Nickel Asia Corporation

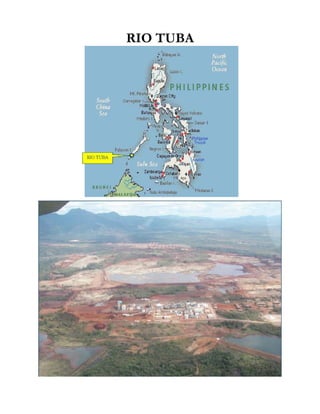

- 1. RIO TUBA

- 3. Summary Notes Nickel Asia Corporation (NAC) Initial Public Offering (IPO) 2010

- 4. Business Rio Tuba We own 60% of RTN, which owns and operates the Rio Tuba mine. PAMCO owns 36% and Sojitz owns the remaining 4%. Rio Tuba is located near the southern tip of Palawan in the southwest Philippines. The mining operations are situated approximately 5 kilometers north of its dedicated pier facilities, which facilitate the loading of nickel ore and the unloading of supplies to and from ships anchored offshore in the Sulu Sea. The mine can also be accessed from the north by a public road. Our mining authority at Rio Tuba derives from a Mining Production Sharing Agreement, or MPSA. The MPSA covers an area of 990 hectares and expires in 2023. An area of 144 hectares within the area covered by our MPSA was previously unminable because it is located in area previously classified as “core zone”, or an area of high environmental value. In December 2009, the mineralized portions of these 144 hectares were reclassified from a “core zone” to a “Mineralized Resources Development Zone” and we believe that the Bureau of Mines will soon permit mining in this zone. We also hold a separate foreshore lease with a 25 year term, expiring in November 2024, on which the pier facilities are located. We have a separate MPSA with respect to a nearby 83.5 hectares, on which we quarry limestone for use by the Coral Bay HPAL facility. RTN has been mining at Rio Tuba since 1975. We are currently mining two deposits within the MPSA area: Guintalunan and Mangingiding. In 2009, the mine exported 0.5 million WMT of saprolite ore. It also delivered 2.5 million WMT of limonite ore to the Coral Bay HPAL facility. In addition, in 2009 RTN sold 149.6 tonnes of limestone to the Coral Bay HPAL facility and generated 888.1 million from such sales. 100

- 5. Business We have 22.9 million WMT of stockpiled limonite ore at Rio Tuba which is used to feed the Coral Bay HPAL facility. See “Processing facilities—Coral Bay HPAL” below. With the doubling of capacity of the Coral Bay HPAL facility in mid-2009, we expect to deliver approximately 2.8 million WMT of limonite ore to the facility per year. In addition to deriving revenue from its mining operations, RTN also derives revenue from the provision of materials handling and transportation services to CBNC, which primarily consists of delivering supplies and other materials to the Coral Bay HPAL facility from RTN’s piers. Power for the Rio Tuba mine facilities comes from a 22 MW coal-fired power plant at the Coral Bay HPAL facility, supplemented with standby diesel generators at the facility. The Rio Tuba water system consists of a surface infiltration gallery and three ground water wells. The system supplies potable and industrial water to the mine and communities of Barangay Rio Tuba. Operational Data. The table below sets forth production volume at our Rio Tuba mine for each of the past three fiscal years and first six months of 2010. 2010 2007 2008 2009 (through June 30) Rio Tuba Nickel Saprolite Limonite Total Saprolite Limonite Total Saprolite Limonite Total Saprolite Limonite Total Production Saleable ore mined (WMT) . . . . . . . . 482,448 1,387,389 1,869,837 670,926 1,618,763 2,289,689 299,741 2,763,606 3,063,347 1,150,232 1,696,995 2,847,227 Waste handled (WMT). . N/A N/A 670,165 N/A N/A 590,168 N/A N/A 591,228 N/A N/A 147,247 Ratio of waste handled to saleable ore mined . . . . . . . . . N/A N/A 0.36 : 1 N/A N/A 0.26 : 1 N/A N/A 0.19 : 1 N/A N/A 0.05 : 1 Sales Volume of ore sold (WMT) . . . . . . . . 418,648 1,332,816 1,751,464 498,092 1,399,436 1,897,528 462,485 2,520,231 2,982,716 670,121 1,137,168 1,807,289 Volume of ore sold (DMT) . . . . . . . . . 298,911 894,727 1,193,638 346,715 933,135 1,279,850 318,399 1,741,978 2,060,377 469,876 751,203 1,221,079 Nickel grade . . . . . . . 1.8% 1.3% 1.4% 1.8% 1.3% 1.5% 1.8% 1.1% 1.2% 1.7% 1.3% 1.4% Contained nickel (tonnes) . . . . . . . . 5,512 11,670 17,182 6,158 12,421 18,579 5,834 19,537 25,371 8,161 9,473 17,634 Payable nickel (tonnes)(1) . . . . . . . 702 813 1,515 539 911 1,450 455 1,257 1,712 228 638 866 Net revenue (US$ million)(2) . . . . 35.6 27.7 63.3 26.6 18.3 44.9 10.3 18.1 28.4 13.4 13.5 26.9 Average realized price (US$ per WMT)(3) . . . 58.2 — 58.2 42.6 — 42.6 13.1 — 13.1 15.2 — 15.2 Average realized LME price (US$ per Ib.)(4) . . 16.5 15.4 15.9 10.5 9.1 9.9 6.7 6.5 6.6 9.2 9.6 9.5 Notes: (1) Payable nickel represents the payable portion of the contained nickel sold to PAMCO and CBNC. The ore sold to China is excluded as it is priced on a per WMT basis. (2) Revenues from sales of nickel ore net of cobalt credits. (3) Average realized price relates to China shipments, which is priced on a per WMT basis. (4) Average realized LME price relates to shipments to PAMCO and deliveries to CBNC, which are both LME-based. Ore reserves and mineral resources. As of December 31, 2009, our Rio Tuba mine had measured and indicated saprolite mineral resources of 16.4 million WMT with an average grade of 1.87% nickel, including proved and provable ore reserves of 12.9 million WMT with an average grade of 1.69% nickel. Measured and indicated limonite mineral resources totaled 60.2 million WMT with an average grade of 1.27% nickel, including proved and provable ore reserves of 53.1 million WMT with an average grade of 1.25% nickel. We believe that our saprolite proved and probable ore reserves at Rio Tuba are sufficient to support production at our 2009 sales rate for approximately 28 years. We believe that our limonite proved and probable ore reserves at Rio Tuba are sufficient to supply the Coral Bay HPAL facility for 18 years at its full operating capacity. Regional Exploration. We are continuing to drill extensively at Rio Tuba to confirm and upgrade our resource and ore reserve estimates. During 2009, we drilled 642 holes totaling 5,266 meters of drilling. 101

- 6. Business The following table sets forth a summary description of our exploration properties. See “Business— Description of our mines”. Mine Location Ownership MPSA/Operating agreement Bulanjao . . . . . . . . . . . . . . . Palawan RTN Mining lease contract covers 3,604.5 hectares Manicani . . . . . . . . . . . . . . Eastern Samar Samar MPSA covers 1,165 hectares and expires in 2017 Kepha. . . . . . . . . . . . . . . . . Surigao del Norte TMC Operating agreement covers 6,980.75 hectares and expires in 2032 La Salle . . . . . . . . . . . . . . . Surigao del Norte TMC Operating agreement covers 6,824 hectares and expires in 2034 Libjo . . . . . . . . . . . . . . . . . Dinagat CMC Operating agreement covers 4,226.27 hectares and expires in 2017 Ludgoron . . . . . . . . . . . . . . Surigao del Norte and TMC Operating agreement covers Surigao del Sur 3,248.06 hectares and expires in 2032 South Dinagat . . . . . . . . . . . Surigao del Norte HMC Operating agreement covers 215 hectares and expires in 2011 119

- 7. MPSA No./ Contract Operating 146 Company ECC No. Issued to Mine site area Term Purpose agreement RTN MPSA No. 114-98-IV RTN Rio Tuba Mine situated 990 25 years For the sustainable (dated June 4, 1998) in Bataraza, Palawan. hectares development and Regulation commercial utilization RTC- Rio Tuba Mine of nickel, cobalt, ECC No. 9612-008 chromite and other (dated December 11, mineral deposits. 1997) RTN MPSA No. 213-2005- RTN Rio Tuba Mine situated 84.5364 25 years from For the development IVB (dated April 28, in Bataraza, Palawan. hectares April 28, 2005 and commercial 2005) utilization of limestone RTC- Rio Tuba Mine and other associated mineral deposits. ECC No. 9612-008 (dated December 11, 1997) RTN MPSA Application Bulanjao AMA IVB- denominated as AMA Exploration 144A-3,604.50 hectares; IVB-144A and AMA AMA IVB-144B-670.50 RTC-Bulanjao IVB-144B hectares Exploration

- 8. Regulation Below is a summary of the NAC Group’s mineral agreements and permits with respect to its mining operations. RIO TUBA NICKEL MINING CORPORATION A. Rio Tuba mine MPSA No. 114-98-IV covering beneficiated nickel mine On June 4, 1998, RTN was issued a mineral and production sharing agreement by the DENR covering an area of 990 hectares, situated at Barangay Rio Tuba, Bataraza, Palawan, valid for 25 years, renewable for another 25 years subject to mutually agreed upon terms and conditions. However, under the Strategic Environmental Plan for Palawan Act (Republic Act No. 7611), operations are currently prohibited within an area of 144 hectares classified as “core zone” which are required to be fully and strictly protected and maintained free of human disruption. Included in the “core zone” are all types of natural forest, areas above 1,000 meters elevation, peaks of mountains or other areas with very steep gradients, and endangered habitats and habitats of endangered and rare species. The primary purpose of the MPSA is to provide for the sustainable development and commercial utilization of nickel, cobalt, chromite and other mineral deposits within the contract area, with all necessary services, technology and financing to be furnished or arranged for by RTN under the terms of such agreement. However, the MPSA does not grant RTN any title over the contract/mining area, without prejudice to RTN’s acquisition of land/surface rights under allowable modes of acquisition under the law. RTN is to undertake and execute, for and on behalf of the Government the sustainable mining operations and is constituted as the exclusive entity to conduct mining operations in the contract area. The share of the Government is the excise tax on mineral products at the time of removal at the rate provided for in R.A. 7729, amending Section 151(a) of the NIRC, as amended, as well as other taxes, duties and fees levied by existing laws. Currently, the excise tax is 2% of the actual market value of the gross output at the time of removal. The provisions of the MPSA relating to environmental protection, mine safety and health require RTN to secure an Environmental Compliance Certificate (“ECC”), an Environmental Protection and Enhancement Program (“EPEP”), allocating at least ten percent (10%) of its total project cost for its initial environment related capital expenditures, although this may be adjusted depending on the nature and scale of operations and technology to be employed in the Contract Area. RTN is also required to submit an annual EPEP every year, based on the approved EPEP, allocating three to five percent (3-5%) of its direct mining and milling cost for the same. RTN is also required to establish a Mine Rehabilitation Fund (“MRF”) based on the financial requirements of the EPEP. Under the obligations of RTN as contractor, RTN is required to allocate royalty payment of not less than one percent (1%) of the value of the gross output of the mineral(s) sold for development of technology and the host and neighboring communities, and for the rights of existing indigenous tribal communities over their ancestral lands. MPSA No. 213-2005-IVB for Rio Tuba Nickel’s Limestone Quarry On April 28, 2005, RTN was issued another MPSA for a total area of 84.5364 hectares in Bataraza, Palawan. This MPSA was also given a validity of 25 years renewable for another 25 years subject to mutually agreed upon terms and conditions. This MPSA covers the Sitio Gotok limestone pit, whereby limestone is to be sold to CBNC and used at the Coral Bay HPAL facility. The terms and conditions of this MPSA mirror the terms of MPSA No. 114-98-IV granted to RTN, albeit covering mining of limestone rather than nickel products. B. Bulanjao exploration MPSA Application for expiring mining lease contracts On June 17, 2003, RTN filed an application to renew and to convert into MPSAs 14 existing mining lease contracts which were due to expire in the period from June 2003 to August 2004. The application included six small mining blocks of new areas located within the said existing mining lease contracts. No operations are currently being conducted in these areas. The application remains pending. 147

- 9. Material contracts OMNIBUS AGREEMENT On November 25, 2002, SMM and RTN entered into an Omnibus Agreement pursuant to their Stockholders Agreement dated July 1, 2002 (the “Stockholders’ Agreement”). The Stockholders’ Agreement provides that SMM and RTN and the other stockholders who are parties thereto, agree to incorporate a Philippine Corporation for the purpose of producing and selling to SMM mixed sulfide. Pursuant to this, CBNC was incorporated. Thereafter, CNBC and RTN entered into an agreement whereby the latter shall develop, construct, and operate a private commercial causeway, trestles and dolphins in the foreshore and offshore of Rio Tuba, Bataraza, Palawan (“Pier Facilities”), and thereafter grant CBNC access to the Pier Facilities. By virtue of this agreement, RTN entered into the abovementioned Omnibus Agreement whereby SMM will finance RTN’s construction of the Pier Facilities in the form of a loan. The loan extended to RTN is in the total amount of US$1,764,000.00 repayable in consecutive semi- annual amounts within 5 years starting on the last business day of February 2004 up to the last business day of August 2008 in Japan. RTN shall pay interest on the loan based on the principal balance of the loan from time to time outstanding at the rate per annum which is equal to LIBOR for such period plus the margin of 2%, calculated on the basis of a 360-day year and for actual number of days elapsed. SMM will be responsible for all taxes imposed on or with regard to any aspect of the loan transaction. On July 21, 2003, an Amendment to the Omnibus Agreement was executed between SMM and RTN for the purpose of increasing the loan facility from US$1,764,000.00 to $1,949,000.00. On October 31, 2003, a Second Amendment to the Omnibus Agreement was entered into for the purpose of extending the term of repayment of the loan facility from the original five (5) years to ten (10) years. The last day of repayment being on the last business day of August 2013 in Japan. Finally, on February 20, 2007, a Third Amendment to the Omnibus Agreement was executed for the purpose of increasing the loan facility from US$1,949,000.00 to US$10,909,000.00 and extending the last repayment to the last business day of February 2018 in Japan. CORAL BAY STOCKHOLDERS AGREEMENT The Coral Bay Stockholders’ Agreement was executed on July 1, 2002 by and among SMM, Mitsui, Nissho Iwai Corporation (“NIC”) and RTN, wherein the parties agreed to incorporate a stock corporation under Philippine laws, to be named Coral Bay Nickel Corporation in the Municipality of Bataraza, Palawan, for the purpose of producing, selling and exporting exclusively to SMMCL mixed sulphide using the technology of high-pressure acid leaching process. Under the Coral Stockholders’ Agreement, CBNC shall have an authorized capital stock of Philippine Pesos equivalent to one million U.S. Dollars (US$1,000,000.00) divided into common shares, each with a par value of one peso (81.00). Thereafter, if CBNC successfully secures an Environmental Compliance Certificate from the DENR and completes its registration with the Board of Investment or PEZA with respect to the construction and operation of the plant it will construct for the purpose of carrying out the purpose of the establishment of CBNC, it shall increase its authorized capital stock to such amount in Philippine peso equivalent to fifty two million five hundred thousand U.S. dollars (US$52,500,000.00) divided into common shares with a par value of One Peso (81.00). SMM shall grant CBNC a non-exclusive license of the technology it owns to produce the products and extend technical assistance to CBNC; lend its qualified personnel to CBNC for the latter’s operation and off-take the products whereby SMM shall purchase all products produced by CBNC. Mitsui and NIC shall assist CBNC in procuring material and equipment necessary for the operation. RTN, on the other hand, shall supply CBNC with nickel ore; establish the ecozone and lease or sub-lease or otherwise enter into such agreements with respect to the land as will grant or transfer the right to use the land to CBNC and make the infrastructure and utility available to CBNC; and provide 172

- 10. Material contracts CBNC with other assistance and hold CBNC, SMM, Mitsui, and NIC harmless from and against any claims including environmental and labor problems which may arise out of or in connection with the past, present and future activities of RTN. The agreement took effect upon execution and shall cease to be effective upon the dissolution of CBNC. ORE SUPPLY AGREEMENT On June 1, 2004, RTN and CBNC entered into an Ore Supply Agreement pursuant to the Stockholders’ Agreement for the purpose of producing and selling to SMM nickel cobalt mixed sulphide to be used for the production of electrolytic nickel and cobalt. The Ore Supply Agreement provides that RTN will supply limonite ore exclusively to CBNC. The price of ore delivered under the agreement is determined based on payable nickel contained in the ore delivered, and an average of LME nickel prices over an agreed quotational period. The agreement became effective upon execution and shall terminate on the date on which CBNC ceases to operate the Coral Bay HPAL facility or RTN has supplied all its available limonite ore to CBNC, whichever comes earlier. NICKEL ORE SALE AGREEMENTS WITH PAMCO On December 7, 2007, we entered into an agreement expiring on December 31, 2012 with PAMCO and Sojitz for the annual supply of 250,000 WMT (plus or minus 50,000 WMT at PAMCO’s option) of saprolite ore from our Rio Tuba mine. The agreement provides that as long as commercial production of saprolite ore at the Rio Tuba mine is possible, the parties will use efforts to renew the agreement for five-year terms. On December 8, 2009, we entered into agreements with PAMCO for the supply of 600,000 WMT (plus or minus 10% per shipment) of saprolite ore from our Taganito mine and 300,000 WMT (plus or minus 10% per shipment) of saprolite ore from our Cagdianao mine. These agreements cover deliveries of ore from January through December 2010. On July 31, 2010, we entered into agreements with PAMCO for the annual supply of 400,000 WMT to 600,000 WMT, at PAMCO’s option (plus or minus 10% per shipment), of saprolite ore from our Taganito mine and 200,000 WMT to 300,000 WMT, at PAMCO’s option (plus or minus 10% per shipment), of saprolite ore from our Cagdianao mine. These agreements cover deliveries of ore from January 1, 2011 to December 31, 2015. Each agreement provides that provided that commercial production of saprolite ore at the Taganito mine and Cagdianao mine, respectively, is possible, by the end of 2013 the parties will use efforts to negotiate quantities of saprolite ore to be delivered from 2016 through 2018 and, upon reaching agreement, will terminate the applicable contract and enter into a new five year agreement covering deliveries of saprolite ore from the applicable mine from years 2013 through 2018. The price of ore delivered under agreements with PAMCO is on an FOB basis and is determined based on payable nickel contained in the ore delivered, and an average of LME nickel prices over an agreed quotational period. Under these agreements, we are entitled to a provisional payment of 90% of our invoice for each shipment, with the remainder to be paid upon reconciliation. Given a range of LME nickel prices of US$8.00 to US$12.00 per pound, the following table summarizes the payable percentage of nickel contained in our shipments to PAMCO. Payable percentage of contained Nickel at an LME Nickel price of Grade of Saprolite Ore US$8.00 to US$12.00 per pound Ni 2.30% . . . . . . . . . . . . . . . . . . . . .. .. . .. .. .. .. .. .. .. . .. .. .. . Above 26% Ni 2.05-2.10% . . . . . . . . . . . . . . . . .. .. . .. .. .. .. .. .. .. . .. .. .. . Approximately 19% to 21% Ni 1.80-1.90% . . . . . . . . . . . . . . . . .. .. . .. .. .. .. .. .. .. . .. .. .. . Approximately 13 to 15% Ni G 2.0% (crushed saprolite ore) . . .. .. . .. .. .. .. .. .. .. . .. .. .. . Approximately 16% to 19% 173

- 11. -2- The Subsidiaries HMC HMC was registered with the SEC on October 9, 1979, is a 100% owned subsidiary of the Company and is primarily engaged in the exploration, mining and exporting of nickel ore located in Hinatuan, Nonoc and Manicani Islands, Surigao del Norte. The registered office address of HMC is 3rd Floor, NAC Centre (formerly BMMC Building), 143 Dela Rosa corner Adelantado Streets, Legaspi Village, Makati City. CMC CMC was registered with the SEC on July 25, 1997, is a 100% owned subsidiary of the Company and is primarily engaged in the exploration, mining and exporting of nickel ore located in Barangay Valencia, Municipality of Cagdianao, Province of Dinagat Island. The registered office address of CMC is 03825 Narciso Street, Surigao City. TMC TMC was registered with the SEC on March 4, 1987, is a 65% owned subsidiary of the Company and is primarily engaged in the exploration, mining and exporting of nickel ore located in Claver, Surigao del Norte. The registered office address of TMC is 4th Floor, NAC Centre (formerly BMMC Building), 143 Dela Rosa corner Adelantado Streets, Legaspi Village, Makati City. RTN RTN was registered with the SEC on July 15, 1965, is a 60% owned subsidiary of the Company and is primarily engaged in the exploration, mining and exporting nickel ore and providing non- mining services located in Barangay Rio Tuba, Municipality of Bataraza, Palawan. The registered office address of RTN is 2nd Floor, NAC Centre (formerly BMMC Building), 143 Dela Rosa Street, Legaspi Village, Makati City, Philippines. Falck Exp Inc. (FEI) FEI was registered with the SEC on November 22, 2005, is a 88% owned subsidiary of the Company through HMC, CMC and TMC, and is primarily engaged in the business of exploring, prospecting, and operating mines and quarries of all kinds of ores and minerals, metallic and non- metallic. FEI has not yet started commercial operations. The registered office address of FEI is 3rd Floor, NAC Centre (formerly BMMC Building), 143 Dela Rosa Street, Legaspi Village, Makati City, Philippines. La Costa Shipping and Lighterage Corporation (LCSLC) LCSLC was registered with the SEC on October 23, 1992, is a 100% owned subsidiary of the Company, and is primarily engaged in the chartering out of Landing Craft Transport (LCT) and providing complete marine services. The registered office address of LCSLC is 7th Floor, NAC Centre (formerly BMMC Building), 143 Dela Rosa Street, Legaspi Village, Makati City, Philippines. LCSLC was acquired by HMC in April 2010 (see Note 27). Samar Nickel Mining Resources Corporation. (SNMRC) SNMRC was registered with the SEC on May 11, 2010, is a 100% owned subsidiary of the Company and is primarily engaged in the exploration, mining and exporting of mineral ores. SNMRC has not yet started commercial operations. The registered office address of SNRMC is 6th Floor, NAC Centre (formerly BMMC Building), 143 Dela Rosa Street, Legaspi Village, Makati City, Philippines. The Parent Company’s registered office address is 6th Floor, NAC Centre (formerly BMMC Building), 143 Dela Rosa Street, Legaspi Village, Makati City. F-11 *SGVMC408835*

- 12. - 65 - 33. Significant Agreements a. Memorandum of Understanding (MOU) On September 14, 2009, the Parent Company and TMC entered into a Memorandum of Understanding (MOU) with SMM. Pursuant to the terms thereof, the Parent Company and SMM will move ahead on a joint venture basis to build a nickel-cobalt processing plant using the HPAL technology to be located within the TMC’s mine in Surigao del Norte, while TMC will supply low-grade nickel ore to the plant over the life of the project. The estimated project cost is $1.4 billion and construction over a three-year period is expected to start in the first quarter of 2010. The plant will have an annual capacity of 51,000 dry metric tons of mixed nickel-cobalt sulfide over an estimated 30-year project life. The MOU provides that the equity share of the Parent Company and SMM shall be 20%-25% and 75%-80%, respectively. b. Derivative Agreements Commodity Collar In February and March 2010, the Parent Company entered into nickel collar contracts to hedge the nickel price realized during the contract period. Final delivery under the nickel collar contract will occur in December 2010. As at June 30, 2010, 350 MT of nickel collar contracts were accounted for on a mark-to-market basis through earnings, and the aggregate fair values of the nickel collar contracts was P5,918. There were no outstanding nickel collar contracts as = at December 31, 2009 (see Note 32). c. Sales Agreements Nickel Ore Sale Agreement with PAMCO and Sojitz (see Note 28) Nickel Ore Supply Agreement with CBNC (see Note 28) Nickel Ore Supply Agreements with Chinese customers HMC, CMC, RTN and TMC have ore supply agreements with a number of Chinese customers, each for a fixed tonnage at specific nickel grades and iron content. The fixed tonnage of ore is generally the volume of expected delivery within a few months. Sale of ore to Chinese customers amounted to P1.2 billion and =0.4 billion for the six months ended = P June 30, 2010 and 2009, respectively. d. Mining Agreements Mineral Production Sharing Agreement (MPSA) RTN On June 4, 1998, the Philippine Government (the Government) approved the conversion of RTN’s Mining Lease Contracts under the old mining regime into an MPSA with the Government pursuant to the Philippine Mining Act of 1995. The MPSA allows RTN to explore, develop and continue mining operations for nickel ore within the Contract Area covering 990 hectares in the Municipality of Bataraza, southern Palawan Island. Under RTN’s Environmental Compliance Certificate (ECC), however, 144 hectares of the Contract Area are excluded from mining operations, being located within an area classified as “core zone” where mining is prohibited under current regulations of the Palawan Council for Sustainable Development (PCSD). F-74 *SGVMC408835*

- 13. - 66 - On April 28, 2005, RTN and the Government entered into a second MPSA covering 85 hectares in the Municipality of Bataraza, which allows RTN to mine limestone in Sitio Gotok. Limestone being mined by RTN pursuant to this second MPSA is being sold to CBNC and used at the Coral Bay HPAL plant. Under both MPSAs, RTN pays a two percent (2%) excise tax on gross revenues as provided in the Philippine NIRC as the Government’s share in its output. Both MPSAs are valid for twenty five (25) years from issuance and renewable for another term of not more than twenty- five (25) years at the option of RTN, with approval from the Government. On June 20, 2003, RTN submitted an Application for MPSA covering previously approved Mining Lease Contracts over an area of 4,274 hectares within the Municipalities of Bataraza and Rizal. Most of the Contract Area is within the core zone and the Application is pending. On May 30, 2008, the PCSD issued a Resolution interposing no objections to the revision by the Municipality of Bataraza of its Environmentally Critical Areas Network map that, among others, seeks to reclassify the core zone within the Contract Area into a mineral development area. The reclassification was approved by the Municipal Development Council of the Municipality of Bataraza on November 18, 2009, and subsequently approved by the Provincial Board on January 5, 2010. The processing of the Application for MPSA by the Mines and Geosciences Bureau is consequently under way. HMC Tagana-an Nickel Project On July 25, 2007, the Government approved the conversion of HMC’s Mining Lease Contract into an MPSA, which allows HMC to explore, develop and continue mining operations for nickel ore within the Contract Area covering 773.77 hectares in the Municipality of Tagana- an, Surigao del Norte. Under the MPSA, HMC pays the Government a two percent (2%) excise tax and a five percent (5%) royalty on gross revenues, as the Contract Area is within the Surigao Mineral Reservation. The MPSA is valid for twenty-five (25) years from issuance and renewable at the option of HMC, with approval from the Government. Manicani Nickel Project On August 13, 1992, HMC and the Government entered into an MPSA, which allows HMC to explore, develop and mine nickel ore within the Contract Area covering 1,165 hectares in Manicani Island, Municipality of Guian, Eastern Samar. Under the MPSA, HMC shall pay the Government a two percent (2%) excise tax, a one percent (1%) royalty and ten percent (10%) of its net revenues, defined as gross revenues less all cost items that are deductible for income tax purposes. The MPSA is valid for twenty-five (25) years from issuance and renewable at the option of HMC, with approval from the Government. On August 2, 2004, the Regional Panel of Arbitrators of the MGB recommended the cancellation of the MPSA as a result of allegations by third parties against the operations of HMC. On September 4, 2009, the Mines and Adjudication Board of the Department of Environment and Natural Resources issued a decision setting aside the decision of the Panel of Arbitrators. Hence, the MPSA remains in effect. HMC is currently not conducting mining operations in Manicani. F-75 *SGVMC408835*

- 14. - 76 - project cost is $1.4 billion and construction over a three-year period is expected to start in the first quarter of 2010. The plant will have an annual capacity of 51,000 dry metric tons of mixed nickel-cobalt sulfide over an estimated 30-year project life. The MOU provides that the equity share of the Parent Company and SMM shall be 20%-25% and 75%-80%, respectively. b. Derivative Agreements Commodity Swap and Commodity Collar Contracts The Parent Company had entered into commodity swap contracts with respect to its nickel production from June 2007 to November 2008 (see Note 32). As at December 31, 2009, 2008 and 2007, commodity swap contracts were accounted for on a mark-to-market basis through earnings, and the aggregate fair values of these contracts were nil and P63.4 million = and P311.1 million, respectively (see Note 32). = In June 2007, the Company entered into nickel collar contract to hedge the nickel price realized during the contract period. Final delivery under the nickel collar contract occurred last May 2008. As of December 31, 2007, 90 MT of nickel collar contracts were accounted for on a mark-to-market basis through earnings and the aggregate fair values of the copper collar contracts was =67.5 million. There were no outstanding nickel collar contracts as of P December 31, 2008 and 2009 (see Note 32). Other Derivative Contracts The Parent Company also entered into plain and structured foreign exchange forward contracts with financial institutions to sell US$ against delivery of Philippine peso from September 2007 to December 2008 (refer to Note 32 on the terms of foreign exchange contracts). The contracts were entered in 2007 for no consideration. The results of this activity were reflected in the consolidated statement of financial position and profit or loss in the consolidated statement of comprehensive income in 2008. There are no outstanding derivative contracts as at December 31, 2009. c. Sales Agreements Nickel Ore Sale Agreement with PAMCO and Sojitz (see Note 28) Nickel Ore Supply Agreement with CBNC (see Note 28) Nickel Ore Supply Agreements with Chinese customers HMC, CMC, RTN and TMC have ore supply agreements with a number of Chinese customers, each for a fixed tonnage at specific nickel grades and iron content. The fixed tonnage of ore is generally the volume of expected delivery within a few months. Sale of ore to Chinese customers amounted to P1.9 billion, =0.6 billion and =6.7 billion in 2009, 2008 = P P and 2007, respectively. d. Mining Agreements Mineral Production Sharing Agreement (MPSA) RTN On June 4, 1998, the Philippine Government (the Government) approved the conversion of RTN’s Mining Lease Contracts under the old mining regime into an MPSA with the Government pursuant to the Philippine Mining Act of 1995. The MPSA allows RTN to explore, develop and continue mining operations for nickel ore within the Contract Area *SGVMC408748* F-168

- 15. - 77 - covering 990 hectares in the Municipality of Bataraza, southern Palawan Island. Under RTN’s Environmental Compliance Certificate (ECC), however, 144 hectares of the Contract Area are excluded from mining operations, being located within an area classified as “core zone” where mining is prohibited under current regulations of the Palawan Council for Sustainable Development (PCSD). On April 28, 2005, RTN and the Government entered into a second MPSA covering 85 hectares in the Municipality of Bataraza, which allows RTN to mine limestone in Sitio Gotok. Limestone being mined by RTN pursuant to this second MPSA is being sold to CBNC and used at the Coral Bay HPAL plant. Under both MPSAs, RTN pays a two percent (2%) excise tax on gross revenues as provided in the Philippine NIRC as the Government’s share in its output. Both MPSAs are valid for twenty five (25) years from issuance and renewable for another term of not more than twenty-five (25) years at the option of RTN, with approval from the Government. On June 20, 2003, RTN submitted an Application for MPSA covering previously approved Mining Lease Contracts over an area of 4,274 hectares within the Municipalities of Bataraza and Rizal. Most of the Contract Area is within the core zone and the Application is pending. On May 30, 2008, the PCSD issued a Resolution interposing no objections to the revision by the Municipality of Bataraza of its Environmentally Critical Areas Network map that, among others, seeks to reclassify the core zone within the Contract Area into a mineral development area. The reclassification was approved by the Municipal Development Council of the Municipality of Bataraza on November 18, 2009, and subsequently approved by the Provincial Board on January 5, 2010. The processing of the Application for MPSA by the Mines and Geosciences Bureau is consequently under way. HMC Tagana-an Nickel Project On July 25, 2007, the Government approved the conversion of HMC’s Mining Lease Contract into an MPSA, which allows HMC to explore, develop and continue mining operations for nickel ore within the Contract Area covering 773.77 hectares in the Municipality of Tagana-an, Surigao del Norte. Under the MPSA, HMC pays the Government a two percent (2%) excise tax and a five percent (5%) royalty on gross revenues, as the Contract Area is within the Surigao Mineral Reservation. The MPSA is valid for twenty-five (25) years from issuance and renewable at the option of HMC, with approval from the Government. Manicani Nickel Project On August 13, 1992, HMC and the Government entered into an MPSA, which allows HMC to explore, develop and mine nickel ore within the Contract Area covering 1,165 hectares in Manicani Island, Municipality of Guian, Eastern Samar. Under the MPSA, HMC shall pay the Government a two percent (2%) excise tax, a one percent (1%) royalty and ten percent (10%) of its net revenues, defined as gross revenues less all cost items that are deductible for income tax purposes. The MPSA is valid for twenty-five (25) years from issuance and renewable at the option of HMC, with approval from the Government. On August 2, 2004, the Regional Panel of Arbitrators of the MGB recommended the cancellation of the MPSA as a result of allegations by third parties against the operations of HMC. On September 4, 2009, the Mines and Adjudication Board of the Department of Environment and Natural Resources issued a decision setting aside the decision of the Panel *SGVMC408748* F-169

- 16. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 4 3 Introduction and Location 3.1 Introduction NAC describes itself as the largest nickel mining company in the Philippines today. NAC owns a majority share of four operating mines located throughout the Philippines. The Company also controls a 6% equity interest in the Coral Bay High Pressure Acid Leach (“HPAL”) facility at Rio Tuba in the Philippines. The principal business of NAC involves selling nickel laterite ore to customers in Japan, China and the Philippines. The operating subsidiaries of NAC whose mineral projects are addressed in this Independent Technical Report are: Rio Tuba Nickel Mining Corporation (“RTN”), 60% owned by NAC Taganito Mining Corporation (“TMC”), 65% owned by NAC Cagdianao Mining Corporation (“CMC”), 100% owned by NAC Hinatuan Mining Corporation (“HMC”), 100% owned by NAC. Each of these subsidiaries is a corporation incorporated under the laws of the Philippines. The structure of these corporations within the NAC group is shown in Figure 3-1. NAC’s assets include the following six mineral projects: Rio Tuba Mine (owned and operated by RTN), which primarily supplies the Coral Bay HPAL plant Taganito Mine (owned and operated by TMC), which produces ore for direct shipment to Japan and China Cagdianao Mine (operated by CMC), which produces ore for direct shipment to Japan and China Taganaan Mine (owned and operated by HMC), which produces ore for direct shipment to Japan and China Collectively, the above mineral projects are referred to as “the Properties” or “the Operations” or “the mines”. NAC also has several exploration properties, including tenements at Manicani, South Dinagat, Bulanjao (near Rio Tuba and managed by RTN), Ludgoron, Kepha and La Salle (all three managed by TMC) and Libjo (managed by CMC). Manicani, Bulanjao, Ludgoron and Kepha have declared Mineral Resources. The Properties are all located in the Philippines, as described in the following sections of this report. The ore types produced from the mines and the sales customers for the ore are shown in Figure 3-2. WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-22

- 17. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 5 1 Key shareholders include SMM (26.0%) and PAMCO (1.5%). 2 Balance owned by PAMCO and Sojitz 3 Balance owned by SMM, Mitsui and Sojitz 4 Balance owned by SMM 5 Under construction, expected to be operational in 2013 6 Chart does not include La Costa, Winterberry or Falck. The company holds directly or indirectly, a 100% equity interest in La Costa and Winterberry and an 88% equity interest in Falck. La Costa owns and operates four LTCs. Winterberry owns and operates our corporate aircraft and Falck has no material assets or operations Figure 3-1: Corporate Structure Diagram Figure 3-2: NAC ore types and sales customers 3.2 Rio Tuba Mine The Rio Tuba mine is located near the southern tip of Palawan Island in the southwest Philippines. The island is bounded by the South China Sea on the west and by the Sulu Sea on the east and has a total land area of approximately 14,896 km2. RTN’s current operations are included within the geographical coordinates 8°33’-14.68” – 8°36’39.76” north latitude and 117°22’52.00” – 117°25’58.44” east longitude. WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-23

- 18. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 6 The barangay Rio Tuba, located adjacent to the site, is the nearest community. Its population is estimated to be around 3,000 inhabitants. Deliveries of limonite ore to Coral Bay Nickel Company (CBNC”) High Pressure Acid Leach (HPAL) processing facility is completed from stockpiles at Rio Tuba mine. Delivery of limonite ore to the HPAL processing facility commenced in November 2004 in connection with the pre-commissioning of the Coral Bay HPAL facility. NAC currently supplies all of the limonite ore required for the operation of the Coral Bay HPAL facility and currently expects to continue to do so. 3.3 Taganito Mine The Taganito mine is located within the municipality of Claver in the province of Surigao del Norte on Mindanao Island. The mine site is 4,862.71 ha in size and is located within the geographical coordinates 9°30’00” – 9°33’00” north latitude and 125°47’00” – 125°53’00” east longitude. The mine site is adjacent to the barangays of Taganito, Urbiztondo and Hayanggabon. The combined population of these communities is approximately 4,300 inhabitants. Taganito mine supplies saprolite and limonite ore to customers in Japan and China. 3.4 Cagdianao Mine The Cagdianao mine is located adjacent to Barangay Valencia in the Municipality of Cagdianao on Dinagat Island in the province of Surigao del Norte. The mine area covers approximately 697 ha, bounded by Barangay Valencia to the west of the active mining areas and the hamlet of Baliwan to the southwest. The combined population of these communities is approximately 1,200 inhabitants. CMC’s current operations comprise an aggregate area of 229 ha and are included within the geographical coordinates 10°08’27” – 10°10’27” north latitude and 125°39’00” – 125°40’31” east longitude. Cagdianao mine supplies both saprolite and limonite ore types to customers in Japan and China. 3.5 Taganaan Mine The Taganaan mine is located on Hinatuan Island, which is 25 km due east of Surigao City and bounded by the Hinatuan Passage to the north and Banug Strait to the south and west and the Pacific Ocean to the east. The mine operations, which generally cover the entire island, are geographically located between 9º44’ – 9º49’ north latitude and 125º42’ – 125º44’ east longitude. Barangay Talavera, located on nearby Talavera Island, is the nearest community. Two coastal hamlets, one on the southeast side of Hinatuan Island, the other on the west side of Talavera Island, are not directly affected by the project. The combined population of these communities is approximately 1,700 inhabitants. Taganaan mine supplies both saprolite and limonite ore types to customers in Japan and China. Maps showing the location of the Properties are provided as Figure 3-3. WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-24

- 19. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 8 4 Mineral and Land Titles The mines are operated under Mineral Production Sharing Agreements (“MPSA”). An MPSA is an agreement pursuant to which the Government grants to the contractor the exclusive right to conduct mining operations within a contract area and shares in the gross output from the operations. The Government’s share consists of an excise tax of 2% of the “gross revenue from mining” (see “Taxation” below). In addition, if an MPSA covers an area that lies within a mineral reservation, the contractor is required to pay the Government a further royalty of not less than 5% of gross revenues from the sales of minerals from the properties. The contractor under an MPSA is required to provide all the necessary financing, technology, management and personnel. An application for a MPSA generally takes eight to 12 months to process. The current MPSA’s under which NAC operates it mines are shown in Table 4-1. Table 4-1: MPSA Details Effective Renewal Surface Area Property Title Agreement Holder Date Year (ha) Rio Tuba Mine MPSA 114-98-IV 4-Jun-98 2023 RTN 990 (1) Sitio Gotok MPSA 213-2005-IVB 28-Apr-05 2030 RTN 83.53 Taganito Mine MPSA 266-2008-XIII-SMR 18-Jun-09 2034 TMC 4,862.71 (2) Cagdianao Mine MPSA 078-97-XIII-SMR 19-Nov-97 2022 East Coast 697 Taganaan Mine MPSA 246-2007-XIII-SMR 25-Jul-07 2032 HMC 773.77 (3) South Dinagat Mine MSPA 072-97-XIII-SMR 7-Aug-97 2022 PNPI 25,000 Manicani Mine MPSA 012-92-VIII 13-Aug-92 2017 HMC 1,165 (1) Sitio Gotok limestone pit is mined by RTN and sold to CBNC for use at the Coral Bay HPAL facility. (2) Cagdianao is operated by CMC under the East Coast Agreement between CMC and East Coast dated December 14, 1998. (3) South Dinagat is operated by HMC under the South Dinagat Agreement between HMC and PNPI dated October 18, 2001. 4.1 Rio Tuba Mine On 17 June 2003, RTN filed an application to convert 463 previously expired mining contracts covering an additional 4,275 ha on which no operations are currently being conducted, and to convert them to an MPSA. The application remains in process. The mineralised areas within the application area which is included in the previously classified CORE ZONE / RESTRICTED ZONE per ECAN zone map have already been reclassified as a Mineral Resources Development Zone thus allowing mining per Bataraza municipal council resolution No. 68 and PCSD Res. No. D8-358. The Mineral Resource Development Zone has been integrated into the Municipality’s Comprehensive Land and Water Use Plan which was approved by the Sangguniang Bayan of Bataraza and also ratified and approved by the Sangguniang Panlalawigan of the Province of Palawan in its Res. No. 8300-10 dated 5 January 2010. Meanwhile, all documentary requirements pertinent to the MPSA application have been submitted to the Mines and Geoscience Bureau, Region IVB (MIMAROPA), except the PCSD Clearance which is now being requested from the council. WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-26

- 20. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 9 RTN has two existing lease contracts with the Department of Environment and Natural Resources (“DENR”) with respect to its authority to use the foreshore land in Barangay Rio Tuba for a pier site. Both of these leases expire in November 2024. Figure 4-1, Figure 4-2 and Figure 4-3 are general arrangement maps showing the location of mining and the MPSA boundary for the RTN. Figure 4-1: Location Map of the Rio Tuba Mine Area WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-27

- 21. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 10 Figure 4-2: Rio Tuba MPSA Aerial Photo Figure 4-3: Rio Tuba Ownership and MPSA Topography map WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-28

- 22. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 38 6.6.3 Bulanjao (Rio Tuba) 6.6.3.1 Location and Accessibility The Bulanjao nickel deposit is within the mineral property of Rio Tuba Nickel Mining Corporation (“RTNMC”) denominated under AMA IVA-144A, with an area of 3,604.50 hectares, approved by the Local Government Unit of the Municipality of Bataraza and under AMA-IVA-144B, with an area of about 670.50 hectares, that has yet to be approved by the Local Government Unit of the Municipality of Rizal. It is located at the southeast tip of Palawan Island bounded by geographical coordinates 8 0 33’ 14.68” – 80 36’ 39.76” N latitude and 1170 22’ 52.00” – 1170 25’ 55.44” E longitude adjacent to the existing MPSA area of RTNMC. It is accessible by a 1hr and 20 minutes air travel from Manila to Puerto Princesa and another 45 minute flight via a single engine aircraft or a 6hr land travel by car. Palawan Island is the most western island of the Philippines situated between South China Sea and the Sulu Sea (Figure 6-11). 6.6.3.2 Geology The Rio Tuba ultramafic complex is the Southern Palawan segment of an ophiolite belt that covers Balabac Island in the South and extends to the Northeast up to Bahile Isthmus where it is in contact (along a fault) with a pre-Jurassic metamorphic basement sequence. Southern Palawan is underlain by rocks composed of dunite, peridotite, serpentinite, and gabbro that have been thrusted into a chert spilite formation, the oldest rocks in the region. Unconformably overlying the ultramafic rocks south of the Bulanjao Range are Pliocene to Pleistocene clastic sedimentary rocks with calcareous sandstone, siltstone and limestone members. The general geology of the Rio Tuba Nickel Property is a sequence of layered peridotite and dunite underlying the Bulanjao Range and a detached dunite block at Guintalunan hill. Magmatic rocks consisting in gabbro, pegmatite and small intrusive bodies of dioritic composition constitute the bulk of the rocks exposed in Northern Bulanjao. Physical and chemical weathering in situ of the Rio Tuba ultramafic complex resulted in the development of a thick reddish brown laterite mantle that caps a secondary nickel enriched saprolite zone of significant volume of economic grade. 6.6.3.3 Exploration Sub-surface evaluation of the project area through test pits and core drilling had been carried out initially at 300 m by 300 m grid then at 100 m by 100 m, 50 m by 50 m and finally at 25 m by 25 m. A total of 2,142 drill holes with a total length of 25,612 meters were drilled. Core samples were collected every meter and half cores are assayed for nickel, iron, and cobalt content at the RTN in-house laboratory located at the property. The other half is kept for future reference. The drilling campaign will be continued, especially within the northern and central area, to upgrade the Inferred Resource to Indicated Resource and Measured Resource. WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-56

- 23. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 39 Figure 6-11: Location map of Bulanjao exploration area 6.6.3.4 Mineral Resource The Mineral Resources estimated by NAC for the Bulanjao project are shown in Table 6-3. Table 6-3: Mineral Resource estimate for Bulanjao as at 31 December 2009 Contained Ni Mineral Class WMT DMT %Ni %Fe (t) Saprolite Measured 5,444,682 3,436,911 1.97 11.42 67,821 Indicated 2,013,999 1,292,441 1.92 11.60 24,866 Inferred 8,293,554 5,167,108 1.80 12.13 92,886 Limonite Measured 7,585,071 5,218,821 1.31 35.51 68,319 Indicated 11,631,869 8,100,481 1.06 34.01 85,651 Inferred 5,360,884 3,722,374 1.17 36.05 43,671 Cut-off grades: Saprolite - ≥1.20%Ni; <20.0%Fe Limonite - ≥0.10%Ni; ≥20.0%Fe WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-57

- 24. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 58 7.8 Planned Production 7.8.1 Ore and Waste Production Schedule The ore and associated waste mining schedule for 2010, 2011 and 2012 are listed in Table 7-12. Table 7-12: NAC ore and waste mining schedule, 2010 to 2012 Company Forecast 2010 2011 2012 Rio Tuba Nickel Mining Total material moved (wmt) (1) 5,467,429 5,584,151 5,556,832 (2) Ore mined 2,186,134 2,304,377 2,839,508 (3) Stockpile retrieving 2,547,762 2,434,177 1,796,183 Waste handled 733,533 845,597 921,141 Ratio of waste handled to ore mined 0.34 : 1 0.37 : 1 0.32 : 1 Shipment volume (wmt) 3,646,572 4,393,717 3,893,717 Taganito Mining (1) Total material moved (wmt) 3,676,849 5,403,847 7,469,458 Ore mined (2) 569,350 684,616 684,616 Stockpile retrieving (3) 332,500 1,069,231 1,104,290 Waste handled 2,774,999 3,650,000 5,680,552 Ratio of waste handled to ore mined 4.87 : 1 5.33 : 1 8.30 : 1 Shipment volume (wmt) 1,165,000 1,000,000 1,000,000 Cagdianao Mining Total material moved (wmt) (1) 834,774 507,999 534,283 Ore mined (2) 467,371 316,461 332,458 Stockpile retrieving (3) - - - Waste handled 367,403 191,538 201,825 Ratio of waste handled to ore mined 0.79 : 1 0.61 : 1 0.61 : 1 Shipment volume (wmt) 950,000 900,000 300,000 Hinatuan Mining Total material moved (wmt) (1) 1,214,706 2,941,516 2,898,640 (2) Ore mined 1,214,706 2,941,516 2,898,640 (3) Stockpile retrieving - - - Waste handled - - - Ratio of waste handled to ore mined 0.00 : 1 0.00 : 1 0.00 : 1 Shipment volume (wmt) 1,950,000 1,950,000 2,898,640 NAC Group Consolidated (1) Total material moved (wmt) 11,193,758 14,437,513 16,459,213 (2) Ore mined 4,437,561 6,246,970 6,755,222 Stockpile retrieving (3) 2,880,262 3,503,408 2,900,473 Waste handled 3,875,935 4,687,135 6,803,518 Ratio of waste handled to ore mined 0.87 : 1 0.75 : 1 1.01 : 1 Shipment volume (wmt) 7,711,572 8,243,717 8,092,357 1. Total material moved includes ore mined, stockpile retrieving and waste handled. 2. Ore mined represents saleable ore and transitional ore mined during the period. 3. Stockpile retrieving represents amount of ore retrieved from existing stockpiles during the period. WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-76

- 25. SRK Consulting NAC002_Nickel Asia Corporation: Independent Technical Report Page 59 From the above mining schedules it can be seen that Rio Tuba mines the majority of the ore produced by NAC. Over the period 2010 to 2012, Rio Tuba accounts for an average of 66% of total annual ore production during this period. It can also be seen that Rio Tuba, Hinatuan (Taganaan) and Cagdianao have low strip ratios (tonnes of waste per tonne or ore). At Taganito there is a considerable tonnage of waste required to be mined in 2010 and 2011 to allow for mining of ore, resulting in strip ratios of 4.4 and 6.0 for those years, but the waste quantity reduces considerably in 2012. 7.9 Mine Operating Status All of the mines are subject to climatic conditions that result in suspension of the operations from time to time. The nature of the material is such that any more than a light sprinkling of rain will make the haulroads untrafficable. For this reason, mining operations at all of the mines are scheduled around the dry season with minimal mine production forecast during the wet season. During this wet period operations focus on some minor prestripping, desiltification of silt traps and some remedial work. On the Island of Palawan where Rio Tuba is located the rainy season is from July to October. Being on the east coast of the Philippines, both Cagdianao and Taganito have a wet season extending from November through to March. WARR/kami NAC002_Nickel_Asia_SRK_Report_Rev18 October 2010 A-77