Stock Research Report for PEET as of 9/8/11 - Chaikin Power Tools

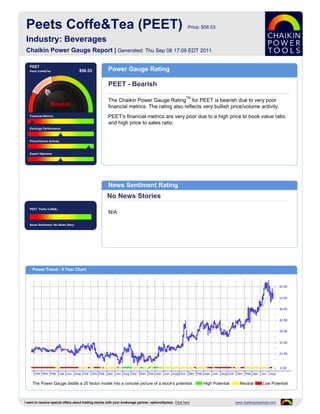

- 1. Peets Coffe&Tea (PEET) Price: $56.53 Industry: Beverages Chaikin Power Gauge Report | Generated: Thu Sep 08 17:09 EDT 2011 PEET Peets Coffe&Tea $56.53 Power Gauge Rating PEET - Bearish TM The Chaikin Power Gauge Rating for PEET is bearish due to very poor financial metrics. The rating also reflects very bullish price/volume activity. Financial Metrics PEET's financial metrics are very poor due to a high price to book value ratio and high price to sales ratio. Earnings Performance Price/Volume Activity Expert Opinions News Sentiment Rating No News Stories PEET Peets Coffe&.. N/A News Sentiment :No News Story Power Trend - 5 Year Chart The Power Gauge distills a 20 factor model into a concise picture of a stock's potential. High Potential Neutral Low Potential I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 2. Financials & Earnings Financial Metrics Financial Metrics Rating LT Debt/Equity Ratio Very Bearish Price to Book Value PEET's financial metrics are very poor. The company may be overvalued and has relatively low revenue per share. Return on Equity The rank is based on a low long term debt to equity ratio, high price to book value ratio, high return on equity, high price to sales ratio and relatively low cash flow. Price to Sales Ratio Business Value Assets and Liabilities Valuation Returns Ratio TTM Ratio TTM Ratio TTM Current Ratio 4.21 Price/Book 4.37 Return on Invest 12.5% LT Debt/Equity 0.00 Price/Sales 2.19 Return on Equity 12.5% Earnings Performance Earnings Performance Rating Earnings Growth Neutral Earnings Surprise PEET's earnings performance has been neutral. The company has a stable 5 year earnings trend and is priced relatively high compared to next year's projected EPS. Earnings Trend The rank is based on high earnings growth over the past 3-5 years, better than Projected P/E Ratio expected earnings in recent quarters, a relatively poor trend in earnings this year, a relatively high projected P/E ratio and consistent earnings over the past 5 years. Earnings Consistency 5 Year Revenue and Earnings Growth EPS Estimates 12/06 12/07 12/08 12/09 12/10 Factor Actual EPS Prev EST EPS Current Change Revenue(M) 210.49 249.39 284.82 311.27 333.81 Quarterly EPS $0.29 $0.27 -0.02 Rev % Growth 20.15% 18.48% 14.21% 9.29% 7.24% Yearly EPS $1.34 $1.50 +0.16 EPS $0.57 $0.61 $0.81 $1.48 $1.34 Factor Actual EPS Growth Est EPS Growth Change EPS % Growth -25.97% 7.02% 32.79% 82.72% -9.46% 3-5 year EPS 13.87% 18.33% +4.46 EPS Surprise EPS Quarterly Results Estimate Actual Difference % Difference FY Qtr 1 Qtr 2 Qtr 3 Qtr 4 Total Latest Qtr $0.32 $0.38 $0.06 18.75 12/09 $0.23 $0.26 $0.19 $0.79 $1.47 1 Qtr Ago $0.34 $0.41 $0.07 20.59 12/10 $0.23 $0.32 $0.29 $0.50 $1.34 2 Qtr Ago $0.48 $0.48 $0.00 0.00 12/11 $0.42 $0.40 - - - 3 Qtr Ago $0.24 $0.28 $0.04 16.67 Fiscal Year End Month is December. I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 3. Price Trend & Expert Opinions Price/Volume Activity Price/Volume Activity Rating Relative Strength vs Market Very Bullish Chaikin Money Flow Price and volume activity for PEET is very bullish. PEET has outperformed the S&P 500 over 26 weeks and is experiencing sustained buying. Price Trend The rank for PEET is based on its price strength versus the market, positive Price Trend ROC Chaikin money flow, a positive Chaikin price trend, a negative Chaikin price trend ROC and an increasing volume trend. Volume Trend Relative Strength vs S&P500 Index Chaikin Money Flow Chart shows whether PEET is performing better or worse than the market. Chaikin Money Flow analyzes supply and demand for a company's stock. Price Activity Price Activity Volume Activity Factor Value Factor Value Factor Value 52 Week High 63.30 % Change Price - 4 Weeks -1.46% Average Volume 20 Days 134,007 52 Week Low 33.20 % Change Price - 24 Weeks 17.04% Average Volume 90 Days 178,567 % Change YTD Rel S&P 500 42.06% % Change Price - 4 Wks Rel to S&P -7.86% Chaikin Money Flow Persistency 61% % Change Price - 24 Wks Rel to S&P 26.69% Expert Opinions Expert Opinions Earnings Estimate Revisions Neutral Short Interest Expert opinions about PEET are neutral. Analysts are raising their EPS estimates for PEET and short interest in PEET is high. Insider Activity The rank for PEET is based on analysts revising earnings estimates upward, a high short interest ratio, insiders not purchasing significant amounts of stock, Analyst Opinions optimistic analyst opinions and price strength of the stock versus the Beverages industry group. Relative Strength vs Industry Earnings Estimate Revisions Analyst Recommendations EPS Estimates Revision Summary Current 7 Days Ago % Change Factor Value Last Week Last 4 Weeks Current Qtr 0.27 0.27 0.00% Mean this Week Hold Up Down Up Down Next Qtr 0.44 0.44 0.00% Mean Last Week Hold Curr Qtr 0 0 0 0 Curr Yr 0 0 0 0 Current 30 Days Ago % Change Change 0.00 Next Qtr 0 0 0 0 Current FY 1.50 1.50 0.00 Mean 5 Weeks Ago Hold Next Yr 0 0 0 0 I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here www.chaikinpowertools.com

- 4. The Company & Its Competitors PEET's Competitors in Beverages News Headlines for PEET Company Power Historic EPS Projected EPS Profit Margin PEG PE Revenue(M) Peet’s Coffee & Tea Introduces New Gauge growth growth Medium-Roast Specialty Coffee Line - Aug 2, PEET 13.87% 18.33% 5.93% 2.06 36.48 334 2011 KOF 10.82% 12.34% 9.40% 1.52 21.03 8,588 Peet’s Coffee & Tea Unveils New Light Freddos - Jul 6, 2011 FMX 8.50% 13.54% 8.89% 1.34 15.76 13,921 Ahead of the Bell: Peet's Coffee and Tea KO 9.02% 9.00% 29.69% 2.03 19.29 35,119 upgraded - Mar 30, 2011 CCE -10.80% 10.00% 8.50% 1.26 13.71 6,714 DPS 13.37% 10.50% 9.37% 1.31 14.80 5,636 PEP 12.71% 8.25% 10.11% 1.68 14.60 57,838 CCH 10.26% 5.36% 5.15% 2.69 15.98 9,255 Company Details Company Profile PEETS COFFE&TEA Peet's Coffee & Tea is a specialty coffee roaster and marketer of branded fresh roasted PO BOX 12509 whole bean coffee sold under strict freshness standards through multiple channels of BERKELEY, CA 94712 distribution. The company sells its fresh roasted coffee, hand selected tea and related USA items in several distribution channels, including specialty grocery and gourmet food Phone: 5105942100 stores, online and mail order, office and restaurant accounts and company-owned stores Fax: 510-594-2180 in four states. Website: http://http://www.peets.com/ Full Time Employees: 3,523 Sector: Consumer Staples Power Gauge Ratings are created using a relative ranking system that assigns a rank of 0 to 100 (100 being the highest) to each stock in the universe. Rank is calculated by evaluating each of the stocks factors and combining them into a single number using a weighting formula. A stock's rank ranges from 100-0, where 100 is the strongest, and a rank of 95 indicates the stock is better than 95% of the stocks in the universe. Chaikin Stock Research(CSR) is not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange Commission or with any state securities regulatory authority. CSR is not responsible for trades executed by users of this research report, our web site or mobile app based on the information included herein. The information presented in this report does not represent a recommendation to buy or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information in this report is generic by nature and is not personalized to the specific financial situation of any individual. The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions. Copyright (c) 1978-(Present) by ZACKS Investment Research, Inc ("ZACKS"). The information, data, analyses and opinions contained herein (1) includes the confidential and proprietary information of ZACKS, (2) may not be copied or redistributed, for any purpose, (3) does not constitute investment advice offered by ZACKS, (4) are provided solely for informational purposes, and (5) are not warranted or represented to be correct, complete, accurate or timely. ZACKS shall not be responsible for investment decisions, damages or other losses resulting from, or related to, use of this information, data, analyses or opinions. Past performance is no guarantee of future performance. ZACKS is not affiliated with Chaikin Power Tools. This report from Chaikin Power Tools is for informational purposes only and is not a recommendation to buy or sell securities. LM 2.3 DS 3.0 LS 2.1 Data Provided by ZACKS Investment Research, Inc., www.zacks.com Special offers to trade stocks from optionsXpress: www.chaikinpowertools.com