Esm slideshare ppt

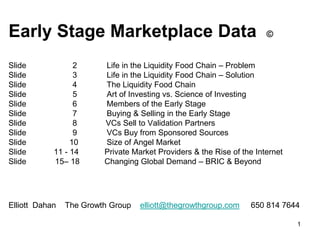

- 1. Early Stage Marketplace Data © Slide 2 Life in the Liquidity Food Chain – Problem Slide 3 Life in the Liquidity Food Chain – Solution Slide 4 The Liquidity Food Chain Slide 5 Art of Investing vs. Science of Investing Slide 6 Members of the Early Stage Slide 7 Buying & Selling in the Early Stage Slide 8 VCs Sell to Validation Partners Slide 9 VCs Buy from Sponsored Sources Slide 10 Size of Angel Market Slide 11 - 14 Private Market Providers & the Rise of the Internet Slide 15– 18 Changing Global Demand – BRIC & Beyond Elliott Dahan The Growth Group elliott@thegrowthgroup.com 650 814 7644 1

- 2. LIFE IN THE LIQUIDITY FOOD CHAIN THE PROBLEM All Startups need BOTH Validation and Funding 2

- 3. LIFE IN THE LIQUIDITY FOOD CHAIN THE SOLUTION Create a global marketplace that satisfies the self interests of each member of the Early Stage Community 3

- 4. The Liquidity Food Chain BUY EXIT - IPO & Corporate M&A (2) SELL PRE-IPO - Private Networks (Sharespost/2ndMarket) GROWTH – Alternative Trading Systems, Series B +++, Corp Dev /Corp M&A EXPANSION - Series A/B – VC / Corp Dev THE EARLY STAGE MARKETPLACE Early Stage Funders – Angels/VCs/Work-For-Hire Sponsoring Organizations – Accelerators, Incubators, Univ. Public & Private Mentoring Organizations Sponsored Companies – startups Validation Partners (1) – Corporate Partners / Corp. Dev. NOTES (1) Validation Partners can provide either funding and or partnership (2) ―venture capitalists report selling to a public company (49.9%) as the most likely course of action for a liquidity event. Nearly 24.6% indicate their plans to sell to a private company while 16.8% are planning for an initial public offering.‖ Pepperdine – ―Private Capital Markets Project‖ – August 2009 BUY 4 SELL

- 5. BUYING DECISIONS OF THE LIQUIDITY FOOD CHAIN Public IPO / Corp. M&A Hardcore Financial Data Corp M&A Pre-Exit PMN – 2ndMkt / Short term / Liquidity Sharespost /VCs/PE/Corp Corp M&A M&A Series B++ Strong Potential ATS – Xpert Financial/ VC Corp Development /Corp Dev Early Stage Marketplace Team / Mkt Size / Angels/VCs/Corp Dev Solution /. . “GUT” Seed/Series A ART of Investing SCIENCE of Investing 5

- 6. The Members of the Early Stage Community (www.earlystagemarketplace.com) 6

- 7. EARLY STAGE MEMBERS ARE CONSTANTLY BUYING AND SELLING FROM EACH OTHER ESM MEMBER BUY FROM SELL TO Validation Partner Sponsored Companies Internal Oper. Divisions, Funders Funders, Corp Spinout VCs Sponsoring Sponsored Companies Funders, Non Profit Grants, Corp. Sponsorships, Organizations Mentors/Advisors/Pro Bono Sponsored Sponsoring Sponsoring Orgs, Funders, Organizations Validation Partners, other Companies Sponsored Companies Sponsored Companies, Validation Partners, Funders Tech Transfers, Corp. Upstream Funders, Funders Spinouts, Funders to syndicate current round 7

- 8. VCs & Validation Partners Working Together in the Early Stage Collaboration Community Pepperdine – ―Private Capital Markets Project‖ – August 2009 ―Regarding exit plans, venture capitalists report selling to a public company (49.9%) as the most likely course of action for a liquidity event. Nearly 24.6% indicate their plans to sell to a private company while 16.8% are planning for an initial public offering.‖ VCs report that 75% of their projected 8 Exit/Liquidity will be with Validation Partners

- 9. VCs and Deal Flow Sources Pepperdine – ―Private Capital Markets Project‖ – August 2009 ―Deal flow comes from a variety of sources. The largest category is entrepreneurs themselves (26.6%) followed by members (25.9%) and word of mouth (13.5%).‖ 1) 85% of VC Deal Flow is sourced from a “Sponsor” with 12% sourced from Other and 4% from Websites 2) “Vouching” is important at all levels – From the Angellist homepage - 9 ―Who do you trust? Who do you know? -

- 10. SIZE OF ANGEL MARKET • Angel investors are estimated to provide 90 percent of the seed and start-up capital in this country— for 30,000 to 50,000 companies per year. Angels invest $15 to $30 billion per year in U.S. start-up companies William H. Payne Entrepreneur, Angel Investor, and Kauffman Foundation Entrepreneur- in-Residence 2010 Ewing Marion Kauffman Foundation • SBA estimates that there are at least 250,000 angels active in the country, funding about 30,000 small companies a year. The total investment from angels has been estimated at anywhere from $20 billion to $50 billion as compared to the $3 to $5 billion per year that the formal venture capital community invests. http://www.smallbusinessnotes.com/ 2010 • EBAN estimates that the number of business angels in Europe is around 75,000, a small number in comparison to the US, which has an estimated 250,000. The European angel market represents circa 25% of the American angel market. EBAN (European Business Angel Network) White Paper 2010 10

- 11. Private Market Providers COMPANY LICENSE STAGE TRANSACTION TYPE NEEDED LINEAR OR COMMUNITY MicroVest No Seed Linear - aggregates to invest in global micro for profit funds Angel List No Seed-Series A Linear - startup to Angel - good example of Vouching Angelsoft No Seed-Series A Linear - startup to Angel - application driven - deal flow tools - no Vouching Angel Pool No Seed-Series A Linear - Angel to Angel syndication Angel Bridge No Seed-Series A Linear - Angel to Angel syndication Xpert Financial Yes Mid Growth Linear - Private Offerings, Secondary Markets - Broker/Dealer to Investor Axial Market Yes Mid Growth Linear - Private Placements - Broker/Dealer to Investor Sharespost Yes Late Growth Linear - Pre IPO companies NOTE 1 Second Market Yes Late Growth Linear - Pre IPO companies ESM NO Seed-Series A Collaborate Community - (1) has its own special-purpose funds to buy up private-company shares and charge participants a 5 percent fee to manage them. Sharespost has raised three such funds — two for Facebook shares and one for shares in LinkedIn, which is in registration for IPO. 11

- 12. ―The New Financial Matchmakers‖ Bob Rice Booz & Com Summer 2011 ― a new generation of private securities platforms that has begun to emerge over the past few years provides much more (than traditional platforms): opportunity discovery and recommendation engines; analytics and evaluation tools; secure virtual diligence rooms with tiered access rights; industry benchmarks and comparables; deal and deal flow management systems. These platforms also offer the reach equal to that of the Internet itself.‖ The Early Stage platform is not Linear – it is a Community where all members are both Buyers and Sellers – constant transactions between Members 12

- 13. SEC may let startups use social networks to raise money April 9, 2011 | Dean Takahashi Federal securities regulators are weighing demands to make it easier for fast-growing companies to use social networks such as Facebook and Twitter to raise money by tapping thousands of investors for very small amounts of shares. The Securities and Exchange Commission is looking at adapting its rules to encourage Internet-age techniques for small companies raising capital. The issue is part of a wider review by the agency into whether to ease decades-old constraints on share issues by closely held companies. Crowd funding could be a cheap source of cash, competing with angel investors who specialize in giving seed rounds to start-ups. Since the amounts of money are small, the downside risk isn’t too bad for investors. But the trick will be in protecting the public from scammers who have no intention of following through on promises. REGISTERED SPONSORING ORGANIZATIONS AND FUNDERS ELIMINATE THE “SCAMMING” ELEMENT 13

- 14. Cantor Fitzgerald Bets On An Expanding Private-Stock Market VentureWire October 10, 2011 • Cantor Fitzgerald is looking to cash in on a growing secondary market for shares in hot private companies such as Facebook and Twitter. The financial services firm is creating a private markets group to afford clients opportunities to invest in private company stock ―For us this is an opportunity to be the dominant player in a very fragmented market,‖ Shawn Matthews, the firm’s chief executive, told VentureWire. • The market has also drawn interest lately from J.P. Morgan Chase, which raised $1.2 billion for a digital growth fund, and Goldman Sachs Group, which raised $1 billion from its foreign clients to invest in Facebook. • Matthews also said his firm doesn’t plan to rely on existing secondary market players to find deals. ―We come already with a significant investment bank behind us,‖ he said. “We’ll be sourcing our own deals. I think that’s where our competitive advantage lies.” • Based in New York, Cantor Fitzgerald has more than 5,000 institutional clients and 1,400 employees in 30 offices worldwide, the firm said. 14

- 15. ½ of US VCs will invest outside of US in 2011 15

- 16. Number of venture firms expected to decline in traditional markets; expected to grow in emerging markets Increase Increase Remain Decrease Decrease +30% 1% - 30% the Same 1% - 30% +30% Brazil 30% 68% 3% NA NA China 48% 51% NA 1% NA India 21% 73% NA 9% 9% US NA 4% 4% 68% 24% the team (Yuri Milner and DST) is studying opportunities across Asia, including China, India, Indonesia and South Korea. Over the next five years, DST expects to devote 40 percent of its capital to the region. NYT, 9/28/2011 16 Deloitte 2010 Venture Capital Global Report

- 17. Limited Partners inclination to invest in VC home country –Next 5 yrs More No Change Less Inclined Inclined Brazil 92% 8% NA China 91% 6% 3% India 76% 18% 6% US 15% 29% 56% Deloitte 2010 Venture Capital Global Report 17

- 18. Venture Capitalists Chase Seed-Stage Deals DEALS INDIA OCTOBER 25, 2011 • Large investment funds in India such as Sequoia Capital India, Norwest Venture Partners India, Nexus Venture Partners and Draper Fisher Jurvetson have started focusing strongly on their India "seed" initiatives. Over the last one year, Sequoia has made at least nine such investments. • Helion Venture Partners, SAIF Partners and a few others also incubate start-ups, and back them in their next rounds of funding. • Norwest, Nexus and Draper Fisher have started their own seed capital programs. Blume Venture Advisors, which is still in the midst of raising money for its fund, has completed more than a dozen deals, including its $300,000 investment in Adepto Solutions Pvt. Ltd, a Mumbai-based developer of social commerce platform Trol.ly. • Other recent seed-stage deals include My First Cheque's investment of an undisclosed amount in MeriCAR Workshops, which runs MeriCAR.com, India's first dedicated car-servicing portal. 18