Contenu connexe

Similaire à New base 494 special 10 december 2014 (20)

Plus de Khaled Al Awadi (20)

New base 494 special 10 december 2014

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 1

NewBase 10 December 2014 - Issue No. 494 Khaled Al Awadi

NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE

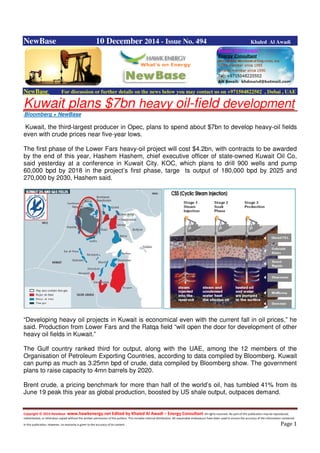

Kuwait plans $7bn heavy oil-field development

Bloomberg + NewBase

Kuwait, the third-largest producer in Opec, plans to spend about $7bn to develop heavy-oil fields

even with crude prices near five-year lows.

The first phase of the Lower Fars heavy-oil project will cost $4.2bn, with contracts to be awarded

by the end of this year, Hashem Hashem, chief executive officer of state-owned Kuwait Oil Co,

said yesterday at a conference in Kuwait City. KOC, which plans to drill 900 wells and pump

60,000 bpd by 2018 in the project’s first phase, targe ts output of 180,000 bpd by 2025 and

270,000 by 2030, Hashem said.

“Developing heavy oil projects in Kuwait is economical even with the current fall in oil prices,” he

said. Production from Lower Fars and the Ratqa field “will open the door for development of other

heavy oil fields in Kuwait.”

The Gulf country ranked third for output, along with the UAE, among the 12 members of the

Organisation of Petroleum Exporting Countries, according to data compiled by Bloomberg. Kuwait

can pump as much as 3.25mn bpd of crude, data compiled by Bloomberg show. The government

plans to raise capacity to 4mn barrels by 2020.

Brent crude, a pricing benchmark for more than half of the world’s oil, has tumbled 41% from its

June 19 peak this year as global production, boosted by US shale output, outpaces demand.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 2

Nizar al-Adsani, CEO of state-run Kuwait Petroleum Corp, estimated that oil will trade at about

$65 for six months. Kuwait is pumping 2.9mn bpd, he said at the same conference.

Kuwait, like neighbouring Saudi Arabia and the UAE, wants to boost output of refined fuels to

supply its domestic market and also to export. Refined products can fetch a higher price on

international markets than raw crude.

Kuwait National Petroleum Corp plans to expand its refining capacity to 1.4mn bpd from 937,000

bpd, Mohammad Ghazi al-Mutairi, the company’s CEO, said yesterday at the conference. State-

run KNPC will reach this target when it completes the country’s fourth and biggest refinery, the

615,000-bpd Al-Zour facility, and upgrades existing plants to produce clean fuel, he said.

Crude density is becoming heavier in the

Middle East, and refineries must be

improved to process it, al-Mutairi said.

Kuwait’s heavy-oil has an American

Petroleum Institute crude gravity of 12 to

20 degrees. That shows it is a very heavy

crude.

Al-Zour will be able to process all of

Kuwait’s heavy crude, he said. Lighter

crude is generally more valuable than

heavier varieties because it more readily

yields high-value products such as gasoline.

Bids on Al-Zour will close next month and commercial operation is expected by mid-2019, al-

Mutairi said.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 3

Kuwait:GlassPoint showcases solar EOR- Steam at conference

(OEPPA Business Development Dept) + NewBase

GlassPoint Solar, the leader in solar enhanced oil recovery (EOR), is set to showcase its

innovative solar steam generation technology to local and international oil operators, executives

and government officials at the SPE International Heavy Oil Conference and Exhibition (HOCE),

currently under way in Kuwait. GlassPoint will discuss how its solar EOR systems can empower

oil producers throughout the Gulf region with an economical alternative to using natural gas in

heavy oil production.

Rod MacGregor, CEO and President of GlassPoint Solar, said, “Heavy oil production is an integral

part of achieving Kuwait’s 2020 and 2030 strategies. Planned thermal EOR projects in North and

West Kuwait stand to be some of the largest steam flooding projects in the world and will require

burning significant amounts of imported natural gas or costly fuel oil to produce steam. By

deploying GlassPoint solar steam generators to extract Kuwait’s heavy oil reserves, the country

can reduce its reliance on imported energy.”

Hussain Shehab, GlassPoint’s Kuwait Country Chairman and long-time Kuwait Oil Company

veteran, added, “GlassPoint’s technology has already been proven as a viable solution for

producing steam in desert oilfields to save gas. Using solar EOR will help Kuwait reach its heavy

oil production targets without compromising other gas dependent industries. The decision made

today on fuel choice and the integration of solar will affect the next 100 years of production and

have profound effects on the country. Solar EOR is a strategic decision for the oil and gas

industry, for Kuwait’s economy, for the environment and its people.”

Shehab explained that Kuwait is just beginning its thermal EOR developments. The country has

been importing gas for years, which means securing the gas for steam may cost up to $13 per

MMBtu. Using fuel oil or diesel could be even more expensive, in addition to reducing Kuwait’s

export revenue and contributing to poor air quality. Solar steam could supply the majority of

Kuwait’s thermal EOR needs at half the cost of these fuel alternatives.

GlassPoint Solar had recently announced a $53 million equity investment from the State General

Reserve Fund (SGRF), the largest sovereign wealth fund in the Sultanate of Oman, Royal Dutch

Shell (Shell) and GlassPoint’s existing investors. The funding will be used to accelerate the

deployment of GlassPoint’s solar steam generators, which can reduce an oilfield’s natural gas

consumption by up to 80 per cent.

GlassPoint’s pilot project in southern Oman with PDO has been operating successfully since late

2012 and continues to exceed contracted performance targets. The system, which generates an

average of 50 tonnes of steam daily, serves as an operational baseline for large-scale projects in

Oman and throughout the region.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 4

Oman: Study moots solar energy for pilot water desalination schemes

(OEPPA Business Development Dept)

Having successfully piloted small-scale solar energy schemes for electricity generation in rural

areas of the country, Oman must now seriously explore the potential for harnessing the sun’s

power for water desalination as well, according to a newly published report on the Sultanate’s

renewable energy prospects.

The report, compiled by the International Renewable Energy Agency (IRENA) in collaboration with

Oman’s Public Authority for Electricity and Water (PAEW), noted in particular the potential for

solar energy based water desalination in the northern areas of the Sultanate.

“There is potential in implementing pilot desalination plants that use solar energy in rural areas

(North Oman, Musandam coastal areas) where the demand for water is very low and the water

supplied through ships transport from desalination plants, is economically feasible considering

diesel price and cost of Operation & Maintenance (O&M) of the ships,” the report titled ‘Sultanate

of Oman — Renewables Readiness Assessment’, stated.

IRENA is an intergovernmental organisation that supports countries in their transition to a

sustainable energy future. Headquartered in Abu Dhabi (UAE), the Agency promotes the

widespread adoption and sustainable use of all forms of renewable energy, including bioenergy,

geothermal, hydropower, ocean, solar and wind energy, in the pursuit of sustainable development,

energy access, energy security and low-carbon economic growth and prosperity.

According to the report, solar energy has become an attractive option for water desalination in the

wake of the sharp decline in the cost of photo-voltaic (PV) based systems for electricity

generation. It is particularly competitive in rural areas where diesel is currently used as the primary

fuel for electricity generation. Solar PV, the report emphasises, has also become “an economically

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 5

attractive solution for power production in the MIS (Main Interconnected System serving the

northern half of Oman) and the Salalah system replacing gas-fired power”.

Water storage capacity could be added to cover the water demand at night and would have the

value of “storing” electricity produced in daytime replacing or supplementing battery storage, it

said.

Another option that merits consideration, says IRENA, is solar thermal desalination, where the

heat is supplied by concentrating solar collectors. The two currently available techniques are

parabolic trough systems and solar towers. Both systems may be combined with heat storage.

Solar thermal desalination processes are being tested in pilot projects and are not yet available as

commercial solutions.

The Sultanate, like much the rest of the GCC, depends on large-scale desalination to meet its

potable water needs. Making up the country’s desalination capacity are seven major plants, which

supply the urban and industrial regions of the country. Also in operation are more than 30 small

desalination units covering rural areas unserved by the country’s water grids. Groundwater, on the

other hand, accounts for around 15 per cent of the nation’s total water demand and is chiefly

earmarked for irrigation purposes.

In its latest 7-Year Outlook for the power and water sector, the Oman Power and Water

Procurement Company (OPWP) has projected an eight per cent growth in water demand over the

2013–2019 period. Gas-based water desalination is expected to meet all of this projection

demand, it is pointed out.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 6

Algeria Could Achieve Shale Gas Production of 20 bcm by 2022

N.Gas Asia + NewBase

Commercial production of shale gas in Algeria could start by 2022 with production averaging 20

billion cu m (bcm), Sonatrach’s CEO Saïd Sahnoun said Sunday in Algiers.

"We expect to enter the pilot phase of the

unconventional resources exploitation in

2019 with the perspective to start production

in 2022," Sahnoun said in his speech at the

9th

North Africa Oil & Gas Summit,

reported Algeria Press Service. Sahnoun

said output could reach 30 bcm by 2025-

2027 as investments increase.

At estimated 700 trillion cubic feet

(TCF), Algeria holds world’s third largest

technically recoverable shale gas reserves

in its seven shale basin, according the

International Energy Agency (IEA). he North

African nation is encouraging foreign energy

firms to invest and exploit local shale gas

resources.

Earlier this year, Statoil and Shell said they

would test shale potential at Timissit Permit

Licence in the Illizi-Ghadames Basin

onshore Algeria. The award was part of the

Algerian Ministry of Energy and Mines,

National Agency for Hydrocarbon Resources

Valorisation’s (ALNAFT) Fourth International Bid Round, which was launched in January 2014.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 7

Seychelles: WHL Energy reports initial interpretation results of

Seychelles 3D seismic. Source: WHL Energy+ NewBas

Australian energy company WHL Energy has provided an update regarding the early

interpretation of the Junon 3D seismic dataset acquired within its offshore Seychelles project

area.

WHL Energy received an interim PreSTM data set for the Junon 3D seismic survey in mid-

November and has commenced interpretation of this data. The initial interpretation indicates that

potentially large structures are present at Junon East, Junon Central and Junon South,

although Junon South appears to have higher risk.

Importantly, the scale of these structures appears to be similar to that previously mapped on the

earlier 2D seismic data used to plan the latest 3D seismic acquisition. Junon Central is mapped to

be a relatively simple tilted fault block closure covering approx. 20 km2, and a structure of similar

scale appears to be present at Junon East. Additional possible new leads have also been

mapped in the central graben area, although these are of a more modest size.

WHL Energy is pleased to report that while the quality of the interim processed data volume is

still challenging, the 3D data set is providing much more definitive mapping in the Junon area.

The final PreSTM processed volume, which is expected to provide significantly improved data

quality for the interpretation, is expected to be delivered to the Company at the beginning of

2015.

'It is both exciting and encouraging that this initial interpretation of the Junon 3D survey is

confirming the potentially large structures identified on the 2D seismic data. It is also interesting

that we are now identifying new leads as we continue to refine the processing of the large

amount of data acquired in the Junon 3D seismic survey. We look forward to receiving the final

PreSTM data set and the results of the ongoing interpretation, which we believe will provide even

greater clarity and will further de-risk future exploration activities.'

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 8

Russia: Energy-starved Ukraine gets Russian gas since June

AFP + NewBase

Energy-starved Ukraine said yesterday it had received the first Russian natural gas shipments

since a politically charged price dispute saw Moscow cut off its Westward-leaning neighbour in

June.

The resumption of gas

flows means the war-

scarred nation of 45mn

people should have

enough supplies to heat

homes through the

bitter winter months.

Ukraine was forced to

delay school openings

by a month and

postpone the launch of

winter household

heating due to fast-

depleting fuel reserves.

Western allies and

global markets hope an

interim solution to the

two sides’ longest-ever

gas dispute bodes well

for peace returning to

the outer edge of the

European Union’s

eastern frontier.

“Imports from Russia

began two days earlier

than planned,”

Ukraine’s gas transport

company Ukrtransgaz

said in a statement.

The former Soviet republic received nearly half its gas from Russia prior to a February revolution

that ousted a Moscow-backed leadership and saw its successors strike a landmark EU

partnership pact.

The dramatic political shift out of Russia’s orbit prompted Moscow to cancel the special rates it

had offered Ukraine’s more compliant rulers. Kiev called the near doubling of its gas bill a form of

“economic aggression” and refused to pay up.

Months of EU-led negotiations made no progress and Russia halted the flow of gas meant for

Ukraine - but not its other European clients – on June 16. EU mediations ultimately produced a

six-month deal at the end of October that requires Ukraine to pay Russia $3.1bn by the end of the

year to cover past debts.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 9

Ukraine separately agreed to pay up to $1.5bn for slightly discounted winter deliveries from funds

made available by the European Union and the International Monetary Fund. The country’s state

energy company Naftogaz transferred a payment of $378mn to its Russian counterpart Gazprom

on Friday for the delivery of about onebn cubic metres of gas this month.

Ukraine was dealt more good news on Tuesday with the arrival of an International Monetary Fund

team that will determine if Kiev was paring down its bloated Soviet-era social benefits system

enough to merit the release of new emergency loans.

The Fund helped piece together a $27bn global Ukrainian rescue package – contributing $17.1bn

of its own funds over two years – just weeks after the historic change in Kiev leadership. But it has

since warned that the effectively bankrupt country may need at least $19bn more in international

aid should its war against pro-Russian insurgents rage across the industrial east through the end

of next year.

Economists believe that Ukraine – its hard currency and gold reserves dipping below $10bn for

the first time in nearly a decade – was facing an inevitable default on its foreign debt and an even

more dramatic fall in output in the coming months.

“On the economics alone, we think default looks almost inevitable,” Capital Economic consultancy

said in a research note. The London-based consultancy estimated that monthly repayments on

the public sector’s foreign currency debt would average $500mn a month over the coming year.

It added that Russia has the right to demand the early repayment of a $3bn bond it issued the

ousted government last year should Ukraine’s debt-to-GDP ratio reach more than 60% - a

condition the consultancy said is probably already in effect.

“But the picture is complicated by politics,” Capital Economics added. “The US, EU and IMF are

unlikely to allow Ukraine to have a messy default.” Analysts believe that Kiev’s Western backers

and lenders were especially cheered by Ukrainian President Petro Poroshenko’s decision to

appoint as finance minister a US investment banker who once worked in the State Department.

The Chicago native Natalie Jaresko will work alongside new Economy Minister Aivaras

Abromavicius – a Lithuanian private equity firm director whose business is focused on frontier

markets such as Ukraine.

Poroshenko and Prime Minister Arseniy Yatsenyuk “were clearly taking into account that the new

ministers will have to work closely with our foreign partners,” said Razumkov Centre economist

Vasiliy Yurchyshyn. “I expect a positive outcome from this visit. The amount of aid will be

increased - not right away, but soon enough,” said the Kiev-based analyst.

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 10

US: Oil shale output still surges - to add 103,000 bpd by Jan – EIA

Source: Reuters + NewBase

Oil production from the United States' biggest shale plays is poised to keep expanding at the

same breakneck pace into early next year, according to new U.S. projections released on

Monday that highlighted a slow response to tumbling prices.

Oil production from the three main plays - the Bakken, Eagle Ford and Permian Basin - is set

to rise by some 103,000 barrels per day (bpd) in January from December, the U.S. Energy

Information Administration said. That's just a hair below December's 105,000 bpd rise, and a

faster rate than most months this year.

Well productivity continues to grow, as drillers get better at squeezing more barrels of crude out

of each well - and out of each dollar. Each new Bakken well is set to produce some 550 barrels a

day in January, up from under 500 bpd as recently as June, the data showed.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 11

A more than 40 percent slump in global oil prices since summer, and Saudi Arabia's refusal to

cut output to prop up the market, has put a spotlight on the U.S. shale industry, which is

expected to slow after four years of growth due to lower prices.

Production from the Bakken formation will rise by some 27,000 bpd to 1.25 million bpd, while

Eagle Ford oil production will rise by some 30,000 bpd to 1.69 million bpd, according to the EIA's

drilling productivity report. Oil production from the Permian Basin of West Texas and New Mexico

will see output grow 46,000 bpd to 1.87 million bpd, the EIA said.

Natural gas production in the major shale plays meanwhile is expected to grow 0.6 billion cubic

feet per day (bcfd) month-over-month to 44.7 bcfd in January.

Gas production increases will be driven primarily by output from the Marcellus centered under

Pennsylvania and West Virginia, which will rise to 16.3 bcfd in January from 16.1 bcfd in

December, EIA data showed. Gas output at the Eagle Ford in South Texas will gain about 0.1

bcfd to 7.4 bcfd in January. Haynesville near the borders of Texas, Louisiana and Arkansas will

also gain near 0.1 bcfd to 6.9 bcfd in January.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 12

Oil Price Drop Special Coverage

Market, not Opec, to set fair oil price, UAE official

Gulf News + NewBase

Market fundamentals and high-cost crude producers, rather than Organisation of Petroleum

Exporting Countries (Opec), are the ones that will set a fair price for oil in coming months, a UAE

oil official said on Tuesday.

“The way I see it, it is the market which will dictate the oil price. Prices are driven by supply and

demand... marginal fields are going to set the [fair] price,” said Mubarak Al Ketbi, deputy director

of the marketing and refining directorate at state-run Abu Dhabi National Oil Co (ADNOC).

“Opec is not a price setter. The market will set the price,” Ketbi told the Platts Middle East Crude

Oil Summit in Dubai, declining to comment later on any specific oil price target for the UAE, a core

Gulf Opec producer.

Prices have fallen more than 40 per cent since June and Brent crude for January delivery hit

$65.33 (Dh239.95) a barrel on Tuesday, its lowest since September 2009. At a meeting last

month, Opec decided against reducing production, despite its own forecasts of a surplus and calls

from members including Iran and Venezuela for output cuts to shore up prices.

On Monday, the head of Kuwait’s state oil company predicted that oil prices were likely to remain

around $65 for the next six to seven months, echoing the views of other Gulf Opec delegates who

saw oil hovering around $65-70 for a few months before bouncing back to around $80.

Oil hits five-year low, crushing risk appetite

Oil prices plumbed fresh five-year lows on Tuesday, prompting investors worried about the global

economy and renewed political uncertainty in Greece to dump shares.

The Athens government brought forward a presidential vote to next week in a gamble that could

trigger parliamentary polls if Prime Minister Antonis Samaras fails to have his candidate elected.

Greek government bond yields soared 47 basis points to 7.81 per cent and stocks fell.

Chinese shares notched up their biggest daily percentage loss in more than five years and the

yuan currency took its biggest hit against the dollar since 2008, adding to the gloom pervading

emerging markets.

The dollar pulled back, propelling gold higher.

But the main action was in oil. Brent crude fell as far as $65.29 a barrel in Asian trade, its lowest

since September 2009, before rebounding to just under $67. Brent has fallen some 43 per cent in

the last six months on concern over a supply glut. It last traded at $66.77 per barrel.

European shares fell, following losses in Asia. Wall Street also looked set to open some 0.6 per

cent lower, according to stock index futures. The pan-European Eurofirst 300 was down 1.6 per

cent, hit by energy shares.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 13

“Weak oil and commodity prices in general are probably signalling that the recovery of the world

economy is weak,” said Philippe Gijsels, head of research at BNP Paribas Fortis Global Markets

in Brussels.

Greek stocks sank as the earlier-than-expected start to the three-stage presidential vote increased

uncertainty over the government’s planned exit from an EU/IMF bailout. Tokyo’s Nikkei stock

index closed down 0.7 per cent, pulling away from 7-1/2-year highs as the stronger yen prompted

investors to take profits on exporters.

Shanghai shares dropped more than 5 per cent for their biggest one-day percentage fall since

August 2009, snapping a two-week rally fuelled in part by speculation the central bank would ease

policy further.

The yuan slid nearly half a per cent against the dollar and last traded at 6.1855. The dollar fell 0.8

per cent to 119.71 yen, pulling away from Monday’s seven-year high of 121.86.

“People are cutting the higher-yielding currencies which they’ve been funding through being short

yen and that position is being reversed somewhat, which is manifesting itself in a much lower

dollar/yen,” said Neil Jones, head of FX hedge fund sales at Mizuho bank in London.

The dollar had earlier gained on a Wall Street Journal report that Federal Reserve officials were

considering dropping an assurance that short-term interest rates would remain near zero for “a

considerable time” at its December 16-17 policy meeting.

However, San Francisco Fed President John Williams told Market News International on Monday

that “’considerable time’ captures about as best you can with two words ... the appropriate time for

lift off”.

The euro strengthened 0.4 per cent to $1.2368 and the greenback dropped 0.3 per cent against a

currency basket. German 10-year government bond yields, the Eurozone benchmark, edged

down 1.6 bps to 0.71 per cent The weaker dollar pushed gold higher. It was last up 1.1 per cent at

$1,215.51.

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 14

Saudi seen keeping January oil supply to Asia steady

Reuters

Saudi Arabia, the world’s top crude exporter, will keep supplies at full contracted volumes for

Asian term buyers in January, industry sources said yesterday, the latest sign the kingdom is

holding firm against falling prices caused by oversupply.

Coming less than a week after Saudi Arabia slashed January prices to Asia and within two weeks

of blocking an Opec output cut, the kingdom is maintaining pressure on non-Opec producers to

cut production.

Oil fell to a five-year low on Monday and is down more than

40% since June as a weakening global economy saps

demand for crude amid surging output from US shale

formations.

“There was no change in supplies ... It was as expected,” an

industry source said, who added that he has not seen any

sign that Middle East producers are planning cuts in

contracted volumes.

Another industry source said Saudi Arabia had notified his

company of its intention to hold contracted volumes steady

from December.

Saudi Arabia decided against calls last month from poorer members of the Opec oil exporter

group for production cuts to arrest a slide in global prices, sending benchmark crude plunging to

multiple year lows.

The Opec producer has supplied full contractual volumes to most Asian buyers since late 2009.

Economists expect oil price fall to impact Kingdom's fiscal position

Zawya + NewBase

Lower oil prices will have a direct impact on the balance of payments and fiscal position of the

Kingdom as Brent crude oil fell almost $2 a barrel on Monday to a new five-year low, analysts say.

However, the government is expected to maintain elevated fiscal

expenditures; negative sentiment associated with fiscal deficits could

slow down nonoil economic activity.

John Sfakianakis of Ashmore Group, said: "Obviously, any decline in

oil prices could impact Saudi revenues as they comprise 90 percent of

total revenues. However, Saudi Arabia has substantial fiscal buffers to

withstand lower oil prices. Fiscal priorities will have to be adjusted but

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 15

that is perfectly normal given the context of oil prices. Saudi Arabia can cover many years of worth

of government expenditures."

He added: "Oil prices have been exaggerated on the downside and they have been under

pressure but there are enough catalysts in 2015 that will help stabilize prices at a higher level from

where they are now. Emerging markets will enter a higher growth phase next year and that will

help fuel greater demand."

Sfakianakis said: "OPEC will have to continue to maintain its strategic position as the most

important supplier of oil in the international oil market."

Fahad Alturki, chief economist and head of research at Jadwa Investment, said: "Lower oil prices

will have a direct impact on the balance of payments and fiscal position of the Kingdom. While the

government maintains elevated fiscal expenditures, negative sentiment associated with fiscal

deficits could slow down nonoil economic activity."

He added that oil prices have fallen due to a combination of long-term factors (accelerating US

supply and increased OECD fuel efficiency) and short-term factors (weaker than expected global

economic growth, stabilization in geopolitics and a rising dollar).

"A number of variables could result in different price levels over the next two years but prices of

$85/83 per barrel for 2015-2016 are most likely. At this level, prices would assist global economic

recovery and push some US shale oil out of the market," Alturki said.

Basil M. Al-Ghalayini, CEO of BMG Financial Group, said: "I believe the Saudi government will

continue its commitment to finance the mega projects, which have been listed in the previous

budgets. However, 2015 budget, which could be set at a price of $65, might witness expenditure

cut across all service-driven ministries by 25 percent."

Commenting on Monday's Tadawul fall, Al-Ghalayini said: "As for the Saudi stock market, the

unclear direction of the oil prices had its negative impact on traders' sentiment where the index hit

below the 9,000 mark. The Tadawul All-Share Index closed Monday at 8,785.73, down 1.74

percent.

Paul Gamble, director, sovereign group, FitchRatings, told Arab News: "Falling prices, combined

with our expectation that oil production will be cut in 2015, will push the budget into deficit. This

could well cause the government to lower capital spending."

However, he said: "Some big projects, such as the Riyadh metro, will be financed by drawing

down deposits, rather than through the budget, so will not be affected." Fitch forecasts Brent to

average $ 83 per barrel in 2015 and $90 per barrel in 2016.

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 16

Some OPEC members will be much more challenged than others, depending on the level of oil

prices needed to balance their budgets. Those countries that need higher oil prices have

historically been those that did not adhere well to agreed OPEC production quotas. The challenge

for OPEC will be agreeing how to share out any production cuts if it feels prices are too low.

In a report dated Dec. 5, the US investment bank said oil prices could fall as low as $43 a barrel

next year. The bank cut its average 2015 Brent base-case outlook by $28 to $70 per barrel, and

by $14 to $88 a barrel for 2016.

Brent crude for January was down $1.45 at $67.62 a barrel by 1030 GMT, having fallen $1.72 to

$67.35 -- its lowest since October 2009. US crude was down $1.16 at $ 64.68 a barrel, after hitting

a session low of $64.63. The US contract, also known as West Texas Intermediate, touched

$63.72 last week, its lowest since July 2009, Reuters said.

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 17

NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE

Your Guide to Energy events in your area

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 18

NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE

Your partner in Energy Services

NewBase energy news is produced daily (Sunday to Thursday) and

sponsored by Hawk Energy Service – Dubai, UAE.

For additional free subscription emails please contact Hawk Energy

Khaled Malallah Al Awadi,

Energy Consultant

MSc. & BSc. Mechanical Engineering (HON), USA

ASME member since 1995

Emarat member since 1990

Mobile : +97150-4822502

khdmohd@hawkenergy.net

khdmohd@hotmail.com

Khaled Al Awadi is a UAE National with a total of 25 years of experience in

the Oil & Gas sector. Currently working as Technical Affairs Specialist for

Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy

consultation for the GCC area via Hawk Energy Service as a UAE

operations base , Most of the experience were spent as the Gas Operations

Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility &

gas compressor stations . Through the years , he has developed great

experiences in the designing & constructing of gas pipelines, gas metering & regulating stations

and in the engineering of supply routes. Many years were spent drafting, & compiling gas

transportation , operation & maintenance agreements along with many MOUs for the local

authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE

and Energy program broadcasted internationally , via GCC leading satellite Channels.

NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE

NewBase 10 December 2014 K. Al Awadi

- 19. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced,

redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained

in this publication. However, no warranty is given to the accuracy of its content . Page 19