Boeing's Global Strategy

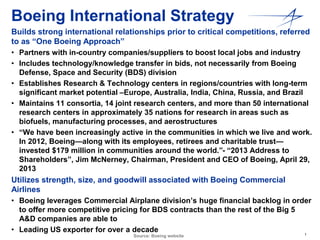

- 1. Boeing International Strategy Builds strong international relationships prior to critical competitions, referred to as “One Boeing Approach” • Partners with in-country companies/suppliers to boost local jobs and industry • Includes technology/knowledge transfer in bids, not necessarily from Boeing 1 Defense, Space and Security (BDS) division • Establishes Research & Technology centers in regions/countries with long-term significant market potential –Europe, Australia, India, China, Russia, and Brazil • Maintains 11 consortia, 14 joint research centers, and more than 50 international research centers in approximately 35 nations for research in areas such as biofuels, manufacturing processes, and aerostructures • “We have been increasingly active in the communities in which we live and work. In 2012, Boeing—along with its employees, retirees and charitable trust— invested $179 million in communities around the world.”- “2013 Address to Shareholders”, Jim McNerney, Chairman, President and CEO of Boeing, April 29, 2013 Utilizes strength, size, and goodwill associated with Boeing Commercial Airlines • Boeing leverages Commercial Airplane division’s huge financial backlog in order to offer more competitive pricing for BDS contracts than the rest of the Big 5 A&D companies are able to • Leading US exporter for over a decade Source: Boeing website

- 2. 2 Boeing General Facts • $81.7B in revenue (up $12.963B, or 19% from 2011) • $44.1B in International revenue, 54% of total revenue (Commercial + Defense, up 4% from 2011) • $7.8B in International BDS revenue, 24% of total BDS revenue (up 7% from 2011) • $390B total backlog (Commercial + Defense, up $34.8B, or 10% from 2011) • $71B total BDS backlog (up $11B, or 18% from 2011) • 42% of BDS division’s backlog from International customers • $70B in new orders for Commercial Airlines, $44B in new orders for BDS (combined, 36% of total backlog) • 70% of Boeing Commercial Airplanes division’s total backlog from International customers • $3.9B in net income (down $.12B, or 3% from 2011) Source: Boeing website

- 3. 3 Boeing Sales by Division (2012) Total Sales $81.7B $32,607 40% $49,127 60% $16,384 20% $7,584 9% $8,639 11% Boeing Defense, Space and Security Commercial Airplanes Boeing Military Aircraft Network & Space Systems Global Services & Support “2013 BDS priorities are: extend and grow our core business by bringing improved capability and affordability to our customers; expand global sales and operations; successfully execute our development programs, including the KC-46A Tanker; and use our market-based affordability efforts to fund investment in tomorrow’s capabilities and programs” Source: Boeing Annual Report 2012, Website Sales (in Millions)

- 4. 4 Boeing Global Footprint Canada U.S. UK France Hungary Italy Saudi Arabia Qatar UAE India Korea Singapore Australia China Japan Russia Countries with the Largest Boeing Presence Commercial + Defense – 174,400 employees in 70 Countries Defense – 59,000 employees • 28,000 suppliers and partners worldwide (Commercial + Defense) • Customers in 150 countries (Commercial + Defense) • Outside the US, Australia is Boeing’s largest operational footprint, with more than 3,000 employees; operates seven wholly owned subsidiaries under Boeing Australia Holdings Pty Ltd Source: Boeing website

- 5. 5 Boeing International Leadership President, Boeing International Senior Vice President, BD Shepard W. “Shep” Hill President, Boeing Australia & South Pacific Ian Thomas President, Boeing Brazil Donna Hrinak General Manager, Boeing Canada Operations Kevin Bartelson President, Boeing United Kingdom Sir Roger Bone President, Boeing Central & Eastern Europe Henryka Bochniarz President, Boeing China Bertrand-Marc Allen President, Boeing EU & NATO Antonio De Palmas President, Boeing France Yves Galland President, Boeing Germany & Northern Europe Matthew Ganz President, Boeing India Pratyush Kumar President, Boeing Israel David Ivry President, Boeing Italy Rinaldo Petrignani President, Boeing Japan George Maffeo President, Boeing Korea Patrick W. Gaines President, Boeing Southeast Asia Ralph (Skip) Boyce President, Boeing Middle East Jeff Johnson President, Boeing Saudi Arabia Ahmed Jazzar President, Boeing Turkey Bernard Dunn President, Boeing Russia/CIS Sergey Kravchenko Boeing Consultant, Latin America Source: Boeing Website Alexander F. Watson

- 6. 6 Boeing International • Boeing International is composed of country and regional executives in 20 offices worldwide, whose focus is to: – “Provide strategic council on political, economic, and industrial developments around the world” – “Collaborate with Government Operations to create an integrated view of domestic and global government issues and developments” – “Ensure good corporate citizenship around the globe by developing policies and procedures that comply with the diverse laws, customs, and business” • Looking to international business to compensate for declines in DoD spending, ultimate goal is 30% by the end of 2013, 35% by 2021 • Especially looking toward the Asia-Pacific region, specifically South Korea, India, and Japan; they expect this region to account for 50% of International BDS revenue in the next 10 years “I shared that our goal was to reach a sustained level of 30% of Boeing’s defense revenues coming from international sales over the next several years. Progress in this area is evident in that Boeing reported 24% international revenues in 2012 and an increase to 28% in the first quarter of 2013. This is up from 7% just five years ago. Perhaps most significant is the fact that 42% of Boeing's defense backlog of $70 billion is outside the U.S. One of the most important drivers behind our progress has been a true One-Boeing global approach, and we shared many real examples of how this is a unique advantage for us.” –Dennis Muilenburg, President and CEO Boeing Defense, Space & Security/ June 14, 2013 “Leveraging the international strengths of our company has been a high priority for several years, and the return on that investment in our people and resources has improved our results and expanded future opportunities… we are aggressively pursuing–and expanding–our share of growing international markets.” –Jim McNerney, Chairman, President and CEO of Boeing, April 29, 2013 Source: Boeing website

- 7. Australia In 2007, Boeing opened the Office of Australian Industry Capability (OAIC) in Seattle, WA “to match Australian-developed technology with global partners, leading to sales and collaboration opportunities. In order to identify where these opportunities lay, the OAIC along with Boeing Research and Technology have conducted technology assessments in Australia visiting a wide range of companies, universities, and government facilities.” Furthermore, Boeing Defense Australia (BDA) is an entirely separate BDS division focusing entirely on Australia, is now the country’s leading defense aerospace enterprise, with 1,300 employees in 16 locations throughout Australia. India In February 2009, Boeing opened the Boeing Analysis & Experimentation Center (A&E Centre) in partnership with Bharat Electronics Unlimited. In March 2009, Boeing opened its Boeing Research & Technology-India center, which is the focal point for all Boeing technology initiatives in the country, collaborating with Indian R&D organizations, government agencies, private defense agencies, and universities. South Korea Boeing currently has a strong working relationship with KAI Ltd., the Republic of Korea’s national aerospace company and sole source for all of the government’s military logistics and aerospace projects. KAI builds wings and forward fuselages for the F-15K program, and two years ago, KAI signed an agreement to develop a weapons bay for the Silent Eagle. Perhaps most importantly, however, is the significant goodwill they have established through partnerships with other Korean Commercial Airplane companies, such as Korean Air, a key supplier of composite structures and components for 787 and 747-8 airplane programs. In September 2012, Boeing opened its Avionics Maintenance, Repair, and Overhaul Center in Korea… Boeing works with ~20 companies in Korea, spending more than $250M annually. “Over the past half century of working in partnership with the Republic of Korea, Boeing has come to know Korea’s strong infrastructure and the excellent knowledge and talent base of the its people and industry. We can tap into that as we expand our presence locally and grow our operations while supporting Korea’s development objectives.” – Joe Song, VP of IBD for Asia- Pacific region of BDS. Brazil June 18, 2013/ “Embraer and Boeing sign an agreement to market Embraer’s KC-390 medium airlifter in limited international venues…Boeing will be the lead for KC-390 sales, sustainment and training opportunities in the USA, UK, and ‘select Middle East markets.’ ” Furthermore, in April, Boeing and Embraer signed an agreement to “cooperate in commercial airplane efficiency and safety, research and technology, and sustainable aviation biofuels.” These factors place Boeing in a far better position than either Dassault or Saab, especially considering the fact that Brazil is very focused on finally becoming the country of the future and dispelling the old joke about it’s continuous but unfulfilled hopes of technological equivalence with other economic world powers (Brazil does have the 6th largest economy in the world). Brazil insists on technology transfer for all defense agreements, and Boeing responded indirectly to this April 3, 2012, when it opened a new Aerospace Research and Technology Center in Brazil. Finally, Boeing selected Elbit systems on June 14, 2012, to produce the low-profile head-up display (LPHUD) that will be part of the Advanced Cockpit System for Boeing fighter jets, presenting “additional opportunities for Elbit Systems to develop advanced cockpit avionics capabilities at its Brazilian subsidiary, AEL Sistemas.” 7 Boeing International Relationships Source: Boeing website

- 8. 8 Recent Boeing Contracts (2012-2013) Saudi Arabia • June 20, 2013/ Boeing and Sikorsky Aircraft Corp. form equal-share joint venture to compete for sustainment for Saudi Arabia’s rotorcraft fleet • Nov. 2, 2012/ Boeing receives $3.5B contract for 68 F-15S to F-15SA conversion kits, and 4 base stand-up kits • Received LOA for 84 new Boeing F-15 fighters, 70 new AH-64E Apache helicopters, 36 AH-6i Apache helicopters, all together approx. $21B in sales India • Mid 2012 finalized order for 10 C-17 airlifters in a $4.1B deal for Indian Air Force (Largest deal between India and the US in history) South Korea • April 17, 2013/ S. Korea’s Defense Acquisition Program Administration (DAPA) announces $1.6B contract awarded to Boeing for 36 AH-64E Apache helicopters • Potential $7.3B program replacing South Korea’s fleet of 60 F-4 Phantoms, but in 30+ rounds of bidding by DAPA, neither Boeing nor LM meet price requirements, same situation with $.9B program replacing 20 maritime aircraft Australia • 24 F/A-18E/F Super Hornets, looking to purchase more than 10 P-8 Poseidon maritime aircraft General International Sales • 32 C-17s to Australia, Canada, India, Qatar, UAE, UK, and the Strategic Airlift Capability initiative of NATO and Partnership for Peace nations • “International F/A-18 demand remains promising and management spoke of "dozens and dozens" of potential sales (Brazil, Qatar, Malaysia cited but there are others). Management mentioned a per hour flight cost of $16,000 for the F/A-18E/F, which is substantially below that of the F-35” ($24,000/hour) – Capital Alpha Partners LLC Notes on Boeing’s Investor Conference from DC Defense Perspective, May 2012 Source: Boeing website, IHS Jane’s, Defense Industry Daily, DoD, Capital Alpha Partners LLC

- 9. 9 Raytheon International Strategy Emphasize accessibility, diversity of employees, “mid-range, high-value solutions” • “Raytheon has facilities, businesses and customers in nearly every corner of the globe. Day in and day out, members of our team interact with people from an extremely diverse range of backgrounds. Thus, diversity of talent and thought is the cornerstone of our ability to provide solutions to the global market…We continue to strive to build a culture around recognizing, respecting and leveraging individual and cultural differences. Yet, as the global environment rapidly changes and becomes even more competitive, the next steps in our companywide journey to inclusiveness will be critical.” • Seek to employ as many people from different countries and socio-economic backgrounds as possible, in order to better formulate (and market) their “Customer Focused” solutions to target international markets • Readily admit that “We compete worldwide with a number of U.S. and international companies in [defense] markets, some of which may have more extensive or more specialized engineering, manufacturing and marketing capabilities than we do in some areas.” • Instead of trying to sell “101%” solutions, they focus on “99%” solutions, going for the lower end of both product/service requirements and price, as a result they are quite successful internationally with countries operating with much smaller defense budgets than the US Utilize training services to build brand recognition internationally • Using Raytheon Professional Services LLC, they seek to get a foot in the door with training services for a very wide variety of industries, which are always well received, as they often are replacing outdated second or third-world business models with highly analyzed US business practices • Follow up with Air Traffic Management systems, radars, sensors, surveillance & targeting solutions, then move on to Integrated Air & Missile Defense systems, like the Patriot program Source: Raytheon Annual Report 2012, Website

- 10. 10 Raytheon General Facts • $24.4B in revenue (down $.38B, or 2% from 2011) • $6.2B in International revenue, 26% of total revenue, (highest in the A&D industry, but up only 1% from 2011, 3% from 2010) • $36.2B in total backlog (up $.9B, or 2.5% from 2011) • $12.7B in International backlog, 35% of total backlog (down $.3B, or 2% from 2011) • $1.9B in net income (up $.004B, or .2% from 2011) As of April 1, 2013: “The Raytheon Company structure will consist of four businesses: Intelligence, Information and Services, resulting from the combination of the Intelligence and Information Systems and Raytheon Technical Services businesses; and the Integrated Defense Systems, Missile Systems, and Space and Airborne Systems businesses, each of which will be expanded by the realignment of the former Network Centric Systems business operations.” Source: Raytheon Annual Report 2012, Website

- 11. 11 Raytheon Sales by Region and Division (2012) International Sales ($6.2B) $2,470 $1,252 Sales (in Millions) Sales (in Millions) $2,510 $18,182 United States Asia/Pacific Middle East/N. Africa Europe Total Sales $24.4B $5,037 19% $5,693 22% $5,333 20% $6,251 24% $4,058 15% Integrated Defense Systems Missile Systems Space & Airborne Systems Intelligence & Information Systems, Technical Services Network Centric Systems Source: Raytheon Annual Report 2012, Website

- 12. 12 Raytheon Global Footprint 68,000 employees in 19 countries Providing products and technical services to more than 100 countries Key Raytheon Locations Global companies established in the UK (Raytheon Systems Limited), Australia (Raytheon Australia), France (ThalesRaytheonSystems), Germany (Raytheon Anschütz), Spain (Raytheon Spain), and Canada (Raytheon Canada Limited), and maintains offices in 12 other countries Source: Raytheon Website Close-up of Raytheon locations in Europe & MENA Canada U.S. UK France Saudi Arabia UAE India Australia Spain Germany Oman Qatar

- 13. 13 Raytheon Leadership Raytheon Chairman & CEO William H. Swanson Exec. VP & COO Thomas A. Kennedy Senior Vice President Business Development CEO, Raytheon International Thomas M. Culligan Senior Vice President HR & Security Keith J. Peden Senior Vice President General Counsel & Secretary Jay B. Stephens Senior Vice President CFO David C. Wajsgras VP President, Integrated Defense Systems Daniel Crowley VP President, Intelligence, Information & Services Lynn Dugle VP President, Missile Systems Taylor Lawrence VP President, Space & Airborne Systems Richard Yuse VP Gen. Manager, Intelligence, Information & Services John Harris II VP & CIO Rebecca Rhoads VP Controller & CAO Mike Wood VP & Treasurer Richard Goglia VP Engineering, Tech.& Mission Assurance Mark Russell VP Contracts & Supply Chain David Wilkins VP Corporate Affairs & Communications Pamela Wickham VP Raytheon Company Evaluation Team Edward Miyashiro VP Internal Audit Lawrence Harrington VP Michael Hoeffler Source: Raytheon Website

- 14. 14 Raytheon International As US Defense market tightens its collective belt, Raytheon increasingly looks overseas for customers for its “mid-range, high value” defense solutions Raytheon Company Strategy: (points 2-5) • Leverage our domain knowledge in air, land, sea, space, and cyber for all markets. • Expand international business by building on our relationships and deep market expertise. • Build upon our Customer Focused mindset, further strengthening our company based on performance, relationships and solutions. • Deliver innovative supply chain solutions to accelerate growth, create competitive advantage and bring value to our global customers “Raytheon International, Inc. leads the company’s efforts to capture new overseas business, and coordinates the operations of its international locations. Recent bookings with civilian and military customers in Europe, Asia and the Middle East demonstrate Raytheon International’s successful strategy of pursuing a worldwide customer base.” “International sales were principally in the areas of air and missile defense systems, missile systems, airborne radars, naval systems, air traffic control systems, electronic equipment, computer software and systems, personnel training, equipment maintenance and microwave communications technology.” “International sales rose 10 percent in the quarter from a year earlier, and overseas sales will account for 28 percent of revenue this year, up from 26 percent in 2012” – Dave Wajsgras, CFO of Raytheon, 7/25/13 International Growth: “Because of the breadth of our offerings, our systems integration capability, the value of our solutions and our strong legacy in the international marketplace, we believe that we are well positioned to continue to grow our international business... We believe demand continues to grow for solutions in air and missile defense, air traffic management, precision engagement, homeland security, naval systems integration and ISR [Intelligence, Surveillance & Reconnaissance]. In addition, as coalition forces increasingly integrate military operations worldwide, we believe that our capabilities in network-enabled operations will continue to be a key discriminator in these markets.” “International sales of air and missile defense offerings helped the contractor boost [operating income] by 21% at its Integrated Defense Systems unit in the quarter from a year earlier, according to the statement. While the company’s profits and sales rose, order backlog declined 4.4 percent to $32.4 billion in the quarter, compared with $33.9 billion a year earlier.” (9% increase in actual sales) Source: Raytheon Annual Report 2012, Website, Bloomberg News

- 15. 15 Recent Raytheon Contracts (2012-2013) Middle East • Oman: Approx. $1.5B contract for ground-based air defense system currently in final negotiation stage • “Raytheon Chief Executive Bill Swanson said on the company's earnings call that Raytheon is also making good progress on several other large international sales, including missile defense systems to Qatar and Kuwait” • Oman: Raytheon Anschütz awarded contract for four Integrated Bridge & Navigation Systems for Royal Navy of Oman • UAE: AutoTrac III air traffic management system installed for undisclosed amount • Saudi Arabia: $600M+ contract for Command, Control, Communications, Computers & Intelligence system (C4I) • Saudi Arabia: $55M contract for TOW 2A Radio Frequency missiles (2010) Europe • Germany: $155.6M contract for Block 2 Rolling Airframe Missiles for delivery to the German navy, largest single RAM award by Germany • UK: Approx. $120M contact for Paveway IV precision-guided bombs Asia/Pacific • Australia/India: $45.3M contract to provide MK 54 lightweight torpedo hardware, test equipment, spares and related engineering and repair services for both Navies • India: Building ground stations for the GPS-Aided Geosynchronous Augmented Navigation system (GAGAN) in partnership with the Indian Space Research Organization (ISRO) & Airports Authority of India (AAI) Patriot Missile Program • Installed in 12 countries: US, Netherlands, Germany, Japan, Israel, Saudi Arabia, Kuwait, Taiwan, Greece, Spain, South Korea and UAE • Turkey in talks for ~$500M installation, Qatar in talks for ~$2B contract to install 11 fire units Source: Raytheon Website, Reuters

- 16. General Dynamics Int’l Strategy General Dynamics has no actual division devoted to pursuing International sales, or overarching International strategy, however, the Combat Systems and Information Systems & Technology Business Groups “continue to pursue opportunities presented by international demand for military equipment and information technologies from our indigenous international operations and through exports from our U.S. businesses.” Aerospace (Gulfstream and Jet Aviation) • Solely commercial business, zero integration with defense businesses • Though 60% of backlog is with international customers, both companies operate as separate entities from GD, not 16 leveraging either brand name or goodwill (new International service centers say “Gulfstream” over front door) Marine Systems (Bath Iron Works, Electric Boat, and NASSCO) • Solely domestic market, almost entirely for the US Navy Combat Systems (Land Systems, Armament & Technical Products, and Ordnance & Tactical Systems) • Land Systems and its subsidiaries, Land Systems - Canada, Land Systems - Australia, & European Land Systems do the largest chunk of Combat Systems’ international business, utilize the “demonstrated success of [General Dynamic’s] US military vehicles” in promoting sales, but also design vehicles especially for those markets • Armament & Technical Products has two international branches manufacturing heavy-duty axles, suspension, planetary axles, etc. for commercial vehicles, but only as a result of buying AxleTech International • Have a specialized branch of OTS, Ordnance & Tactical Systems – Canada, which is the Prime Contractor & Ammunition System Integrator to the Canadian Government Information Systems & Technology (IS&T) (Advanced Information Systems, Information Technology, and C4 Systems) • C4 systems provides a number of command, control, communications, and computer services “to non-U.S. customers, including the Canadian Department of National Defence, the U.K. Ministry of Defence and public agencies and private companies in Europe and the Middle East” Source: General Dynamics Annual Report 2012, website

- 17. 17 General Dynamics General Facts • $31.5B in revenue (down $1.18B, or 4% from 2011) • $6.5B in International revenue, 21% of total revenue (up $.2B, 3% from 2011) • $51.3B in total backlog (down $6.1B, or 11% from 2011) • $35.6B in defense backlog (down $3.9B, or 10% from 2011) – “The decrease occurred in our Combat Systems and Marine Systems groups as work continued on large, multi-year contracts awarded in prior periods.” • $(332)M in net income (down $2.86B, or 113% from 2011) Only commonality between four Business Groups is the tendency to make acquisitions of companies poised to seize a key or niche market, instead of competing. This fails if they misread the long-term market value of their acquisitions, as was the case in 2012 with IS&T, which resulted in an operating loss of $1.37B for that Business Group. Source: General Dynamics Annual Report 2012, website

- 18. 18 General Dynamics Sales by Region and Division (2012) International Sales ($6.5B) Sales (in Millions) Sales (in Millions) $878 $165 $1,027 $679 $548 $541 $713 $534 $288 $876 $260 Canada Other N. America UK Switzerland Russia Spain Other EU China Other Asia/Pacific Africa/ME S. America Total Sales $31.5B $6,912 22% 6,592 $10,017 32% $7,992 21% 25% Aerospace Marine Systems Combat Systems Information Systems & Technology Source: General Dynamics Annual Report 2012

- 19. 19 General Dynamics Global Footprint Countries with General Dynamics Subsidiary Operations Commercial + Defense – 92,000 employees Canada U.S. Australia Brazil UK France Spain Germany Switzerland Italy Mexico “In 2012, 66 percent of our revenues were from the U.S. government, 13 percent were from U.S. commercial customers, 8 percent were from international defense customers, and the remaining 13 percent were from international commercial customers.” Source: General Dynamics Annual Report 2012, website

- 20. 20 General Dynamics Leadership General Dynamics, Chairman & CEO Phebe N. Novakovic Exec. Vice President Marine Systems John P. Casey Exec. Vice President Information Systems & Technology David K. Heebner Exec. Vice President Aerospace Joseph T. Lombardo Exec. Vice President Combat Systems Mark C. Roualet Senior Vice President General Counsel & Secretary Gregory Gallopoulos Senior Vice President Planning & Development Robert W. Helm Senior Vice President HR & Administration Walter M. Oliver Senior Vice President CFO L. Hugh Redd Vice Presidents President, CFO, Administration & General Counsel, Gulfstream Aerospace; President , Jet Aviation; President, Bath Iron Works; President, NASSCO; President, Electric Boat; President, Advanced Information Systems; President, Information Technology; President, C4 Systems; President, Armament & Technical Products; President, Ordnance & Tactical Systems; President, Land Systems; President, European Land Systems; GD Tax; GD Controller; GD HR & Shared Services Source: General Dynamics website

- 21. General Dynamics Combat Systems International Subsidiaries “As a result of the demonstrated success of our U.S. military vehicles, we have cultivated continued international demand. The group’s U.S. exports include Abrams tanks and Light Armored Vehicles (LAVs) for U.S. allies around the world. The international operations of our U.S. military vehicles business also have generated significant indigenous opportunities. We are modernizing approximately 600 LAV III combat vehicles for the Canadian government, as well as providing long-term support to all Canadian LAV vehicles. For the U.K. Ministry of Defence, we are producing the Foxhound armored vehicle and will co-produce the Specialist Vehicle with the U.K. operations of our Information Systems and Technology group.” General Dynamics Land Systems – Canada • Formerly GM Defense, acquired in 2003 and are the preferred provider to the Canadian Gov’t of LAVs, sub-system 21 integration; presence in Canada for 35 years General Dynamics Land Systems – Australia • Provides Australian Defence Force with ASLAV/LAV (light armored-vehicles) and M1A1 tanks General Dynamics European Land Systems • Through its offices in Madrid, Spain, Kaiserslautern, Germany, Kreuzlingen, Switzerland, and Vienna, Austria it sells Wheeled Vehicles (PIRANHA, EAGLE, PANDUR), Tracked Vehicles (Pizarro, ASCOD), Mobile Military Bridge Systems, and Artillery & Ammunition to various allied governments • Recently awarded contract by Germany for 100 EAGLE V 4x4 Vehicles General Dynamics – United Kingdom Limited • Provides Armoured Fighting Vehicles (AFV) to the British Army General Dynamics – Ordnance & Tactical Systems Canada • Prime Contractor & Ammunition System Integrator to the Canadian Gov’t General Dynamics Armament & Technical Products (two international locations) • Saint Etienne, France: “This facility houses the company’s European product development team & aftermarket support & manufactures high-speed planetary axles, independent suspension axle systems & transfer cases” • Osasco, Brazil: “This location manufactures axles and provides engineering & quality support for the local Brazilian market” Source: General Dynamics Annual Report 2012, website

- 22. networking…computing and information assurance” as well as “land, airborne, and underwater ISR systems” for the DoD, federal and civilian agencies and also “to non-U.S. customers, including the Canadian Department of National Defence, the U.K. Ministry of Defence and public agencies and private companies in Europe and the Middle East. For example, we designed, procured, integrated and installed the telecommunications, security and control systems for the newly operating Khalifa Port in the United Arab Emirates.” • Responsible for a multitude of other smaller systems for Canadian military, including either design and production or support services for integrated mission sensors and systems for ground vehicles, helos, ships and submarines 22 General Dynamics IS&T International Subsidiaries “Our Information Systems & Technology group provides critical technologies, products and services that support a wide range of government and commercial communication and information sharing and security needs. The group consists of a three-part portfolio centered on secure mobile communication systems, information technology solutions and mission support services, and intelligence, surveillance and reconnaissance systems.” • Also self-defined as C4 Systems, Information Technology, and Advanced Information Systems, respectively • Information Technology’s only international clients are large commercial companies like AT&T, Verizon, and T-Mobile, which are based out of the US, and a small handful of logistical contracts for the UK Dept. of Health, and systems engineering for two London boroughs • Advanced Information Systems is made up of a number of smaller companies GD bought for the purpose of satisfying certain customer needs, but revolves around cybersecurity, mission systems, and ISR, and serves the US Gov’t almost exclusively • C4 Systems operates in 13 countries and “specializes in command and control, communications, General Dynamics – Canada • “System architect, system design authority, and system integrator” for BOWMAN system for the UK MoD, replacing outdated Clansman radio with secure integrated voice, data, and multimedia mobile communications system General Dynamics – United Kingdom Limited • “Prime Contractor and Systems Integrator” for BOWMAN system for the UK MoD • Supplying Royal Netherlands Navy with the New Integrated Marines Communications and Information System Source: General Dynamics Annual Report 2012, website (NIMCIS)

- 23. 23 Recent General Dynamics Contracts (2012-2013) Australia • Received five year, $40M Through Life Support contract for Armored Vehicles Middle East • Egypt: $225M for production of M1A1 tank kits for the Egyptian Land Forces under an Egyptian tank co-production program • Saudi Arabia: $160M for the production of an M1A2 variant for the Kingdom of Saudi Arabia. • Israel: $315M for Merkava Armored Personnel Carrier hulls and material kits for the Israeli Ministry of Defense Europe • UK: $115M for 151 Foxhound armored vehicles for the U.K. Ministry of Defence • UK: $110M for the design, integration and production of seven prototypes under the U.K.’s SV program, in addition to the integration work being performed by the Information Systems and Technology group • Spain: $150M for Pizarro Advanced Infantry Fighting Vehicles scheduled for delivery to the Spanish Army through 2016 Canada • “$870M for the upgrade and modernization of LAV III combat vehicles for the Canadian Army, including a $135M contract modification awarded in 2012 to upgrade an additional 66 vehicles bringing the total to approximately 600 vehicles “ South Africa • $75M contract awarded to GD SATCOM Technologies and partner Stratosat Datacom Ltd. To supply 64 radio-telescope antennas, ancillary electronic components and support for S. Africa’s MeerKAT radio telescope program Source: General Dynamics Annual Report 2012, website

- 24. Northrop Grumman Int’l Strategy International markets not a key piece of overall strategy “As part of our business and operational strategies and priorities, we continue to seek effective ways to help build and strengthen the communities where we work and live. As we grow our presence in international markets, we will be expanding our community support in those regions as well.” – Annual Report 2012, “Letter to Shareholders” 24 “Our corporate citizenship team developed an international engagement strategy that we began to implement in 2013.” – Corporate Responsibility Report 2012 (only mention of International involvement other than in Costa Rica) • No mention of “worldwide”, “world-class”, “global”, or “International” in Corporate “Vision, Values, and Behavior” • But, because “Revenue from the U.S. Government… accounted for 90 percent or more of total revenues in each of the years ended December 31, 2012, 2011 and 2010” they have been well aware for some time that “We face continued uncertainty in our business environment due to the substantial fiscal and economic challenges facing the U.S. Government, our primary customer, including the potential for sequestration and issues surrounding the national debt ceiling.” • As a result, pursuing more and more business through their UK office, which explains why all descriptions of foreign business are written with UK spelling, with a heavy emphasis on modernization & logistics: “A full 70% of the lifecycle cost of a military weapons system, or a piece of military hardware or capability is post-production. It’s in logistics, sustainment and modernization. So we feel that’s a very good business for us. What we’re focused on is that part of logistics where we can apply the decades of experience Northrop Grumman has in designing, developing, building, maintaining and upgrading military equipment. So we feel we have the level of expertise and capability required to provide the solutions that our customers need. You know, given the global security environment, we feel there will be operations ongoing throughout the world.” – Christopher Jones, CVP and President, Technical Services, June 25, 2013 Narrowing and Strengthening Focus Through Divestitures, Utilizing UK as Point of Sale • Sold Shipbuilding Business Sector, and some non-core businesses, concentrating on what they believe are biggest potential growth markets: Cybersecurity, C4I, Unmanned Systems, Airport Systems, and Logistics & Sustainment • Primarily selling to European markets through UK, have redone most European Postal Centers, and a handful of Air Traffic Management systems, commercially, provide Radar and Sensing Systems, Navigation Systems for defense Emphasizing Trustworthiness, Ethical Behavior • Only A&D Company with clearly promoted versions of their “Vision, Values, and Behavior” and “Standards of Business Conduct” written for “our associates employed overseas” in Belgium, Holland/The Netherlands, Norway, Germany, Italy, France, Spain, Japan, Malaysia, Taiwan, and China • Also have separate OpenLine channel to report Ethics & Business Conduct 24/7 for Europe, Taiwan, Japan, China, and Korea Source: Northrop Grumman Annual Report 2012, Northrop Grumman Corporate Responsibility Report 2012, Website

- 25. 25 Northrop Grumman General Facts • $25.2B in revenue (down $1.2B, or 5% from 2011) • $2.5B in International revenue, 10% of total revenue (up $.003M, or .5% from 2011) • $40.8B in total backlog (up $1.3B, or 3% from 2011) • $4.9B in International backlog, 12% of total backlog (up $2.13B, or 43% from 2011) • $1.98B in net income (down $.14B, or 7% from 2011) Stated Vision: “Our vision is to be the most trusted provider of systems and technologies that ensure the security and freedom of our nation and its allies. As the technology leader, we will define the future of defense—from undersea to outer space, and in cyberspace.” #1 “Key Behavior”: “We all have the company values listed on the back of our badges—Quality, Customer Satisfaction, Leadership, Integrity, People, Suppliers. Integrity must characterize everything we do. We want everyone who comes in contact with us to know that we do things the right way at Northrop Grumman. We don't take short cuts.” Source: Northrop Grumman Annual Report 2012, Website

- 26. 26 Northrop Grumman Sales by Division (2012) Aerospace Systems: “Aerospace Systems is a premier developer, integrator, producer and supporter of manned and unmanned aircraft, spacecraft, high-energy laser systems and microelectronics critical to maintaining the nation's security.” Electronic Systems: “Electronic Systems… is a leader in the design, development, manufacture, and support of solutions for sensing, understanding, anticipating, and controlling the operating environment for our global military, civil, and commercial customers.” Information Systems: “Information Systems… is a leading global provider of advanced solutions for the DoD, national intelligence, federal civilian, state and local agencies, and international allies, as well as certain commercial customers. Focus areas are in cybersecurity; C4ISR; intelligence processing; air and missile defense; decision support systems; information technology; and systems engineering and integration.” Technical Services: “Technical Services… is a premier supplier of life cycle solutions and innovative technical support and services for customers globally. Key capabilities include platform sustainment and modernization, [as well as] innovative and affordable logistics, and also provides an array of other advanced technology and engineering services, including space, missile defense, nuclear security, training and simulation.” Total Sales $3,019 11% Source: Northrop Grumman Annual Report 2012 Sales (in Millions) $9,977 37% $6,950 25% $7,356 27% $25.2B Aerospace Systems Electronic Systems Information Systems Technical Services

- 27. 27 Northrop Grumman Global Footprint S. Korea Taiwan Japan Australia Singapore U.S. UK Germany France Italy India Belgium Switzerland Saudi Arabia UAE 68,100 Employees in 25 Countries (Commercial + Defense) Offices in 15 Countries Most Significant Foreign Offices are in UK, France, Germany, and Italy Source: Northrop Grumman Annual Report 2012, Website

- 28. 28 Northrop Grumman Leadership Chairman, CEO, and President, Northrop Grumman Corporation Wes Bush Corporate Vice President Government Relations Sid Ashworth Corporate Vice President President, Enterprise Shared Services Mark Caylor Corporate Vice President General Counsel Sheila Cheston Corporate Vice President President, Electronic Systems Gloria Flach Corporate Vice President President, Technical Services Christopher Jones Corporate Vice President Communications Darryl Fraser Corporate Vice President Operations Linda Mills Corporate Vice President CFO James Palmer Corporate Vice President President, Aerospace Systems Thomas Vice Corporate Vice President President, Aerospace Systems Kathy Warden Corporate Vice President Chief HR Officer Denise Peppard Corporate Vice President Chief Global BD Officer David Perry Source: Northrop Grumman Website

- 29. 29 Northrop Grumman Global Subsidiaries “A key element of Northrop Grumman’s growth is its commitment to the international marketplace…Northrop Grumman has a well-established international presence outside the United States and maintains a network of more than 30 regional business development offices and local businesses serving customers in key international markets in Europe, the Middle East and Asia Pacific regions.” • 3 of 4 Business Sectors drive International sales: Electronic Systems (encompasses most International Offices), Information Systems, and Technical Services • Seven key International Subsidiaries: – Park Air Systems: UK Office, provides both commercial and defense oriented ground-to-air communication systems – Remotec: UK Office, provides Airport Realtime Collaboration (ARC) and other Airport Systems to commercial clients – Northrop Grumman Mission Systems Europe: UK Office, provides C4I services, both “Civil & Security” and Defense, especially focusing in Command & Control (C2) capabilities, and integrated sensor systems for Situational Awareness (SA) – Solystic: French office, “supplier to the largest international postal operators” of postal automation systems – Northrop Grumman LITEF Gmhb: German office, specializing in intertial sensors, intertial reference and navigation systems – Sperry Marine: German office, specializing in Commercial Navigation Systems & Integrated Navigation & Bridge Systems – Northrop Grumman Italia: Italian office, specializing in Integrated Navigation Systems (INS), including GPS, Air Data Sensors (ADS), and Magnetic Sensor Units (MSU) Source: NG AR 2012, northropgrummaninternational.com, Solystic Website, LITEF Website, Sperry Marine Website, NG Italia Website

- 30. United Kingdom: “The UK is Northrop Grumman’s largest international customer and remains a critically important market for the company as a supplier base and a source for technology partners. The company has a heritage of operating in the UK that spans 100 years… sales into overseas markets from Northrop Grumman’s UK entities accounting for some 70% of our UK businesses.” • 10 Locations across the UK, sustains employment for 5,000 people in supply chain • Developed a series of unmanned ground systems to deal with bomb threats in the 1970’s and has shifted to meet modern threats, integral cybersecurity and technology partner for a number of British Government offices Australia: “Northrop Grumman has a strong customer base and has been supporting a variety of both defence and civil programmes for more than 20 years. It is a key supplier in the defence, security, information systems, and public safety communications markets providing a range of capabilities and technologies including as a key subcontractor for the Wedgetail AEW&C, F-35 Lightning II, and the FA/18 Super Hornet programmes. The company was recently awarded a contract to build a cyber-test range for the University of New South Wales and Canberra campus at the Australian Defence Force Academy. Further expanding and solidifying the company’s presence in Australia, particularly in cyber security, Northrop Grumman recently acquired M5 Network Security, a Canberra-based provider of cyber-security and secure mobile communications to Australian military and intelligence organizations.” India: “Northrop Grumman has been working with the Indian armed forces and Indian industry for more than 25-years. We support India in a variety of defence and civil applications including air traffic control communications systems and radars, unmanned ground vehicles for the Indian Army and marine navigation systems for the Indian Navy and bring significant capabilities for homeland defence modernization and command & control, intelligence, surveillance and reconnaissance (C2ISR). We continue to develop our presence in India through strategic industrial partnerships and in 2007 opened offices in New Delhi which has been expanded to include representatives from several Northrop Grumman businesses.” Middle East & Africa: “Northrop Grumman has had an active presence in the Middle East for more than a decade with its regional headquarters in Abu Dhabi, UAE and has well established partnerships with Dubai, the UAE and other countries in the region, where it supports a variety of defence and civil programmes. The company opened an office in Riyadh, Saudi Arabia in 2008.” 30 Other Northrop Grumman Global Offices Source: Northrop Grumman Website (NOTE: UK SPELLING)

- 31. 31 Recent Northrop Grumman Contracts (2012-2013) • $1.7B contract for NATO unmanned Alliance Ground Surveillance System (AGS) based on Global Hawk • $66.3B JV contract w/ Finmeccanica for NATO cybersecurity • $1.0B in contracts for “International Air Defense Programs” • Contract to provide London’s Metropolitan Police Services’ new Command & Control system • (Park Air Systems) Contract for Air Traffic Communication System in North Sea, offshore England • (Park Air Systems) Contract for Ground-to-Air Communication System in Curacao for Dutch Caribbean Air Navigation Service Provider • (Park Air Systems) Contract for Integrated nationwide IP-based VHF System for all aircraft operating in Uruguay • (Park Air Systems) Contract for NATO to add Air Traffic Communications for Kandahar Air Base, to existing Park Air T6 Radio Series in Afghanistan • (Park Air Systems) Contract for Ground-to-Air Communication Systems across Chile • (Remotec) Contract for Airport Realtime Collaboration (ARC) System to UK’s East Midlands Airport Source: Northrop Grumman Annual Report 2012, Website

Notes de l'éditeur

- Source for regional sales: Annual Report pg. 122 (130/144 in PDF format)