express or implied, as to any matter whatsoever relating to the Service, including without limitation the implied warranties of merchantability, fitness for a particular purpose. Neither Saral Gyan Capital Services nor its affiliates will be responsible for any loss or liability incurred to the user as a consequence of his or any other person on his behalf taking any investment decisions based on the above recommendation. Use of the Service is at any persons, including a Customer's, own risk. The investments discussed or recommended through this service may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advisors as they believe necessary. Information herein is believed to be reliable but Saral Gyan Capital Services and its affiliates do not warrant its completeness or accuracy. The service should not be construed to be an advertisement for solicitation for buying or selling of any securities.