Financial Management

•Télécharger en tant que PPTX, PDF•

0 j'aime•1,573 vues

This slide is for Financial Management assignment I don't really guarantee the answer

Signaler

Partager

Signaler

Partager

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (16)

Capital budgeting decision criteria and risk analysis

Capital budgeting decision criteria and risk analysis

Calculating risk-adjusted NPV (eNPV) - The right way

Calculating risk-adjusted NPV (eNPV) - The right way

Chapter 10:Risk and Refinements In Capital Budgeting

Chapter 10:Risk and Refinements In Capital Budgeting

Similaire à Financial Management

Similaire à Financial Management (20)

3.Quantitative Problem Bellinger Industries is considering two .docx

3.Quantitative Problem Bellinger Industries is considering two .docx

1. Projects S and L have the following cash flows, and both have a.docx

1. Projects S and L have the following cash flows, and both have a.docx

Top of Form 1.The difference between the present value.docx

Top of Form 1.The difference between the present value.docx

Manajemen Keuangan Lanjutan - Capital BUdgeting.pdf

Manajemen Keuangan Lanjutan - Capital BUdgeting.pdf

Plus de Micha Paramitha

Plus de Micha Paramitha (14)

Business Law Final Presentation - Foreign Investment in Indonesia

Business Law Final Presentation - Foreign Investment in Indonesia

Dernier

God is a creative God Gen 1:1. All that He created was “good”, could also be translated “beautiful”. God created man in His own image Gen 1:27. Maths helps us discover the beauty that God has created in His world and, in turn, create beautiful designs to serve and enrich the lives of others.

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...christianmathematics

https://app.box.com/s/7hlvjxjalkrik7fb082xx3jk7xd7liz3TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

Dernier (20)

ICT role in 21st century education and it's challenges.

ICT role in 21st century education and it's challenges.

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

Explore beautiful and ugly buildings. Mathematics helps us create beautiful d...

Python Notes for mca i year students osmania university.docx

Python Notes for mca i year students osmania university.docx

Beyond the EU: DORA and NIS 2 Directive's Global Impact

Beyond the EU: DORA and NIS 2 Directive's Global Impact

Ecological Succession. ( ECOSYSTEM, B. Pharmacy, 1st Year, Sem-II, Environmen...

Ecological Succession. ( ECOSYSTEM, B. Pharmacy, 1st Year, Sem-II, Environmen...

Micro-Scholarship, What it is, How can it help me.pdf

Micro-Scholarship, What it is, How can it help me.pdf

Measures of Dispersion and Variability: Range, QD, AD and SD

Measures of Dispersion and Variability: Range, QD, AD and SD

Seal of Good Local Governance (SGLG) 2024Final.pptx

Seal of Good Local Governance (SGLG) 2024Final.pptx

Energy Resources. ( B. Pharmacy, 1st Year, Sem-II) Natural Resources

Energy Resources. ( B. Pharmacy, 1st Year, Sem-II) Natural Resources

Mixin Classes in Odoo 17 How to Extend Models Using Mixin Classes

Mixin Classes in Odoo 17 How to Extend Models Using Mixin Classes

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

Financial Management

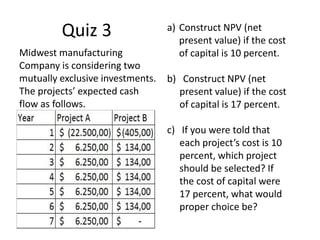

- 1. Quiz 3 Midwest manufacturing Company is considering two mutually exclusive investments. The projects’ expected cash flow as follows. a) Construct NPV (net present value) if the cost of capital is 10 percent. b) Construct NPV (net present value) if the cost of capital is 17 percent. c) If you were told that each project’s cost is 10 percent, which project should be selected? If the cost of capital were 17 percent, what would proper choice be?

- 2. Answer a) Construct NPV (net present value) if the cost of capital is 10 percent.

- 3. Answer b) Construct NPV (net present value) if the cost of capital is 17 percent.

- 4. Answer c) If you were told that each project’s cost is 10 percent, which project should be selected? If the cost of capital were 17 percent, what would proper choice be? 10% Project A : $7,918.75 Project B : - $ 405 We would select Project A because the amount is more than 0 17% Project A : $2,018.75 Project B : - $ 405 We would select Project A because the amount is more than 0

- 5. Chapter 11: Capital Budget Risk-Adjusted Discount Rates A method for incorporating the project’s level of risk into the capital-budgeting process, in which the discount rate is adjusted upward to compensate for higher than normal risk or downward to adjust for lower than normal risk. FCF IO K* N = = = = the annual expected free cash flow in time period t. the initial cash outlay. the risk-adjusted discount rate. the project’s expected life.

- 6. Example 1 A toy manufacture is considering the introduction of a line of fishing equipment with an expected life of five years. In the past, this firm has been quite conservative in its investment in new products, sticking primarily to standard toys. In this context, the introduction of a line of fishing equipment is considered an abnormally risky project. Management thinks that the normal required rate of return for the firm of 10 percent is not sufficient. Instead, the minimally acceptable rate of return on this project should be 15 percent. The initial outlay would be $110,000, and the expected free cash flows from this project are as given below:

- 7. Example 1 The project would have been accepted Project B with a net present value $3,700

- 8. Example 2 Bennett Company wishes to apply the Risk-Adjusted Discount Rate (RADR) approach to determine whether to implement Project A or B. rate of return on Project A : 14% Project B : 11%

- 9. Example 2 The project would have been accepted Project B with a net present value $9,802

- 10. Certainty Equivalent vs. Risk-Adjusted Discount Rate Methods Certainty Equivalent Risk-Adjusted Discount Rate Step 1 : Adjust the discount rate upward for risk, or down in the case of less than normal risk. Step 2 : Discount the expected free cash flows back to the present using the risk-adjusted discount rate. Step 3 : Apply the normal decision criteria except in the case of the internal rate of return, where the risk-adjusted discount rate replaces the required rate of return as the hurdle rate

- 11. Certainty Equivalent Example The risk-risk free rate of interest is 6 percent. What is the project’s net present value?

- 12. Answer

- 13. Comparing Certainty Equivalent and Risk Adjusted Discount Rate Methods A firm with a required rate of return of 10 percent is considering introducing a new product. This product has an initial outlay of $800,000, and expected life of 10 years, and free cash flows of $10 0,000 each year during its life. Because of the increased risk associated with this project, management is requiring a 15 percent rate of return.

- 14. Comparing Certainty Equivalent and Risk Adjusted Discount Rate Methods Certainty Equivalent

- 15. Comparing Certainty Equivalent and Risk Adjusted Discount Rate Methods Risk-Adjusted Discount Rate Method

Notes de l'éditeur

- Project b jadicuma 6xpembayaran178.57

- Project B hanya 6x pembayaran76.06