Les 21 5

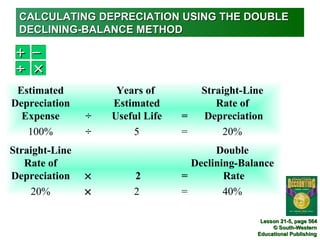

- 1. CALCULATING DEPRECIATION USING THE DOUBLE DECLINING-BALANCE METHOD + − ÷ × Estimated Years of Straight-Line Depreciation Estimated Rate of Expense ÷ Useful Life = Depreciation 100% ÷ 5 = 20% Straight-Line Double Rate of Declining-Balance Depreciation × 2 = Rate 20% × 2 = 40% Lesson 21-5, page 564 © South-Western Educational Publishing

- 2. CALCULATING DEPRECIATION USING THE DOUBLE DECLINING-BALANCE METHOD 1 2 3 4 1. Enter the double declining-balance rate. 2. Determine the annual depreciation expense. 3. Determine the ending book value. 4. Transfer the book value to the following year. Lesson 21-5, page 564 © South-Western Educational Publishing

- 3. CALCULATING THE LAST YEAR’S DEPRECIATION EXPENSE 2 3 1 1. Transfer the book value. 2. Determine the last year’s depreciation. 3. Verify the ending book value. Lesson 21-5, page 565 © South-Western Educational Publishing

- 4. COMPARISON OF THE TWO METHODS OF DEPRECIATION Lesson 21-5, page 566 © South-Western Educational Publishing

- 5. TERMS REVIEW declining-balance method of depreciation Lesson 21-5, page 567 © South-Western Educational Publishing