Oz Metals: How Much Zinc Did Glencore Hide Away?

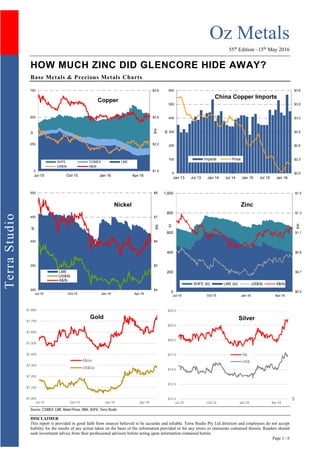

- 1. Oz Metals 55th Edition –15th May 2016 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 1 / 6 TerraStudio HOW MUCH ZINC DID GLENCORE HIDE AWAY? Base Metals & Precious Metals Charts Source: COMEX, LME, Metal Prices, RBA, SHFE, Terra Studio $1.5 $2.2 $2.9 $3.6 0 250 500 750 Jul-15 Oct-15 Jan-16 Apr-16 $/lb kt Copper SHFE COMEX LME US$/lb A$/lb $2.0 $2.3 $2.6 $2.9 $3.2 $3.5 $3.8 0 100 200 300 400 500 600 Jan 13 Jul 13 Jan 14 Jul 14 Jan 15 Jul 15 Jan 16 kt China Copper Imports Imports Price $4 $5 $6 $7 $8 300 350 400 450 500 Jul-15 Oct-15 Jan-16 Apr-16 $/lb kt Nickel LME US$/lb A$/lb $0.5 $0.7 $0.9 $1.1 $1.3 $1.5 0 200 400 600 800 1,000 Jul-15 Oct-15 Jan-16 Apr-16 $/lb kt Zinc SHFE (kt) LME (kt) US$/lb A$/lb $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 Jul-15 Oct-15 Jan-16 Apr-16 Gold A$/oz US$/oz 0$10.0 $12.5 $15.0 $17.5 $20.0 $22.5 $25.0 Jul-15 Oct-15 Jan-16 Apr-16 Silver A$ US$

- 2. Oz Metals 55th Edition –15th May 2016 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 2 / 6 TerraStudio Markets & Majors Thomson Reuters - The zinc market has for years been a story of shattered bullish dreams. Time after time investors have been lured into the market by promises of supply shortfall and higher prices only to realise they were chasing a mirage. Mines that were supposed to close always seemed able to eke out a few more years of production. LME stocks would spend months declining only for massive tonnages miraculously to reappear, as often as not at the U.S. port of New Orleans. The best way to get a grip on what is happening in the upstream part of the zinc market is to look at treatment charges, which are paid by miners to smelters for transforming their material into refined metal. The benchmark treatment charge for deliveries this year has slid by 17% to $203/t from $245/t in 2015, according to the first-quarter report from Nyrstar, one of the largest smelting entities in the world. Spot treatment charges have also been falling. Those for imported material into China are currently assessed by Shanghai Metals Market at $120/t, down from $150 at the start of the year and from $200 this time last year. Sliding charges are one reason why China's zinc concentrates imports fell by 10% over the first three months of this year. The other reason is that there is less concentrate around. The International Lead and Zinc Study Group (ILZSG) is forecasting mine supply outside of China to contract by 9.4% this year due to a combination of mine closures and price-related cutbacks. The giant Century mine in Australia, for example, milled its very last ore in the first quarter of this year and has moved onto care and maintenance. The fact that Century was still generating concentrates several months after it had supposedly closed is symptomatic of the elastic timeline of the much anticipated zinc supply crunch. But closed it finally has after producing 6.5 million tonnes of zinc over its 16-year life. Also now closed is the Lisheen mine in Ireland. Accentuating such natural atrophy of mine production are the temporary suspensions initiated in reaction to low prices such as Nyrstar's mothballing of its Middle Tennessee mines. The single biggest suspension has been the removal by Glencore of 500,000 tonnes of annualised capacity at its Australian, Kazakh and Peruvian operations. There is a broad analysts’ consensus that the zinc concentrates market is going to move into significant supply-demand deficit this year. The scale of that deficit will depend on the extent that China's small- scale zinc mine sector can lift production. ILZSG, for example, is forecasting a 12.4% lift in Chinese production. But even if that proves accurate and there are many analysts who would question whether there is that much flex in China, the Group is still looking at a 1.4% fall in global output this year. The key question is when raw material tightness transitions to refined metal tightness. Much, of course, is going to depend on Glencore, which has cut more production than any other zinc producer. That suspended mine capacity will at some stage be reactivated but it seems unlikely that a company with such a big stake in the global zinc game is going to snuff out early any rally in the price. But Glencore itself will be no doubt be sensitive to that other "known unknown" in this market, namely the amount of refined metal that is available to cushion the impact of raw materials shortfall. There is little doubt that there are substantial tonnages of zinc being stored outside of the LME warehousing system, particularly in New Orleans. It's been movement of this material onto LME warrant at the U.S port that has killed off premature price rallies in the past. The last major warranting at New Orleans was in January when 40,000 tonnes hit the LME system. But even with that inflow LME stocks have fallen below the 400,000-tonne level for the first time since 2009. That may yet prove to be an unreliable indicator. Only time will tell whether the New Orleans carousel has a few more turns to make. What is not in doubt, however, is that zinc's slow- fuse narrative of pending raw materials crunch is burning a lot quicker now than it has at any time in the last decade.

- 3. Oz Metals 55th Edition –15th May 2016 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 3 / 6 TerraStudio Thomson Reuters - Copper production at Chile's large mines dropped 3.0% in annual terms in the first quarter of 2016, held back by the temporary closure of a plant at BHP Billiton's Escondida mine, according to government statistics. Production at Escondida plummeted 23.5% to 265,600t, as the company shut a concentrator there in February. The plant is scheduled to be shut for a year, as the company undergoes an ambitious investment plan to boost efficiency. Production at world number one copper producer Codelco, meanwhile, rose 8.4% to 469,800t, helped by an ongoing ramp-up at the Ministro Hales deposit and high production figures at the Salvador mine, according to Chile's Cochilco copper commission. Copper prices, meanwhile, are expected to average $2.15/lb in 2016, according to the government body. Thomson Reuters - BHP Billiton joins Rio in shifting focus to growth. BHP Billiton has talked up its future growth options, joining fellow mining giant Rio Tinto in marking a shift in focus after four years of aggressive cost cutting. While big miners are still looking to sell assets to help cut debt or to exit businesses like nickel and coal, they are also preparing for a pick-up in demand as looming supply gaps in at least some commodities sow the seeds for higher prices. After Rio hit the go button last week on the long stalled $5.3 billion expansion of the Oyu Tolgoi copper mine in Mongolia, BHP said on Tuesday it expects to sign off on copper and oil projects next year. BHP Billiton CEO Andrew Mackenzie outlined a plan to potentially increase the value of the company by 70% via cost cutting, boosting efficiencies and betting on a handful of oil, copper and potash growth assets. In an investor conference, he indicated that he would not wait for a bounce in metal prices to expand the company; he also dampened speculation that BHP Billiton would seek to take advantage of record-low mining valuations and a swell of distressed asset sales by buying new mines. Codelco's El Teniente copper unit in Chile is developing three projects to maintain annual production at around 450,000 tonnes of copper, requiring a total investment of US$1 billion. Meanwhile, the mine is also considering new initiatives to counteract delays in the US$5.1 billion Nuevo Nivel Mina expansion project, deterred until 2022 due to security issues, general manager Mauricio Larraín told Diario Financiero. Codelco is mulling over the construction of a US$370 million facility near the Calama mining center in northern Chile that would use new technology to remove arsenic from copper concentrate, Reuters reported, citing a company executive. The plant would be capable of processing about 200,000 tonnes of concentrate per year, resulting in 60,000 tonnes of refined copper. Glencore said record-low sector margins are setting the scene for the next price upswing as current margins cannot sustain present production levels over the medium term and structural deficits are returning, led by zinc. Meanwhile, supply challenges for copper and zinc remain due to resource quality and scarcity at current prices. DRC state miner Gécamines plans to investigate Freeport-McMoRan's sale of its majority interest in the Tenke Fungurume copper project in the country to China Molybdenum, Reuters reported. Gécamines, which holds a 20% stake in the project, said it "will assert its rights." Separately, Freeport CEO Richard Adkerson recognized the company's "current need" to resolve the extension of its mining contract over the Grasberg copper mine in Indonesia, the Financial Times reported, noting the mine's importance to Freeport, contributing US$3 billion, or 20% of the company's 2015 revenues. Thomson Reuters - Brazilian miner Vale said it will stick to a plan to sell $10 billion of core assets by next year in order to reduce debt, despite a recent rise in commodity prices. The miner did, however, reduce forecasted sales of non-core assets to a range of $4 billion to $5 billion for 2016, down from $4 billion to $5.5 billion. Thomson Reuters - Goldman Sachs raised its gold price forecasts for the coming months, citing stronger net speculative positioning and a recently

- 4. Oz Metals 55th Edition –15th May 2016 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 4 / 6 TerraStudio weaker U.S. dollar. The influential bank said it has revised its three-, six and 12-month price outlooks for gold, raising them respectively to $1,200 per ounce, $1,180 per ounce and $1,150 per ounce, from $1,100/oz, $1,050/oz and $1,000/oz in an earlier forecast. The global gold hedge book grew by 18 tonnes in the fourth quarter, an industry report showed, and producers continued to hedge in 2016 to lock in a sharp price rise in the first quarter. Miners use hedging, usually by selling future production forward, to guarantee returns for their output. Société Générale and GFMS analysts at Thomson Reuters said in their quarterly Global Hedge Book Analysis that miners were continuing to hedge, after gold posted its biggest quarterly rise in nearly 30 years in the first three months of this year. "Since the beginning of 2016, we have seen renewed interest in hedging within the gold producer community...in some cases for reasons of basic price risk management, in addition to more customary mandates for project financing," GFMS analyst William Tankard said. Surging inflows into gold-backed exchange-traded funds drove global gold demand to its highest first- quarter total on record this year, despite a near 20 percent drop in jewellery buying, the World Gold Council said. Demand hit 1,290 tonnes in the period, the WGC said in its latest Gold Demand Trends report, the best first quarter and second strongest quarter overall since its data series began. Argentine mining minister Daniel Meilán said that the elimination of export taxes on mining companies, a measure adopted in February, has already attracted Chilean, Australian and French investors. He claimed that there are 30 potential investment projects in the country for the next decade, Los Andes reported. Base Metals The board of Eramet agreed to financing and cost- saving measures to help its SLN nickel business in New Caledonia survive a severe market downturn, supported by a loan from the French government. The deal follows months of wrangling between Eramet and local authorities in New Caledonia, which is a minority shareholder in SLN, about how to salvage the nickel producer that lost around 250 million euros ($284.48 million) last year. After the Solomon Islands' Ministry of Mines, Energy and Rural Electrification pledged to run an inclusive and transparent process in the awarding of license on the Isabel nickel deposit in the country, Axiom Mining said it has submitted an application for a prospecting license over the deposit. Earlier in March, the Solomon Islands Court of Appeal ruled that neither Sumitomo Metal Mining nor Axiom Mining were entitled to the Isabel nickel deposit. OZ Minerals has decided to accelerate the pre- feasibility study on its Carrapateena copper project in South Australia, using a larger scope of 4 million tonnes throughput per annum from the previous 2.8mtpa operation, with a view to achieving first copper concentrate production in 2019. Precious Metals The government of Thailand has ordered Kingsgate Consolidated operating subsidiary Akara Resources to shut down operations at the Chatree gold mine and metallurgical plant by the end of 2016 and start the rehabilitation process. The government claims that the environmental and health problems caused by Chatree outweigh its economic benefit. Saracen Mineral Holdings declared commercial production at the Thunderbox gold project in Western Australia, effective April 1. The mine produced 7,026 ounces of gold at all-in sustaining cost of A$1,107 per ounce in April. Havilah Resources poured first gold from its Portia gold mine in South Australia on May 9, just over 13 months after the start of mining. A scoping study into Kin Mining’s Leonora gold project in Western Australia showed the project can produce 315,600 ounces of gold over a seven-year mine life and will need A$55 million to build based on a gold price of A$1,500 per ounce with payback in 45 months. The project is estimated to generate

- 5. Oz Metals 55th Edition –15th May 2016 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 5 / 6 TerraStudio net present value of A$56.3 million, an internal rate of return of 30% and revenue of A$461.6 million. The operation is expected to deliver 30,500 ounces of gold in the first year, peaking at 65,800 ounces in the fifth year and then declining to 10,500 ounces during its final year. Specialty Metals & Minerals Altech Chemicals has agreed to sell exploration license E70/3923 at Meckering, Western Australia, to Dana Shipping and Trading SA for A$2.0 million. The license is surplus to the company's feedstock requirements for its high purity alumina facility in Malaysia. The maiden ore reserve for IMX Resources Chilalo graphite project in Tanzania, based only on indicated resources, was estimated at 5.1 million tonnes grading 11.9% total graphitic carbon for 613,800 tonnes of contained graphite. IMX Resources said that the initial public offer of Graphex Mining has been cleared to proceed, with the company having addressed all concerns raised by ASIC. The priority offer to IMX shareholders has closed, while the general offer is expected to close on May 11 due to demand exceeding the maximum A$7 million raising. Lithium Australia has decided to divest five significant graphite projects in Western Australia as part of its strategy to build an initial portfolio of raw materials for emerging battery technologies. The returns are intended to be distributed directly to the company shareholders. Argosy Minerals has signed a binding heads of agreement with private Argentinian company Ekeko SA to acquire 4,279 hectares of mining titles comprising the Salar de Pocitos and Mina Teresa lithium projects in Argentina. Capital Mining executed a binding agreement to purchase Shaw River Lithium Pty Ltd., which holds 13 prospecting license applications in Western Australia's Pilbara region. The licenses hold 14 targets and cover 2,534 hectares. Other than lithium, the licenses are also prospective for tin and tantalum. Kingston Resources will acquire 20 lithium- prospective tenement applications in Western Australia and the Northern Territory, and raise up to A$6.9 million. The tenement applications, which cover four project areas including Mount Cattlin, Greenbushes, Bynoe/Wingate and North Arunta. Latin Resources intends to form a joint venture with Lepidico Ltd, which will acquire and advance lithium projects in Argentina and Peru. Two joint venture companies, one in Argentina and the other in Peru, will be formed under the agreement. The nuclear royal commission forecasts that uranium prices will remain flat, with a recovery expected at the soonest in 2018, The Australian Financial Review reported. Funding, JV, Mergers & Acquisitions Buying and selling activity in the global mining sector fell by 45% in value in the first quarter versus a year ago as a five-year downward trend continued, according to British accountancy firm EY. Miners have been forced to sell assets after a prolonged commodities rout left them facing piles of debt. Buyers held back as they waited to see whether the market had reached the bottom and deal value fell to $3.3 billion in the first quarter of this year versus just over $6 billion in 2015, EY said. The number of deals fell to 72 from 87 in the first quarter of 2015, with gold making up nearly half of them. Goldcorp is acquiring Kaminak Gold Corp in an all- share deal worth C$520 million. Both companies' boards backed the transaction, which is expected to close by Aug. 15. Kaminak Gold will not consider any alternative transactions and will pay a deal termination fee equal to C$20.3 million should the deal not complete. Caravel Minerals completed the sale of the Wynberg copper project in Queensland, to CopperChem Ltd for A$400,000. China Hanking Holdings has acquired two mining tenements in Western Australia from Cazaly Resources' Sammy Resources Pty Ltd unit for A$220,000.

- 6. Oz Metals 55th Edition –15th May 2016 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 6 / 6 TerraStudio The tenements span about 19.1km2 and host the Zeus gold deposit, which contains 29,634 oz of gold resources. Mantle Mining Corp. completed the acquisition of a 95% stake in Morning Star Gold. The company now plans to restart work at the Norton gold project in Queensland and the Morning Star gold project in Victoria. Golden Rim Resources Ltd is proposing to acquire Herencia Resources Plc subsidiary Paguanta Resources (Chile) SA, which holds a 70% interest in the Paguanta project in northern Chile, for US$2.3m. Hancock Prospecting Pty Ltd unit Gold Exploration Victoria Pty Ltd has elected to take its interest up to 50% in Catalyst Metals’ Four Eagles gold project in Victoria. Gold Exploration previously earned a 25% interest by spending A$2.1 million on the project since March 2015, and will now spend a further A$2.1 million on exploration to earn an additional 25% equity interest. GWR Group Ltd is acquiring a 100% stake in the Hatches Creek tungsten project in Australia's Northern Territory from joint venture partner Davenport Resources Ltd. To discuss any benchmarking or other engagement, please contact: J-F Bertincourt, +61 406 998 779, jf@terrastudio.biz First quartile Second Quartile Third Quartile DugaldRiver McArthurRiver GeorgeFisher Cannington Century Skorpion Mehdiabad Antamina 0 0 ZincEquivalentGrade(%) Zinc Equivalent Metal Content (million tonnes) Polymetallic Mines and Projects: Grade vs. Size Epithermal, CRD/Mantos, MVT, SEDEX, VMS Mines Projects