Monetary&fiscalpolicy

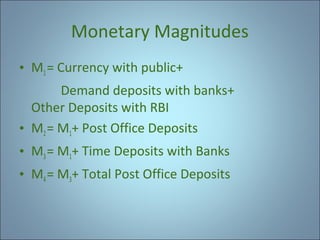

- 1. Monetary Magnitudes • M1 = Currency with public+ Demand deposits with banks+ Other Deposits with RBI • M2 = M1+ Post Office Deposits • M3 = M1+ Time Deposits with Banks • M4 = M3+ Total Post Office Deposits

- 2. What is Monetary Policy? • The term monetary policy refers to actions taken by central banks to affect monetary magnitudes or other financial conditions. • Monetary Policy operates on monetary magnitudes or variables such as money supply, interest rates and availability of credit. • Monetary Policy ultimately operates through its influence on expenditure flows in the economy. • In other words affects liquidity and by affecting liquidity, and thus credit, it affects total demand in the economy.

- 3. Aims of Monetary policy • MP is a part of general economic policy of the govt. • Thus MP contributes to the achievement of the goals of economic policy.

- 4. Objective of MP may be:

- 5. Central Bank Objectives • Advanced Economies European Central Bank-Price Stability Japan-Price Stability & financial Stability UK-Inflation USA –Max employment,Stable prices.

- 6. Price Stability: The Dominant Objective • Price stability does not mean complete year-to-year price stability which is difficult to attain. • Price stability refers to the long run average stability of prices. • Price stability involves avoidance of both inflationary and deflationary pressures. • Price Stability contributes improvements in the standard of living of people. • It promotes saving in the economy while discouraging unproductive investment • It contributes to the overall financial stability of the economy

- 7. Instruments of Monetary Policy I. Quantitative or General Controls • Bank Rate Policy • Variable Reserve Ratio • Open Market Operations (OMOs) II. Qualitative instruments or Selective Controls

- 8. Bank Rate Policy • Bank rate is the minimum rate at which the central bank of a country provides loans to the commercial banks. • It is also known as rediscount rate because central banks earlier used to provide finance to commercial banks by rediscounting bills of exchange. • Changes in the bank rate affect the credit creation by banks by altering the cost of credit.

- 9. Bank Rate &Supply of money • Bank rate is an important component of the supply of money in the economy. • When bank rate increasing the cost of borrowing is high and hence results in the reduction of money supply in the economy. • During the periods of recession ,growth and depression bank rate plays a very important role to increase investment and aggregate demand in the economy .

- 10. Limitations • Responsiveness of businessmen to changes in the lending rate of interest. For changes in bank rate to cause changes in all the other interest rate in the market a well organised money market is needed. The bank rate can check a boom and inflation but the role in recovery is limited.

- 11. Variable Reserve Ratios • Banks are required to maintain a certain percentage of their total demand and time deposits in the form of reserves or balances with the RBI • It is called Cash Reserve Ratio or CRR • SLR –Statutory Liquidity Ratio • Since reserves are high-powered money or base money, by varying CRR, RBI can reduce or add to the bank’s required reserves and thus affect bank’s ability to lend. • Present CRR Rate :4.00%

- 12. • Statutory Liquidity Ratio (SLR) • In terms of Section 24 (2-A) of the B.R. Act, 1949 all Scheduled Commercial Banks, in addition to • the average daily balance which they are required to maintain under Section 42 of the RBI Act,1934, are required to maintain in India • a) in cash, or • b) in gold valued at a price not exceeding the current market price • c) in unencumbered approved securities valued at a price as specified by the RBI from time to time

- 13. • At present, all Scheduled Commercial Banks are required to maintain a uniform SLR of 25 per cent of the total of their demand and time liabilities in India as on the last Friday of the second preceding fortnight which is stipulated under section 24 of the B.R. Act, 1949.

- 14. • an amount of which shall not, at the close of the business on any day, be less than 25 per cent or • such other percentage not exceeding 40 per cent as the RBI may from time to time, by notification • in gazette of India, specify, of the total of its demand and time liabilities in India as on the last • Friday of the second preceding fortnight,

- 15. OPEN MARKET OPERATIONS • It is another important instrument of credit control. • OMO means the purchase and sale of securities by the central bank of the country. • When central bank sells securities in the open market it receives payment in the form of cheque on one of the commercial banks. • If the purchaser is bank the cheque is drawn against the purchasing bank.

- 16. USE OF OMO • This method is adopted to make bank rate policy effective. • EX: If member bank do not raise lending rates due to the availability of surplus funds central bank can withdraw surplus funds by sale of securities and compels the members banks to raise the interest rate. • Note: Once the banks purchase securities surplus funds will be reduced and banks borrow from central bank and rate of interest increases.

- 17. Limitations of OMO • The market for securities in short and long term should be active as in the case of USA and UK. • In India OMO as an instrument did nor play a significant role . • General public do not buy more of government securities.

- 18. • Qualitative instruments or Selective Controls • It was introduced to check the speculation activities in the market and control the flow of credit selectively. • A method through which credit may be extended to certain areas and contracted to certain other areas . • This method is very useful during the periods of business cycles .

- 19. • Monetary policy is used as an important technique to combat the inflationary and deflationary tendencies in the economy. • To overcome the ill effects of business cycles monetary policy is used as an important tool in the economy . • Monetary policy is one of the tools that a national Government uses to influence its economy. Using its monetary authority to control the supply and availability of money, a government attempts to influence the overall level of economic activity in line with its political objectives

- 20. • Every bank is required to maintain at the close of business every day, a minimum proportion of their Net Demand and Time Liabilities as liquid assets in the form of cash, gold and un-encumbered approved securities. The ratio of liquid assets to demand and time liabilities is known as Statutory Liquidity Ratio (SLR). Present SLR is 25%(18.12.2010). RBI is empowered to increase this ratio up to 40%. An increase in SLR also restrict the bank’s leverage position to pump more money into the economy.

- 21. • Repo (Repurchase) rate is the rate at which the RBI lends shot-term money to the banks. When the repo rate increases borrowing from RBI becomes more expensive. Therefore, we can say that in case, RBI wants to make it more expensive for the banks to borrow money, it increases the repo rate; similarly, if it wants to make it cheaper for banks to borrow money, it reduces the repo rate. Present Repo Rate(7.50)23.3.13 • Reverse Repo rate is the rate at which banks park their short-term excess liquidity with the RBI. The RBI uses this tool when it feels there is too much money floating in the banking system. An increase in the reverse repo rate means that the RBI will borrow money from the banks at a higher rate of interest. As a result, banks would prefer to keep their money with the RBI. Present RRR(6.50) 23.3.13 • Thus, we can conclude that Repo Rate signifies the rate at which liquidity is injected in the banking system by RBI, whereas Reverse repo rate signifies the rate at which the central bank absorbs liquidity from the banks

- 22. Meaning of Fiscal Policy The word fisc means ‘state treasury’ and fiscal policy refers to policy concerning the use of ‘state treasury’ or the govt. finances to achieve the macroeconomic goals. It refers to the Revenue and Expenditure policy of the Govt. which is generally used to cure recession and maintain economic stability in the country.

- 23. • Fiscal Policy And Macroeconomic Goals • Economic Growth: By creating conditions for increase in savings & investment. • •Employment: By encouraging the use of labourabsorbing technology • •Stabilization: fight with depressionary trends and booming (overheating) indications in the economy • •Economic Equality: By reducing the income and wealth gaps between the rich and poor. • Balanced Regional Development • •Price stability: employed to contain inflationary and deflationary tendencies in the economy.

- 24. Instruments of Fiscal Policy Budgetary surplus and deficit Government Expenditure Taxation –Direct and Indirect Public debt Deficit Financing

- 25. Components of Budget • Revenue Receipts • Capital Receipts • Revenue Expenditure • Capital Expenditure

- 26. RUPEE COMES FROM • • • • • • • • • Where The Rupee Comes From service & other taxes 7% excise 17% customs 12% income tax 13% corporation tax 21% borrowings 19% non-debt capital reciepts 1% Non Tax revenue 10%

- 27. • Where the rupee goes to state's share of taxes & duties 18% • non plan assistance to states 5% • planned state assistance 7% • central plan 20% • interest 20% • defence 12% • subsidies 7% • Other Plan expenditure 11%

- 28. GOVERNMENT (Public)EXPENDITURE An important instrument of fiscal policy State has to fulfill certain social obligations like providing free public health,education,housing facilities. The responsibility of building the infrastructure and large capital goods industries, spending on agricultural sector are the major reason for the increase in public expenditure.

- 29. TAXATION • An important source of public revenue • Direct Tax - Includes taxes on personal income, corporate income tax&taxes on property and waelth. • Indirect Tax – Includes sales tax, excise duty & customs duty(Import &export duties) • Developing countries depend on indirect tax

- 30. Public debt • Important source of public revenue & a common practice in all the countries. • They help in the development process like building infrastructure facilities and for welfare activities funding . • Government can raise public debt in the form of voluntary loan or in the form of compulsory loan. • Example for Compulsory loan –Issue of bonds, Provident fund etc Voluntary loan – Example- By issuing bills and securities in the market

- 31. Deficit Financing • The fiscal policies have an impact on the goods market and the monetary policies have an impact on the asset markets and since the two markets are connected to each other via the two macrovariables — output and interest rates, the policies interact while influencing the output or the interest rates.

- 32. • Deficit financing is an approach to money management that involves spending more money than is collected during the same period. Sometimes referred to as a budget deficit, this strategy is employed by corporations and small businesses, governments at just about every level, and even household budgets. When used properly, deficit financing helps to launch a chain of events that ultimately enhances the financial condition rather than simply creating debt that may or may not be repaid.