P7 32

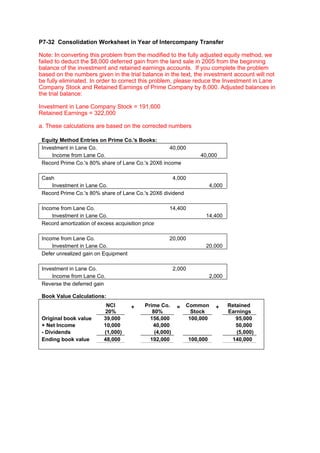

- 1. P7-32 Consolidation Worksheet in Year of Intercompany Transfer Note: In converting this problem from the modified to the fully adjusted equity method, we failed to deduct the $8,000 deferred gain from the land sale in 2005 from the beginning balance of the investment and retained earnings accounts. If you complete the problem based on the numbers given in the trial balance in the text, the investment account will not be fully eliminated. In order to correct this problem, please reduce the Investment in Lane Company Stock and Retained Earnings of Prime Company by 8,000. Adjusted balances in the trial balance: Investment in Lane Company Stock = 191,600 Retained Earnings = 322,000 a. These calculations are based on the corrected numbers Equity Method Entries on Prime Co.'s Books: Investment in Lane Co. 40,000 Income from Lane Co. 40,000 Record Prime Co.'s 80% share of Lane Co.'s 20X6 income Cash 4,000 Investment in Lane Co. 4,000 Record Prime Co.'s 80% share of Lane Co.'s 20X6 dividend Income from Lane Co. 14,400 Investment in Lane Co. 14,400 Record amortization of excess acquisition price Income from Lane Co. 20,000 Investment in Lane Co. 20,000 Defer unrealized gain on Equipment Investment in Lane Co. 2,000 Income from Lane Co. 2,000 Reverse the deferred gain Book Value Calculations: NCI + Prime Co. = Common + Retained 20% 80% Stock Earnings Original book value 39,000 156,000 100,000 95,000 + Net Income 10,000 40,000 50,000 - Dividends (1,000) (4,000) (5,000) Ending book value 48,000 192,000 100,000 140,000

- 2. Deferred Gain Calculations: Prime Co.'s Total = share + NCI's share Downstream Asset (20,000) (20,000) Extra Depreciation 2,000 2,000 0 Total (18,000) (18,000) 0 P7-32 (continued) Basic elimination entry Common stock 100,000 ← Original amount invested (100%) Retained earnings 95,000 ← Beginning balance in RE Income from Lane Co. 22,000 ← Prime’s share of NI - Def. Gain NCI in NI of Lane Co. 10,000 ← NCI share of Lane Co.'s NI Dividends declared 5,000 ← 100% of Lane Co.'s dividends Investment in Lane Co. 174,000 ← Prime's share of BV - Def. Gain NCI in NA of Lane Co. 48,000 ← NCI share of BV of net assets Excess Value (Differential) Calculations: NCI 20% + Prime Co. 80% = Goodwill Beginning balance 10,000 40,000 50,000 Changes (3,600) (14,400) (18,000) Ending balance 6,400 25,600 32,000 Amortized excess value reclassification entry: Goodwill impairment loss 18,000 Income from Lane Co. 14,400 NCI in NI of Lane Co. 3,600 Excess value (differential) reclassification entry: Goodwill 32,000 Investment in Lane Co. 25,600 NCI in NA of Lane Co. 6,400 Eliminate intercompany accounts: Accounts Payable 7,000 Cash and Accounts Receivable 7,000

- 3. Eliminate gain on purchase of land Investment in Lane Co. 8,000 NCI in NI of Lane Co. 2,000 Land 10,000 Accumulated Equipment Depreciation Lane Co. 70,000 Actual 7,000 5,000 2,000 25,000 Prime Co. 75,000 "As If" 30,000 Eliminate the gain on Equipment and correct asset's basis: Gain on sale 20,000 Equipment 5,000 Accumulated Depreciation 25,000 Accumulated Depreciation 2,000 Depreciation Expense 2,000 P7-32 (continued) Investment in Income from Lane Co. Lane Co. Beginning Balance 188,000 80% Net Income 40,000 40,000 80% Net Income 4,000 80% Dividends 14,400 Excess Val. Amort. 14,400 Realize Def. Gain 2,000 20,000 Defer Equipment Gain 20,000 2,000 Realize Def. Gain Ending Balance 191,600 7,600 Ending Balance 174,000 Basic 22,000 Land Adjustment 8,000 25,600 Excess Reclass. 14,400 0 0

- 4. b. This worksheet is based on the corrected numbers: Elimination Entries Prime Co. Lane Co. DR CR Consolidated Income Statement Sales 240,000 130,000 370,000 Gain on Sale of Equipment 20,000 20,000 0 Less: COGS (140,000) (60,000) (200,000) Less: Depr.&Amort. Expense (25,000) (15,000) 2,000 (38,000) Less: Other Expenses (15,000) (5,000) (20,000) Less: Goodwill Impairment Loss 18,000 (18,000) Income from Lane Co. 7,600 22,000 14,400 0 Consolidated Net Income 87,600 50,000 60,000 16,400 94,000 NCI in Net Income 10,000 3,600 (6,400) Controlling Interest in NI 87,600 50,000 70,000 20,000 87,600 Statement of Retained Earnings Beginning Balance 322,000 95,000 95,000 322,000 Net Income 87,600 50,000 70,000 20,000 87,600 Less: Dividends Declared (30,000) (5,000) 5,000 (30,000) 165,00 Ending Balance 379,600 140,000 0 25,000 379,600 Balance Sheet Cash and Accounts Receivable 113,000 35,000 7,000 141,000 Inventory 260,000 90,000 350,000 Land 80,000 80,000 10,000 150,000 Buildings & Equipment 500,000 150,000 5,000 655,000 Less: Accumulated Depreciation (205,000) (45,000) 2,000 25,000 (273,000) 174,00 Investment in Lane Co. 191,600 8,000 0 0 25,600 Goodwill 32,000 32,000 241,60 Total Assets 939,600 310,000 47,000 0 1,055,000 Accounts Payable 60,000 20,000 7,000 73,000 Bonds Payable 200,000 50,000 250,000 100,00 Common Stock 300,000 100,000 0 300,000 165,00 Retained Earnings 379,600 140,000 0 25,000 379,600 NCI in NA of Lane Co. 2,000 48,000 52,400 6,400 274,00 Total Liabilities & Equity 939,600 310,000 0 79,400 1,055,000

- 5. P7-32 (continued) These financial statements are based on the corrected numbers: c. Prime Company and Subsidiary Consolidated Balance Sheet December 31, 20X6 Cash and Receivables $ 141,000 Inventory 350,000 Land 150,000 Buildings and Equipment $655,000 Less: Accumulated Depreciation (273,000) 382,000 Goodwill 32,000 Total Assets $1,055,000 Accounts Payable $ 73,000 Bonds Payable 250,000 Stockholders’ Equity: Controlling Interest: Common Stock $300,000 Retained Earnings 379,600 Total Controlling Interest $679,600 Total Noncontrolling Interest 52,400 Total Stockholders’ Equity 732,000 Total Liabilities and Stockholders' Equity $1,055,000

- 6. Prime Company and Subsidiary Consolidated Income Statement Year Ended December 31, 20X6 Sales $ 370,000 Cost of Goods Sold $200,000 Depreciation and Amortization Expense 38,000 Goodwill Impairment Loss 18,000 Other Expenses 20,000 Total Expenses (276,000) Consolidated Net Income $ 94,000 Income to Noncontrolling Interest (6,400) Income to Controlling Interest $ 87,600 Prime Company and Subsidiary Consolidated Retained Earnings Statement Year Ended December 31, 20X6 Retained Earnings, January 1, 20X6 $ 322,000 Income to Controlling Interest, 20X6 87,600 $ 409,600 Dividends Declared, 20X6 (30,000) Retained Earnings, December 31, 20X6 $ 379,600

- 7. P7-32 (continued) b. This worksheet is based on the uncorrected numbers: Prime Lane Elimination Entries Co. Co. DR CR Consolidated Income Statement Sales 240,000 130,000 370,000 Gain on Sale of Equipment 20,000 20,000 0 (140,000 Less: COGS ) (60,000) (200,000) Less: Depr.&Amort. Expense (25,000) (15,000) 2,000 (38,000) Less: Other Expenses (15,000) (5,000) (20,000) Less: Goodwill Impairment Loss 18,000 (18,000) Income from Lane Co. 7,600 22,000 14,400 0 Consolidated Net Income 87,600 50,000 60,000 16,400 94,000 NCI in Net Income 10,000 3,600 (6,400) Controlling Interest in NI 87,600 50,000 70,000 20,000 87,600 Statement of Retained Earnings Beginning Balance 330,000 95,000 95,000 330,000 Net Income 87,600 50,000 70,000 20,000 87,600 Less: Dividends Declared (30,000) (5,000) 5,000 (30,000) 165,00 Ending Balance 387,600 140,000 0 25,000 387,600 Balance Sheet Cash and Accounts Receivable 113,000 35,000 7,000 141,000 Inventory 260,000 90,000 350,000 Land 80,000 80,000 10,000 150,000 Buildings & Equipment 500,000 150,000 5,000 655,000 Less: Accumulated (205,000 Depreciation ) (45,000) 2,000 25,000 (273,000) 174,00 Investment in Lane Co. 199,600 8,000 0 8,000 25,600 Goodwill 32,000 32,000 241,60 Total Assets 947,600 310,000 47,000 0 1,063,000 Accounts Payable 60,000 20,000 7,000 73,000 Bonds Payable 200,000 50,000 250,000 100,00 Common Stock 300,000 100,000 0 300,000 165,00 Retained Earnings 387,600 140,000 0 25,000 387,600 NCI in NA of Lane Co. 2,000 48,000 52,400 6,400 274,00 Total Liabilities & Equity 947,600 310,000 0 79,400 1,063,000

- 8. P7-32 (continued) These financial statements are based on the uncorrected numbers: c. Prime Company and Subsidiary Consolidated Balance Sheet December 31, 20X6 Cash and Receivables $ 141,000 Inventory 350,000 Land 150,000 Buildings and Equipment $655,000 Less: Accumulated Depreciation (273,000) 382,000 Investment in Lane Co. 8,000 Goodwill 32,000 Total Assets $1,063,000 Accounts Payable $ 73,000 Bonds Payable 250,000 Stockholders’ Equity: Controlling Interest: Common Stock $300,000 Retained Earnings 387,600 Total Controlling Interest $687,600 Total Noncontrolling Interest 52,400 Total Stockholders’ Equity 740,000 Total Liabilities and Stockholders' Equity $1,063,000

- 9. Prime Company and Subsidiary Consolidated Income Statement Year Ended December 31, 20X6 Sales $ 370,000 Cost of Goods Sold $200,000 Depreciation and Amortization Expense 38,000 Goodwill Impairment Loss 18,000 Other Expenses 20,000 Total Expenses (276,000) Consolidated Net Income $ 94,000 Income to Noncontrolling Interest (6,400) Income to Controlling Interest $ 87,600 Prime Company and Subsidiary Consolidated Retained Earnings Statement Year Ended December 31, 20X6 Retained Earnings, January 1, 20X6 $ 330,000 Income to Controlling Interest, 20X6 87,600 $ 417,600 Dividends Declared, 20X6 (30,000) Retained Earnings, December 31, 20X6 $ 387,600