Basic accounting unit3

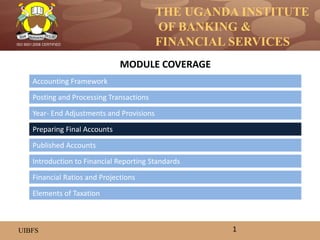

- 1. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Accounting Framework Posting and Processing Transactions Year- End Adjustments and Provisions Preparing Final Accounts Introduction to Financial Reporting Standards Published Accounts MODULE COVERAGE 1 Financial Ratios and Projections Elements of Taxation

- 2. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED At the end of each financial year, a bank prepares and presents its financial statements that show its financial performance over the financial period and the financial position at the close of the year. This is intended to show how prudently the financial resources have been managed. At a minimum, financial statements of a banking institution include: (i) The Balance Sheet - showing the organisation’s financial position as at the end of the period (ii) The Profit and Loss Account/Income Statement -showing performance for a stated period and the resulting profit or loss realized during the period (iii)The Cash flow Statement showing the movement of cash in and out of the organization for a stated period. (iv)Loan Portfolio / Asset Quality Report (by whatever name a bank chooses to call it) showing the detailed updates on the status of the loan portfolio. Below is a detailed description of the four components of the financial statements. 2

- 3. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED The Balance Sheet The Balance sheet is a snap shot of a bank’s asset and liability position at a point in time. It reflects: What the bank owns and what is owed to it (assets), what it owes other persons or entities (liabilities) The difference between the two above is the equity or the net worth. It is the capital or the claim on the bank by its owners. Categorization of balance sheet items Current Assets – These are assets that are owned by the bank and which are expected to last for not more than a year in their current form. They are all assets that are expected to expire, be used up or change form within one year. Non-current Assets / fixed assets – These are assets that are owned and held by the bank, expected to last for more than one year in their current form. Current Liabilities – These are debts / obligations of the bank which must be settled in the next 12 months from the balance sheet date. Non- Current Liabilities/Long term liabilities- These are debts or obligations that must be settled after more than one year from the balance sheet date. Equity- This represents the owners/ shareholders funds in the bank. Equity is the total claim on the business by its owners. Equity = Total Assets – Total Liabilities. 3

- 4. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Typical current assets of a bank: • Cash • Deposits in financial institutions • Deposits with BoU • Loan portfolio • Capital market investments securities • Government securities • Other short term assets Typical non-current assets of a bank: • Long term investments • Fixed assets • Accumulated depreciation • Net fixed assets • Total assets Typical current liabilities of a bank: • Customers’ deposits • Amounts due to other banks • Due to BoU • Due to other institutions • Other current liabilities Typical non-current liabilities of a bank: • Time deposits > 1 year • Long term bonds issued • Long – term debt • Other long – term liabilities 4

- 5. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Typical equity items in a bank’s balance sheet: • Paid up share capital (funds injected in the bank by shareholders as capital) • Retained profit/ revenue reserves (undistributed profit accumulated) • Special reserves (special capital accounts created for statutory or other purposes) • Other capital accounts Below is a simple example of a typical balance sheet structure. 5

- 6. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED ASSETS UGX Current Assets: • Cash on hand and in banks (a ) • Deposits in Financial Institutions (b) • Short Term Investments (c) • Gross Loan Portfolio (d) • Less: Loan Loss Reserve (e) • Other Short Term Assets (f) Total Current Assets –g (sum a to f) 6

- 7. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED ASSETS UGX Non Current Assets • Long term investments (h) • Fixed assets (i) • Less: Accumulated Depreciation (j) • Net fixed assets (k): (i-j) Total Non Current Assets (l): (h+k) TOTAL ASSETS – m (g+l) 7

- 8. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED EQUITY AND LIABILITIES UGX Current Liabilities • Customers’ deposits • Amounts due to other banks • Due to BoU • Due to other institutions • Other current liabilities Total Current Liabilities (n) Non Current Liabilities • Time deposits > 1 year • Long term bonds issued • Long – term debt • Other long – term liabilities Total Non Current Liabilities (o) Total Liabilities (p) XX 8

- 9. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED EQUITY UGX Paid up share capital Retained profit/ revenue reserves Special reserves Other capital accounts Total Equity (q) TOTAL LIABILITIES & EQUITY (p+q) XX Note: In a balance sheet, assets should always be equal to the sum of liabilities and equity. 9

- 10. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED The Income Statement • The Income Statement is a summary of incomes earned and expenses incurred during the financial period, with the bottom line being the profit or loss realized. • The Income Statement, which is also known as Profit and Loss Account, summarizes all the financial effects of transactions during a specific period of time, usually a month, quarter or year. • It records the income that was received and expenses incurred during the period, showing the profit earned or loss incurred (difference between income & expenses). Categorization of income statement items • Income • Operating expenses • Net income from operations before tax • Net income from operations after tax • Financing expenses • Grant income (if applicable) Typical components of a bank’s income • Interest income from loans • Fee income from loans • Income from investments • Other operating income • Total operating income 10

- 11. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Interest income from loans - This is interest received on loans advanced by the bank to its customers. Interest income can be recorded on accrual basis (interest due but not yet received) or cash basis (when the cash is received). Fee income from loans - These are fees and commissions, including penalty fees (if applicable) received on loans advanced by the bank. Income from investments -This is revenue from interest, fees, dividends or other payments generated by financial assets other than the loan portfolio. Examples are interest earned on bearing deposits with other institution, certificates of deposits, Treasury Bills and Government Bonds, and dividends earned from the bank’s equity investments in other organizations. This includes not only interest received in cash but also interest accrued but not yet received. Other operating income - Revenue generated from sources other than the above. This may include rent received, commission on services to other organizations, fee income unrelated to loans (e.g. money transfer/remittance fees, charges for school fees collection, commission/fees charged for electricity & water bills collection. Total operating income - This is the summation of all operating income during the period or year-to-date. 11

- 12. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Financing Expenses - These arise where an institution acquires debt in form of a loan, issues a bond or other debt instrument on which it pays interest and/or fees. Financing expenses are costs the bank pays to access and use such debt. Examples of financing cost are interest on loans payable, loans (payable) processing fees and commitment fees and interest paid on bond issued by the bank. Below is a list of the line items under financing expenses of an income statement: i. Interest and fees paid on loans (market and concessional) ii. Interest and fees paid on bonds iii. Interest paid on fixed deposit, savings and current accounts (where applicable) iv. Interest paid on borrowings from BoU. v. Total financing expenses (sum of all the above) Gross financial margin- This is the difference between what is earned by the bank by providing financial services and its financing costs. It therefore, reflects how well the bank is performing in terms of generating a sufficient ‘spread’, which is the difference between total operating revenue and total financing expenses. Gross Financial Margin = Total Operating Revenue – Total Financing Expenses 12

- 13. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Provision for Loan Losses - A provision is an expense account created for potential loss in asset value or crystallization of claims against the bank. • The loan loss provision is an example of such, created in anticipation of potential default by borrowers of some loans. This is a non-cash expense that creates or increases the loan loss reserve on the balance sheet. • This expense may be comprised of general and specific provisions. The general provision is calculated as a percentage of the value of the Gross Loan portfolio that is at risk of default based on aging analysis. • Specific provisions are made for specific loans. It is common to use the term provision for loan losses and loan loss reserve interchangeably. To avoid confusion between this expense and the loan loss reserve, analysts prefer to use the term reserve for the balance sheet account (accumulated provisions over the years as the loan portfolio quality changes), and the term provision for the expense account (additional or incremental loan loss reserves created during the accounting period). • It is also helpful to include the word expense when referring to this latter account. The provision for loan loss expense should always be separated from other operating costs. 13

- 14. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Net Financial Margin (NFM) - Represents the difference between the incomes generated from the portfolio and other investments, and the costs directly associated with those investments during the period (Financing expenses and provision for loan losses). This represents the amount of income available to cover operating expenses for the period or year-to-date. Operating expenses - Operating expenses include the following items; (costs incurred by the bank in its operations, other than financing or capital costs). i. Personnel expenses ii. Rent and utilities iii. Travel and transport iv. Stationery and office supplies v. Other operating expenses vi. Depreciation (a non-cash expense that is determined by estimating the useful life of each asset and expensing a portion of the useful life for the period). Depreciation represents a decrease in the value of property/assets and accounts for the portion of useful lifetime that is expensed during each accounting period. Net Income from operations before tax- Net Income from Operations =Total Operating Income - Total Expenses. 14

- 15. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Income Taxes - These include all taxes paid on net income or other measure of profits as defined by tax authorities. Income tax for a bank, like is the case with any other incorporated entity is levied on net profit. It is known as corporation tax. In Uganda, this is currently 30% of pre-tax profit. Net income from Operations after Tax = Net profit from operations - tax Grant income A grant is a donation made by an organization or person to the bank. Major categories are; i. Grant income for loans to specific causes/ sectors ii. Grant income for fixed assets iii. Grant income for operating expenses iv. Un restricted grant income Grant income is usually: Recorded on the Income statement for memorandum purposes only. Not included in the retained surplus / deficit current year 15

- 16. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Grant income for loans – These are funds donated to the Banking Institution to capitalize the loan fund, that is, which are restricted to use as lending funds and cannot be used for operating expenses. This amount may be disclosed on the Income Statement for memorandum purposes only and is not included in the retained surplus/deficit. It normally goes to the balance sheet as separate item, commonly called “Revolving Funds” under liabilities or equity. Grant income for fixed assets – These are funds donated to the Banking Institution to purchase fixed assets, which are restricted to fixed asset purchases and cannot be used for operating expenses. This amount is usually disclosed on the Income Statement for memorandum purposes only and is not included in the retained surplus/deficit of the current year. It should prudently, go to the equity portion of the balance sheet as a non – distributable reserve. 16

- 17. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Grant income for operating expense. – These are funds donated to the bank to cover operating expenses and supplement earned income. This amount is recorded on the Income Statement for memorandum purposes only and is not included in the retained surplus/deficit. It goes to the balance sheet as a reserve. Unrestricted grant income – Unrestricted funds donated to the bank to cover any need including funds for loan capital, purchase of fixed assets, or operating shortfalls. This amount is recorded on the Income Statement for memorandum purposes only and is not included in the retained surplus/ deficit Total grants received - This represents all the grant income to support the delivery of financial services (and non –financial services if applicable). Net Income after Grants (for the period) - Summation of net income after tax and total grants received after the period. 17

- 18. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Typical Income Statement Structure Income UGX • Interest and fee income • Investment income • Other operating income Total operating income Operating Expenses • Personnel expenses • Rent & Utilities • Travel & Transport • Depreciation • Stationary & Office Supplies • Other operating expenses Total Operating Expenses Net Income from Operations xxx Financing expenses UGX • Interest and charges paid on loan • Interests paid on customer deposits Total financing expenses Gross Financial Margin Provision for Loan Losses Net Financial Margin Total income xxx Less: Income Tax Net income after tax Grants received Income after grants for period xx 18

- 19. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED The Cash Flow Statement A cash flow statement is a logical summary statement of how cash flowed in and out of the business (bank) during the reporting period. Information about the cash flow is useful in providing users of financial statements with a basis to assess the ability of the enterprise to generate cash and other liquid assets and its utilization of the cash. The economic decisions that are taken by users require an evaluation of the ability of an enterprise to generate cash and cash equivalents and the timing and certainty of their generation. Typical Components of a cash flow statement; Cash flow from operating activities These are the principal revenue producing activities of the enterprise. The amount of the cash flows arising from operating activities is an indicator of the extent to which the operations of the enterprise have generated sufficient cash flows to repay loans, maintain the operating capability of the enterprise, pay dividends and make new investments without recourse to external sources of financing. Cash flows from operating activities are primarily derived from the principal revenue- producing activities of the enterprise. Therefore, they generally result from the transactions and other events that enter into the determination of net profit or loss. 19

- 20. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Investing Activities These are cash flows that represent the extent to which expenditures have been made for resources intended to generate future income and cash flows. Examples include cash payments to acquire equity or debt instruments in other companies/ enterprises. They involve acquisition and disposal of long term assets and other investments. Financing Activities These are activities that result in changes in the size and composition of equity capital and borrowings of the enterprise. They are useful in predicting claims on future cash flows arising from financing activities. Cash and Cash Equivalents Cash comprises cash on hand and demand deposits (current accounts with other banks and with BoU). Cash equivalents are short term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant amount of changes in value. Cash equivalents are held for the purpose of meeting short term cash commitments rather than for investment or other purposes. 20

- 21. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Benefits of Cash flow Information Information about the cash flow of an enterprise is useful in providing users of financial statements with a basis to assess the ability of the enterprise to maintain healthy liquidity. The economic decisions that are taken by users require an evaluation of the ability of the enterprise to generate cash. A cash flow statement, when used in conjunction with the rest of the financial statements, provides information for this. It indicates the reporting entity’s liquidity, solvency and ability to manage liquid assets in order to adapt to changing circumstances and opportunities. Historical cash flow information is often used as an indicator of the amount, timing and certainty of future cash flows. It is also useful in checking the accuracy of past assessments of future cash flows and in examining the relationship between profitability and net cash flow and the impact of changing prices. The difference between the income statement and the cash flow statement are: 1. The income statement includes all costs incurred or reasonable income earned, whether or not the actual cash has changed hands while the cash flow statement only includes actual cash inflows and outflows. 21

- 22. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED 2. The income statement only includes revenue and expenditure items which affect the profits, while a cash flow statement includes all cash-involving transaction- including capital expenses like fixed asset acquisition or disposal. 3. The income statement includes estimated non-cash expenses like fixed asset depreciation and provisions, which the cash flow statement does not include. 4. The income statement is the aggregated (average) incomes or costs over a period of time (usually a year) while the cash flow statement is period by period (daily, weekly or monthly) incomes or costs as they occur. Preparing the cash flow statement There are two methods for preparing the cash flow statements. a. The direct method; by which major classes of gross cash receipts and gross cash payments are analyzed to determine where each cash movement should be reported in order to arrive at the net cash effect for that particular line item for the period. b. The indirect method, which works back from net profit or loss, adding or deducting non cash transactions, deferrals or accruals and items of income or expense associated with investing and financing cash flows to arrive at net cash flow. Both methods yield the same result. 22

- 23. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Cash Inflows: • Interest and fee income • Investment income • Cash from capital investment inflows • New loans payable • Other operating income • Donations/Grants Total cash inflows xxx Cash outflows: • Financing expenses • Investments • Operating expenses • Non operating expenses Total cash out flows xxx Net Cash flow xxx Opening Cash Balance xxx Closing Cash Balance xxx 23 Preparing the cash flow- Direct method

- 24. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Cash Flow from Operations: • Cash receipts/repayments from clients • Cash paid to employees • Cash paid for operating expenses • Taxes paid • Interest paid Net Cash Flow from Operations Cash Flow from Investing Activities • Purchases of non current assets • Proceeds from sale of non current assets • Purchases of stock or other securities • Proceeds from the sale or redemption of investments Net Cash Flow from Investing Activities • Cash Flow from Financing Activities • Proceeds from loans, notes, and other debt instruments • Installment payments on loans or other debt repayment • Cash received from the issuance of stock or equity in the business • Dividend payments, purchases of treasury stock or returns of capital Net Cash Flow from Financing Activities Net increase in cash & cash equivalents for the period xxx Cash & cash equivalents (beginning of period) xxx Net cash flow (end of the period) xxx 24 Preparing the cash flow- Indirect Method

- 25. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Loan portfolio reports Although it is not a mandatory requirement by the accounting profession, the portfolio report is vitally important for any financial institution. A portfolio report provides information about the lending activity of a bank. It provides information about the volume and quality of the portfolio. It usually also includes other key portfolio performance indicators (e.g. outreach, concentration and spread). A portfolio report should present the health of the portfolio, scale of late payment on loans of the end of the reporting period, and any measurement of late payment should be thoroughly explained. Information in a portfolio report usually includes: a. Number and value of loans outstanding at the end of the period b. Total value and number of loans disbursed during the period c. Outstanding balance of loans to different sectors d. Number and value of outstanding loan balances in arrears, value of payments in arrears e. Value of loans written off during period f. Portfolio aging analysis g. Pending loans (not yet booked in the system) h. Re-scheduled loans i. Information on loan terms, loan officers, savings accounts and balances, etc. 25

Notes de l'éditeur

- At the end of this unit, the students should be able to: Define and explain the key financial statements constituting the Final Accounts. Explain the meaning and significance of the line items under each financial statement.

- The method of recording interest received should be described in the notes to the financial statements, and should remain consistent across accounting periods. If a bank records interest on an accrual basis (which is the usual practice), this should generally stop if the loan becomes non- performing.

- Information about the specific components of historical operating cash flows is useful, in conjunction with other information, in forecasting future operating cash flows.