Roll Rate Model - Using R in Finance

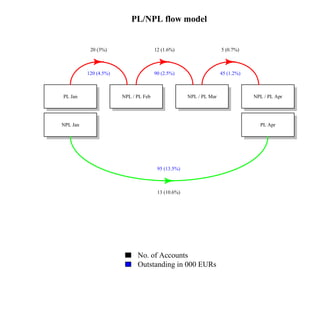

- 1. PL/NPL flow model 20 (3%) 12 (1.6%) 5 (0.7%) 120 (4.5%) 90 (2.5%) 45 (1.2%) PL Jan NPL / PL Feb NPL / PL Mar NPL / PL Apr NPL Jan PL Apr 95 (13.5%) 13 (10.6%) No. of Accounts Outstanding in 000 EURs

- 2. Roll Forward Portfolio Analysis Number of Accounts and Outstanding in 000 EURs 200 (15.5%) Current (no dpd) 1−30 dpd 3132.5 (17.1%) 2700.2 (12.8%) 90 (11.4%) 45 (17.4%) 32 (10.5%) 31−60 dpd 61−90 dpd 91−120 dpd 3023.9 (19.9%) 1509.7 (12.3%) 890.2 (17.5%) 25 (12.3%) 20 (7.5%) 32 (9.9%) 121−150 dpd 151−180 dpd 181+ dpd 1200.2 (9%) 990.1 (11.9%) Number of Accounts * dpd − Days Past Due Outstanding in 000 EURs

- 3. Roll Back Portfolio Analysis Number of Accounts 181+ dpd 5 9 5 151−180 dpd Current (no dpd) 9 7 3 4 7 10 5 1 6 5 9 6 121−150 dpd 1−30 dpd 7 4 4 8 3 5 6 7 9 3 91−120 dpd 31−60 dpd 9 3 4 61−90 dpd

- 4. Roll Back Portfolio Analysis Outstanding in 000 EURs 181+ dpd 119 59 73 151−180 dpd Current (no dpd) 90 99 69 66 56 91 78 72 87 115 108 65 121−150 dpd 1−30 dpd 51 89 67 77 114 120 111 110 63 113 91−120 dpd 31−60 dpd 100 104 118 61−90 dpd