Chapter 1

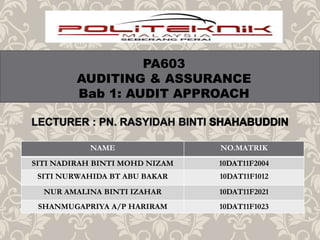

- 1. PA603 AUDITING & ASSURANCE Bab 1: AUDIT APPROACH NAME NO.MATRIK SITI NADIRAH BINTI MOHD NIZAM 10DAT11F2004 SITI NURWAHIDA BT ABU BAKAR 10DAT11F1012 NUR AMALINA BINTI IZAHAR 10DAT11F2021 SHANMUGAPRIYA A/P HARIRAM 10DAT11F1023

- 2. 1.1 Understanding The Nature of Audit Approach 1.1.1 Discuss the Audit Approach step 1.1.2 Differentiate the types of audit approch a. Interim Audit b. Financial Audit c. Compliance Audit 1.1.3 Determine The used of each type of Audit Approach 1.1.4 Explain The uses of flowchart In Audit Approch

- 3. STEP 1 • Adequately plan, control and record his work. STEP 2 • Ascertain the entity’s system for recording and processing transactions and assess the adequacy and reliability of the system. STEP 3 • Obtain relevant and reliable audit evidence. STEP 4 • If the auditor wish to rely on any internal controls, he should ascertain and evaluate the internal controls and performs.(internal control..eg: filing, punch card) STEP 5 • Carry out a substantive review of the financial statements, and in conjunction with the conclusion drawn from other audit evidence obtained, to give him a reasonable basis for his opinion on the financial statements.

- 4. INTERIM AUDIT • To establish prove the reliability and completeness of the accounting books and records as a basis for the preparation of the financial statement. • Risk assessment procedure and planning analytical procedure. FINANCIAL AUDIT • Substantive procedure on the financial statement so as to enable the auditor to give an opinion on the financial statements. ( True and Fairview) • Determine whether the overall financial statement are prepared in accordance with specific financial reporting framework. COMPLIANCE AUDIT • Audit to conform whether a firm is following the terms of an agreement. • Determine the extent to which rules, policies, laws, covenants or government regulations are followed by the entity being audited.

- 5. INTERIM AUDIT • To establish the reliability and completeness of the accounting books and records. COMPLIANCE AUDIT • To confirm whether a firm following the term of an agreement. FINANCIAL AUDIT • To carry out substantive procedures on the financial statement so as to enable the auditor to given an opinion on the financial statement.

- 6. Flowcharts are a great tool to use to visualize complex systems involved in an organization and are easier and less time consuming for someone to understand than a narrative. By placing everything in a visual manner it will be easier for an auditor to see the redundancies and an organization's system of internal accounting control. EXAMPLE OF FLOWCHART

- 7. 1.2 Know The Types of Audit Test 1.2.1 Discuss each type of audit test a. Vouching b. Verifications c. Test of Control d. Substantive Test e. Walk-through Test f. Depth Test g. Weakness test h.Rotational test 1.2.2 Explain the uses and purpose of each type of audit test

- 8. Audit Test A procedure performed by either an external or internal auditor in oder to assess the accurancy of various fianancial statement assertions. 2 common catergorizations of audit tests are : a) substantive test b) test internal control

- 9. Type of Audit Test Vouchin g Vouching is a technical term, which refers to the inspection of documentary evidence supporting & substantiating a transactions, by an auditor. It is the essence of Auditing It is the practice followed in an audit, with the objective of establishing the authenticity of the transactions recorded in the primary books of account.

- 10. As for verifications , auditors are Verification normally required to see that the supporting document are verified while auditing. sIs normally done by nominated person in the company which involves reviewing, inspecting & checking to ensure that the documents conform to specific requirements. On the other hand, there’s another physical verifications which is done by the auditors themselves. This is an auditing procedure whereby an auditor inspects the actual assets of the company to make sure that they are the same with the written records. Are audit procedures performed to test Test of control the operating effectiveness of control in preventing or detecting material misstatements at the relevant assertion level. An auditor might use inspections of documents, observations of specific control, re- performance of the control, or other audit procedures to gather evidence about control.

- 11. Substantive test Are those activities performed by the auditor to detect material misstatements or fraud at the assertions level. A procedure used during accounting audits to check for errors in the balance sheets & other financial documentations. A substantive test might involve checking a random sample of transactions for errors, comparing acc. balance to find discrepancies,or analysis and review of procedures used to execute and record transactions. Walk- through test Is a procedure used during an audit of an entity’s accounting system to gouge its reliability. Walk- though tests trace the transactions step-by-step through the accounting system from its inception to the final disposition. Also known as a combination of observation, documentation and inquiry in the form of a transactions walkthrough. Involve the tracing of a few transactions through the accounting system.

- 12. Depth test Involve the examinations of books of accounts in depth. Such a system of checking is adopted in big business houses, where detailed examination of all the records in not possible. This system of checking is undertaken with a view to check the incidence of error and frauds in the books of accounts. Also known as “cardle-to-grave” Weakness test Once the depth test is completed, the auditor will be able to form a view regarding the number of errors or weaknesses noted in the depth test and take the necessary action to ensure that an adequate level of assurance is attained Also known as “additional test”

- 13. Rotational Test An idea of the adequacy of the client’s internal control system can be obtained from the previous year’s audit. The auditor needs to consider whether there is a need to carry out rotational test and whether they should be performed on selected areas only This technique is useful when the client company has a large number of departments or branches. This test may be applied as long as the controls identified have not changed since they were last tested and the assessed risk of material misstatement as the assertion level is not significant.

- 14. The used & purposes of Each Type of Audit Test

- 15. Purposes & uses of Vouching Proper Evidence The purpose vouching is to note that proper evidence is available for every entry. This signatures, initials and rubber stamp are evidence that document has been authorized and checked Proper Authority The purpose of vouching is to note that there is proper authority behind every transactions. In the absence of any signature of manager the transaction are not acceptable at all Right Period The purpose of vouching is to check that date of the vouchers relate to accounting period. This adjustments in books are made on the basis of current year record of transactions. Correct Amount The purpose of vouching to check that correct amounts have been recorded in the entry. The vouching is useful to record only correct amount in the books or accounts.

- 16. Purposes & uses of Verifications The general objective to be achieved by audit verifications work is to establish whether the financial statements present a true and fair view Verification means to obtain and examine evidence in respect of an item assets that: o The asset exists on a given date. o The asset is legally owned by the concern. o There are no unrecorded assets. o The asset are disclosed, classified, and presented in accordance with recognized accounting policies and the requirement of law Audit techniques that may be used physical inspection, observation and confirmation.

- 17. Purposes & uses of Test of control The objective : to obtain evidence about the effectiveness of control to support the auditor’s opinion on the company’s internal control over financial report Test of controls are usually “dual purpose” [1] to test compliance with an entity’s designed internal controls, formal or informal [2] to “re-performed” certain accounting systems and internal control procedures Purposes & uses of Substantive test To reveal monetary errors or misstatements in the recording or reporting of transactions and balances. To determine whether transactions-related audit objectives have been satisfied Inspect supporting documents like invoices to confirm that sales did occur. Arrange for suppliers to confirm in writing the details of the amount owing at balance date as evidence that accounts payable is a liability (right & obligations) Make inquiries of management about the collectability of customers accounts as evidence that trade debtors are accurate as to its valuations

- 18. Purposes & uses of Walk-Through test PURPOSE: to establish reliability of client’s accounting & internal control procedures & to reveal system deficiencies & material weakness that need to be rectified at the earliest USE: The auditors selects one or a few documents for the initiation of a transaction type & traces them step by step through the entire accounting process. The auditor is required to performs at least one walk through for each major class or transactions. The walk through procedure, documentation of the internal control in flow charts or internal control questionnaires, reading the general ledger and consideration of the prior years control risk assessment may permit an assessment of control risk in the current period that is less then high.

- 19. Purposes & uses of Depth Test To provide audit evidence to assist the auditor in arriving at his opinion where the auditor is still unable to form an opinion from the results of the walkthrough test and to confirm the accuracy client’s accounting system that involve only a small number of transactions. To confirm the accuracy of clients accounting system (walk through checks)- involve only a small number of transactions. To perform compliance test( the auditor may use a number of transactions, testing the control in depth at each stage). Such test will provide evidence as to whether or not he may rely upon that control in planning later audit work. To provide evidence of a substantive nature (to check that transactions have been properly recorded in the accounting records or in the financial statements.

- 20. Purposes & uses of Weakness Test PURPOSE: Is to establish whether material errors have in fact accrued ( if they have an extended program of work on the verifications of associated asset will be carried out) USE: Additional test are done in view of the number of errors or weaknesses noted in the depth test. Necessary in order to support conclusions drawn in a test of control that the level of confidence or assurance required has been obtained. Purposes & uses of Rotational Test PURPOSE: is to improve audit approach efficiency, some firms rely to varying degrees on controls tested in previous engagements. Controls are therefore tested on a rotations basis. USE: Where the system of internal control is known from past experience to be sound, it is considered a useful technique to apply by carrying out tests on selected only. Where there is a large number of departments or branches, it is impractical to test procedures at all departments or branches.

- 21. 1.3 Perform The Audit Procedures And Techniques 1.3.1 Explain the need of audit procedures and audit techniques 1.3.2 Elaborate the audit procedures through : a. Test of control b. Analytical procedures c. Substantive Procedures

- 22. The need of audit procedure and audit techniques is to obtain an audit evidence

- 23. Ascertainment the arithmetical accuracy of the books of account by checking posting, casting, cross casting, carry forwards, opening and closing balances etc. Examining the documentary evidences and the authority in support of the transaction Ensuring that information disclosure is adequate in annual financial statements and that it conveys the real picture about the asset, liabilities and operation results. Audit Procedures Verification of existence, owernership and title and value of the assets and determination of the extent and nature of liabilities.

- 24. Posting checking Casting checking Confirmation Physical verification Audit techniques

- 26. Analytical Procedures Analytical procedures are a form of audit evidence. Analytical procedures are an important type of evidence on an audit. They involve a comparison of recorded values with expectations developed by the auditor. They consists of evaluations of financial information made by a study of plausible relationships among both financial and nonfinancial data. For example, the current-year accounts receivable balance can be compared to the prior-years' balances after adjusting for any increase or decrease in sales and other economic factors. There are three types of analytical procedures: 1. Preliminary analytical procedures 2. Substantive analytical procedures 3. Final analytical procedures Auditing standards require that the auditor conduct analytical procedures in planning the audit. Analytical procedures can be helpful in identifying the existence of unusual transactions or events and amounts, ratios, and trends that might have implications for audit planning.

- 27. Substantive procedure Substantive procedures are intended to create evidence that an auditor assembles to support the assertion that there are no material misstatements in regard to the completeness, validity, and accuracy of the financial records of an entity. Thus, substantive procedures are performed by an auditor to detect whether there are any material misstatements in accounting transactions. Example of substantive procedure is Bank confirmation Accounts receivable confirmation Inquire of management regarding the collectibility of customer accounts Match customer orders to invoices billed Match collected funds to invoices billed Observe a physical inventory count Confirm inventories not on-site Match purchasing records to inventory on hand or sold Confirm the calculations on an inventory valuation report Observe fixed assets

- 28. The End

Notes de l'éditeur

- ncy