JSW Energy Ltd. Q3 FY16 Result Update

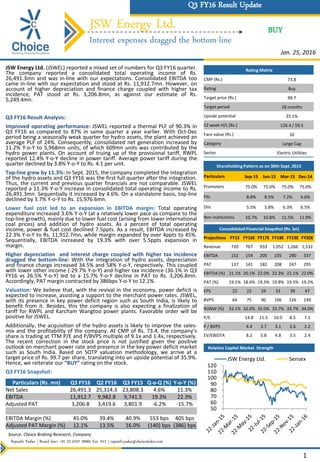

- 1. JSW Energy Ltd. Interest expenses dragged the bottom-line BUY Relative Capital Market Strength JSW Energy Ltd. (JSWEL) reported a mixed set of numbers for Q3 FY16 quarter. The company reported a consolidated total operating income of Rs. 26,491.3mn and was in-line with our expectations. Consolidated EBITDA too came in-line with our expectation and stood at Rs. 11,912.7mn. However, on account of higher depreciation and finance charge coupled with higher tax incidence, PAT stood at Rs. 3,206.8mn, as against our estimate of Rs. 5,249.4mn. Q3 FY16 Result Analysis: Improved operating performance: JSWEL reported a thermal PLF of 90.3% in Q3 FY16 as compared to 87% in same quarter a year earlier. With Oct-Dec period being a seasonally weak quarter for hydro assets, the plant achieved an average PLF of 24%. Consequently, consolidated net generation increased by 11.2% Y-o-Y to 5,968mn units, of which 609mn units was contributed by the hydro power plants. On account of truing up of the provisional tariff, RWPL reported 12.4% Y-o-Y decline in power tariff. Average power tariff during the quarter declined by 3.8% Y-o-Y to Rs. 4.1 per unit. Top-line grew by 11.3%: In Sept. 2015, the company completed the integration of the hydro assets and Q3 FY16 was the first full quarter after the integration. Thus, the current and previous quarter financials are not comparable. JSWEL reported a 11.3% Y-o-Y increase in consolidated total operating income to Rs. 26,491.3mn. Sequentially it increased by 4.6%. On a standalone basis, top-line declined by 3.7% Y-o-Y to Rs. 15,976.6mn. Lower fuel cost led to an expansion in EBITDA margin: Total operating expenditure increased 3.6% Y-o-Y (at a relatively lower pace as compare to the top-line growth), mainly due to lower fuel cost (arising from lower international coal prices) and addition of hydro assets. As a percent of total operating income, power & fuel cost declined 7.5ppts. As a result, EBITDA increased by 22.3% Y-o-Y to Rs. 11,912.7mn, while margin expanded by over 4ppts to 45%. Sequentially, EBITDA increased by 19.3% with over 5.5ppts expansion in margin. Higher depreciation and interest charge coupled with higher tax incidence dragged the bottom-line: With the integration of hydro assets, depreciation and finance charge increased 34.5% and 58% Y-o-Y, respectively. This coupled with lower other income (-29.7% Y-o-Y) and higher tax incidence (36.1% in Q3 FY16 vs 26.5% Y-o-Y) led to a 15.7% Y-o-Y decline in PAT to Rs. 3,206.8mn. Accordingly, PAT margin contracted by 386bps Y-o-Y to 12.1%. Valuation: We believe that, with the revival in the economy, power deficit is expected to increase, assisting a support to the merchant power rates. JSWEL, with its presence in key power deficit region such as South India, is likely to benefit from it. Besides, this the company is also expecting a finalization of tariff for RWPL and Karcham Wangtoo power plants. Favorable order will be positive for JSWEL. Additionally, the acquisition of the hydro assets is likely to improve the sales- mix and the profitability of the company. At CMP of Rs. 73.4, the company’s share is trading at TTM P/E and P/BVPS multiple of 9.1x and 1.4x, respectively. The recent correction in the stock price is not justified given the positive outlook on merchant power rate and presence in the key power deficit market such as South India. Based on SOTP valuation methodology, we arrive at a target price of Rs. 99.7 per share, translating into an upside potential of 35.9%. Hence, we reiterate our “BUY” rating on the stock. Q3 FY16 Snapshot: Rajnath Yadav | Board line: +91 22 6707 9999; Ext. 912 | rajnath.yadav@choiceindia.com 1 Jan. 25, 2016 Rating Matrix CMP (Rs.) 73.8 Rating Buy Target price (Rs.) 99.7 Target period 18 months Upside potential 35.1% 52 week H/L (Rs.) 126.4 / 59.5 Face value (Rs.) 10 Category Large Cap Sector Electric Utilities Q3 FY16 Result Update Source: Choice Broking Research, Company Shareholding Pattern as on 30th Sept. 2015 Particulars Sep-15 Jun-15 Mar-15 Dec-14 Promoters 75.0% 75.0% 75.0% 75.0% FIIs 8.8% 8.5% 7.2% 6.6% DIIs 5.5% 5.8% 6.3% 6.5% Non institutions 10.7% 10.8% 11.5% 11.9% Consolidated Financial Snapshot (Rs. bn) Projections FY15 FY16E FY17E FY18E FY19E FY20E Revenue 720 767 933 1,052 1,266 1,532 EBITDA 152 154 205 235 280 337 PAT 137 141 182 208 247 295 EBITDA (%) 21.1% 20.1% 22.0% 22.3% 22.1% 22.0% PAT (%) 19.1% 18.4% 19.5% 19.8% 19.5% 19.2% EPS 22 22 29 33 39 47 BVPS 64 75 90 106 126 149 RONW (%) 33.1% 32.0% 35.0% 33.7% 33.7% 34.0% P/E 14.8 11.5 10.0 8.5 7.1 P / BVPS 4.4 3.7 3.1 2.6 2.2 EV/EBIDTA 8.2 5.8 4.8 3.5 2.4 50 60 70 80 90 100 110 120 JSW Energy Ltd. Sensex Particulars (Rs. mn) Q3 FY16 Q2 FY16 Q3 FY15 Q-o-Q (%) Y-o-Y (%) Net Sales 26,491.3 25,314.3 23,808.3 4.6% 11.3% EBITDA 11,912.7 9,982.8 9,741.5 19.3% 22.3% Adjusted PAT 3,206.8 3,419.6 3,801.9 -6.2% -15.7% EBITDA Margin (%) 45.0% 39.4% 40.9% 553 bps 405 bps Adjusted PAT Margin (%) 12.1% 13.5% 16.0% (140) bps (386) bps

- 2. BUY 2 Q3 FY16 Quarter Actual vs. Estimates: Source: Choice Broking Research, Company Source: Choice Broking Research, Company Q3 FY16 Result Update Q3 FY16 Quarter Performance: Particular (Rs. mn) Q3 FY16 Actual Q3 FY16 EstimatesVariance (%) Reason / Comments Total Operating Income 26,491.3 26,386.9 0.4% Top-line came in-line with our estimates EBITDA 11,912.7 11,640.4 2.3% EBITDA came in-line with our estimates Adjusted PAT 3,206.8 5,249.4 -38.9% Higher than expected depreciation and finance charge coupled with higher tax incidence led to a fall in PAT Particulars (Rs. mn) Q3 FY16 Q2 FY16 Q3 FY15 Q-o-Q (%) Y-o-Y (%) Total Operating Income 26,491.3 25,314.3 23,808.3 4.6% 11.3% Total Operating Expenditure (14,578.6) (15,331.5) (14,066.8) -4.9% 3.6% EBITDA 11,912.7 9,982.8 9,741.5 19.3% 22.3% Depreciation (2,650.4) (2,240.1) (1,971.1) 18.3% 34.5% EBIT 9,262.3 7,742.7 7,770.4 19.6% 19.2% Interest Expenses (4,491.2) (3,511.4) (2,843.2) 27.9% 58.0% Other Income 264.4 897.9 376.1 -70.6% -29.7% Exceptional Items 0.0 1,500.0 0.0 -100.0% - Profit Before Tax (PBT) 5,035.5 6,629.2 5,303.3 -24.0% -5.0% Tax Expenses (1,816.3) (1,537.2) (1,405.1) 18.2% 29.3% Adjusted PAT 3,206.8 3,419.6 3,801.9 -6.2% -15.7% Basic EPS (Rs.) 2.0 2.1 2.3 -6.0% -15.5% Diluted EPS (Rs.) 2.0 2.1 2.3 -6.0% -15.5% EBITDA Margin (%) 45.0% 39.4% 40.9% 553 bps 405 bps Adjusted PAT Margin (%) 12.1% 13.5% 16.0% (140) bps (386) bps Jan. 25, 2016 JSW Energy Ltd.

- 3. BUY 3 Consolidated Key Operating Metric: Q3 FY16 Result Update Valuation: Source: Choice Broking Research, Company Particulars Q3 FY15 Q4 FY15 Q1 FY16 Q2 FY16 Q3 FY16 Q-o-Q (%) Y-o-Y (%) Average Deemed PLF (%) 65.3% 61.0% 56.8% 80.8% 73.8% (70) bps 85 bps Vijayanagar PLF (%) 100.0% 100.0% 81.0% 81.0% 96.0% 150 bps (40) bps Ratnagiri PLF (%) 84.0% 57.0% 66.0% 84.0% 90.0% 60 bps 60 bps Barmer PLF (%) 77.0% 87.0% 80.0% 86.0% 85.0% (10) bps 80 bps Himachal Pradesh (%) 0.0% 0.0% 0.0% 72.0% 24.0% (480) bps 240 bps Net Generation (mn units) 5,366.0 4,698.0 4,480.0 5,637.0 5,968.0 5.9% 11.2% Vijayanagar 1,770.0 1,726.0 1,405.0 1,430.0 1,689.0 18.1% -4.6% Ratnagiri 2,024.0 1,333.0 1,574.0 2,038.0 1,955.0 -4.1% -3.4% Barmer 1,572.0 1,639.0 1,501.0 1,504.0 1,715.0 14.0% 9.1% Himachal Pradesh 0.0 0.0 0.0 665.0 609.0 -8.4% - Sales Mix (%) 100.0% 100.0% 100.0% 100.0% 100.0% - - Long Term PPAs 53.5% 53.9% 55.6% 55.4% 50.8% (463) bps (269) bps Merchant Sales 46.5% 46.1% 44.4% 44.6% 49.2% 463 bps 269 bps Average Realization (Rs. Per Unit) 4.3 4.4 4.2 4.0 4.1 2.5% -3.8% Fuel Cost per Unit (Rs.) 2.3 2.2 2.2 2.2 2.1 -4.7% -10.9% Other Operational Expenses per Unit (Rs.) 0.3 0.5 0.7 0.8 0.6 -27.0% 88.2% We believe that, with the revival in the economy, power deficit is expected to increase, assisting a support to the merchant power rates. JSWEL, with its presence in key power deficit region such as South India, is likely to benefit from it. Besides, this the company is also expecting a finalization of tariff for RWPL and Karcham Wangtoo power plants. Favorable order will be positive for JSWEL. Additionally, the acquisition of the hydro assets is likely to improve the sales-mix and the profitability of the company. At CMP of Rs. 73.4, the company’s share is trading at TTM P/E and P/BVPS multiple of 9.1x and 1.4x, respectively. The recent correction in the stock price is not justified given the positive outlook on merchant power rate and presence in the key power deficit market such as South India. Based on SOTP valuation methodology, we arrive at a target price of Rs. 99.7 per share, translating into an upside potential of 35.9%. Hence, we reiterate our “BUY” rating on the stock. SOTP Valuation Methodology Value (Rs. mn) Value per Share (Rs.) Vijayanagar and Ratnagiri DCF 59,608.4 36.3 Raj West Power Ltd. DCF 44,664.7 27.2 Himachal Baspa Power Co. Ltd. DCF 27,629.4 16.8 Barmer Lignite Mining Co. Ltd. 1 x Investment 9,197.3 5.6 JSW Power Trading Co. Ltd. 1 x Investment Value 1,577.6 1.0 JSW Energy (Kutehr) Ltd. 1 x Investment 2,450.0 1.5 Toshiba JSW Power Systems Pvt. Ltd. 1 x Investment 1,002.3 0.6 Cas & Cash Equivalent Actuals 17,375.7 10.6 Total Value 99.7 Source: Choice Broking Research, Company Jan. 25, 2016 JSW Energy Ltd.

- 4. 4 Financial Statements: Source: Choice Broking Research Source: Choice Broking Research BUY Q3 FY16 Result Update Consolidated Profit and Loss Statement Particulars (Rs. mn) FY12 FY13 FY14 FY15 FY16E FY17E Total Operating Income 61,267.7 89,343.0 87,054.2 93,801.6 99,691.8 119,282.6 Fuel Cost (36,541.1) (42,959.2) (41,373.5) (46,811.3) (42,932.5) (46,777.6) Purchase of Power (3,582.6) (11,482.1) (8,409.5) (2,247.7) (6,090.8) (4,000.0) Employee Benefits Expense (904.7) (1,267.6) (1,334.2) (1,469.2) (1,732.0) (1,900.4) Increase / Decrease in Banked Energy / Inventory 26.8 25.6 1,883.5 (1,920.6) 0.0 0.0 Other Expenses (5,708.9) (5,727.8) (5,306.5) (5,118.7) (6,826.4) (7,716.9) EBITDA 14,557.2 27,931.9 32,514.0 36,234.1 42,110.1 58,887.7 Depreciation and Amortization Expense (5,033.5) (6,615.3) (8,099.5) (7,897.6) (9,087.5) (11,172.3) EBIT 9,523.7 21,316.6 24,414.5 28,336.5 33,022.7 47,715.3 Finance Costs (7,172.4) (9,627.9) (12,059.4) (11,374.6) (14,181.4) (19,006.1) Other Income 1,386.8 2,134.3 2,022.1 2,301.1 2,365.0 2,735.5 Exceptional Items (Net) (1,612.7) (1,965.9) (3,776.9) (342.3) 1,500.0 0.0 PBT 2,125.4 11,857.1 10,600.3 18,920.7 22,706.2 31,444.7 Tax Expenses (419.2) (2,733.1) (2,836.0) (5,149.9) (6,445.9) (9,095.7) Adjusted PAT 3,313.1 11,002.4 11,324.3 13,837.4 14,083.9 21,429.0 Consolidated Balance Sheet Particulars (Rs. mn) FY12 FY13 FY14 FY15 FY16E FY17E Share Capital 16,400.5 16,400.5 16,400.5 16,400.5 16,400.5 16,400.5 Reserves and Surplus 40,600.2 45,637.1 49,311.2 58,779.7 71,450.3 89,564.9 Minority Interest 500.2 452.3 503.2 547.1 688.1 808.1 Long Term Borrowings 87,172.4 88,526.7 89,323.2 80,623.5 145,785.7 139,954.2 Deferred Tax Liabilities 1,291.6 1,524.2 1,932.9 2,929.7 2,550.7 3,051.9 Other Long Term Liabilities 14.0 18.6 18.6 140.0 140.0 140.0 Long Term Provisions 286.4 305.7 309.3 337.7 453.9 543.0 Short Term Borrowings 5,710.1 6,467.6 2,076.9 1,482.2 4,895.1 0.0 Trade Payables 25,288.7 25,678.4 16,405.1 16,393.3 21,620.7 23,064.8 Other Current Liabilities 14,262.2 14,872.1 12,268.5 12,550.7 14,661.0 17,542.1 Short Term Provisions 1,461.7 3,897.8 3,894.5 4,015.6 4,006.5 4,793.9 Total Liabilities 192,988.0 203,781.0 192,443.9 194,200.0 282,652.5 295,863.5 Fixed Assets 146,152.0 148,740.8 142,386.9 136,346.0 218,685.9 215,204.1 Goodwill on Consolidation 294.1 279.9 106.0 96.6 96.6 96.6 Non Current Investments 2,870.8 2,714.2 2,535.0 2,327.2 2,327.2 3,404.0 Long Term Loans and Advances 13,067.9 13,992.2 13,820.6 17,638.7 17,638.7 25,345.7 Other Non Current Assets 490.7 676.9 992.2 1,334.1 1,334.1 1,334.1 Current Investments 2,100.2 6,835.6 6,341.9 13,861.2 13,861.2 17,311.6 Inventories 7,658.4 4,414.7 4,157.7 5,482.6 5,171.4 6,285.5 Trade Receivables 10,639.8 18,487.4 11,976.3 11,722.9 15,600.9 16,661.4 Cash and Bank Balances 6,685.7 3,989.8 5,674.5 3,514.5 4,895.1 5,857.1 Short Term Loans and Advances 1,816.1 2,239.7 2,047.9 1,478.0 1,478.0 2,493.0 Other Current Assets 1,212.3 1,409.8 2,404.9 398.2 1,563.3 1,870.5 Total Assets 192,988.0 203,781.0 192,443.9 194,200.0 282,652.5 295,863.5 Jan. 25, 2016 JSW Energy Ltd.

- 5. 5 Financial Statement (Contd…) Source: Choice Broking Research Source: Choice Broking Research BUY Q3 FY16 Result Update Consolidated Cash Flow Statement Particulars FY12 FY13 FY14 FY15 FY16E FY17E Cash Flow From Operations Activities 20,286.8 17,246.2 22,691.2 33,928.5 37,462.7 52,213.2 Cash Flow from Investing Activities (18,201.7) (9,441.1) (3,625.1) (4,207.6) (87,562.4) (18,204.2) Cash Flow from Financing Activities (5,531.8) (6,844.1) (18,590.5) (23,272.2) 51,480.4 (33,047.1) Net Cash Flow (3,446.7) 961.0 475.6 6,448.7 1,380.6 962.0 Opening Balance of Cash & Cash Balance 12,202.2 8,755.5 9,716.5 10,192.1 3,514.5 4,895.1 Closing Balance of Cash & Cash Balance 8,755.5 9,716.5 10,192.1 16,640.8 4,895.1 5,857.1 Consolidated Financial Ratio FY12 FY13 FY14 FY15 FY16E FY17E Profitability & Return Ratios EBITDA Margin (%) 23.8% 31.3% 37.3% 38.6% 42.2% 49.4% PAT Margin (%) 5.4% 12.3% 13.0% 14.8% 14.1% 18.0% RoNW (%) 5.8% 17.6% 17.1% 18.3% 15.9% 20.1% RoCE (%) 6.3% 13.4% 15.3% 17.6% 13.6% 19.1% Working Capital & Liquidity Ratios Current Ratio (X) 0.7 0.7 0.8 0.6 0.7 0.7 Quick Ratio (X) 0.5 0.6 0.6 0.5 0.5 0.6 Interest Coverage Ratio 1.3 2.2 2.0 2.5 2.3 2.5 Net Debt to EBITDA Ratio 5.8 3.0 2.4 1.8 3.1 2.0 Turnover & Leverage Ratios Fixed Asset Turnover (X) 0.4 0.6 0.6 0.7 0.5 0.6 Total Asset Turnover (X) 0.3 0.4 0.5 0.5 0.4 0.4 Debt Equity Ratio (X) 1.6 1.5 1.4 1.1 1.7 1.3 Dividend Pay Out Ratio 0.6 0.1 0.3 0.3 0.2 0.2 Valuation Ratios DPS (Rs.) 1.2 0.6 2.3 2.3 1.8 2.0 BVPS (Rs.) 35.1 38.1 40.4 46.2 54.0 65.1 EPS (Rs. Cr) 2.0 6.7 6.9 8.4 8.6 13.1 P / E (X) 36.7 11.0 10.7 8.8 8.6 5.7 P / BVPS (X) 2.1 1.9 1.8 1.6 1.4 1.1 EV / Sales (X) 3.4 2.3 2.3 2.0 2.5 2.0 EV / EBITDA (X) 14.1 7.4 6.2 5.1 6.0 4.0 Jan. 25, 2016 JSW Energy Ltd.