Q2 2014 Retail Market Research Report

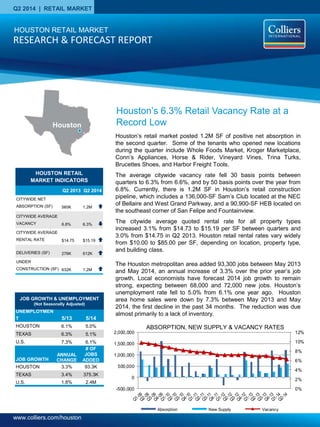

- 1. www.colliers.com/houston Q2 2014 | RETAIL MARKET HOUSTON RETAIL MARKET INDICATORS Q2 2013 Q2 2014 CITYWIDE NET ABSORPTION (SF) 560K 1.2M CITYWIDE AVERAGE VACANCY 6.8% 6.3% CITYWIDE AVERAGE RENTAL RATE $14.75 $15.19 DELIVERIES (SF) 276K 612K UNDER CONSTRUCTION (SF) 632K 1.2M Houston’s retail market posted 1.2M SF of positive net absorption in the second quarter. Some of the tenants who opened new locations during the quarter include Whole Foods Market, Kroger Marketplace, Conn’s Appliances, Horse & Rider, Vineyard Vines, Trina Turks, Brucettes Shoes, and Harbor Freight Tools. The average citywide vacancy rate fell 30 basis points between quarters to 6.3% from 6.6%, and by 50 basis points over the year from 6.8%. Currently, there is 1.2M SF in Houston’s retail construction pipeline, which includes a 136,000-SF Sam’s Club located at the NEC of Bellaire and West Grand Parkway, and a 90,900-SF HEB located on the southeast corner of San Felipe and Fountainview. The citywide average quoted rental rate for all property types increased 3.1% from $14.73 to $15.19 per SF between quarters and 3.0% from $14.75 in Q2 2013. Houston retail rental rates vary widely from $10.00 to $85.00 per SF, depending on location, property type, and building class. The Houston metropolitan area added 93,300 jobs between May 2013 and May 2014, an annual increase of 3.3% over the prior year’s job growth. Local economists have forecast 2014 job growth to remain strong, expecting between 68,000 and 72,000 new jobs. Houston’s unemployment rate fell to 5.0% from 6.1% one year ago. Houston area home sales were down by 7.3% between May 2013 and May 2014, the first decline in the past 34 months. The reduction was due almost primarily to a lack of inventory. ABSORPTION, NEW SUPPLY & VACANCY RATES 0% 2% 4% 6% 8% 10% 12% -500,000 0 500,000 1,000,000 1,500,000 2,000,000 Absorption New Supply Vacancy Houston’s 6.3% Retail Vacancy Rate at a Record Low HOUSTON RETAIL MARKET RESEARCH & FORECAST REPORT Houston UNEMPLOYMEN T 5/13 5/14 HOUSTON 6.1% 5.0% TEXAS 6.3% 5.1% U.S. 7.3% 6.1% JOB GROWTH ANNUAL CHANGE # OF JOBS ADDED HOUSTON 3.3% 93.3K TEXAS 3.4% 375.3K U.S. 1.8% 2.4M JOB GROWTH & UNEMPLOYMENT (Not Seasonally Adjusted)

- 2. RESEARCH & FORECAST REPORT | Q2 2014 | HOUSTON RETAIL MARKET SALES ACTIVITY Houston’s second quarter retail investment sales activity included 51 sales transactions. Total sales transaction value totaled $376M and the average price per SF was $163. The average cap rate was 7.2%. Several of the more significant transactions that closed during the second quarter are high- lighted on the left. LEASING ACTIVITY Houston retail leasing activity in the second quarter reached 1.2M SF. Overall, transactions under 10,000 SF comprised the largest group of retail leases, with the market recording eleven leases over 10,000 SF and five over 20,000 SF in the second quarter. A partial list of the leases signed during the second quarter are listed in the table below. COLLIERS INTERNATIONAL | P. 2 Southway Shopping Center 8006-8230 S Gessner Dr, Houston, TX Southwest Submarket RBA: 178,768 SF Built: 1976/2003 Buyer: American Realty Capital Seller: RPD Catalyst LLC Date: June 6, 2014 Price: $27.5M or $161/SF Cap: N/A Kirkwood Shopping Center 11920-11990 Westheimer, Houston, TX Far West Submarket RBA: 81,607 SF Built: 1979/2008 Buyer: Private REIT Seller: Revesco Properties Date: May 23, 2014 Price: $17.1M or $210/SF Cap: N/A Marq*E Entertainment Center I-10 and Silber Near NW Spring Valley Submarket RBA: 351,811 SF Built: 1999 Buyer: Levcor, Inc. Seller: Canyon Capital Realty Advisors Date: June, 2014 Price: Undisclosed Cap: N/A RETAIL SALE TRANSACTIONS Cinco-Westheimer Shopping Center 20680 Westheimer Pky, TX Far Katy South Submarket RBA: 17,500 SF Built: 2006 Buyer: Hass Holdings, LLC Seller: Prime Property Center MGNT Date: June, 2014 Price: $3.8M or $214/SF Cap: 9.8% Building Name/Address Submarket SF Tenant Lease Date Tanglewood Court Near West 90,945 HEB Apr-14 Market at First Colony Stafford 64,169 Floor & Décor Outlets of America Apr-14 Fiesta Mart - FM529 Far Katy North 60,000 Fiesta Mart May-14 Fairmont Junction Plaza Southeast Ret 42,130 Bravo Ranch Supermarket Mar-14 Fondren Road Plaza Southwest Ret 46,133 Fitness Connection May-14 River Oaks District Inner Loop River Oaks 10,117 Hermès May-14 Q2 2014 Retail Leases

- 3. RESEARCH & FORECAST REPORT | Q2 2014 | HOUSTON RETAIL MARKET RENTAL RATES According to our data source CoStar Property, the citywide average quoted rental rate for all property types increased 3.1% from $14.73 to $15.19 per SF between quarters and 3.0% from $14.75 in Q2 2013. Houston Class A retail rental rates vary widely from $10.00 to $85.00 per SF depending on location and center type. Recent quoted rates for community centers and power centers range from $20.00 - $40.00 per SF and theme/entertainment centers range from $25.00 - $35.00 per SF. Lifestyle centers in Class A locations such as High Street, Uptown Park and The Vintage range from $40.00 - $85.00 per SF. Strip centers range from $30.00 - $50.00 per SF and neighborhood centers range from $25.00 - $45.00 per SF. VACANCY & AVAILABILITY The average citywide vacancy rate fell 30 basis points between quarters to 6.3% from 6.6%, and by 50 basis points over the year from 6.8%. This is the lowest Houston’s vacancy rate has been in the last 10 years. By product type on a quarterly basis, theme/entertainment centers posted the largest decrease in vacancy, 2,060 basis points, from 30.5% in the first quarter to 9.9% in the second quarter 2014. Lifestyle centers recorded the largest increase in vacancy between quarters increasing 90 basis points from 4.9% to 5.8%. Houston’s retail construction pipeline contains 1.2M SF and second quarter deliveries totaled 612,000 SF. ABSORPTION & DEMAND Houston’s retail market posted 1.2M SF of positive net absorption in the second quarter. Some of the tenants that moved into space during the second quarter are listed in the table at right. HOUSTON RETAIL MARKET STATISTICAL SUMMARY COLLIERS INTERNATIONAL | P. 3 Q2 2014 ABSORPTION Tenant/ Submarket SF Occupied Kroger Marketplace Far North 31,622 Whole Foods Galleria 52,000 Anthem College Far North 31,622 Conn’s Appliances Montgomery County 22,500 Harbor Freight Tools NASA/Clear Lake 15,040 Chulas Sports Cantina Pasadena/Galena Park 13,775 King Dollar Stafford 12,779 Dollar Tree NASA/Clear Lake 12,500 Brucettes Shoes Galleria 9,122 Horse & Rider Montgomery County 8,460 Prudential Gary Green Realtors NASA/Clear Lake 8,300 RENTABLE AREA DIRECT VACANTSF DIRECT VACANCY RATE SUBLET VACANCY SF SUBLET VACANCY RATE TOTAL VACANCYSF TOTAL VACANCY RATE Q22014NET ABSORPTION Q12014NET ABSORPTION CLASSA RENTALRATES (in-line)* Strip Centers (unanchored) 32,630,810 2,976,361 9.1% 6,505 0.0% 2,982,866 9.1% 236,187 151,434 $30.00-$50.00 Neighborhood Centers (one anchor) 68,350,477 6,529,679 9.6% 24,192 0.0% 6,553,871 9.6% 521,534 94,018 $25.00-$45.00 Community Centers (two anchors) 43,407,750 2,875,256 6.6% 79,387 0.2% 2,954,643 6.8% (16,076) (133,012) $20.00-$40.00 Power Centers (three or > anchors) 22,956,259 789,134 3.4% - 0.0% 789,134 3.4% 84,491 40,414 $20.00-$40.00 Lifestyle Centers 3,782,009 185,635 4.9% 33,789 0.9% 219,424 5.8% (1,029) 33,490 $40.00-$85.00 Outlet Centers 1,899,333 250,203 13.2% - 0.0% 250,203 13.2% (10,215) 34,231 $20.00-$40.00 Theme/Entertainment 553,786 54,849 9.9% - 0.0% 54,849 9.9% 1,028 15,200 $25.00-$35.00 Single-Tenant 68,370,776 1,498,122 2.2% 64,554 0.1% 1,562,676 2.3% 257,105 273,749 N/A Malls 26,219,981 1,398,588 5.3% 54,750 0.2% 1,453,338 5.5% 144,177 37,219 N/A Greater Houston 268,171,181 16,557,827 6.2% 263,177 0.1% 16,821,004 6.3% 1,217,202 572,609

- 4. RESEARCH & FORECAST REPORT | Q2 2014 | HOUSTON RETAIL MARKET Accelerating success. COLLIERS INTERNATIONAL 1233 W. Loop South Suite 900 Houston, Texas 77027 Main +1 713 222 2111 LISA R. BRIDGES Director of Market Research | Houston Direct +1 713 830 2125 Fax +1 713 830 2118 lisa.bridges@colliers.com The Colliers Advantage Enterprising Culture Colliers International is a leader in global real estate services, defined by our spirit of enterprise. Through a culture of service excellence and a shared sense of initiative, we integrate the resources of real estate specialists worldwide to accelerate the success of our partners. When you choose to work with Colliers, you choose to work with the best. In addition to being highly skilled experts in their field, our people are passionate about what they do. And they know we are invested in their success just as much as we are in our clients’ success. This is evident throughout our platform—from Colliers University, our proprietary education and professional development platform, to our client engagement strategy that encourages cross-functional service integration, to our culture of caring. We connect through a shared set of values that shape a collaborative environment throughout our organization that is unsurpassed in the industry. That’s why we attract top recruits and have one of the highest retention rates in the industry. Colliers International has also been recognized as one of the “best places to work” by top business organizations in many of our markets across the globe. Colliers International offers a comprehensive portfolio of real estate services to occupiers, owners and investors on a local, regional, national and international basis. *Information herein has been obtained from sources deemed reliable, however its accuracy cannot be guaranteed. COLLIERS INTERNATIONAL | P. 4