Basel III Framework Credit Risk Management

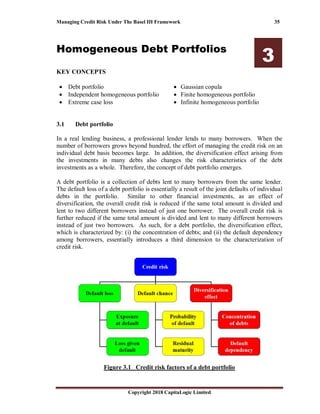

- 1. Managing Credit Risk Under The Basel III Framework 35 Copyright 2018 CapitaLogic Limited Homogeneous Debt Portfolios 3 KEY CONCEPTS • Debt portfolio • Independent homogeneous portfolio • Extreme case loss • Gaussian copula • Finite homogeneous portfolio • Infinite homogeneous portfolio 3 Homogeneous debt portfolios 3.1 Debt portfolio In a real lending business, a professional lender lends to many borrowers. When the number of borrowers grows beyond hundred, the effort of managing the credit risk on an individual debt basis becomes large. In addition, the diversification effect arising from the investments in many debts also changes the risk characteristics of the debt investments as a whole. Therefore, the concept of debt portfolio emerges. A debt portfolio is a collection of debts lent to many borrowers from the same lender. The default loss of a debt portfolio is essentially a result of the joint defaults of individual debts in the portfolio. Similar to other financial investments, as an effect of diversification, the overall credit risk is reduced if the same total amount is divided and lent to two different borrowers instead of just one borrower. The overall credit risk is further reduced if the same total amount is divided and lent to many different borrowers instead of just two borrowers. As such, for a debt portfolio, the diversification effect, which is characterized by: (i) the concentration of debts; and (ii) the default dependency among borrowers, essentially introduces a third dimension to the characterization of credit risk. Figure 3.1 Credit risk factors of a debt portfolio

- 2. 36 Managing Credit Risk Under The Basel III Framework Copyright 2018 CapitaLogic Limited 3.2 Portfolio one-year expected loss The sum of the 1-year ELs of all debts in a portfolio is referred to as the portfolio 1-year EL which is a natural extension of the 1-year EL to a debt portfolio from a single debt.6 For a debt portfolio comprising NOB debts from NOB different borrowers, the portfolio 1-year EL is: ( ){ } [ ]( ) k NOB k k=1 NOB RM k k k k k=1 NOB k k k k k=1 Portfolio 1-year EL = 1-year EL = EAD × LGD × Min PD , 1 - 1 - PD EAD × LGD × PD × Min 1, RM ≈ ∑ ∑ ∑ Consider a debt portfolio comprising only one debt with credit risk factors EAD USD 10,000, LGD 90 percent, PD 3 percent and RM one year. The portfolio 1-year EL is simply: 10,000 × 90% × 3% × 1 = USD 270 Consider another debt portfolio comprising two debts lent to two different borrowers, each with credit risk factors EAD USD 5,000, LGD 90 percent, PD 3 percent and RM one year. Again, the portfolio EAD is: 5,000 + 5,000 = USD 10,000 and the portfolio 1-year EL is also: 5,000 × 90% × 3% × 1 + 5,000 × 90% × 3% × 1 = USD 270 Apparently, the portfolio 1-year EL has yet to capture the reduction in credit risk arising from the diversification effect and is not an effective credit risk measure for a debt portfolio. In fact, the formula of the portfolio 1-year EL is constructed without any factor of the diversification effect incorporated. 3.3 Homogeneous portfolio ★★★★★★★★★★★★ A homogeneous portfolio is a debt portfolio comprising at least thirty debts with identical characteristics in terms of EAD, LGD, PD and default dependency among borrowers. The RMs are unified artificially to one year across all debts, subject to three criteria that: 6 In contrast to the 1-year EL, the concept of the EL cannot be extended to a debt portfolio.