Downsizing In Place 10 10 08

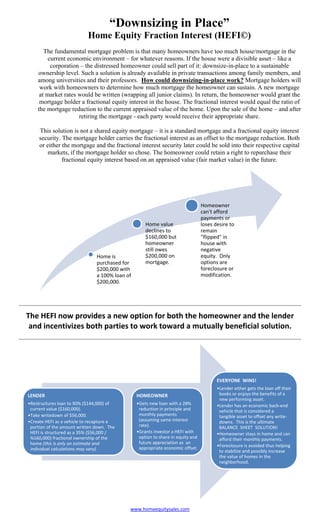

- 1. “Downsizing in Place” Home Equity Fraction Interest (HEFI©) The fundamental mortgage problem is that many homeowners have too much house/mortgage in the current economic environment – for whatever reasons. If the house were a divisible asset – like a corporation – the distressed homeowner could sell part of it: downsize-in-place to a sustainable ownership level. Such a solution is already available in private transactions among family members, and among universities and their professors. How could downsizing-in-place work? Mortgage holders will work with homeowners to determine how much mortgage the homeowner can sustain. A new mortgage at market rates would be written (wrapping all junior claims). In return, the homeowner would grant the mortgage holder a fractional equity interest in the house. The fractional interest would equal the ratio of the mortgage reduction to the current appraised value of the home. Upon the sale of the home – and after retiring the mortgage - each party would receive their appropriate share. This solution is not a shared equity mortgage – it is a standard mortgage and a fractional equity interest security. The mortgage holder carries the fractional interest as an offset to the mortgage reduction. Both or either the mortgage and the fractional interest security later could be sold into their respective capital markets, if the mortgage holder so chose. The homeowner could retain a right to repurchase their fractional equity interest based on an appraised value (fair market value) in the future. Homeowner can't afford payments or Home value loses desire to declines to remain $160,000 but quot;flippedquot; in homeowner house with still owes negative Home is $200,000 on equity. Only purchased for mortgage. options are $200,000 with foreclosure or a 100% loan of modification. $200,000. The HEFI now provides a new option for both the homeowner and the lender and incentivizes both parties to work toward a mutually beneficial solution. EVERYONE WINS! •Lender either gets the loan off their LENDER HOMEOWNER books or enjoys the benefits of a new performing asset. •Restructures loan to 90% ($144,000) of •Gets new loan with a 28% •Lender has an economic back‐end current value ($160,000). reduction in principle and vehicle that is considered a •Take writedown of $56,000. monthly payments tangible asset to offset any write‐ •Create HEFI as a vehicle to recapture a (assuming same interest downs. This is the ultimate portion of the amount written down. The rate). BALANCE SHEET SOLUTION! HEFI is structured as a 35% ($56,000 / •Grants investor a HEFI with •Homeowner stays in home and can %160,000) fractional ownership of the option to share in equity and afford their monthly payments. home (this is only an estimate and future appreciation as an appropriate economic offset. •Foreclosure is avoided thus helping individual calculations may vary). to stabilize and possibly increase the value of homes in the neighborhood. www.homeequitysales.com

- 2. The Housing Crisis: A Downsize-in-place Solution John O’Brien October, 2008 Despite the enactment of Treasury Secretary Paulson’s program to relieve our nation’s financial institutions of their toxic assets, there is a consensus that, by itself, it is insufficient to stem the U.S. economic crisis. The underlying problem that still needs to be tackled is the country’s residential housing crisis; specifically, distressed homeowners who cannot afford their mortgage payments. This problem has been compounded by a downward spiral of falling house prices that has often resulted in negative equity even for those homeowners who are able to afford their payments. Although congress passed housing legislation this summer to alleviate these problems, mortgage originators don’t appear fond of the program’s FHA-guarantee plan. Unless something more is done, families will continue to lose their homes to foreclosure, residential real estate prices will continue to fall, banks will continue to lose mortgage clients (and be saddled with properties) because of the perverse incentive of negative equity to walk away from a home, and thus financial institutions will continue to be plagued with toxic assets. What should be done about the housing crisis, if anything? Is there a responsible and practical approach to the problem? Regardless of cause, many people now suffer from having “too much house,” meaning that they can no longer afford their mortgage payments. A desirable solution to the current crisis would diminish the mortgage burden of distressed but responsible homeowners while allowing them to remain in their homes; in other words, the solution would enable them to “downsize-in-place.” How could a downsize-in-place mechanism work and yet be fair to both financially strapped homeowners — as well as anxious lenders — and not be a taxpayer-financed bailout? Consider the example below.

- 3. 1. George and Mary Bailey purchased a home for its appraised value (with no down payment), originating a $300,000 mortgage with the Potter Building & Loan Association. 2. Now, the Baileys cannot afford their mortgage payments. 3. The Baileys are willing and able to carry a mortgage at the home’s currently appraised value of $265,500 (a decline of $34,500, or 11.5%, from its original price). 4. Needing to mitigate the deterioration of its balance sheet, the Potter Association retires the original $300,000 mortgage and replaces it with a new $265,500 mortgage. And, in return for forgiving the $34,500 difference between the old and new mortgage amounts, Potter receives a security from the Baileys for ownership of a minority, fractional-interest in the home. Since the fractional-interest security is an equity stake, it does not burden the Baileys with any principal or interest payments. 5. The fractional-interest percentage is determined by the amount of mortgage loan forgiven as a fraction of the current home value. In this example, the fractional- interest is 13% ($34,500 divided by $265,500); the homeowner’s fractional interest is 87%. In essence, the Potter Association and the Baileys become partners in the home. They each hope for, and have a stake in, the home’s price appreciation. When the house is sold, the Potter Association would receive all of the sale proceeds up to the “break-even” amount of $305,172 ($305,172 times 0.87 equals $265,500, the new mortgage amount), assuming the Baileys still owe $265,500 on their mortgage. Naturally, the break-even amount declines as the mortgage principal is paid off.

- 4. If the home later sells for $350,000, for example, the Baileys would receive a net of $39,000 ($350,000 times 0.87, less the $265,500 mortgage). Correspondingly, the Potter Association would receive the $265,500 mortgage repayment plus $45,500 ($350,000 times 0.13), for a total of $310,500. In this example, the lender receives $10,500 over the original $300,000 mortgage — a premium for bearing the risk of the $34,500 forgiveness in the mortgage restructuring transaction. Conversely, if the home later sells for $275,000, the Baileys would receive a gross of $239,250 ($275,000 times 0.87) but because they owe $265,500 their net is zero. The Potter Association would receive the entire $275,000 – the mortgage amount of $265,500 plus a portion ($9,500) of their 0.13 share of the sale price. This is a much better scenario for Potter then what they would have received in a foreclosure. The general result is that the lender receives all sale proceeds up to the level of the new mortgage’s outstanding principal; after that, the proceeds are divided according to each partners’ percentage holdings. The fractional-equity solution is a win-win scenario whether or not the property rises in value after the mortgage restructuring: the homeowner benefits by being able to keep their home; the lender benefits by avoiding the costs and uncertainties of foreclosure. The HEFI also allows for the flexibility that is typically expected from homeownership, such as being able to sell your home at any time. This can happen at any time as long as the home is sold at Fair Market Value. Another advantage is that the HEFI allows for the homeowner to repurchase or buy-out the HEFI owner thus regaining control of 100% of their equity and appreciation. These attributes, along with others, lend to the HEFI facilitating a true “partnership” between the lender and the homeowner as they both share in the value of the home, for better or for worse. Since the financially distressed homeowner “paid” for her mortgage forgiveness by reducing her home ownership percentage — i.e., “downsizing-in-place” — there is no reason for other homeowners, or taxpayers in general, to feel that they are being disadvantaged. There is no bail-out; it’s a private-sector buy-out.

- 5. The home fractional-interest security principal is perhaps even more useful beyond the immediate foreclosure crisis. For example, home-equity partnering could help prospective buyers afford a home suited to their needs. (In an informal way, some parents already do this for their children and some universities for their professors). For retirees who enjoy substantial home equity, home-equity partnering could provide them with liquidity in the form of a lump-sum payment to supplement their reduced income, or to allow immediate giving to children and grandchildren. Home-equity partnering could help single-family home developers arrange financing beyond debt for qualified first-time buyers. It could even benefit high net worth individuals by allowing them to spread the risk of wealth concentrated in a single property. In all these cases, since the financing is equity and not debt, there is no leveraging or additional loan principal or interest payment. Crises often ignite innovation. The current mortgage foreclosure crisis should lead to better options for consumer home financing, options that include equity as well as debt. John O’Brien Managing Partner Home Equity Securities, LLC Adjunct Professor and Faculty Director Master's in Financial Engineering Program Haas School of Business, U.C. Berkeley