JLL Pittsburgh Office Insight & Statistics - Q2 2020

•

0 j'aime•60 vues

COVID-19 delays most projects in the second quarter, but activity begins to return in June.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (20)

JLL Pittsburgh Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q4 2017

JLL Pittsburgh Office Insight & Statistics - Q4 2017

JLL Pittsburgh Office Insight & Statistics - Q4 2019

JLL Pittsburgh Office Insight & Statistics - Q4 2019

JLL Pittsburgh Office Insight & Statistics - Q3 2019

JLL Pittsburgh Office Insight & Statistics - Q3 2019

JLL Pittsburgh Office Insight & Statistics - Q1 2019

JLL Pittsburgh Office Insight & Statistics - Q1 2019

JLL Grand Rapids Office Insight & Statistics - Q4 2019

JLL Grand Rapids Office Insight & Statistics - Q4 2019

Cushman & Wakefield Montreal Americas Marketbeat Office Q12019 #CRE #RealEstate

Cushman & Wakefield Montreal Americas Marketbeat Office Q12019 #CRE #RealEstate

JLL Cincinnati Office Insight & Statistics - Q2 2016

JLL Cincinnati Office Insight & Statistics - Q2 2016

Similaire à JLL Pittsburgh Office Insight & Statistics - Q2 2020

Similaire à JLL Pittsburgh Office Insight & Statistics - Q2 2020 (20)

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

JLL Pittsburgh Office Insight & Statistics - Q3 2021

JLL Pittsburgh Office Insight & Statistics - Q3 2021

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

JLL Grand Rapids Office Insight & Statistics - Q2 2018

JLL Grand Rapids Office Insight & Statistics - Q2 2018

JLL Pittsburgh Office Insight & Statistics - Q1 2017

JLL Pittsburgh Office Insight & Statistics - Q1 2017

JLL Grand Rapids Office Insight & Statistics - Q3 2018

JLL Grand Rapids Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q3 2017

JLL Pittsburgh Office Insight & Statistics - Q3 2017

JLL Pittsburgh Industrial Insight & Statistics - Q4 2019

JLL Pittsburgh Industrial Insight & Statistics - Q4 2019

Plus de Tobiah Bilski

Plus de Tobiah Bilski (13)

JLL Pittsburgh Industrial Insight & Statistics - Q4 2021

JLL Pittsburgh Industrial Insight & Statistics - Q4 2021

JLL Pittsburgh Industrial Insight & Statistics - Q3 2021

JLL Pittsburgh Industrial Insight & Statistics - Q3 2021

JLL Pittsburgh Industrial Insight & Statistics - Q2 2021

JLL Pittsburgh Industrial Insight & Statistics - Q2 2021

JLL Pittsburgh Industrial Insight & Statistics - Q1 2021

JLL Pittsburgh Industrial Insight & Statistics - Q1 2021

JLL Pittsburgh Industrial Insight & Statistics - Q4 2020

JLL Pittsburgh Industrial Insight & Statistics - Q4 2020

JLL Pittsburgh Industrial Insight & Statistics - Q3 2020

JLL Pittsburgh Industrial Insight & Statistics - Q3 2020

JLL Pittsburgh Industrial Insight & Statistics - Q3 2019

JLL Pittsburgh Industrial Insight & Statistics - Q3 2019

JLL Pittsburgh Industrial Insight & Statistics - Q2 2019

JLL Pittsburgh Industrial Insight & Statistics - Q2 2019

JLL Pittsburgh Industrial Insight & Statistics - Q1 2019

JLL Pittsburgh Industrial Insight & Statistics - Q1 2019

JLL Pittsburgh Industrial Insight & Statistics - Q4 2018

JLL Pittsburgh Industrial Insight & Statistics - Q4 2018

JLL Pittsburgh Industrial Insight & Statistics - Q3 2018

JLL Pittsburgh Industrial Insight & Statistics - Q3 2018

JLL Pittsburgh Industrial Insight & Statistics - Q2 2018

JLL Pittsburgh Industrial Insight & Statistics - Q2 2018

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

Dernier

Dernier (20)

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

Call Girls In Sarai Rohilla ☎️8447779280{Sarai Rohilla Escort Service In Delh...

Call Girls In Sarai Rohilla ☎️8447779280{Sarai Rohilla Escort Service In Delh...

Cheap Rate ✨➥9582086666▻✨Call Girls In Gurgaon Sector 1 (Gurgaon)

Cheap Rate ✨➥9582086666▻✨Call Girls In Gurgaon Sector 1 (Gurgaon)

Call girls in Shakti Nagar Delhi~8447779280°/=@/ Short 1500 Night 6000}ESCORT...

Call girls in Shakti Nagar Delhi~8447779280°/=@/ Short 1500 Night 6000}ESCORT...

Low Rate ✨➥9711108085▻✨Call Girls In East Of Kailash (E.K) (Delhi)

Low Rate ✨➥9711108085▻✨Call Girls In East Of Kailash (E.K) (Delhi)

Low Rate ✨➥9582086666▻✨Call Girls In Gurgaon Sector 21 (Gurgaon)

Low Rate ✨➥9582086666▻✨Call Girls In Gurgaon Sector 21 (Gurgaon)

Call Girls in Maurice Nagar (Delhi) ꧁8447779280꧂ Female Escorts Service in De...

Call Girls in Maurice Nagar (Delhi) ꧁8447779280꧂ Female Escorts Service in De...

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Low Rate Call girls in Sant Nagar{Delhi }8447779280} Service Escorts In South...

Low Rate Call girls in Sant Nagar{Delhi }8447779280} Service Escorts In South...

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

Call girls In Rana Pratap Bagh {Delhi ↫8447779280↬Escort Service (Delhi)

Call girls In Rana Pratap Bagh {Delhi ↫8447779280↬Escort Service (Delhi)

JLL Pittsburgh Office Insight & Statistics - Q2 2020

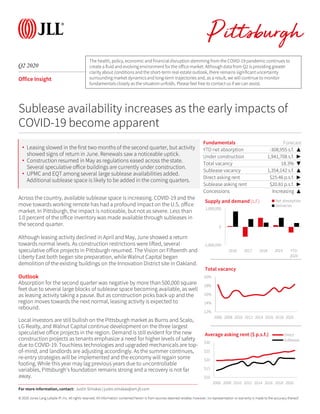

- 1. © 2020 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q2 2020 Pittsburgh Office Insight Across the country, available sublease space is increasing. COVID-19 and the move towards working remote has had a profound impact on the U.S. office market. In Pittsburgh, the impact is noticeable, but not as severe. Less than 1.0 percent of the office inventory was made available through subleases in the second quarter. Although leasing activity declined in April and May, June showed a return towards normal levels. As construction restrictions were lifted, several speculative office projects in Pittsburgh resumed. The Vision on Fifteenth and Liberty East both began site preparation, while Walnut Capital began demolition of the existing buildings on the Innovation District site in Oakland. Outlook Absorption for the second quarter was negative by more than 500,000 square feet due to several large blocks of sublease space becoming available, as well as leasing activity taking a pause. But as construction picks back up and the region moves towards the next normal, leasing activity is expected to rebound. Local investors are still bullish on the Pittsburgh market as Burns and Scalo, LG Realty, and Walnut Capital continue development on the three largest speculative office projects in the region. Demand is still evident for the new construction projects as tenants emphasize a need for higher levels of safety due to COVID-19. Touchless technologies and upgraded mechanicals are top- of-mind, and landlords are adjusting accordingly. As the summer continues, re-entry strategies will be implemented and the economy will regain some footing. While this year may lag previous years due to uncontrollable variables, Pittsburgh’s foundation remains strong and a recovery is not far away. Fundamentals Forecast YTD net absorption -308,955 s.f. ▲ Under construction 1,941,708 s.f. ▶ Total vacancy 18.3% ▼ Sublease vacancy 1,354,142 s.f. ▲ Direct asking rent $25.46 p.s.f. ▶ Sublease asking rent $20.81 p.s.f. ▶ Concessions Increasing ▲ -1,000,000 0 1,000,000 2016 2017 2018 2019 YTD 2020 Supply and demand (s.f.) Net absorption Deliveries Sublease availability increases as the early impacts of COVID-19 become apparent 12% 14% 16% 18% 20% 2006 2008 2010 2012 2014 2016 2018 2020 Total vacancy For more information, contact: Justin Simakas | justin.simakas@am.jll.com • Leasing slowed in the first two months of the second quarter, but activity showed signs of return in June. Renewals saw a noticeable uptick. • Construction resumed in May as regulations eased across the state. Several speculative office buildings are currently under construction. • UPMC and EQT among several large sublease availabilities added. Additional sublease space is likely to be added in the coming quarters. $10 $15 $20 $25 $30 2006 2008 2010 2012 2014 2016 2018 2020 Average asking rent ($ p.s.f.) Direct Sublease The health, policy, economic and financialdisruption stemming from the COVID-19 pandemic continues to create a fluid and evolving environment for the office market. Although data from Q2 is providing greater clarity about conditions and the short-term real estate outlook, there remains significant uncertainty surrounding market dynamics and long-term trajectories and, as a result, we will continue to monitor fundamentalsclosely as the situation unfolds. Please feel free to contact us if we can assist.

- 2. © 2020 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Class Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD Completions (s.f.) Under Development (s.f.) Northern I-79 / Cranberry Totals 4,376,907 5,577 106,081 2.4% 15.0% 21.0% $25.75 0 0 East Totals 3,053,814 -56,532 -35,774 -1.2% 26.1% 26.4% $20.13 0 0 North Totals 3,751,808 -71,273 -109,279 -2.9% 12.9% 13.5% $19.33 0 0 South Totals 2,311,420 -41,091 -14,121 -0.6% 14.1% 14.2% $20.15 0 140,000 Southpointe Totals 2,972,107 -8,184 -11,978 -0.4% 16.7% 19.5% $21.57 0 40,000 West Totals 7,229,171 -131,194 -73,032 -1.0% 17.4% 20.9% $22.00 0 220,000 Suburban Totals 23,695,227 -302,697 -138,103 -0.6% 17.0% 19.7% $21.67 0 400,000 CBD Totals 18,969,985 -244,900 -273,241 -1.4% 16.1% 18.3% $27.87 0 0 Fringe Totals 8,715,084 -32,640 106,542 1.2% 14.9% 18.4% $29.01 214,671 648,737 Oakland / East End Totals 2,334,209 -9,059 -4,153 -0.2% 4.4% 4.4% $35.72 0 892,971 Urban Totals 30,019,278 -286,599 -170,852 -0.6% 14.9% 17.3% $28.54 214,671 1,541,708 Pittsburgh Totals 53,714,505 -589,296 -308,955 -0.6% 15.8% 18.3% $25.46 214,671 1,941,708 Northern I-79 / Cranberry A 3,691,749 -10,935 93,582 2.5% 14.0% 21.2% $26.46 0 0 East A 1,580,784 -52,639 -32,220 -2.0% 31.1% 31.5% $21.46 0 0 North A 809,347 -15,618 -4,321 -0.5% 11.1% 11.3% $23.84 0 0 South A 0 0 0 0.0% 0.0% 0.0% $0.00 0 140,000 Southpointe A 1,909,754 -61,505 -57,893 -3.0% 10.1% 13.9% $22.97 0 40,000 West A 3,943,914 -88,831 -67,566 -1.7% 13.7% 18.6% $24.24 0 220,000 Suburban A 11,935,548 -229,528 -68,418 -0.6% 15.3% 19.9% $23.93 0 400,000 CBD A 13,498,998 -253,980 -315,733 -2.3% 15.4% 18.3% $30.42 0 0 Fringe A 2,880,141 -872 103,394 3.6% 8.0% 12.0% $36.96 214,671 648,737 Oakland / East End A 1,149,696 4,133 6,272 0.5% 6.4% 6.4% $38.35 0 892,971 Urban A 17,528,835 -250,719 -206,067 -1.2% 13.6% 16.5% $32.27 214,671 1,541,708 Pittsburgh A 29,464,383 -480,247 -274,485 -0.9% 14.3% 17.8% $28.97 214,671 1,941,708 Northern I-79 / Cranberry B 685,158 16,512 12,499 1.8% 20.4% 20.4% $22.38 0 0 East B 1,473,030 -3,893 -3,554 -0.2% 20.7% 21.1% $17.84 0 0 North B 2,942,461 -55,655 -104,958 -3.6% 13.4% 14.0% $17.92 0 0 South B 2,311,420 -41,091 -14,121 -0.6% 14.1% 14.2% $20.15 0 0 Southpointe B 1,062,353 53,321 45,915 4.3% 28.7% 29.7% $20.71 0 0 West B 3,285,257 -42,363 -5,466 -0.2% 21.9% 23.7% $20.47 0 0 Suburban B 11,759,679 -73,169 -69,685 -0.6% 18.6% 19.4% $19.75 0 0 CBD B 5,470,987 9,080 42,492 0.8% 18.0% 18.4% $22.85 0 0 Fringe B 5,834,943 -31,768 3,148 0.1% 18.3% 21.6% $24.47 0 0 Oakland / East End B 1,184,513 -13,192 -10,425 -0.9% 2.5% 2.5% $22.71 0 0 Urban B 12,490,443 -35,880 35,215 0.3% 16.7% 18.4% $23.66 0 0 Pittsburgh B 24,250,122 -109,049 -34,470 -0.1% 17.6% 18.9% $21.69 0 0 Q2 2020 Office Statistics Pittsburgh For more information, contact: Justin Simakas | justin.simakas@am.jll.com