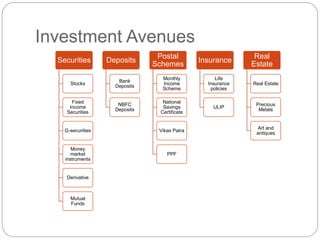

Investment avenues

- 1. Investment Avenues Securities Stocks Fixed Income Securities G-securities Money market instruments Derivative Mutual Funds Deposits Bank Deposits NBFC Deposits Postal Schemes Monthly Income Scheme National Savings Certificate Vikas Patra PPF Insurance Life Insurance policies ULIP Real Estate Real Estate Precious Metals Art and antiques

- 2. Securities Equity Shares:- Large-cap, Mid-cap, Small-cap stocks: categorized by market capitalization. Market Capitalization is calculated by multiplying the current price of the stock with the no. of outstanding shares in the market. Blue Chip Shares: The shares of Cos. which have a consistent track record and are doing exceedingly well compared with other Cos. They are market leaders and have the potential to influence the market.

- 3. Growth shares: Stocks that have a higher rate of growth in profitability than the industry growth rate Income shares: These stocks belong to Cos. that have stable operations and pay regular dividend Defensive shares: relatively unaffected by market movements.

- 4. Cyclical shares: The business cycle affects cyclical shares eg. Automotive sector shares Speculative shares: shares that have a lot of speculative trading in them are referred to as speculative shares.

- 5. Fixed Income Securities Preference shares: are hybrid. Their claims on the Cos. income are limited and they receive a fixed dividend like bonds. In the event of liquidation of the Co., their claims on the assets of the firm are also fixed. Like equity, it is a perpetual liability of the Co. The decision to pay dividend is discretionary unlike in bonds where it is mandatory. Preference dividend is tax exempt.

- 6. Debentures: Investors have to hold on till maturity. These reasons contribute towards high coupon rates on debentures.

- 7. Bonds: They are issued by PSUs. The value of the bond in the market depends upon the interest rate and the maturity. The coupon rate is the nominal interest rate offered on the bonds. Being contractual it cannot be changed during the tenure of the instrument.

- 8. Government Securities Securities issued by the central govt, state govt and quasi-govt agencies are known as govt securities or gilt-edged securities. The rate of interest on these securities is relatively lower because of their high liquidity and safety.

- 9. Money market securities Money market securities have a short term maturity say less than a year. Treasury bill: It is an instrument of short-term borrowing by the Govt. of India. Generally T-bills are of 91 days. Interest rates are low

- 10. Commercial papers: It is a short term negotiable instrument with a fixed maturity period. It is an unsecured promissory note issued by the Co. either directly or through banks. CP can be issued for maturities between min 7 days and a max of up to one yr . The CPs are sold at discount and redeemed at their face value. The denomination of commercial paper is high and hence mostly favored by Cos. and institutional investors.

- 11. Certificate of deposit: It is a marketable receipt of funds deposited in a bank for a fixed period at a specified rate of interest. It is a readily negotiable instrument. The denominations of the CD and the interest rate on them are high. It is mainly preferred by institutional investors and Cos. more than by individuals. Min deposit that could be accepted from a single subscriber should not be less than Rs. 1 lakh and in multiples of Rs. 1 lakh thereafter.

- 12. The maturity period of CDs issued by banks should not be less than 7 days and not more than 1 year. The FIs can issue CDs for a period not less than 1 yr. and not exceeding 3 yrs from the date of issue.

- 13. Deposits They earn a fixed rate of return. They are not negotiable instruments. Bank Deposits: Risk averse investors prefer bank deposits. Current A/c does not offer any interest. Savings A/c offers very low interest rate Fixed deposit A/c carries high interest rate but money maybe locked in for a fixed period. They are considered safe because of RBI regulation.

- 14. NBFC Deposits: comes under the purview of RBI In spite of strict rules and regulations laid down by RBI the default rate is high. To improve liquidity the percentage of liquid assets required to be maintained by them has been enhanced by RBI.

- 15. Post office Monthly Income Account Scheme From 1.4.2017, interest rates are as follows:- 7.60% per annum payable monthly. In multiples of INR 1500/- Maximum investment limit is INR 4.5 lakhs in single account and INR 9 lakhs in joint account. An individual can invest maximum INR 4.5 lakh in MIS (including his share in joint accounts) For calculation of share of an individual in joint account, each joint holder have equal share in each joint account. Account may be opened by individual. Account can be opened by cash/cheque and in case of cheque the date of realization of cheque in Govt. account shall be date of opening of account. Nomination facility is available at the time of opening and also after opening of account.

- 16. • Account can be opened in the name of minor and a minor of 10 years and above age can open and operate the account. • Joint account can be opened by two or three adults. • All joint account holders have equal share in each joint account. • Maturity period is 5 years from 1.12.2011. • Can be prematurely en-cashed after one year but before 3 years at the discount of 2% of the deposit and after 3 years at the discount of 1% of the deposit. (Discount means deduction from the deposit.) • A bonus of 5% on principal amount is admissible on maturity in respect of MIS accounts opened on or after 8.12.07 and up to 30.11.2011. No bonus is payable on the deposits made on or after 1.12.2011.

- 17. 15 year Public Provident Fund A/c From 1.4.2017, interest rates are as follows:- 7.9% per annum (compounded yearly). Minimum INR. 500/- Maximum INR. 1,50,000/- in a financial year. Deposits can be made in lump-sum or in 12 installments. An individual can open account with INR 100/- but has to deposit minimum of INR 500/- in a financial year and maximum INR 1,50,000/- Joint account cannot be opened. Account can be opened by cash/cheque and In case of cheque, the date of realization of cheque in Govt. account shall be date of opening of account. Nomination facility is available at the time of opening and also after opening of account. Account can be transferred from one post office to another.

- 18. Maturity period is 15 years but the same can be extended within one year of maturity for further 5 years and so on. Maturity value can be retained without extension and without further deposits also. Premature closure is not allowed before 15 years. Deposits qualify for deduction from income under Sec. 80C of IT Act. Interest is completely tax-free.

- 19. Withdrawal is permissible every year from 7th financial year from the year of opening account.. Loan facility available from 3rd financial year. No attachment under court decree order. The PPF account can be opened in a Post Office which is Double handed and above.

- 20. Senior Citizen’s Savings Scheme From 1.4.2016, interest rates are as follows:- 8.6 % per annum, payable from the date of deposit of 31st March/30th Sept/31st December in the first instance & thereafter, interest shall be payable on 31st March, 30th June, 30th Sept and 31st December. There shall be only one deposit in the account in multiple of INR.1000/- maximum not exceeding INR 15 lakh. An individual of the Age of 60 years or more may open the account. An individual of the age of 55 years or more but less than 60 years who has retired on superannuation or under VRS can also open account subject to the condition that the account is opened within one month of receipt of retirement benefits and amount should not exceed the amount of retirement benefits. Maturity period is 5 years.

- 21. • A depositor may operate more than one account in individual capacity or jointly with spouse (husband/wife). • Account can be opened by cash for the amount below INR 1 lakh and for INR 1 Lakh and above by cheque only. • Nomination facility is available at the time of opening and also after opening of account. • Joint account can be opened with spouse only and first depositor in Joint account is the investor. • In case of SCSS accounts, quarterly interest shall be payable on 1st working day of April, July, October and January. • Premature closure is allowed after one year on deduction of an amount equal to1.5% of the deposit & after 2 years 1% of the deposit. • After maturity, the account can be extended for further three years within one year of the maturity by giving application in prescribed format. In such cases, account can be closed at any time after expiry of one year of extension without any deduction. TDS is deducted at source on interest if the interest amount is more than INR 10,000/- p.a. Investment under this scheme qualifies for the benefit of Section 80C of the Income Tax Act, 1961 from 1.4.2007

- 22. Kisan Vikas Patra Amount Invested doubles in 110 months (9 years & 2 months) • Available in denominations of Rs 1,000, 5000, 10,000 and Rs 50,000. Minimum deposit Rs 1000/- and no maximum limit. • Certificate can be purchased by an adult for himself or on behalf of a minor or by two adults. • KVP can be purchased from any Departmental Post office. • Facility of nomination is available. • Certificate can be transferred from one person to another and from one post office to another. • Certificate can be encashed after 2 & 1/2 years from the date of issue.

- 23. National Savings Certificate 5 years(VIII Issue) From 1.4.2016, interest rates are as follows:- 8.1% compounded six monthly but payable at maturity. INR. 100/- grows to INR 147.61 after 5 years. Minimum INR. 100/- No maximum limit available in denominations of INR. 100/-, 500/-, 1000/-, 5000/- & INR. 10,000/-.. A single holder type certificate can be purchased by, an adult for himself or on behalf of a minor or by a minor. Deposits qualify for tax rebate under Sec. 80C of IT Act. The interest accruing annually but deemed to be reinvested under Section 80C of IT Act.

- 24. Post office Time deposit scheme Interest payable annually but calculated quarterly. From 1.4.2016, interest rates are as follows:- Period Rate 1yr.A/c 7.1% 2yr.A/c 7.2% 3yr.A/c 7.4% 5yr.A/c 7.9% Minimum INR 200/- and in multiple thereof. No maximum limit. Account may be opened by individual.

- 25. Post office savings A/c Salient Features: Rate of interest 4.0% per annum Minimum amount Rs 20/- for opening. Account can be opened by cash only. Min balance to be maintainedin a non-cheque facility account is INR 50/-. Cheque facility available if an account is opened with INR 500/- and for this purpose minimum balance of INR 500/-in an account is to be maintained. Interest earned is Tax Free up to INR 10,000/- per year from financial year 2012-13. Nomination facility is available

- 26. Sukanya Samriddhi Account Rate of interest 8.6% Per Annum(w.e.f 1-4- 2016),calculated on yearly basis ,Yearly compounded. Minimum INR. 1000/-and Maximum INR. 1,50,000/- in a financial year. Subsequent deposit in multiple of INR 100/- Deposits can be made in lump-sum No limit on number of deposits either in a month or in a Financial year m No limit on number of deposits either in a month or in a Financial year

- 27. A legal Guardian/Natural Guardian can open account in the name of Girl Child. • A guardian can open only one account in the name of one girl child and maximum two accounts in the name of two different Girl children. • Account can be opened up to age of 10 years only from the date of birth. For initial operations of Scheme, one year grace has been given. With the grace, Girl child who is born between 2.12.2003 &1.12.2004 can open account up to1.12.2015. • If minimum Rs 1000/- is not deposited in a financial year, account will become discontinued and can be revived with a penalty of Rs 50/- per year with minimum amount required for deposit for that year.

- 28. Partial withdrawal, maximum up to 50% of balance standing at the end of the preceding financial year can be taken after Account holder’s attaining age of 18 years. • Account can be closed after completion of 21 years. • Normal Premature closure will be allowed after completion of 18 years /provided that girl is married.

- 29. Life Insurance Life Insurance is a contract for payment of a sum of money to the person assured (or to the person entitled to receive the same) on the happening of the event insured against. Ususally , the contract provides for the payment of an amount on the date of maturity or at a specified dates at regular intervals or if death occurs.

- 30. Life Insurance Major advantages : Protection: full protection against risk of death of the saver. The full assured sum is paid. Easy payments: Premiums can be paid in easy installments through monthly, quarterly, half yearly or yearly mode. Liquidity: Loans can be raised on the security of the policy Tax relief: Premiums paid are tax free (max. upto Rs 1 lakh)

- 31. Endowment Policy It covers the risk for a period specified by the insurer. A certain portion of the premium gets invested and generates a certain return every year. This return is declared as bonus. At the end of the specified period, the sum assured is paid back to the policy holder, along with the bonus accumulated during the term of the policy. Unlike whole life, an endowment life insurance policy is designed primarily to provide a living benefit during the lifetime of the individual and secondarily to provide for life insurance

- 32. Therefore, it is more of an investment than a whole life policy. The premium for an endowment life policy is higher than that for a whole life policy.

- 33. Whole life policy It remains in force as long as the policy holder is alive. The risk is covered for the entire life of the policy holder. The whole life policy amount and the bonus are payable to the nominee of the beneficiary upon the death of the policy holder. The policy holder is not entitled to receive any money during his lifetime i.e. there is no survival benefit.

- 34. Term life policy It is the purest form of life insurance. If the insured person passes away, the family is protected by a certain amount. The policy is taken for a chosen period and the risk is covered for that period only. A term plan meets the needs of people who are initially unable to pay the larger premium required for a whole life or an endowment assurance policy. If the premium is not paid within the grace period, the policy will lapse without acquiring any paid-up value. The policy holder may survive the term, but the risk cover comes to an end.

- 35. Money back policy A portion of the sum assured is paid to the policyholder in the form of survival benefit at fixed intervals before the maturity date. If the policy holder survives till the end of the policy term, the survival benefits would be deducted from the maturity value. In the event of death at any time within the policy term, the death claim comprises the full sum assured without dedcution of survival benefit amounts that might have already been paid . Bonus is calculated on the full sum assured.

- 36. ULIP It is a market linked insurance plan. In ULIP premium gets invested in equity along with corporate bonds and G-secs. Life insurance premium deductible under Sec 80C

- 37. Mutual Funds Mutual funds are a vehicle to mobilize moneys from investors, to invest in different markets and securities, in line with the investment objectives agreed upon, between the mutual fund and the investors. Mutual fund schemes announce their investment objective and seek investments from the public. Depending on how the scheme is structured, it may be open to accept money from investors, either during a limited period only, or at any time.