New base energy news 15 july 2020 issue no. 1356 by senior editor khaled-compressed

- 1. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 15 July 2020 - Issue No. 1356 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE OPEC Sees Demand for Its Crude Above Pre-Virus Levels in 2021 Bloomberg Grant Smith OPEC+ is seeking extra production cuts from members that have missed their targets again in June, potentially tempering the impact of the supply resumption planned by the wider coalition next month. A technical committee that met online on Tuesday outlined plans for countries including Iraq, Nigeria and Kazakhstan to make an additional 842,000 barrels a day of compensatory cuts in August and September, according to delegates. The proposal will be discussed on Wednesday by a ministerial monitoring committee led by Saudi Arabia and Russia, the delegates said, asking not to be named because the information isn’t public. They’re expected to announce that the group’s overall curbs of 9.6 million barrels a day -- about 10% of global supplies -- will be relaxed in August as global fuel demand recovers. To prevent the supply increase destabilizing a still-fragile market, Riyadh and Moscow are keen for the cartel’s laggards to make up for earlier cheating. On paper, full delivery of the compensation cuts could shrink the scheduled 2 million-barrel-a-day supply increase by almost half. Iraq’s state oil-marketing company has told at least four Asian refiners it will supply less crude to them next month as it seeks to comply with its OPEC+ commitment, according to people with knowledge of the matter. SOMO, as the company is known, told some buyers it would try to meet their full needs after August, the people said. www.linkedin.com/in/khaled-al-awadi-38b995b

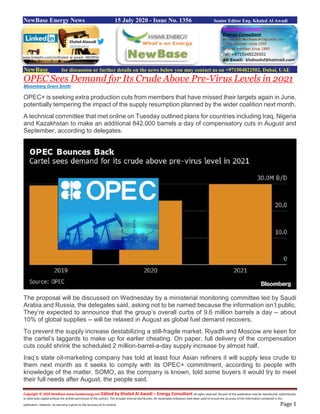

- 2. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 It’s still unclear how much of the reparations will delivered by those countries that still haven’t fully met their original pledges. “With Iraq, Kazakhstan, Nigeria and Angola all under-complying in May and June, these guys now need to over-comply to make up for the lost cuts,” Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd., said in a Bloomberg television interview on Tuesday. Last month, stragglers across the alliance agreed to make good on their lapses in May, which amounted to 1.26 million barrels a day. But the technical committee found that, while several had stepped up their efforts in June, they still missed the mark. Overproduction within the OPEC cartel amounted to a further 380,000 barrels a day last month, its data showed. With a second wave of coronavirus infections hitting the U.S., signs of a renewed economic slowdown and oil-storage tanks still brimming, it’s no surprise that the cartel might want to act gradually. “The transition to higher production coincides with a move back to movement restrictions in populous U.S. states and other countries around the world,” said Louise Dickson, an analyst at consulting firm Rystad Energy A/S. “Where will the extra oil go now if people are ordered back to their homes to reduce the spread?” A monthly report published by the Organization of Petroleum Exporting Countries on Tuesday gives an insight into why, despite the ongoing economic slump, the cartel believes the easing is justified. Demand for OPEC’s crude is forecast to climb from here, and even surpass pre-virus levels in 2021. OPEC Bounces Back Cartel sees demand for its crude above pre-virus level in 2021 Source: OPEC During the second quarter, when lockdowns aimed at containing the pandemic were at their height, demand for OPEC crude was barely half the level seen the previous year, at just 15.87 million

- 3. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 barrels a day. But the group expects it will be back at prior levels above 30 million in the fourth quarter. “They are seeing the demand recovery that we all are,” said Sen of Energy Aspects. “It is the right time to start increasing production -- gradually, of course.”

- 4. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Saudi Aramco reorganise downstream business to improve efficiency The National + NewBase Saudi Aramco, the world’s largest oil-exporting company, will re-organise the downstream segment of its energy arm into four commercial business units. The downstream business, which refers to refining and petrochemicals, will operate through four units – fuels (which includes refining, trading, retail and lubricants), chemicals, power and a pipelines, distribution and terminals division, the company said in a statement on Tuesday. The company completed its acquisition of a 70% stake in Sabic from the Public Investment Fund last month The units will be backed by three corporate functions of manufacturing, strategy and marketing as well as affiliates affairs. The reorganisation, which will be completed by year-end, is “another step” in Saudi Aramco’s strategy to develop a global, integrated downstream business, said senior vice president at Aramco Downstream, Abdulaziz Al Gudaimi. The refining and petrochemicals part of the energy value chain has become increasingly significant to Gulf oil producers. Saudi Aramco and its UAE counterpart Adnoc are both undertaking multibillion-dollar investments in downstream projects to extract more value from their crude production. Saudi Aramco last month completed its acquisition of a 70 per cent stake in Sabic, the region’s largest petrochemicals firm, for $69.1 billion (Dh253bn) from the kingdom's Public Investment Fund as it looks to grow its specialty chemicals business. Aramco’s acquisition is in line with its long-term strategy to drive growth through an enhanced downstream portfolio by increasing its refining capacity from 4.9 million to 8 million-to-10 million barrels per day by 2030, of which 2m bpd to 3m bpd will be converted into petrochemical products.

- 5. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Aramco's reorganisation "will improve the focus as well as decision making inside the newly-created units, giving them strategic autonomy to pursue growth opportunities," said Vijay Valecha, chief investment officer at Century Financial in Dubai. The reorganisation will also help the company offset losses suffered by its refining units due to a write down in inventories, he added. "Downstream is a very crucial part of Aramco’s business as it will enable it to transform to a vertically integrated player with higher profit margins." The company also has plans to consolidate its downstream business under a separate, wholly-owned unit before December 31, 2024. Saudi Aramco to announce second quarter results on August 9 Saudi Aramco, the world’s largest oil-exporting company, will announce its second quarter results on August 9. The company, which is listed on the Tadawul exchange, will host a webcast for investors on August 10 at 4.30pm UAE time, it said on Monday. Aramco reported a 25 per cent decline in its first quarter profit amid a global economic slowdown induced by the Covid-19 pandemic coupled with lower oil prices, declining refining and chemicals margins as well as inventory re-measurement losses. Net profit for the three months ending March 31 fell to 62.5 billion Saudi riyals (Dh61.2bn/$16.7bn) from the year-earlier period. Aramco's sales for the quarter fell 16.2 per cent to 225.6bn riyals. Last month, Aramco completed its 70 per cent share acquisition of Sabic, the region’s biggest petrochemicals firm, for $69.1bn from the kingdom's Public Investment Fund. Aramco’s acquisition is in line with its long-term strategy to drive growth through an enhanced downstream portfolio by increasing global refining capacity from 4.9 million to 8 million-to-10 million barrels per day by 2030, of which 2m bpd to 3m bpd will be converted into petrochemical products.

- 6. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Oman’s be’ah proposes biodiesel fuel from waste cooking oil Oman Observer + NewBase Oman Environmental Services Holding Company SAOC (be’ah), the Sultanate’s solid waste management flagship, has embarked on a plan to harness the potentially prodigious quantities of used cooking oil (UCO) generated daily across the country for use as feedstock in the production of commercially valuable and eco-friendly biodiesel. On Monday, the state-run utility invited interest investors to prequalify for a competitive tender leading to the award of a contract for the management and recycling of UCO in the Sultanate. The initiative is expected to lead to the production and sale of biodiesel in Oman, said be’ah. “The purpose of this pre-qualification document is to assess international and local interest from developers with relevant experience to manage the collection and/or the treatment of generated (used cooking oil) from local generators to be utilised as a feedstock into biodiesel production, on a Design, build, own and operate (DBOO) basis,” it stated. The utility is allocating a 25,000 sq meter plot of land within the Barka landfill for the establishment of the biodiesel facility. According to experts, sizable quantities of cooking oil are generated every day by hotels, restaurants, fast food outlets, school cafeterias, catering companies, camps and even residential homes. While a portion of this waste is collected by firms for onward export to overseas-based recyclers, the remainder is understood to be disposed of in drains and landfills. Additionally, there are concerns that waste cooking oil is being resold to the detriment of public health. Indeed, consumer and environmental health are underlying objectives behind this biodiesel project is environment-driven, says be’ah. The initiative aims to (i) eliminate illegal dumping of used cooking oil down the drain, which leads to blockages that cost the government of Oman major expenses to

- 7. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 resolve these blockages; and (ii) eradicate environmental and health concerns resulting from the reselling or reusing of UCO in refrying causing severe health impacts. A key goal is to harness the commercial potential behind the recycling of waste cooking oil, be’ah has stressed. By promoting recycling and conversion into biodiesel, the project will help reinforce a recently introduced ban on exports of recyclable waste and thereby encourage the commercialization of recycling opportunities in-country. Equally, it will promote the “replacement of petroleum diesel consumption by integrating appropriate biodiesel blends that minimize the negative effects on standard diesel engines and NOx emissions”, be’ah further added. Interested investors have been invited to submit an outline of their proposal for the “design, build, procurement, construction, insurance, financing, testing, commissioning, operating and maintaining a biodiesel production facility” using used cooking oil as feedstock. Also solicited by be’ah are details about the choice of advanced and efficient technologies that are proposed by the investor to minimise energy and chemical losses, while producing biodiesel at “international quality standards”. be’ah says it is collaborating with Royal Oman Police Customs to restrict any exports of used cooking oil with the goal of promoting its recycling in-house. Collectors duly approved by be’ah and the Ministry of Environment and Climate Affairs (MECA) will also be integrated into the collection scheme, it stated.

- 8. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Pakistan: MOL discovers gas, condensate in TAL Block Pakistan Today + NewBase MOL, the operator of TAL Block in Pakistan, has made a new gas and condensate discovery. This marks the company’s 13th discovery in Pakistan and the 10th discovery in the TAL Block. The Mamikhel South-1 exploratory well successfully reached a total depth of 4,939 m on May 23, 2020. Upon testing the well flowed gas and condensate from Lockhart & Hangu formation at a flow rate of 6516 boepd (16.12 MMscf/d and 3240 bpd respectively), with flowing well-head pressure of 4,476 PSI at 32/64” choke. Further testing of the well is ongoing. MOL has a proven track record of successfully operating in Pakistan’s upstream sector for 21 years and holds equity stakes in four blocks in the country. MOL has made 13 oil, gas and condensate discoveries in Pakistan since 2000 and discovered over 400 million boe hydrocarbon reserves. As the operating shareholder MOL is responsible for 89 mboepd gross production (as of Q1 2020) in the TAL block, one of the largest hydrocarbon producing blocks in the country, where MOL has 8.4 per cent share. MOL’s partners in the Joint Venture consortium are OGDCL, PPL, POL and GHPL. MOL Pakistan is the country’s second largest producer of LPG, crude oil and condensate. As the operator it currently addresses around 9 per cent of the natural gas needs of Pakistan, 25 per cent of oil and condensate needs and 22 per cent of LPG. Dr Berislav Gašo, MOL Group’s E&P EVP commented: “I am delighted to announce that we have made another discovery in Pakistan. This new discovery has de-risked an exploration play in deeper reservoir in the TAL Block, leading to new upside opportunities.

- 9. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 The Mamikhel South-1 discovery will also help to improve the energy security of the country from indigenous resources. We are thankful to our Joint Venture partners as well as the Government of Pakistan for their continued support.” MOL aims to transform its E&P division into an international platform and the new discovery strengthens this ambition further. Currently, MOL Group has upstream presence in 14 countries with production activities in 9 of them. Besides its core region, Central & Eastern Europe (Hungary and Croatia), MOL has a well-established presence and partnerships in the CIS region (Russia, Kazakhstan, Azerbaijan), the Middle East, Africa and Pakistan as well as the North Sea region (UK, Norway). MOL Group is an integrated, international oil and gas company, headquartered in Budapest, Hungary. It is active in over 40 countries with a dynamic international workforce of 25,000 people and a track record of more than 100 years in the industry. MOL’s exploration and production activities are supported by more than 75 years’ experience in the hydrocarbon field. At the moment, there are production activities in 9 countries and exploration assets in 14 countries. MOL Group operates three refineries and two petrochemicals plants under integrated supply chain management in Hungary, Slovakia and Croatia, and owns a network of about 1900 service stations across 10 countries in Central and South Eastern Europe.

- 10. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Thailand: Mubadala's 2020 development drilling and workover program increases production capacity at the Manora oil fieldSource: Tap Oil JV partner Tap Oil reports that Manora oil field gross production capacity has been increased by approx. 4,500 bopd with successful completion of the 2020 development drilling and workover program. Highlights: Four new development wells (MNA-25,MNA-26H, MNA-27 and MNA-28) safely drilled, completed and brought into production in line with pre-drill expectations. Two workovers (MNA-7 & MNA-15) also completed and achieving pre-drill objectives. All wells now on stream, adding over 4,500 bopd gross to total field production capacity. Manora now capable of producing around 9,500 bopd gross. MNA-28 intersected the thick, high quality 490 series oil reservoirs high to prognosis and is a key additional oil producer. MNA-25 is now the new crestal development well for the 600 series oil reservoirs in the Central Fault Block (CFB). MNA-26H is a horizontal well which will produce otherwise undrained oil in the high-quality 370-10 reservoir of the Eastern Fault Block (EFB). MNA-27 is now the crestal well for the 490 series reservoirs in the EFB.

- 11. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 The previously shut-in MNA-15 well had a new electrical submersible pump (ESP) installed and is currently producing at around 500 bopd gross, while MNA-7 was converted to a water injection well to add an estimated 8,000 bwpd water disposal capacity required for the forecast ramp-up of production. The total cost of the Manora 2020 development drilling and workover program is approx.US$15.08million (US$4.52 million net to Tap), with the program completed 8.5% under budget and ahead of schedule. Gross crude oil liftings of 1,460,000 bbls (438,000 bbls net to Tap) have been scheduled between July and December 2020. Production currently constrained to around 7,000 bopd gross until early September 2020 due to Manora FSO crude oil storage capacity constraints. JV partner Tap Oil has provided updated information in relation to the completion of the Manora 2020 development drilling and workover campaign using the Valaris 115 jack-up drilling rig. The Manora oil field is located in the G1/48 concession in the Gulf of Thailand, where Tap holds a 30% non-operated interest. The Operator of the Manora oil field, Mubadala Petroleum, successfully completed the 54 day program comprising four new development wells and the workover of two existing wells with no lost time incidents, 8.5% under budget and 2.5 days ahead of schedule. The total cost of the program is estimated at approx. US$15.08 million (US$4.52 million net to Tap). The program commenced on 14 May 2020 (seeASX release dated 16/6/20) with the Valaris 115 rig released on 4 July 2020. Chris Newton, Tap Executive Chairman commented: 'Consistent with strategy, the objective of the development drilling program was to convert booked proved and probable reserves into production and cashflow. With a significant portion of Manora operating costs being fixed, the increased production decreases per barrel operating costs and further optimises production and ultimate oil recovery. Results of the four new wells have met or exceeded pre-drill expectations and the joint venture partners can now benefit from increased production, falling unit operating costs and a recovering oil price environment. The increased water disposal capacity is critical to production optimisation and acceleration tactics that are key value drivers late in Manora’s field life. I would like to take the opportunity to congratulate the Mubadala Petroleum drilling team as well as the rig contractor, Valaris, for an expertly executed program that yet again drove down Manora drilling costs. As a result of the program, total field production capacity has nearly doubled to approx. 9,500 bopd gross.'

- 12. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 U.S. crude oil and natural gas production in April had biggest monthly decreases in years…… U.S. EIA, Monthly Crude Oil and Natural Gas Production Report Production of crude oil and natural gas decreased in the United States in April 2020 by 670,000 barrels per day (b/d) and 2.6 billion cubic feet per day (Bcf/d), respectively, according to the U.S. Energy Information Administration’s (EIA) Monthly Crude Oil and Natural Gas Production Report. Production declines of that magnitude usually arise only in natural disasters such as hurricanes: the drop in U.S. crude oil production in April was the largest since September 2008 when Hurricanes Gustav and Ike caused production to fall by 1.03 million b/d. The April 2020 decline in natural gas production was the largest monthly decrease since Hurricane Isaac-related shut-ins in August 2012. April was the first full month to be affected by the low crude oil and natural gas prices related to the sudden drop in petroleum demand associated with coronavirus (COVID-19) mitigation efforts. The declining market led oil and natural gas operators to shut-in wells and limit the number of wells brought online, lowering the output for the major oil- and natural gas-producing regions.

- 13. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 U.S. crude oil production decreased by 5.3% in April, and several states and regions reported declines. Texas saw the largest crude oil production decrease of 234,000 b/d (-4.3%) from March to April 2020. More crude oil is produced in Texas than in any other state or region of the United States, accounting for 41% of the national total in 2019. North Dakota saw the second-largest decrease, 195,000 b/d, or 13.8%. Both Texas and North Dakota noted their largest recorded monthly decreases. Of the top six crude oil-producing states, Colorado was the only state to record an increase in April as a result of more new wells coming online than were shut-in. The U.S. Energy Information Administration (EIA) expects U.S. crude oil production to fall in 2020 as efforts to mitigate the spread of COVID-19 continue to result in a steep drop in demand for petroleum products and lower oil prices. EIA expects crude oil prices will average $40 per barrel (b) for the first half of 2020 and will average $39/b in the second half of 2020. In its July Short-Term Energy Outlook (STEO), EIA forecasts that U.S. crude oil production will average 11.6 million barrels per day (b/d) in 2020. These levels would be 0.6 million b/d lower than the 2019 average of 12.2 million b/d. U.S. natural gas production decreased by a lesser percentage than crude oil production in April, down only 2.3%. Texas also saw the largest monthly decrease for natural gas production in April, decreasing by 1.2 Bcf/d, or 4%. Oklahoma had the second-largest decrease at 0.5 Bcf/d, or 6%. Louisiana and Pennsylvania recorded production increases for April. EIA forecasts that U.S. marketed natural gas production—which it defines as gross withdrawals of natural gas less natural gas used for repressuring reservoirs, quantities vented or flared, and nonhydrocarbon gases removed in treating or processing operations—will continue to decline for the remainder of 2020. EIA forecasts that U.S. marketed natural gas production will average 96 Bcf/d in 2020, down from 99 Bcf/d in 2019.

- 14. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase July 16-2020 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil rises after US crude stocks drop, focus on OPEC+ meeting Reuters + NewBase Oil prices rose on Wednesday after a sharp drop in U.S. crude inventories, with the market waiting for more direction from a meeting later in the day on the future level of production by OPEC and its allies. Brent crude futures were up 28 cents, or 0.65 per cent, at $43.18 a barrel as of 10.38 GMT, and U.S. WTI crude futures rose 38 cents, or 0.94 per cent, to $40.67 a barrel. Oil price special coverage

- 15. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 In a sign of improving demand despite the coronavirus pandemic, U.S. crude inventories fell by 8.3 million barrels in the week to July 10, beating analysts' expectations for a decline of 2.1 million barrels, according to data from industry group the American Petroleum Institute. Official data from the U.S. Department of Energy's Energy Information Administration (EIA) is due on Wednesday. On supply, the market will be closely watching the Joint Ministerial Monitoring Committee (JMMC) of the Organization of the Petroleum Exporting Countries (OPEC) later on Wednesday. Key members of OPEC and allies including Russia, a group known as OPEC+, are set to decide whether to extend output cuts of 9.7 million barrels per day (bpd) that end in July or ease them to 7.7 million bpd. "OPEC+ decision on production cut tapering will set the tone for the oil market," ANZ Research said in a note. In June, OPEC and its allies delivered compliance of 107 per cent with their agreed oil output cuts, an OPEC+ source said on Tuesday. Meanwhile, OPEC said in its monthly report that global oil demand would soar by a record 7 million bpd in 2021 as the global economy recovers from the coronavirus pandemic although it would stay below 2019 levels. OPEC+ meets today to decide on oil cuts easing OPEC and allies such as Russia meet today Wednesday 18/07/2020 to decide oil output policy from August amid broad market expectations the group will ease supply curbs as the global economy slowly recovers from the coronavirus pandemic. The Organization of the Petroleum Exporting Countries and allies, known as OPEC+, have been cutting output since May by 9.7 million barrels per day, or 10% of global supply, after the virus destroyed a third of global demand. After July, the cuts are due to taper to 7.7 million bpd until December. A panel involving key ministers and known as the Joint Ministerial Monitoring Committee (JMMC) meets on Wednesday after 12 GMT to recommend the next level of cuts. Five OPEC+ sources have said no recommendations have been made to prolong record cuts into August. OPEC’s secretary general Mohammad Barkindo said this week the oil market was getting closer to balance. On Tuesday, OPEC said it saw demand recovering by 7 million bpd in 2021 after falling by 9 million this year. Oil prices LCOc1 have recovered to almost $43 a barrel from a 21-year low below $16 in April. The recovery in prices have allowed some U.S. producers to resume suspended production, a sign that is set to weigh on OPEC’s decision on Wednesday. The real production increase from August could be less than 2 million bpd given Iraq, Nigeria and Angola promised to over-comply to make up for high output in May-June. Saudi Arabia’s oil exports in August will remain the same as in July as the extra barrels the kingdom is set to pump will be used domestically, industry sources told Reuters.

- 16. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 U.S. Henry Hub natural gas spot prices reached record lows Source: U.S. Energy Information Administration, Short-Term Energy Outlook In the first half of 2020, natural gas prices at the U.S. Henry Hub benchmark reached record lows. The average monthly Henry Hub spot price in the first six months of the year was $1.81 per million British thermal units (MMBtu). Monthly prices reached a low of $1.63/MMBtu in June, the lowest monthly inflation-adjusted (real) price since at least 1989. Prices started the year low because of mild winter weather, which resulted in less natural gas demand for space heating. Beginning in March, spring weather and the economic slowdown induced by mitigation efforts for the coronavirus disease 2019 (COVID-19) contributed to lower demand, further lowering prices. Warmer-than-normal temperatures in January through March resulted in more natural gas than average in underground storage at the end of the heating season. The traditional heating season runs between November 1 and March 31. Injections into underground storage so far during the 2020 refill season (April 1 to October 31) have also been relatively high, lagging behind only 2019 and 2015 for total net injections for the Lower 48 states through May. High storage levels indicate high natural gas production relative to consumer demand. Contributing to high U.S. storage levels and lower prices has been a decline in liquefied natural gas (LNG) exports. Demand for U.S. liquefied natural gas exports has fallen by half in the first half of 2020, from 9.8 billion cubic feet per day (Bcf/d) in late March to less than 4.0 Bcf/d in June. U.S. industrial demand is down by 0.6 Bcf/d, or 2.7%, compared with the first half of 2019. The monthly average Henry Hub price was less than $2/MMBtu in each month from February through June. Before 2020, the real Henry Hub price averaged less than $2/MMBtu in one month: March 2016. The daily Henry Hub price reached its lowest level in more than 20 years on June 16, 2020, settling at $1.38/MMBtu, according to Natural Gas Intelligence. Prices at key trading hubs across the country have generally traded close to the Henry Hub basis, and they are largely driven by regional temperatures. Except for California, prices at all major trading hubs in population centers averaged less than $2/MMBtu in the first half of 2020. Prices at PG&

- 17. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Citygate in Northern California and SoCal Citygate in Southern California averaged $2.57/MMBtu and $2.35/MMBtu, respectively. The mild winter this year helped keep the natural gas price at the Algonquin Citygate in New England relatively low, averaging $1.88/MMBtu in the first half of the year. Algonquin natural gas prices are often significantly higher than Henry Hub in the winter because of pipeline constraints. Source: U.S. Energy Information Administration, Short-Term Energy Outlook The U.S. Energy Information Administration (EIA) expects natural gas prices to stay low in the coming months before eventually increasing by the end of 2020. In its July 2020 Short-Term Energy Outlook (STEO), EIA forecasts the Henry Hub natural gas spot price for the second half of this year will average $2.05/MMBtu. By the fall, EIA expects low prices to lead to further declines in natural gas production as a result of lags between natural gas price changes and adjustments to production levels. EIA expects U.S. dry natural gas production to decrease by 3% to average 89.2 Bcf/d in 2020, down from 92.2 Bcf/d in 2019. EIA expects that the low price of natural gas will encourage more natural gas consumption in the electric power sector in 2020, which is already 7% higher in the first half of 2020 compared with last year. EIA expects consumption in all other sectors to decline and that overall 2020 natural gas consumption will decline by 3 Bcf/d. EIA expects natural gas spot prices to rise by the fourth quarter of 2020 as production falls and the winter heating season begins.

- 18. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase Special Coverage The Energy world - Special 16- July -2020 Tesla’s Furious Rally May Have 55% Upside, Analyst Says Bloomberg - Courtney Dentch and Esha Dey Tesla Inc. shares rose again on Tuesday, rebounding from Monday’s rare decline, after at least one analyst said the stock’s dizzying rally isn’t over yet. “Is it time to redeploy capital after an amazing run? Resoundingly, we think the answer is NO,” Piper Sandler analyst Alexander Potter wrote in a note. “In our view, Tesla is the most consequential company in the mobility ecosystem, and this is unlikely to change in the next decade.” Potter lifted his price target to $2,322, the highest among the 30 analyst targets tracked by Bloomberg, from $939, a target he’s held since April. The new price target implies another 55% of upside over the next 12 months. That steep valuation reflects Potter’s expectation that the company will deliver nearly 4 million vehicles in 2025, implying an overall market share of about 7% in China and 9.5% in the United States. Before the pandemic hit, Tesla had said it expected 2020 deliveries to exceed 500,000 units. However, a more significant driver of the new price target is the company’s full-self-driving software, the analyst said. Tesla said earlier it may earn gross margins of over 30%, if more customers opt to buy that software. Piper Sandler’s analysis showed the company could be earning mid-20s operating margin by the end of a 20-year forecast period, even with less than half of the users opting for full self driving. “We assume that the lump-sum price of the full-self-driving software package will eventually rise to nearly $40,000, up from $9,000 at present, with a 6-year subscription plan costing about 125% more (in aggregate) than an up-front purchase,” Potter wrote. Due to the high margins associated with the software package, Tesla could “conceivably” be selling vehicles at cost, or even below cost, while still achieving higher operating margins by the 2030s, the analyst added.

- 19. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 The reasons behind the gains aren’t always clear. Improving operations and profit Tesla gained as much as 6.2% to $1,569 in New York, before paring those gains. The stock fell 3.1% Monday. No stranger to volatility, the stock has been on a relentless rally, more than tripling since the start of the year and advancing 60% in the past month alone. That compares to a 21% gain in the high-flying Nasdaq 100 for the year, or 9.7% in the past month. ability, a potential for “game-changing” battery technology at an upcoming event, short covering and a potential inclusion in the S&P 500 Index have all helped push the price higher. The surge has added $202.3 billion to its market value -- or more than Exxon Mobil’s entire market cap these days -- and propelled it to displace Toyota Motor Corp. as the world’s biggest carmaker by stock value. An average of 17.7 million shares have traded hands daily since the beginning of the year, more than double the activity in the same period last year. Much of the trading has come from retail investors clamoring to get into the growing electric vehicle space. On the Robinhood trading app, more than 40,000 accounts took positions in Tesla in a single four-hour span on Monday. It was the 10th most popular stock on the platform. Still, not everyone is cheering the run. The stock last week was poised to cross $20 billion in short interest bets, the first to do so, according to data from S3 Partners. Amid the rally, the skeptics have suffered more than $18 billion in mark-to-market losses, including $4.1 billion in losses in July alone. “If Tesla’s stock price continues to trend upward, we expect even more short covering as mark-to- market losses accumulate,” S3 said in its July 9 report.

- 20. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 Tesla Euphoria Powers Equity Boom for Electric Imitators Tesla Inc.’s eye-popping run has left stock prognosticators in the dust, brought smaller imitators along for the ride and triggered a race by entrants new and old to cash in. It’s a phenomenon that alarms valuation experts and even gives pause to those who stand to gain from the electric-car euphoria. The companies whose shares are surging along with Tesla’s are a long way from the sales volume achieved by Elon Musk -- and his automaker is coming off a quarter in which vehicle deliveries shrank from a year ago and remain far short of the world’s top-producing manufacturers. This week’s trading has been a microcosm of just how fleeting momentum can be even for the world’s most successful EV company. Tesla’s stock soared 16% during Monday’s session, abruptly fell and then finished down 3%, shedding $55 billion of market capitalization in the process. Retail investors -- including the 10,000 users an hour who were adding shares on the investing platform Robinhood during a stretch -- likely were burned in the process. On Tuesday, the stock traded up as much as 6.2% and down as much as 4.4% within the first hour of New York trading. Shares of NIO Inc. and Nikola Corp. also pared their big gains for the year. The Nikola Two semi truck. .. Source: Nikola Corp. Investors valued Nikola as high as $28.8 billion last month, despite the company being a year away from producing its first battery-powered semi truck. Two other electric-vehicle makers are now trying to replicate its reverse-merger listing strategy, with one being led by the founder of an EV maker that went bankrupt less than seven years ago. “There’s a lot of delirium,” said Aswath Damodaran, a professor at New York University’s Stern School of Business. “Each company is looking up the ladder: Tesla is the next Amazon, Nikola is the next Tesla, and so on.” Damodaran said he doubts that each new entrant will be able to pull off their growth projections and that the electric-vehicle market is not big enough for every one of the companies to succeed. “We are all now reaching for a dream,” Damodaran said, “and that’s not the way to invest.” Signs of the Times For almost all of Monday’s roller-coaster ride, Tesla shares traded above $1,500, where the two most optimistic analysts surveyed by Bloomberg had set their fair-value estimates just last week. A new biggest bull emerged after Monday’s close, though Piper Sandler & Co.’s Alexander Potter signaled some expectation of client pushback. He ended the title of his report: “Defending Our New $2,300+ Price Target.”

- 21. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 RBC Capital Markets analyst Joe Spak nodded to the heady times for the clean-transportation sector with a report initiating coverage of Nikola last week that asked: “Can Zero Emissions Remain Zero Gravity?” He rated the stock the equivalent of a hold, calling the company “still more of a business plan than business.” Going Gangbusters U.S.-listed electric-vehicle makers are having a banner year Source: Bloomberg data, Note: Nikola YTD gain figure includes advance prior to June 4 listing of combined-company shares. After Nikola, the most valuable U.S.-listed electric-auto entrant is NIO Inc., the Chinese maker of battery-powered SUVs. Through June, it’s handed over less than 50,000 vehicles in the roughly two years since it started delivering vehicles. But its stock has surged 244% this year. Then there’s Workhorse Group Inc., which is trying to produce and sell just 400 electric delivery vehicles this year. Its shares started surging in the run-up to Vice President Mike Pence’s visit to a politically significant factory that an affiliate acquired from General Motors Co. and is trying to revive. The stock is up 408% year-to-date. Workhorse’s C650 and C1000 electric delivery trucks. Source: Workhorse Group Inc.

- 22. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 Few Survivors Investors are rewarding these companies based on their business plans, but Tesla may prove to be the exception rather than the rule when it comes to mass-producing, retailing and servicing vehicles. They face an uphill battle getting the cash they need to compete with Tesla and major carmakers, said Tony Posawatz, a consultant who led development of GM’s plug-in hybrid Chevrolet Volt. “It’s a craze,” said Posawatz, who’s on the board of Lucid Motors Inc., which is trying to start producing its debut electric sedan by year-end. “There are 20-something EV startups in the U.S. Knowing the history of the industry, the kind of capital needed, I’ll say Tesla and two or three others will survive.” Waiting in the Wings How unlisted U.S. clean-transportation companies plan to compete Source: Company statements, Bloomberg News reporting Lucid handed majority ownership to Saudi Arabia’s sovereign wealth fund in exchange for a $1.3 billion investment last year. That haul pales in comparison to the roughly $4.85 billion Rivian Automotive Inc. has brought in since early 2019 from the likes of Amazon.com Inc., Ford Motor Co. and T. Rowe Price Associates Inc.

- 23. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 Cautionary Tale Fisker Automotive, the EV startup founded before the global financial crisis by decorated auto designer Henrik Fisker, offers a cautionary tale of just how difficult the auto business can be. The company generated buzz by getting its snazzily styled Karma hybrid onto the driveways of celebrities including Justin Bieber and Leonardo DiCaprio back when Musk was still getting Tesla off the ground. But it went bankrupt in 2013, losing U.S. taxpayers $139 million. China’s Wanxiang Group acquired the company out of Chapter 11 and renamed it Karma Automotive. Last week, it announced having raised $100 million from outside investors and plans to seek an additional $200 million. Chief Strategy Officer Greg Tarr said that he’s getting plenty of incoming calls but turning down some offers from opportunists who are just chasing a hot trend and don’t understand Karma’s business model. “I would say there’s too much enthusiasm,” Tarr said in a phone interview. “You have some investors that don’t have any knowledge of the EV space and aren’t asking proper due-diligence questions.” Seeking Redemption For Fisker, 56, his ticket to redemption could be to follow in Nikola’s footsteps. Fisker Inc., his second EV venture, announced Monday that it too plans to combine with a special purpose acquisition company, or SPAC, in a deal that could generate more than $1 billion of proceeds and fund the development of an electric SUV called the Ocean, which is slated for production in late 2022. The Fisker deal with Spartan Energy Acquisition Corp. is the third time in the last four months that an EV company has sought to go public via a SPAC transaction. After Nikola’s deal closed in June, Hyliion Inc., a maker of electrified powertrains for semi trucks, announced it was planning to combine with Tortoise Acquisition Corp. Whereas Tesla has gone its own way after doing joint-venture projects in its early years with Toyota Motor Corp. and Daimler AG, the new entrants listing their shares by way of SPACs all are going to lean heavily on incumbents for the foreseeable future. Nikola has a joint venture with commercial- vehicle maker CNH Industrial NV and has said it will need to team up with a to-be-named manufacturer for a planned pickup. Hyliion plans to be a supplier to manufacturers of big rigs. And Fisker is negotiating with Volkswagen AG to use the German giant’s electric-vehicle platform for its SUV.

- 24. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24 NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced twice weekly and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 30 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat “with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base. Khaled is the Founder of NewBase Energy, and an international consultant, advisor, ecopreneur and journalist with expertise in waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. Currently in process for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with more than 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management and environmental sustainability in different parts of the world. Khaled can be reached at any time, see contact details above. Khaled has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase: For discussion or further details on the news above you may contact us on +971504822502, Dubai, UAE NewBase 2020 K. Al Awadi

- 25. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 25

- 26. Copyright © 2020 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 26 For Your Recruitments needs and Top Talents, please seek our approved agents below