Cosc V2.0

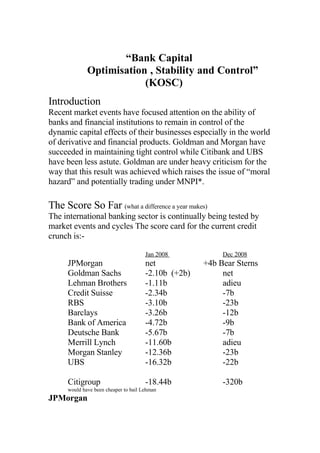

- 1. “Bank Capital Optimisation , Stability and Control” (KOSC) Introduction Recent market events have focused attention on the ability of banks and financial institutions to remain in control of the dynamic capital effects of their businesses especially in the world of derivative and financial products. Goldman and Morgan have succeeded in maintaining tight control while Citibank and UBS have been less astute. Goldman are under heavy criticism for the way that this result was achieved which raises the issue of “moral hazard” and potentially trading under MNPI*. The Score So Far (what a difference a year makes) The international banking sector is continually being tested by market events and cycles The score card for the current credit crunch is:- Jan 2008 Dec 2008 JPMorgan net +4b Bear Sterns Goldman Sachs -2.10b (+2b) net Lehman Brothers -1.11b adieu Credit Suisse -2.34b -7b RBS -3.10b -23b Barclays -3.26b -12b Bank of America -4.72b -9b Deutsche Bank -5.67b -7b Merrill Lynch -11.60b adieu Morgan Stanley -12.36b -23b UBS -16.32b -22b Citigroup -18.44b -320b would have been cheaper to bail Lehman JPMorgan

- 2. While JPMorgan can be commended for its position today, the roots of this success were less in the intellectual capital of its senior management and more in the less elegant past - Asia, Russia, LTCM, CSLT, Internet, Telecom, Worldcom, Enron. JPMorgan has paid dearly for these episodes over the years with true costs often many times the actual legal and balance-sheet disclosures. This sea-change of results is no accident but was achieved by the committed application of internal controls, retained capital and credit management and across business optimisation. Bill Demchek and Rob Standing played early roles while Blythe Masters lead the long climb from a 15USD share price and an effective single A credit rating. This activity first appeared in the 2003 annual report and has been a strong component of investor relations since that inclusion. Bertrand de Paliers and Tim Frost built the derivatives and credit derivatives businesses which lead the charge in dual reporting, a key component of COSC. Proposed Approach - Significant features of the COSC approach to core bank management Retained Portfolio Capital Optimisation Capital stabilisation Enhanced leverage of business franchises Balance sheet buffering and export Retained Credit Re-cycling Tight Corporate Governance

- 3. How do we achieve these goals? Optimisation on three levels Refined CVA* model – Basic requirements for Basle II need true credit costing and management over time. However this CVA allocation needs to be adjusted for diversification and correlation (both internal and external) and needs to be weighted appropriately for the different phases of the business cycle. Non-adverse DRE* model. Seeking equivalence across credit, balance sheet and term components often generates adverse P&L functions. Implementations of DRE models must not limit their ability to optimise the balance sheet and the bank portfolio yield. (static/dynamic credit alignment, normalised credit curve, excess management, always positive yield function) ALE* allows co-management of static, dynamic and impaired credait components throughout the entire work-out boundary. The work-out boundary must be the target domain of all bank business. This is a dynamic, across-business, across-asset-class function which needs to be proactive rather than reactive. Dynamic optimisation, adjustment and re-cycling of the three levels will require trading of all asset classes, efficient use of proxy asset classes and inclusion of residual asset classes. (credit derivatives, derivative/OTC trading, peak lopping, boundary trading, cross-gamma) A COSC team would build this skill set to avoid moral hazard risk and ensure that no MNPI trading takes place in full anticipation of market phenomena. The team Past teams have included trading, portfolio management, sales, legal, credit and technology skill sets. Past teams have produced a significant number of MDs in major institutions globally as well as a few world class tenures. Team building has mostly been organic with middle office, technology, legal, credit, trading and sales desk recruitment. Major awards have been won while significant contributions to the intellectual capital of institutions are paramount to the proscribed approach. A balanced trade-off between infrastructure, core bank function and bottom line contribution requires a sophisticated remuneration structure for the team.

- 4. Core functions The implementation of the COSC approach will depend on the structure and objectives of the importing institution and its component businesses combined with the objectives and mandate of the COSC team. Some possible functions are outlined below:- Assignment of CVA, DRE, ALE, INPV, capital use and funding down to individual business level would require education and over-sight. The COSC approach would seek an objective to push these functions down to business level while promoting a senior management pallet of across portfolio optimisation, business growth directing and cycle compensation. Core credit portfolios can produce significant opportunities for COSC techniques which would be paramount to ensuring that components of the team are profit motivated. Cross Gamma and correlation trading of the retained portfolio and proxy trading of the residual components would all be normal activities of a COSC team. Corporate/Sovereign transition management through the entire “work- out boundary” would be a limited basket component or a combined portfolio function in conjunction with existing work-out or credit teams. JPMorgan have invested heavily over the last decade in infrastructure for managing COSC components. However, a significant sub-set of the COSC infra-structure can be implemented for relatively low cost using state-of-the-art techniques and assignment down to business level. Objectives COSC – Capital Optimisation, Stability and Control are the primary objectives. They impact on the bank retained credit portfolio and the balance sheet use of the component businesses. Significantly enhanced leverage of selected business franchises Obviation of the need for time-risky business self-insurance practices

- 5. Implementation and enhancement of sound management control, compliance and corporate governance functions Generation of pre-allocation trading revenue from the enhanced businesses and core retained portfolio of 300mUSD. Allocation of 20% of this revenue to fund the required infrastructure over 5 years. NB COSC would not inherit responsibility for core bank infra-structure (although it may assist in this process) but would create a dynamic intra-lay which would allow integration and optimisation across a continually evolving landscape. Key advisory roles fulfilled by the team By definition, the team will impact on certain management functions and would expect to be tasked to participate in these functions. Senior management Corporate governance Credit Strategy Legal structure, enforceability and scale Allocation of INPV Allocation of balance sheet and funding Businesses (typically EM, Rates Derivatives, High Yield, Commodities, Structured Products, Equity) Enhanced leverage. Enhanced INPV transactions. Enhanced credit structures. CVA, DRE, ALE right-way/wrong-way trades. Capital , balance sheet and funding optimisation and compensation. Regulatory Functions Capital and Basle 2 Balance sheet Compliance (material non public information, moral hazard) Pedigree The back-bone of the technologies and trading techniques for COSC were developed under such market leaders as Alan Wheat, Chris Gokjian and Bob Diamond. The core effective techniques at JPMorgan were developed under the aegis of Rob Standing and Blythe Masters.

- 6. • 10Yrs JPM and heritage institutions. • JPM Derivatives Deal of the Year 2002. • 15yrs straight A audit with substantial P/L. • Recovery Rate post default greater than 150%. • Record post default deal P/L greater than 72mUSD. Key to Terms * CVA - credit value adjustment DRE - derivative risk equivalent ALE - adjusted loss equivalent INPV - input PV EVD - Extractable value difference RR - Recovery rate LGD - Loss given default MNPI – Material non-public information oo