Biweekly Financial Commentary 09 02 02

- 1. Seng Heng Bank - Center for Investment and Risk

Analytics

誠興銀行 - 投資及風險研究中心

投資新思維

刊登日期 :二零零九年二月二日(市民日報)

作者為誠興銀行投資及風險研究中心分析員黃碩東

長楂與系統買賣

傳統智慧告訴我們只要長楂一隻好股票,一段時間後必定有一個好回報.但一場金融海

嘯令很多股票都錄得大幅度的下跌,那麼長楂是否真的如想像般的好?

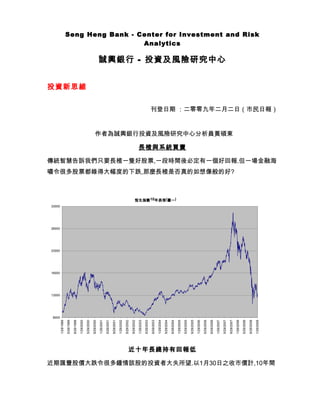

恆生指數10年表現(圖一)

33000

28000

23000

18000

13000

8000

1/29/1999

5/29/1999

9/29/1999

1/29/2000

9/29/2000

1/29/2001

9/29/2001

1/29/2002

9/29/2002

1/29/2003

5/29/2003

9/29/2003

1/29/2004

5/29/2004

9/29/2004

1/29/2005

5/29/2005

9/29/2005

5/29/2006

9/29/2006

5/29/2007

9/29/2007

9/29/2008

1/29/2009

5/29/2000

5/29/2001

5/29/2002

1/29/2006

1/29/2007

1/29/2008

5/29/2008

近十年長綫持有回報低

近期匯豐股價大跌令很多鍾情該股的投資者大失所望.以1月30日之收市價計,10年間

- 2. Seng Heng Bank - Center for Investment and Risk

Analytics

誠興銀行 - 投資及風險研究中心

匯豐之股價是下跌了5.5%,加入股息後回報為46.1%,即每年平均回報為3.8%.以股票

這一類高風險的資產而言可說是十分低.那麼恆生指數又如何?從圖一可見,10年前指

數為約9500點,相比起今天上升了39.6%,但計入股息後上升了93.2%,即每年平均回報

為6.8%.若不是於99年低位開始計算,而是於2000年開始計的話,計入股息後回報只會

有1.5%.那麼讀者可能會問為什麼不以2007計算,這樣回報一定會高很多,需知道經濟

是有週期性的,我們必須以一整個大週期作計算,而事實上很多較成熟之股票市場在一

個經濟週期過後,指數價格很多時是原地踏步.例如標普500指數(見圖二),科網爆破後

2002年指數低位是回到97年水平,而今次金融海嘯的價位也是回到2002年低位水平.

若是長楂的話,週期中間指數的升幅可說只是由如浮雲.

250天平均線模擬系統

那麼若是如筆者所說,一個經濟週期過後指數便會打回原型,一個很簡單的問題便會產

生;我們是否能夠在週期開始時買進,或在週期完結前賣出?首先要解決的問題是如何

判斷那時候是週期的開始及結束.市場時常以250天平均線作為一個牛市及熊市的分

水嶺.所以一個最簡單的做法是以這個做指標,即若指數升過250天平均線便買入,跌穿

便賣出,也可以正實一下這個250天線的實質作用.

- 3. Seng Heng Bank - Center for Investment and Risk

Analytics

誠興銀行 - 投資及風險研究中心

標普500指數(圖二)

1800

1600

1400

1200

1000

800

600

1/29/1996

5/29/1996

9/29/1996

1/29/1997

5/29/1997

9/29/1997

1/29/1998

9/29/1998

1/29/1999

5/29/1999

9/29/1999

1/29/2000

5/29/2000

9/29/2000

1/29/2001

5/29/2001

9/29/2001

1/29/2002

5/29/2002

9/29/2002

1/29/2003

5/29/2003

9/29/2003

1/29/2004

9/29/2004

1/29/2005

5/29/2005

9/29/2005

1/29/2006

5/29/2006

9/29/2006

1/29/2007

5/29/2007

9/29/2007

1/29/2008

5/29/2008

9/29/2008

1/29/2009

5/29/1998

5/29/2004

恆生指數與模擬系統之比較

圖三是恆生指數與250天模擬系統之過往10年回報,可見於2001-2002年期間,當恆指

大跌時, 由於恆指大部分時間是低於250天平均線,所以模擬系統大部分時間於期內手

持現金,而至約03年中,恆指回升過250天平均線, 模擬系統便買入恆指(若真正執行,讀

者可買入以追蹤恆指為目標之盈富基金2800),之後大部分時間都是手持指數,直至08

年中賣出後便持現金至現在. 在回報方面, 模擬系統這10年在未計股息前之平均每年

回報為8.93%,而若長楂恆指的話平均回報僅為3.22%,可見於這10年, 250天線模擬系

統的確能夠跑嬴長楂恆指,而且幅度不少. 主要原因是於指數大幅度下跌時, 模擬系統

往往能夠作出正確的賣出信號.從圖四可看到由高位之跌幅%.可見在2001-2003及今

次兩次之大熊市中, 模擬系統的最大高位跌幅%均比恆生指數為細. 恆生指數的由高

位最大跌幅為66%,而模擬系統則只是41%.

- 4. Seng Heng Bank - Center for Investment and Risk

Analytics

誠興銀行 - 投資及風險研究中心

恆生指數與250天模擬系統之回報(圖三)

注: 藍線為恆指之回報,淺綠為系統買入恆指,深綠為手持現金

那麼讀者可能會懷疑過往十年模擬系統跑嬴指數只是巧合,事實上卻不是如此.若由

1970年至1999年計這30年, 模擬系統的年平均回報是 15.91%,而恆指的回報為

15.19%(未計股息),而模擬系統的由高位最大跌幅為66%,而恆指則為91.5%(發生於

1973-74年之股災).

總結

由上述可見,一個很簡單的買賣程式已經可以提升回報.而事實上這樣一個系統的最

大好處為可以減低由高位最大跌幅%及波動性.需知道當一個組合下跌5成,要回復至

原來水平便需要上升100%. 在牛市中,平均線買賣系統很多時候回報均會比指數低.

但在大熊市中,其功能便會發揮.

- 5. -70.0%

-60.0%

-50.0%

-40.0%

-30.0%

-20.0%

-10.0%

0.0%

1/27/99

5/27/99

9/27/99

1/27/00

5/27/00

9/27/00

1/27/01

5/27/01

9/27/01

1/27/02

5/27/02

9/27/02

1/27/03

5/27/03

9/27/03

1/27/04

250天模擬系統

5/27/04

Analytics

9/27/04

1/27/05

恆生指數

5/27/05

9/27/05

由高位跌幅%(Max. Drawdown%)圖四

1/27/06

5/27/06

9/27/06

誠興銀行 - 投資及風險研究中心

1/27/07

5/27/07

9/27/07

1/27/08

5/27/08

Seng Heng Bank - Center for Investment and Risk

9/27/08

(讀者如有任何意見,可電郵至feedback@stshb.com)

1/27/09