Contenu connexe Similaire à Financial Model Sample Format - Cement Company (20) 1. Driver Sheet

ABC Cement Company Limited

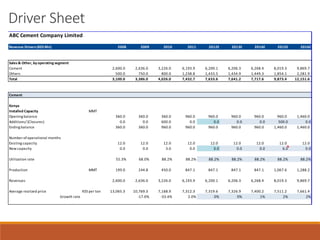

Revenue Drivers(KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

Sales& Other, by operating segment

Cement 2,600.0 2,636.0 3,226.0 6,193.9 6,200.1 6,206.3 6,268.4 8,019.3 9,869.7

Others 500.0 750.0 800.0 1,238.8 1,433.5 1,434.9 1,449.3 1,854.1 2,281.9

Total 3,100.0 3,386.0 4,026.0 7,432.7 7,633.6 7,641.2 7,717.6 9,873.4 12,151.6

Cement

Kenya

Installed Capacity MMT

Opening balance 360.0 360.0 360.0 960.0 960.0 960.0 960.0 960.0 1,460.0

Additions/ (Closures) 0.0 0.0 600.0 0.0 0.0 0.0 0.0 500.0 0.0

Ending balance 360.0 360.0 960.0 960.0 960.0 960.0 960.0 1,460.0 1,460.0

Number ofoperational months

Existing capacity 12.0 12.0 12.0 12.0 12.0 12.0 12.0 12.0 12.0

New capacity 0.0 0.0 3.0 0.0 0.0 0.0 0.0 6.0 0.0

Utilization rate 55.3% 68.0% 88.2% 88.2% 88.2% 88.2% 88.2% 88.2% 88.2%

Production MMT 199.0 244.8 450.0 847.1 847.1 847.1 847.1 1,067.6 1,288.2

Revenues 2,600.0 2,636.0 3,226.0 6,193.9 6,200.1 6,206.3 6,268.4 8,019.3 9,869.7

Average realized price KES per ton 13,065.3 10,769.3 7,168.9 7,312.3 7,319.6 7,326.9 7,400.2 7,511.2 7,661.4

Growth rate -17.6% -33.4% 2.0% 0% 0% 1% 2% 2%

2. Driver Sheet (cont’d)

ABC Cement Company Limited

Revenue Drivers(KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

Other sales 500.0 750.0 800.0 1,238.8 1,433.5 1,434.9 1,449.3 1,854.1 2,281.9

As a % ofCement sales 19.2% 28.5% 24.8% 20.0% 23% 23% 23% 23% 23%

Cost ofsales (1,560.0) (1,793.0) (2,213.0) (3,716.4) (3,816.8) (3,820.6) (3,820.2) (4,837.9) (5,857.1)

As a % ofsales 50.3% 53.0% 55.0% 50.0% 50.0% 50.0% 49.5% 49.0% 48.2%

Other operating income 15.7 8.0 116.4 74.3 88.4 84.1 77.2 88.9 97.2

As a % ofsales 0.5% 0.2% 2.9% 1.0% 1.2% 1.1% 1.0% 0.9% 0.8%

Distribution costs (268.3) (278.2) (263.5) (483.1) (496.2) (473.8) (463.1) (572.7) (704.8)

As a % ofsales 8.7% 8.2% 6.5% 6.5% 6.5% 6.2% 6.0% 5.8% 5.8%

Administrative costs (431.7) (553.9) (583.3) (706.1) (702.3) (687.7) (694.6) (918.2) (1,130.1)

As a % ofsales 13.9% 16.4% 14.5% 9.5% 9.2% 9.0% 9.0% 9.3% 9.3%

Operating Expense (2,260.0) (2,625.1) (3,059.8) (4,905.6) (5,015.3) (4,982.1) (4,977.9) (6,328.8) (7,692.0)

Finance costs (263.7) (495.2) (828.3) (880.2) (1,212.7) (1,355.2) (1,526.2) (1,972.2) (2,256.8)

Average rate ofinterest 9.9% 9.5% 9.5% 9.5% 9.5% 9.5% 9.5% 9.5% 9.5%

Debt schedule

Opening balance 1,704.0 2,670.7 5,212.7 8,718.8 11,218.8 12,764.8 14,264.8 16,064.8 20,760.1

Additions 1,565.4 3,574.0 5,705.4 4,454.0 3,500.0 1,500.0 1,800.0 7,500.0 5,800.0

Repayment (598.7) (1,032.0) (2,199.3) (1,954.0) (1,954.0) 0.0 0.0 (2,804.7) (2,804.7)

Ending balance 2,670.7 5,212.7 8,718.8 11,218.8 12,764.8 14,264.8 16,064.8 20,760.1 23,755.4

Tax rate 34.1% 43.8% 37.5% 39.4% 38.5% 38.0% 38.0% 37.0% 36.0%

3. Driver Sheet (cont’d)

Balance Sheet Drivers(KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

Current assets:

Inventories 787.1 1,084.3 1,129.9 1,500.0 1,512.1 1,486.4 1,444.4 1,789.4 2,080.4

As a % ofCOGS 50.5% 60.5% 51.1% 40.4% 39.6% 38.9% 37.8% 37.0% 35.5%

Inventory days 184.7 220.7 186.4 147.3 145.0 142.0 138.0 135.0 130.0

Trade and other receivables 951.9 1,378.6 1,787.1 1,800.0 1,772.8 1,737.6 1,712.7 2,164.0 2,589.7

As a % ofsales 30.7% 40.7% 44.4% 24.2% 23.2% 22.7% 22.2% 21.9% 21.3%

Days receivable 112.4 148.6 162.0 88.4 85.0 83.0 81.0 80.0 78.0

Current liabilities:

Trade & other payables 785.7 1,123.8 1,231.4 1,300.0 1,303.6 1,277.0 1,256.0 1,564.0 1,856.3

As a % ofCOGS 50.4% 62.7% 55.6% 35.0% 34.2% 33.4% 32.9% 32.3% 31.7%

Days payable 184.3 228.8 203.1 127.7 125.0 122.0 120.0 118.0 116.0

Non-current assets:

Property, plant & equipment -Total

Opening balance 4,201.9 5,473.8 8,843.2 12,659.8 15,659.8 18,713.2 21,769.7 24,856.8 30,780.8

Additions 1,230.9 2,462.1 3,870.9 3,000.0 3,053.4 3,056.5 3,087.1 5,924.0 4,860.6

Transfers 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Disposals (3.4) (4.3) (1.0) 0.0 0.0 0.0 0.0 0.0 0.0

Translation gains/(loss) 44.4 (64.7) (53.4) 0.0 0.0 0.0 0.0 0.0 0.0

Revaluation surplus/(deficit) 0.0 976.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Balance at the end ofthe year 5,473.8 8,843.2 12,659.8 15,659.8 18,713.2 21,769.7 24,856.8 30,780.8 35,641.5

Depreciation

Opening balance 898.4 1,101.7 155.1 470.5 825.5 1,255.2 1,741.0 2,300.5 2,940.3

Charge for the year 201.9 221.7 315.2 355.0 429.7 485.8 559.5 639.8 763.9

Depreciation rate ( as a % ofaverage gross balance) 4.2% 3.1% 2.9% 2.5% 2.5% 2.4% 2.4% 2.3% 2.3%

Translation gain/(loss) 4.8 (0.0) 0.4 0.0 0.0 0.0 0.0 0.0 0.0

Transfers 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Write back on revaluation 0.0 (1,163.9) 0.0 0.0 0.0 0.0 0.0 0.0 0.0

4. Driver Sheet (cont’d)

Days receivable 112.4 148.6 162.0 88.4 85.0 83.0 81.0 80.0 78.0

Current liabilities:

Trade & other payables 785.7 1,123.8 1,231.4 1,300.0 1,303.6 1,277.0 1,256.0 1,564.0 1,856.3

As a % ofCOGS 50.4% 62.7% 55.6% 35.0% 34.2% 33.4% 32.9% 32.3% 31.7%

Days payable 184.3 228.8 203.1 127.7 125.0 122.0 120.0 118.0 116.0

Non-current assets:

Property, plant & equipment -Total

Opening balance 4,201.9 5,473.8 8,843.2 12,659.8 15,659.8 18,713.2 21,769.7 24,856.8 30,780.8

Additions 1,230.9 2,462.1 3,870.9 3,000.0 3,053.4 3,056.5 3,087.1 5,924.0 4,860.6

Transfers 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Disposals (3.4) (4.3) (1.0) 0.0 0.0 0.0 0.0 0.0 0.0

Translation gains/(loss) 44.4 (64.7) (53.4) 0.0 0.0 0.0 0.0 0.0 0.0

Revaluation surplus/(deficit) 0.0 976.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Balance at the end ofthe year 5,473.8 8,843.2 12,659.8 15,659.8 18,713.2 21,769.7 24,856.8 30,780.8 35,641.5

Depreciation

Opening balance 898.4 1,101.7 155.1 470.5 825.5 1,255.2 1,741.0 2,300.5 2,940.3

Charge for the year 201.9 221.7 315.2 355.0 429.7 485.8 559.5 639.8 763.9

Depreciation rate ( as a % ofaverage gross balance) 4.2% 3.1% 2.9% 2.5% 2.5% 2.4% 2.4% 2.3% 2.3%

Translation gain/(loss) 4.8 (0.0) 0.4 0.0 0.0 0.0 0.0 0.0 0.0

Transfers 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Write back on revaluation 0.0 (1,163.9) 0.0 0.0 0.0 0.0 0.0 0.0 0.0

At the end ofthe year 1,101.7 155.1 470.5 825.5 1,255.2 1,741.0 2,300.5 2,940.3 3,704.2

PPE, net 4,372.1 8,688.2 12,189.3 14,834.3 17,458.0 20,028.7 22,556.3 27,840.5 31,937.2

Balance Sheet Drivers(KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

Current assets:

Inventories 787.1 1,084.3 1,129.9 1,500.0 1,512.1 1,486.4 1,444.4 1,789.4 2,080.4

As a % ofCOGS 50.5% 60.5% 51.1% 40.4% 39.6% 38.9% 37.8% 37.0% 35.5%

Inventory days 184.7 220.7 186.4 147.3 145.0 142.0 138.0 135.0 130.0

Trade and other receivables 951.9 1,378.6 1,787.1 1,800.0 1,772.8 1,737.6 1,712.7 2,164.0 2,589.7

As a % ofsales 30.7% 40.7% 44.4% 24.2% 23.2% 22.7% 22.2% 21.9% 21.3%

Days receivable 112.4 148.6 162.0 88.4 85.0 83.0 81.0 80.0 78.0

Current liabilities:

Trade & other payables 785.7 1,123.8 1,231.4 1,300.0 1,303.6 1,277.0 1,256.0 1,564.0 1,856.3

As a % ofCOGS 50.4% 62.7% 55.6% 35.0% 34.2% 33.4% 32.9% 32.3% 31.7%

Days payable 184.3 228.8 203.1 127.7 125.0 122.0 120.0 118.0 116.0

Non-current assets:

Property, plant & equipment -Total

Opening balance 4,201.9 5,473.8 8,843.2 12,659.8 15,659.8 18,713.2 21,769.7 24,856.8 30,780.8

Additions 1,230.9 2,462.1 3,870.9 3,000.0 3,053.4 3,056.5 3,087.1 5,924.0 4,860.6

Transfers 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Disposals (3.4) (4.3) (1.0) 0.0 0.0 0.0 0.0 0.0 0.0

Translation gains/(loss) 44.4 (64.7) (53.4) 0.0 0.0 0.0 0.0 0.0 0.0

Revaluation surplus/(deficit) 0.0 976.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Balance at the end ofthe year 5,473.8 8,843.2 12,659.8 15,659.8 18,713.2 21,769.7 24,856.8 30,780.8 35,641.5

Depreciation

Opening balance 898.4 1,101.7 155.1 470.5 825.5 1,255.2 1,741.0 2,300.5 2,940.3

Charge for the year 201.9 221.7 315.2 355.0 429.7 485.8 559.5 639.8 763.9

Depreciation rate ( as a % ofaverage gross balance) 4.2% 3.1% 2.9% 2.5% 2.5% 2.4% 2.4% 2.3% 2.3%

Translation gain/(loss) 4.8 (0.0) 0.4 0.0 0.0 0.0 0.0 0.0 0.0

Transfers 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Write back on revaluation 0.0 (1,163.9) 0.0 0.0 0.0 0.0 0.0 0.0 0.0

5. Income Statement

ABC Cement Company Limited

Income Statement (KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

Turnover 3,100.0 3,386.0 4,026.0 7,432.7 7,633.6 7,641.2 7,717.6 9,873.4 12,151.6

Cost ofsales (1,560.0) (1,793.0) (2,213.0) (3,716.4) (3,816.8) (3,820.6) (3,820.2) (4,837.9) (5,857.1)

Gross profit 1,540.0 1,593.0 1,813.0 3,716.4 3,816.8 3,820.6 3,897.4 5,035.4 6,294.5

Expenses:

Other operating income 15.7 8.0 116.4 74.3 88.4 84.1 77.2 88.9 97.2

Distribution costs (268.3) (278.2) (263.5) (483.1) (496.2) (473.8) (463.1) (572.7) (704.8)

Administrative expenses (431.7) (553.9) (583.3) (706.1) (702.3) (687.7) (694.6) (918.2) (1,130.1)

Operating profit 855.7 768.9 1,082.6 2,601.4 2,706.7 2,743.2 2,816.9 3,633.4 4,556.8

Finance costs (263.7) (76.5) (226.3) (880.2) (1,212.7) (1,355.2) (1,526.2) (1,972.2) (2,256.8)

Profit before taxation 592.0 692.4 856.2 1,721.3 1,494.1 1,388.0 1,290.8 1,661.2 2,300.1

Taxation charge (202.0) (302.9) (321.0) (678.0) (575.2) (527.5) (490.5) (614.6) (828.0)

Profit for the year 390.0 389.4 535.3 1,043.3 918.9 860.6 800.3 1,046.6 1,472.1

Annualized earnings per share -basic & diluted (KES) 3.94 3.93 5.40 10.53 9.28 8.69 8.08 10.57 14.86

Weighted average number ofshares outstanding (mn) 99.1 99.1 99.1 99.1 99.1 99.1 99.1 99.1 99.1

Operating Profit % 27.6% 22.7% 26.9% 35.0% 35.5% 35.9% 36.5% 36.8% 37.5%

EBITDA 1,057.6 990.5 1,397.7 2,956.4 3,136.4 3,229.0 3,376.5 4,273.2 5,320.7

6. Balance Sheet – Assets

ABC Cement Company Limited

Balance Sheet (KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

ASSETS

Non current assets:

Property, plant and equipment 4,372.1 8,688.2 12,189.3 14,834.3 17,458.0 20,028.7 22,556.3 27,840.5 31,937.2

Operating lease prepayments 33.6 32.1 30.5 30.5 30.5 30.5 30.5 30.5 30.5

Intangible assets 10.9 7.1 54.2 54.2 54.2 54.2 54.2 54.2 54.2

Goodwill 50.9 50.9 50.9 50.9 50.9 50.9 50.9 50.9 50.9

Total non current assets 4,467.5 8,778.3 12,324.8 14,969.8 17,593.6 20,164.3 22,691.9 27,976.0 32,072.8

Current assets:

Inventories 787.1 1,084.3 1,129.9 1,500.0 1,512.1 1,486.4 1,444.4 1,789.4 2,080.4

Trade and other receivables 951.9 1,378.6 1,787.1 1,800.0 1,772.8 1,737.6 1,712.7 2,164.0 2,589.7

Due from Employee Share Ownership Plan (ESOP) 83.6 66.8 49.0 49.0 49.0 49.0 49.0 49.0 49.0

Due from related parties 16.2 20.6 61.9 61.9 61.9 61.9 61.9 61.9 61.9

Tax recoverable 0.0 0.0 13.3 13.3 13.3 13.3 13.3 13.3 13.3

Short term Deposits 0.0 0.0 843.0 843.0 843.0 843.0 843.0 843.0 843.0

Cash and bank balances 46.1 812.5 355.9 923.2 782.8 607.2 725.8 695.2 641.4

Total current assets 1,885.0 3,362.7 4,240.1 5,190.4 5,035.0 4,798.4 4,850.1 5,615.8 6,278.7

Total assets 6,352.5 12,141.1 16,564.9 20,160.3 22,628.6 24,962.7 27,541.9 33,591.9 38,351.5

7. Balance Sheet – Liabilities

ABC Cement Company Limited

Balance Sheet (KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

ASSETS

Non current assets:

Property, plant and equipment 4,372.1 8,688.2 12,189.3 14,834.3 17,458.0 20,028.7 22,556.3 27,840.5 31,937.2

Operating lease prepayments 33.6 32.1 30.5 30.5 30.5 30.5 30.5 30.5 30.5

Intangible assets 10.9 7.1 54.2 54.2 54.2 54.2 54.2 54.2 54.2

Goodwill 50.9 50.9 50.9 50.9 50.9 50.9 50.9 50.9 50.9

Total non current assets 4,467.5 8,778.3 12,324.8 14,969.8 17,593.6 20,164.3 22,691.9 27,976.0 32,072.8

Current assets:

Inventories 787.1 1,084.3 1,129.9 1,500.0 1,512.1 1,486.4 1,444.4 1,789.4 2,080.4

Trade and other receivables 951.9 1,378.6 1,787.1 1,800.0 1,772.8 1,737.6 1,712.7 2,164.0 2,589.7

Due from Employee Share Ownership Plan (ESOP) 83.6 66.8 49.0 49.0 49.0 49.0 49.0 49.0 49.0

Due from related parties 16.2 20.6 61.9 61.9 61.9 61.9 61.9 61.9 61.9

Tax recoverable 0.0 0.0 13.3 13.3 13.3 13.3 13.3 13.3 13.3

Short term Deposits 0.0 0.0 843.0 843.0 843.0 843.0 843.0 843.0 843.0

Cash and bank balances 46.1 812.5 355.9 923.2 782.8 607.2 725.8 695.2 641.4

Total current assets 1,885.0 3,362.7 4,240.1 5,190.4 5,035.0 4,798.4 4,850.1 5,615.8 6,278.7

Total assets 6,352.5 12,141.1 16,564.9 20,160.3 22,628.6 24,962.7 27,541.9 33,591.9 38,351.5

EQUITY & LIABILITIES

Equity:

Share capital 495.3 495.3 495.3 495.3 495.3 495.3 495.3 495.3 495.3

Share premium 302.0 302.0 302.0 302.0 302.0 302.0 302.0 302.0 302.0

Revaluation surplus 35.3 1,531.8 1,465.4 1,465.4 1,465.4 1,465.4 1,465.4 1,465.4 1,465.4

Translation reserve (68.1) (86.8) (99.6) (99.6) (99.6) (99.6) (99.6) (99.6) (99.6)

Retained earnings 1,363.0 1,886.7 2,499.1 3,542.4 4,461.2 5,321.8 6,122.1 7,168.7 8,640.7

Equity attributable to equityholders ofthe parent 2,127.5 4,128.9 4,662.2 5,705.5 6,624.3 7,484.9 8,285.2 9,331.7 10,803.8

Non-controlling interest 0.0 0.0 (18.6) (18.6) (18.6) (18.6) (18.6) (18.6) (18.6)

Total capital & reserves 2,127.5 4,128.9 4,643.6 5,686.9 6,605.7 7,466.3 8,266.6 9,313.2 10,785.2

Non-current liabilities:

Borrowings 1,638.7 3,013.5 6,764.8 9,264.8 12,764.8 14,264.8 13,260.1 17,955.4 20,950.7

Deferred income tax 728.5 1,644.1 1,950.1 1,950.1 1,950.1 1,950.1 1,950.1 1,950.1 1,950.1

Finance leases 14.7 0.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Total non-current liabilities 2,382.0 4,658.4 8,714.8 11,214.8 14,714.8 16,214.8 15,210.1 19,905.4 22,900.7

Current liabilities:

Borrowings 1,032.0 2,199.3 1,954.0 1,954.0 0.0 0.0 2,804.7 2,804.7 2,804.7

Finance leases 13.8 7.4 1.0 1.0 1.0 1.0 1.0 1.0 1.0

Trade & other payables 785.7 1,123.8 1,231.4 1,300.0 1,303.6 1,277.0 1,256.0 1,564.0 1,856.3

Due to related parties 3.2 6.5 16.5 0.0 0.0 0.0 0.0 0.0 0.0

Unclaimed dividends 3.5 3.6 3.5 3.5 3.5 3.5 3.5 3.5 3.5

Current tax payable 4.7 13.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Total current liabilities 1,842.9 3,353.8 3,206.5 3,258.5 1,308.1 1,281.5 4,065.2 4,373.3 4,665.5

Total equity & liabilities 6,352.5 12,141.1 16,564.9 20,160.3 22,628.6 24,962.7 27,541.9 33,591.9 38,351.5

8. Cash Flow Statement

ABC Cement Company Limited

Cash Flow (KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

OPERATING ACTIVITIES

Proft before taxation 705.5 948.7 1,113.0 1,721.3 1,494.1 1,388.0 1,290.8 1,661.2 2,300.1

Adjustments:

Depreciation 201.9 221.7 315.2 355.0 429.7 485.8 559.5 639.8 763.9

Amortisation ofoperating lease prepayments 0.3 0.3 1.1 0.0 0.0 0.0 0.0 0.0 0.0

Amortisation ofintangible assets 2.4 3.8 3.9 0.0 0.0 0.0 0.0 0.0 0.0

Interest expense charged to statement ofcomprehensive income 154.1 117.8 226.3 880.2 1,212.7 1,355.2 1,526.2 1,972.2 2,256.8

Finance income recognised in statement ofcomprehensive income (0.2) (9.8) 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Net unrealised foreign exchange gains (23.4) (53.5) 53.5 0.0 0.0 0.0 0.0 0.0 0.0

Loss/ (Gain) on disposal ofproperty, plant and equipment (0.8) (0.9) 0.1 0.0 0.0 0.0 0.0 0.0 0.0

Adjusted proft before working capital 1,039.7 1,228.1 1,713.1 2,956.4 3,136.4 3,229.0 3,376.5 4,273.2 5,320.7

(Increase) Decrease in inventories (229.9) (297.2) (45.6) (370.1) (12.1) 25.7 42.0 (345.0) (291.0)

(Increase) Decrease in trade and other receivables (542.4) (426.7) (408.5) (12.9) 27.2 35.2 24.9 (451.3) (425.7)

Movement due from related party balances (15.4) (1.1) (31.3) (16.5) 0.0 0.0 0.0 0.0 0.0

Increase (Decrease) in trade and other payables 345.0 338.1 107.6 68.6 3.6 (26.5) (21.1) 308.1 292.3

Decrease in due from ESOP 0.0 16.9 17.8 0.0 0.0 0.0 0.0 0.0 0.0

Cash generated from operating activities 597.1 858.1 1,353.1 2,625.5 3,155.0 3,263.5 3,422.3 3,785.0 4,896.3

Interest paid (262.8) (287.2) (502.7) (880.2) (1,212.7) (1,355.2) (1,526.2) (1,972.2) (2,256.8)

Interest received 0.2 9.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Corporation tax paid (1.7) (21.8) (46.9) (678.0) (575.2) (527.5) (490.5) (614.6) (828.0)

Net cash genertaed from operating activities 332.8 558.9 803.6 1,067.3 1,367.1 1,380.8 1,405.7 1,198.1 1,811.5

9. Cash Flow Statement (cont’d)

ABC Cement Company Limited

Cash Flow (KES Mn) 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

OPERATING ACTIVITIES

Proft before taxation 705.5 948.7 1,113.0 1,721.3 1,494.1 1,388.0 1,290.8 1,661.2 2,300.1

Adjustments:

Depreciation 201.9 221.7 315.2 355.0 429.7 485.8 559.5 639.8 763.9

Amortisation ofoperating lease prepayments 0.3 0.3 1.1 0.0 0.0 0.0 0.0 0.0 0.0

Amortisation ofintangible assets 2.4 3.8 3.9 0.0 0.0 0.0 0.0 0.0 0.0

Interest expense charged to statement ofcomprehensive income 154.1 117.8 226.3 880.2 1,212.7 1,355.2 1,526.2 1,972.2 2,256.8

Finance income recognised in statement ofcomprehensive income (0.2) (9.8) 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Net unrealised foreign exchange gains (23.4) (53.5) 53.5 0.0 0.0 0.0 0.0 0.0 0.0

Loss/ (Gain) on disposal ofproperty, plant and equipment (0.8) (0.9) 0.1 0.0 0.0 0.0 0.0 0.0 0.0

Adjusted proft before working capital 1,039.7 1,228.1 1,713.1 2,956.4 3,136.4 3,229.0 3,376.5 4,273.2 5,320.7

(Increase) Decrease in inventories (229.9) (297.2) (45.6) (370.1) (12.1) 25.7 42.0 (345.0) (291.0)

(Increase) Decrease in trade and other receivables (542.4) (426.7) (408.5) (12.9) 27.2 35.2 24.9 (451.3) (425.7)

Movement due from related party balances (15.4) (1.1) (31.3) (16.5) 0.0 0.0 0.0 0.0 0.0

Increase (Decrease) in trade and other payables 345.0 338.1 107.6 68.6 3.6 (26.5) (21.1) 308.1 292.3

Decrease in due from ESOP 0.0 16.9 17.8 0.0 0.0 0.0 0.0 0.0 0.0

Cash generated from operating activities 597.1 858.1 1,353.1 2,625.5 3,155.0 3,263.5 3,422.3 3,785.0 4,896.3

Interest paid (262.8) (287.2) (502.7) (880.2) (1,212.7) (1,355.2) (1,526.2) (1,972.2) (2,256.8)

Interest received 0.2 9.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Corporation tax paid (1.7) (21.8) (46.9) (678.0) (575.2) (527.5) (490.5) (614.6) (828.0)

Net cash genertaed from operating activities 332.8 558.9 803.6 1,067.3 1,367.1 1,380.8 1,405.7 1,198.1 1,811.5

INVESTING ACTIVITIES

Additions to property, plant and equipment (1,111.5) (2,216.9) (3,618.6) (3,000.0) (3,053.4) (3,056.5) (3,087.1) (5,924.0) (4,860.6)

Additions to operating lease prepayments (21.1) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Additions to intangible assets (6.8) 0.0 (51.0) 0.0 0.0 0.0 0.0 0.0 0.0

Proceeds ofdisposal ofproperty, plant and equipment 0.8 0.9 0.8 0.0 0.0 0.0 0.0 0.0 0.0

Net cash used in investing activities (1,138.6) (2,216.0) (3,668.8) (3,000.0) (3,053.4) (3,056.5) (3,087.1) (5,924.0) (4,860.6)

FINANCING ACTIVITIES

Finance lease payments (19.0) (22.4) (7.6) 0.0 0.0 0.0 0.0 0.0 0.0

Purchase ofshares from non-controlling interest (100.2) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Borrowings received 1,081.7 2,493.0 4,377.8 4,454.0 3,500.0 1,500.0 1,800.0 7,500.0 5,800.0

Repayment ofamounts borrowed (181.7) (499.1) (1,251.7) (1,954.0) (1,954.0) 0.0 0.0 (2,804.7) (2,804.7)

Dividends paid (123.6) (123.8) (148.7) 0.0 0.0 0.0 0.0 0.0 0.0

Net cash used in financing activities 657.2 1,847.7 2,969.8 2,500.0 1,546.0 1,500.0 1,800.0 4,695.3 2,995.3

Increase in cash and cash equivalents (148.7) 190.6 104.6 567.3 (140.4) (175.7) 118.6 (30.6) (53.8)

Cash and cash equivalents at the beginning ofthe year 8.5 (137.9) 53.1 134.8 702.1 561.7 386.1 504.7 474.1

Effect oftranslation adjustment on cash held in foreign subsidiaries 2.3 0.4 (23.0) 0.0 0.0 0.0 0.0 0.0 0.0

Cash and cash equivalents at the end ofthe year (137.9) 53.1 134.8 702.1 561.7 386.1 504.7 474.1 420.3

Investments in short-term deposits 0.0 0.0 (843.0) (843.0) (843.0) (843.0) (843.0) (843.0) (843.0)

Bank overdraft 184.0 759.4 1,064.1 1,064.1 1,064.1 1,064.1 1,064.1 1,064.1 1,064.1

Cash & bank balances 46.1 812.5 355.9 923.2 782.8 607.2 725.8 695.2 641.4

10. Discounted Cash Flow Valuation (DCF)

ABC Cement Company Limited

Discounted Cash Flow (KES Mn) 2012E 2013E 2014E 2015E 2016E Terminal Year

Assumption: The valuation isdone ason January 1, 2012

Total Revenue 7,633.6 7,641.2 7,717.6 9,873.4 12,151.6 12,151.6

Growth % 2.7% 0.1% 1.0% 27.9% 23.1%

EBITDA 3,136.4 3,229.0 3,376.5 4,273.2 5,320.7 5,320.7

EBITDA% 41.1% 42.3% 43.7% 43.3% 43.8% 43.8%

EBIT 2,706.7 2,743.2 2,816.9 3,633.4 4,556.8 4,556.8

EBIT % 35.5% 35.9% 36.5% 36.8% 37.5% 37.5%

Tax on EBIT 1,042.1 1,042.4 1,070.4 1,344.4 1,640.5 1,640.5

Effective Tax % 38.5% 38.0% 38.0% 37.0% 36.0% 36.0%

NOPAT 1,664.6 1,700.8 1,746.5 2,289.0 2,916.4 2,916.4

NOPAT % 21.8% 22.3% 22.6% 23.2% 24.0% 24.0%

Depreciation & Amortization 429.7 485.8 559.5 639.8 763.9 763.9

Capex 3,053.4 3,056.5 3,087.1 5,924.0 4,860.6 763.9

Capex % 40.0% 40.0% 40.0% 60.0% 40.0% 6.3%

Working Capital Changes 18.6 34.5 45.9 (488.3) (424.4) (424.4)

Free Cash Flows to Firm 5,166.3 5,277.5 5,438.9 8,364.6 8,116.5 4,019.7

Growth % 2.2% 3.1% 53.8% -3.0%

Years Discounted 0.5 1.5 2.5 3.5 4.5

Discounting Factor 0.9410 0.8333 0.7379 0.6534 0.5786

Discounted Cash Flow 4,861.6 4,397.7 4,013.3 5,465.4 4,696.2

Assumption: The valuation isdone ason January 1, 2012

Valuation Parameters(KES Mn) Other Analysis

WACC 12.9% DTV/EV 69.7%

Terminal Growth Rate 5.1% Implied Exit EBITDAMultiple 14.5x

Terminal FCFF 4,019.7 EV/2012EFCF 15.0x

Discounted Terminal Value 53,962.0

Discounted Cash Flow of Forecasted Period 23,434.2 Sensitivity Analysis

Enterprise Value 77,396.2 Enterprise Value Sensitivity

Debt 11,218.8

Minority Interest 18.6 66,158.8 4.6% 4.9% 5.1% 5.4% 5.6%

Equity Value 66,158.8 11.9% 70,101.5 72,269.5 74,596.2 77,099.7 79,801.0

Shares Outstanding (mn) 99.1 12.4% 66,167.3 68,071.4 70,105.4 72,283.0 74,620.1

Market Value per share 667.9 12.9% 62,678.1 64,364.6 66,158.8 68,071.3 70,114.4

13.2% 61,076.4 62,668.1 64,358.3 66,156.5 68,073.2

13.4% 59,559.2 61,064.0 62,659.3 64,353.2 66,155.4

WACC

Growth Rate

Weighted Average Cost ofCapital

Comparableson Nairobi Stock Exhange Levered Beta

ARMCement Ltd 0.80

Bamburi Cement Ltd 0.73

E.A.Portland Cement Ltd 0.19

Mean Unlevered Beta 0.50

Weightage 0.50

Industry Beta 1.12

Weightage 0.50

Total Unlevered Beta 0.81

WACC Calculation

US Risk Free Rate ofReturn (Rf) 2.6%

Kenya Country Risk Premium 6.0%

Equity Risk Premium (Rm -Rf) 11.8%

Gearing (D/Eq) 1.97

Leverage (D/D+Eq) 0.66

Eq/D+Eq 0.34

Corporate Tax Rate (t) 30.0%

1-t 70.0%

Levered Beta 192.0%

Ke (Unlevered) 12.2%

Ke (Levered) 25.3%

Kd 9.5%

Kd (1-t) 6.7%

WACC 12.9%

11. Ratio Analysis

ABC Cement Company Limited

Key ratios 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E

Profitability ratios

Gross margin % 49.7% 47.0% 45.0% 50.0% 50.0% 50.0% 50.5% 51.0% 51.8%

EBITDAmargin % 34.1% 29.3% 34.7% 39.8% 41.1% 42.3% 43.7% 43.3% 43.8%

EBITmargin % 27.6% 22.7% 26.9% 35.0% 35.5% 35.9% 36.5% 36.8% 37.5%

Net margin % 12.6% 11.5% 13.3% 14.0% 12.0% 11.3% 10.4% 10.6% 12.1%

RoA% 6.1% 4.2% 3.7% 5.7% 4.3% 3.6% 3.0% 3.4% 4.1%

RoE% 20.2% 12.4% 12.2% 20.1% 14.9% 12.2% 10.1% 11.9% 14.6%

Debt-to-Equity % 125.5% 126.2% 187.0% 196.6% 192.7% 190.6% 193.9% 222.5% 219.9%

Dividend yield % 0.2% 0.2% 0.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Inventory days 184.7 220.7 186.4 147.3 145.0 142.0 138.0 135.0 130.0

Days receivable 112.4 148.6 162.0 88.4 85.0 83.0 81.0 80.0 78.0

Days payable 184.3 228.8 203.1 127.7 125.0 122.0 120.0 118.0 116.0

Cash conversion cycle 112.7 140.6 145.3 108.0 105.0 103.0 99.0 97.0 92.0

Valuation Ratios

P/Ex 169.6x 169.9x 123.6x 63.4x 72.0x 76.9x 82.7x 63.2x 44.9x

P/S x 21.3x 19.5x 16.4x 8.9x 8.7x 8.7x 8.6x 6.7x 5.4x

P/BV x 31.1x 16.0x 14.2x 11.6x 10.0x 8.8x 8.0x 7.1x 6.1x

Per share Ratios

EPS (KES) 3.9 3.9 5.4 10.5 9.3 8.7 8.1 10.6 14.9

Sales per share (KES) 31.3 34.2 40.6 75.0 77.1 77.1 77.9 99.7 122.7

DPS (KES) 1.2 1.2 1.5 0.0 0.0 0.0 0.0 0.0 0.0

BVPS (KES) 21.5 41.7 47.1 57.6 66.9 75.6 83.6 94.2 109.1

Dupont Analysis

Net margin 12.6% 11.5% 13.3% 14.0% 12.0% 11.3% 10.4% 10.6% 12.1%

Asset Turnover 48.8% 27.9% 24.3% 36.9% 33.7% 30.6% 28.0% 29.4% 31.7%

Financial leverage 3.0 2.9 3.6 3.5 3.4 3.3 3.3 3.6 3.5

RoE 18.3% 9.4% 11.5% 18.3% 13.9% 11.5% 9.7% 11.2% 13.6%