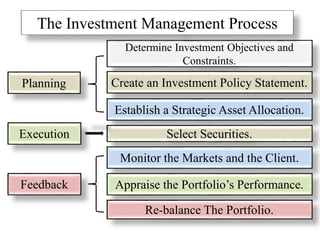

The investment management process

- 1. Planning Execution Feedback Determine Investment Objectives and Constraints. Create an Investment Policy Statement. Establish a Strategic Asset Allocation. Select Securities. Monitor the Markets and the Client. Appraise the Portfolio’s Performance. Re-balance The Portfolio. The Investment Management Process

- 2. KNOW – YOUR – CLIENT!

- 3. Learning About Clients Client Interviews: Information gathering usually begins with a client interview during which the investment advisor can learn about the client’s life and dreams and can identify any issues or problems. The initial interview is also a good opportunity for the advisor and client to share their philosophies about investing to determine whether they will be able to work together compatibly. E.g., it ‘may not be’ appropriate for an aggressive investor to have an advisor who is used to dealing with conservative investors.

- 4. Client Interviews (contd) The investment advisor may find that some clients have difficulty expressing certain concepts in words. E.g., while many individual investors know where they want to be financially in 10, 20, or 30 years, most have a hard time explaining how much risk they are willing to accept to reach their goals. To help obtain information that may not come out in an interview, most investment advisors and firms use a standardized or customized client questionnaire. Learning About Clients

- 5. Client Questionnaires: Can be multiple choice (clients select from a pre-determined list of responses) or open-ended (the client must write down the answer). Some questionnaires focus on only one type of information needed to develop a client’s investment policy, particularly the client’s attitudes toward risk, while others gather a broader range of information. Risk questionnaires are popular tools because of the difficulty clients have in expressing their tolerance for risk. A scoring system is normally utilised to evaluate client responses. Learning About Clients

- 6. Questionnaires - Advantages Questionnaires can be used to specify and prioritize generic financial and lifestyle goals. - specifications about client goals and to express which goals are more important than others. Questionnaires can be used to pinpoint areas for client education. – questionnaires can uncover inconsistencies in a client’s understanding Family members can fill out additional questionnaires - separate questionnaires can identify potential conflicts between two or more family members.

- 7. Questionnaires - Disadvantages Clients may not understand some of the questions or may think they understand them when they do not. Do not automatically assume your client is as knowledgeable as you are about investing. Clients may think they can predict how they will react in certain instances, but real life situations may produce entirely different reactions. – when an actual market decline occurs, many investors are not as bold as they formally thought.

- 8. Questionnaires - Disadvantages Questionnaires are based on the assumption that clients take a holistic approach to their assets. - Questionnaires, apply a single set of questions to all client accounts as if each investor viewed all assets in the same way.

- 9. What Advisors Need to Know Information needed for the Investment policy statement IPS, is divided into four categories: • Personal situation • Financial situation • Personal and financial goals • Attitudes toward risk

- 10. Personal Situation • Age • Marital status (single, married, divorced, separated) • Number of dependents • Employment details (type of work, job stability) • Educational background (certification, post-graduate) • Investing experience (number of years, types of securities) • If married, all of the above information for the spouse • If married, who makes the investment decisions

- 11. Financial Situation • Amount of investable assets • Annual income from all sources (other than investment income) • Annual savings target (or a list of annual expenses) • Type of investment accounts (cash accounts, margin accounts, registered retirement plans) • Other investments (company pension, employee stock options) • Real estate (home, cottage)

- 12. Personal and Financial Goals • Desired retirement age • Desired retirement income • Plans for major expenditures (vacation property, paying for a child’s education, annual vacations) • Gifting of assets (during lifetime or on death)

- 13. Attitudes Toward Risk How the client defines risk - (income shortfall, delayed retirement, less wealth) • Client’s willingness to take on risk Attitude Behaviour (Its really a two- way street)

- 14. Investor Behaviour Standard finance theory assumes that investors are: • Are risk-averse • Have rational expectations • Manage their portfolios as a whole Behavioral finance theory, on the other hand, suggests that investors: • Can be risk-averse or risk-seeking, depending on the situation • Have biased expectations • Practice mental portfolio accounting

- 15. Risk Aversion versus Risk Seeking In Standard Finance, investors are assumed to be risk- averse, that is, given the choice between two investments with identical expected returns, they will invest in the one with the least amount of risk, as measured by the standard deviation of returns. But in reality, clients faced with the possibility of a loss, are often risk seeking rather than risk averse. In dealing with gains, people tend to be risk averse, but when dealing with losses, tend to be risk seeking. This asymmetric attitude toward risk can help explain why some investors are unwilling to sell securities that have gone down in value.

- 16. Rather than sell and realize the losses, investors sometimes hold on in the hope of a recovery, even if there is a chance that the loss could become even bigger. * Standard deviation : is a statistical measure of risk that measures the extent to which returns differ from the average or expected level of return. (Pls commit to memory) Risk Aversion versus Risk Seeking (1)

- 17. Biased Expectations Standard finance assumes that investors have rational expectations, that is, they all gather and act on information in an efficient and unbiased way. i.e the “rational economic human being” is a model of human economic behaviour that hypothesizes that three principles rule economic decisions made by individuals: • Perfect rationality • Perfect self-interest • Perfect information

- 18. Behavioural finance commonly defined as the application of psychology to understand human behaviour in finance or investing. It claims that most people vastly overstate their abilities. E.g., in a magazine study a group of adult men were asked three questions: • How would you rate your ability to get along with others? • How would you rate your ability as a leader? • How would you rate your athletic ability? Biased Expectations

- 19. All the men answered that they were in the top quartile in terms of their ability to interact with others, and no fewer than 25% said they were in the top 1%. A full 70% of the men placed themselves in the top quartile of leadership ability, and 60% answered that they were in the top quartile as athletes. Thus, people are can be a poor judge of their own abilities. Investment advisors must keep this in mind when they assess client responses to questions in interviews and on questionnaires. Overconfidence may cause investors to believe they are more tolerant of risk than they really are. Biased Expectations

- 20. Mental Accounting Standard finance assumes that investors consider their entire portfolio when they make decisions. Behavioral finance, suggests that people compartmentalize their portfolio into different accounts. Mental accounting refers to the phenomenon whereby people do not treat their assets as a single portfolio, but keep track of them separately (Ref: earlier referenced slides). In practical terms, this means that an investor who made N6,000 investing in one stock, but lost N5,000 investing in another, is likely to dwell on the N5,000 loss, despite the fact that the investor’s overall wealth increased by N1,000.

- 21. Investor Personality Types Eight Investor Personality Types (IPTs) with three personality dimensions: • Idealism versus Pragmatism (I vs. P) • Framing versus Integrating (F vs. N) • Reflecting versus Realism (T vs. R)

- 22. Visual Depiction of Personality Dimensions Idealism (I) Framing (F) Reflecting (T) Pragmatism (P) Realism (R) Integrating (N) Combinations of the three different personality dimensions results in Eight Possible Investor Personality Types. These are: IFT, IFR, INT, INR, PFT, PFR, PNT and PNR.

- 23. Idealism Versus Pragmatism (I Vs. P) Clients that fall into the “idealist” end of the I vs. P spectrum overestimate their investing abilities, display excessive optimism about the capital markets and do not seek out information that contradicts their views. E.g, many investors continued buying technology stocks even as they fell during the meltdown in 2000, eternally optimistic that these stocks would make a comeback - discerning patterns where none exist, and believing their above-average market acumen gives them an exaggerated degree of control over the outcomes of their investments.

- 24. Such clients are disinclined to thorough research and they can fall prey to speculative market fads. Idealists are susceptible to overconfidence, optimism, availability, self- attribution, illusion of control, confirmation, recency and representativeness biases. On the other hand, Pragmatists, display a realistic grasp of their own skills and limitations as investors - are not too overconfident about the capital markets and demonstrate a healthy dose of skepticism regarding their investing abilities, understand that investing is an undertaking based on probabilities, and research to confirm their beliefs. Pragmatists are investors who are typically not susceptible to the aforementioned biases. Idealism Versus Pragmatism (I Vs. P)

- 25. Framing Versus Integrating (F Vs. N) Framers: evaluate each of their investments individually and do not consider how each investment fits into an overall portfolio plan. They are rigid in their mental approach to analyzing problems. Also they perceive their portfolio as composed of ‘unique’ money, rather than a composite of well-managed investments. E.g., these clients typically have different allocations for “retirement money”, “vacation money” and “university savings”. This is not necessarily a bad thing, but advisors need to watch for content overlap amongst allocations to guard clients against over-concentrations in an asset class.

- 26. Framers also subconsciously “anchor” their estimates of market or security price levels, clinging to arbitrary purchase “points”, which leads to bias in future calculations. But Integrators, are characterized by an ability to contemplate broader contexts and externalities. Correctly viewing their portfolios as systems whose components can interact and balance one another out. Integrators understand the correlations between various financial instruments and structure their portfolios accordingly, and are also flexible in their approach to the market and security price levels. Framing Versus Integrating (F Vs. N)

- 27. Framers may be susceptible to the following biases: anchoring, conservatism, mental accounting, framing and ambiguity aversion. Integrators are investors who are typically not susceptible to the aforementioned biases. Framing Versus Integrating (F Vs. N)

- 28. Reflecting Versus Realism (T Vs. R) Reflectors have difficulty living with the consequences of their decisions and have difficulty taking action to rectify their behaviours - justifying and rationalizing incorrect actions and hesitating to own up to decisions that have not worked out beneficially. They are also prone to decision paralysis because they dread the sensation of regret should they miscalculate. E.g., holding inherited securities – out of a sense of loyalty to a deceased relative – which may not be a good fit in a diversified portfolio in the current investment environment.

- 29. Realists, on the other hand, have less trouble coming to terms with the consequences of their choices. They don’t tend to scramble for excuses in order to justify incorrect actions, and responsibility for their mistakes. They don’t experience regret as acutely and, therefore, don’t dread it ahead of time. Reflectors may be susceptible to the following biases: cognitive dissonance, loss aversion, endowment, self- control, regret aversion, status quo and hindsight. Realists are investors who are typically not susceptible to the aforementioned biases. Reflecting Versus Realism (T Vs. R)

- 30. Application Of Bias In Asset Allocation High Level Of Wealth (Adapt) Emotional Biase (Adapt) Cognitive Biase (Moderate) Low Level Of Wealth (moderate) Moderate & Adapt Moderate & Adapt Adapt Moderate Source: Pompian, M. and Longo, J. “Incorporating Behavioral Finance Into Your Practice.” Journal of Financial Planning, March 2005, 58–63.

- 31. Individual Clients may be better served by moving them up or down the efficient frontier (a set of optimal portfolios), adjusting risk and return levels depending upon the clients behavioral tendencies i.e. client’s best practical allocation – Micheal Pompian A best practical allocation may slightly underperform over the long term and have lower risk, but is an allocation that the client can comfortably adhere to over the long run. Many clients, in response to a market downturn, want to sell in a panic. Incorporation of Bias In Asset Allocation

- 32. Incorporation of Bias In Asset Allocation 2 principles for constructing a best practical allocation, in light of client behavioral biases: • Moderate biases in less-wealthy clients; adapt to biases in wealthier ones - client outliving his assets constitutes a far graver investment failure than his inability to accumulate the greatest possible wealth. • Moderate cognitive biases; adapt to emotional ones – emotional biases originate from impulse or intuition rather than conscious calculation, they are difficult to rectify. Whilst, cognitive biases stem from faulty reasoning, better information and advice – they can be corrected.

- 33. Fortuna Favi et Fortus Ltd., :118 Old Ewu Road, Aviation Estate, Lagos, :07032530965 www.ffavifortus.com info@ffavifortus.com