Stock Investment Tips Recommendation 17-01-2014

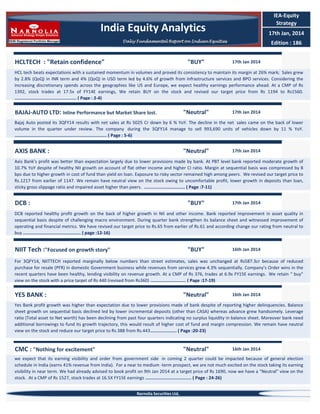

- 1. IEA-Equity Strategy India Equity Analytics 17th Jan, 2014 Daliy Fundamental Report on Indian Equities HCLTECH : "Retain confidence" "BUY" Edition : 186 17th Jan 2014 HCL tech beats expectations with a sustained momentum in volumes and proved its consistency to maintain its margin at 26% mark; Sales grew by 2.8% (QoQ) in INR term and 4% (QoQ) in USD term led by 4.6% of growth from Infrastructure services and BPO services. Considering the increasing discretionary spends across the geographies like US and Europe, we expect healthy earnings performance ahead. At a CMP of Rs 1392, stock trades at 17.5x of FY14E earnings, We retain BUY on the stock and revised our target price from Rs 1194 to Rs1560. ............................................... ( Page : 2-4) BAJAJ-AUTO LTD: Inline Performance but Market Share lost. "Neutral" 17th Jan 2014 Bajaj Auto posted its 3QFY14 results with net sales at Rs 5025 Cr down by 6 % YoY. The decline in the net sales came on the back of lower volume in the quarter under review. The company during the 3QFY14 manage to sell 993,690 units of vehicles down by 11 % YoY. ...................................................................... ( Page : 5-6) AXIS BANK : "Neutral" 17th Jan 2014 Axis Bank’s profit was better than expectation largely due to lower provisions made by bank. At PBT level bank reported moderate growth of 10.7% YoY despite of healthy NII growth on account of flat other income and higher CI ratio. Margin at sequential basis was compressed by 8 bps due to higher growth in cost of fund than yield on loan. Exposure to risky sector remained high among peers. We revised our target price to Rs.1217 from earlier of 1147. We remain have neutral view on the stock owing to uncomfortable profit, lower growth in deposits than loan, sticky gross slippage ratio and impaired asset higher than peers. ............................... ( Page :7-11) DCB : "BUY" 17th Jan 2014 DCB reported healthy profit growth on the back of higher growth in NII and other income. Bank reported improvement in asset quality in sequential basis despite of challenging macro environment. During quarter bank strengthen its balance sheet and witnessed improvement of operating and financial metrics. We have revised our target price to Rs.65 from earlier of Rs.61 and according change our rating from neutral to buy ............................................ ( page :12-16) NIIT Tech :"Focused on growth story" "BUY" 16th Jan 2014 For 3QFY14, NIITTECH reported marginally below numbers than street estimates, sales was unchanged at Rs587.3cr because of reduced purchase for resale (PFR) in domestic Government business while revenues from services grew 4.3% sequentially. Company’s Order wins in the recent quarters have been healthy, lending visibility on revenue growth. At a CMP of Rs 376, trades at 6.9x FY15E earnings. We retain “ buy” view on the stock with a price target of Rs 440 (revised from Rs360) ........................... ( Page :17-19) YES BANK : "Neutral" 16th Jan 2014 Yes Bank profit growth was higher than expectation due to lower provisions made of bank despite of reporting higher delinquencies. Balance sheet growth on sequential basis declined led by lower incremental deposits (other than CASA) whereas advance grew handsomely. Leverage ratio (Total asset to Net worth) has been declining from past four quarters indicating no surplus liquidity in balance sheet. Moreover bank need additional borrowings to fund its growth trajectory, this would result of higher cost of fund and margin compression. We remain have neutral view on the stock and reduce our target price to Rs.388 from Rs.443.................... ( Page :20-23) CMC : "Nothing for excitement" "Neutral" 16th Jan 2014 we expect that its earning visibility and order from government side in coming 2 quarter could be impacted because of general election schedule in India (earns 41% revenue from India). For a near to medium -term prospect, we are not much excited on the stock taking its earning visibility in near term. We had already advised to book profit on 9th Jan 2014 at a target price of Rs 1690, now we have a “Neutral” view on the stock. At a CMP of Rs 1527, stock trades at 16.5X FY15E earnings ................................... ( Page : 24-26) Narnolia Securities Ltd,

- 2. HCLTECH "BUY" 17th Jan' 14 "Retain confidence" Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 1392 1560 1194 12% 30.7% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 532281 HCLTECH 1398/653 97287 1193062 6319 Stock Performance 1M 17.8 15.4 Absolute Rel. to Nifty 1yr 109.4 105.1 YTD 149.1 131 Share Holding Pattern-% Promoters FII DII Others Current 61.84 26.01 5.70 6.45 1 year forward P/E 4QFY13 61.92 24.45 6.49 7.14 3QFY13 61.99 24.32 6.56 7.13 HCL tech beats expectations with a sustained momentum in volumes and proved its consistency to maintain its margin at 26% mark; Following the successive 10th quarter, again company witnessed healthy growth in 2QFY14 than street expectation. Sales grew by 2.8% (QoQ) in INR term and 4% (QoQ) in USD term led by 4.6% of growth from Infrastructure services and BPO services. During the quarter, the company has crossed the landmark of USD5bn. PAT grew by 5.6 %(QoQ) in INR term and 7.1% (QoQ) in USD term. The company continues to lead the industry in profitable growth, with 11 successive quarters of net income margin expansion, having reported 55% growth in Net Income on Yearly basis. Management is confident to focus on vendor consolidation and cost control activities to maintain its growth story. Stable Margin: During the quarter, its EBITDA Margin was almost flat at 26% and good thing is, company has been able to maintain its range of 25-26% for its margin. PAT margin improved by 50bps to 18.3%, sequentially. Segmental Performance: Infrastructure Services (contributes 34% of sales) continued to lead with growth at 4.6%, and BPO services (contributes 5% of sales) grew by 10%(QoQ)followed by Enterprise Application at 1.6%, Custom Application Services at 1.4% and Engineering/ R&D Services at 1%, respectively. Mixed performance across verticals: The Company contributed strong growth in the Retal and manufacturing verticals. Retail & CPG and Manufacturing’s revenue growth up by 6.5% and 3.7% respectively and Financial Services up by 2.4%. While growth from Healthcare and Other services declined by 5.2% and 16.1% respectively. Healthy deal pipeline: During the quarter, HCL Tech reported an addition of 15 transformational deals in the US and Europe for the December quarter. These wins have been in the momentum markets of manufacturing and Financial Services as well as the emerging momentum markets of life sciences & Healthcare and Public Services. Across the geographies, USA and Europe remain best to drive deal wins during the quarter because of healthy scenario of demand environment. View and Valuation: HCL tech’s decent level of utilization, focused on cost control and utilization of new market opportunities through vendor’s consolidation would provide a new shape to the company in near future. On performance front, it continues to be bullish on the rebid market and bullish on short-term to medium term, momentum on deals pipeline also looking robust. Considering the increasing discretionary spends across the geographies like US and Europe, we expect healthy earnings performance ahead. At a CMP of Rs 1392, stock trades at 17.5x of FY14E earnings, We retain BUY on the stock and revised our target price from Rs 1194 to Rs1560. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 2QFY14 8184 2125 1495 26.0% 18.3% 1QFY14 7961 2093 1416 26.3% 17.8% (QoQ)-% 2.8 1.5 5.6 (30bps) 50bps 1QFY13 6273.8 1417 965 22.6% 15.4% Rs, Crore (YoY)-% 30.4 50.0 54.9 340bps 290bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 2

- 3. HCLTECH Sales(USD term) and Sales growth-%(QoQ) In dollar terms, the revenues grew by 4% QoQ (cc terms 3.1%) to USD 1321mn and net profit grew by 7.1% QoQ to USD 241.6mn. (Source: Company/Eastwind) Margin-% Tha company expects to maintain EBIT margin at 18.5-19.5% in FY14 (Source: Company/Eastwind) Clients Metrics Clients Contribution . Top 5 Clients Top 10 Clients Top 20 Clients 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 15.3% 15.8% 16.0% 16.4% 16.2% 15.7% 15.4% 15.4% 24.1% 24.2% 24.3% 24.7% 24.5% 24.2% 24.0% 23.8% 34.2% 33.9% 33.9% 34.1% 33.6% 33.3% 32.8% 33.0% 1QFY14 15.1% 23.8% 33.2% 2QFY14 14.8% 23.8% 33.6% Employee Metrics . No of Employee Gross Addition Attrition 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 70321 72055 72474 74675 75621 75226 74226 74912 87196 88332 6927 4931 3303 5274 4479 3291 2933 4316 8061 7593 15.9% 15.7% 15.0% 14.0% 13.6% 13.6% 14.2% 14.9% 16.10% 16.6% Utilization rate Utilization down from 84.9% to 84.1%. Further, it's Utilization are at decent levels, indicated can still derive more efficiency . (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 3

- 4. HCLTECH Key facts from Con-Call The company is expecting to catch up more deal from US and Europe because of better demand environment ahead. Clients are looking vendor’s consolidation, and company will try to turn this opportunity into deal. The company expects to see margin at a range of 21-22% in near term. The wage hike is spread over two quarters or rather more than two quarters. Q3 and Q4 margin could be impact be 30bps. The infrastructure business is largely under penetrated globally, less than 5% from an Indian (vendor's) standpoint. They expect to see significant growth over there, in that business and expect to raise infrastructure services margins by supporting customers migrating to cloud computing. Financials; Rs, Cr Net Sales-USD Net Sales Raw Materials Cost Employee Cost Operation and other expenses Total Expenses EBITDA Depreciation Other Income Extra Ordinery Items EBIT Interest Cost PBT Tax PAT Growth-% Sales-USD Sales EBITDA PAT Margin -% EBITDA EBIT PAT Expenses on Sales-% Employee Cost RM Cost Operation and other expenses Tax rate Valuation CMP No of Share NW EPS BVPS RoE-% Dividend Payout ratio P/BV P/E FY10 2704.6 12136.3 443.6 6253.7 3498.5 10195.7 1940.6 418.1 154.1 0.0 1522.5 204.1 1472.4 213.4 1259.0 FY11 3545.3 15730.3 522.1 8589.6 4163.2 13274.9 2455.4 459.7 299.7 0.0 1995.7 142.6 2152.8 488.5 1664.3 FY12 4151.5 20830.6 612.0 11104.6 5418.8 17135.3 3695.2 549.2 206.5 0.0 3146.0 142.6 3209.8 782.7 2427.1 FY13 4686.5 25581.1 959.3 12574.2 6386.4 19919.9 5661.2 636.8 306.6 44.5 5024.4 105.6 5269.9 1225.3 4044.6 FY14E 5379.7 32278.2 968.3 16139.1 7101.2 24208.6 8069.5 748.6 511.6 -484.2 7320.9 79.2 7269.1 1744.6 5524.5 FY15E 6492.2 38628.3 1158.8 19507.3 8691.4 29357.5 9270.8 903.4 645.6 77.3 8367.3 59.4 9030.8 2212.5 6818.2 24.1% 18.6% 5.9% -4.6% 31.1% 29.6% 26.5% 32.2% 17.1% 32.4% 50.5% 45.8% 12.9% 22.8% 53.2% 66.6% 14.8% 26.2% 42.5% 36.6% 20.7% 19.7% 14.9% 23.4% 16.0% 12.5% 10.4% 15.6% 12.7% 10.6% 17.7% 15.1% 11.7% 22.1% 19.6% 15.8% 25.0% 22.7% 17.1% 24.0% 21.7% 17.7% 51.5% 3.7% 28.8% 14.5% 54.6% 3.3% 26.5% 22.7% 53.3% 2.9% 26.0% 24.4% 49.2% 3.8% 25.0% 23.3% 50.0% 3.0% 22.0% 24.0% 50.5% 3.0% 22.5% 24.5% 364.9 67.9 6288.8 18.5 92.6 20.0% 25.0% 3.94 19.68 493.5 68.9 7653.0 24.2 111.1 21.7% 31.5% 4.44 20.43 490.0 69.3 9837.9 35.0 141.9 24.7% 33.1% 3.45 13.99 759.5 69.6 13164.0 58.1 189.1 30.7% 24.2% 4.02 13.07 1392.0 69.6 17548.4 79.4 252.1 31.5% 20.6% 5.52 17.54 1392.0 69.6 23226.5 97.9 333.7 29.4% 16.7% 4.17 14.21 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 4

- 5. BAJAJ-AUTO LTD. "NEUTRAL" 17th Jan' 14. Inline Performance but Market Share lost. Result Update Neutral CMP Target Price Previous Target Price Upside Change from Previous 1908 1870 - Market Data BSE Code 532977 NSE Symbol 52wk Range H/L Mkt Capital (Rs, Cr) Average Daily Volume Nifty BAJAJ-AUTO 2193/1657 55,208 197712 6318 1M 0.2 -1.8 1yr -9.0 -14.0 YTD 13.0 -5.0 Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY1 4 50.0 50.0 50.0 18.7 17.8 17.4 6.9 7.8 7.7 24.4 24.4 24.8 One Yr Price Movement Bajaj Auto posted its 3QFY14 results with net sales at Rs 5025 Cr down by 6 % YoY. The decline in the net sales came on the back of lower volume in the quarter under review. The company during the 3QFY14 manage to sell 993,690 units of vehicles down by 11 % YoY. The total number of 2W sold during the quarter was 887,671 units down by 10 %YoY. The company during the quarter sold 106,019 units of 3W down by 25 % YoY. The company during 3QFY14 also have lost 3% market share. The operating EBITDA during the quarter came at Rs 1135 Cr and OPM was 22.1 % however the company have gained Rs 95 Cr towards time value of foreign exchange contracts. Therefore adjusted OPM stands at 21 %.The company during the quarter managed to hold its prices across its models which helps to maintain its OPM levels at early twenties range. The realization of dollar for the quarter was at Rs 62. The net profits of the company for 3QFY14 came at Rs 905 Cr and NPM at 17.6 %.The other income for the quarter came at Rs 222 Cr and Tax Rate was 31 %. Stock Performance-% Absolute Rel. to Nifty Declined Sales Growth ; Loss in Market Share ; Maintained EBITDA Margin; Not so Optimistic guidance.. The realization per vehicle for the quarter was at Rs 50567 and it was Rs 47060 for the same time last fiscal. Management Commentary The management of the company after results said that they donot look significant change in industry outlook going forward. The management stated that though they have lost nearly 3 % of market share during the quarter however are hopeful to regain it on the back of 125 cc discover bike (Launched way back in Nov 2013) and another forthcoming launch in March 2014.The company further said that they donot see OPM to cross 21% levels in near term. The company reiterated that they will not foray in scooter segments. View & Valuation The stock is trading at Rs 1908 and it has achieved our previous target price of Rs 2100, we have turned to neutral for the stock post our target price achievement .The 3QFY14 results are not much strong to make a convincing thought more over the management of company has not hinted relatively stronger business outlook going forward. Post analysis of 3QFY14 results and management commentary does not make any strong conviction and maintain our NEUTRAL view for the stock with Target Price of Rs 1870. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 5131 1135 905 22.1% 17.6% 2QFY14 5175 1132 837 21.9% 16.2% (QoQ)-% (0.9) 0.3 8.1 20bps 150bps 3QFY13 5413 1012 819 18.7% 15.1% Rs, Crore (YoY)-% -5.2 12.2 10.5 340bps 250bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 5

- 6. BAJAJ-AUTO LTD. SALES & PAT TREND The decline in the net sales in the quarter came on the back of lower volume sales. (Source: Company/Eastwind) OPM & NPM TREND The company during the quarter managed to hold its prices across its models which helps to maintain its OPM levels at early twenties range (Source: Company/Eastwind) Volume Trend The total number of 2W sold during the quarter was 887,671 units down by 10 %YoY. The company during the quarter sold 106,019 units of 3W down by 25 % YoY. (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 6

- 7. AXIS BANK Result Updated CMP Target Price Previous Target Price Upside Change from Previous NEUTRAL 1173 1217 1147 4 6 Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 532215 AXISBANK 1549/764 55229 5.19 lakh 6318 "NEUTRAL " 16th Jan, 2014 Bank’s profitability was better than expectation largely due to lower provisions. At operating profit level bank registered moderate growth of 10.7% YoY led higher Cost Income ratio and flat other income despite of healthy NII growth. Bank’s exposure to risky sector (Power+ Infrastructure) remained at 12.87% higher among peers. However retail growth in advance would help bank to keep NIM at high but lower growth in deposits especially in CA and term deposits remain a cause of worry. We revised our target price to Rs.1217 from earlier of 1147. We remain have neutral view on the stock owing to uncomfortable profit, lower growth in deposits than loan, sticky gross slippage ratio and impaired asset higher than peers. Healthy NII growth on the back of higher CD ratio and margin expansion on YoY basis Bank reported NII growth of 19.6% YoY to Rs.2984 cr versus expectation of Rs.3006 cr due to lower than expected loan growth and lower loan yield. NIM margin Stock Performance 1M Absolute -6.3 Rel.to Nifty -9.2 1yr -15.1 -20.0 YTD -15.1 -20.0 expansion on year to year basis along with higher credit deposits ratio helped bank to report fairly stable interest income. Cost of deposits was by and large stable at 7.3% led by CASA deposits growth. Other income grew by 2% YoY taking revenue growth of 12.6% YoY despite of healthy growth in NII. Share Holding Pattern-% Current 4QFY13 3QFY1 3 Promoters 33.9 33.9 33.9 FII 43.2 43.4 40.7 DII 9.7 4.9 8.8 Others 13.2 17.8 16.6 Axis Bank Vs Nifty CI ratio marginally increased but still comfortable Cost Income ratio increased marginally to 43.5% from 42.5% in 3QFY13 but remained comfortable as operating leverage stable at 0.55%. Employee cost and other operating cost increased by 6.5% and 20% respectively. Higher growth in other operating cost was on account of 96 branches and 532 ATMs added during the third quarter. In the absence of healthy other income and higher CI ratio, operating profit grew by 10.7% YoY to Rs.2615 cr. Inch up deterioration in asset quality During quarter bank reported inch up deterioration in asset quality with GNPA in absolute term increased by 10% QoQ to Rs.3008 cr whereas as provisions (loan loss) increased by 6% QoQ basis. As the result net NPA in absolute term increased by 20% QoQ. In percentage term GNPA and net NPA stood at 0.47% and 0.9% against 0.42% and 0.9% in 2QFY14. Gross slippage ratio for the quarter was 1.1%. Bank reported recoveries were Rs.122 cr write-off were Rs.193 cr. Outstanding restructure assets at the end of quarter was Rs.4900 cr which was 2.32% of net advance, higher among peers. Rs, Cr Financials 2011 2012 2013 2014E 2015E NII 6566 8026 9666 12224 14775 Total Income 11238 13513 16217 19146 21697 PPP 6377 7413 9303 11206 12367 Net Profit 3340 4224 5179 5826 6934 EPS 81.4 102.2 110.7 124.2 148.2 (Source: Company/Eastwind) 7 Narnolia Securities Ltd,

- 8. AXIS BANK Loan growth higher than deposits growth; CASA remain healthy On balance sheet front, bank’s advance grew by 18% YoY as against our expectation of 20% led retail advance growth of 44% YoY followed by SME (25% YoY) and agriculture (15% YoY) growth. Deposits grew by 7% YoY versus expectation of 16%. Lower deposits growth was primarily due to muted growth in current account and term deposits which were reported 5% and 3% YoY growth respectively. Saving deposits grew by 23% YoY taking overall deposits growth to 7%. CASA deposits registered growth of 250 bps YoY to 42.6%. A credit deposit for the quarter was high at 80.6% implying some dependency on other than deposits. Borrowings as a percentage of NDTL (net demand time liability) increased to 15.6% from 13.7% in 3QFY13 but still at comfortable level (above of HDFC bank and below of ICICI bank). Bank is able to maintain its cost of fund under control basically from high base of CASA deposits. Margin compression on sequential basis due to declined loan yield as compare to cost of fund Sequentially NIM was declined by 8 bps to 3.71% from 3.79% due to declined of loan yield as compare to cost of fund. Loan yield was 10.5% versus 10.7% in previous quarter whereas cost of fund remains stable at 6.3%. Deposits cost (EW Calculation) other than borrowing increased marginally to 6.18% from 6.16% on sequential basis. We do not see margin compression >10 bps in next couple of quarters because of low cost deposits (CASA) support and increasing share of high yield retail advance. Valuation & View Bank’s profitability was better than expectation largely due to lower provisions. At operating profit level bank registered moderate growth of 10.7% YoY led higher Cost Income ratio and flat other income despite of healthy NII growth. Bank’s exposure to risky sector (Power+ Infrastructure) remained at 12.87% higher among peers. However retail growth in advance would help bank to keep NIM at high but lower growth in deposits especially in CA and term deposits remain a cause of worry. We revised our target price to Rs.1217 from earlier of 1147. We remain have neutral view on the stock owing to uncomfortable profit, lower growth in deposits than loan, sticky gross slippage ratio and impaired asset higher than peers. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 8

- 9. AXIS BANK Fundamenatl throught graph NII growth led by healthy CD ratio and margin expansion on YoY basis Lower other income and higher CI ratio led muted PPP growth Profit growth was higher than expectation on the back of lower provisions Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 9

- 10. AXIS BANK Quarterly Result Quarterly Result Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions PBT Tax Net Profit 3QFY14 5557 2110 49 73 7789 1644 4628 4805 2984 1644 4628 655 1358 2013 2615 202 2413 808 1604 2QFY14 5394 2143 35 37 7609 1766 4703 4672 2937 1766 4703 644 1309 1953 2750 687 2062 700 1362 Balance Sheet Date Net Worth Deposits Loan 37649 36224 27027 262398 255365 244501 211467 201303 179504 Asset qualtiy( Rs Cr) GNPA NPA %GNPA %NPA 3008 1003 1.4 0.5 2734 838 1.4 0.4 3QFY13 % YoY Gr % QoQ Gr 3QFY14E Variation 4907 13.3 3.0 5748 3.4 2014 4.8 -1.5 2235 5.9 25 97.7 39.4 35 -29.2 19 277.1 95.6 38 -47.4 6965 11.8 2.4 8056 3.4 1615 1.8 -6.9 1774 7.9 4110 12.6 -1.6 4780 3.3 4470 7.5 2.8 5049 5.1 2495 19.6 1.6 3006 0.8 1615 1.8 -6.9 1774 7.9 4110 12.6 -1.6 4780 3.3 615 6.5 1.7 0 1134 19.8 3.8 0 1749 15.1 3.1 2008 -0.3 2362 10.7 -4.9 2772 6.0 387 -47.7 -70.5 752 271.4 1975 22.2 17.0 2020 -16.3 628 28.8 15.5 687 -15.0 1347 19.1 17.7 1333 -16.9 2275 679 1.3 0.4 39.3 3.9 7.3 2.8 17.8 5.0 32.2 10.0 47.8 19.7 37558 272935 214892 -0.2 4.0 1.6 - Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 10

- 11. AXIS BANK FINANCIALS & ASSUPTION Income Statement 2011 2012 2013 2014E 2015E Interest Income Interest Expense NII Change (%) Non Interest Income Total Income Change (%) Operating Expenses Pre Provision Profits Change (%) Provisions PBT PAT Change (%) 15155 8589 6566 31.2 4671 11238 25.3 4860 6377 22.4 3033 3345 3340 34.8 21995 13969 8026 22.2 5487 13513 20.2 6100 7413 16.2 3189 4224 4224 26.5 27183 17516 9666 20.4 6551 16217 20.0 6914 9303 25.5 4124 5179 5179 22.6 31198 18974 12224 26.5 6922 19146 18.1 7940 11206 20.5 2402 8804 5826 12.5 38490 23716 14775 20.9 6922 21697 13.3 9330 12367 10.4 2461 9906 6934 19.0 189166 34 77758 18 26268 71788 142408 36 219988 16 91412 18 34072 92921 169760 19 252614 15 112100 23 43951 113738 196966 16 290506 15 124917 11 51266 129873 228481 16 334081 15 143655 15 58956 149354 265037 16 460 1404 3.1 549 1146 2.1 708 1304 1.8 813 1174 1.4 942 1174 1.2 Balance Sheet Deposits( Rs Cr) Change (%) of which CASA Dep Change (%) Borrowings( Rs Cr) Investments( Rs Cr) Loans( Rs Cr) Change (%) Valuation Book Value CMP P/BV Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 11

- 12. DCB "BUY" 17th Jan,2014 Result Updated CMP Target Price Previous Target Price Upside Change from Previous BUY 59 65 62 10 5 DCB reported healthy profit growth with the support of robust NII along with other income. We note that bank’s operating as well as financial metrics has been improving continuously. Although on CASA front, we disappointed little bit but continuous decreasing dependency on addition fund (borrowing as a percentage of net demand time liability) would keep NIM at current level. Improvement of asset quality along with comfortable PCR would provide cushion to its earnings. We have revised our target price from Rs.61 to Rs.65 and recommend buy. Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 532772 DCB 60.55/38.05 1475 13.76 lakh 6318 Asset quality improved despite of tight macro environment During this quarter, bank made total provision (includes loan loss, investment depreciation, standard asset, restructure assets etc) of Rs.10 cr versus Rs.7 cr in previous quarter and Rs.5 cr in last quarter. On sequential basis gross NPA improved by 12% to 208 cr from Rs.235 cr. In percentage of gross advance GNPA for the quarter improved to 2.8% from 3.5% in 2QFY14. Bank made lower loan loss provision to the tune of Rs.151 cr versus Rs.178 cr in previous quarter. As the result provision coverage ratio was declined from 76% to 72.6% sequentially. Net NPA in absolute term stable with Rs.57 cr and improved to 0.8% from 0.9% of net advances on quarter to quarter basis. Stock Performance 1M Absolute 17.1 Rel.to Nifty 14.2 1yr 15.9 11.0 YTD -15.1 -20.0 Share Holding Pattern-% Current 4QFY13 3QFY1 3 Promoters 18.5 18.5 18.5 FII 11.9 11.4 11.4 DII 15.0 14.1 12.5 Others 54.6 56.1 57.7 DCB Vs Nifty Registered healthy loan and deposits growth, balance sheet consolidated DCB reported higher than expected loan growth of 23.4% YoY to Rs.7362 cr against our expectation of Rs.7125 cr. Deposits grew by 27% YoY led by term deposits growth of 34% YoY. CASA reported growth of 9% YoY but in percentage term, it stood at 24.8% as against 28.9% in 3QFY13. Credit deposits ratio stable at sequential basis at 76.7% versus 76% in previous quarter and 78.9% in 3QFY14. Higher CD ratio during the last quarter was on account of higher dependence on borrowing rather than deposits. Borrowing as a percentage of NDTL (net demand time liability) reduced to 24.8% in 3QFY14 from 28.9% in 3QFY13. Declining share of CASA ratio little disappointed us but bank was able to keep cost of fund under control. We do not see larger impact on NIM due to declined of CASA. Financials NII Total Income PPP Net Profit EPS 2011 189 301 86 21 1.1 2012 228 328 84 55 2.3 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. Rs, Cr 2013 2014E 2015E 284 369 364 401 509 505 126 188 192 102 153 157 4.1 6.1 6.3 (Source: Company/Eastwind) 12

- 13. DCB Robust growth in NII on the back of healthy NII growth and supportive other income DCB in its quarter result reported revenue growth of 25.6% YoY to Rs.125 cr in line with our expectation of Rs.127 cr. Growth in NII was come from sequentially improvement of credit deposits ratio, margin expansion led by higher loan yield in compare to cost of fund. During quarter bank reported NII growth of 30% YoY to Rs.94 against our expectation of Rs.88 cr. Bank reported other income of Rs.328 cr versus Rs.289 cr in last quarter in which commission income was 267 cr registered growth of 20% YoY. Bank has been continuous strengthen its core earnings contribution to total earnings as the ratio of other income to total income has been declining from 20% in 1QFY11 to 10% in 3QFY14. Declining share of other income in total income Rs. Cr 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 Other Income(A) 30 27 26 29 23 23 26 28 28 Total Income(B) 150 155 166 177 185 202 210 221 241 %(A/B) 20 17 16 16 13 11 13 13 11 2QFY13 28 247 11 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 29 33 45 27 33 258 286 306 296 324 11 12 15 9 10 Cost to Income declined sequentially led operating profit growth of 46% YoY Cost to Income ratio was declined to 63.4% from 68.5% in 3QFY13 and 66.2% in 2QFY14 which surprise us positively. We assumed 66% of CI ratio for the quarter but looking at bank’s strategy to keep operating leverage under control we tweak our assumption to 63.2% for FY14. Employee cost and other operating cost increased by 12.7% and 20% YoY respectively. Healthy core earnings, higher other income and lower CI ratio led operating profit growth of 46% YoY. Source: Company/Eastwind Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 13

- 14. DCB Higher profit growth led by healthy revenue growth, sequential improvement of CI ratio and improvement in asset quality With the support of healthy core income, higher other income, sequentially improvement of CI ratio and improving asset quality led net profit growth of 35% YoY to Rs.36 cr as against our expectation of Rs.34. In our earlier note dated 13th Dec.2014 (Private sector banking result preview), we highlighted that DCB, HDFC bank and ICICI bank would report better result. Compression of NIM on account of higher cost of fund rather than growth of loan yield NIM declined 13 bps QoQ to 3.55% from 3.68% largely due to higher growth came in cost of fund than yield on loan. Sequentially cost of fund increased to 7.86% against 7.56% whereas yield on loan increased to 12.96% from 12.73%. Higher cost fund was account of declining share of low cost CASA franchise in total deposits. Valuation & View DCB reported healthy profit growth with the support of robust NII along with other income. We note that bank’s operating as well as financial metrics has been improving continuously. Although on CASA front, we disappointed little bit but continuous decreasing dependency on addition fund (borrowing as a percentage of net demand time liability) would keep NIM at current level. Improvement of asset quality along with comfortable PCR would provide cushion to its earnings. We have revised our target price from Rs.61 to Rs.65 and rate buy from neutral. Source: Eastwind/ Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 14

- 15. DCB Quarterly Result( Rs Cr) 3QFY14 2QFY14 3QFY13 % YoY % QoQ 3QFY14E Variation Interest/discount on advances / bills 222 205 181 23.0 8.3 214 -3.8 Income on investments 63 58 48 32.7 9.6 62 -2.8 Interest on balances with Reserve Bank of India 5 5 1 736.4 -11.7 4 -20.0 Others 0 0 0 -26.8 -5.9 0 Total Interest Income 291 269 229 26.8 8.2 279 -3.9 Others Income 33 27 29 13.6 20.4 36 10.2 Total Income 324 296 258 25.3 9.3 316 -2.5 Interest Expended 197 178 157 25.1 10.9 191 -3.0 NII 94 91 72 30.5 3.0 88 -5.9 Other Income 33 27 29 13.6 20.4 36 10.2 Total Income 127 119 101 25.6 7.0 125 -1.8 Employee 39 39 35 12.7 1.8 0 Other Expenses 41 40 34 20.0 3.4 0 Operating Expenses 80 78 69 16.3 2.6 82 2.2 PPP( Rs Cr) 46 40 32 45.9 15.6 42 -8.6 Provisions 10 7 5 105.5 42.2 9 -14.4 PBT 36 33 27 35.1 9.9 34 -7.0 Tax 0 0 0 0 Net Profit 36 33 27 35.1 9.9 34 -7.0 Balance Sheet (Rs Cr) Net Worth Deposits Loan 1115 9592 7362 1079 8788 6677 969 7558 5964 15.1 26.9 23.4 3.4 9.1 10.3 1113 9203 7125 Asset quality (Rs Cr) GNPA NPA % GNPA % NPA 208 57 2.8 0.8 235 57 3.5 0.9 234 44 3.9 0.7 -11.1 31.1 -11.6 -0.2 - -0.2 -4.1 -3.2 Source: Eastwind/ Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 15

- 16. DCB Income Statement 2010 2011 2012 2013 2014E 2015E Interest Income Interest Expense NII Change (%) Non Interest Income Total Income Change (%) Operating Expenses Pre Provision Profits Change (%) Provisions PBT PAT Change (%) 459 317 142 -28.2 107 249 -21.6 201 48 -36.5 121 -73 -79 -10.1 536 347 189 33.6 112 301 21.2 215 86 79.9 57 29 21 -127.2 717 489 228 20.4 100 328 8.9 244 84 -2.6 29 55 55 157.1 916 632 284 24.9 117 401 22.4 275 126 50.5 24 102 102 85.3 1121 753 369 29.6 140 509 26.8 322 188 48.7 35 153 153 49.7 1241 1088 153 -58.5 140 293 -42.4 182 111 -40.5 0 111 111 -27.0 4787 3 1693 17 504 2018 3460 6 5610 17 1975 17 861 2295 4271 23 6336 13 2035 3 1123 2518 5284 24 8364 32 2272 12 1526 3359 6586 25 9618 15 2710 19 814 3689 7640 16 11061 15 1904 -30 1282 3270 9168 20 Avg. Yield on loans Avg. Yield on Investments Avg. Cost of Deposit Avg. Cost of Borrowimgs 10.4 4.7 5.9 6.8 9.4 5.8 5.2 6.4 10.1 6.9 6.4 7.2 10.8 5.8 6.4 6.4 9.7 6.8 5.9 6.0 9.7 6.8 5.9 6.0 Valuation Book Value CMP P/BV 30 32.2 1.1 31 45.9 1.5 36 45 1.3 40 45 1.1 46 57 1.2 51 57 1.1 Balance Sheet Deposits( Rs Cr) Change (%) of which CASA Dep Change (%) Borrowings( Rs Cr) Investments( Rs Cr) Loans( Rs Cr) Change (%) Ratio Source: Eastwind/ Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 16

- 17. NIIT Tech "BUY" 16th Jan' 14 "Focused on growth story" Result update Buy Below than street expectations, but confident on future growth; CMP Target Price Previous Target Price Upside Change from Previous 376 440 360 17% 22% For 3QFY14, NIITTECH reported marginally below numbers than street estimates, sales was unchanged at Rs587.3cr because of reduced purchase for resale (PFR) in domestic Government business while revenues from services grew 4.3% sequentially. During the quarter, company has been able to maintain healthy order book and eyeing on strong order pipeline. Post earning, management is gearing up for its paradigm shift in growth strategy for the future and set an aspirational target to grow revenues to USD 1 bn in the next 5yrs. They stated that, margins will start seeing improvement from Q4FY14, led by the improvement in the margin from the Geographic Information Systems (GIS) business and the Morris joint venture. PAT declined by 12%(QoQ) impacted by a loss in other income as a result of revaluation of foreign currency assets and liabilities due to period end exchange difference. Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 532541 NIITTECH 399/234 2281 20884 6321 Stock Performance 1M 12.7 10.2 Absolute Rel. to Nifty 1yr 36.3 31.4 YTD 43.3 38.5 Share Holding Pattern-% Promoters FII DII Others Current 31.08 32.35 17.34 19.23 1 year forward P/E 2QFY14 31.19 29.21 19.94 19.66 1QFY14 31.23 29.04 19.67 20.06 Steady margin: EBITDA Margin improved by 120bps (QoQ) to 16.2% on the back of reduction Employee cost by 3.5%, sequentially. Healthy growth traction from US and Europe: The contribution to the total revenues from the U.S. increased to 44% from 41% (up 7%,QoQ) and EMEA stood at 38% from 36%( up 6%, QoQ). The revenue share from rest of the world declined from 23% to 18% (down 22% QoQ). Post result management stated that the demand environment is clearly showing positive signs in the US with the debt issue being the only overhang. Slow deal execution in Government and Insurance projects: Among industry segments, Travel and Transportation contributed to 37% (up by 3%, QoQ), BFS was 17% (up by 21%, QoQ), Government projects declined from 10% to 6% (down by 40%, QoQ) to the revenue mix. Healthy order addition: During the quarter, the company secured a USD 300 million vendor consolidation deal from a top BFSI client for a period of 10 years. It has secured fresh order of USD 377mn versus USD 84mn in 2QFY14. However, in 3Q FY14, order has primarily been in the international market. During the quarter, NIIT Tech forayed into Latin America through its partnership with GRU Aeroporto Internacional de São Paulo (Sao Paolo International Airport), to implement and transform the cargo handling system at the airport. View and Valuation: We expect good growth from Travel & Tourism vertical in FY'14 and the BFSI expected to be softer. However, the MFG and Govt verticals expected to improve going forward. Company’s Order wins in the recent quarters have been healthy, lending visibility on revenue growth. At a CMP of Rs 376, trades at 6.9x FY15E earnings. We retain “ buy” view on the stock with a price target of Rs 440 (revised from Rs360). Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 587.3 95.1 52.5 16.2% 8.9% 2QFY14 587.3 88.6 60.4 15.1% 10.3% (QoQ)-% 0.0 7.3 (13.1) 110bps (120bps) 3QFY13 500.1 81.3 56.6 16.3% 11.3% Rs, Crore (YoY)-% 17.4 17.0 -7.2 (10bps) (140bps) (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 17

- 18. NIIT Tech Sales and PAT growth-%(QoQ) Company expects FY14 to be better than FY13 with respect to both revenue growth and EBIT margin. And also expects stronger growth in the US and Asian markets compared with Europe. Management also expects to see demand environmrnt ahead. (Source: Company/Eastwind) Margin-% It expects the growth momentum will sustain with holding the margins going forward. (Source: Company/Eastwind) Clients Metrics The 3QFY14 witnessed sustained hiring and attrition improved from 12.44% to 13.40% on LTM basis. Managent is very confident to maintain attrition at 12-13% and utilization at 77-80%. (Source: Company/Eastwind) Clients Metrics: During the quarter, Company added 4 new clients, each in BFSI, travel and transportation, manufacturing, and government segment. Employee Metrics: Total headcount increased from 8017 from 8,160 at the end of the quarter. Utilzation declined to 78.4% from 80.3%(2QFY14) because of weak quarter and still, company is good to maintain attrition at a mark of 12-13%, which is better than its peers. Higher DSO: The DSO days were 98 (2QFY14 – 100) during the quarter.In general, the DSO days are typically used to be at 80 days. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 18

- 19. NIIT Tech Operating Metrics; . Banking and Finacial Services Insurance Transport Manufacturing Government Others Sales Mix-Geography Americas EMEA RoW Revenue Concentration % DSO-days Top-5 Top-10 Headcounts No of Headcounts 1QFY13 13% 21% 40% 7% 8% 11% 2QFY13 13% 20% 42% 6% 5% 14% 3QFY13 12% 19% 42% 6% 8% 13% 4QFY13 12% 19% 37% 6% 11% 15% 1QFY14 12% 18% 36% 7% 13% 14% 2QFY14 14% 19% 37% 6% 10% 14% 3QFY14 17% 18% 38% 7% 6% 14% 36% 39% 25% 38% 39% 23% 37% 40% 23% 38% 37% 25% 38% 37% 26% 41% 36% 23% 44% 38% 18% 84 30% 43% 75 32% 47% 76 34% 48% 82 32% 47% 98 31% 46% 100 36% 49% 96 37% 49% 7444 7617 7882 8158 8207 8017 8160 Financials; Rs in Cr, Sales Employee Cost Other expenses Total expenses EBITDA Depreciation Other Income EBIT Interest Cost Profit (+)/Loss (-) Before Taxes Provision for Taxes Net Profit (+)/Loss (-) Growth-% (YoY) Sales EBITDA PAT Expenses on Sales-% Employee Cost Other expenses Tax rate Margin-% EBITDA EBIT PAT Valuation: CMP No of Share NW EPS BVPS RoE-% P/BV P/E FY10 913.7 503.71 239.75 743.46 170.24 35.81 7.64 134.43 0 142.07 14.42 127.65 FY11 1232.25 601.36 393.1 994.46 237.79 31.46 13.6 206.33 2.22 217.71 32.3 185.41 FY12 1576.48 891.12 415.26 1306.38 270.1 36.42 30.37 233.68 3.84 260.21 63.75 196.46 FY13 2021.36 1115.1 576.96 1692.06 329.3 56.69 22.75 272.61 1.91 293.45 75.05 218.4 FY14E 2341.54 1334.68 620.51 1955.19 386.35 65.73 46.83 320.62 2.59 364.86 103.99 260.88 FY15E 2814.74 1562.18 774.05 2336.24 478.51 73.49 56.29 405.02 1.94 459.37 133.22 326.15 -6.8% 2.3% 9.6% 34.9% 39.7% 45.2% 27.9% 13.6% 6.0% 28.2% 21.9% 11.2% 15.8% 17.3% 19.4% 20.2% 23.9% 25.0% 55.1% 26.2% 10.1% 48.8% 31.9% 14.8% 56.5% 26.3% 24.5% 55.2% 28.5% 25.6% 57.0% 26.5% 28.5% 55.5% 27.5% 29.0% 18.6% 14.7% 14.0% 19.3% 16.7% 15.0% 17.1% 14.8% 12.5% 16.3% 13.5% 10.8% 16.5% 13.7% 11.1% 17.0% 14.4% 11.6% 170.25 5.88 579.78 21.71 98.60 22.0% 1.73 7.84 184.65 5.93 752.11 31.27 126.83 24.7% 1.46 5.91 270.90 5.96 922.20 32.96 154.73 21.3% 1.75 8.22 262.35 6.02 1094.12 36.28 181.75 20.0% 1.44 7.23 376.00 6.02 1346.30 43.33 223.64 19.4% 1.68 8.68 376.00 6.02 1663.24 54.18 276.29 19.6% 1.36 6.94 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 19

- 20. YES BANK Result update CMP Target Price Previous Target Price Upside Change from Previous Market Data BSE Code NSE Symbol Neutral 353 388 443 10 14 532648 YESBANK 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 547/216 12729 18.04 6320 "NEUTRAL" 16th Jan, 2014 Yes bank reported better than expected profit largely due to lower provision despite of reported higher delinquencies. This has resulted of lower provision coverage ratio but still it is above of regulatory requirement. Incremental deposits (other than CASA) were remained muted whereas advance reported handsomely. Bank would face liquidity problem or would have to dependent on additional borrowings to maintain its growth trajectory. This would result of higher cost of fund and margin compression in our view. Leverage ratio (total asset to net worth) has been declining from past four quarters indicated no surplus liquidity in balance sheet. In the absence of comfortable earnings we remain have neutral view. Also, we reduce our target price from Rs.443 to Rs.388. NII growth of 14% YoY led by advance growth and stable cost of fund Bank’s NII grew by 14% YoY to Rs.665 cr largely due to stable margin and other income. In 3QFY14, bank reported other income of Rs.388 cr up by 24% YoY whereas margin was stable at 2.9% declined mere by 10 bps YoY. Credit deposits Stock Performance 1M Absolute -2.7 1yr -29.2 YTD -29.2 deposits base. We observed that bank’s cost of deposits (Calculated) remain at Rel.to Nifty -35.4 -35.4 improved handsomely to 13.3% from 12.7% in 3QFY13. -5.4 ratio was improved by 330 bps QOQ but was declined by 400 bps YoY due to lower Share Holding Pattern-% Current 4QFY13 3QFY1 3 Promoters 25.6 25.6 25.7 FII 35.1 46.0 49.0 DII 19.4 15.7 13.2 Others 20.0 12.7 12.1 1 Yr P/BV elevated level despite of relatively have higher CASA base whereas yield on loan Muted PPP growth due to higher CI ratio Cost to Income ratio was highest ever to 41.6% because of bank’s strategy to increase market share of CASA. During quarter bank hire 647 employee and opened 17branches and 36 ATMs. As the result employee cost and operating cost were increased by 20% and 42% respectively. Due to higher operating cost, pre provisioning profit increased by 9% YoY despite of healthy NII and other income. Operating leverage increased to 0.41% from 0.39% in 3QFY14. We expect this ratio to remain high because of bank would continue to increase its CASA franchise base by opening new branches and hiring. Stable margin on sequential basis despite of lower lending yield and marginal increased of cost of fund On sequential basis NIM of bank remained flat at 2.9% but declined 10 bps on YoY basis. Lending yield declined sharply to 13.3% from 13.6% due to increased share of low yield Corporate and Institutional banking. Cost of deposits increased to 10.9% from 10.8% on QoQ basis. Despite of lower lending yield and higher cost of fund, margin stable on sequential basis was probably due to lower earnings asset growth as we get evidence from negative growth of balance sheet on QoQ basis. Financials NII Total Income PPP Net Profit EPS 2011 1247 1870 1190 727 20.9 2012 1616 2473 1540 977 27.7 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. Rs, Cr 2013 2014E 2015E 2219 2440 2374 3476 4217 4150 2142 2328 2614 1301 1778 1098 36.3 49.4 35.6 (Source: Company/Eastwind) 20

- 21. YES BANK Deposits growth moderate sequentially but advance reported handsome growth On balance sheet front, bank’s advance grew by 14.7% YoY led by retail banking growth followed by corporate and institutional banking. Retail loan registered growth of 47% YoY whereas corporate banking reported 18% YoY growth. Deposits grew by 20.7% YoY led by CASA deposits growth of 38% YoY followed by term deposits (17% YoY). We observed that bank’s incremental deposits (other than CASA) were remained muted at Rs.24 cr as against Rs.1708 cr in second quarter. Bank would have to depend on additional borrowings to maintain its growth trajectory if the present trend continued which would be the result of higher cost of fund and margin compression. Sequentially credit deposits ratio was higher at 73.9% from 70.6% on account of lower deposits base especially of term deposits. Valuation & View Yes bank reported better than expected profit largely due to lower provision despite of reported higher delinquencies. This has resulted of lower provision coverage but it is still above of regulatory requirement. Incremental deposits (other than CASA) were remained muted whereas advance increased handsomely. Bank would face liquidity problem or would have to dependent on additional borrowings to maintain its growth trajectory. This would result of higher cost of fund and margin compression in our view. Leverage ratio (total asset to net worth) has been declining from past four quarters indicated no surplus liquidity in balance sheet. In the absence of comfortable earnings we reduce our target price to Rs.388 from Rs.443. Valuation Band ( 1 yr forward P/BV) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 21

- 22. YES BANK Quarterly Result Quarterly Result Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions PBT Tax Net Profit Balance Sheet Data Advances Shareholders’ Funds Deposits Asset Quality GNPA NPA % GNPA % NPA PCR(%) 3QFY14E 1666 840 8 0 2514 388 2902 1849 665 388 1053 194 245 439 615 13 601 186 416 2QFY14 1618 875 8 0 2501 446 2947 1829 672 446 1118 185 220 405 713 179 534 163 371 3QFY13 %YoY Gr %QoQ Gr 1394 19.5 3.0 726 15.8 -4.0 4 82.6 -7.5 10 -96.4 20.0 2134 17.8 0.5 313 23.8 -13.1 2447 18.6 -1.5 1549 19.3 1.1 584 13.9 -1.0 313 23.8 -13.1 898 17.4 -5.8 162 19.8 4.7 172 42.1 11.2 334 31.3 8.2 563 9.1 -13.8 57 -76.6 -92.6 507 18.7 12.7 164 13.0 14.2 342 21.4 12.0 50,293 6,610 68,060 47717 6610 67575 43,857 5,679 56,401 14.7 5.4 16.4 0.0 20.7 0.7 195.8 42.3 0.39 0.08 78.4 132.1 19.36 0.28 0.04 85.3 76.2 15.6 0.17 0.04 79.5 157.0 48.3 171.2 118.5 Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 22

- 23. YES BANK Financials & Assuption Income Statement 2011 2012 2013 2014E 2015E Interest Income Interest Expense NII Change (%) Non Interest Income Total Income Change (%) Operating Expenses Pre Provision Profits Change (%) Provisions( Incl tax) PAT Change (%) 4042 2795 1247 6307 4692 1616 8294 6075 2219 11985 9544 2440 11213 8840 2374 58.2 29.6 37.3 10.0 -2.7 623 1870 857 2473 1257 3476 1776 4217 1776 4150 37.2 32.2 40.6 21.3 -1.6 680 1190 933 1540 1335 2142 1889 2328 1535 2614 37.9 29.4 39.1 8.7 12.3 463 727 563 977 841 1301 604 1778 1046 1098 52.2 34.4 33.1 36.7 -38.2 Balance Sheet 2011 2012 2013 2014E 2015E Deposits( Rs Cr) Change (%) of which CASA Dep Change (%) Borrowings( Rs Cr) Investments( Rs Cr) Loans( Rs Cr) Change (%) 45939 49152 66956 80347 96416 Ratio 71.4 7.0 36.2 20.0 20.0 4751 7392 12688 20087 28925 68.6 55.6 71.6 58.3 44.0 6691 18829 34364 14156 27757 37989 20922 42976 47000 21358 49835 54050 30447 62163 62157 54.8 10.5 23.7 15.0 15.0 2011 2012 2013 2014E 2015E 8.7 5.5 5.0 7.5 11.7 6.7 7.8 6.0 11.5 6.7 9.1 7.2 15.2 7.6 11.9 7.5 11.5 6.5 9.2 7.5 Valuation 2011 2012 2013 2014E 2015E Book Value CMP P/BV 109.3 310 2.8 132.5 367 2.8 161.9 367.3 2.3 193.1 350.35 1.8 223.7 350.35 1.6 Avg. Yield on loans Avg. Yield on Investments Avg. Cost of Deposit Avg. Cost of Borrowimgs Souce: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 23

- 24. CMC "Neutral" 15th Jan' 14 "Nothing for excitement" Results update Neutral CMP Target Price Previous Target Price Upside Change from Previous 1527 - Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 517326 CMC 1780/1107 4736 20884 6189.35 Stock Performance Absolute Rel. to Nifty 1M 17.12 15.93 1yr 15.4 10.52 YTD 27.37 22 Share Holding Pattern-% Promoters FII DII Others Current 51.12 22.63 18.26 7.99 1 year forward P/E 1QFY14 4QFY13 51.12 51.12 23.32 21.84 17.83 19.05 7.73 7.99 Witnessed inline Sales and PAT numbers; CMC Ltd Witnessed inline set of numbers with flat sales growth than previous quarter led by 2% sales decline in System Integration (contributes 64% of Sales) and 14% decline in IT enabled Services (contributes 13% of Sales). PAT grew by 4.9% on sequential basis. Usually, third quarter is not a growth quarter in the international markets. We believe, CMC will continue with its efforts to enhance revenue contribution of high margin System Integration and ITES segments. Further, its high focus on education space will also add margin in near term. Steady Margin: Steady Margin: During the quarter EBITDA Margin inched up by 40bps (QoQ) to 16.1%. However, Management is still confident to maintain the margin in a range of 15-16%. Mix growth response from segmental front: Sales from System Integration (65% of total sales) down by 2%, IT enabled Services (15% of total sales) down by 13.6%. While the Customer services business (18.4% of total sales) and Education and Training seen double digit growth by 15.9% and 17.6 %(QoQ)– SEZ Sales was flat sequentially. The company expects to see good growth traction in ITeS and System Integration. Deal pipeline: The deal pipeline is in line with the last year. It indicated that pursuing good number of deals in the Developed and as well emerging markets. Considering current sound demand environment across geographies (like US and Europe) and verticals Company is more optimistic for clients acquisition and deal executions ahead. Now, CMC is focusing on new emerging segments like IMS (Infrastructure Management Services), Cloud, Big data, Mobility and Analytics. Considering its impressive client as well as market response, company is expecting to quantify into revenue. Its new and emerging projects like Mining Management System, GPS System and Port & Cargo Management System would play a major role for generating revenue. View and Valuation: CMC expects the growth momentum to improve in the 2HFY14E than 1HFY14. The Company remains a strong with excellent earning visibility led by joint effort of market strategy by TCS (contributes 59% of sales) in its product and solutions. However, we expect that its earning visibility and order from government side in coming 2 quarter could be impacted because of general election schedule in India (earns 41% revenue from India). For a near to medium -term prospect, we are not much excited on the stock taking its earning visibility in near term. We had already advised to book profit on 9th Jan 2014 at a target price of Rs 1690, now we have a “Neutral” view on the stock. At a CMP of Rs 1527, stock trades at 16.5X FY15E earnings. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 560.96 90.81 70.55 16.2% 12.6% 2QFY14 560.75 88.41 67.3 15.8% 12.0% (QoQ)-% 0.0 2.7 4.8 40bps 60bps 3QFY13 492.97 83.2 61.07 16.9% 12.4% Rs, Crore (YoY)-% 13.8 9.1 15.5 (70bps) 20bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 24

- 25. CMC Sales and Sales growth-%(QoQ) Second half of FY14 will be better than the first half. And expects to sees opportunities in the international markets in FY15E (Source: Company/Eastwind) Margin-% The management expects operating Profit margin between 15 percent and 16 percent . (Source: Company/Eastwind) Clients Metrics Despite salary hike during the quarter, company's employee cost on sales increased from 25.1% (2QFY14) to 25.6%. (Source: Company/Eastwind) Employee Metrics: The total headcount for the quarter stood at 10,890 employees out of which 4,555were on company payrolls while the remaining 6,235 were subcontractors. Clients Metrics: The Company added 14 clients during the quarter out of which 10 from India and the 4 from the USA. In FY13, the company added 80 clients. During the quarter, its DSO increased from 79days to 83days. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 25

- 26. CMC Key facts from Concall (attended on 16th Oct, 2013) ►CMC continues to target growth ahead of the overall IT industry; the company expects to grow faster than that in the current financial year ►Expects operating Profit margin at 16 percent for FY14E, ►The company expects to maintatin its tax regime at 20-20.5% for coming quarter. For next year tax rate could be stand at a range of 20-21%. ►Company’s hiring Plan; a net addition of 400-500 this year ► Notably, it targets revenues of Rs 250-300 crore from Education and Training business in next two 3-4 years timeline. Financials; Rs, Cr Net Sales Purchases of stock-in-trade Employee Cost Subcontracting and outsourcing cost Other expenses Total Expenses EBITDA Depreciation Other Income EBIT Interest Cost PBT Tax PAT Growth-% Sales EBITDA PAT Margin -% EBITDA EBIT PAT Expenses on Sales-% Employee Cost Subcontracting Cost Tax rate Valuation CMP No of Share NW EPS BVPS RoE-% Dividen Payout ratio P/BV P/E FY10 870.73 99.35 276.16 173.56 159.94 709.01 161.72 9.85 18.75 151.87 3.17 167.45 24.23 143.22 FY11 1084.40 99.28 345.13 262.35 170.17 876.93 207.47 10.46 11.80 197.01 0.22 208.59 32.42 176.17 FY12 1469.34 145.40 440.22 446.11 213.63 1245.36 223.98 21.37 17.46 202.61 0.02 220.05 68.59 151.46 FY13 1927.87 188.56 521.65 679.73 222.88 1612.82 315.05 23.20 13.17 291.85 0.18 304.84 76.76 228.08 FY14E 2155.00 193.95 560.30 818.90 215.50 1788.65 366.35 25.73 21.55 340.62 0.1 362.07 101.38 260.69 FY15E 2415.28 217.37 640.05 917.81 253.60 2028.83 386.44 37.23 24.15 349.21 0.25 373.11 93.28 279.84 -7.4% 27.7% 23.3% 24.5% 28.3% 23.0% 35.5% 8.0% -14.0% 31.2% 40.7% 50.6% 11.8% 16.3% 14.3% 12.1% 5.5% 7.3% 18.6% 17.4% 16.4% 19.1% 18.2% 16.2% 15.2% 13.8% 10.3% 16.3% 15.1% 11.8% 17.0% 15.8% 12.1% 16.0% 14.5% 11.6% 31.7% 19.9% 14.5% 31.8% 24.2% 15.5% 30.0% 30.4% 31.2% 27.1% 35.3% 25.2% 26.0% 38.0% 28.0% 26.5% 38.0% 25.0% 1340.00 1.50 510.68 95.48 340.45 28.0% 18.6% 3.94 14.03 2079.55 1.50 654.02 117.45 436.01 26.9% 19.9% 4.77 17.71 994.80 3.00 772.19 50.49 257.40 19.6% 23.2% 3.86 19.70 1410.00 3.03 946.26 75.27 312.30 24.1% 19.4% 4.51 18.73 1527 3.03 1145.07 86.04 377.91 22.8% 23.7% 4.04 17.75 1527 3.03 1354.19 92.35 446.93 20.7% 25.3% 3.42 16.53 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 26

- 27. N arnolia Securities Ltd 402, 4th floor 7/ 1, Lord s Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 em ail: research@narnolia.com , w ebsite : w w w .narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.