Contenu connexe

Similaire à Fis strategic insights vol 4 november 2011 (20)

Fis strategic insights vol 4 november 2011

- 1. FIS ENTERPRISE STRATEGY VOLUME 4 • NOVEMBER 2011

Driving Efficiency at IN THIS ISSUE

Financial Institutions by • Driving Efficiency at

Financial Institutions by

Leveraging Customer Data Leveraging Customer

Data

• Exclusivity Provision of

Durbin Amendment:

By Fred Brothers Impact and Revenue

EXECUTIVE VICE PRESIDENT, ENTERPRISE STRATEGY Opportunities

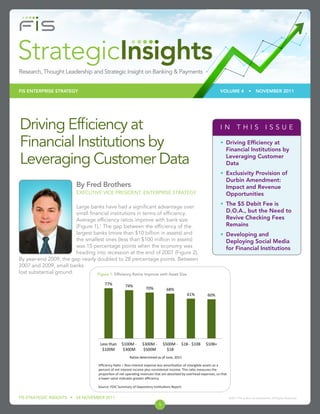

Large banks have had a significant advantage over

• The $5 Debit Fee is

small financial institutions in terms of efficiency. D.O.A., but the Need to

Average efficiency ratios improve with bank size Revive Checking Fees

(Figure 1).1 The gap between the efficiency of the Remains

largest banks (more than $10 billion in assets) and • Developing and

the smallest ones (less than $100 million in assets) Deploying Social Media

was 15 percentage points when the economy was for Financial Institutions

heading into recession at the end of 2007 (Figure 2).

By year-end 2009, the gap nearly doubled to 28 percentage points. Between

2007 and 2009, small banks

lost substantial ground. Figure 1: Efficiency Ratios Improve with Asset Size

77% 74%

70% 68%

61% 60%

Less than $100M - $300M - $500M - $1B - $10B $10B+

$100M $300M $500M $1B

Ratios determined as of June, 2011

Efficiency Ratio = Non-interest expense less amortization of intangible assets as a

percent of net interest income plus noninterest income. This ratio measures the

proportion of net operating revenues that are absorbed by overhead expenses, so that

a lower value indicates greater efficiency.

Source: FDIC Summary of Depository Institutions Report

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

1

- 2. Although large banks have generally Figure 2: Except for Large Banks, Efficiency Ratios Deteriorated during the Recession

sustained efficiency ratios around 55 85%

percent for the last seven years, their

ratios ticked upward in the first half of 2011

80%

— interestingly, at the same time all other

banks’ ratios were going down. Sustaining Less than $100M

75%

FIS ENTERPRISE time, let alone making

efficiency over STRATEGY VOLUME 1 • JULY 2011

$100M - $300M

continuous improvement, is tough to

70% $300M - $500M

achieve in this climate.

$500M - $1B

Efficiency ratios will certainly decline 65%

(improve) somewhat as the economy

$1B - $10B

improves. But the multi-year earnings 60%

$10B+

outlook in banking is negatively impacted

by increased regulatory and capital 55%

requirements, tighter risk controls, and

consumer spending trends. I believe many 50%

of these changes are permanent and 2004 2005 2006 2007 2008 2009 2010 June

business-as-usual operating approaches 2011

will not bring efficiency back to pre-recession

Source: FDIC Summary of Depository Institutions Report

levels. Many institutions must shift to a

longer-term, strategic approach to achieve

permanent cost efficiencies.

I’ll talk about the future of efficiency ratios in coming month’s articles. This month, I discuss how to use data to make

efficiency improvements.

From recent research FIS Enterprise Strategy conducted with 3,000 banking customers nationwide, we know that: 1)

on average, only about 40 percent of banks’ primary DDA customers are profitable (that includes marginally profitable

customers), 2) banks aren’t getting as much share of their profitable customers’ financial wallets as they could get, and

3) banks also aren’t getting enough share of the financial wallet of another 40 percent of their customers who could be

profitable if banks could capture a greater portion of their assets and/or loans.

A few months ago, we talked with a dozen banking executives who are in various stages of applying data-based

strategies to align the right product with the right customer at the right time to help their financial institutions grow

revenues and manage risk in this tough economic climate. Those furthest into the process had realized the most benefits.

Gains resulting from integrating data analytics into their marketing, IT, risk and financial management processes include:

• Customer acquisition initiatives are more effective leading to increased revenue generation from marketing campaigns

directed toward attracting new customers.

• Analytics is fueling product innovation and helping end free checking.

• Information is pushed out via the channels specific customers are using, which improves campaign efficiency.

• Bankers can focus their resources on retaining and deepening relationships with customers who have been identified

as being profitable or potentially profitable. Institutions are increasingly mining retail checking account data for

indicators and patterns of customers who are mass affluent or own small businesses.

• Customized product packages and corresponding value propositions are created based on applying predictive

models that suggest a high propensity for purchase by specific segments of customers. As a result, the potential

package “sale” is more relevant and beneficial to both the customer and the bank. Even simple packages (e.g., DDA,

savings and debit or prepaid card) can be developed to manage customers who — for better or worse — are married

to their banks, but will not likely be profitable for their primary DDA provider in my lifetime.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

2

- 3. Our discussions also led to a list of guidelines that we compiled based on the collective wisdom of banking executives

who have endured through the painstaking process of integrating data analytics into their organizations and are now

reaping the rewards.

Top management commitment and strategic focus are vital to success. Data analytics champions need to spend

time with senior management to help them envision how analytics can drive revenue and boost efficiencies over time.

Bankers stressed the importance of initially focusing on achieving a limited number of goals that have the best potential

FIS ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

to generate successful results relatively quickly.

Successful implementation of data analytics programs takes time. One bank took 18 months just to hire the right

person to head the data analytics function. Most have outlined 5 – 7 year plans to fully realize their goals.

Standards are critical. Implementation policies need to be in place to ensure data aren’t misused. Data usage

certification is considered to be a best practice especially if access is decentralized. Certification of users mitigates

bottlenecks common to centralized management of data.

Manage data analytics centrally; apply data analytics locally. Most bankers agreed that centralized data management

is ideal, but success hinges on end users — e.g., marketing and risk management — having timely access to information.

Business units work with IT to shape priorities and define standards. IT builds and maintains the data warehouse.

Information can be provided to employees and/or employees can be trained and authorized to access relevant

databases.

Monitor customer activity daily. Near-term opportunities can be identified through timely monitoring and delivery of

key data to bank sales personnel. One bank delivers “top-three” selling opportunities for each customer daily to their

telephone customer service representatives and pushes “next-best” product opportunities to customers when they log

on to their account online.

Determine rules for measuring customer profitability. One banker cautioned that refined approaches to profitability

are required to account for a bank’s overhead so that customers aren’t penalized for factors that are not within their

control. Another banker pointed out that some customers deemed unprofitable today would be profitable under

“normal” economic conditions.

Prioritize channels to use for communications and focus on getting information to those channels first. One bank

conducted a funnel analysis on customer acquisition to identify the best marketing channels to focus on out of 16

different points of contact. The analysis enabled them to designate the most effective marketing channels and number of

contacts for specific product and customer segment campaigns.

While certainly requiring initial and ongoing investment, data analytics can ultimately help banks do more with less

thereby improving efficiency. But, it’s not an easy task to lasso vast amounts of data coming from multiple sources and

make it actionable. It’s a long-term commitment, but one that’s ultimately required as the industry drives toward future

efficiency ratios that will required to remain competitive. We’d love to hear about your experiences — good, bad or ugly

— with data analytics. Just reply to this newsletter and let us know your thoughts.

1 FDIC Summary of Depository Institutions Report

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

3

- 4. Exclusivity Provision of Durbin Amendment:

Impact and Revenue Opportunities

FIS ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

Interview with Neil Marcous

SENIOR VICE PRESIDENT, PAYMENT NETWORK SOLUTIONS

The exclusivity provision of the Durbin Amendment impacts all issuers of debit cards effective

April 1, 2012. All issuers, regardless of size, must maintain at least two debit network

relationships. There is no distinction between signature and PIN authentication with respect to

the two-network-path requirement for debit cards. The two networks must not be affiliated in

terms of ownership. For example, an issuer cannot meet Durbin’s exclusivity requirement by

using only VisaCheck® signature and Visa’s Interlink® PIN debit service.

So what does the exclusivity provision mean for financial institutions? In an in-depth interview,

Neil Marcous, senior vice president, FIS Payment Network Solutions, explains the impact and opportunities associated

with the exclusivity provision and how financial institutions can comply with the law and maximize their revenue

opportunities.

Impacts of Exclusivity Provision

Q: What are the major impacts of the exclusivity provision of the Durbin Amendment for financial institutions?

Neil Marcous:

Financial institutions may feel they have to be in multiple PIN payment networks, but they actually have to be only in two

debit networks. You need a signature network and a PIN network that are unaffiliated. Then, you will be in compliance on the

non-exclusivity clause.

Financial institutions that need to choose another network include: 1) financial institutions only using affiliated debit networks

for both PIN and signature — such as MasterCard/Maestro and Visa/InterLink, and 2) financial institutions that are only in a

signature network and do not have a PIN network. For financial institutions choosing another network, the biggest challenges

are: 1) timing — time is short to choose a network, sign contracts, and go live by April 2012, and 2) strategic fit with the new

network.

There is an important second impact for financial institutions that have multiple PIN networks on their card. Many smaller

financial institutions are in three-to-five PIN debit networks, which is not a good idea in a post-Durbin environment. Since

Oct. 1, 2011, the merchant has had the ability to determine where the transaction is routed. That means merchants can

choose least-cost routing — directing the transaction to the network where it will cost them the least. Suppose a financial

institution participates with network “A,” which has decided upon a below- market interchange strategy to make it more

attractive to merchants. Let’s say that this merchant-centric network charges the merchant and pays issuers 25 cents per

purchase transaction. But the financial institution also has network “B” that has an issuer-centric strategy, which would

result in the issuer receiving 35 cents per purchase transaction. Until October 1 of this year, the institution was usually able

to specify their preferred network such that it could receive the highest interchange possible. Now, merchants can send

everything to the merchant-centric network in this example, if they choose to route transactions this way. As a result of having

multiple PIN networks, financial institutions can experience diminishing revenue streams.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

4

- 5. Opportunities for Revenue Enhancement

Q: What opportunities for financial institutions are arising from the need to comply with the exclusivity provision of the Durbin

Amendment?

Neil Marcous:

FIS ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

The final regulations of the Durbin Amendment are creating more urgency for financial institutions to review PIN debit

network options and consolidate PIN debit networks. Only one PIN debit network is needed to fulfill the regulations, if the

card also participates in a signature network. If the issuer prefers to have the card participate only in PIN-based networks,

then two PIN networks are required.

Financial institutions no longer need four or five PIN networks for reach and penetration across the entire country. If, in fact,

you do have multiple PIN networks, the merchant is making the decision about where the transaction is routed and is going

to least-cost route it. However, if you only have a preferred PIN network and a signature program, you have complied with

the regulations and have more predictability and control over your transaction earnings. More networks aren’t better; it

means greater expense and reduced interchange income.

Lead Time for Adding a Network

Q: What kind of lead time do you need to prepare to add an additional network?

Neil Marcous:

Technically, most financial institutions only require a few weeks to add a network, but they need to factor in sufficient time

to decide which network to select and to enter into contracts with that network. For larger customers that want to connect

directly to the network, more time is required to allow for ordering telecommunications, installing equipment and certifying

the transaction messages over the new interface.

There are varying degrees of timing that we outline for customers in our RFPs. Time is definitely of the essence now for

financial institutions that need to be compliant by April 1.

Questions to Ask in Evaluating PIN Payment Network Alternatives

Q: From the issuer’s perspective, what criteria would you use in evaluating PIN debit network alternatives for your financial

institution?

Neil Marcous:

If you’re going to pare down to a single PIN and a single signature network, you need to consider both the strategic

alignment of the PIN debit network with the financial institution’s interests and the relationship down the road. An

organization needs to know the network is not only able to represent its best interests now but also is looking at payment

innovations on the horizon. The network should have a strategy going beyond PIN debit that addresses alternative paths that

are developing such as mobile at the point-of-sale, debit purchases on the Internet, couponing and prepaid reloadable. You

need to ask the question: what is the organization behind the network you’re picking and what are they investing in research

and development on advanced capabilities that will be important to the institution in the future?

For additional information about the FIS Network Solutions and how FIS can help institutions best meet the new Durbin

regulations, please contact your sales account manager. If you do not have a sales account manager, please contact us at:

http://www.nyce.net/contact/index.htm.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

5

- 6. The $5 Debit Fee is D.O.A., but the Need

to Revive Checking Fees Remains

FIS ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

By Paul McAdam

SENIOR VICE PRESIDENT, RESEARCH & THOUGHT LEADERSHIP

The recent miscalculation on debit card usage fees by several large banks serves as a

microcosm of the ongoing challenges the retail banking industry will face over the next few

years. The populist movement that reversed banks’ decisions to impose or pilot debit card

fees magnifies three problems banks will face as they seek to restore pre-recession levels of

profitability:

1) There is massive consumer skepticism regarding the motivations of banks and other large “institutions.”

The 2008 financial meltdown and bank bailouts are not-too-distant memories for many consumers and the home

foreclosure crisis is still affecting millions. Most consumers don’t know or care about the fact that the banking

industry has lost billions of dollars of revenue due to recent regulations. They simply view any efforts by the

banking industry to raise fees in the midst of a recession as unjust. Arguments by banks to leverage fees to restore

profitability to pre-recession levels will receive harsh reactions until consumers’ personal income statements and

balance sheets return to pre-recession levels.

2) This skepticism awoke the silent majority and is driving increased consumer activism across many industries

and institutions including banks. Depending on one’s ideology, institutions such as large corporations, labor

unions, the military-industrial complex, the government, and others could be viewed as guilty of preserving their

own self-interests at the expense of the greater societal good. The Tea Party movement and Occupy Wall Street

serve as examples of consumer activism not seen in forty years. Large bank fee increases are an easy target for

activists. While the extent to which activists may target fee increases by smaller banks is unknown, it is not outside

the realm of possibility — particularly within large metro markets.

3) The effectiveness of the consumer activism is accelerated by the power of social media technologies. With

social media, any consumer who has motivation and Internet access has the potential to spread a message to

millions. Consider the role that social media played in the recent debit card fee conversation. In the span of just 30

days:

• Molly Catchpole, the 23 year-old, recent college graduate from Washington, D.C. collected more than 300,000

petitions against the Bank of America debit card fee on Change.org.

• Kristen Christian, the 27 year-old San Francisco art gallery owner, started the November 5th “Bank Transfer Day”

movement on Facebook and more than 75,000 consumers pledged to participate by moving their money from a

large bank to a credit union.

• Consumers Union sent messages regarding the Bank of America debit card fee to 780,000 opt-in email

subscribers.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

6

- 7. Once opposition to the debit card fee went viral on social media, it drew national media coverage and the cycle of

media exposure fed upon itself. At the time I wrote this article, a Google search on “Bank of America $5 debit card fee”

generated 16.5 million results.

And now, anti-bank consumer activism is further emboldened with the news that Bank of America, Chase, Wells Fargo

and others reversed course on their debit card usage fees. Although the debit card issue will fade with time, subsequent

rounds of social media activism will surely emerge as large banks tweak their fee policies inVOLUME 1 •months.

FIS ENTERPRISE STRATEGY the coming JULY 2011

Evolution to Relationship-based Pricing

For the past 15 years, financial institutions have freely provided debit cards to consumers and encouraged their usage —

and it worked. Recent FIS consumer research found that 71 percent of consumers purchase goods using a debit card and

39 percent use their debit card to get cash back at a store checkout line. Clearly it was misconceived to start charging fees

on such a widely adopted service that has always been free. The move was viewed by consumers, media and eventually

politicians as an unjust way to fill the revenue gap left in the wake of the Durbin interchange ruling.

A friendlier approach would have been to announce fee increases for packages of checking account services and give

consumers various options to receive free checking by consolidating their financial relationships with their primary checking

account provider or by altering their behaviors to reduce the cost of servicing them. Banks must revise their economic

models to remain profitable and continue to have the ability to invest in the payment and channel access conveniences that

consumers increasingly demand. However, fairness and transparency count these days.

In order to satisfy their own need to build healthy relationships with customers and also prove the tremendous value

they provide, banks must transition to relationship-based pricing models with a new proposition: “Make us your primary

checking account provider, consolidate your financial relationships with us, and many of you can avoid fees.” Shifting to

relationship-based pricing must be communicated through significant marketing campaigns and frontline employee training

to reinforce the numerous benefits of checking account services.

Wide Variations in Customer Profitability

I realize that some readers have no plans to increase fees and will completely disagree with my viewpoint. But before you

call me crazy, I’d ask you to read on. We’ve completed recent consumer research which provides a compelling defense for

transitioning some consumer checking account relationships from “free” to “fee.”

An August 2011 FIS Enterprise Strategy survey of 3,000 bank customers and credit union members with checking accounts

on the topics of loyalty and profitability revealed that many institutions are overserving and undercharging a significant

number of their customers (see Figure 1).

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

7

- 8. Figure 1: Only 39% of Primary DDA Relationships are Profitable

High Unprofitable Potentially Profitable Profitable

Loyals Loyals Loyals

FIS ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

9% 18% 17%

Loyalty to

Primary

DDA

Provider Unprofitable Potentially Profitable Profitable

Non-Loyals Non-Loyals Non-Loyals

10%* 24% 22%

Low

Low High

Profitability to Primary DDA Provider

* Read as: 10% of consumers are in the “Unprofitable Non-Loyals” segment.

Source: FIS™Enterprise Strategy, August 2011; n = 3,000

• Thirty-nine percent of consumers maintain a relationship that is profitable to their primary checking account

provider (17 percent loyal, 22 percent not loyal).

• Another 42 percent of consumers are potentially profitable to their primary provider (18 percent loyal, 24 percent

not loyal). While these particular customers are currently unprofitable to their primary checking account provider,

they have the potential to become profitable customers.

• Meanwhile, 19 percent of consumers are unprofitable to their primary provider and will remain unprofitable for the

foreseeable future (9 percent loyal, 10 percent not loyal).

Take a look at Figure 2. It displays the average deposit and loan balances each segment maintains with the primary

checking account provider.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

8

- 9. Figure 2: Most Consumers Maintain Modest Balances with their Primary Checking Account Provider

Deposit and Loan Balances Held with the Primary Checking Account Provider

$140,000 $135,000*

FIS ENTERPRISE STRATEGY $117,000 VOLUME 1 • JULY 2011

$120,000

$100,000

Loans

Deposits

$80,000

$60,000

$40,000

$20,000

$6,500 $5,900

$2,600 $3,000

$0

Profitable Profitable Potentially Potentially Unprofitable Unprofitable

Loyals Non-loyals Profitable Profitable Loyals Non-loyals

Loyals Non-loyals

* Read as: “Profitable Loyals” hold combined deposit and loan balances of $135,000 with their primary checking account provider.

Note: Deposits include checking, savings, MMDA and CDs. Loans include first and second mortgages, credit card balances and auto and educational loans.

Source: FIS™ Enterprise Strategy, August 2011; n = 3,000

The profitable segments maintain the majority of their deposit and loan balances with the primary checking account

provider and generate 70 percent of the total checking fee revenues collected by financial institutions. Their checking and

debit card fees should not be increased. In fact, these customers should have product packages that provide free checking

services based on total balances.

The potentially profitable segments hold modest deposit balances with the primary checking account provider. These

consumers generate 26 percent of the total checking fee revenues collected by financial institutions. Although they are

currently unprofitable, they have sizeable loan balances residing at other financial institutions. Qualified members of this

segment should receive incentives to move loans to the primary checking account provider in order to avoid checking

account fees.

The unprofitable segments maintain very small deposit and loan balances with the primary checking account provider and

all other financial institutions. They have virtually no resources of significance to shift to their primary checking account

provider, but they are the heaviest users of channels and pay the lowest fees. They generate only 4 percent of the total

checking fee revenues collected by financial institutions.

The unprofitable segments will be the most vocal in expressing displeasure with fee increases and state that: 1) financial

institutions are assessing fees on the customers who can least afford them, and 2) increasing fees in the midst of recession

and high unemployment is unjust. These are fair points, but it’s equally true that financial institutions are currently

overserving and undercharging these customers.

Financial institutions can offer lost-cost packages to these consumers and give them the option of aligning their behaviors

with the costs associated with servicing them. A checkless checking account or a general purpose reloadable prepaid card

may be the best option for these customers.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

9

- 10. Preparing for Attrition

We’ve already seen, and will continue to see, increased customer churn due to the pricing actions taken by the large banks.

But I’d strongly caution smaller banks and credit unions against offering aggressive free checking campaigns in an effort

to capture a flood of defecting large bank customers. Learning from the debit card experience, the large banks will mine

customer data and establish their future pricing policies in a manner that will lead to substantial churn within unprofitable

FIS ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

segments, significantly lower churn within the potentially profitable segments, and very limited churn within the profitable

segments.

Although large banks will suffer some collateral damage and lose a few profitable customers as they shift into relationship-

based pricing models, the vast majority of their defectors will be unprofitable customers. As a smaller financial institution,

do you really want to add a bunch of new free checking customers who only have the financial resources to generate a few

thousand dollars of deposit and loan business balances — mostly composed of credit card debt — for the primary checking

account provider? Even though free checking customers tend to be loyal ones, they are not necessarily profitable.

The new economic realities in retail banking will require financial institutions to choose a path: 1) transition some consumer

checking account relationships from “free” to “fee,” or 2) maintain an entirely “free” positioning.

I’ve recently had conversations with several banks that eliminated free checking earlier this year. All of them have

experienced higher overall customer balances and profits as a result of re-pricing. They certainly experienced some

customer attrition, but it hasn’t been higher than anticipated due to their proactive outreach campaigns to move customers

into the right products.

Increasing checking account fees may not be the right approach for every institution. But much like the invasion of “Totally

Free Checking” programs several years ago, it’s a trend that cannot be ignored.

As always, I’m interested in receiving your feedback. I’d also welcome the opportunity to learn more about results

your institution has experienced through either “fee” or “free” checking account programs. E-mail me at

paul.mcadam@fisglobal.com to let me know.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

10

- 11. Developing and Deploying Social Media

for Financial Institutions

FIS ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

By Mandy Putnam

DIRECTOR, RESEARCH & THOUGHT LEADERSHIP

The Social Media Imperative

Social media has made it to the big leagues. Most days and most newscasts can’t go without at

least one story about Facebook, a YouTube viral video, or some new announcement a celebrity

or politician made via Twitter. Two-thirds of online adults use social networking sites — more than

double the percentage using sites in 2008. And the biggest growth in both participation and daily

usage has been among the over-30 age segment.1

Despite the rapid adoption of social media across consumer segments, financial institutions do not value social media

channels highly compared with other points of contact with customers. Less than one in five executives recently

interviewed by FIS™ Enterprise Strategy rated social media as important (Figure 1).

Figure 1: Only a Fifth of Bankers Consider Social Media to be an Important

Communication and Delivery Channel

(top 2-box score on 5-point scale)

Online banking 93%*

Branches 71%

ATM machines 70%

Call Center (live rep) 55%

IVR / Automated telephone banking 48%

Mobile banking 43%

Social media 18%

Self-service kiosks and/or video banking 6%

* Read as: 93% of bankers view online banking as an important channel

Source: FIS™ Enterprise Strategy, August 2011

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

11

- 12. Although some financial institutions are reluctant to participate actively in social media, it has become imperative to

converse with consumers on their terms, which increasingly include social media conversations, in order to capture value

especially from younger generations.

“Deciding whether to get involved means deciding if you want to be part of the conversation …

There will be a conversation

FIS ENTERPRISE STRATEGY with or without you … If you don’t use social media, • JULY 2011

VOLUME 1 then your

business will go elsewhere.”

– Hadley Stern, vice president at Fidelity Labs, a division of Fidelity Investments

Building a strategic plan for developing and deploying a

financial institution’s social media presence can be divided Figure 2: Social Media Plan Includes Four Steps

into four steps (Figure 2).

1.

Planning a Social Media Strategy

Planning

Determine business objectives

The objectives of your social media program must be tied

directly to your overall corporate goals, or else they have no

meaning. To maximize success, look at the ways that your

consumers want to interact with you online. Forrester 2.

surveyed more than 2,500 consumers and found the top 4. Measuring

Monitoring

ways that they would like to interact with their banks on

social networking sites:2

1) Alert me about upcoming products or special offers

2) Offer financial advice

3.

3) Offer customer service (e.g., help with questions, Contributing

complaints, etc.)

4) Present relevant financial service promotional offers to me Source: FIS™ Enterprise Strategy, October 2011

Address compliance and security

After getting a clearer picture of the social media goals and channels to be targeted, turn next to regulatory compliance

and security. Before beginning any social media initiatives, double-check the latest regulatory guidelines as well as obtain

advice from you own legal department to make sure that your social media plans conform to authorized parameters in the

space. Also, communicate proactively with consumers to assure them that their personal financial information will be kept

separate from social media communications.

Monitoring the Social Media Landscape

Listen to the conversation

Conversations about your bank are already happening. Tools such as Google Alerts (www.google.com/alerts) and Twitter

Search (search.twitter.com/advanced) can help you find these conversations. Be sure to set up searches for product names,

searches within a local radius, and other keywords that go to the heart of your bank’s offerings and goals. If your bank is

a larger institution, you may want to look into social media monitoring tools such as Radian6 that will not only find the

conversations, but help you analyze the sentiments they express and summarize the opinions being discussed.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

12

- 13. Contributing to the Social Media Conversation

Focus on engagement rather than selling

Participants in social media expect to interact informally and “authentically” with each other, whether they are consumers or

corporate representatives. Most financial institutions start with social media monitoring and then graduate to supporting PR

and customer education. It’s essential to first establish credibility with customers through social media before trying to sell

FIS ENTERPRISE Some of the more effective ways to communicate in social media channels concentrate on: JULY 2011

them anything. STRATEGY VOLUME 1 •

• Two-way conversation

• Information that is relevant to the audience

• Simple, conventional language

• Photos and videos that give a “face” to an institution or a personal touch

• Storytelling

Use social media to facilitate responsiveness

Social media can be used to respond more quickly and cost-effectively to customer questions, concerns, and complaints.

Many large banks have established problem resolution teams that focus on social media conversations. As one financial

eBusiness coordinator told us, monitoring social media can help mitigate the impact of potentially damaging publicity.

“Social media has more opportunity than risk; better to be out there than not. We can listen: the

good, bad or otherwise, we can address it. If we weren’t out there, then there’s no telling how big

or how far something negative may be able to spread if we couldn’t participate.”

– eBusiness coordinator from financial institution

At the same time, it’s also important to not over-communicate when responding to customer issues/problems conveyed

through social media. An appropriate amount of discretion must be exercised not to blow a problem out of proportion

or stir up a large group of customers over non-issues or minor complaints that can be resolved through private

conversations with customers.

Execute targeted social media programs based on core competencies and customer expectations

“Social media” encompasses a stunning array of websites and communication channels, but it’s not possible to have a

“social media presence” everywhere. Choose where and how to get involved based on your core competencies and

your customers’ social media preferences.

Speak to corporate social responsibility (CSR) initiatives

Social media is especially well-suited to working hand-in-hand with your corporate social responsibility initiatives. For

example, financial institutions can use social media involvement to help decide how charitable donations are allocated or

to promote involvement in a charitable organization.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

13

- 14. Measuring Social Media Results

As with any corporate initiative, measurement and assessment are important parts of the social media program. Metrics you

might use to measure your social media programs include:

• Traffic: The number of Twitter followers, Facebook fans, or views on YouTube will show the raw amount of attention

FIS your programs are receiving. Increased Web site traffic or traffic to a company blog will show secondary results that

ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

your social media presence can bring.

• Interaction: Customer participation demonstrates that the company has engaged its audience. Interaction can be

measured by comments the blog or Facebook page receives, Twitter replies, or participation in forums.

• Brand Mentions: Word of mouth and the viral nature of social media have the ability to drastically increase brand

mentions. Tracking the number and types (positive vs. negative or neutral) of mentions online via tools such as Google

Alerts, Radian6, or Trackur will help demonstrate whether your social media efforts are raising brand or product

awareness.

• Sales: Where possible, referrals from social media to the sales channel should be tracked.

This article is derived from a report entitled “Developing and Deploying Social Media for Financial Institutions,” which can

be downloaded from: http://www.fisglobal.com/Insightspapers/index.htm.

1Mary Madden and Kathryn Zickuhr, “Pew Internet & American Life Project,” Pew Research Center, August 26, 2011.

2“How US Financial Firms Should Approach Interacting with Consumers on Social Web Sites,” Forrester Research, Inc., October 2010.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

14

- 15. FIS ENTERPRISE STRATEGY VOLUME 1 • JULY 2011

Strategic Insights is a monthly newsletter that provides research, thought leadership and strategic commentary on recent

events in banking and payments. The newsletter is produced by the Enterprise Strategy team at FIS. FIS is one of the

world’s top-ranked technology providers to the banking industry. With more than 30,000 experts in 100 countries, FIS

delivers the most comprehensive range of solutions for the broadest range of financial markets, all with a singular focus:

helping you succeed.

If you have questions or comments regarding Strategic Insights, please contact Paul McAdam, SVP, Research & Thought

Leadership at 708.449.7743 or paul.mcadam@fisglobal.com.

FIS STRATEGIC INSIGHTS • V4 NOVEMBER 2011 ©2011 FIS and/or its subsidiaries. All Rights Reserved.

15