Charts of the week for feb 13 2012

Charts of the Week for stocks, bonds and investment securities by http://ProActInvest.net for February 13th, 2012 is a report and video that reviews monthly, weekly and daily movement of the stock market from a technical analysis perspective, tracking key movements in the stock market by technology stocks (QQQ), semiconductor stocks (SMH), midcap stocks (MDY) and smallcap stocks (IWM) and reviews which fixed income ETFs look especially interesting. We also review fixed income, commodities (gold, silver and crude oil), forex charts of the USD/Euro and discuss the Federal Reserve's monetary policy and its impact on the real estate market and the financial markets. The report or video will also discuss key macroeconomic reports released by the government and insights by leading financial market analysts and economists that may have some relevance to traders and investors in financial securities.

Recommandé

Contenu connexe

Dernier

Dernier (15)

En vedette

En vedette (20)

Charts of the week for feb 13 2012

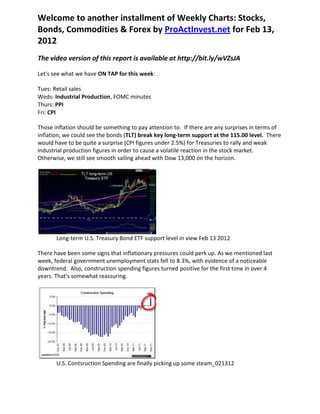

- 1. Welcome to another installment of Weekly Charts: Stocks, Bonds, Commodities & Forex by ProActInvest.net for Feb 13, 2012 The video version of this report is available at http://bit.ly/wVZsJA Let's see what we have ON TAP for this week: Tues: Retail sales Weds: Industrial Production, FOMC minutes Thurs: PPI Fri: CPI Those inflation should be something to pay attention to. If there are any surprises in terms of inflation, we could see the bonds (TLT) break key long-term support at the 115.00 level. There would have to be quite a surprise (CPI figures under 2.5%) for Treasuries to rally and weak industrial production figures in order to cause a volatile reaction in the stock market. Otherwise, we still see smooth sailing ahead with Dow 13,000 on the horizon. Long-term U.S. Treasury Bond ETF support level in view Feb 13 2012 There have been some signs that inflationary pressures could perk up. As we mentioned last week, federal government unemployment stats fell to 8.3%, with evidence of a noticeable downtrend. Also, construction spending figures turned positive for the first time in over 4 years. That's somewhat reassuring. U.S. Contsruction Spending are finally picking up some steam_021312

- 2. With an inflation rate up around 3% and Five and Ten Year Treasuries yielding less than 2%, something will have to give eventually. The only thing it seems that is holding up Treasuries is central bank buying as a form of monetary stimulus. Indeed, central banks all over the world are adding liquidity to get the world economy back up on its feet and running. Just today there was news that the ECB will provide subsidized financing to European commercial and investment banks at a rate of just 1% - essentially giving European banks carte blanche to lend at upwards of 4% -a gift of 3% in carry trade profits (estimated to total $158 billion), giving them the highest incentive to lend money to businesses throughout Europe. This comes in the face of the Greek government agreeing to abide by stringent fiscal austerity measures as outlined by the ECB. With Europe and the U.S. on a fiscal diet, it is the central banks (namely the ECB, the Fed, and even BRIC central banks in China, Brazil and India) that are picking up the slack by pumping money into the global economy by keeping the cost of capital low. This eventually will lead to inflationary pressures - which will be more apparent on the long end of the yield curve than at the short end. In addition, as we can see from the latest government report, the trade deficit in the U.S. is not improving. The U.S. Trade Deficit is not improving_021312 This is not a self-correcting phenomenon as it normally is. Usually, trade deficits are corrected either by depreciating the currency or increasing the savings rate. Since the Fed is making sure that interest rates will stay super low at least until 2014, there is really no incentive to save - indeed quite the opposite. So the dollar would have to weaken - that is, only if China's central bank allows it to. The only other natural development that will help correct this imbalance would be for Treasury rates at the long end of the curve to steepen, which is why we feel that long-term Treasuries are a short. Something has to give - either the dollar or interest rates. I suspect that it will long-term U.S. government interest rates that will have to break higher eventually. With the reassuring news coming out of Europe, we believe that the USD/Euro has stabilized above the 126.00 support level. A test of the 133.00 resistance level is imminent.

- 3. Forex USDEuro exchange rate likely to test 133 resistance_02132012 Turning to the U.S. stock market, ProActInvest.net's intermediate and short-term models are still long (as they have been since December 20, 2011). As we mentioned over the past weeks, Dow 13,000 is still within striking distance (about 1.5% away). We still like technology (QQQ) with AAPL leading the way and finally reaching the $500/share level! With a measurable rebound in construction spending and real estate, as well as the fact that the BRIC nations are in an accomodative monetary policy mode, we like residential home building companies from China and Brazil. The ones that are attractive in terms of growth at a reasonable price are Gafisa (GFA) from Brazil and Xinyuan Real Estate Company from China (XIN). We like also like the long-term chart formations for these names. Gafisa SA ADR GFA_long-term double bottom basing formation 021312 XIN Xinyuan Real Estate_ADR_forming an attractive base formation_ 021312 Thats it for ProActInvest.net's Charts of the Week for February 13, 2012. Please check out the YouTube video version of this report by searching for the ProActInvest.net channel in the YouTube search box. Please "like" the video and leave a comment. I'll also try to respond to any special requests that you may have. FYI, I am in the process of completing a video tutorial entitled Should I have Convertible Bonds in my portfolio?" When it's completed, I'll send out a link via e-mail to all subscribers. If you want to get access to the link, make sure to sign up in the opt-in box in the upper right corner of the ProActInvest.net web site (preferred method), or leave a comment under this blog post. Oh, and please spread the word about ProActInvest.net to your friends. Thanks for your interest and have a great week! Sincerely, Rich Wiegand