Malaysia greenback project june 2015 alison ang

•Télécharger en tant que PPT, PDF•

1 j'aime•3,809 vues

Signaler

Partager

Signaler

Partager

Recommandé

1437 - Water Management of Yield Record Holding SRI Farmer in Indonesia; A Ca...

1437 - Water Management of Yield Record Holding SRI Farmer in Indonesia; A Ca...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1601- SRI monitoring - Overview and preliminary results - Samar, Philippines

1601- SRI monitoring - Overview and preliminary results - Samar, PhilippinesSRI-Rice, Dept. of Global Development, CALS, Cornell University

1436 - Participation and Impact of SRI Training in Madagascar

1436 - Participation and Impact of SRI Training in MadagascarSRI-Rice, Dept. of Global Development, CALS, Cornell University

1603 - Improving Food Production for Health in a Water-constrained World - Ag...

1603 - Improving Food Production for Health in a Water-constrained World - Ag...SRI-Rice, Dept. of Global Development, CALS, Cornell University

Recommandé

1437 - Water Management of Yield Record Holding SRI Farmer in Indonesia; A Ca...

1437 - Water Management of Yield Record Holding SRI Farmer in Indonesia; A Ca...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1601- SRI monitoring - Overview and preliminary results - Samar, Philippines

1601- SRI monitoring - Overview and preliminary results - Samar, PhilippinesSRI-Rice, Dept. of Global Development, CALS, Cornell University

1436 - Participation and Impact of SRI Training in Madagascar

1436 - Participation and Impact of SRI Training in MadagascarSRI-Rice, Dept. of Global Development, CALS, Cornell University

1603 - Improving Food Production for Health in a Water-constrained World - Ag...

1603 - Improving Food Production for Health in a Water-constrained World - Ag...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1606 - The System of Rice Intensification (SRI) in Iran

1606 - The System of Rice Intensification (SRI) in IranSRI-Rice, Dept. of Global Development, CALS, Cornell University

1433 - Farmer Evaluation of the SRI and Conventional Rice Cultivation Method...

1433 - Farmer Evaluation of the SRI and Conventional Rice Cultivation Method...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1438 - Development of Small-Scale Equipment for the System of Rice Intensific...

1438 - Development of Small-Scale Equipment for the System of Rice Intensific...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1327 - FTCs and Farmer Tef Demonstration and Results 2012

1327 - FTCs and Farmer Tef Demonstration and Results 2012SRI-Rice, Dept. of Global Development, CALS, Cornell University

1430 - Application of SRI Principles in Sustainable Rice Production in Bhutan

1430 - Application of SRI Principles in Sustainable Rice Production in BhutanSRI-Rice, Dept. of Global Development, CALS, Cornell University

1605 - Community of Hope Agricultural Project - SRI in Liberia

1605 - Community of Hope Agricultural Project - SRI in LiberiaSRI-Rice, Dept. of Global Development, CALS, Cornell University

1434 - Improving and Scaling Up the System of Rice Intensification in West Af...

1434 - Improving and Scaling Up the System of Rice Intensification in West Af...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1610 - Carbon offsetting to sustainably finance the System of Rice Intensifi...

1610 - Carbon offsetting to sustainably finance the System of Rice Intensifi...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1602 - Scaling Up Climate Smart Rice Production in West Africa

1602 - Scaling Up Climate Smart Rice Production in West AfricaSRI-Rice, Dept. of Global Development, CALS, Cornell University

1510 - Farmer Adaptation of System of Rice Intensification (SRI) Methods in t...

1510 - Farmer Adaptation of System of Rice Intensification (SRI) Methods in t...SRI-Rice, Dept. of Global Development, CALS, Cornell University

0961 The System of Rice Intensification (SRI): Rethinking Agricultural Parad...

0961 The System of Rice Intensification (SRI): Rethinking Agricultural Parad...SRI-Rice, Dept. of Global Development, CALS, Cornell University

Contenu connexe

En vedette

1606 - The System of Rice Intensification (SRI) in Iran

1606 - The System of Rice Intensification (SRI) in IranSRI-Rice, Dept. of Global Development, CALS, Cornell University

1433 - Farmer Evaluation of the SRI and Conventional Rice Cultivation Method...

1433 - Farmer Evaluation of the SRI and Conventional Rice Cultivation Method...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1438 - Development of Small-Scale Equipment for the System of Rice Intensific...

1438 - Development of Small-Scale Equipment for the System of Rice Intensific...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1327 - FTCs and Farmer Tef Demonstration and Results 2012

1327 - FTCs and Farmer Tef Demonstration and Results 2012SRI-Rice, Dept. of Global Development, CALS, Cornell University

1430 - Application of SRI Principles in Sustainable Rice Production in Bhutan

1430 - Application of SRI Principles in Sustainable Rice Production in BhutanSRI-Rice, Dept. of Global Development, CALS, Cornell University

1605 - Community of Hope Agricultural Project - SRI in Liberia

1605 - Community of Hope Agricultural Project - SRI in LiberiaSRI-Rice, Dept. of Global Development, CALS, Cornell University

1434 - Improving and Scaling Up the System of Rice Intensification in West Af...

1434 - Improving and Scaling Up the System of Rice Intensification in West Af...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1610 - Carbon offsetting to sustainably finance the System of Rice Intensifi...

1610 - Carbon offsetting to sustainably finance the System of Rice Intensifi...SRI-Rice, Dept. of Global Development, CALS, Cornell University

1602 - Scaling Up Climate Smart Rice Production in West Africa

1602 - Scaling Up Climate Smart Rice Production in West AfricaSRI-Rice, Dept. of Global Development, CALS, Cornell University

1510 - Farmer Adaptation of System of Rice Intensification (SRI) Methods in t...

1510 - Farmer Adaptation of System of Rice Intensification (SRI) Methods in t...SRI-Rice, Dept. of Global Development, CALS, Cornell University

0961 The System of Rice Intensification (SRI): Rethinking Agricultural Parad...

0961 The System of Rice Intensification (SRI): Rethinking Agricultural Parad...SRI-Rice, Dept. of Global Development, CALS, Cornell University

En vedette (18)

1606 - The System of Rice Intensification (SRI) in Iran

1606 - The System of Rice Intensification (SRI) in Iran

1433 - Farmer Evaluation of the SRI and Conventional Rice Cultivation Method...

1433 - Farmer Evaluation of the SRI and Conventional Rice Cultivation Method...

1438 - Development of Small-Scale Equipment for the System of Rice Intensific...

1438 - Development of Small-Scale Equipment for the System of Rice Intensific...

1327 - FTCs and Farmer Tef Demonstration and Results 2012

1327 - FTCs and Farmer Tef Demonstration and Results 2012

1430 - Application of SRI Principles in Sustainable Rice Production in Bhutan

1430 - Application of SRI Principles in Sustainable Rice Production in Bhutan

1605 - Community of Hope Agricultural Project - SRI in Liberia

1605 - Community of Hope Agricultural Project - SRI in Liberia

1434 - Improving and Scaling Up the System of Rice Intensification in West Af...

1434 - Improving and Scaling Up the System of Rice Intensification in West Af...

1610 - Carbon offsetting to sustainably finance the System of Rice Intensifi...

1610 - Carbon offsetting to sustainably finance the System of Rice Intensifi...

1602 - Scaling Up Climate Smart Rice Production in West Africa

1602 - Scaling Up Climate Smart Rice Production in West Africa

1510 - Farmer Adaptation of System of Rice Intensification (SRI) Methods in t...

1510 - Farmer Adaptation of System of Rice Intensification (SRI) Methods in t...

0961 The System of Rice Intensification (SRI): Rethinking Agricultural Parad...

0961 The System of Rice Intensification (SRI): Rethinking Agricultural Parad...

Similaire à Malaysia greenback project june 2015 alison ang

Taking Mobile Financial Services to the Next Level in Africa: Tanzanian Exper...

Taking Mobile Financial Services to the Next Level in Africa: Tanzanian Exper...Alliance for Financial Inclusion

Similaire à Malaysia greenback project june 2015 alison ang (20)

RBZ GOVERNORS SPEECH - 2016 - AGENT BANKING AND DIGITAL FINANCIAL SERVICES

RBZ GOVERNORS SPEECH - 2016 - AGENT BANKING AND DIGITAL FINANCIAL SERVICES

Taking Mobile Financial Services to the Next Level in Africa: Tanzanian Exper...

Taking Mobile Financial Services to the Next Level in Africa: Tanzanian Exper...

Current state of migration in the Mediterranean - Nov 2016 by OECD

Current state of migration in the Mediterranean - Nov 2016 by OECD

Tanzania financial inclusion through post office outreach

Tanzania financial inclusion through post office outreach

Financial Inclusion Capital for the Underserved - by Bunmi Lawson

Financial Inclusion Capital for the Underserved - by Bunmi Lawson

2015 InterMedia FII BANGLADESH QuickSights Summary Report

2015 InterMedia FII BANGLADESH QuickSights Summary Report

Plus de IFAD International Fund for Agricultural Development

Plus de IFAD International Fund for Agricultural Development (20)

Malaysia greenback project june 2015 alison ang

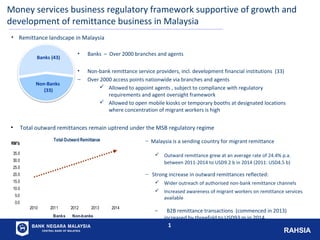

- 1. RAHSIA 1 Money services business regulatory framework supportive of growth and development of remittance business in Malaysia • Non-bank remittance service providers, incl. development financial institutions (33) − Over 2000 access points nationwide via branches and agents Allowed to appoint agents , subject to compliance with regulatory requirements and agent oversight framework Allowed to open mobile kiosks or temporary booths at designated locations where concentration of migrant workers is high • Banks – Over 2000 branches and agents Banks (43) Non-Banks (33) • Remittance landscape in Malaysia 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 2010 2011 2012 2013 2014 RM'b Total Outward Remittance Banks Non-banks − Malaysia is a sending country for migrant remittance Outward remittance grew at an average rate of 24.4% p.a. between 2011-2014 to USD9.2 b in 2014 (2011: USD4.5 b) − Strong increase in outward remittances reflected: Wider outreach of authorised non-bank remittance channels Increased awareness of migrant workers on remittance services available − B2B remittance transactions (commenced in 2013) increased by threefold to USD93 m in 2014 • Total outward remittances remain uptrend under the MSB regulatory regime

- 2. RAHSIA PROJECT: GREENBACK 2.0 – Malaysia’s Proposal • Promote awareness on formal remittance channels and expand financial inclusion among target groups • Improve further market transparency, competition, and reduce prices for remittance services Target groupd: a)Urban foreign workers b)Plantation workers c)SMEs • Local councils • Industry players • The SME corp., SMI Association and banks • Plantation companies • Migrant Association and relevant Embassies • Survey – Market environment and remittance market behavior • Awareness programs – Remittance education workshop, city tour, business expo and remittance fair Supporting tools: Usage of technology/social media platform, e.g. Pick a remit apps

Notes de l'éditeur

- 2007 2008 2009 2010 2011 Total Outward (RM mil) 7,958 8,575 10,535 13,414 15,656 Annual growth (%) - 8% 23% 27% 17% Of which: Non-banks (RM mil) 865 2,011 3,944 6,703 7,891 Banks (RM mil) 7,093 6,563 6,591 6,711 7,765 Exchange rate used: 1 usd = RM3.50 (as at 31 Dec 2014)