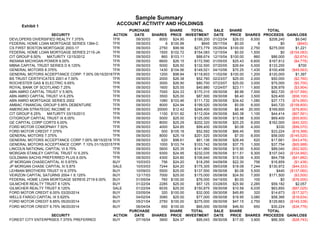

Sample Summary of Account Activity and Holdings

- 1. Sample Summary Exhibit 1 ACCOUNT ACTIVITY AND HOLDINGS PURCHASE SHARE TOTAL SALE SHARE TOTAL SECURITY ACTION DATE SHARES PRICE INVESTMENT DATE PRICE SHARES PROCEEDS GAIN/LOSS DEVLOPERS DIVERSIFIED REALTY 7.375% TFR 09/30/03 8000 $24.90 $199,200 01/22/04 $26.03 8,000 $208,240 $9,040 FEDERAL HOME LOAN MORTGAGE SERIES 1384-C TFR 09/30/03 6 $100.99 $645 05/17/04 $0.00 6 $0 ($645) CS FIRST BOSTON MORTGAGE 2003-17 TFR 09/30/03 2750 $99.56 $273,779 05/26/04 $100.00 2,750 $275,000 $1,221 FEDERAL HOME LOAN MORTGAGE SERIES 2115-JA TFR 09/30/03 1500 $102.72 $154,083 12/15/04 $0.00 1,500 $0 ($154,083) CIT GROUP 6.50% MATURITY 12/15/2012 TFR 09/30/03 860 $103.11 $88,674 12/15/04 $100.00 860 $86,000 ($2,674) INDIANA MICHIGAN POWER 6.00% TFR 09/30/03 6600 $26.15 $172,590 01/05/05 $25.43 6,600 $167,812 ($4,778) MBNA CAPITAL TRUST SERIES D 8.125% TFR 09/30/03 5000 $26.50 $132,500 07/20/05 $26.64 5,000 $133,200 $700 GENERAL MOTORS 8.375% TFR 09/30/03 1430 $104.56 $149,521 04/10/06 $70.25 1,430 $100,458 ($49,063) GENERAL MOTORS ACDEPTANCE CORP. 7.00% 05/15/2016TFR 09/30/03 1200 $98.84 $118,603 11/02/06 $100.00 1,200 $120,000 $1,397 BS TRUST CERTIFICATES 2001-4 7.00% TFR 09/30/03 2000 $26.38 $52,760 02/23/07 $25.00 2,000 $50,000 ($2,760) ROCHESTER GAS & ELECTRIC 6.65% TFR 09/30/03 3000 $26.90 $80,700 07/23/07 $25.00 3,000 $75,000 ($5,700) ROYAL BANK OF SCOTLAND 7.25% TFR 09/30/03 1600 $25.55 $40,880 12/24/07 $23.11 1,600 $36,976 ($3,904) ABN AMRO CAPITAL TRUST V 5.90% TFR 09/30/03 7000 $24.33 $170,310 09/30/08 $8.96 7,000 $62,720 ($107,590) ABN AMRO CAPITAL TRUST VI 6.25% TFR 09/30/03 3500 $25.00 $87,500 09/30/08 $8.40 3,500 $29,400 ($58,100) ABN AMRO MORTGAGE SERIES 2002 TFR 09/30/03 1080 $103.46 $111,732 09/30/08 $34.42 1,080 $37,173 ($74,560) AMBAC FINANCIAL GROUP 5.95% DEBENTURE TFR 09/30/03 8000 $24.94 $199,520 09/30/08 $5.09 8,000 $40,720 ($158,800) AMERICAN STRATEGIC INCOME III TFR 09/30/03 20000 $12.42 $248,400 09/30/08 $8.48 20,000 $169,600 ($78,800) CIT GROUP 6.25% MATURITY 03/15/2013 TFR 09/30/03 1100 $101.82 $112,004 09/30/08 $40.38 1,100 $44,414 ($67,591) CITIGROUP CAPITAL TRUST IX 6.00% TFR 09/30/03 5000 $25.00 $125,000 09/30/08 $13.88 5,000 $69,400 ($55,600) GE CAPITAL CORP CORTS 6.00% TFR 09/30/03 8000 $25.29 $202,320 09/30/08 $20.25 8,000 $162,000 ($40,320) FORD MOTOR COMOPNAY 7.50% TFR 09/30/03 4000 $24.85 $99,400 09/30/08 $0.08 4,000 $330 ($99,070) FORD MOTOR CREDIT 7.375% TFR 09/30/03 500 $105.18 $52,592 09/30/08 $66.45 500 $33,224 ($19,368) GENERAL MOTORS 7.375% TFR 09/30/03 8000 $25.19 $201,520 09/30/08 $7.00 8,000 $56,000 ($145,520) GENERAL MOTORS ACCEPTANCE CORP 7.00% 08/15/2018 TFR 09/30/03 620 $98.61 $61,136 09/30/08 $28.49 620 $17,661 ($43,476) GENERAL MOTORS ACCEPTANCE CORP. 7.10% 01/15/2015TFR 09/30/03 1000 $103.74 $103,742 09/30/08 $37.75 1,000 $37,754 ($65,988) LINCOLN NATIONAL CAPITAL VI 6.75% TFR 09/30/03 5600 $25.35 $141,960 09/30/08 $15.90 5,600 $89,040 ($52,920) MORGAN STANLEY CAPITAL TRUST IV 6.25% TFR 09/30/03 9300 $24.95 $232,035 09/30/08 $11.51 9,300 $107,043 ($124,992) GOLDMAN SACHS PREFERRED PLUS 6.00% TFR 09/30/03 4300 $24.80 $106,640 09/30/08 $15.06 4,300 $64,758 ($41,882) JP MORGAN CHASECAPITAL XI 5.875% BUY 10/03/03 756 $24.20 $18,295 04/09/08 $22.30 756 $16,859 ($1,436) JP MORGAN CHASE CAPITAL XI 5.875 SALE 10/03/03 7244 $24.20 $175,305 09/03/08 $18.08 7,244 $130,972 ($44,333) LEHMAN BROTHERS TRUST IV 6.375% BUY 10/09/03 5500 $25.00 $137,500 09/30/08 $0.08 5,500 $440 ($137,060) VEIRZON CAPITAL SATURNS 2004-1 8.125% BUY 12/17/03 7000 $25.00 $175,000 05/08/08 $24.50 7,000 $171,500 ($3,500) FEDERAL HOME LOAN MORTGAGE SEREIS 2719 6.00% BUY 01/05/04 760 $100.00 $76,000 04/15/05 $0.00 100 $0 ($76,000) GILMCHER REALTY TRUST 8.125% BUY 01/22/04 2285 $25.00 $57,125 03/28/05 $25.90 2,285 $59,182 $2,057 GILMCHER REALTY TRUST 8.125% SALE 01/22/04 6035 $25.00 $150,875 09/30/08 $10.58 6,035 $63,850 ($87,025) FORD MOTOR CREDIT 6.00% 03/20/2014 BUY 03/05/04 320 $100.00 $32,000 09/30/08 $45.85 320 $14,673 ($17,327) WELLS FARGO CAPITAL IX 5.625% BUY 04/02/04 3080 $25.00 $77,000 09/30/08 $18.95 3,080 $58,366 ($18,634) FORD MOTOR CREDIT 6.85% 05/20/2014 BUY 05/21/04 2750 $100.00 $275,000 09/30/08 $47.15 2,750 $129,663 ($145,338) FORD MOTOR CREIDT 6.75% 06/20/2014 BUY 06/04/04 650 $100.00 $65,000 09/30/08 $46.50 650 $30,224 ($34,776) PURCHASE SHARE TOTAL SALE SHARE TOTAL SECURITY ACTION DATE SHARES PRICE INVESTMENT DATE PRICE SHARES PROCEEDS GAIN/LOSS FOREST CITY ENTERPRSES 7.375% PREFERRED BUY 07/16/04 3900 $24.37 $95,043 09/30/08 $17.00 3,900 $66,300 ($28,743)

- 2. Sample Summary Exhibit 1 ACCOUNT ACTIVITY AND HOLDINGS ROYAL BANK OF SCOTLAND SERIES M 6.40% BUY 08/19/04 1600 $25.00 $40,000 09/30/08 $9.26 1,600 $14,816 ($25,184) JP MORGAN CHASE CAPITAL XIV 6.20% BUY 09/28/04 1760 $25.00 $44,000 09/30/08 $19.71 1,760 $34,690 ($9,310) PARTNER REAL ESTATE LIMITED SERIES D 6.50% BUY 11/10/04 1900 $25.00 $47,500 09/30/08 $16.88 1,900 $32,072 ($15,428) GENERAL MOTORS ACCEPTANCE CORP. 7.375% BUY 12/17/04 5450 $25.00 $136,250 09/30/08 $8.20 5,450 $44,690 ($91,560) LEHMAN BROTHERS TRUST VI 6.24% BUY 01/05/05 7700 $25.00 $192,500 09/30/08 $0.11 7,700 $847 ($191,653) ROYAL BANK OF SCOTLAND SERIES N 6.35% BUY 05/12/05 3000 $25.00 $75,000 09/30/08 $0.10 3,000 $290 ($74,711) DIGITAL REALITY SERIES B 7.875% BUY 07/20/05 5300 $25.00 $132,500 09/30/08 $19.20 5,300 $101,760 ($30,740) METLIFE SERIES B 6.50% BUY 07/27/05 1500 $25.38 $38,070 12/29/05 $26.00 1,500 $39,000 $930 METLIFE SERIES B 6.50% SALE 07/27/05 1700 $25.38 $43,146 10/26/07 $24.98 1,700 $42,466 ($680) UBS CAPITAL X 6.50% BUY 04/12/06 4100 $25.00 $102,500 09/30/08 $18.57 4,100 $76,137 ($26,363) ROYAL BANK OF SCOTLAND SERIES Q 6.75% BUY 05/25/06 2200 $25.00 $55,000 12/21/06 $26.35 2,200 $57,970 $2,970 ROYAL BANK OF SCOTLAND SERIES Q 6.75% SALE 05/25/06 1800 $25.00 $45,000 12/24/07 $20.92 1,800 $37,656 ($7,344) AEGON NV 6.875 PREFERRED BUY 06/26/06 2000 $25.00 $50,000 09/30/08 $8.85 2,000 $17,698 ($32,302) JP MORGAN CHASE CAPITAL XIX 6.625% BUY 09/28/06 900 $25.00 $22,500 03/27/08 $25.00 900 $22,500 $0 JP MORGAN CHASE CAPITAL XIX 6.625% SALE 09/28/06 2100 $25.00 $52,500 09/30/08 $20.80 2,100 $43,680 ($8,820) COUNTRYWIDE CAPITAL V 7.00% BUY 11/08/06 4800 $25.00 $120,000 09/30/08 $7.95 4,800 $38,160 ($81,840) UBS CAPITAL XII 6.30% BUY 01/26/07 1800 $25.00 $45,000 09/30/08 $18.78 1,800 $33,804 ($11,196) CITIGROUP 6.35% PREFERRED BUY 03/06/07 2200 $25.00 $55,000 09/30/08 $13.92 2,200 $30,624 ($24,376) GE CAPITAL TRUST 6.00% BUY 04/24/07 2600 $25.00 $65,000 09/30/08 $20.32 2,600 $52,832 ($12,168) PARTNER REAL ESTATE LIMITED SERIES D 6.50% BUY 05/31/07 1216 $24.56 $29,865 09/30/08 $16.88 1,216 $20,526 ($9,339) ROYAL BANK OF SCOTLAND SERIES S 6.60% BUY 06/28/07 850 $25.00 $21,250 12/24/07 $20.70 350 $7,245 ($14,005) DEUTSCHE BANK CAPITAL TRUST IX 6.625% BUY 07/20/07 1000 $25.00 $25,000 09/30/08 $15.30 1,000 $15,300 ($9,700) ROYAL BANK OF SCOTLAND SERIES S 6.60% BUY 08/02/07 3739 $24.43 $91,344 09/30/08 $8.65 4,239 $36,667 ($54,676) ING GROUP NV 7.375% BUY 10/04/07 1400 $25.00 $35,000 09/30/08 $19.71 1,400 $27,594 ($7,406) FIFTH THIRD CAPITAL TRUST VI 7.25% BUY 10/30/07 1700 $25.00 $42,500 09/30/08 $9.15 1,700 $15,555 ($26,945) BANK OF AMERICA PREFERRED 7.25% BUY 11/20/07 1200 $25.00 $30,000 09/30/08 $21.35 1,200 $25,620 ($4,380) LEHMAN BROTHERS 7.95% BUY 02/12/08 1722 $25.00 $43,050 09/30/08 $0.06 1,722 $103 ($42,947) CREDIT SUISSE PREFERRED 7.90% BUY 03/28/08 4000 $25.00 $100,000 09/30/08 $20.40 4,000 $81,600 ($18,400) BARCLAYS BANK 8.125% BUY 04/11/08 567 $25.00 $14,175 09/30/08 $17.10 567 $9,696 ($4,479) DEUTSCHE BANK CAPITAL TRUST II 6.55% BUY 04/28/08 348 $22.59 $7,861 09/30/08 $14.50 348 $5,046 ($2,815) CITIGROUP 8.50% PREFERRED BUY 05/13/08 8346 $25.00 $208,650 09/30/08 $17.35 8,348 $144,838 ($63,812) ALLIANZ SE 8.375% BUY 06/10/08 929 $25.00 $23,225 09/30/08 $20.15 929 $18,719 ($4,506) BB&T CAPITAL TRUST V 8.95% BUY 09/10/08 1135 $25.00 $28,375 09/30/08 $24.50 1,135 $27,808 ($568) TOTAL ($2,950,088) INTEREST, DISTRIBUTIONS AND DIVIDENDS RECEIVED $1,824,597 NET PROFIT/LOSS ($1,125,491)

- 3. Sample Summary Exhibit 2 TRANSACTION HISTORY INTIAL SALE SALE SECURITY SECURITY ACTION DATE VALUE DATE PROCEEDS GAIN/LOSS CLASSIFICATION SECTOR JP MORGAN CHASECAPITAL XI 5.875% BUY 10/03/03 $18,295 04/09/08 $16,859 ($1,436) PREFERRED FINANCIAL LEHMAN BROTHERS TRUST IV 6.375% BUY 10/09/03 $137,500 09/30/08 $440 ($137,060) PREFERRED FINANCIAL VEIRZON CAPITAL SATURNS 2004-1 8.125% BUY 12/17/03 $175,000 05/08/08 $171,500 ($3,500) PREFERRED FINANCIAL FEDERAL HOME LOAN MORTGAGE SEREIS 2719 6.00% BUY 01/05/04 $76,000 04/15/05 $0 ($76,000) DEBENTURE FINANCIAL GILMCHER REALTY TRUST 8.125% BUY 01/22/04 $57,125 03/28/05 $59,182 $2,057 PREFERRED REAL ESTATE FORD MOTOR CREDIT 6.00% 03/20/2014 BUY 03/05/04 $32,000 09/30/08 $14,673 ($17,327) DEBENTURE FINANCIAL WELLS FARGO CAPITAL IX 5.625% BUY 04/02/04 $77,000 09/30/08 $58,366 ($18,634) PREFERRED FINANCIAL FORD MOTOR CREDIT 6.85% 05/20/2014 BUY 05/21/04 $275,000 09/30/08 $129,663 ($145,338) DEBENTURE FINANCIAL FORD MOTOR CREIDT 6.75% 06/20/2014 BUY 06/04/04 $65,000 09/30/08 $30,224 ($34,776) DEBENTURE FINANCIAL FOREST CITY ENTERPRSES 7.375% PREFERRED BUY 07/16/04 $95,043 09/30/08 $66,300 ($28,743) PREFERRED REAL ESTATE ROYAL BANK OF SCOTLAND SERIES M 6.40% BUY 08/19/04 $40,000 09/30/08 $14,816 ($25,184) PREFERRED FINANCIAL JP MORGAN CHASE CAPITAL XIV 6.20% BUY 09/28/04 $44,000 09/30/08 $34,690 ($9,310) PREFERRED FINANCIAL PARTNER REAL ESTATE LIMITED SERIES D 6.50% BUY 11/10/04 $47,500 09/30/08 $32,072 ($15,428) PREFERRED REAL ESTATE GENERAL MOTORS ACCEPTANCE CORP. 7.375% BUY 12/17/04 $136,250 09/30/08 $44,690 ($91,560) PREFERRED FINANCIAL LEHMAN BROTHERS TRUST VI 6.24% BUY 01/05/05 $192,500 09/30/08 $847 ($191,653) PREFERRED FINANCIAL ROYAL BANK OF SCOTLAND SERIES N 6.35% BUY 05/12/05 $75,000 09/30/08 $290 ($74,711) PREFERRED FINANCIAL DIGITAL REALITY SERIES B 7.875% BUY 07/20/05 $132,500 09/30/08 $101,760 ($30,740) PREFERRED REAL ESTATE METLIFE SERIES B 6.50% BUY 07/27/05 $38,070 12/29/05 $39,000 $930 PREFERRED FINANCIAL UBS CAPITAL X 6.50% BUY 04/12/06 $102,500 09/30/08 $76,137 ($26,363) PREFERRED FINANCIAL ROYAL BANK OF SCOTLAND SERIES Q 6.75% BUY 05/25/06 $55,000 12/21/06 $57,970 $2,970 PREFERRED FINANCIAL AEGON NV 6.875 PREFERRED BUY 06/26/06 $50,000 09/30/08 $17,698 ($32,302) PREFERRED FINANCIAL JP MORGAN CHASE CAPITAL XIX 6.625% BUY 09/28/06 $22,500 03/27/08 $22,500 $0 PREFERRED FINANCIAL COUNTRYWIDE CAPITAL V 7.00% BUY 11/08/06 $120,000 09/30/08 $38,160 ($81,840) PREFERRED FINANCIAL UBS CAPITAL XII 6.30% BUY 01/26/07 $45,000 09/30/08 $33,804 ($11,196) PREFERRED FINANCIAL CITIGROUP 6.35% PREFERRED BUY 03/06/07 $55,000 09/30/08 $30,624 ($24,376) PREFERRED FINANCIAL GE CAPITAL TRUST 6.00% BUY 04/24/07 $65,000 09/30/08 $52,832 ($12,168) PREFERRED FINANCIAL PARTNER REAL ESTATE LIMITED SERIES D 6.50% BUY 05/31/07 $29,865 09/30/08 $20,526 ($9,339) PREFERRED REAL ESTATE ROYAL BANK OF SCOTLAND SERIES S 6.60% BUY 06/28/07 $21,250 12/24/07 $7,245 ($14,005) PREFERRED FINANCIAL DEUTSCHE BANK CAPITAL TRUST IX 6.625% BUY 07/20/07 $25,000 09/30/08 $15,300 ($9,700) PREFERRED FINANCIAL ROYAL BANK OF SCOTLAND SERIES S 6.60% BUY 08/02/07 $91,344 09/30/08 $36,667 ($54,676) PREFERRED FINANCIAL ING GROUP NV 7.375% BUY 10/04/07 $35,000 09/30/08 $27,594 ($7,406) PREFERRED FINANCIAL FIFTH THIRD CAPITAL TRUST VI 7.25% BUY 10/30/07 $42,500 09/30/08 $15,555 ($26,945) PREFERRED FINANCIAL BANK OF AMERICA PREFERRED 7.25% BUY 11/20/07 $30,000 09/30/08 $25,620 ($4,380) PREFERRED FINANCIAL LEHMAN BROTHERS 7.95% BUY 02/12/08 $43,050 09/30/08 $103 ($42,947) PREFERRED FINANCIAL CREDIT SUISSE PREFERRED 7.90% BUY 03/28/08 $100,000 09/30/08 $81,600 ($18,400) PREFERRED FINANCIAL BARCLAYS BANK 8.125% BUY 04/11/08 $14,175 09/30/08 $9,696 ($4,479) PREFERRED FINANCIAL DEUTSCHE BANK CAPITAL TRUST II 6.55% BUY 04/28/08 $7,861 09/30/08 $5,046 ($2,815) PREFERRED FINANCIAL CITIGROUP 8.50% PREFERRED BUY 05/13/08 $208,650 09/30/08 $144,838 ($63,812) PREFERRED FINANCIAL INTIAL SALE SALE SECURITY SECURITY ACTION DATE VALUE DATE PROCEEDS GAIN/LOSS CLASSIFICATION SECTOR ALLIANZ SE 8.375% BUY 06/10/08 $23,225 09/30/08 $18,719 ($4,506) PREFERRED FINANCIAL

- 4. Sample Summary Exhibit 2 TRANSACTION HISTORY BB&T CAPITAL TRUST V 8.95% BUY 09/10/08 $28,375 09/30/08 $27,808 ($568) PREFERRED FINANCIAL JP MORGAN CHASE CAPITAL XI 5.875 SALE 10/03/03 $175,305 09/03/08 $130,972 ($44,333) PREFERRED FINANCIAL GILMCHER REALTY TRUST 8.125% SALE 01/22/04 $150,875 09/30/08 $63,850 ($87,025) PREFERRED REAL ESTATE METLIFE SERIES B 6.50% SALE 07/27/05 $43,146 10/26/07 $42,466 ($680) PREFERRED FINANCIAL ROYAL BANK OF SCOTLAND SERIES Q 6.75% SALE 05/25/06 $45,000 12/24/07 $37,656 ($7,344) PREFERRED FINANCIAL JP MORGAN CHASE CAPITAL XIX 6.625% SALE 09/28/06 $52,500 09/30/08 $43,680 ($8,820) PREFERRED FINANCIAL BUY SIDE TRANSACTIONS BY CLASSIFICATION BUY SIDE TRANSACTION BY SECTOR Sept. 2003 - Sept. 2008 Sept. 2003 - Sept. 2008 Exhibit 2.A Exhibit 2.B 35 40 36 40 30 30 20 20 5 10 4 10 0 0 0 0 0 PREFERREDS BONDS MUNI BONDS MBS FINANCIALS REAL ESTATE AUTOMOTIVE

- 5. Sample Summary Exhibit 2 TRANSACTION HISTORY

- 6. Sample Summary Exhibit 2 TRANSACTION HISTORY

- 7. Sample Summary PORTFOLIO ALLOCATION Exhibit 3 September 2008 INTIAL ENDING SECURITY % OF SECURITY VALUE VALUE CLASSIFICATION SECTOR PORTFOLIO ABN AMRO CAPITAL TRUST V 5.90% $170,310 $62,720 PREFERRED FINANCIAL 2.81% ABN AMRO CAPITAL TRUST VI 6.25% $87,500 $29,400 PREFERRED FINANCIAL 1.32% ABN AMRO MORTGAGE SERIES 2002 $111,732 $37,173 DEBENTURE FINANCIAL 1.67% AMBAC FINANCIAL GROUP 5.95% DEBENTURE $199,520 $40,720 DEBENTURE FINANCIAL 1.83% AMERICAN STRATEGIC INCOME III $248,400 $169,600 CLOSED END FUND MBS 7.61% CIT GROUP 6.25% MATURITY 03/15/2013 $112,004 $44,414 DEBENTURE FINANCIAL 1.99% CITIGROUP CAPITAL TRUST IX 6.00% $125,000 $69,400 PREFERRED FINANCIAL 3.11% GE CAPITAL CORP CORTS 6.00% $202,320 $162,000 PREFERRED FINANCIAL 7.27% FORD MOTOR COMOPNAY 7.50% $99,400 $330 PREFERRED AUTOMOTIVE 0.01% FORD MOTOR CREDIT 7.375% $52,592 $33,224 DEBENTURE FINANCIAL 1.49% GENERAL MOTORS 7.375% $201,520 $56,000 PREFERRED AUTOMOTIVE 2.51% GENERAL MOTORS ACCEPTANCE CORP 7.00% 08/15/2018 $61,136 $17,661 DEBENTURE FINANCIAL 0.79% GENERAL MOTORS ACCEPTANCE CORP. 7.10% 01/15/2015 $103,742 $37,754 DEBENTURE FINANCIAL 1.69% LINCOLN NATIONAL CAPITAL VI 6.75% $141,960 $89,040 PREFERRED FINANCIAL 4.00% MORGAN STANLEY CAPITAL TRUST IV 6.25% $232,035 $107,043 PREFERRED FINANCIAL 4.80% GOLDMAN SACHS PREFERRED PLUS 6.00% $106,640 $64,758 PREFERRED FINANCIAL 2.91% LEHMAN BROTHERS TRUST IV 6.375% $137,500 $440 PREFERRED FINANCIAL 0.02% FORD MOTOR CREDIT 6.00% 03/20/2014 $32,000 $14,673 DEBENTURE FINANCIAL 0.66% WELLS FARGO CAPITAL IX 5.625% $77,000 $58,366 PREFERRED FINANCIAL 2.62% FORD MOTOR CREDIT 6.85% 05/20/2014 $275,000 $129,663 DEBENTURE FINANCIAL 5.82% FORD MOTOR CREIDT 6.75% 06/20/2014 $65,000 $30,224 DEBENTURE FINANCIAL 1.36% FOREST CITY ENTERPRSES 7.375% PREFERRED $95,043 $66,300 PREFERRED REAL ESTATE 2.98% ROYAL BANK OF SCOTLAND SERIES M 6.40% $40,000 $14,816 PREFERRED FINANCIAL 0.66% JP MORGAN CHASE CAPITAL XIV 6.20% $44,000 $34,690 PREFERRED FINANCIAL 1.56% PARTNER REAL ESTATE LIMITED SERIES D 6.50% $47,500 $32,072 PREFERRED REAL ESTATE 1.44% GENERAL MOTORS ACCEPTANCE CORP. 7.375% $136,250 $44,690 PREFERRED FINANCIAL 2.01% LEHMAN BROTHERS TRUST VI 6.24% $192,500 $847 PREFERRED FINANCIAL 0.04% ROYAL BANK OF SCOTLAND SERIES N 6.35% $75,000 $290 PREFERRED FINANCIAL 0.01% DIGITAL REALITY SERIES B 7.875% $132,500 $101,760 PREFERRED REAL ESTATE 4.57% UBS CAPITAL X 6.50% $102,500 $76,137 PREFERRED FINANCIAL 3.42% AEGON NV 6.875 PREFERRED $50,000 $17,698 PREFERRED FINANCIAL 0.79% COUNTRYWIDE CAPITAL V 7.00% $120,000 $38,160 PREFERRED FINANCIAL 1.71% UBS CAPITAL XII 6.30% $45,000 $33,804 PREFERRED FINANCIAL 1.52% CITIGROUP 6.35% PREFERRED $55,000 $30,624 PREFERRED FINANCIAL 1.37% INTIAL ENDING SECURITY % OF

- 8. Sample Summary PORTFOLIO ALLOCATION Exhibit 3 September 2008 SECURITY VALUE VALUE CLASSIFICATION SECTOR PORTFOLIO GE CAPITAL TRUST 6.00% $65,000 $52,832 PREFERRED FINANCIAL 2.37% PARTNER REAL ESTATE LIMITED SERIES D 6.50% $29,865 $20,526 PREFERRED REAL ESTATE 0.92% DEUTSCHE BANK CAPITAL TRUST IX 6.625% $25,000 $15,300 PREFERRED FINANCIAL 0.69% ROYAL BANK OF SCOTLAND SERIES S 6.60% $91,344 $36,667 PREFERRED FINANCIAL 1.65% ING GROUP NV 7.375% $35,000 $27,594 PREFERRED FINANCIAL 1.24% FIFTH THIRD CAPITAL TRUST VI 7.25% $42,500 $15,555 PREFERRED FINANCIAL 0.70% BANK OF AMERICA PREFERRED 7.25% $30,000 $25,620 PREFERRED FINANCIAL 1.15% LEHMAN BROTHERS 7.95% $43,050 $103 PREFERRED FINANCIAL 0.00% CREDIT SUISSE PREFERRED 7.90% $100,000 $81,600 PREFERRED FINANCIAL 3.66% BARCLAYS BANK 8.125% $14,175 $9,696 PREFERRED FINANCIAL 0.44% DEUTSCHE BANK CAPITAL TRUST II 6.55% $7,861 $5,046 PREFERRED FINANCIAL 0.23% CITIGROUP 8.50% PREFERRED $208,650 $144,838 PREFERRED FINANCIAL 6.50% ALLIANZ SE 8.375% $23,225 $18,719 PREFERRED FINANCIAL 0.84% BB&T CAPITAL TRUST V 8.95% $28,375 $27,808 PREFERRED FINANCIAL 1.25% TOTALS $2,228,393

- 9. Sample Summary PORTFOLIO ALLOCATION Exhibit 4 September 2003 INTIAL ENDING SECURITY % OF SECURITY VALUE VALUE CLASSIFICATION SECTOR PORTFOLIO ABN AMRO CAPITAL TRUST V 5.90% $170,310 $62,720 PREFERRED FINANCIAL 4.58% ABN AMRO CAPITAL TRUST VI 6.25% $87,500 $29,400 PREFERRED FINANCIAL 2.35% ABN AMRO MORTGAGE SERIES 2002 $111,732 $37,173 DEBENTURE FINANCIAL 3.00% AMBAC FINANCIAL GROUP 5.95% DEBENTURE $199,520 $40,720 DEBENTURE FINANCIAL 5.36% INDIANA MICHIGAN POWER 6.00% $172,590 $167,812 DEBENTURE-TAX EXEMPT MUNICIPAL 4.64% AMERICAN STRATEGIC INCOME III $248,400 $169,600 CLOSED END FUND MBS 6.68% CIT GROUP 6.25% MATURITY 03/15/2013 $112,004 $44,414 DEBENTURE FINANCIAL 3.01% CITIGROUP CAPITAL TRUST IX 6.00% $125,000 $69,400 PREFERRED FINANCIAL 3.36% GE CAPITAL CORP CORTS 6.00% $202,320 $162,000 PREFERRED FINANCIAL 5.44% CS FIRST BOSTON MORTGAGE 2003-17 $273,779 $275,000 DEBENTURE FINANCIAL 7.36% DEVLOPERS DIVERSIFIED REALTY 7.375% $199,200 $208,240 PREFERRED REAL ESTATE 5.36% FEDERAL HOME LOAN MORTGAGE SERIES 1384-C $645 $0 DEBENTURE FINANCIAL 0.02% FEDERAL HOME LOAN MORTGAGE SERIES 2115-JA $154,083 $0 DEBENTURE FINANCIAL 4.14% FORD MOTOR COMOPNAY 7.50% $99,400 $330 PREFERRED AUTOMOTIVE 2.67% FORD MOTOR CREDIT 7.375% $52,592 $33,224 DEBENTURE FINANCIAL 1.41% GENERAL MOTORS 7.375% $201,520 $56,000 PREFERRED AUTOMOTIVE 5.42% GENERAL MOTORS 8.375% $149,521 $100,458 DEBENTURE AUTOMOTIVE 4.02% GENERAL MOTORS ACCEPTANCE CORP 7.00% 08/15/2018 $61,136 $17,661 DEBENTURE FINANCIAL 1.64% GENERAL MOTORS ACCEPTANCE CORP. 7.10% 01/15/2015 $103,742 $37,754 DEBENTURE FINANCIAL 2.79% GENERAL MOTORS ACDEPTANCE CORP. 7.00% 05/15/2016 $118,603 $120,000 DEBENTURE FINANCIAL 3.19% LINCOLN NATIONAL CAPITAL VI 6.75% $141,960 $89,040 PREFERRED FINANCIAL 3.82% MBNA CAPITAL TRUST SERIES D 8.125% $132,500 $133,200 PREFERRED FINANCIAL 3.56% MORGAN STANLEY CAPITAL TRUST IV 6.25% $232,035 $107,043 PREFERRED FINANCIAL 6.24% GOLDMAN SACHS PREFERRED PLUS 6.00% $106,640 $64,758 PREFERRED FINANCIAL 2.87% ROCHESTER GAS & ELECTRIC 6.65% $80,700 $75,000 DEBENTURE-TAX EXEMPT MUNICIPAL 2.17% ROYAL BANK OF SCOTLAND 7.25% $40,880 $36,976 PREFERRED FINANCIAL 1.10% BS TRUST CERTIFICATES 2001-4 7.00% $52,760 $50,000 PREFERRED FINANCIAL 1.42% CIT GROUP 6.50% MATURITY 12/15/2012 $88,674 $86,000 DEBENTURE FINANCIAL 2.38% TOTALS $3,719,747

- 10. Sample Summary ALLOCATION AND CONCENTRATION COMPARISON Exhibit 5 SECURITY CLASSIFICATION BEGINNING ALLOCATION ENDING ALLOCATION % CHANGE IN ALLOCATION PREFERREDS 48.18% 75.09% 55.86% BONDS 38.34% 17.30% -54.87% MUNICIPAL BONDS 6.81% 0.00% -100.00% MORTGAGE BACKED SECURITIES (MBS) 6.68% 7.61% 13.97% SECTOR BEGINNING WHEIGHTING ENDING WHEIGHTING S&P 500 INDEX WHEIGHTING* DIFFERENCE FINANCIALS 69.05% 79.96% 13.33% 66.63 REAL ESTATE 5.36% 9.90% 2.62% 7.28 AUTOMOTIVE 12.11% 2.53% 3.51% -0.98 PORTFOLIO ALLOCATION SECTOR WHEIGHTING Exhibit 5.A Exhibit 5.B 75.09% 69.05% 79.96% 48.18% 38.34% 17.30% 13.33% 6.81% 6.68% 7.61% 12.11% 9.90% 0.00% 2.53% 2.62% 3.51% 5.36% SEPT. 2003 SEPT. 2008 SEPT. 2003 SEPT. 2008 S&P 500 PREFERREDS BONDS MUNICIPAL BONDS MBS FINANCIALS REAL ESTATE AUTOMOTIVE