12 eng104-dap an-v1.0

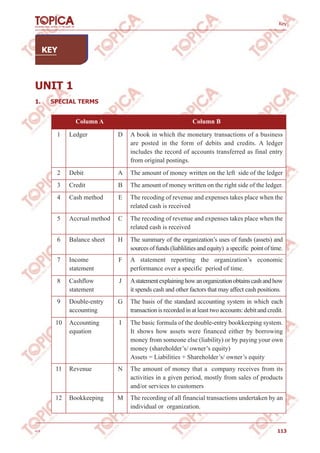

- 1. UNIT 1 1. SPECIAL TERMS Column A Column B 1 Ledger D A book in which the monetary transactions of a business are posted in the form of debits and credits. A ledger includes the record of accounts transferred as final entry from original postings. 2 Debit A The amount of money written on the left side of the ledger 3 Credit B The amount of money written on the right side of the ledger. 4 Cash method E The recoding of revenue and expenses takes place when the related cash is received 5 Accrual method C The recoding of revenue and expenses takes place when the related cash is received 6 Balance sheet H The summary of the organization’s uses of funds (assets) and sources of funds (liablilities and equity) a specific point of time. 7 Income statement F A statement reporting the organization’s economic performance over a specific period of time. 8 Cashflow statement J Astatementexplaininghowanorganizationobtainscashandhow it spends cash and other factors that may affect cash positions. 9 Double-entry accounting G The basis of the standard accounting system in which each transaction is recorded in at least two accounts: debit and credit. 10 Accounting equation I The basic formula of the double-entry bookkeeping system. It shows how assets were financed either by borrowing money from someone else (liability) or by paying your own money (shareholder’s/ owner’s equity) Assets = Liabilities + Shareholder’s/ owner’s equity 11 Revenue N The amount of money that a company receives from its activities in a given period, mostly from sales of products and/or services to customers 12 Bookkeeping M The recording of all financial transactions undertaken by an individual or organization. Key 113v1.0

- 2. 114 Key 2. READING 2.1. What is the definition of Accounting? 1. Accounting is the process of financially measuring, recording and summarizing and communicating the economic activity of an organization. 2. Why is it important for business people to understand the basic accounting concepts? Because technical accounting terms such as assets, liabilities, equity, revenue, expense, income and cash flow are widely used throughout the micro-finance field. 3. What kinds of information does accounting activity provide? It provides information required to answer questions such as: What are the resources of the organization? What debt does it owe? Are its operating expenses too high relative to revenue? Are the organization’s current lending activities generating enough income for it to be sustainable? 4. What does the accounting information help managers in the business management? It helps managers to analyze the financial status of their organization and manage the organization’s finances to ensure future financial stability. 5. Who are financial accounting aimed at? How about management accounting? Financial accounting aims at external audiences and management accounting aims at internal audiences. 6. What kinds of information about the company do financial statements provide? They provides the concise picture of financial position of the organization. 7. What are most popular financial statements? They are Balance Sheet, the Income Statement, and the Statement of Change in Financial Position or Cash Flow Statement). 13 Creditor O A party (e.g. person, organization, company, or government) that has a claim to the services of a second party. The first party, in general, has provided some property or service to the second party under the assumption (usually enforced by contract) that the second party will return an equivalent property or service. 14 Audit L An evaluation of a person, organization, system, process, project or product in order to certain the validity and reliability of information, and also provide an assessment of a system's internal control. 15 Journals K A daily record of events or business v1.0

- 3. Key 115 2.2. 1. F 2. T 3. T 4. F 5. T 6. F 2.3. 1. c 2. e 3. d 4. a 5. b 2.4. 1. F 2. F 3. T 4. F 5. T 6. T 2.5. 3. LISTENING 3.1. 1. Why is accounting called the ‘language of business’? Because it is able to communicate financial information about an organization. 2. How is a standardized accounting system achieved? It is achieved by following an accounting principles and rules. 3. What are revenues and expenditures? Revenues are the incoming money, expenditures are outgoing money. 4. In what ways are the balance sheet and the income statement different? The balance sheet shows the financial position of a company at one point of time while the income statement shows the financial performance of a company over a period of time. 5. How are accountants classified in the United States? The accountants in the US are classified as public, private, or governmental. 6. What kinds of services do public accountants provide? Public accountants provide accounting services such as auditing and tax computation. 7. Who do private and governmental accountants work for? Private accountants work for private companies and corporations, governmental account- ants work for governmental agencies and bureaus. 3.2. 1. d 2. c 3. b 4. c 5. a 3.3. (1) interested (2) creditors (3) collecting (4) summarizing (5) interpreting (6) involved (7) handling (8) transactions (9) reflect (10) compare (11) periods (12) investor Verb Noun(s) Adjective ‘calculate Calcu’lation – – Con’sistency Con’sistent – Con’vention Con’ventional ‘measure ‘measurement – ‘measure Presen’tation – ‘value ‘value, valu’ation ‘valuable v1.0

- 4. Key 116 4. VOCABULARY EXERCICES 4.1. 1. a 2. b 3. b 4. b 5. a 6. b 7. a 8. d 9. d 10. b 11. a 12. c 4.2. 1. journal 2. posted 3. ledger 4. transferred 5. double-entry 6. debits 7. credits 8. trial balance 9. transactions 10. invoice 11. receipt 12. vouchers TAPESCRIPT An accounting overview Hi everyone, accounting is frequently called the ‘language of business’ because of its ability to communicate financial information about an organization. Why is called so? Various interested parties, such as managers, potential investors, creditors, and the government, depend on a company’s accounting system to help them make informed financial decisions. An effective accounting system, therefore, must include accurate collecting, recording, classifying, summarizing, interpreting and reporting of information on the financial status of an organization. In order to achieve a standardized system, the accounting process follows accounting principles and rules. Regardless of the type of business or the amount of money involved, common procedures for handling and presenting financial information are used. Incoming money (revenues) and outgoing money (expenditures) are carefully monitored, and transactions are summarized in financial statements, which reflect the major financial activities of an organization. Ok.As you may know, two common financial statements are the balance sheet and the income statement. The balance sheet shows the financial position of a company at one point in time, while the income statement shows the financial performance of a company over a period of time. Financial statements allow interested parties to compare one organization to another and/or to compare accounting periods within one organization. For example, an investor may compare the most recent income statements of two corporations in order to find out which one would be a better investment. People who specialize in the field of accounting are known as accountants. In the United States, accountants are usually classified as public, private, or governmental. Public accountants work independently and provide accounting services such as auditing and tax computation to companies and individuals. Public accountants may earn the title of CPA (Certified Public Accountant) by fulfilling rigorous requirements. Private accountants work solely for private companies or corporations that hire them to maintain financial records, and governmental accountants work for governmental agencies or bureaus. Both private and governmental accountants are paid on a salary basis, whereas public accountants receive fees for their services. Through effective application of commonly accepted accounting systems, private, public, and governmental accountants provide accurate and timely financial information that is necessary for organizational decision-making. v1.0

- 5. Key 117 UNIT 2 1. SPEACIAL TERMS 2. READING 2.1. 1. T 2. F - If business fails , a sole proprietorship must use his personal wealth to pay all the debts. 3. F – At the beginning of a partnership, partners must agree on how much each contributes and how the partnership can be changed or terminated. 4. T 5. F- Only some stockholders ( the Board of Directors) can decide how to use of the company’s profits 6. T 7. T 8. T Column A Column B 1 Articles of co-partnership (n) C The agreement telling the terms and conditions of a partnership. 2 Articles of incorporation (n) E The agreement telling the terms, conditions and purposes of a corporation. 3 Asset (n) A Anything of value to a compay. Anything which can be sold or converted into cash. 4 Bankrupt (a) F Unable to pay ones debts and legally released from the liability. 5 Dissolve (n) B To break up a partnership or corporation. 6 Dividends (n) D A share of the profits of corporation which is given to the stockholders. 7 Entity (n) L Aseparate unit for ownership or legal purposes. 8 Inventory(n) I The amount of goods, merchandise or materi- als on hand. 9 Liability (n) G Debt or legal responsibility. 10 Partnership (n) M A business owned by two or more individuals. 11 Proprietorship (n) H Sole ownership of a small business. 12 Corporation (n) J Company or a group of persons granted a charter to do business as a separate unit with its own rights and responsibilities. v1.0

- 6. Key 118 2.2. 1. Private 2. Open market 3. Public limited 4. Quoted 5. Interim 6. Corporation 7. Listed 8. Quarterly 9. Annual Report 10. Annual General Meeting 2.3. 1. d 2. a 3. b 4. c 5. e 2.4. 3. LISTENING 3.1. 1. Helping to open new units as Development Manager 2. Long hours, getting home very late at night. 3. Pizza was the only option in home delivery 4. In Italia, when he was on holiday. 5. Because ‘fresh pasta’ will cook in two to three minutes compared to thirteen for pizza. Ownership The trader The partner The shareholder Change of Owner- ship By sale of business assets By sale of partners’ part with consent of others By transfer of shares (with consent of all members in private limited companies and unrestricted with public company) Control By the trader Shared by partners By the holders of the majority of voting shares Management By the trader Shared by partners as agreed By the directors Number of members 1 up to 20 Mininum 2. There is no maximum Owners’ liability in event of insolvency unlimited unlimited Limited to amount of capital contributed Owners’ entitle- ment to profits The total The total, divided as agreed Limited to amount of capital contributed Termination of the business Atwill,ondeath oroninsolvency By contract of partners on insolvency, on death or bankruptcy of a partner. Dividends as declared by directors Sole trader Partnership Private and Public Company Formation formalities None Article of co-partnership Register with the state Legal Status None Firm insepa- rated from owner None Firm inseparated from owners A ‘legal person’ separate from owners v1.0

- 7. Key 119 3.2. 1. At lunchtime Pasta delivers mainly to offices and businesses. In the evenings Pasta’s business is residential. 2. The average customer is between 20 and 40. Very many of their customers are women who want a change front pizza and who recognize that pasta is good for them. 3.3. 1. Research 2. Talk 3. Believe 4. Listen, learn 5. Get 4. VOCABULARY EXERCISES 4.1. 1. d 2. a 3. a 4. c 5. d 6. c 4.2. 1. B 2. A 3. C 4. B 5. A 6. C 7. B 8. A 9. C 10. C 11. A 12. B 5. SPEAKING 5.1 Public Limited Company - Hoskins Group plc Sole Trader – The Tackle Exchange Partnership – Freed, Stone, Goodman Private Limited company – Accolade Group Ltd. 5.2 Advantages Disadvantages 1. Sole trader 1. Partnership 2. Partnership 2. Partnership/sole trader 3. Limited company 3. Partnership/sole trader 4. Limited company 4. Limited company 6. Writing Practice 1 1. likewise/similarly 2. also 3. too 4. as/just as 5. workers/Both robots and human workers 6. Nether/nor human 7. like/just like/similar 8. similar to/are the same 9. are the same 10. are alike/are similar 11. be compared to/be compared Practice 2 1. however/nevertheless/nonetheless/still 2. although/even though 3. but/yet 4. Despite/In spite of Practive 3 1. however/in comparison/on the other hand 2. on the contrary v1.0

- 8. Key 120 3. while/whereas 4. but 5. differs from 6. Compared to/Compared 7. different from/dissimilar to/unlike TAPECRIPT Extract 1 When I was working for the pizza restaurant company and helping to open new units, I was quite busy and getting home very late at night and I’m not a wonderful cook. I like to spend my time sort of reading and doing other things and sport and I use to use home delivery is pizza and so that’s really, that’s where it kind of started in terms of, you know, looking at that as an opinion or as something that isn’t, wasn’t currently available. And then as I said, When I was on holiday in Italy I came across takeaway pasta business which kind of sort of made me think a little bit. When I was working for the pizza restaurant company setting up new operations, we were, I was Development Manager for opening a pasta operation alongside the pizza operation and there we were using automated machinery that was well suited to cooking pasta quite quickly. And really pasta which is what we use, because it will cook in two or three minutes as opposed to pizza which will take about thirteen minutes to prepare and cook. That is the sort of basis and then the difficult area is sort of the sauces and that side of things, but basically that your main base product of pasta is relatively, relatively simple and quick to cook. Extract 2 We do quite a lot of lunchtime business in terms of offices and businesses within the area that we deliver. But predominantly it’s residential in the evenings and our main client base is I suppose aged between 20 and 40 although we have customers who are over 50 and we have customers who are sorts of under 10. The main part of our market is I suppose between 20 and 35, male and female. We’re quite surprised by the number of female customers, but I think that’s predominantly because they recognize that pasta is good for them and it’s a change from pizza as well. Extract 3 To research whatever they want to do very carefully, to talk to friends and relatives and people they know about what they want to do and to really not give up. You need to believe in what you are doing but you can get a lot of support from people around you and which, which doesn’t cost you anything, just costs you some time in talking to people. To listen to people and to learn from others. And also to get the right sort of background in what you are doing whether it be in terms of working for someone who is doing a similar operation to what you want to do. v1.0

- 9. Key 121 UNIT 3 1. SPECIAL TERMS 2. READING 2.1. 1. F 2. T 3. F 4. T 5. T 6. F 7. T 8. F 9. T 10. F 2.2. Column A Column B 1 Profit and loss account F Financial statement which shows the profit or loss made by a company during the accounting period 2 Balance sheet B Financial statement which shows a company’s financial condition (amount of debits and credits) on the last day of an accounting period 3 Share certificate G A document which represents a part of the total stock value of a company and which shows who owns it 4 capital expendi- ture J Major spending on large items necessary for the business, such as property or equipment 5 Bottom line C The net profit or net income line on a profit and loss account or income statement 6 Business plan A Adescription of the ways a new business hopes to make money, showing possible income and expenditure 7 Liquidity E Cash and other liquid assets in excess of current liabilities; the ease with which an asset can be spent or sold 8 Dividend H A share in the annual profits of a limited company, paid to shareholders 9 Fixed assets D Items of value which are not easily changed into cash but which the business needs 10 Intangible assets I Those whose value can only be quantified or turned into cash with difficulty (e.g. copyrights, trade marks) Balance sheet Income statement Cash flow statement - assets - liabilities - shareholders’ equity - EPS - revenue - costs - expenses - inflows of cash - outflows of cash - investing activities v1.0

- 10. 122 1 Although investors are making profit D they may still have a negative cash flow. 2 There are some transactions that take cash out of the business, A but they are not classified as expenses. 3 Money borrowed from a lender is not considered income, B nor is it counted as expense when paid back. 4 Interest paid for loans is counted as expense, E and it will appear as an expense and use of cash. 5 All the three main financial statements give different angles of the business, C and each is important to the overall health of the business. Key 2.3. 1. How do companies use their assets? 2. What kind of assets are trademarks? 3. At which time does a balance sheet show information about a company’s assets, liabilities and shareholders’ equity? 4. In income statements, which word literally shows a company’s net earnings or losses? 5. Why does a company need a cash flow statement? 2.4. 2.5. 1. records 2. assets and debts 3. on the left 4. on the right 5. in the middle 6. revenue 7. expenses 8. movement 9. whether or not 10. business plans 3. LISTENING 3.1. 1. T 2. F 3. T 4. T 5. F 3.2. 1. information 2. revenue 3. specified 4. expenses 5. earmings 6. earned 7. movement 8. operating 9. expenses 10. bottom 11. changes 12. balance 13. combined 14. investment 15. government office 4. VOCABULARY EXERCICES 4.1. 1 – b (interest) 2 – a (raised) 3 – b (own - owe) 4 – a (before) 5 – c (shares) 4.2. 1. Balance sheet 2. Profit and loss account 3. Cash flow statement 4. Earning per share 5. Payroll 6. Accounting period 7. Business plan 8. Dividend v1.0

- 11. 123 Key Typescripts Good morning everyone. Welcome to our seminar on finance! As you already knew, I am John Richer, head of Finance de- partment of Green Investment company. Today, I am going to tell you about financial statements. My talk will be very short, so I would be very glad to answer all your questions at the end of my talk. Well, as you know, financial statements are necessary sources of information about companies for a wide variety of users. Those who use financial statement information include company management teams, in- vestors, creditors, governmental oversight agencies and the Internal Revenue Service. However, users of financial statement information do not necessarily need to know everything about accounting to use the information in basic statements. But, of course, to effectively use financial statement information, it is helpful to know a few simple concepts and to be familiar with some of the fundamental characteristics of basic financial statements. Now I will tell you some main types of financial statements. There are four basic types of financial statements: balance sheets, income statements, cash-flow statements, and shareholders’ equity. Typically, financial statements are used in relation to business endeavors. Firstly, let’s look at the balance sheet. Well, balance sheet financial statements are used to provide insight into a company’s assets and debts at a particular point in time. Information about the company’s shareholder equity is included as well. Typically, a company lists its assets on the left side of the balance sheet and its debts and liabilities on the right. Sometimes, however, a balance sheet has assets listed at the top, debts in the middle, and shareholders’equity at the bottom. Now, let’s move on to the income statement. Income financial statements present information concerning the revenue earned by a company in a specified time period. Income statements also show the company’s expenses in attaining the income and shareholder earnings per share. At the bottom of the income statement, a total of the amount earned or lost is included. Often, income statements provide a record of revenue over a year’s time. Ok, right. And next is the cash flow statement. Cash-flow financial statements provide a look at the movement of cash in and out of a company. These financial statements include information from operating, investing, and financing activities. The cash-flow statement can be important in determining whether or not a company has enough cash to pay its bills, handle expenses, and acquire assets. At the bottom of a cash-flow statement, the net cash increase or decrease can be found. And finally, I will give you the overview of the last basic type of financial statement. Shareholders’equity show changes in a company's or organization’s retained earnings over a specific period of time. These statements show the beginning and final balance of retained earnings, as well as any adjustments to the balance that occur during the reporting period. This information is sometimes included as part of the balance sheet, or it may be combined with an income statement. However, it is frequently provided as a completely separate statement. v1.0

- 12. Key The average individual does not typically have a use for financial statements. However, sole proprietors may use them in the same manner as other businesses. High-net-worth individuals may also use them for the purpose of obtaining loans, participating in investment deals, and developing financial, tax, and business plans. In some cases, personal financial statements may be used when running for a government office. Well, that brings me to the end of my presentation. And now are there any questions? Er… er… please! UNIT 4 1. SPECIAL TERMS Column A Column B 1 Business cycle F Recurring fluctuations in economic activity consisting of recession and recovery and growth and decline 2 Financial instrument E Any stock, share, money, or other financial security 3 Financial statement A analysis A detailed examination or report on financial performance 4 Gross margin B The difference between the price of goods paid by a shopkeeper and the price paid by the customer 5 Gross profit C An amount of money received from sales of goods minus the cost of manufacturing or buying them 6 Horizontal analysis D The examination of two or more organizations that produce similar goods or carry out the same stage of the production process 7 Liquidity J Liquidity ratio Finance of assets that are easily turned into cash the relationship between the amount of money held in cash and the total amount held in deposits and investments 8 Net sales revenue K The amount of money made from the sale of goods minus the cost of producing, selling and distributing them 9 Ratio analysis G The examination based on the relationship between two amounts determined by the number of times one contains the other 10 Solvency H Solvency ratio Having enough money to pay your debts; having an excess of assets over liabilities 11 Trend analysis I The examination of a movement in a certain direction 12 Vertical analysis L The examination of two or more organizations that deal with different stages in a production process 124 v1.0

- 13. 2. Reading 2.1. 1. F 2. F 3. T 4. F 5. T 2.2. 1. It is a valuable tool used by investors and creditors, financial analysts, and others in their decision-making processes related to stocks, bonds, and other financial instruments. 2. The goal in analyzing financial statements is to assess past performance and current financial position and to make predictions about the future performance of a company. 3. Financial analysts assess the profitability, liquidity, and solvency of companies in order to make recommendations about the purchase or sale of securities, such as stocks and bonds. 4. Analysts can obtain useful information by comparing a company's most recent financial statements with its results in previous years and with the results of other companies in the same industry. 5. It is called Horizontal Analysis since the analyst is reading across the page to compare any single line item, such as sales revenues. 6. Ratio analysis enables the analyst to compare items on a single financial statement or to examine the relationships between items on two financial statements. 7. In judging how well on a company is doing, analysts typically compare a company's ratios to industry statistics as well as to its own past performance. 2.3. 1. b 2. a 3. a 4. b 5. a 2.4. 1. enables 2. compare 3. average 4. industry 5. similar 6. successive 7. trends 8. indications 9. problems 10. them 3. LISTENING 3.1. Listening 1 1. What does ratio analysis provide? It provides relative measures of the firm's conditions and performance. 2. How is horizontal analysis used? Horizontal analysis is used to evaluate the trend in the accounts over the years. 3. What about vertical analysis? It discloses the internal structure of the firm 4. What does “it” in this sentence: It indicates the existing relationship between sales and each income statement account refer to? a. the horizontal analysis 125 Key v1.0

- 14. Key b. the vertical analysis c. the structure of the firm. 5. What are the two types of comparison in financial ratio analysis? They are industry comparison and trend analysis. 6. What will the firm’s financial analyst do after completing the financial statement analysis? After completing the financial statement analysis, the firm's financial analyst will consult with management to discuss plans and prospects, any problem areas identified in the analy- sis, and possible solutions. Listening 1 1. similar 2. averages 3. determine 4.competitors 5. available 6. sources 7. lines of business 8. publishes 9. computed 10. a percentage 11. balance 12. income statement 13. past 14. future 15. financial condition 4. VOCABULARY EXERCISES 4.1. Column A Column B 1 The current ratio (or working capital) meas- ures liquidity – i.e. having enough cash to meet short-term obligations. It shows if a business can pay its most urgent debts. C Current assets ______________ Current liabilities 2 Acompany’s profit margin or return on sales is the percentage difference between sales income and the cost of sales. F Pre-tax profit ___________ Sales 3 Productivity shows the amount of work or sales per employee. A Sales volume ___________________________ Number (or wages) of employees 4 Earnings per share relates the company’s profits to the number of ordinary shares it has issued. D Distributable profit _______________ Number of shares 126 v1.0

- 15. Key 4.2. 1. b 2. d 3. a 4. b 5. b 6. a 7. d 8. a 9. c 10. d 11. c 12. d 13. a 14. a TAPE SCRIPT Financial Statement Analysis Good morning everyone. Welcome to our seminar on finance! As you already knew, I am John Richer, head of Finance department of Green Investment company. Today, I am going to tell you about financial statement analysis. My talk will be very short, so I would be very glad to answer all your questions at the end of my talk. As you know, ratio analysis is the most common form of financial analysis. It provides relative measures of the firm's conditions and performance. Horizontal Analysis and Vertical Analysis are also popular forms. Horizontal analysis is used to evaluate the trend in the accounts over the years, while vertical analysis, also called a Common Size Financial Statement discloses the internal structure of the firm. It indicates the existing relationship between sales and each income statement account. It shows the mix of assets that produce income and the mix of the sources of capital, whether by current or long-term debt or by equity funding. When using the financial ratios, a financial analyst makes two types of comparisons: Firstly, the industry comparison. This means the ratios of a firm are compared with those of similar firms or with industry averages or norms to determine how the company is faring relative to its competitors. Industry average ratios are available from a number of sources, including: (a) Dun & Bradstreet. Dun & Bradstreet computes 14 ratios for each of 125 lines of business. They are published in Dun's Review and Key Business Ratios. (b) Robert Morris Associates. This association of bank loan officers publishes Annual Statement Studies. Sixteen ratios are computed for more than 300 lines of business, as well as a percentage distribution of items on the balance sheet and income statement (common size financial statements). 5 Acompany’s debt/ equity ratio compares the amount of debt to the firm’s own capital. B (long-term) loan capital ___________________________ Shareholders’ equity or net assets 6 Return on equity shows profit compared to shareholders’ capital. E Pre-tax profit ___________ Owners’ equity 127v1.0

- 16. Key And secondly, the trend analysis. By this way, a firm's present ratio is compared with its past and expected future ratios to determine whether the company's financial condition is improving or deteriorating over time. After completing the financial statement analysis, the firm's financial analyst will consult with management to discuss plans and prospects, any problem areas identified in the analysis, and possible solutions. And now, let’s move on to the next part, which deals with… REVISION A 1. Finance and Companies 1.1. 1) fixed assets 2) current assets 3) fixed asset 4) X 5) current liabilities 6) current asset 7) X 8) intangible asset 9) Long-term liabilities 10) X 1.2. 1) e 2) a 3) c 4) d 5) g 6) b 7) h 8) j 9) f 10) i 1) m 12) l 13) k 1.3. 1) G 2) D 3) H 4) E (or A ) 5) A 2. Accountancy 1) Accountant 2) Accounts 3) the bookkeepers 4) accountancy 5) auditors 6) fair view 7) window dressing 3. Financial Statements and Analysis 3.1. 1) j. profit and loss report 2) a. balance sheet 3) h. fixed assets 4) i. pre-tax profit 5) f. finance director 6) e. dividends 7) c. cash budget 8) d. current assets 9) b. capital expenditure 10) g. financial advisor 3.2. 1) A 2) A 3) A 4) B 5) D 6) B 7) A 8) D 9) B 10) C 4. Financial Results 1) annual report 2) a profit and loss account 3) loss 4) accounting standard 5) pre-tax loss 6) exceptional profit 7) gross profit 8) bottom line 9) in the red 10) red ink 128 v1.0

- 17. UNIT 5 1. SPECIAL TERMS 1. f 2. c 3. b 4. a 5. i 6. g 7. j 8. l 9. e 10. h 11. k 12.d 2. READING 2.1. 1. T 2. NG 3. NG 4. T 5. F 6. F 7. T 8. T 9. F 10. NG 2.2. 1. financial securities 2. commodities 3. liquidity 4. general 5. specialized 6. market economy 7. raising of capital 8. issues a receipt 9. dividends 10. Intermediaries 2.3. 1. If a large number of people want to buy a certain stock, its price will go up, just as if many people were bidding on an item at an auction. 2. They will want to own more of that company’s shares. 3. The government’s decisions affect both how much an individual stock may be worth (new regulations on a business) and what sort of instruments people want to be investing in. The governments interest rates, tax rates, trade policy and budget deficits all have an im- pact on prices. 4. Investors closely watch indicators showing general trends that signal changes in the economy to predict what is going to happen next. 5. They show changes in the way ordinary people spend their money and how the economy is likely to perform. 6. They can change how people think about the value of different investments and about how they should invest in the future. 7. At any time (around the clock. When the market opens in New York, the Tokyo market has just closed and the London market is half way through its trading day.) 8. A bull market is a period during which stock prices are generally rising. 9. If investors feel that they are in a bull market, they will feel confident investing, adding to the growth of the market. 10. No, it doesn’t. (These trends may quickly change). 3. LISTENING 3.1. 1. How does an English dictionary explain the phrase “to sell a bear”? To sell a bear is to sell what one has not. 2. What are investors always concern about? Investors are always concerned about the possibility of a company failing. Key 129v1.0

- 18. Key 130 3. What will happen when a company goes belly up? In the modern world, a company that does not earn enough profit is said to go belly up. A company that goes belly up dies like a fish. 4. What do investors want from a company whose stocks they own? They want a company whose stocks they own to earn more profit than expected. 5. What does “windfall” mean? A windfall is something wonderful that happens unexpectedly. 3.2. 1. stock exchange 2. brokers 3. part of that company 4. increases 5. decreases 6. big board 7. bull market 8. bear market 9. at a set price 10. price drops 4. VOCABULARY EXCERCISES 4.1. 1. own 2. capital 3. borrow 4. loan 5. interest 6. debt 7. raise 8. shares 9. finance 10. control. 4.2. 1. C. floating 2. B. underwrite 3. A. quoted 4. B. at the moment 5. A. nominal 6. C. buying 7. A. fixed 8. A. bulls TAPESCRIPT Stock Market: The Business of Investing Bells sound. Lighted messages appear. Men and women work at computers. They talk on the telephone.At times they shout and run around. This noisy place is a stock exchange. Here expert salespeople called brokers buy and sell shares of companies. The shares are known as stocks. People who own stock in a company, own part of that company. People pay brokers to buy and sell stocks for them. If a company earns money, its stock increases in value. If the company does not earn money, the stock decreases in value. Brokers and investors carefully watch for any changes on the Big Board. That is the name given to a list of stocks sold on the New York Stock Exchange. The first written use of the word with that meaning was in a newspaper in Illinois in eighteen thirty-seven. It said: "The sales on the board were one thousand seven hundred dollars in American gold." v1.0

- 19. Key 131 Investors and brokers watch the Big Board to see if the stock market is a bull market or a bear market. In a bear market, prices go down. In a bull market, prices go up. Investors in a bear market promise to sell a stock in the future at a set price. But the investor does not own the stock yet. He or she waits to buy it when the price drops. The meaning of a bear market is thought to come from an old story about a man who sold the skin of a bear before he caught the bear. An English dictionary of the sixteen hundreds said, "To sell a bear is to sell what one has not." Word experts dispute the beginnings of the word bull in the stock market. But some say it came from the long connection of the two animals -- bulls and bears -- in sports that were popular years ago in England. Investors are always concerned about the possibility of a company failing. In the modern world, a company that does not earn enough profit is said to go belly up. A company that goes belly up dies like a fish. Fish turn over on their backs when they die. So they are stomach, or belly, up. Stock market investors do not want that to happen to a company. They want a company whose stock they own to earn more profit than expected. This would sharply increase the value of the stock. Investors are hoping for a windfall. The word windfall comes from England of centuries ago. There, poor people were banned from cutting trees in forests owned by rich land owners. But, if the wind blew down a tree, a poor person could take the wood for fuel. So a windfall is something wonderful that happens unexpectedly. UNIT 6 1. SPECIAL TERMS 1. m 2. i 3. h 4. a 5. g 6. l 7. d 8. f 9. e 10. n 11. b 12. k 13. j 14. c 2. READING 2.1. 1. They are measured in terms of money. 2. A store of gold backs the US dollar. 3. They are judged in terms of the strength of the national economies which support them. 4. Governments and authorized banks can issue paper notes. 5. They are called ‘instrument of credit’. 6. They use the phrase ‘purchasing power’ v1.0

- 20. Key 132 7. Inflation is the name for too much money in circulation, with the result that its value decreases. 8. They co-operate with governments in efforts to stabilize economies and prevent inflation. 9. He agrees to leave his money in the bank for a minimum specified period of time. 10. It makes its main profit by lending deposited money at a rate of interest higher than any which the bank pays to its depositors. 11. They talk of ‘liquidity’ because money flows in streams into and out of reservoirs called banks. 12. The trust among bankers, depositors and borrowers maintains the banking system. 13. This trust permits business to be done without any legal tender visibly changing hands. 2.2. 1. F 2. F 3. T 4. T 5. T 6. T 7. T 8. T 9. F 2.3. 1. T 2. F 3. F 4. F 5. F 6. T 7. T 8. F 2.4. 1. If you use HOBS you will be given an identity number and a password. X 2. You can make ten monthly payments to cover the cost of buying HOBS. - 3. The Bank of Scotland charges customers £10 a month for using HOBS. X 4. If you want to take advantage of the Cash Management Service this will cost you extra. X 5. You can arrange for The Bank of Scotland to give you a personal demonstration of how HOBS works. X 6. The HOBS terminal can fit into a small place. - 2.5. With HOBS the customers can 1. Have instant access to an account 2. View previous transactions 3. Transfer between accounts 4. Order statements and chequebooks. 5. Pay regular bills 6. Benefit from flexible banking hours 7. Access the system from anywhere in the UK 8. Save money on bank charges 9. See what cleared balances are (only for subscribers to the cash management service) 10. Earn high interest (only for subscribers to the HOBS investment account) v1.0

- 21. Key 133 3. LISTENING 3.1. Listening 1 3.2. Listening 2 1. developments 2. found 3. fetch 4. transferred 5. cheque 6. around 7. holdings 8. development 9. vaults 10. actually 4. VOCABULARY EXERCISES 4.1. A house, a car and an insurance policy are assets. A mortgage and a bank loan are liabilities. 4.2. a. Opening. b. Sole c. Request d. The same e. Liabilities f. Many g. Voluntary h. Prospective i. Sometimes j. Public k. Individuals l. Lends. 4.3. The adjectives can precede almost any nouns, but they go better with some nouns than others. The nouns listed here are the ones in the passage which collocate naturally with the adjectives: (…………………………indicates that the list may not be complete and you may find other examples). a. National bank (national asset)………………………………………… b. Different details/ information/ activities………………………………. c. Sole trader/ proprietor/ owner/ account………………………………... d. Limited company/ liability/ requirements……………………………… e. The same details/ information/ references/ forms………………………………. Section 1 1. banking 2. to explain the role of the bank 3. goldsmiths Section 3 1. incorrect 2. incorrect Section 5 1. overdraft 2.correct Section 7 1. a run on the bank 2. bankrupt Section 2 1. No key is possible 2. cheque 3. No key is possible Section 4 1. incorrect Section 6 1. No key is possible 2. 90% v1.0

- 22. Key 134 f. Personal details/ assets/ reference/ account details/ assets/ reference/ account/ customers/ liabilities/services/ property………………………………… g. Additional/ details/ assets/ references/ services/ information (Note: ‘additional’ is usually followed by the plural form except for mass nouns such as ‘information’) h. More customers/ information/ form/ details/ companies/ requirements/ valuables………… i. Prospective customers/ business/ employee j. Legal status/ reference/ business/ activities k. Private limited company/ property l. Public limited company /property/ assets (= national assets/ statement (a declaration made to journalists for publication)) ( Note the difference between ‘private property’ e.g. a house or garden from which the pub- lic are excluded and ‘personal property’ e.g. possessions belonging specifically to a certain person (watch, camera, clothes, etc). 5. WRITING Sample letter Charles Colwell 24 Dundas Street London SW1 9FZ November, 6th Mr Smith Branch Manager National Savings Bank 509 Wellington Street London SW1V 9AW Dear Mr Smith Following the recent telephone conversation that I had with Ms Henry, I am confirming in writing the complaint that I made to her concerning the £30 overdraft charge that your bank has mistakenly debited from my account. As you may remember, approximately one month ago I arranged for the transfer of £500 from my savings account to my current account. Unfortunately your bank gave exactly the opposite instructions, transferring instead £500 from my current account to my savings account, with the result that my current account became overdrawn. When I realized that mistake had been made I contacted you personally and you assured me that the situation would be rectified immediately and that no overdraft charge would be made. On receiving my latest statement I was therefore most surprised to see that my current account had indeed been debited by £30 for overdraft charges. Although the transfer of the funds has now been credited to the correct account, I see no reason why I should pay a penalty as a result of a mistake made by your bank, especially as I had your personal guarantee that this would not be the case. v1.0

- 23. Key 135 I have been a customer of your bank for several years now and have had, to date, no reason to complain about the qual- ity of the services provided. However, I feel that in the pres- ent circumstances this situation should be clarified immediately and I expect a full explanation of these mis- takes. Failing this, I will have no alternative but to consider transferring my accounts to another bank. Yours sincerely, Charles Colwell TAPESCRIPT You are now going to hear part of a lecture, divided into short sections to help you to understand it. As you listen, answer the questions below. Section 1 Morning all! All well this morning, I trust, as we’re about to start on a most important topic... banking. Actually, I’m going to make this into a bit of a story. It’s a story that has some basis in fact, although, like all stories, it’s not strictly true. But I hope it will at least explain the role of banks. It goes like this. Once upon a time people used gold, gold bullions that is, as money. They were dangerous times, and people wanted a safe place to keep their gold. So they deposited it with goldsmiths, a goldsmith being someone who worked with gold, for jewellery and so on, and who also had a guarded vault to keep it safe in. Vault? V-A-U-L-T. And when people wanted some of their gold to pay for things with, they went and fetched it from the goldsmith. Section 2 Now two developments turned these goldsmiths into bankers. The first was that people found it a lot easier to give the seller a letter than it was to fetch some gold and then physically hand it over to him. This letter transferred some of the gold they had at the goldsmith’s to the seller. This letter we would nowadays call a cheque. And of course once these letters, or cheques, were easier to carry around than gold, and a lot less dangerous, people started to say that their money holdings were what they had with them plus their deposits. So a system of deposits was started. The second development, and I’m sure you can see what’s coming, was that goldsmiths realized they had a great deal of unused gold lying in their vaults doing nothing. This development was actually of greater importance than the first. v1.0

- 24. Key 136 Section 3 Now let’s turn to the first bank loan ever and see what happens. A firm asked a goldsmith for a loan. The goldsmith realized that some of the gold in his vault could be lent to the firm, and of course he asked the firm to pay it back later with a little interest. Well, let’s as- sume it was only a little interest! Of course, at that moment the gold- smith was short of gold. It wasn’t actually his gold. But he reckoned that it was unlikely that everyone who had deposited gold with him would want it back at the same time. At any rate, not before the firm had repaid him with his little bit of interest. Safe enough, he thought. Section 4 As economists, let’s take a look at what actually happened in that simple transaction. Have a look at this table. The first row shows what our goldsmith did before he made this loan. He had a hundred pounds of gold, which he owed to the people who had deposited it with him. So his assets and liabilities were the same. But when he lent, let’s say, ten pounds of gold to the firm, he actually had only ninety pounds of gold in the vault, plus the value of his loan. His assets still equal his liabilities, but he’s happy because he’s going to get some interest. Section 5 Now it so happened that the firm who took out the loan didn’t really want to carry that ten pounds of god around. So it asked the goldsmith if, instead of actually taking the gold, it could be given a deposit. Today we would call this an overdraft. An overdraft. The third row of our table shows what happened then. As you can see although the goldsmith’s assets and liabilities are the same, but are now worth a hundred and ten pounds, not a hundred. But of course, you can see in the fourth row, when the firm wrote a cheque for ten pounds, and that person came in to collect is ten pounds’worth of gold, the goldsmith’s assets fell – but so did his liabilities. The important point to notice here is that it made no difference to our goldsmith whether his initial loan was in actual gold or in the form of a deposit, or overdraft. Section 6 Now let’s turn to the question of reserves. People originally deposited a hundred pounds of gold. The goldsmith lent ten pounds, leaving himself with ninety. As a banker, which he now is, he’s relying on the fact that not everyone will want their gold back at the same time – if they did, he couldn’t pay out. His reserves of ninety pounds are not enough. Note that reserves are the amount of gold that is immediately available, in the vault, to meet depositors’demands. Look at the old fashioned goldsmith in the table again. He has a hundred percent reserve ratio. The reserve ratio is, of course, the ratio of reserves to deposits. Once he has made his loan, our goldsmith has a ninety percent deposit ratio. This is a small risk, with a small profit. How much dare he lend out in order to make a profit through his interest charges? What are the risks involved? A good question, and one which occupies our banks today, just as it did him then. v1.0

- 25. Key 137 Section 7 As today, most people didn’t mind that the goldsmith had lent ten pounds to a firm. They knew the firm, and were sure he would get his money back. But our goldsmith took too much of a risk. He lent eighty percent of the gold he had. This panicked people. They doubted he could pay them all back, he was bound to lose some of the gold he had lent. So they rushed round to get their gold back before it was too late. There was what we would now call a run on the bank. A financial panic. And a financial panic leads to exactly what people fear. The bank cannot pay them, goes bankrupt, and they go bankrupt as well. Now, before I go on I’d like to ask you a question. What do you think our goldsmith’s reserve ratio should have been? Hm? Think about it for a moment and then give me your reasons for your decision. OK? UNIT 7 1. SPECIAL TERMS 1. Ppayee 2. Loan 3. Commercial bank 4. Savings bank 5. Bank draft 6. Overdraft 7. Clearance 8. Bank charges 9. Standing order 10. Statement 11. Base rate 2. READING 2.1. 1. A bank is a financial institution whose primary activity is to act as a payment agent for customers and to borrow and lend money. 2. By conducting checking or current accounts for customers, paying cheques drawn by customers on the bank, and collecting cheques deposited to customers' current accounts. 3. By accepting funds deposited on current account, accepting term deposits and by issuing debt securities such as banknotes and bonds. 5. - retail banking, dealing directly with individuals and small businesses; - business banking, providing services to mid-market business; - corporate banking, directed at large business entities; - private banking, providing wealth management services to High Net Worth Individuals and families; and - investment banking, relating to activities on the financial markets. 6. In the 1930s 7. The original objective was to provide easily accessible savings products to all strata of the population. 8. Investment banks guarantee the sale of stock and bond issues. 9. The term ‘bancassurance’ is used to describe the sale of insurance products in a bank. 10. Central banks provide liquidity to the banking system and act as lender of last resort in event of a crisis. v1.0

- 26. 2.2. 1. F 2. F 3. T 4. F 5.T 6. F 7. F 8. T 9. T 10. T 2.3. 1. function 2. implement 3. control 4. fix 5. act 6. issue 7. influence 8. supervise 2.4. 1. reserve 2. interest 3. assets 4. cash 5. maturity 6. liquid 3. LISTENING 3.1.1. 1. setting interest rate ceilings and floors 2. printing money, or destroying it 3. open-market operations 4. exchange rate supervision 5. commercial bank supervision 6. act as a lender of last resort 3.1.2. 1. B 2. A 3. F 4. D 5. C 6. E 3.2.1. Mary Ann is clearly in favour of central bank independence, although at the end she does say that independence should be adapted to economic conditions. 3.2.2. 1. True (the problem, of course, is that this tends to lead to inflation after the election.) 2. False (she says that there should be a separate body responsible for implementing monetary policy, i.e. that the central bank should not be part of the government.) 3. False (she says that the government, not the central bank, should be responsible for budgetary policy.) 4. True (she says that budgetary policy means having a larger or smaller deficit, without mentioning the possibility of having a budget surplus – more tax revenue than public spending) 5. True (she says that central bank independence should ‘be adapted to the economic condi- tions in the country and outside the country.’) 4. VOCABULARY EXERCICES 4.1. 1. withdraw 7. commission 13. credit transfer 2. cash dispenser 8. statement 14. slip 3. issued 9. in full 15. salaries 4. debited 10. interest 16. banker’s draft 5. credit rating 11. outstanding (also call a bank draft) 6. financial institutions 12. standing order 4.2. 1. account 2. deposit 3. cheque 4. debit 5. cash 6. payment 7. debit card 8. credit 9. transactions 10. balance Key 138 v1.0

- 27. Key 139 TAPESCRIPT PART ONE INTERVIEWER: Marry Ann, you’re an expert on central banking. Could you briefly summarize the functions of a cen- tral bank? MARY ANN: Yes, I would say there are four of them. The first one is actually to implement monetary policy. There are roughly three ways to do it. First, setting interest rate ceilings and floors, which means limiting, upwards or downwards, the fluctuations of the interest rate. The second way to implement monetary policy is simply printing money, or destroying it – coins, banknotes. The third one which is a bit more modern, is those open-market operations, which are simply buying and selling government bonds to and from commercial banks. So that was the first main task of a central bank. The second one is exchange rate supervision, I would say. Mainly for floating exchange rates but one should not forget that even for a fixed exchange rate the central bank still has to make sure that it has enough reserves to counteract any upswing or downswing of this exchange rate. Third main task, yes, commercial bank supervision I would say – make sure that the commercial banks have enough liquidities, for instance, to avoid any bank run. INTERVIEWER: What’s a bank run? MARY ANN: The bank run is a sort of, kind of panic, a situation in which investor or simply customers of the banks run to the bank and take their money out because they realize or they think they realize that their bank is not trustworthy any more. And to avoid this actually, the central bank has to make sure they have a sufficient liquidity ratio, for instance. Fourth main task of the central bank would be to act as a lender of last resort in case, actually, one of these commercial banks goes bankrupt and the investors, the people putting money in the bank, have to get back their money. PART TWO INTERVIEWER: And I know that you believe that central banks should normally be independent from the government, rather than a government department. Why is this? MARY ANN: Well, the main reason is what we call, in economics, the political business cycle. If the central bank mainly acts as a branch of government, then this government is inclined – incited – to increase abruptly, for instance, money supply just before elections in order to favour em- ployment, but, of course, this has a negative effect on inflation, but as the government is not sure to bereelected,atleastithassomepositiveimpactonemploymentjustbeforetheelection,which is pos- itive. There are also other reasons, which are more technical probably, but the main other one I would quote is the fact that it’s more efficient for a separate body to implement monetary policy while the government is really only restrained to implementing what we call budg- etary policy, which means having a larger or smaller budget deficit. INTERVIEWER: But you think the independent bank is a model for the future? MARYANN: Yes, I would argue it is not, it should be completely independent. Actually I’m working presently on something that tends to show that the independence should actually be adapted to the economic conditions in the country and outside the county, but yes, generally a more independent central bank is certainly more, well certainly more desirable than a non-independent central bank. v1.0

- 28. REVISION B 1. Financial Markets 1.1. 1. financial 2. derivatives 3. dealers 4. flotation 5. speculator 6. securities 1.2. 1. B 2. A 3. C 4. A 5. C 6. B 1.3. 1. C 2. C 3. A 4. C 5. B 6. B 7. B 8. B 1.4. 1. saving 2. investment 3. competition 4. partners 5. quotations 6. membership 2. Personal Finance and Banking 2.1. 1. B 2. G 3. A 4. D 5. C 6. F 2.2. 2.2.1. 1. False 2. False 3.True 4. True 5. False 6. True 7. True 8. False 2.2.2. 1. transfer, current account, an overdraft 2. account balance 3. interest rate 4. interest 5. bank statement, banking charge 3. Company Finance and Banking 3.1. 3.1.1. a. In case there is some restriction on the drawing of chouse. b. Who has the right. c. How limited companies were formed. d. The formation can affect borrowing or the signing of chouse. e. Affect f. Non-limited companies. g. Assets. h. If they wish. 3.1.2. a. Activities. b. Complicated. c. formed. d. Certain. e. Restrictions f. Documents g. Gwner h. Affect i. Ownership j. Refused k. Opportunity 3.2. Match words and definitions 1. j- creditor 2. a- standing order 3. d- dividend 4. n- bankdraft 5. b- commercial bank 6. c- overdraft 7. l- to lidiquate 8. g- invoice 9. n- deposit 10. e- expertise 11. h- bank charges 12. k- underwrite 13. m- savings bank 14. f- payee Key 140 v1.0