Acnts peckin

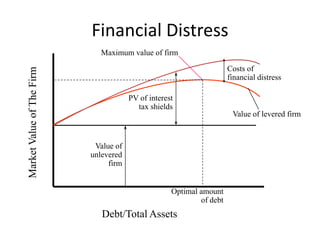

- 1. Financial Distress Maximum value of firm Costs of Market Value of The Firm financial distress PV of interest tax shields Value of levered firm Value of unlevered firm Optimal amount of debt Debt/Total Assets

- 2. Capital Structure and Financial Distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial Distress

- 3. Financial Choices Trade-off Theory - Theory that capital structure is based on a trade-off between tax savings and distress costs of debt. Pecking Order Theory - Theory stating that firms prefer to issue debt rather than equity if internal finance is insufficient.

- 4. Pecking Order Theory The announcement of a stock issue drives down the stock price because investors believe managers are more likely to issue when shares are overpriced. Therefore firms prefer internal finance since funds can be raised without sending adverse signals. If external finance is required, firms issue debt first and equity as a last resort. The most profitable firms borrow less not because they have lower target debt ratios but because they don't need external finance.

- 5. Pecking Order Theory Some Implications: Internal equity may be better than external equity. Financial slack is valuable. If external capital is required, debt is better. (There is less room for difference in opinions about what debt is worth).

- 6. Pecking Order Theory Stewart Myers (1984) • Managers are better informed than investors. Investors might see an external equity issuance a bad news about the company, assuming that managers want outside shareholders to share the loss, thus investors will react to this issuance negatively, increasing the issuance cost of external equity. 6

- 7. Firms therefore prioritize their sources of financing according to the law of least effort, or of least resistance: internal funds are used first, and when that is depleted, debt is issued, and when it is not sensible to issue any more debt, equity is issued. This theory maintains that businesses adhere to a hierarchy of financing sources and prefer internal financing when available, and debt is preferred over equity if external financing is required. 7

- 8. MM Version Three: with Multiple Frictions • Taxes: mentioned earlier (in MM Version Two). • Bankruptcy cost: direct costs (such as legal costs) and indirect costs (such as reputation loss and financial distress). • Agency problems: [e.g.] risk-shifting firm may increase risk and thereby extract value from existing bondholders. (Covenants could reduce the problems) • Free cash flow reduction: debt might reduce extra cash in the firms hence alleviate management deviations. 8

- 9. PECKING ORDER THEORY • Firm do not have any target capital structure and there is no optimum capital structure. • Assumption Asymmetric information-Professional managers of the firm are well equipped with more information when compared to investors.

- 10. Why to prefer retained earnings more?? • Easy to use , cheaper & no transaction cost • Avoid capital market regulations. • Don’t have adequate reliable information about capital market. • The announcement of a stock issue drives down the stock price because investors believe managers are more likely to issue when shares are overpriced. • Therefore firms prefer internal finance since funds can be raised without sending adverse signals. • Shareholders need not pay any personal taxes. • No Interest - steady cash flow. •

- 11. Why to prefer debt more?? • Tax deductibility of interest charges.

- 12. Outcome of the theory • The most profitable firms borrow less not because they have lower target debt ratios but because they don't need external finance. • Negative inverse relationship between profitability and debt ratio.