NewBase 638 special 01 july 2015

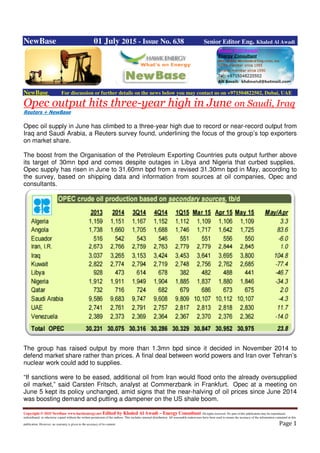

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 01 July 2015 - Issue No. 638 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Opec output hits three-year high in June on Saudi, Iraq Reuters + NewBase Opec oil supply in June has climbed to a three-year high due to record or near-record output from Iraq and Saudi Arabia, a Reuters survey found, underlining the focus of the group’s top exporters on market share. The boost from the Organisation of the Petroleum Exporting Countries puts output further above its target of 30mn bpd and comes despite outages in Libya and Nigeria that curbed supplies. Opec supply has risen in June to 31.60mn bpd from a revised 31.30mn bpd in May, according to the survey, based on shipping data and information from sources at oil companies, Opec and consultants. The group has raised output by more than 1.3mn bpd since it decided in November 2014 to defend market share rather than prices. A final deal between world powers and Iran over Tehran’s nuclear work could add to supplies. “If sanctions were to be eased, additional oil from Iran would flood onto the already oversupplied oil market,” said Carsten Fritsch, analyst at Commerzbank in Frankfurt. Opec at a meeting on June 5 kept its policy unchanged, amid signs that the near-halving of oil prices since June 2014 was boosting demand and putting a dampener on the US shale boom.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 If the total remains unrevised, June’s supply would be Opec’s highest since it pumped 31.63mn bpd in June 2012, based on Reuters surveys. The biggest increase in June has come from Iraq, which has helped push Opec output higher this year. Exports from southern Iraq have jumped to 3mn bpd after Iraq split the crude stream into two grades, Basra Heavy and Basra Light, to resolve quality issues. Some companies have increased production following the move. Shipments from Iraq’s north via Ceyhan in Turkey have remained steady despite tensions between Baghdad and the Kurdistan Regional Government over budget payments. The KRG, which says it has not received its share of revenues from Baghdad, has boosted independent sales and cut allocations to Iraq’s State Oil Marketing Organisation, say trade and industry sources. Still, this does not appear to have curbed actual volumes. Top exporter Saudi Arabia has not scaled back output from May’s record, sources in the survey said, as Riyadh meets higher demand internationally and from domestic power plants and refineries. However, there is no sign yet of a further sizeable boost in Saudi supply, they said. Nigeria increased output by 60,000 bpd and the increase would have been larger without loading delays at the Bonny terminal and a force majeure on exports of Forcados crude. Of the countries with lower output, Libya posted a slight decline as supply remained disrupted by unrest and negotiations to reopen closed oilfields had yet to succeed. Angola exported fewer cargoes following a strong month in May. Kuwait’s output was reduced slightly as a result of the shutdown of the Wafra oilfield, shared by Saudi Arabia and Kuwait, sources in the survey said.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 No wonder Opec output hits three-year high in June Saudis Boosted Oil Output in April as U.S. Idled Rigs Saudi Arabia boosted crude oil production for a second month to the highest level in at least three decades, helping to raise OPEC output as U.S. supply growth showed signs of slowing.The Middle Eastern country increased crude output by 13,700 barrels a day in April to 10.308 million, according to data the country communicated to the Organization of Petroleum Exporting Countries’ secretariat in Vienna. Prices collapsed by almost half last year as Saudi Arabia led OPEC in maintaining production rather than cede market share to booming U.S. supply. The group has become more unified about keeping its output target because prices are now rising, according to Kuwait’s oil minister.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Abu Dhabi mulls merger to rescue troubled Taqa Reuters + NewBase Abu Dhabi may merge its national energy company Taqa into another state-owned business to make the company's crippling debts more manageable. Founded in 2005 and the only listed quasi-sovereign company in the emirate, Abu Dhabi National Energy Company (Taqa) went on an expansion drive to create an energy giant to rival international oil majors such as Exxon and BP. The main objective is to turn around Taqa's performance, sources familiar with the matter told Reuters. Billions of dollars were spent on assets, with Canada and the North Sea among its favoured destinations, in areas including oil and gas exploration, underground gas storage, power generation and water desalination. But the last 18 months have seen its strategy fall apart, with the huge debts taken on to fund its expansion and a big drop in oil prices calling into question its very existence. "The company is embroiled in a battle for its future," said a source close to the company, declining to be named due to the matter's sensitivity. After plunging to a fourth-quarter loss of Dh3.6 billion ($980 million), Taqa said it would slash capital spending by 39 per cent this year and make Dh1.5 billion of cost savings over the next two years. It is also conducting a review of its assets ahead of potential sales.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Now, Blackstone has been hired to advise on ways to tackle its debt pile, according to the source, with total liabilities reaching some Dh104.8 billion ($28.5 billion), according to its first-quarter financial statement. Sources told Reuters last week that Taqa was raising a $3 billion five-year loan aimed as consolidating multiple debts into a single, cheaper facility. Taking a first step to improve its debt situation could open the way to a merger with another state-owned company. "It is the biggest stumbling block so by reducing the debt, Abu Dhabi can do whatever it wants and fold it into any other entity," said the source, adding merger considerations were still at any early stage. Should a merger happen, shareholders owning the 27.8 per cent of Taqa not controlled by the government will hope it follows the smooth path of Aldar Properties' share-swap merger with Sorouh Real Estate in 2013 - and not Aabar Investments' takeover by International Petroleum Investment Company in 2010, which faced a backlash from minority shareholders after the initial offer was regarded as too low. Monopoly utility Abu Dhabi Water and Electricity Authority (Adwea) or Mubadala Petroleum, an arm of one of the emirate's main investment funds, are the likely merger candidates, according to three Abu Dhabi-based sources. Adwea already owns 53.4 per cent of Taqa on behalf of the government and would be a good fit with Taqa's power generation assets in the United Arab Emirates. Mubadala's energy focus would also ensure synergies, the sources said. The company declined to comment. A spokesman for Mubadala dismissed merger talk as rumours. Adwea could not be reached for comment. Taqa has already received government help, including assets transferred to it and the conversion of a shareholder loan into equity, according to a Moody's report in which it downgraded the Abu Dhabi firm's baseline credit assessment by three notches due to concerns over its debts. Moody's also assumed the government was behind a transaction disclosed in Taqa's 2014 accounts where a "related party" agreed to purchase certain oil and gas assets. "If the company had not entered into this transaction, they (Taqa) would have had to increase impairments by Dh6.6 billion," said Moody's analyst Julien Haddad, adding if this sum was removed from Taqa's equity position, which stood at Dh8.7 billion at the end of 2014, it would have further eroded the capital base of a company "already thinly capitalised".

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Like energy companies globally, Taqa has been hit hard by the 45 per cent decline in the oil price since June 2014. But its problems extend beyond the recent downturn, and have not been solved by multiple management changes. Carl Sheldon stepped down in February 2014 as chief executive and Edward LaFehr, appointed chief operating officer at that time, has been in charge since then. In April 2014, Taqa's board was revamped with more than half replaced at the end of their three-year terms, while its finance chief left in September and no permanent replacement has been named. "All they are doing is managing down the value of the company," said one of the Abu Dhabi-based sources of the leadership situation. One thing LaFehr has done is launch a review of the company's assets, which is being undertaken by Macquarie and McKinsey & Company. Sales are expected to centre on Taqa's North American oil and gas business, although one of the sources said it would likely retain its 85 percent interest in a tolling agreement for the Red Oak power plant in New Jersey, as well as its 50 percent stake in Lakefield wind farm in Minnesota.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 UAE: Lower oil prices drag on Ipic earnings to Dh5.6bn The National + NewBase International Petroleum Investment Company (Ipic), an Abu Dhabi government-owned energy holding company, yesterday said last year’s earnings fell by 29 per cent, mainly on lower oil prices. Ipic, which owns or holds stakes in nearly two dozen domestic and international companies, said that revenues for last year fell by 3 per cent to Dh188 billion, with lower oil prices partially offset by revenue from new acquisitions. Earnings were down to Dh5.6bn, compared to Dh7.9bn a year earlier, and would have been lower had it not been for foreign exchange gains. Ipic’s managing director, the UAE’s oil minister Suhail Al Mazrouei, said via a statement accompanying the results: “Especially in a year of falling oil prices and difficult economic conditions, Ipic’s balanced portfolio helped navigate and surpass the market”. The company valued total assets at Dh243.5bn, down from Dh251.2bn at the end of 2013. Mr Al Mazrouei emphasised that Ipic paid down Dh13bn of debt last year as part of its balance sheet restructuring, making the total outstanding at the end of last year just under Dh110bn, versus total equity of just under Dh60bn. The government is keen to keep a lid on debt associated with “government-related entities” (GRIs), including Ipic and Taqa (also known as Abu Dhabi National Energy Company). As Moody’s Investors Service pointed out recently: “Abu Dhabi has very low central government debt of 2.7 per cent of 2013 GDP [but] contingent debt related to Abu Dhabi GRIs amounted to $77.3bn, or 29.8 per cent of GDP, which is among the highest indebted public sectors, globally, as a share of GDP”, adding that Taqa and Ipic represent more than two-thirds of the GRI debt. Moody’s recently downgraded its “baseline credit assessment” for Taqa to Ba3, making it “high risk”, although it maintains an A3 official rating on Taqa’s debt because of the implied government backing. The Moody’s analyst Rehan Akbar said yesterday: “We do not have a baseline credit assessment for Ipic but the Aa2 rating is aligned with that of the government of Abu Dhabi (Aa2 stable) given the intrinsic linkages between the two and we fully expect the government to stand behind Ipic’s financial obligations.” Ipic, whose holdings include 100 per cent of Spain’s Cepsa, an integrated oil company, as well as a 24.9 per cent stake in Vienna-based OMV, has been shifting its strategy in a low oil price environment. It also owns all or part of companies operating a pipeline bringing crude from Abu Dhabi to neighbouring emirate Fujairah, building a refinery at the port there and a liquefied natural gas plant.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Oman’s OTI mulls fuel storage capacity in E. Africa Oman Observer + NewBase Non-Opec member Oman is weighing moves to invest in fuel storage capacity in East Africa with the aim of boosting sales in key markets in this rapidly developing continent, according to a report by Bloomberg. The international news agency quoted the head of Oman Trading International Ltd, the fuel trading arm of the Omani government, as saying that the company plans to invest in facilities to store fuel in Mozambique or Tanzania to cater to potential markets unserved by seaports and marine terminals. “We’ve seen fundamental changes in the market,” Chief Executive Office Talal al Aufi was quoted as saying in an interview. “Asia as a market is now enjoying a period where there are options with all the growth in oil production.” Oman Trading is seeking storage capacity in Africa for up to 100 million cubic meters (26 billion gallons) of refined products, and it plans to complete a transaction before the end of the year, Al Aufi said. The company also sees an opportunity to expand trading in Iraq, where it supplies gasoline, he said. Significantly, OTI, which is a joint venture between Oman Oil Company and Vitol Group, the world’s largest independent energy trader, is also mulling plans to set up an office in the United States sometime during the first half of 2016. An office in the US will give Oman Trading a base to buy and sell Latin American crude, said Al Aufi. Exports from Colombia and Venezuela, among other regional suppliers, have been pushed out of the US market by increased local production, and many of those barrels are now flowing to Asia, where Middle Eastern crudes were traditionally dominant, he said. Infrastructure investments in Africa and a physical presence in the US are vital for the company to extend its reach beyond traditional markets in Asia, according to the CEO. Oman sells most of its oil to China, where Middle Eastern crude producers face growing competition from suppliers outside Opec.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Algeria: Increase in energy investments in Q1 2015 APS The investments of the energy sector reached DZD327 billion ($3.6 billion) in the first quarter of 2015, an increase of 19% compared with the same period a year earlier, Energy Ministry told APS. The investments increased despite the drop in oil revenues, as a result of the fall in oil prices. With regard to production, it was noted that in refining 7 million tonnes were produced, all products taken together, against 7.6 million tonnes during the same period of 2014 (-8.2%). To meet the national demand, which is in continuous growth, the sector imported 581,000 tonnes of refined products (-9%). The sector also recorded an increase in the production of electricity to reach 16,000 Gwh during the same period (+8.5%). The production of desalinated water increased by 2%, to reach 96 million m3 in the first quarter of 2015 against 94 million m3 during the same period of 2014. Energy: Khebri holds talks with Iranian counterpart Minister of Energy Salah Khebri received, Monday at his ministry’s headquarters, the Iranian President’s special envoy, minister of Energy Hamid Chitchian, said the ministry Monday in a communiqué. The talks between the two men focused on the presentations of the electricity sectors in both countries as well as on the development of cooperation relations between the two countries in the field of energy, particularly in electricity, added the communiqué. Also Minister of Water Resources and Environment Abdelwahab Nouri has examined with Iranian Energy Minister Hamid Chitchian means to strengthen cooperation in the sector. The two ministers assessed cooperation in the field of water resources and environment and examined means to boost it, said the Ministry in a statement. The two sides expressed satisfaction at the progress made in the implementation of the memorandum of understanding signed between the two countries in November 2008 in Teheran, and reiterated their willingness to achieve together the cooperation programme agreed on as part of the MoU. The two ministers intend to establish partnerships between the economic operators of the two countries, said the source. The meeting took place as part of the visit paid by the Iranian energy minister to Algeria (29-30 June) as the special envoy of Iranian President Hassan Rohani in preparation for the 3rd Summit of the Gas Exporting Countries Forum, to be held in Teheran on 23 November, said the Ministry's statement.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 GCC Region maintains ‘positive outlook’ economical growth-QNB Gulf Times + QNB QNB is maintaining a positive outlook for the GCC region, with a growth forecast of 4-4.5% for 2015 in its “investment outlook” released yesterday. Saudi Arabia’s purchasing managers index (PMI) fell to 57 in May on weaker growth in output and new business. However, the index showed another robust expansion in the Saudi private non-oil sector, it said. At the same time, the UAE’s PMI was little changed in May (56.4), QNB said. The US economy contracted in Q1, 2015, but the latest data suggest that the weakness is confined to the first quarter (Q1). The Euro area recovery is continuing into Q2 supported by lower oil prices, a weaker euro, a fading fiscal drag and improving credit channels. Monetary and fiscal support in China is starting to impact the economy. Emerging markets (EMs) are slowing, except India, which enjoyed strong capital inflows in Q1, QNB said. Growth in the GCC and Sub-Sahara Africa (SSA) is expected to remain strong despite lower commodity price, QNB said.The recovery of the oil price and the massive liquidity were the main reasons behind the recovery of the GCC Equity market, QNB said and added it hence remained “neutral”. “We believe the Large buffers and available financial reserves should allow most of GCC countries to avoid sharp cuts in government spending, limiting the impact on near-term growth, which would result in a positive reflection on the stock markets of this countries. We believe GCC markets are oversold and the valuation is being attractive for some of these markets and there will be strong inflow in markets like Saudi Arabia, which is the biggest regional market,” QNB said. On commodities, QNB said, “We remain neutral on a 3-month basis, and we downgrade to underweight on a 12-month. We expect a decrease in the oil price before a proper recovery, as the price is high relative to current and forecast fundamentals: 1) US producer response has been large, we believe it remains short of the slowdown required and will reverse at the current price, 2) the reaction of non-Opec producers remains null and low-cost producers such as Saudi Arabia, Iraq and Russia are on track to grow production sharply, 3) access to equity and debt capital markets is already back to being open. “A lower oil price and stronger dollar are driving cost deflation across the commodity complex, as energy is a large share of operating costs.”

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Hansa Hydrocarbons awarded licences in Germany and the Netherlands. Source: Hansa Hydrocarbons Hansa Hydrocarbons announced Wednesday that it has recently been awarded a number of licences in the Dutch and German sectors of the Southern North Sea. The awards comprise five contiguous licences, namely Blocks N04, N05, N07c & N08 in the Netherlands and the Geldsackplate licence in Germany, together termed the GEms (Gateway to the Ems) acreage. The gross area is some 814 sq kms and the licences are situated approx. 20 km north and north east of the Dutch island of Schiermonnikoog. The water depth ranges from 10 m to 30 m. The GEms acreage is bounded to the north and north-east by the 4Quads and H&L licences where Hansa holds interests of 60% and 20% respectively. The exploration targets are a continuation of the basal Rotliegend play proven in the neighboring H&L acreage and recognised in the 4Quads. The area benefits from extensive coverage of modern 3D seismic data acquired in the mid-1990s however no wells have been drilled on the licences with the benefit of this data. Hansa’s propriety studies of the existing well data have enabled the reservoir sands to be mapped directly on 3D seismic over extensive structural closures which together hold significant resource potential. As a first stage of the work program, Hansa is reprocessing the existing 3D seismic data in order to enhance imaging. Hansa is operator of all the licences holding a 100% in the Geldsackplate licence and a 60% interest in the Dutch licences post participation by EBN, the Dutch state entity. John Martin, Hansa Hydrocarbon’s CEO, said: 'These awards further extend Hansa’s unique position in the basal Rotliegend play across our adjacent 4Quads and H&L licences and add well-defined low risk prospectivity to our growing resource base. They are testimony to our ability to identify material opportunity in a mature basin through conducting significant regional work and leveraging knowledge across the basin and across borders. With processing of the large 4Quads 3D seismic survey acquired in 2014 due to be complete in the coming months and the re-processing of the existing 3D seismic across the GEms acreage, there is some real momentum building up in pursuit of this multi-tcf conventional gas play which will lead to exploration drilling within the next eighteen months.'

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Indonesia: Eni signs LNG sale & purchase agreements with Pertamina for Jangkrik field. Source: Eni Eni, together with its partners ENGIE (formerly GDF SUEZ) and Saka Energi Muara Bakau, signed Tuesday two agreements with Pertamina (PERSERO) for the purchase and sale of liquefied natural gas (LNG) coming from Jangkrik Fields Development Project. Under such Sale & Purchase Agreements, Pertamina will purchase 1.4 million tonnes per annum of LNG starting from 2017. 'The signing of these agreements represents a key milestone for the Jangkrik Field Development Project. It is one of the first deep-water gas projects in Indonesia being developed under a fast track scheme, and confirms Eni’s commitment in supplying gas for the development of the Indonesian domestic market. I’m very pleased with the strong and fruitful relationship with the Indonesian Authorities, Pertamina and our Joint Ventures Partners in Jangkrik', Eni’s CEO, Claudio Descalzi, said. The Jangkrik Fields Development Project which consists of Jangkrik and Jangkrik North- East fieldsrequires the drilling of production wells to be linked to a Floating Production Unit for gas and condensate treatment, and subsea pipeline laying for transportation to the Bontag Terminal. Production start-up is expected in 2017. The Jangkrik fields, discovered in the Muara Bakau block in 2009 and 2011, are located at a depth of 400 meters in the Makassar Strait, approx. 100 km east of Balikpapan. Eni is the operator of the block with 55% of working interest, whereas the other JV partners are GDF Suez Exploration Indonesia, a subsidiary of ENGIE, formerly GDF SUEZ, with 33.334% stake and Saka Energi Muara Bakau with 11.666% stake. Eni has been operating in Indonesia since 2001 and currently holds a large portfolio of exploration, production and development assets which have an increasing importance in contributing to the overall growth of the company. Eni’s average equity production in the Country amounts to 17,000 barrels of oil equivalent per day.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 ENGIE, China Investment Corporation Sign Energy MoU France’s ENGIE and China Investment Corporation (CIC) signed energy related MoU in Paris on Tuesday. The memorandum was signed on the occasion of Chinese Premier Li Keqiang’s visit to France. Under the new agreement ENGIE and CIC would cooperate in the areas of large energy projects, particularly renewable energy projects in fast developing countries and in new technologies and in energy efficiency fields, especially in China. The cooperation between ENGIE and CIC started in 2011. It was notably marked by the establishment of shareholder relationship in ENGIE’s exploration and production activities in which CIC holds a 30 percent ownership interest. “Today’s MoU is the consolidation of the two parties’ cooperation in the past years, and it keeps pace with their new strategies. The MoU also illustrates their common vision on the transition to a low carbon economy at a global scale,” the French firm said in a statement Tuesday. In natural gas, ENGIE signed a worldwide partnership in 2011 with the Chinese sovereign fund CIC granting the latter a 30 percent share in ENGIE exploration and production activities. The Group sold 2.3 million metric tons of LNG to the China National Offshore Oil Corporation(CNOOC), with deliveries beginning in 2013, and installed the first floating regasification terminal in China. In 2012, ENGIE also began a cooperation agreement with PetroChina to explore the upstream gas potential in Qatar, then extended the agreement to gas storage in China in 2013. The Group currently assists Shanghai Gas Group, a unit of Shenergy Group, for the expansion of one of its LNG terminals.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Global energy sector looks to ADIPEC2015 awards for achieving sustainability through innovation (WAM + NewBase ) --- As regional and global oil and gas companies continue to submit their nominations for the prestigious ADIPEC 2015 Awards ahead of the 30 July deadline, members of the Regional Select Jury (RSJ), which is comprised of senior professionals from across the industry, emphasised the pivotal role that developments in technology play in creating and harnessing sustainable energy resources. "With eight categories that span the most critical issues surrounding the energy sector, the ADIPEC Awards encourage and uphold organisations that champion forward thinking attitudes and value new ideas brought by young talent," said Ali Khalifa Al Shamsi, Director of Strategy & Coordination at ADNOC, and ADIPEC 2015 Chairman. "This is essential in order to continue meeting the ever-growing global demand for energy in the context of today's market conditions." Set to take place on the opening night of the Abu Dhabi International Petroleum Exhibition & Conference (ADIPEC), one of the world's top three energy events, the ADIPEC 2015 Awards are currently accepting nominations and offer both regional and global companies a platform to showcase accomplishments that shape the future of the industry. Among the eight categories of the ADIPEC 2015 Awards, 'Best Oil & Gas Innovation or Technology' (Surface or Sub-surface) is currently showing the most interest, demonstrating the region's unwavering commitment to advancing the oil and gas industry, and to meeting the rising global demand for energy. The 'Best Oil & Gas Corporate Social Responsibility (CSR) / Health, Safety, and Environment (HSE) Project or Initiative' category, and the new 'Best Dissertation of the Year' category follow, both looking at critical areas that promote progress within the energy sector. Also new to this year's Awards is the 'Best Practice' category, which recognises the creation and successful implementation of an initiative that offers improvement to an internal business process, structure, or culture. The remaining four categories for 2015 include 'Best Oil & Gas Mega Project', 'Best Oilfield Services Company' (Local, Regional or International),'Young ADIPEC Engineer', and 'Oil & Gas Woman of the Year'. Last year, the ADIPEC Awards received a record-breaking 390 submissions from more than 100 organisations across 26 countries, marking an increase of 100 submissions when compared with 2013.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Oil Price Drop Special Coverage Oil prices drop as Greece defaults and output soars, after yesterday’s gain Reuters + NewBase Oil prices fell on Wednesday after Greece became the first developed economy to default on a loan with the International Monetary Fund and as both U.S. and OPEC production hit new records. Greece, as expected, was not able to repay 1.6 billion euros it owed to the IMF, in what was the largest missed payment in the Fund's history. Greece's default pushed up the dollar versus the euro , with the stronger greenback pressuring crude prices as it increases dollar-denominated oil import prices for countries using different currencies. Front-month Brent crude futures were trading at $63.09 per barrel at 0116 GMT, down 50 cents from their last settlement. U.S. crude futures fell 65 cents at $58.82 per barrel. Analysts said rising production from the Organization of Petroleum Exporting Countries (OPEC) as well as in the United States also weighing on prices. "Iraqi crude production climbed to a record level this month, with OPEC crude oil output estimated to have reached 32.1 million barrels per day against a target of 30 million barrels per day," ANZ said in a morning note. Overall OPEC supply rose to a three-year high of 31.60 million barrels per day (bpd) in June, up from 31.30 million bpd in May, according to a Reuters survey. The group has raised output by more than 1.3 million bpd since it decided in November 2014 to defend market share rather than prices.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 A final deal between world powers and Iran over Tehran's nuclear work could add to supplies. A June 30 deadline for a nuclear deal that could let Iran export more crude into an oversupplied market has been extended by a week to July 7. In the United States, crude production rose 9,000 barrels a day to 9.701 million barrels a day in April, the highest since May 1971, the U.S. Energy Information Administration said in monthly data released Tuesday. Crude inventories rose by 1.9 million barrels in the week to 468.9 million, compared with analyst expectations for a decrease of 2.000 million barrels. However, demand was also up with refinery crude runs rising by 77,000 barrels per day, API data showed Iran Faces Slow Road Back to Oil Market Even With Nuclear DealShare on FacebookShare on Twitter Bloomberg + NewBase As Iran nears a deal to ease oil sanctions after almost two years of talks, selling more crude remains a long way off. The nation’s goal of increasing exports 50 percent as soon as restrictions are lifted won’t be fulfilled, say Goldman Sachs Group Inc., Bank of America Corp. and Societe Generale SA. That would require an extra 500,000 barrels of daily output, which the banks say will take six to 12 months as OPEC’s fourth-biggest producer complies with terms of a deal and revives aging wells. The impact on prices will be limited, the banks predict. “They’ve got to meet the requirements of any agreement, and that’s going to take time,” Jeff Currie, head of commodities research at Goldman Sachs, said by e-mail from New York on Monday. “When you shut these fields in to that significant of a degree, your ability to bring back production to previous levels will be limited because you’ve done damage to the fields that will require significant investment.” The U.S. and five other global powers seek an agreement with the Persian Gulf nation to curtail its nuclear program in exchange for removing sanctions that have squeezed its oil trade and economy. Iranian oil exports have plunged 46 percent since 2011 as a result of the restrictions, according to the U.S. Energy Information Administration. Deal Approaches Diplomats in Vienna are close to clinching the historic agreement, with both sides having shown the “political will” to finish drafting a long-term accord, European Union foreign policy chief, Federica Mogherini, said June 28. Iranian Foreign Minister Mohammad Javad Zarif rejoined the talks Tuesday, saying he was there “to get a final deal.” The negotiations, now in their 21st month, have been extended to July 7 from June 30. Oil prices have lost about 45 percent in the past year as Saudi Arabia, Iran’s rival for political sway in the Persian Gulf, leads the Organization of Petroleum Exporting Countries in an effort to defend market share by pumping more oil. While the announcement of a deal would trigger a “knee-jerk” price drop, the slow pace of restoring exports would damp the impact, Societe Generale predicts. Brent oil, the global benchmark, slid 0.8 percent to $63.07 a barrel on the London-based ICE Futures Europe exchange at 11:53 a.m. Singapore time on Wednesday.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 U.S. and European officials said after an interim accord on April 2 that restrictions will only be phased out gradually, and will be contingent on Iran’s cooperation with inspections by the International Atomic Energy Agency. That verification process will take from six months to a year, U.S. Secretary of State John Kerry said. More Oil Iran can add 1 million barrels a day to exports within seven months of sanctions being lifted, re- attaining its pre-sanctions capacity, Iranian Oil Minister Bijan Namdar Zanganeh said at an OPEC meeting in Vienna on June 5. That won’t be possible without substantial investment by foreign oil majors, who will be reluctant to re-enter Iran before the legal implications are clear, said Harry Tchilinguirian, head of commodity market strategy at BNP Paribas SA. The country aims to add a further 1 million barrels of daily capacity eventually, Zanganeh has said. If Iran could deliver the extra oil it hopes to, it would effectively double the global surplus that’s already projected for the rest of the year. Stored Crude While restoring production from Iranian oil fields will be slow, the country has stockpiled crude on tankers that could hit the market more quickly, after IAEA inspectors certify compliance with terms of an agreement, Bank of America said. The country has nine vessels, probably laden with about 19 million barrels of crude, moored off its coast, according to London-based Bloomberg oil strategist Julian Lee. “That will hit the market almost immediately, or over the course of a few weeks,” said Francisco Blanch, Bank of America’s New York-based head of commodities research. A deal “puts additional downward pressure on prices” by prolonging the global oil surplus for about six months, Blanch said. Expectations for additional Iran crude are more muted than they were before the accord reached in April, which clarified the pace of Iran’s potential return, said Societe Generale’s Mike Wittner. “It’s really a 2016 issue for the oil market,” Wittner said by phone from New York. “By the second half of next year the market may be able to absorb the additional Iranian crude without too much of an issue. This is not slam-dunk bearish.”

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 01 July 2015 K. Al Awadi

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19