Report template gme v5

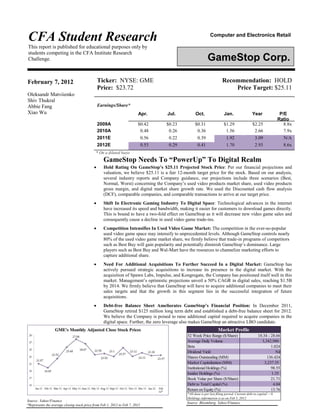

- 1. CFA Student Research This report is published for educational purposes only by students competing in the CFA Institute Research Challenge. Ticker: NYSE: GME Recommendation: HOLD Price: $23.72 Price Target: $25.11 Earnings/Share* Apr. Jul. Oct. Jan. Year P/E Ratio 2009A $0.42 $0.23 $0.31 $1.29 $2.25 8.8x 2010A 0.48 0.26 0.36 1.56 2.66 7.9x 2011E 0.56 0.22 0.39 1.92 3.09 N/A 2012E 0.53 0.29 0.41 1.70 2.93 8.6x * On a diluted basis GameStop Needs To “PowerUp” To Digital Realm Hold Rating On GameStop’s $25.11 Projected Stock Price: Per our financial projections and valuation, we believe $25.11 is a fair 12-month target price for the stock. Based on our analysis, several industry reports and Company guidance, our projections include three scenarios (Best, Normal, Worst) concerning the Company’s used video products market share, used video products gross margin, and digital market share growth rate. We used the Discounted cash flow analysis (DCF), comparable companies, and comparable transactions to arrive at our target price. Shift In Electronic Gaming Industry To Digital Space: Technological advances in the internet have increased its speed and bandwidth, making it easier for customers to download games directly. This is bound to have a two-fold effect on GameStop as it will decrease new video game sales and consequently cause a decline in used video game trade-ins. Competition Intensifies In Used Video Game Market: The competition in the ever-so-popular used video game space may intensify to unprecedented levels. Although GameStop controls nearly 80% of the used video game market share, we firmly believe that trade-in programs of competitors such as Best Buy will gain popularity and potentially diminish GameStop’s dominance. Large players such as Best Buy and Wal-Mart have the resources to channelize marketing efforts to capture additional share. Need For Additional Acquisitions To Further Succeed In a Digital Market: GameStop has actively pursued strategic acquisitions to increase its presence in the digital market. With the acquisition of Spawn Labs, Impulse, and Kongregate, the Company has positioned itself well in this market. Management’s optimistic projections unveil a 50% CAGR in digital sales, reaching $1.5B by 2014. We firmly believe that GameStop will have to acquire additional companies to meet their sales targets and that the growth in this segment lies in the successful integration of future acquisitions. Debt-free Balance Sheet Ameliorates GameStop’s Financial Position: In December 2011, GameStop retired $125 million long term debt and established a debt-free balance sheet for 2012. We believe the Company is poised to raise additional capital required to acquire companies in the digital space. Further, the zero leverage also makes GameStop an attractive LBO candidate. Source: Bloomberg, Yahoo!Finance Source: Yahoo!Finance *Represents the average closing stock price from Feb 1, 2012 to Feb 7, 2012 GameStop Corp. February 7, 2012 Oleksandr Matviienko Shiv Thukral Abbie Fang Xiao Wu Computer and Electronics Retail 52 Week Price Range ($/Share) 18.34 - 28.66 Average Daily Volume 3,342,980 Beta 1.024 Dividend Yield Nil Shares Outstanding (MM) 136.424 Market Capitalization (MM) 3,237.35 Institutional Holdings (%) 98.55 Insider Holdings (%) 1.35 Book Value per Share ($/Share) 21.71 Debt to Total Capital (%) 4.04 Return on Equity (%) 13.76 Market Profile *All data is per last filing period. Current debt to capital = 0. Holdings information is as on Feb 5, 2012

- 2. CFA Institute Research Challenge February 7, 2012 2 Investment Summary We initiate coverage on GameStop with a hold rating and a target price of $25.11, a 5.82% increase from its current stock price. GameStop is the world’s largest video game and entertainment software retailer. The Company, ranked 255 on the Fortune 500 annual listing of public companies, operates 6,627 retail outlets across 17 countries. By retiring $125 million of long term debt in December 2011, the Company is now debt- free. Further, the Company is likely to meet its FY 2011 EPS guidance after repurchasing 2 million shares of common stock. Shift In Electronic Gaming Industry To Digital Space GameStop is in the midst of a changing business environment as the industry is shifting away from consoles and towards the digital market space. With the increased speed and bandwidth of the internet, it has become very convenient for gamers to download digital content from their homes. Further, developers have created online gateways where customers can download gaming content for a fee. As a result, GameStop’s new video game sales may decline, causing a further decline in its used video game trade-ins. Debt-free Balance Sheet Supports The Need For Additional Acquisitions in Digital Space GameStop has made significant progress in the digital space. The Company acquired Spawn Labs, Impulse, and Kongregate and positioned itself well in this segment. Management expects that digital sales will increase by 50% CAGR to reach $1.5 B in 2014. We firmly believe that GameStop will have to acquire additional companies to meet its sales targets and that the growth in this segment lies in the successful integration of future acquisitions. Further, the debt-free balance sheet will help raise the requisite financing on favorable terms. However, the zero leverage and steady cash flows may make GameStop also an attractive LBO target. Competition Intensifies In Video Game Market Along with the transition to the digital space, the industry is also characterized by an increase in competition levels, especially in the used products segment. GameStop operates in an industry where both suppliers and buyers have significant bargaining power. In addition, there are a plethora of inexpensive substitutes available for entertainment. Also, the presence of gigantic players such as Best Buy and Wal-Mart intensifies the competition levels. At present, according to industry analysts, GameStop controls approximately 80% of the used video products market. Even though the Company’s dominance is highly pronounced, we believe that the trade-in programs of such players as Best Buy may potentially gain popularity, thereby depleting GameStop’s share. Large players such as Target and Wal-Mart have ample resources at hand, and can channelize targeted marketing efforts to capture additional used video product share. Figure 1: GameStop Stock Price History Note: Peer Group Average represents average stock returns of peer companies selected for this analysis (see Peer analysis section) Source: Bloomberg & Yahoo!Finance

- 3. CFA Institute Research Challenge February 7, 2012 3 Estimated Stock Price ProbabilityDensity $25.11 $28.87 $32.64 $21.34 $17.57 66% 95% Figure 3: Price Probability Distribution Valuation We give GameStop a Hold Rating and forecast that stock price will be trading at $25.11 at the end of the next 12 months. In calculating this target price we used DCF method as a primary price determinant, and comparable companies and transaction multiples analysis to define a range of possible prices. The multiples approach also served as a means to check the accuracy of the DCF output. DCF Method For DCF valuation, free cash flow to firm was calculated and then discounted for 4Q2011 and FY2012-2015. Additionally, we analyzed three scenarios: best-case, normal-case, and worst-case. Detailed explanations are contained in Financial projections section. The price ranges for each of three scenarios were determined using sensitivity (discount rate/terminal growth rate) tables. Normal-case DCF price was assumed to be the base of our recommendation. Estimated WACC was 10.08%. Please, refer to Appendix 1 for WACC calculation and Appendix 2 for the DCF model. Comparable Companies Method We used such metrics as EV/Sales, EV/EBITDA and P/E as a base for multiples approach in general. Moreover, we used trailing and forward multiples to determine both current and expected market valuation metrics. Peer analysis section describes companies which were selected as a base for this approach and analyzes GameStop’s relative standing among its peers. Trailing max/min multiples for GameStop were determined using average and median peers’ multiples. Please, refer to Appendix 3 for detailed data. Combined with GameStop’s respective financial metrics, this analysis yielded the price range between $17 and $24. The relatively low valuation on EV/Sales can be explained by GameStop’s current relatively high EV/Sales multiple. Please refer to Appendix 4 for details. Further, forward multiples analysis was done for FY2011 and FY2012. Max/min multiples for GameStop were determined using average and median peers’ multiples. Combined with GameStop’s respective financial metrics, this analysis yielded the price range between $16 and $24 for FY2011 and $15 and $23 for FY2012. Please refer to Appendix 5 and 6 for details. Comparable Transactions Method Four transactions within the last two years were selected as comparable. They involved companies which were engaged in specialty electronics retail operations. Please, find the description of selected transactions as well as target companies’ description in Appendix 7. Max/min multiples for GameStop were determined using average and median comparable transaction multiples. Combined with GameStop’s respective financial metrics, this yielded the price range between $28 and $36. It is worth noting that transaction multiples valuation, as a rule, gives higher price range because valuation multiples include acquisition premium. This yielded higher results in comparison to comparable companies’ method. Please refer to Appendix 8 for detailed results. Valuation Results Reconciliation Based on the analyses presented above, the given “football field” graph presents a reconciliation of valuation results obtained by using different methods. Figure 4: GameStop Valuation “Football Field” Source: CFA University Team 15.00 20.00 25.00 30.00 35.00 Trans EV/Sales, EV/EBITDA combined Trailing peers, EV/Sales Trailing peers, EV/EBITDA Trailing peers, P/E FY2011 peers, EV/Sales FY2011 peers, EV/EBITDA FY2011 peers. P/E FY2012 peers, EV/Sales FY2012 peers. EV/EBITDA FY2012 peers, P/E DCF range Current Price: $24 DCF PRICE: $25 GAMESTOP'S VALUATION FOOTBALL FIELD Figure 2: Valuation Methodology Source: CFA University Team Source: CFA University Team

- 4. CFA Institute Research Challenge February 7, 2012 4 Figure 5: Video Products Markets Projections Figure 6: GameStop’s Global Market Share and Total Gross Margin Source: GameStop, EIU, Bloomberg, CFA University Team Risks to the Price Target Further, we have conducted a risk analysis to our target price estimation. Please refer to Appendix 9 for details. Financial Projections We projected various line items on GameStop’s financial statements such as revenue, cost of goods sold, other operating expenses, working capital accounts, capital expenditures, and other operating and non- operating items. These projections were performed using historical data, trends, and various financial and economic agencies such as Bloomberg, Reuters, NPD Group, and Economist Intelligence Unit (EIU). The most important drivers for GameStop’s valuation model are described below. Total Video Game and Products Market Dynamics We projected market for new video software and hardware, PC entertainment software, and other related products separately for USA, Canada, Australia and Europe. These projections were based on historical figures provided in GameStop’s 10-Ks, data on projected industry dynamics from NPD Group, and expected household audio and video equipment nominal market demand growth from EIU. We projected market dynamics for digital mobile, social, console, and PC games based on historical 2010 numbers for north-american market ($6 billion) and expected 2014 figure ($12 billions), as given in GameStop’s 10-K. We extrapolated north-american digital market dynamics to market dynamics in Europe and Australia to have separate projections for geographical regions GameStop operates in. We projected used video products market dynamics separately for USA, Canada, Australia, and Europe. This forecast was based on industry analysts data concerning used video product market in North America in 2010 and our analysis on potential market in Europe and Australia which was based on historical inter-relations between market for new video software and hardware, PC entertainment software, and other related products in North America, Europe and Australia. Further, the analysis included GameStop’s revenue from used video products market from all geographical locations shares dynamics. We also used personal disposable income (in PPP terms) expected growth rates from EIU to forecast used video product market dynamics. GameStop’s Market Share Dynamics We forecast GameStop’s market share for each geographical market. The forecasts were based on historical market shares dynamics and various statistical techniques used to extrapolate the historical performance into the future (exponential smoothing and moving averages). Further, the analysis included our considerations of general industry trends and anticipated dynamics such as entrance of new competitors into used video products market, competition concentration in digital video market, Power-Up rewards program expansion etc. We created three scenarios concerning GameStop’s used video product market share in FY2015 and digital market share growth which eventually drove our revenue projections. The detailed analysis is given in Scenario and Sensitivity analyses section. Please find detailed dynamics of GameStop’s market shares in different markets according to different scenarios in Appendix 10. Gross Profit Margin Dynamics We forecast gross profit margins separately for GameStop’s main products. The forecast was based on historical data and used various statistical tools (exponential smoothing and moving averages) to extrapolate expected future dynamics, while taking into account the seasonality of gross profit margins as well as projected product mix shift towards digital content and anticipated increase in digital and used products competition. We created three case scenarios concerning GameStop’s used video product margin in FY2015. The detailed analysis is given in Scenario and Sensitivity analyses section. Please find detailed dynamics of GameStop’s gross profit margins according to various scenarios in Appendix 11. Other Operating Items Such items as capital expenditures, acquisitions, working capital needs, depreciation and amortization, share repurchases were taken into account when we created GameStop’s financial model. The capital expenditures forecast was based on management’s projections for FY2011 and were adjusted to take into account the projected depreciation and disposal rates. Further, these projections also included the anticipated EIU’s Producer Price Index (PPI) projections going forward. Acquisitions were projected based on GameStop’s average historical acquisition budget, adjusted for PPI index going further. The split of acquisition expenditures between PPE and Intangibles (which depreciate and amortize, respectively), and goodwill, was made according to historical split between these items from GameStop’s acquisition history. The projection of capital and acquisition expenditures is consistent with anticipated digital market revenue and profit growth rates. Further, they reflect both recent digital acquisitions trend and management’s strategy concerning an operational shift into digital industry. The depreciation and amortization rate was forecast based on the average useful life of assets in online retail/digital industry and the projected decrease in physical store count. Working capital items were forecast based on the GameStop’s historical data as well as peer average figures, Source: GameStop, EIU, CFA University Team

- 5. CFA Institute Research Challenge February 7, 2012 5 Figure 7: Working Capital Accounts Figure 8: Sensitivity Analysis Figure 10: Liquidity, Efficiency & Leverage Analysis Source: Bloomberg, CFA University Team combined with projected revenue and cost of goods sold. As of January 2012, GameStop had approximately $330 million remaining from announced earlier share repurchase program. We assumed this amount would be spent evenly through FY2012-2015 on share repurchases. We forecast average share repurchase price equal to our fair value price of $25.11. We forecast no dividend payments and terminal growth rate of 2.5%, which is consistent with GameStop’s projected revenue growth rates and anticipated long-term US and global GDP growth rates. Scenario and sensitivity analyses We believe complete investment analysis should entail several scenarios dependent on key value drivers. One of the most important value drivers for GameStop are: 1) the used video game market share projections; 2) the projected digital market share growth rate; and 3) the projected used video game margins. The best-case scenario is based on management’s projections concerning digital revenue ($1.5 billion in FY2014), from which we have derived implicit expected digital market share growth rate. Further, the best- case scenario incorporates management comments concerning the anticipated strengths of used products business. The Normal-case scenario is based on industry trends, EIU, NPD forecasts, and different statistical methods used to derive key drivers. Worst-case scenarios represent depressed normal-case projections, as well as some industry experts’ forecasts. Further, we conducted additional sensitivity analysis across the aforementioned scenarios by varying 1) Weighted Average Cost of Capital and 2) Terminal Growth Rate. Therefore, based on the results of a given analysis we can determine the ultimate price range of DCF results taking into account various scenarios and sensitivity factors: $19-$35. The lower range represents intersection point of worst-case and normal-case share prices and upper range represents intersection of normal-case and best-case share prices. Please refer to Appendix 12 for detailed results of the DCF valuation according to different scenarios. Financial Analysis Financial analysis is crucial in evaluating current financial position of GameStop, which will give a necessary perspective on the company’s prospects and, therefore, build a base for a DCF analysis. Balance Sheet & Financing Historically, current assets represented around 43-45% of total assets. Merchandise inventories and cash items were the major current assets representing 39-41% of total assets, while goodwill and net PP&E were major long-term assets representing 49-51% of total assets. On the liabilities side, current liabilities were in the order of 33-42% of total assets. Long-term liabilities, mainly in form of long-term borrowings, represented 4-11% of total liabilities and equity. Finally, equity, mainly in form of additional paid-in capital and retained earnings represented historically 55-57% of total assets. Main transformations, which occurred with balance sheet structure, are stipulated by GameStop’s acquisitions. These acquisitions caused decrease in cash by 22% and made goodwill the major item of the GameStop’s assets in 2010. Further, by redemption of all of the long-term debt, accounts payable became a major item on a liabilities side in 2011. For detailed balance sheet analysis please refer to Appendix 13. Liquidity analysis: GameStop liquidity ratios are lower than its peer group average indicating a certain degree of illiquidity. Moreover, historically, these ratios have been deteriorating. Efficiency Analysis: GameStop is less efficient in managing its assets when compared to peer group averages. However, the Company is more effective in managing its working capital needs than its peers. It takes GameStop on average 2-3 days to collect its receivables and 58-79 days to sell off the inventory, by contrast, peer average for collecting A/R is 12-13 days and for inventory is 83-97 days. This results in significantly lower WC percentages for GameStop, which helps Company to conserve cash for its strategic needs. Leverage Analysis: GameStop has historically and currently much less debt than its peers which makes the Company a safer investment, as well as an attractive target for an LBO. This also helps GameStop to preserve some cash for acquisitions or other strategic initiatives by not requiring to service any debt. Moreover, current D/E is zero as the Company paid all of its outstanding debt in December 2011. 25.11 -1.0% -0.5% 0.0% 0.5% 1.0% -1.0% 67.95 82.20 105.46 150.24 272.04 -0.5% 33.49 $ 35.96 $ 38.96 $ 42.71 47.50 0.0% 23.13 $ 24.06 $ 25.11 $ 26.31 27.69 0.5% 18.15 $ 18.61 $ 19.12 $ 19.67 20.28 1.0% 15.23 15.49 15.78 16.08 16.41 NORMAL CASEANALYSIS TERMINAL GROWTHRATE DISCOUNT RATE Items 2010H 2011E 2012F 2013F 2014F 2015F A/R days 2.5 2.5 2.5 2.5 2.5 2.5 Inventory days 60.8 64.6 68.5 72.3 77.1 80.0 A/P and accruals days 86.3 79.8 79.8 79.8 79.8 79.8 NWC as % of Sales -2.85% -1.32% -0.56% 0.20% 1.15% 1.72% Historical and Projected Working Capital Accounts 43.35 -1.0% -0.5% 0.0% 0.5% 1.0% -1.0% 127.44 155.51 201.32 289.50 529.38 -0.5% 59.72 $ 64.58 $ 70.51 $ 77.89 87.33 0.0% 39.46 $ 41.29 $ 43.35 $ 45.71 48.42 0.5% 29.77 $ 30.68 $ 31.67 $ 32.76 33.96 1.0% 24.11 24.64 25.20 25.80 26.45 BEST CASEANALYSIS TERMINAL GROWTHRATE DISCOUNT RATE 12.65 -1.0% -0.5% 0.0% 0.5% 1.0% -1.0% 27.93 32.95 41.16 56.96 99.95 -0.5% 15.68 $ 16.55 $ 17.61 $ 18.94 20.63 0.0% 11.95 $ 12.28 $ 12.65 $ 13.07 13.56 0.5% 10.12 $ 10.28 $ 10.46 $ 10.66 10.87 1.0% 9.02 9.12 9.22 9.33 9.44 WORSTCASEANALYSIS TERMINALGROWTHRATE DISCOUNT RATE 1.2 Liquidity analysis 2009 2010 3Q2011 2009 2010 3Q2011 Current ratio 1.28 1.23 1.06 1.70 1.63 1.64 Quick ratio 0.65 0.51 0.29 0.74 0.63 0.55 GameStop Peer GroupAverage 1.3. Efficiency analysis 2009 2010 3Q2011 2009 2010 3Q2011 Total Assets turnover 1.92 1.89 1.84 2.38 2.44 2.33 A/R days 2.61 2.49 2.33 12.36 12.93 13.13 Inventory days 58.50 60.81 78.87 85.89 83.64 97.25 A/P days 55.21 52.35 129.50 42.71 41.68 48.11 WC as % of sales 5.2% 4.3% 1.4% 11% 11% 11% GameStop Peer Group Average 1.4. Leverage analysis 2009 2010 3Q2011 2009 2010 3Q2011 Total Debt to Equity 16.43% 8.60% 4.21% 61.15% 48.41% 55.14% Peer Group AverageGameStop Source: GameStop, CFA University Team Source: CFA University Team Scenario analysis Scenario Description DCF-derived share price Best-case FY 2015 US used video products market share is 85% and used video products gross margin is 13.5%, US digital market share CAGR growth rate for FY2011-FY2015 is 35%, $43.35 Normal-case FY 2015 US used video products market share is 70% and used video products gross margin is 11.5%, US digital market share CAGR growth rate for FY2011-FY2015 is 20%, $25.11 Worst-case FY 2015 US used video products market share is 40% and used video products gross margin is 10%, US digital market share CAGR growth rate for FY2011-FY2015 is 5%, $12.65 S ource:GameS top, Bloomberg, Tulane CFA Figure 9: Scenario Analysis Source: CFA University Team

- 6. CFA Institute Research Challenge February 7, 2012 6 Figure 11: Profitability & Solvency Analysis Source: Bloomberg, CFA University Team Figure 12: Z-score Analysis Source: Bloomberg, CFA University Team Figure 13: Cash Flow Analysis Source: Bloomberg,Tulane CFA Source: Bloomberg, CFA University Team Source: GameStop, EIU Figure 14: Key Industry Data Figure 15: Transforming Elecronic Gaming Industry Source: GameStop, Bloomberg, CFA University Team Earnings Gross margin has been consistently improving for past three years, however, operating profit margin has been consistently deteriorating primarily because of increased SG&A and depreciation margins. This, in turn, has caused the net income margins to diminish. Sales growth was moderate 3-4% for past three years and was enough to offset cost of sales growth (2-4%). However, the growth in sales was insufficient to offset increased SG&A and DD&A, which resulted in a declining net income. FY2010, however, was an exception: bottom line growth was 8%, primarily, due to slowdown in SG&A and DD&A margin growth. Earnings per share, on other hand, demonstrated solid growth primarily due to aggressive share repurchases. Please, refer to Appendix 14 for detailed calculations. Profitability Analysis: GameStop’s profitability is generally similar to its peer group average. ROE is slightly lesser than peer average, however, ROA is slightly higher than peer average. On the margin side, when compared to its peers, GameStop has a weaker Gross margin, however, a stronger EBITDA and Net Income margins. Solvency Analysis: GameStop, as well as its peers, are solvent companies: EBIT is more than ten times higher than interest expenses. Despite the fact that GameStop’s interest coverage was historically lower than its peers, as of the third quarter of 2011 its solvency is stronger. Additionally, we calculated GameStop’s Z score from 2007 to 2011 Q3. Although GameStop’s Z-score decreasing trend is observable , we believe it is not a sign of near future financial problems, as it is still well above the 2.99 hurdle. Refer to Appendix 15 for detailed data. Cash Flows GameStop generated positive net cash flows in 2006 and 2007 as the Electronic Gaming Industry expanded. Although the cash flow from operations steadily grew from 2006 to 2009, the Company invested enormous amounts to expand geographically by opening additional stores to satisfy the increasing demand, thereby making the total cash flow negative in 2008. While competition intensified in the used products markets, the stock price dipped and the Company issued a $500 M share repurchase program in 2010. Going forward, we anticipate the Company to be cash flow positive with investments in the growing digital market space. Industry Overview and Competitive Positioning The video game market has experienced a plunge in terms of growth rates in recent past. Per industry estimates, the US video game industry dropped from $22 billion in 2008 to $18.5 billion in 2010. According to industry analysts, the industry is experiencing a major shift towards online gaming and away from console games. One of the major reasons for this shift is the end of the current cycle of the consoles with no new consoles on the horizon till the end of 2012. Another major trend in the industry is that the developers believe that the ever-so- popular Trade-In programs, now adopted by most players, are eroding their profit margins. In retaliation, the developers have increasingly placed digitally downloadable content for a fee to hinder the use of such programs. In fact, some developers have created online passes, which require the consumer to pay a fee to use any online content. Thus far, these measures have not created much impact, but as the industry tilts further towards online gaming, it is bound to negatively impact gaming providers. According to industry sources, console internet access is expected to penetrate the gaming industry in the next few years, and the video gaming industry may closely resemble the PC gaming market where digital distributers retain a bulk of the market share. In fact, the next generation Nintendo console is already focused on revamping social online gaming for consoles and it is expected that Microsoft and Sony would follow suit. Because online content causes hindrance in profits from used sales, developers have an enhanced incentive for pushing for this change. Also, with the availability of inexpensive substitutes such as mobile applications, free-to-play social media games, consumers are reluctant to pay upfront costs for online gaming merchandise. 2.2. Profitability analysis 2009 2010 3Q2011 2009 2010 3Q2011 ROIC* 13.43% 13.30% 12.34% 13.89% 12.83% 12.83% ROA 7.97% 8.14% 7.84% 6.97% 6.15% 4.94% ROE 15.02% 14.52% 13.76% 18.39% 15.14% 13.82% Gross margin 26.82% 26.79% 29.07% 33.33% 33.66% 33.02% EBITDA margin 8.81% 8.84% 6.83% 7.23% 7.79% 6.89% NI margin 4.16% 4.31% 2.77% 3.16% 2.73% 0.51% *For GME was calculated taking into account existence of operating leases GameStop Peer Group Average 2.3 Solvency analysis 2009 2010 3Q2011 2009 2010 3Q2011 Interest coverage 14.03 17.91 14.45 18.26 19.77 11.01 GameStop Peer Group Average

- 7. CFA Institute Research Challenge February 7, 2012 7 Figure 16: GameStop’s Competitive Advantage Source: CFA University Team Figure 17: Future Consoles Source: Bloomberg Figure 18: Projected Industry Trends Source: EIU Figure 19: Companies’ USA Market Shares Source: Bloomberg, CFA University Team Source: Bloomberg, CFA University Team Figure 20: Porter’s Five Forces Consequently, industry experts estimate that developers may also shift away from traditional pricing strategies supporting the sale of games at a discount and making up the difference through DLC sales. With these drastic changes predicted, companies such as GameStop would benefit very little from their Trade-In programs as customers would be encouraged to connect their consoles to the internet to access online content. Because of this shift, GameStop will have to pursue an asset-light strategy and shift their sales from physical stores to digital sales. This would reduce the Company’s Property, Plant & Equipment and will require it to make and integrate acquisitions to maintain its brand equity. Players in the Industry: Cost Leaders or Product Differentiators? The level of competition in the electronic game industry has increased manifold over the past few years. With large merchants such as Wal-Mart, Best Buy, Amazon and Target as key players, the players in the industry have tilted towards being a cost-effective rather than distinguishing themselves with inimitable products from exotic suppliers. The industry itself competes with other forms of entertainment such as movies, television, theatre, sporting events, and family entertainment centers. GameStop and other key players have adopted Trade-In programs that allow customers to purchase new gaming inventory at discounts or through store credits when they return used games. These discounts and store credits characterize the cost-effectiveness of the industry. However, GameStop strives to distinguish itself with high quality human capital providing exceptional service to its customers. Porter’s Five Forces Analysis Bargaining Power of Suppliers: the bargaining power of suppliers is determined by their number, penetration in the market, and industry trends. There are numerous suppliers to the Gaming industry but it is dominated by certain key players such as Microsoft, Nintendo, and Sony. Large suppliers such as the ones mentioned control a majority of the market share, supplying a major chunk of the inventory to gaming companies. For example, in 2011, 72% of the new games purchased by GameStop were supplied by just five developers, indicating a high bargaining power of suppliers. Further, the developers are increasingly generating downloadable content for a fee which forces customers to purchase the digital inventory. This action is targeted to discourage the “trading-in” of used games for discounts on new ones. Given that the used-game market constitutes a major portion of the players’ revenues, we believe that the suppliers will continue to have a high bargaining power in the industry. Bargaining Power of Buyer: the buyer of this industry has a plethora of choices to purchase gaming software and hardware platforms. The players in the industry comprise of large and well-spread out retail chains such as Wal-Mart, Best Buy, Amazon, and Target along with established brands such as GameStop, Game Fly etc. Further, the buyer also has other avenues for entertainment such as mobile applications and free-to-play social media games. Even though companies such as GameStop have reward programs that provide discounts and store credits to customers, we believe that the buyer still has a moderately low switching cost. Given the large number of choices of gaming vendors and moderately low switching costs, we believe that the buyers pose a moderate-to-high bargaining power in this industry. Availability of Substitutes: the gaming industry has numerous entertainment substitutes. The substitutes include movies, television, theater, sporting events, and family entertainment centers. Even though the substitutes are large in number and popular sources of entertainment and may be appealing to some video store customers, we believe that a “gaming-geek” would continue to prefer games over other modes of entertainment. Therefore, we believe that the threat of substitutes is moderate in this industry. Threat of New Entrants: the gaming industry poses high barriers to entry for new players. The infrastructure cost of developing stores is high and new players will find it difficult to raise adequate capital to fulfill this need. Further, most gaming players rely on an established brand identity built through channelized marketing efforts. New Entrants may find it difficult to penetrate a saturated market such as this one to effectively compete in the industry. Further, we also believe that players in this industry depend heavily on strong relationships with developers, which would be hard to nurture for a new entrant. Given the reasons mentioned above, we believe that the industry poses a low threat of new entrants. Competition: the video gaming industry in the US has seen an unprecedented increase in the level of competition in the past few years. Players such as Wal-Mart, Best Buy lever upon their existing operations to provide

- 8. CFA Institute Research Challenge February 7, 2012 8 Figure 21: Revenue Breakdown Source: GameStop Figure 22: GameStop’s History and Milestones Source: GameStop, CFA University Team Figure 23: Map of Operations Source: GameStop Figure 24: GME’s Video Store Count Source: Bloomberg gaming inventory to a wide range of customers. Companies such as Amazon have also been able to capture additional market share through its well-known brand identity, thereby enhancing the level of competition in the gaming market space. Even though, the above mentioned companies do not have well established trade-in programs, experts believe that streamlined marketing efforts will enable these firms to create one, thereby increasing the level of competition. Also, with the high bargaining power of suppliers, moderate-to-high bargaining power of buyers, and availability of viable substitutes, the competitive dynamics governing this industry tighten further. The Herfindahl index calculations yielded the result of approximately 0.09, which indicates that the industry is unconcentrated, thus, relatively competitive. SWOT Analysis On the basis of the Company’s standing and the industry trends, we have conducted a SWOT analysis. For details, please refer Appendix 16. Business Description GameStop’s History GameStop’s predecessor Babbage’s was set-up in 1996 and was renamed GameStop in 1999, after Barnes & Noble acquired it. GameStop became an independent company in 2002 when it spun off from its parent company at the time, Barnes & Noble. Since then, the Company has made a series of acquisitions and opened numerous stores across various geographical locations. In 2003, the Company acquired controlling interest in an Irish Electronic games retailer, Games world Group. In 2004, GameStop procured 420,000 square feet facility in Grapevine, Texas which currently serves as their global headquarters. Please refer to the table on the right for GameStop’s further history. GameStop’s Geography: GameStop operates across 17 countries in the western hemisphere. The Company operates predominantly in the United States, Canada, Australia and several European countries. Some of the European countries include Italy, Ireland, France, Germany, Spain, and the Nordic. In the first three quarters of 2011, approximately 70% of the firm’s revenues came from operations in the United States. Revenue from Europe accounted for 18%, while revenues from Australia and Canada were 6% and 5.3% respectively. GameStop Operations & Strategy GameStop is the world’s largest video game and entertainment software retailer. The Company, ranked 255 on the Fortune 500 annual listing of public companies, operates 6,627 retail outlets worldwide. The firm operates these outlets under the names GameStop, EB Games, and Micromania. GameStop’s operations can be broadly split into 4 categories: New Video Game Software, Used Video Products, Video Game Hardware Platforms, Video Game Accessories such as digital, PC Entertainment Software, and Game Informer magazine. Please find a detailed description of the Company’s main products in Appendix 17. Further, the company also has established E-Commerce platforms through different websites across countries. Customer Profile and Acquisition Strategy GameStop caters to a wide range of customers across the globe. From teenagers and young adults to middle- aged and elderly folks, the firm’s customers represent interest from hi-fi fighting games to low-key Sudoku. Game Informer, the largest video game publication in the US, has more than 4 million paid subscribers. The Company has attracted a large pool of customers through a plethora of marketing initiatives such as loyalty programs, print, broadcast, and social media. GameStop launched the PowerUp rewards loyalty program in 2010 which allows the customers the ability to register for a free or paid membership. The membership provides customers to redeem points for discounts or additional merchandize as well as a subscription to the Game Informer. Through this program, the Company has added approximately 15.5 million customers since October 2010. Further, the Australian version of the PowerUp program, called EB World program, was launched in September 2011 and has attracted an additional 100,000 members.

- 9. CFA Institute Research Challenge February 7, 2012 9 Figure 25: GameStop’s Suppliers Source: GameStop Figure 26: GameStop’s Key Digital Acquisitions Source: GameStop Figure 27: CFA Team Use of Peer Analysis Source: CFA University Team Figure 28: Peer Analysis Source: CFA University Team Supplier Profile GameStop has a vast number of suppliers but the purchases its makes is not evenly distributed. In fact, the Company depends heavily on a handful of suppliers for the procurement of majority of its merchandise. In 2011, the Company purchased approximately 72% of its inventory from five suppliers: Microsoft, Nintendo, Sony, Activision, and Electronic Arts. Recent Developments GameStop has been very active in making its financial statements look attractive. During the recent holiday season, the Company retired $125 million long term debt, thereby establishing a debt-free balance sheet for 2012. Further, GameStop repurchased 2 million shares at an average price of $22.38 per share with 329.8 million remaining in its authorization. This allowed the Company to keep its FY2011 EPS guidance unchanged after lowering same store sales guidance. GameStop recently launched three android based gaming tablets in more than 200 stores. The tablets are Acer's 7-inch ICONIA, the 10-inch Asus Eee Pad transformer, and the Samsung 10-inch Galaxy tab. They come with 7 free games, Kongregate arcade, digital Game Informer, and a web application that provides product advice and a list of games available with the android marketplace. As the Android sales are projected to rapidly grow to $116 million by 2015, per industry reports, we believe the Company will be much benefitted using this platform. The firm plans to exploit this opportunity to position itself as a key player in the US Android tablet market. Further, in September 2011, GameStop launched iOS device trade-ins, whereby gamers can obtain cash or in-store credits for their used iPads, iPhones, and iPods. GameStop has made a series of strategic acquisitions to expand its presence in foreign markets and enhance its competitiveness. GameStop merged with EB games in 2005 which allowed GameStop to enhance its presence in the UK and Ireland. In 2008, GameStop acquired Micromania, a leading video game retailer in France. In 2010, the Company acquired Kongregate and strengthened its digital platform and enhanced its commitment to become the gaming aggregator of choice. In 2011, GameStop acquired Spawn Labs to increase the spectrum of its digital game products and service offerings. Further, the Company acquired Impulse to provide a digital distribution platform to quickly locate and download games through the internet. Therefore, the Company’s strategy to acquire complementary firms serves as a unique methodology to continuous growth. Please refer for an exhaustive list of acquisitions to Appendix 18. Peer Analysis GameStop operates in an industry that is mature and highly fragmented. Its competitors range from large-cap companies like Wal Mart ($207 billion) and Target ($34 billion) to micro-cap companies like hhgregg ($361 million) and Game Group ($160 million). To conduct the peer analysis we chose companies which have similar to GameStop’s operations, business model, revenue structure, and online operations. GameStop’s relative valuation is mostly superior to its peers as it has the highest EV/Sales and EV/ EBITDA multiples. Its P/E is also in the upper range. Combined with low debt levels it can be inferred that market perceives GameStop as an industry leader. For detailed description of a peer companies please refer to Appendix 19. Investment Risks GameStop is subject to a tremendous amount of risk which can be classified into Operational, Strategic, and Financial risks, which may potentially tarnish its growth and sustainability. Key risks are detailed below. Operations Risk Enhanced dependence on few suppliers: the Company critically depends on few vendors for adequate and timely development of software and hardware products. Further, GameStop’s sales are heavily correlated with the timeliness of delivery of gaming inventory. If the vendors fail to provide quality hardware and software on time, it could severely impact GameStop’s sales and brand image. Also, GameStop is heavily dependent on a few suppliers. In 2011, 72% of the purchases made by the Company came from Microsoft, % of Total Purchase 1 Microsoft 18% 2 Nintendo 16% 3 Sony 16% 4 Activision 12% 5 Electronic Arts 10% Total 72% S. No. Supplier Name Peer Analysis Company Ticker Market cap Net debt P/E P/BV EV/Sales EV/EBITDA D/E ROIC Gross margin GameStop Corp GME 3,717.78 -317.9 8.70 1.15 0.35 4.10 4.21% 12.34% 29.07% Best Buy Co, Inc. BBY 9,285.63 -115 7.86 1.59 0.19 3.12 35.71% 16.40% 24.33% RadioShack Corp RSH 1,160.12 -1.3 9.01 1.45 0.26 3.64 83.35% n/a 42.83% Bic Camera, Inc. 3048 982.01 564.4 7.79 1.02 0.21 n/a 98.32% n/a 24.68% GEO Holdings Corp 2681 655.64 164.52 4.90 1.04 0.26 2.62 74.72% 13.18% 44.11% hhgregg, Inc. HGG 361.15 31.79 8.19 1.24 0.18 3.50 11.68% n/a 28.56% Village Vanguard Co Ltd 2769 160.62 37.67 5.52 0.59 0.30 3.02 34.97% 8.92% 42.33% Game Group PLC GMG 159.88 149.54 n/a 0.35 0.12 3.78 47.22% n/a 24.33%

- 10. CFA Institute Research Challenge February 7, 2012 10 Figure 29: Investment Risks Source: GameStop Figure 30: Projected Currency Fluctuations Source: EIU Source: Bloomberg Figure 31: GameStop’s ROIC and ROE Performance Nintendo, Sony, Activision, and Electronic Arts. Because the Company procures most of its inventory from such few suppliers, GameStop may not be able to obtain favorable terms on negotiated contracts, which can negatively impact the firm’s financial position. Further, because the Company has operations in 17 countries across the world, its vendors also carry the burden of the poor economic conditions that prevail. If the vendors are unable to provide marketing support, it could have a negative impact on GameStop’s earnings. Intensified Competition in the Gaming Industry: the industry is flooded with numerous competitors which has intensified the rivalry among all players in gaming industry space. As pressure intensifies, GameStop may reduce prices and increase capital spending, which will reduce margins and profitability. Further, trade-in programs for other players are expected to expand and gain on GameStop’s program. Necessity to Effectively Manage Stores: with widespread operations, effective store management becomes critical. If the Company fails to manage stores well, it can adversely affect its sales and profitability. Further, if the Company is unable to renew leases for stores on competitive terms, its cost structure is bound to increase. Also, the Company’s success depends upon its continued ability to attract, motivate, and retain talented human capital. Failure to retain key personnel and attract talent can potentially damage the smooth business operations. Strategic Risks Industry Shift & Technological changes: the electronic game industry is witnessing a major shift from hardware consoles to sophisticated software platforms and digital online gaming. Although the Company has made a few acquisitions to enter the digital space, it is highly uncertain that it will be able to keep pace with the changing trends of this highly competitive industry. Failure to adapt to technological advances may render GameStop’s existing business model obsolete. Further, with the changing industry trends, the Company is exposed to lose out on the used video game markets. As more and more developers publish downloadable content and charge a fee, GameStop’s used video game revenues are bound to diminish. As the exchange of used games drive revenues for new gaming products (through store credits), the Company may also lose out on sales of new video games. Acquisitions, Investments, and Competing in a New Market: GameStop has made and may make investments and strategic acquisitions to expand into the digital, social media, browser, and mobile gaming market space. The Company acknowledges that it may have to liquidate a portion of its ownership or raise debt-capital to finance future acquisitions. If GameStop is unable to successfully integrate its acquisitions and capitalize on its investments, it will be unable to adapt to the shift in the industry towards digital media. Further, as the industry evolves to the digital media, mobile, and browser gaming spaces, the Company has had to alter its strategy to meet consumer expectations. Although the Company has seen success in its recent android venture, there is no guarantee that future strategies and their execution would be as successful. Also, the company aspires to close stores that are not meeting its profitability hurdles. If the Company is unable to transfer customers to nearby stores, the sales may drop substantially, leaving the company in a poor financial condition. Financial Risks Foreign Currency Risk: the Company uses forward exchange contracts, foreign currency options and currency swaps to mitigate currency risks related to intercompany loans and foreign currency assets and liabilities. The foreign currency contracts are not hedges and therefore the changes in the fair value is recognized in the earnings. In FY 2010, the Company recognized a loss of $7.1 million due to these derivative instruments. Although we encourage the use of financial derivatives to manage currency risk, the fluctuations caused in their fair value can potentially impact GameStop’s bottom line. Potential changes in Global Tax Rate: because the Company operates across several countries, it is subject to different tax rates and varied tax-accounting policies. If these rates were to change in an unfavorable direction, GameStop may have to bear a significant financial impact. Management Background & Corporate Governance We firmly believe GameStop’s biggest intangible resource is its vast and talented human capital. Please refer Appendix 20 for a snapshot of some of the members of GameStop’s management team. Corporate Social Responsibility GameStop is a socially responsible organization. The Company strongly believes that the communities it serves forms an integral part of its organizational culture. The firm chooses to support organizations whose goals align with the Company’s desire to effectively serve the community. GameStop and it’s non-profit partner, Make-A-Wish foundation, work together to provide shopping sprees to children across the US. The process is well established as the children, their families, and their wish granters visit the nearest GameStop stores to purchase gaming inventory. GameStop takes pride in supporting the foundation and makes continuous efforts to makes the children’s dreams come true!

- 11. CFA Institute Research Challenge February 7, 2012 11 Appendices Appendix 1. WACC Calculations Source: Indicated above Appendix 2. DCF Calculations Source: CFA University Team Item Value Description, Sources Risk-free rate 2.00% Average YTM of 10-year US government bonds for January 2012, source: Federal Reserve Equity beta 1.024 GME's monthly returns for past 5 years were regressed on S&P 500, source: Bloomberg Market risk premium 6.72% Arithmetic average of MRP between 1926-2010, source: Ibbotson Size premium 1.20% Mid-cap company, source: Ibbotson Cost of equity 10.08% Risk-free rate + adjusted beta*Market risk premium + Specific risk premium Cost of debt Pre-tax cost of debt 5.50% Determined using ADamodaran credit rating calculation sheet combined with our assumptions Tax rate 34.30% Average historical tax rate After-tax cost of debt 3.61% Pre-tax cost of debt * (1-tax rate) Weighted average cost of capital ("WACC") Share of Equity 100.00% Based on management guidance Share of Debt - 1-Share of Equity WACC 10.08% % Equity * CAPM + % Debt * After-tax cost of debt WACC Calculations Capital Asset Pricing Model ("CAPM") DCF 2010H 1-3Q 2011H 4Q 2011E 2011E 2012F 2013F 2014F 2015F TV Sales USD $9,473,700.00 $5,971,900.00 $3,605,812.91 $9,577,712.91 $9,829,232.08 $10,119,922.09 $10,457,970.44 $10,856,269.63 COGS USD 6,936,100.00 4,233,900.00 2,761,661.51 6,995,561.51 7,196,718.00 7,426,504.82 7,692,098.71 8,004,327.60 EBIT USD 662,600.00 267,400.00 402,375.71 669,775.71 601,082.35 533,398.01 464,246.64 461,171.91 EBIT % 6.99% 4.48% 11.16% 6.99% 6.12% 5.27% 4.44% 4.25% EBIAT USD 433,771.61 176,333.65 264,378.66 440,072.29 394,937.71 350,466.11 305,030.60 303,010.36 310,585.62 Corrections USD CAPEX USD -240,100.00 -162,800.00 -114,800.00 -277,600.00 -282,603.75 -289,103.64 -296,331.23 -304,035.84 -380,791.57 DD&A USD 176,800.00 142,100.00 51,076.22 193,176.22 235,631.03 277,713.75 322,977.08 371,503.97 380,791.57 Delta NWC USD -123,200.00 -58,900.00 -84,312.26 -143,212.26 -71,309.22 -75,274.20 -100,555.41 -66,305.81 -67,963.46 FCFF USD 247,271.61 96,733.65 116,342.61 212,436.25 276,655.77 263,802.01 231,121.04 304,172.68 242,622.16 Discount rate % 10.08% 10.08% 10.08% 10.08% 10.08% 10.08% Period years 0.13 1.13 2.13 3.13 4.13 Factor for the whole period 0.99 0.90 0.82 0.74 0.67 Discounted FCFF USD 114,954.14 248,320.22 215,098.30 171,192.56 204,669.03 PV of TV USD 2,153,376 Terminal Growth rate % 2.5% Enterprise Value USD 3,107,610 EBITDA multiple 4.03 Sales multiple 0.32 Net Debt USD (317,900) Cash, equivalents, S-T inv USD 442,600 Total Debt USD 124,700 Equity Value USD 3,425,510 # of shares 136,424 Price Per Share USD 25.11$

- 12. CFA Institute Research Challenge February 7, 2012 12 Trading Peers Analysis, As Of Latest Historical Filling Period Company M Cap Net debt TEV Revenue, LTM EBITDA, LTM Net income, LTM TEV/Revenue TEV/EBITDA P/E Best Buy Co, Inc. 9285.63 -115 9170.63 50642 3081 1118 0.18 2.98 8.31 RadioShack Corp 1160.12 -1.3 1158.82 4404.8 318.6 117.3 0.26 3.64 9.89 Bic Camera, Inc. 982.01 564.4 1546.41 7504.08 290.12 110.91 0.21 5.33 8.85 GEO Holdings Corp 655.64 164.52 820.16 3187.8 311.8 126.2 0.26 2.63 5.20 hhgregg, Inc. 361.15 31.79 392.94 2210.81 112.19 46.81 0.18 3.50 7.72 Village Vanguard Co Ltd 160.62 37.67 198.29 497.79 50.53 22.27 0.40 3.92 7.21 Game Group PLC 159.88 149.54 309.42 2491.59 79.49 n/a 0.12 3.89 n/a Min 0.12 2.63 5.20 Max 0.40 5.33 9.89 Average 0.23 3.70 7.86 Median 0.21 3.64 8.01 Standard deviation 0.09 0.86 1.60 Appendix 3. Trading Peers Trailing Multipes Analysis, As Of Latest Filling Period Source: Bloomberg Appendix 4. Target Price Determination On Basis Of Trading Peers Trailing Multipes Analysis Source: GameStop, CFA University Team Appendix 5. Trading Peers Forward Multiples Analysis Source: Bloomberg Trading Peers Forward Analysis TEV/Revenue TEV/EBITDA P/E TEV/Revenue TEV/EBITDA P/E Best Buy Co, Inc. 0.16 2.64 6.83 0.16 2.66 6.20 RadioShack Corp 0.22 3.17 8.40 0.21 2.90 7.02 Bic Camera, Inc. n/a n/a n/a n/a n/a n/a GEO Holdings Corp n/a n/a n/a n/a n/a n/a hhgregg, Inc. 0.22 4.64 10.40 0.20 4.22 9.35 Village Vanguard Co Ltd 0.28 2.77 4.66 0.26 n/a 4.13 Game Group PLC 0.08 5.18 n/a 0.08 3.33 12.79 Min 0.08 2.64 4.66 0.08 2.66 4.13 Max 0.28 5.18 10.40 0.26 4.22 12.79 Average 0.19 3.68 7.57 0.18 3.28 7.90 Median 0.22 3.17 7.62 0.20 3.12 7.02 Standard deviation 0.08 1.16 2.43 0.07 0.69 3.31 Company FY2011 FY2012 Trailing Comparable Peers Valuation GME Financial data Revenue Average Multiple Revenue Median Multiple EBITDA Average Multiple EBITDA Median Multiple P/E Average Multiple P/E Median Multiple TEV min TEV max Net debt P min P max $ 9,664,658 0.23 0.21 1,991,653.04 2,219,816.74 -317,900.00 16.93$ 18.60$ $ 771,554 3.70 3.64 2,806,315.78 2,854,044.68 -317,900.00 22.90$ 23.25$ $ 402,977 7.86 8.01 3,168,255.90 3,228,007.81 0.00 23.22$ 23.66$

- 13. CFA Institute Research Challenge February 7, 2012 13 Appendix 6. Target Price Determination On Basis Of Trading Peers Forward Multipes Analysis Source: GameStop, CFA University Team Appendix 7. Comparable Transactions Analysis and Acquired Companies Description Source: Bloomberg, CFA University Team Acquired Companies Description Source: Bloomberg Appendix 8. Target Price Determination On Basis Of Comparable Tramsactions Multipes Analysis Source: GameStop, CFA University Team Target Companies Description Company Description Culture Convenience Club Co. Ltd. Operations included sales and rental of videos, DVDs, CDs, books, game software and other entertainment content TSUTAYA stores. Also operated online information distribution service Soft Map Co. Ltd. Operated retail stores specialized in computers, software, digital products and related supplies based in Tokyo metropolitan area. Also traded second-hand products and an online business. Warehouse Co. Ltd. Provided leisure related services. Rental division operated 24-hour DVD and CD rental stores in Tokyo, Saitama and Chiba Prefectures. Amusement Facilities division operated 12 game centers, karaoke facilities, and pool halls Sumiya Co. Ltd. Operations included retail of A V software and consumer electronics. Also involved in selling furniture Comparable Transactions Analysis Date of Acquisition Target Acquirer Deal Value Announced premium Target's Net Debt TEV, Minority Perspective Target LTM Revenue Target LTM EBITDA Target LTM Net income TEV/Revenue TEV/EBITDA P/E 2/3/2011 Culture Convenience Club Co Ltd MM Holdings Co Ltd 1250.8 27.9% 383.412 1,285.24 1989.13 232.63 61.14 0.65 5.52 14.75 10/14/2009 Sofmap Co Ltd Bic Camera Inc 60.38 -6.54% 38.6688 103.00 1018.71 8.09 0.30 0.10 excl 215.14 5/14/2010 Warehouse Co Ltd Geo Holdings Corp 57.39 18.6% 25.8476 72.56 107.072 21.05 -18.21 0.68 3.45 n/a 11/5/2009 Sumiya Co Ltd Culture Convenience Club Co Ltd 5.16 6.58% 28.5277 33.35 103.335 -6.05 -18.45 0.32 n/a n/a Min 0.10 3.45 Excl Max 0.68 5.52 Excl Average 0.44 4.49 Excl Median 0.48 4.49 Excl Standard deviation 0.28 1.47 Excl Comparable Transactions Valuation GME Financial data Revenue average multiple Revenue median multiple EBITDA average multiple EBITDA median multiple P/E average multiple P/E median multiple TEV min TEV max Net debt P min P max $ 9,664,658 0.44 0.48 4,222,632.93 4,681,802.74 -317,900.00 33.28$ 36.65$ $ 771,554 4.49 4.49 3,461,174.19 3,461,174.19 -317,900.00 27.70$ 27.70$ $ 402,977 Excluded Excluded Excluded Excluded Excluded Excluded Excluded Forward Comparable Peers Valuation, FY2011 GME Financial data Revenue average multiple Revenue median multiple EBITDA average multiple EBITDA median multiple P/E average multiple P/E median multiple TEV min TEV max Net debt P min P max $ 9,577,713 0.19 0.22 1,838,920.88 2,107,096.84 -317,900.00 15.81$ 17.78$ $ 862,952 3.68 3.17 2,735,557.63 3,175,663.11 -317,900.00 22.38$ 25.61$ $ 428,377 7.57 7.62 3,243,884.11 3,262,090.13 0.00 23.78$ 23.91$ Forward Comparable Peers Valuation, FY2012 GME Financial data Revenue average multiple Revenue median multiple EBITDA average multiple EBITDA median multiple P/E average multiple P/E median multiple TEV min TEV max Net debt P min P max $ 9,829,232 0.18 0.20 1,788,920.24 1,965,846.42 -317,900.00 15.44$ 16.74$ $ 836,713 3.28 3.12 2,606,362.18 2,742,328.11 -317,900.00 21.44$ 22.43$ $ 394,938 7.90 7.02 2,772,462.74 3,119,218.05 0.00 20.32$ 22.86$

- 14. CFA Institute Research Challenge February 7, 2012 14 Appendix 9. Key Risks To Price Target Source: CFA University Team Appendix 10. GameStop’s Projected Market Shares On Different Markets According to Three Scenarios Risk Factors Description Risk Probability Potential Impact on Price Target* Used video products market conjuncture Used video products business is one of the key segments of GameStop. Therefore, its dynamics significantly influence the valuation. If used video game market has better than expected dynamics, GameStop price will be higher than our estimates and vice-versa. High Digital sales growth As the gaming industry experiences a shift to digital realm, it is crucial for GameStop to adapt to this change. The management is optimistic concerning digital sales growth rate and we incorporated this into our valuation to a reasonable extent. If used digital sales market grows better- than expected, GameStop price will be higher than our estimates and vice- versa. High Cyclicity of target industry The retail undustry in general and specialty retail in particular are extremely vulnerable to cyclical sales and profitability fluctuations, especially during holiday seasons. The cyclicity is oftentimes hard to analyze and predict in monetary terms. Average Lack of potentially attractive acquisition targets or inability to succesfully integrate acquisitions into GameStop's business model We projected high level of acquisitions and capital expenditures to sustain GameStop's expansion into digital business to support projected digital sales and market share growth. The inability to actually acquire attractive companies or succesfully integrate them into the business model would result in GameStop's share price decline Average

- 15. CFA Institute Research Challenge February 7, 2012 15

- 16. CFA Institute Research Challenge February 7, 2012 16 Source: GameStop, CFA University Team Appendix 11. GameStop’s Projected Gross Margins According to Base Scenarios Source: GameStop, CFA University Team 1.32% 1.02% 8.65% 9.29% 4.78% 4.46% 12.04% 13.50% 11.50% 10.00% 0.50% 2.50% 4.50% 6.50% 8.50% 10.50% 12.50% 2010H 2011E 2012F 2013F 2014F 2015F Gross Profit Margins Projected Dynamics New video game hardware New video game software Other Used video products, Best-case Used video products, Normal-case Used video products, Worst-case

- 17. CFA Institute Research Challenge February 7, 2012 17 Appendix 12. GameStop’s DCF “Football Field” Source: CFA University Team 9.00 19.00 29.00 39.00 49.00 59.00 69.00 79.00 Best Normal Worst Lower Range: $18.61-$18.94 ~~ $19 Upper Range: $30.68-$42.71 ~~ $35 GAMESTOP's DCF FOOTBALL FIELD

- 18. CFA Institute Research Challenge February 7, 2012 18 Appendix 13. Vertical and Horizontal Historical Balance Sheet Analysis Source: GameStop, CFA University Team 1.1. Vertical and horizontal analysis Balance Sheet Assets 2009H 2010H 1-3Q 2011H 2008-2009H 2009-2010H 1-3Q 2010H - 1- 3Q 2011H Current assets Cash and near cash items 18.27% 14.04% 8.15% 56.61% -21.49% 144.45% Accounts and notes receivables 1.29% 1.29% 1.07% -3.00% 2.34% -1.27% Merchandise inventories 21.26% 24.83% 32.73% -2.06% 19.35% -8.45% Deferred income taxes 0.43% 0.57% 0.56% -10.23% 35.85% 39.40% Prepaids 1.20% 1.49% 2.08% 0.51% 27.44% 37.24% Other CA 0.48% 0.33% 0.26% 53.79% -30.38% 1.30% Total Current Assets 42.93% 42.55% 44.84% 17.01% 1.29% 5.92% Long-term assets Goodwill 39.28% 39.42% 37.92% 4.53% 2.56% 2.78% Gross PP&E 25.14% 28.02% 27.69% 14.85% 13.88% 9.41% Accumulated DD&A 13.36% 15.90% 16.59% 23.55% 21.67% 17.24% Net PP&E 11.79% 12.12% 11.10% 6.36% 5.07% -0.52% Other L-T Assets 6.00% 5.90% 6.14% 4.98% 0.54% 9.53% Total Long-term assets 57.07% 57.45% 55.16% 4.95% 2.86% 2.80% Total assets 100.00% 100.00% 100.00% 9.81% 2.19% 4.17% Liabilities and Shareholders' Equity Current liabilities Accounts payables 19.41% 20.30% 26.95% -8.23% 6.90% -3.32% Accrued liabilities 12.76% 12.97% 13.07% 22.80% 3.94% 25.79% Taxes payable 1.25% 1.24% 0.00% n/a 1.29% -100.00% Current portion of L-T debt 0.00% 0.00% 2.30% n/a n/a 100.00% Short-term borrowings 0.00% 0.00% 0.00% n/a n/a n/a Total Current Liabilities 33.41% 34.52% 42.31% 5.95% 5.56% 10.58% Long-term liabilities n/a n/a n/a Long-term borrowings 9.03% 4.92% 0.00% -18.03% -44.33% -100.00% Deferred taxes 0.51% 1.48% 1.23% n/a 193.73% 273.28% Other L-T liabilities 2.09% 1.90% 1.94% -0.66% -7.32% 5.20% Total L-T Liabilities 11.64% 8.30% 3.17% -11.32% -27.14% -53.04% Total Liabilities 45.05% 42.81% 45.49% 0.88% -2.88% 1.03% Equity Total preferred equity 0.00% 0.00% 0.00% n/a n/a n/a Class A CS 0.00% 0.00% 0.00% 21.95% -50.00% -99.99% Additional paid-in-capital 24.43% 18.34% 14.03% -7.42% -23.26% 354.59% Accum other comprh inc 2.31% 3.21% 4.23% -503.50% 41.67% -85.33% Retained earnings 28.21% 35.66% 36.28% 36.97% 29.19% -28.86% Noncontrolling interest 0.00% -0.03% -0.03% n/a 600.00% 14.12% Total equity 54.95% 57.19% 54.51% 18.41% 6.35% 6.94% Total liabilities and Equity 100.00% 100.00% 100.00% 9.81% 2.19% 4.17% Vertical analysis Horizontal analysis

- 19. CFA Institute Research Challenge February 7, 2012 19 Appendix 14. Vertical and Horizontal Historical Income Statement Analysis Source: GameStop, CFA University Team Appendix 15. Altman Z-Score Calculations Source: GameStop, CFA University Team 2.1. Vertical and horizontal analysis Income statement 2009H 2010H 1-3Q 2011H 2008-2009H 2009-2010H 1-3Q 2010H - 1- 3Q 2011H Sales 100.00% 100.00% 100.00% 3.09% 4.36% 3.30% Cost of Sales 73.18% 73.21% 70.93% 1.65% 4.41% 2.14% Gross profit 26.82% 26.79% 29.07% 7.25% 4.23% 6.27% SG&A 18.01% 17.95% 22.25% 12.76% 3.99% 9.10% DD&A 1.79% 1.84% 2.35% 12.13% 7.44% 8.49% Operating earnings 7.02% 6.99% 4.48% -5.65% 4.02% -6.78% Interest income -0.02% -0.02% -0.01% -81.07% -18.18% -48.22% Interest expense 0.50% 0.39% 0.31% -10.02% -18.50% -39.61% Debt extinguishment expense 0.06% 0.06% 0.01% 127.37% 13.21% -89.94% EBT 6.48% 6.56% 4.17% -7.17% 5.59% -1.04% Income taxes 2.34% 2.27% 1.42% -9.70% 0.85% 2.63% Consolidated NI 4.14% 4.29% 2.75% -5.67% 8.28% -2.83% Net loss attributable to noncontrolling interests 0.02% 0.01% 0.02% n/a -25.00% -19.61% Consolidated net income attributable to GameStop 4.16% 4.31% 2.77% -5.27% 8.14% -2.95% Basic net income per common share -6.15% 17.47% 4.46% Diluted net income per common share -5.46% 17.78% 5.45% Vertical Analysis Horizontal Analysis Altman Z-score calculation In thousands 2007 2008 2009 2010 3Q2011 Current Assets 1,794,717 1,818,041 2,127,300 2,154,800 2,436,100 Current Liabilities 1,260,557 1,562,711 1,655,700 1,747,800 2,298,800 Total Assets 3,775,891 4,512,590 4,955,300 5,063,800 5,432,600 Retained Earnings 288,291 398,282 377,300 408,000 403,021 EBIT 501,421 675,119 637,000 662,600 643,148 Market Value of Equity 8,499,357 4,154,887 3,319,383 3,244,780 3,717,780 BV of Total Liabilities 1,913,445 2,212,909 2,232,300 2,167,900 2,471,100 Sales 7,093,962 8,805,897 9,078,000 9,473,700 9,664,658 Altman Z-Score 5.26 3.76 3.37 3.41 3.21 For references: Safe Zone Z Score > 2.99 Grey Zone 1.80 < Z Score < 2.99 Distress Zone Z score < 1.80

- 20. CFA Institute Research Challenge February 7, 2012 20 Appendix 16. GameStop’s SWOT Analysis Source: CFA University Team Appendix 17. GameStop’s Main Products Description Source: GameStop GME: SWOT Analysis Strengths Weaknesses Strong Client Base reflective of Market Penetration Reliance on limited number of Recent Retirement of Debt enhances Balance Sheet Strength vendors Strong FCFF generation ability Absense of geographical diversification in Sales Opportunities Threats Poised for growth in booming Android Gaming Market Competition and Industry shift may diminish "trade-in" profitability Potential to expand in growing Digital Distribution Market Inability to gain significant digital Online retail market growth market share from proven leaders and offset diminishing physical sales Potential to successfully combine physical and online retail businesses through acquisitions S. No. Product Category Description 1 New Video Game Software •Procured from manufacturers such as Sony Entertainment, Nintendo, Microsoft & third party manufacturers such as Electronic Arts and Activision •GME carries more than 1000 SKUs across numerous genres 2 Used Video Products •GME is the largest retailer of Used Video Products •Offers over 3000 SKUs •GME encourages the exchange of used products for new ones by providing store credits •Includes Used Software, iDevices etc 3 Video Game Hardware Platforms •GME provides technology-driven hardware platforms •Platforms include Sony PlayStation 2 and 3 and PSP, Microsoft Xbox 360 and Kinect, and the Nintendo DSi, DSi XL and Wii 4 Video Game Accessories •GME offers more then 300 SKUs of accessories •Accessories include PC entertainment software, digital inventory, Game Informer magazine etc

- 21. CFA Institute Research Challenge February 7, 2012 21 Appendix 18. GameStop’s Acquisitions’ Description Source: GameStop Appendix 19. GameStop’s Peers Description Source: Bloomberg, Yahoo!Finance Name of Company Acquired Deal Date Deal value ( $M) Business Description Impulse, Inc. (UnitedStates) 31-Mar-11 N/A Operates online platforms for digital game distribution Spawn Labs, Inc. (formerly Virsion) (UnitedStates) 31-Mar-11 N/A Develops platforms that provide remote, real-time, interactive access to products, content, and experiences Kongregate, Inc.(UnitedStates) 27-Jul-10 N/A Provides online games for players and developers. Offers action, multiplayer, shooter, adventure and RPG,sports and racing, strategy and defense, puzzle, music, and tutorials games, as well as online advertising services. Jolt Online Gaming (United States) 4-Nov-09 N/A Based in Europe, with servers across the US, the Company supplies rentable servers for online gamings Micromania S.A.S. (France) 1-Oct-08 686 Popular retailer of computer games and playstations. The Gamesman (NewZealand) 2-Jul-08 N/A Operates gaming retail stores and online gaming retail stores. Free RecordShopNorway (Norway) 31-Mar-08 N/A Pioneer in the distribution and sale of home entertainment products in northwest Europe Blockbuster Inc. - Rhino Vedio Games Chain (UnitedStates) 5-Jan-07 N/A Offers DVDs, and video games for rental and sale Peer Companies Description Company Description Best buy Co, Inc. Best Buy Co, Inc. is a specialty retailer which operates in the United States, Europe, Canada, and China. Its main products include consumer electronics, home and office products, entertainment products, appliances, new and used video game hardwre and software, etc. Some of its online retail operations are under the names “Best Buy”, “Best Buy Mobile”, “The Carphone Warehouse”, and “Five Star” . Its stores offer video, audio products, mobile electronics, car stereo, and satellite radio products, as well as, entertainment software products and appliances. Furthermore, the company delivers service contracts and warranties, product repair, and installation services for home theaters RadioShack Corp. RadioShack Corporation sells consumer electronic goods and services, including postpaid and prepaid wireless handsets, communication and home entertainment deivces, media storage, home audio and video end-products, digital cameras, general and special purpose batteries and battery chargers, and wires and cables. Moreover, it offers prepaid consumer service plans in its service platform to third-parties. The company operates 4,467 company-operated retail stores in the United States and 1,304 kiosks located in Target and Sam’s Club stores. It also sells its products through radioshack.com Bic Camera, Inc. Bic Camera, Inc. is a retailer of audio and visual products, information communication equipment with core products such as cameras, televisions, recorders, PCs, as well as video game software and hardware. Additionally, the company is engaged in electronic commerce activities through biccamera.com and it also participates in the provision of satellite and cable TV broadcasting services, installation and repair services for its goods. The company operates in Japan GEO Holdings Corp. Geo Holdings mainly sells audio, video and entertainment software and hardware. It also provides rental and recycling services. Further, the company sells products and provides services online. Geo Holdings has also an amusement segment, which operates cinemas, game and karaoke facilities hhgregg, Inc. hhgregg, Inc. is a retailer of consumer electronics, home appliances and related products. The company operates around 180 stores throughout the USA. It offers a selection of video products, software, hardware, as well as appliances, including refrigerators, cooking ranges, dishwashers, freezers, washers and dryers Village Vanguard Co. Ltd Village Vanguard Co. Ltd. is a retail company which sells video and audio products, books, along with goods for living and decoration. The company operates in Japan and Hong Kong. Game Group PLC The Game Group PLC, headquartered in United Kingdom, is a specialist personal computer and video games retailer, which uses retail outlets and eCommerce sites as trading methods. It offers a range of software and peripherals, including its own brand accessories. It provides services in the United Kingdom and the Republic of Ireland (639 stores), and five international territories, as well as through websites game.co.uk, gameplay.co.uk and gamestation.co.uk.

- 22. CFA Institute Research Challenge February 7, 2012 22 Appendix 20. GameStop’s Key Management Description Source: GameStop S. No. Name Designation Association with GameStop 1 Daniel A. DeMatteo Executive Chairman & Director - Served as GameStop's CEO from 2008 to 2010 - Served as Vice Chairman and COO from 2005 to 2008 - Served as President and COO for GameStop & predecessor companies from 1996 to 2005 2 R. Richard Fontaine Chairman International & Director - Served as Executive Chairman of the Board from 2008 until 2010 - Served as Chairman of the Board and CEO at GameStop or its predecessor companies from 2002 until 2008 3 Michael N. Rosen Director - Serves as a Director since 2001 - Served as the Secretary at the Company or its predecessor companies from 1999 until 200 4 Stephanie M. Shern Director - Serves as a Director since 2002 5 Edward A.Volkwein Director - Serves as a Director since 2002 6 Gerald R. Szczepanski Director - Serves as a Director since 2002 7 Stanley Steinberg Director - Serves as a Director since 2005 8 J. Paul Raines Chief Executive Officer - Serves as the CEO since 2010 - Joined GameStop in 2008 as a COO 9 Robert A. Lloyd Chief Financial Officer - Serves as the CFO since 2010 - Served as the Interim CFO from February 2010 to June 2010 - Served as the Chief Accounting Officer from 2005 to 2010 - Served as the Vice President of Finance at GameStop or its predecessor companies from 2000 to 2005 - Served as the Controller of GameStop's predecessor companies from 1996 to 2000

- 23. CFA Institute Research Challenge February 7, 2012 23 Appendix 21. Projected Financial Statements: Balance Sheet, Income Statement & Cash Flow Statement UNITS 2010H 1-3Q 2011H 4Q 2011E 2011E 2012F 2013F 2014F 2015F Income statement Sales USD 9,473,700$ 5,971,900$ 3,605,813$ 9,577,713$ 9,829,232$ 10,119,922$ 10,457,970$ 10,856,270$ Cost of Sales USD 6,936,100 4,233,900 2,761,662 6,995,562 7,196,718 7,426,505 7,692,099 8,004,328 Gross profit USD 2,537,600 1,738,000 844,151 2,582,151 2,632,514 2,693,417 2,765,872 2,851,942 SG&A USD 1,700,300 1,328,500 390,699 1,719,199 1,795,801 1,882,306 1,978,648 2,019,266 DD&A USD 174,700 142,100 51,076 193,176 235,631 277,714 322,977 371,504 Operating earnings USD 662,600 267,400 402,376 669,776 601,082 533,398 464,247 461,172 Interest income USD (1,800) (700) 0 (700) 0 0 0 0 Interest expense USD 37,000 18,500 - 18,500 - - - - Debt extinguishment expense USD 6,000 600 - 600 - - - - EBT USD 621,400 249,000 402,376 651,376 601,082 533,398 464,247 461,172 Income taxes USD 214,600 84,800 138,799 223,599 206,145 182,932 159,216 158,162 ConsolidatedNI USD 406,800$ 164,200$ 263,577$ 427,777$ 394,938$ 350,466$ 305,031$ 303,010$ Net loss attributable to noncontrolling interests USD 1,200 1,000 - 1,000 - - - - Consolidatednet income attributable to GameStop USD 408,000 165,200 263,577 428,777 394,938 350,466 305,031 303,010 Basic net income per common share USD 2.69$ 1.17$ 1.92$ 3.04$ 2.93$ 2.67$ 2.38$ 2.43$ Diluted net income per common share USD 2.65$ 1.16$ 1.92$ 3.04$ 2.93$ 2.67$ 2.38$ 2.43$ Weighted average shares of common stock-basic USD 151,600 140,800 137,390 141,190 134,739 131,455 128,171 124,888 Weighted average shares of common stock-diluted USD 154,000 141,900 137,390 141,190 134,739 131,455 128,171 124,888 UNITS 2010H 1-3Q 2011H 4Q 2011E 2011E 2012F 2013F 2014F 2015F Balance Sheet Assets Current assets Cash and near cash items 710,800$ 442,600$ 394,822$ 394,822$ 591,601$ 775,586$ 927,184$ 1,152,027$ Accounts and notes receivables USD 65,500 58,100 65,331 65,331 67,047 69,030 71,336 74,052 Merchandise inventories USD 1,257,500 1,778,300 1,239,020 1,239,020 1,350,326 1,471,537 1,625,273 1,754,373 Deferred income taxes USD 28,800 30,400 30,400 30,400 30,400 30,400 30,400 30,400 Prepaids USD 75,700 112,800 80,431 80,431 82,281 84,174 86,278 88,521 Other CA USD 16,500 13,900 17,531 17,531 17,934 18,347 18,806 19,295 Total Current Assets USD 2,154,800 2,436,100 1,827,536 1,827,536 2,139,590 2,449,073 2,759,276 3,118,668 Long-term assets Goodwill USD 1,996,300 2,060,300 2,092,745 2,092,745 2,141,657 2,191,694 2,242,982 2,295,604 Gross PP&E USD 1,419,000 1,504,400 1,575,196 1,575,196 1,760,474 1,945,433 2,130,684 2,316,613 Accumulated DD&A USD 805,200 901,500 941,017 941,017 1,128,235 1,351,841 1,615,026 1,921,045 Net PP&E USD 613,800 602,900 634,179 634,179 632,239 593,592 515,658 395,568 Other L-T Assets USD 298,900 333,300 333,300 333,300 333,300 333,300 333,300 333,300 Total Long-term assets USD 2,909,000 2,996,500 3,060,224 3,060,224 3,107,196 3,118,586 3,091,941 3,024,472 Total assets USD 5,063,800$ 5,432,600$ 4,887,759$ 4,887,759$ 5,246,787$ 5,567,659$ 5,851,217$ 6,143,141$ Liabilities andShareholders' Equity Current liabilities Accounts payables USD 1,028,100$ 1,464,300$ 1,025,129$ 1,025,129$ 1,054,606$ 1,088,279$ 1,127,199$ 1,172,953$ Accrued liabilities USD 657,000 709,800 503,873 503,873 518,361 534,912 554,042 576,531 Taxes payable USD 62,700 - - - - - - - Current portion of L-T debt USD - 124,700 - - - - - - Short-termborrowings USD - - - - - - - - Total Current Liabilities USD 1747800 2298800 1,529,001 1,529,001 1,572,967 1,623,191 1,681,241 1,749,484 Long-term liabilities USD Long-termborrowings USD 249,000 - - - - - - - Deferred taxes USD 74,900 67,000 67,000 67,000 67,000 67,000 67,000 67,000 Other L-T liabilities USD 96,200 105,300 111,881 111,881 114,455 117,087 120,014 123,135 Total L-T Liabilities USD 420,100 172,300 178,881 178,881 181,455 184,087 187,014 190,135 Equity Total preferred equity USD - - - - - - - - Class A CS USD 100.00 100.00 100.00 100.00 99.99 99.99 99.99 99.98 Additional paid-in-capital USD 928,900 762,000 716,800 716,800 634,350 551,900 469,450 387,000 Accumother comprh inc USD 162,500 230,000 230,000 230,000 230,000 230,000 230,000 230,000 Retained earnings USD 1,805,800 1,971,000 2,234,577 2,234,577 2,629,515 2,979,981 3,285,011 3,588,022 Noncontrolling interest USD (1,400) (1,600) (1,600) (1,600) (1,600) (1,600) (1,600) (1,600) Total equity USD 2,895,900 2,961,500 3,179,877 3,179,877 3,492,365 3,760,381 3,982,961 4,203,522 Total liabilities andEquity USD 5,063,800$ 5,432,600$ 4,887,759$ 4,887,759$ 5,246,787$ 5,567,659$ 5,851,217$ 6,143,141$