Fixed Income Update - December 2018

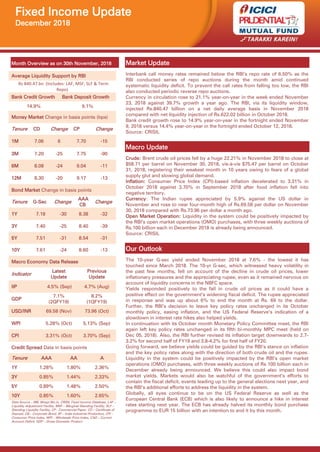

- 1. Fixed Income Update December 2018 Month Overview as on 30th November, 2018 Average Liquidity Support by RBI Rs 840.47 bn (Includes: LAF, MSF, SLF & Term Repo) Bank Credit Growth Bank Deposit Growth 14.9% 9.1% Money Market Change in basis points (bps) Tenure CD Change CP Change 1M 7.06 6 7.70 -15 3M 7.20 -25 7.75 -90 6M 8.08 -24 9.04 -11 12M 8.30 -20 9.17 -13 Bond Market Change in basis points Tenure G-Sec Change AAA CB Change 1Y 7.18 -30 8.38 -32 3Y 7.40 -25 8.40 -39 5Y 7.51 -31 8.54 -31 10Y 7.61 -24 8.60 -13 Macro Economy Data Release Indicator Latest Update Previous Update IIP 4.5% (Sep) 4.7% (Aug) GDP 7.1% (2QFY19) 8.2% (1QFY19) USD/INR 69.58 (Nov) 73.96 (Oct) WPI 5.28% (Oct) 5.13% (Sep) CPI 3.31% (Oct) 3.70% (Sep) Credit Spread Data in basis points Tenure AAA AA A 1Y 1.28% 1.80% 2.36% 3Y 0.85% 1.44% 2.33% 5Y 0.89% 1.48% 2.50% 10Y 0.85% 1.60% 2.65% Data Source – RBI, Mospi.Nic.in, CRISIL Fixed Income Database, LAF – Liquidity Adjustment Facility, MSF – Marginal Standing Facility, SLF – Standing Liquidity Facility, CP - Commercial Paper, CD – Certificate of Deposit, CB – Corporate Bond, IIP – India Industrial Production, CPI – Consumer Price Index, WPI – Wholesale Price Index, CAD – Current Account Deficit, GDP – Gross Domestic Product Market Update Interbank call money rates remained below the RBI’s repo rate of 6.50% as the RBI conducted series of repo auctions during the month amid continued systematic liquidity deficit. To prevent the call rates from falling too low, the RBI also conducted periodic reverse repo auctions. Currency in circulation rose to 21.1% year-on-year in the week ended November 23, 2018 against 39.7% growth a year ago. The RBI, via its liquidity window, injected Rs.840.47 billion on a net daily average basis in November 2018 compared with net liquidity injection of Rs.622.02 billion in October 2018. Bank credit growth rose to 14.9% year-on-year in the fortnight ended November 9, 2018 versus 14.4% year-on-year in the fortnight ended October 12, 2018. Source: CRISIL Macro Update Crude: Brent crude oil prices fell by a huge 22.21% in November 2018 to close at $58.71 per barrel on November 30, 2018, vis-à-vis $75.47 per barrel on October 31, 2018, registering their weakest month in 10 years owing to fears of a global supply glut and slowing global demand. Inflation: Consumer Price Index (CPI)-based inflation decelerated to 3.31% in October 2018 against 3.70% in September 2018 after food inflation fell into negative territory. Currency: The Indian rupee appreciated by 5.9% against the US dollar in November and rose to near four-month high of Rs.69.58 per dollar on November 30, 2018 compared with Rs.73.96 per dollar a month ago. Open Market Operation: Liquidity in the system could be positively impacted by the RBI’s open market operations (OMO) purchases, with three weekly auctions of Rs.100 billion each in December 2018 is already being announced. Source: CRISIL Our Outlook The 10-year G-sec yield ended November 2018 at 7.6% - the lowest it has touched since March 2018. The 10-yr G-sec, which witnessed heavy volatility in the past few months, fell on account of the decline in crude oil prices, lower inflationary pressures and the appreciating rupee, even as it remained nervous on account of liquidity concerns in the NBFC space. Yields responded positively to the fall in crude oil prices as it could have a positive effect on the government’s widening fiscal deficit. The rupee appreciated in response and was up about 6% to end the month at Rs. 69 to the dollar. Further, the RBI’s decision to leave key policy rates unchanged in its October monthly policy, easing inflation, and the US Federal Reserve’s indication of a slowdown in interest rate hikes also helped yields. In continuation with its October month Monetary Policy Committee meet, the RBI again left key policy rates unchanged in its fifth bi-monthly MPC meet (held on Dec 05, 2018). Also, the RBI further revised its inflation target downwards to 2.7- 3.2% for second half of FY19 and 3.8-4.2% for first half of FY20. Going forward, we believe yields could be guided by the RBI’s stance on inflation and the key policy rates along with the direction of both crude oil and the rupee. Liquidity in the system could be positively impacted by the RBI’s open market operations (OMO) purchases, with three weekly auctions of Rs 100 billion each in December already being announced. We believe this could also impact bond market yields. Markets would also be watchful of the government’s efforts to contain the fiscal deficit, events leading up to the general elections next year, and the RBI’s additional efforts to address the liquidity in the system. Globally, all eyes continue to be on the US Federal Reserve as well as the European Central Bank (ECB) which is also likely to announce a hike in interest rates starting next year. The ECB has already halved its monthly bond purchase programme to EUR 15 billion with an intention to end it by this month.

- 2. Fixed Income Update December 2018 Given these circumstances and the fact that the RBI has left key policy rates unchanged, we change our stance to neutral from cautious on the fixed income space and recommend investors to stick to low duration schemes which can mitigate interest rate volatility, accrual schemes which can capture the current elevated yields and dynamic duration schemes which can benefit from volatility. We, therefore, recommend investors to stick to low duration schemes (investing in instruments with maturity in the range of 1-3 years) which can mitigate interest rate volatility, accrual schemes which can capture the current yields and dynamic duration schemes which can benefit out of volatility. Debt Valuation Debt Valuation Index considers WPI, CPI, Sensex YEAR-ON-YEAR returns, Gold YEAR-ON-YEAR returns and Real estate YEAR-ON-YEAR returns over G-Sec yield, Current Account Balance and Crude Oil Movement for calculation. Our Recommendation Our Recommendations Accrual Schemes ICICI Prudential Medium Term Bond Fund (An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 Years and 4 Years. The Macaulay duration of the portfolio is 1 Year to 4 years under anticipated adverse situation) ICICI Prudential Credit Risk Fund (An open ended debt scheme predominantly investing in AA and below rated corporate bonds) ICICI Prudential Floating Interest Fund (An open ended debt scheme predominantly investing in floating rate instruments (including fixed rate instruments converted to floating rate exposures using swaps/derivatives) ICICI Prudential Ultra Short Term Fund (An open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 months and 6 months) These schemes are better suited for investors looking for accrual strategy. Dynamic Duration Schemes ICICI Prudential All Seasons Bond Fund (An open ended dynamic debt scheme investing across duration) This scheme can dynamically change duration strategy based on market conditions.

- 3. Fixed Income Update October 2018 Short Duration Scheme ICICI Prudential Short Term Fund (An open ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1 Year and 3 Years) This scheme maintains short duration maturity. None of the aforesaid recommendations are based on any assumptions. These are purely for reference and the investors are requested to consult their financial advisors before investing. Note: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. ICICI Prudential Short Term Fund is suitable for investors who are seeking*: Short term income generation and capital appreciation solution A debt fund that aims to generate income by investing in a range of debt and money market instruments of various maturities *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Medium Term Bond Fund is suitable for investors who are seeking*: Medium term savings A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety and liquidity *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential All Seasons Bond Fund is suitable for investors who are seeking*: All duration savings A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety and liquidity *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Credit Risk Fund is suitable for investors who are seeking*: Medium term savings A debt scheme that aims to generate income through investing predominantly in AA and below rated corporate bonds while maintaining the optimum balance of yield, safety and liquidity

- 4. Fixed Income Update October 2018 *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Floating Interest Fund is suitable for investors who are seeking*: Short term savings An open ended debt scheme predominantly investing in floating rate instruments *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Ultra Short Term Fund is suitable for investors who are seeking*: Short term regular income An open ended ultra-short term debt scheme investing in a range of debt and money market instruments *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Disclaimer Mutual Fund investments are subject to market risks, read all scheme related documents carefully. In the preparation of the material contained in this document, the AMC has used information that is publicly available, including information developed in-house. Information gathered and material used in this document is believed to be from reliable sources. The Fund however does not warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this material no such party will assume any liability for the same. All recipients of this material should before dealing and or transacting in any of the products referred to in this material make their own investigation, seek appropriate professional advice and carefully read the scheme information document. We have included statements in this document, which contain words, or phrases such as "will", "expect", "should", "believe" and similar expressions or variations of such expressions that are "forward looking statements". Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monitory and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, the performance of the financial markets in India and globally, changes in domestic and foreign laws, regulations and taxes and changes in competition in the industry. All data/information used in the preparation of this material is dated and may or may not be relevant any time after the issuance of this material. The AMC takes no responsibility of updating any data/information in this material from time to time. The AMC (including its affiliates), the Fund and any of its officers directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible/are liable for any decision taken on the basis of this material.