The rise of indirect tax

•

0 j'aime•625 vues

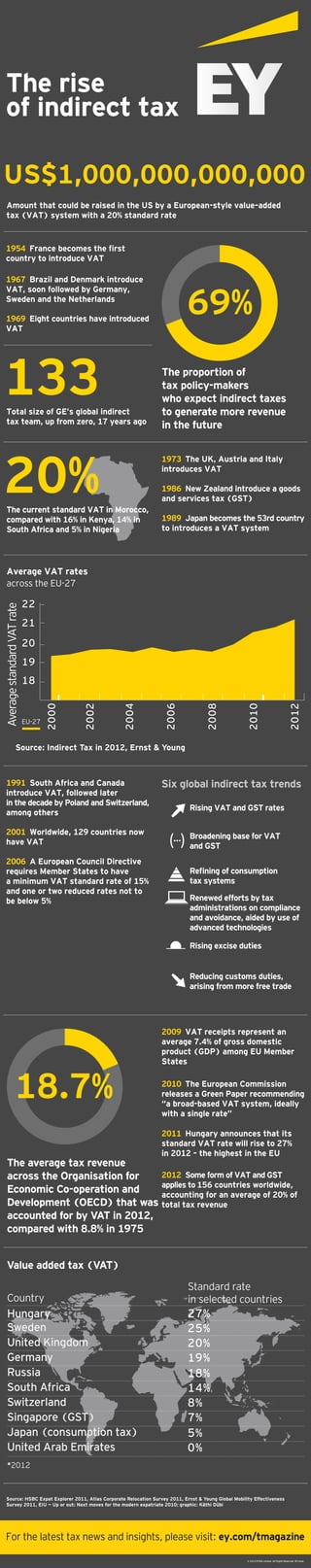

Indirect taxes are booming. As they work to bring public finances under control, governments around the world are increasing VAT, excises and other indirect taxes. They see this as a straightforward way to raise additional revenue. To find out more, visit: http://tmagazine.ey.com/issue/issue-08/

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

An Assessment of the Effectiveness of the VAT Regime in Zimbabwe

An Assessment of the Effectiveness of the VAT Regime in ZimbabweInternational Centre for Tax and Development - ICTD

How foreign investors can adapt to Brazilian systems: overview of taxation, t...

How foreign investors can adapt to Brazilian systems: overview of taxation, t...Moura Tavares Advogados

Contenu connexe

Tendances

An Assessment of the Effectiveness of the VAT Regime in Zimbabwe

An Assessment of the Effectiveness of the VAT Regime in ZimbabweInternational Centre for Tax and Development - ICTD

How foreign investors can adapt to Brazilian systems: overview of taxation, t...

How foreign investors can adapt to Brazilian systems: overview of taxation, t...Moura Tavares Advogados

Tendances (20)

15th wctoh excise-tax-increases-cigarette-consumption-andc2a0government-reven...

15th wctoh excise-tax-increases-cigarette-consumption-andc2a0government-reven...

A Post-Budget 2018 Analysis of the Irish Public Finances

A Post-Budget 2018 Analysis of the Irish Public Finances

An Assessment of the Effectiveness of the VAT Regime in Zimbabwe

An Assessment of the Effectiveness of the VAT Regime in Zimbabwe

Mediation in Criminal and Civil cases 2019 - Statistics

Mediation in Criminal and Civil cases 2019 - Statistics

Stephen Balzan. Malta where does the Russian money goes. The Future of Offsho...

Stephen Balzan. Malta where does the Russian money goes. The Future of Offsho...

Addressing Base Erosion and the Rise of Tax "Sovranism"

Addressing Base Erosion and the Rise of Tax "Sovranism"

Revenue watch index_2010_-presentation_-_icgfm_miami_17_may_2011

Revenue watch index_2010_-presentation_-_icgfm_miami_17_may_2011

How foreign investors can adapt to Brazilian systems: overview of taxation, t...

How foreign investors can adapt to Brazilian systems: overview of taxation, t...

Similaire à The rise of indirect tax

The Tax Burden of Typical Workers in the EU 28 | 2014

The Tax Burden of Typical Workers in the EU 28 | 2014 Conservative Institute / Konzervatívny inštitút M. R. Štefánika

The Impact of Economic Partnership Agreement on Customs Revenues and Challeng...

The Impact of Economic Partnership Agreement on Customs Revenues and Challeng...International Centre for Tax and Development - ICTD

Similaire à The rise of indirect tax (20)

Tax policy and its economic and budgetary impacts - Luiz de Mello, OECD

Tax policy and its economic and budgetary impacts - Luiz de Mello, OECD

The Tax Burden of Typical Workers in the EU 28 | 2014

The Tax Burden of Typical Workers in the EU 28 | 2014

Estonia ranks 1st in the Tax Competitiveness Index

Estonia ranks 1st in the Tax Competitiveness Index

Country Report France 2016 Including an In-Depth Review on the prevention and...

Country Report France 2016 Including an In-Depth Review on the prevention and...

The Impact of Economic Partnership Agreement on Customs Revenues and Challeng...

The Impact of Economic Partnership Agreement on Customs Revenues and Challeng...

Plus de EY

Plus de EY (20)

Quarterly analyst themes of oil and gas earnings, Q1 2022

Quarterly analyst themes of oil and gas earnings, Q1 2022

EY Price Point: global oil and gas market outlook, Q2 | April 2022

EY Price Point: global oil and gas market outlook, Q2 | April 2022

EY Price Point: global oil and gas market outlook, Q2 April 2021

EY Price Point: global oil and gas market outlook, Q2 April 2021

Tax Alerte - Principales dispositions loi de finances 2021

Tax Alerte - Principales dispositions loi de finances 2021

EY Price Point: global oil and gas market outlook (Q4, October 2020)

EY Price Point: global oil and gas market outlook (Q4, October 2020)

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

Liquidity for advanced manufacturing and automotive sectors in the face of Co...

IBOR transition: Opportunities and challenges for the asset management industry

IBOR transition: Opportunities and challenges for the asset management industry

Fusionen und Übernahmen dürften nach der Krise zunehmen

Fusionen und Übernahmen dürften nach der Krise zunehmen

EY Price Point: global oil and gas market outlook, Q2, April 2020

EY Price Point: global oil and gas market outlook, Q2, April 2020

Dernier

Best Practices for Implementing an External Recruiting Partnership

Best Practices for Implementing an External Recruiting PartnershipRecruitment Process Outsourcing Association

Dernier (20)

VIP Call Girls In Saharaganj ( Lucknow ) 🔝 8923113531 🔝 Cash Payment (COD) 👒

VIP Call Girls In Saharaganj ( Lucknow ) 🔝 8923113531 🔝 Cash Payment (COD) 👒

Enhancing and Restoring Safety & Quality Cultures - Dave Litwiller - May 2024...

Enhancing and Restoring Safety & Quality Cultures - Dave Litwiller - May 2024...

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Best Practices for Implementing an External Recruiting Partnership

Best Practices for Implementing an External Recruiting Partnership

7.pdf This presentation captures many uses and the significance of the number...

7.pdf This presentation captures many uses and the significance of the number...

Vip Dewas Call Girls #9907093804 Contact Number Escorts Service Dewas

Vip Dewas Call Girls #9907093804 Contact Number Escorts Service Dewas

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

The Coffee Bean & Tea Leaf(CBTL), Business strategy case study

The Coffee Bean & Tea Leaf(CBTL), Business strategy case study

Cash Payment 9602870969 Escort Service in Udaipur Call Girls

Cash Payment 9602870969 Escort Service in Udaipur Call Girls

Call Girls in Gomti Nagar - 7388211116 - With room Service

Call Girls in Gomti Nagar - 7388211116 - With room Service

VIP Kolkata Call Girl Howrah 👉 8250192130 Available With Room

VIP Kolkata Call Girl Howrah 👉 8250192130 Available With Room

Lucknow 💋 Escorts in Lucknow - 450+ Call Girl Cash Payment 8923113531 Neha Th...

Lucknow 💋 Escorts in Lucknow - 450+ Call Girl Cash Payment 8923113531 Neha Th...

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

The rise of indirect tax

- 1. The rise of indirect tax US$1,000,000,000,000 Amount that could be raised in the US by a European-style value–added tax (VAT) system with a 20% standard rate 1954 France becomes the first country to introduce VAT 1967 Brazil and Denmark introduce VAT, soon followed by Germany, Sweden and the Netherlands 69% 1969 Eight countries have introduced VAT 133 Total size of GE’s global indirect tax team, up from zero, 17 years ago 20% The proportion of tax policy-makers who expect indirect taxes to generate more revenue in the future 1973 The UK, Austria and Italy introduces VAT 1986 New Zealand introduce a goods and services tax (GST) The current standard VAT in Morocco, compared with 16% in Kenya, 14% in South Africa and 5% in Nigeria 1989 Japan becomes the 53rd country to introduces a VAT system 22 21 20 19 2012 2010 2008 2006 2004 EU-27 2002 18 2000 Average standard VAT rate Average VAT rates across the EU-27 Source: Indirect Tax in 2012, Ernst & Young 1991 South Africa and Canada introduce VAT, followed later in the decade by Poland and Switzerland, among others 2001 Worldwide, 129 countries now have VAT 2006 A European Council Directive requires Member States to have a minimum VAT standard rate of 15% and one or two reduced rates not to be below 5% Six global indirect tax trends Rising VAT and GST rates Broadening base for VAT and GST Refining of consumption tax systems Renewed efforts by tax administrations on compliance and avoidance, aided by use of advanced technologies Rising excise duties Reducing customs duties, arising from more free trade 2009 VAT receipts represent an average 7.4% of gross domestic product (GDP) among EU Member States 18.7% 2010 The European Commission releases a Green Paper recommending “a broad-based VAT system, ideally with a single rate” 2011 Hungary announces that its standard VAT rate will rise to 27% in 2012 – the highest in the EU The average tax revenue 2012 Some form of VAT and GST across the Organisation for applies to 156 countries worldwide, Economic Co-operation and accounting for an average of 20% of Development (OECD) that was total tax revenue accounted for by VAT in 2012, compared with 8.8% in 1975 Value added tax (VAT) Country Standard rate in selected countries Hungary Sweden United Kingdom Germany Russia South Africa Switzerland Singapore (GST) Japan (consumption tax) United Arab Emirates 27% 25% 20% 19% 18% 14% 8% 7% 5% 0% *2012 Source: HSBC Expat Explorer 2011, Atlas Corporate Relocation Survey 2011, Ernst & Young Global Mobility Effectiveness Survey 2011, EIU — Up or out: Next moves for the modern expatriate 2010; graphic: Käthi Dübi For the latest tax news and insights, please visit: ey.com/tmagazine © 2013 EYGM Limited. All Rights Reserved. ED none.