The Swedish Economy, No. 3, 31 March 2011

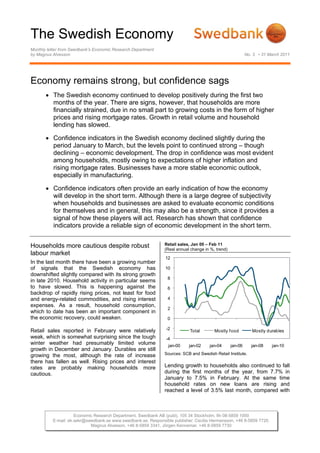

- 1. The Swedish Economy Monthly letter from Swedbank’s Economic Research Department by Magnus Alvesson No. 3 • 31 March 2011 Economy remains strong, but confidence sags • The Swedish economy continued to develop positively during the first two months of the year. There are signs, however, that households are more financially strained, due in no small part to growing costs in the form of higher prices and rising mortgage rates. Growth in retail volume and household lending has slowed. • Confidence indicators in the Swedish economy declined slightly during the period January to March, but the levels point to continued strong – though declining – economic development. The drop in confidence was most evident among households, mostly owing to expectations of higher inflation and rising mortgage rates. Businesses have a more stable economic outlook, especially in manufacturing. • Confidence indicators often provide an early indication of how the economy will develop in the short term. Although there is a large degree of subjectivity when households and businesses are asked to evaluate economic conditions for themselves and in general, this may also be a strength, since it provides a signal of how these players will act. Research has shown that confidence indicators provide a reliable sign of economic development in the short term. Households more cautious despite robust Retail sales, Jan 00 – Feb 11 (Real annual change in %, trend) labour market 12 In the last month there have been a growing number of signals that the Swedish economy has 10 downshifted slightly compared with its strong growth 8 in late 2010. Household activity in particular seems to have slowed. This is happening against the 6 backdrop of rapidly rising prices, not least for food and energy-related commodities, and rising interest 4 expenses. As a result, household consumption, 2 which to date has been an important component in the economic recovery, could weaken. 0 Retail sales reported in February were relatively -2 Total Mostly f ood Mostly durables weak, which is somewhat surprising since the tough -4 winter weather had presumably limited volume jan-00 jan-02 jan-04 jan-06 jan-08 jan-10 growth in December and January. Durables are still growing the most, although the rate of increase Sources: SCB and Swedish Retail Institute. there has fallen as well. Rising prices and interest rates are probably making households more Lending growth to households also continued to fall cautious. during the first months of the year, from 7.7% in January to 7.5% in February. At the same time household rates on new loans are rising and reached a level of 3.5% last month, compared with Economic Research Department, Swedbank AB (publ), 105 34 Stockholm, tfn 08-5859 1000 E-mail: ek.sekr@swedbank.se www.swedbank.se. Responsible publisher: Cecilia Hermansson, +46 8-5859 7720. Magnus Alvesson, +46 8-5859 3341, Jörgen Kennemar, +46 8-5859 7730

- 2. The Swedish Economy Monthly letter from Swedbank’s Economic Research Department, continued No. 3 • 31 March 2011 2.0% in February 2010. As a result, household Confidence indicators point to slowdown interest expenses will rise in the years ahead from a A number of confidence indicators have also begun historically low level of 4.4% of disposable income in to turn lower during the first months of the year, 2010. Business lending grew at a slower rate in the which may be a signal that the economic recovery is beginning of the year, by less than 2% annually losing steam. For example, the National Institute of during January and February. Economic Research's Economic Tendency Indicator Lending and interest rates, Jan 05 – Feb 11 fell slightly during the first three months of the year. (Annual change in % unless otherwise indicated) It should be noted, however, that levels remain very high from a historical perspective, which points to 20% 7% continued economic expansion, though at a slightly 6% slower rate. 15% 5% Economic tendency Indicator, Jan 00 – Mar 11 10% (Index) 4% 120 5% 3% 110 0% 2% 100 Households -5% 1% Companies 90 Interest rate, households (%, new loans, rs) -10% 0% 80 jan-05 jan-07 jan-09 jan-11 Source: Statistics Sweden. 70 At the same time the labour markets continued to 60 develop strongly. Not least hours worked increased in January and February, but also employment jan-00 jan-02 jan-04 jan-06 jan-08 jan-10 numbers. The positive payroll trend that began Source: National Institute of Economic Research. during the first quarter last year therefore continued. Household consumption rose at a faster rate than Household sentiment has dipped since the start of disposable income, however, and the savings ratio 2011, especially when it comes to confidence in fell from 12.9% in 2009 to 10.8% in 2010. As prices their own financial situation, but also with regard to and interest expenses increase, households are the Swedish economy as a whole. Most notable was expected to tighten their budgets, which will affect their growing fear of inflation. In March households their desire to spend. expected prices to rise by 3.4% within 12 months, which is a significant upward revision compared with Household disposable income, consumption and payroll, Q1 January and February, when the corresponding 05 – Q4 10 (Annual change in %) figure was around 3%. Expectations of higher mortgage rates increased as well, to 4.5% from 10.0 4.2% in February. 8.0 6.0 4.0 2.0 0.0 Disposable income Consumption Payroll -2.0 2006Q1 2007Q1 2008Q1 2009Q1 2010Q1 Source: Statistics Sweden. 2 (4)

- 3. The Swedish Economy Monthly letter from Swedbank’s Economic Research Department, continued No. 3 • 31 March 2011 Confidence indicators, Jan 00 – Mar 11 indicators are seen as more of an up-to-the-minute (Net balance) reflection of current conditions. In addition, 40 confidence indicators include more qualitative data, 30 where respondents are encouraged to assess their 20 own financial situation. Although there is a downside, since the information may be subjective, 10 it also has some value in that it provides an 0 indication of how people can be expected to act in ‐10 the near future. ‐20 Companies Households It is important to distinguish between confidence ‐30 indicators where people are asked how they feel ‐40 about the economy, their own and in general, and jan‐00 jan‐02 jan‐04 jan‐06 jan‐08 jan‐10 short-term indicators. The latter include Swedbank’s Source: National Institute of Economic Research. purchasing managers index, where purchasing managers indicate what has happened in areas Business confidence rose in manufacturing. important to their industry such as order bookings Components such as order bookings, production and production rates. This is based on actual growth and employment all increased. In other results, not expectations of how production – and by sectors, confidence indicators declined, although extension the economy – will change. that varied by component. In the construction industry, the labour shortage was cited as an Research has shown that confidence indicators important reason why confidence fell slightly. often provide a relatively good barometer of future Among retailers the sales index retreated, while economic development.1 This type of survey among service companies every component provides a fairly good picture of short-term GDP remained strong, though slightly below the previous growth, so the information is often of value to month. Despite slightly weaker development during economic analysis, as well as to corporate decision- the first three months of the year, index numbers makers. remain at levels that point to continued strong economic development. Magnus Alvesson Confidence indicators provide a quick snapshot of the economy 1 For Swedish data, see, e.g., “Business survey data: Do they Changes in confidence indicators often draw the help in forecasting the macro economy?” Hansson, Jansson and attention of economists and the media. It is Löf, 2003. For European conditions, see “Can confidence generally felt that direct surveys of economic players indicators be useful to predict short term real GDP growth”, Mourougane and Roma, ECB, 2002. provide a more timely picture of current economic conditions than conventional statistics. Official figures are often published later, while confidence Swedbank Economic Research Department Swedbank’s monthly The Swedish Economy newsletter is published as a service SE-105 34 Stockholm, Sweden to our customers. We believe that we have used reliable sources and methods in Phone +46-8-5859 7740 the preparation of the analyses reported in this publication. However, we cannot ek.sekr@swedbank.se guarantee the accuracy or completeness of the report and cannot be held www.swedbank.se responsible for any error or omission in the underlying material or its use. Readers Legally responsible publisher are encouraged to base any (investment) decisions on other material as well. Cecilia Hermansson, +46-8-5859 7720 Neither Swedbank nor its employees may be held responsible for losses or Magnus Alvesson, +46-8-5859 3341 damages, direct or indirect, owing to any errors or omissions in Swedbank’s Jörgen Kennemar, +46-8-5859 7730 monthly The Swedish Economy newsletter. 3 (4)

- 4. Den Svenska Ekonomin Månadsbrev från Swedbanks Ekonomiska sekretariat, fortsättning Nr xx • 2010 xx xx 4 (4)