Financial Analysis - Banque Cantonale Vaudoise - Banque Cantonale Vaudoise (BCV) attracts deposits and offers retail, private, and corporate banking services. BCV operates primarily in the Canton of Vaud.pdf

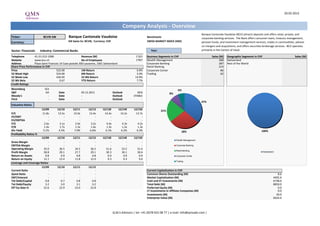

- 1. 20.02.2013 Company Analysis - Overview Banque Cantonale Vaudoise (BCV) attracts deposits and offers retail, private, and Ticker: BCVN SW Banque Cantonale Vaudoise Benchmark: corporate banking services. The Bank offers consumer loans, treasury management, Currency: SIX Swiss Ex: BCVN, Currency: CHF SWISS MARKET INDEX (SMI) pension funds, and investment management services, trades in commodities, advises on mergers and acquisitions, and offers securities brokerage services. BCV operates Sector: Financials Industry: Commercial Banks Year: primarily in the Canton of Vaud. Telephone 41-21-212-1000 Revenue (M) 1'321 Business Segments in CHF Sales (M) Geographic Segments in CHF Sales (M) Website www.bcv.ch No of Employees 1'967 Wealth Management 368 Switzerland 1 Address Place Saint-Francois 14 Case postale 300 Lausanne, 1001 Switzerland Corporate Banking 287 Rest of the World Share Price Performance in CHF Retail Banking 214 Price 522.00 1M Return 6.9% Corporate Center 86 52 Week High 524.00 6M Return 3.4% Trading 62 52 Week Low 436.94 52 Wk Return 14.9% 52 Wk Beta 0.67 YTD Return 7.7% Credit Ratings Bloomberg IG3 6% S&P AA Date 05.12.2011 Outlook NEG 8% Moody's - Date - Outlook STABLE Fitch - Date - Outlook - 37% Valuation Ratios 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E 21% P/E 11.8x 13.5x 13.0x 13.4x 14.4x 14.2x 13.7x EV/EBIT - - - - - - - EV/EBITDA - - - - - - - P/S 2.6x 3.1x 2.9x 3.2x 4.4x 4.3x 4.2x P/B 1.4x 1.7x 1.5x 1.6x 1.3x 1.2x 1.3x Div Yield 5.1% 4.5% 7.0% 6.6% 6.1% 6.2% 6.3% 28% 100% Profitability Ratios % 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Wealth Management Gross Margin - - - - - - - EBITDA Margin - - - - - - - Corporate Banking Operating Margin 35.0 36.5 34.5 36.5 51.6 52.5 51.4 Retail Banking Profit Margin 28.8 29.1 27.7 29.1 30.3 30.1 30.4 Switzerland Return on Assets 0.8 0.9 0.8 0.8 0.9 0.9 0.9 Corporate Center Return on Equity 12.1 12.4 11.8 12.0 9.3 9.3 9.4 Trading Leverage and Coverage Ratios 12/09 12/10 12/11 12/12 Current Ratio - - - - Current Capitalization in CHF Quick Ratio - - - - Common Shares Outstanding (M) 8.6 EBIT/Interest - - - - Market Capitalization (M) 4492.4 Tot Debt/Capital 0.8 0.7 0.8 0.8 Cash and ST Investments (M) 6738.0 Tot Debt/Equity 3.2 3.0 3.1 3.2 Total Debt (M) 8850.0 Eff Tax Rate % 22.6 22.9 23.0 22.8 Preferred Equity (M) 0.0 LT Investments in Affiliate Companies (M) 0.0 Investments (M) 20.0 Enterprise Value (M) 6624.4 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. Company Analysis - Analysts Ratings Banque Cantonale Vaudoise Target price in CHF Broker Recommendation Buy and Sell Recommendations vs Price and Target Price Price Brokers' Target Price 600 600 100% 0% 0% 0% 20% 20% 17% 17% 17% 17% 20% 500 500 33% 33% 80% 400 400 60% 300 100% 100% 100% 300 40% 80% 80% 83% 83% 83% 83% 80% 200 67% 67% 200 100 20% 100 0 Main First Helvea Dimensions Bank Vontobel Kantonalbank Bank AG 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0 Zuercher EVA févr.12 mars.12 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 AG Buy Hold Sell Price Target Price Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date 31-Jan-13 0% 80% 20% 20-Feb-13 522.00 515.00 EVA Dimensions AUSTIN BURKETT sell 20-Feb-13 31-Dec-12 0% 83% 17% 19-Feb-13 512.00 515.00 Bank Vontobel AG TERESA NIELSEN hold 530.00 19-Feb-13 30-Nov-12 0% 100% 0% 18-Feb-13 505.50 501.67 Zuercher Kantonalbank ANDREAS VENDITTI market perform 15-Feb-13 31-Oct-12 0% 83% 17% 15-Feb-13 496.00 507.50 Main First Bank AG KILIAN MAIER underperform 490.00 14-Feb-13 28-Sep-12 0% 83% 17% 14-Feb-13 503.00 507.50 Helvea TIM DAWSON neutral 525.00 14-Feb-13 31-Aug-12 0% 83% 17% 13-Feb-13 471.25 492.50 31-Jul-12 0% 100% 0% 12-Feb-13 481.00 492.50 29-Jun-12 0% 100% 0% 11-Feb-13 488.25 492.50 31-May-12 0% 80% 20% 8-Feb-13 485.50 491.67 30-Apr-12 0% 80% 20% 7-Feb-13 486.25 491.67 30-Mar-12 0% 67% 33% 6-Feb-13 487.00 491.67 29-Feb-12 0% 67% 33% 5-Feb-13 490.75 475.00 4-Feb-13 488.75 475.00 1-Feb-13 489.75 475.00 31-Jan-13 486.25 475.00 30-Jan-13 485.25 475.00 29-Jan-13 486.75 475.00 28-Jan-13 493.75 475.00 25-Jan-13 488.75 475.00 24-Jan-13 486.25 475.00 23-Jan-13 486.25 475.00 22-Jan-13 489.00 475.00 21-Jan-13 490.00 475.00 18-Jan-13 488.50 475.00 17-Jan-13 491.75 475.00 16-Jan-13 487.00 475.00 15-Jan-13 486.75 475.00 14-Jan-13 491.25 475.00 11-Jan-13 493.00 475.00 10-Jan-13 491.25 475.00 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 20.02.2013 Banque Cantonale Vaudoise Company Analysis - Ownership Ownership Type Ownership Statistics Geographic Ownership Distribution Geographic Ownership 0% Shares Outstanding (M) 8.6 Switzerland 93.03% 25% 1% 0%0%0% Float 32.7% United States 3.08% 1% 0% Short Interest (M) Britain 1.47% 4% Short Interest as % of Float Luxembourg 1.34% Days to Cover Shorts Unknown Country 0.40% Institutional Ownership 74.88% Germany 0.15% Retail Ownership 24.81% France 0.14% Insider Ownership 0.30% Others 0.40% 75% Institutional Ownership Distribution 94% Government 89.05% Investment Advisor 7.37% Mutual Fund Manager 2.79% Switzerland United States Britain Institutional Ownership Retail Ownership Insider Ownership Individual 0.40% Luxembourg Unknown Country Germany Pricing data is in CHF Others 0.39% France Others Top 20 Owners: TOP 20 ALL Institutional Ownership Holder Name Position Position Change Market Value % of Ownership Report Date Source Country CANTON OF VAUD 5'762'252 0 3'007'895'544 66.95% 01.01.2012 Co File SWITZERLAND 0% 0% 3% UBS FUND MANAGEMENT 99'092 -291 51'726'024 1.15% 31.10.2012 MF-AGG SWITZERLAND BLACKROCK 58'620 7'662 30'599'640 0.68% 15.02.2013 ULT-AGG UNITED STATES 7% VANGUARD GROUP INC 55'668 1'997 29'058'696 0.65% 31.12.2012 MF-AGG UNITED STATES JUPITER ASSET MANAGE 54'169 -11'500 28'276'218 0.63% 31.07.2012 MF-AGG BRITAIN CREDIT SUISSE ASSET 45'660 775 23'834'520 0.53% 28.12.2012 MF-AGG SWITZERLAND THORNBURG INVESTMENT 44'400 0 23'176'800 0.52% 31.12.2012 MF-AGG UNITED STATES SWISSCANTO FONDSLEIT 31'940 -514 16'672'680 0.37% 30.11.2012 MF-AGG SWITZERLAND NEW JERSEY DIVISION 24'618 0 12'850'596 0.29% 30.06.2012 MF-AGG UNITED STATES PICTET & CIE 23'611 0 12'324'942 0.27% 31.10.2012 MF-AGG SWITZERLAND 90% ALLIANZ ASSET MANAGE 22'742 0 11'871'324 0.26% 31.12.2012 ULT-AGG GERMANY SCHRODER INVESTMENT 18'595 3'950 9'706'590 0.22% 30.06.2012 MF-AGG BRITAIN BNP PARIBAS INV PART 18'469 -113 9'640'818 0.21% 30.11.2012 ULT-AGG FRANCE VONTOBEL ASSET MANAG 16'600 3'350 8'665'200 0.19% 31.10.2012 MF-AGG SWITZERLAND Government Investment Advisor Mutual Fund Manager Individual Others SCHRODER INVESTMENT 16'170 0 8'440'740 0.19% 28.09.2012 MF-AGG SWITZERLAND BARING FUND MANAGERS 12'574 0 6'563'628 0.15% 31.10.2012 MF-AGG BRITAIN PRUDENTIAL FINANCIAL 10'122 0 5'283'684 0.12% 31.12.2012 ULT-AGG UNITED STATES INTERNATIONAL VALUE 9'890 -5'912 5'162'580 0.11% 31.03.2012 MF-AGG UNITED STATES SARASIN 9'201 0 4'802'922 0.11% 30.11.2012 ULT-AGG STEIMER OLIVIER 8'074 0 4'214'628 0.09% 31.12.2011 Co File n/a Top 5 Insiders: Holder Name Position Position Change Market Value % of Ownership Report Date Source STEIMER OLIVIER 8'074 4'214'628 0.09% 31.12.2011 Co File KIENER PASCAL 7'177 3'746'394 0.08% 31.12.2011 Co File ACHARD AIME 1'642 857'124 0.02% 31.12.2011 Co File SCHWARZ JEAN-FRANCOIS 1'583 826'326 0.02% 31.12.2011 Co File SAGER BERTRAND 1'566 817'452 0.02% 31.12.2011 Co File Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 4. Company Analysis - Financials I/IV Banque Cantonale Vaudoise Financial information is in CHF (M) Equivalent Estimates Periodicity: Fiscal Year 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Income Statement Revenue 1'604 1'516 1'438 1'499 1'590 1'727 1'566 1'371 1'352 1'352 1'321 1'029 1'050 1'074 - Cost of Goods Sold Gross Income - Selling, General & Admin Expenses 856 732 674 643 656 645 589 590 608 622 611 (Research & Dev Costs) Operating Income -977 156 427 378 433 429 325 365 393 377 391 531 551 552 - Interest Expense - Foreign Exchange Losses (Gains) - Net Non-Operating Losses (Gains) -36 -18 -12 -210 -247 -287 -134 -24 -14 -14 -12 Pretax Income -1'192 174 359 477 558 576 459 390 407 391 403 414 424 433 - Income Tax Expense 8 17 22 20 23 99 101 88 93 90 92 Income Before XO Items -1'200 157 337 457 534 477 358 301 314 301 311 - Extraordinary Loss Net of Tax 0 0 0 0 0 0 0 0 - Minority Interests 0 3 2 3 4 4 1 1 1 -1 0 Diluted EPS Before XO Items 41.40 34.93 36.39 35.10 36.14 Net Income Adjusted* -1'200 154 335 356 410 473 330 279 313 302 304 312 316 326 EPS Adjusted (141.39) 6.98 39.31 41.36 47.85 55.28 38.39 32.41 36.39 35.10 35.28 36.18 36.66 38.22 Dividends Per Share 0.00 2.00 3.00 4.50 7.00 14.00 20.00 21.00 22.00 32.00 32.00 32.00 32.25 33.00 Payout Ratio % 40.4 7.6 8.5 11.4 25.5 48.3 60.1 60.4 91.2 88.6 0.88 0.88 0.86 Total Shares Outstanding 8 22 8 9 9 9 9 9 9 9 9 Diluted Shares Outstanding 9 9 9 9 9 EBITDA *Net income excludes extraordinary gains and losses and one-time charges. Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 5. Company Analysis - Financials II/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Balance Sheet Total Current Assets + Cash & Near Cash Items 399 368 400 282 321 353 546 1'404 388 1'711 4'735 + Short Term Investments 1'142 1'360 1'489 1'806 2'116 2'146 702 485 2'413 601 693 + Accounts & Notes Receivable + Inventories + Other Current Assets Total Long-Term Assets + Long Term Investments 1'508 1'539 1'573 1'697 1'669 1'671 1'634 2'951 2'966 2'975 3'153 Gross Fixed Assets Accumulated Depreciation + Net Fixed Assets 424 410 392 381 365 286 283 597 588 628 621 + Other Long Term Assets 3'373 2'714 2'413 4'244 1'857 2'037 1'897 515 710 895 633 Total Current Liabilities + Accounts Payable + Short Term Borrowings 3'318 2'987 2'458 3'554 2'091 2'477 2'361 2'243 1'994 2'749 2'447 + Other Short Term Liabilities 2'250 2'130 1'854 4'925 2'336 2'084 1'592 926 974 944 867 Total Long Term Liabilities + Long Term Borrowings 9'255 7'628 6'331 5'475 6'684 6'938 6'508 5'937 5'582 5'202 5'968 + Other Long Term Borrowings 254 253 332 484 628 765 1'076 704 704 704 704 Total Liabilities 31'618 29'789 27'950 32'088 30'176 32'816 33'138 33'215 33'018 35'306 37'189 + Long Preferred Equity 0 0 0 0 0 0 0 0 0 0 0 + Minority Interest 20 21 14 15 14 15 13 14 14 20 1 + Share Capital & APIC 1'695 1'714 1'722 1'596 1'345 891 613 529 445 446 361 + Retained Earnings & Other Equity -814 575 853 1'176 1'495 1'615 1'847 1'975 2'108 2'131 2'249 Total Shareholders Equity 901 2'310 2'588 2'787 2'855 2'521 2'473 2'518 2'567 2'597 2'611 Total Liabilities & Equity 32'519 32'098 30'537 34'875 33'031 35'337 35'611 35'733 35'585 37'903 39'800 Book Value Per Share 103.78 104.24 304.18 325.40 331.73 291.80 286.37 291.49 297.12 300.04 303.28 410.56 418.23 402.06 Tangible Book Value Per Share 89.84 100.82 293.24 314.24 329.80 290.44 285.73 290.95 296.69 295.97 298.98 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 6. Company Analysis - Financials III/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Cash Flows Net Income -1'200 154 335 454 530 473 356 301 313 302 311 313 316 323 + Depreciation & Amortization 1'357 262 1 -77 -110 -175 35 102 58 98 + Other Non-Cash Adjustments 224 -9 82 119 130 144 3 -1 2 -1 + Changes in Non-Cash Capital -34 6 -6 -30 1 85 -79 -11 25 -22 Cash From Operating Activities 347 413 412 467 551 527 315 391 397 377 + Disposal of Fixed Assets + Capital Expenditures + Increase in Investments + Decrease in Investments + Other Investing Activities Cash From Investing Activities + Dividends Paid -121 + Change in Short Term Borrowings + Increase in Long Term Borrowings + Decrease in Long Term Borrowings + Increase in Capital Stocks + Decrease in Capital Stocks + Other Financing Activities Cash From Financing Activities -121 Net Changes in Cash Free Cash Flow (CFO-CAPEX) 347 413 412 467 525 498 304 379 377 353 Free Cash Flow To Firm Free Cash Flow To Equity Free Cash Flow per Share 40.87 18.71 48.33 54.50 61.09 57.90 35.34 43.99 43.77 41.02 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 7. Company Analysis - Financials IV/IV Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Ratio Analysis Valuation Ratios Price Earnings 20.2x 5.2x 7.1x 12.2x 12.8x 7.7x 11.8x 13.5x 13.0x 13.4x 14.4x 14.2x 13.7x EV to EBIT EV to EBITDA Price to Sales 0.4x 2.1x 1.2x 2.2x 3.2x 2.5x 1.7x 2.6x 3.1x 2.9x 3.2x 4.4x 4.3x 4.2x Price to Book 0.8x 1.4x 0.7x 1.2x 1.8x 1.7x 1.1x 1.4x 1.7x 1.5x 1.6x 1.3x 1.2x 1.3x Dividend Yield 0.0% 1.4% 1.5% 1.2% 1.2% 2.8% 6.3% 5.1% 4.5% 7.0% 6.6% 6.1% 6.2% 6.3% Profitability Ratios Gross Margin EBITDA Margin - - - Operating Margin -103.7% 15.3% 41.7% 33.9% 36.8% 36.7% 32.4% 35.0% 36.5% 34.5% 36.5% 51.6% 52.5% 51.4% Profit Margin -127.3% 15.1% 32.7% 40.8% 45.1% 40.5% 35.5% 28.8% 29.1% 27.7% 29.1% 30.3% 30.1% 30.4% Return on Assets -3.6% 0.5% 1.1% 1.4% 1.6% 1.4% 1.0% 0.8% 0.9% 0.8% 0.8% 0.9% 0.9% 0.9% Return on Equity -104.4% 9.7% 13.8% 17.0% 18.9% 17.7% 14.3% 12.1% 12.4% 11.8% 12.0% 9.3% 9.3% 9.4% Leverage & Coverage Ratios Current Ratio Quick Ratio Interest Coverage Ratio (EBIT/I) Tot Debt/Capital 0.93 0.82 0.77 0.76 0.75 0.79 0.78 0.76 0.75 0.75 0.76 Tot Debt/Equity 13.95 4.60 3.40 3.24 3.07 3.73 3.59 3.25 2.95 3.06 3.22 Others Asset Turnover 0.05 0.05 0.05 0.05 0.05 0.05 0.04 0.04 0.04 0.04 0.03 Accounts Receivable Turnover Accounts Payable Turnover Inventory Turnover Effective Tax Rate 9.6% 6.1% 4.3% 4.2% 17.1% 22.1% 22.6% 22.9% 23.0% 22.8% Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 8. Company Analysis - Peers Comparision BANQUE CANTO- VONTOBEL HLDG- VERWALTUNGS-U- BASLER KANTON- LUZERNER KAN- PARTNERS GROUP UBS AG-REG CREDIT SUISS-REG BANK SARASIN-B GAM HOLDING AG LIECHTENSTEIN-BR ST GALLER KA-REG EFG INTERNAT AG VZ HOLDING AG VALIANT HLDG AG REG R BR PC REG J Latest Fiscal Year: 12/2012 12/2012 12/2012 12/2011 12/2011 12/2012 12/2011 12/2012 12/2011 12/2011 12/2011 12/2011 12/2012 12/2011 12/2011 52-Week High 524.00 16.39 27.85 28.80 16.25 33.00 42.45 404.50 11.95 84.00 130.00 113.60 360.00 111.64 223.70 52-Week High Date 20.02.2013 25.01.2013 07.02.2013 20.02.2012 15.02.2013 20.02.2013 22.02.2012 19.02.2013 20.02.2013 20.02.2012 11.02.2013 27.04.2012 06.02.2013 02.03.2012 11.01.2013 52-Week Low 456.96 9.69 15.97 24.50 9.92 17.80 25.50 320.75 4.77 60.00 85.00 98.00 311.00 74.35 157.20 52-Week Low Date 07.03.2012 24.07.2012 03.08.2012 08.10.2012 25.05.2012 28.06.2012 16.11.2012 21.05.2012 24.07.2012 21.11.2012 26.07.2012 16.11.2012 29.02.2012 31.08.2012 04.06.2012 Daily Volume 17'955 6'729'041 4'236'189 1'193 327'314 62'761 9'127 1'546 94'015 5'665 3'371 794 2'056 38'297 26'033 Current Price (2/dd/yy) 522.00 15.31 27.34 27.00 16.15 33.00 31.80 401.00 11.70 80.25 129.50 98.90 360.00 87.35 213.50 52-Week High % Change -0.4% -6.6% -1.8% -6.2% -0.6% 0.0% -25.1% -0.9% -2.1% -4.5% -0.4% -12.9% 0.0% -21.8% -4.6% 52-Week Low % Change 14.2% 58.1% 71.2% 10.2% 62.8% 85.4% 24.7% 25.0% 145.3% 33.8% 52.4% 0.9% 15.8% 17.5% 35.8% Total Common Shares (M) 8.6 3'747.4 1'292.7 62.9 177.1 63.4 28.4 5.5 146.7 5.8 7.8 29.9 8.5 15.8 25.4 Market Capitalization 4'492.4 58'727.0 36'111.5 1'698.3 2'961.2 2'145.0 979.4 2'234.9 1'716.0 474.7 1'036.0 3'096.7 3'060.0 1'379.5 5'700.5 Total Debt 8'415.0 267'400.0 330'510.0 2'024.9 17.5 7'456.5 1'844.5 5'065.0 1'269.7 928.9 1.4 7'662.3 5'639.3 6'379.3 - Preferred Stock - - - - - - - - - - - - - - - Minority Interest 1.0 4'353.0 6'786.0 37.4 - - 101.2 - 24.6 19.0 - 361.6 - - 0.8 Cash and Equivalents 6'742.0 66'383.0 63'708.0 2'764.8 600.1 2'999.6 7'716.7 2'183.0 3'286.2 5'389.3 361.2 3'907.4 2'920.5 1'946.1 96.7 Enterprise Value - 264'097.0 - - - 6'978.0 - - - - 804.8 - - - 5'605.2 Valuation Total Revenue LFY 1'321.2 37'392.0 38'313.0 831.5 812.2 890.7 555.0 501.6 1'078.2 320.7 143.8 935.8 685.4 693.4 448.8 LTM 1'321.2 37'470.0 38'313.0 795.5 983.4 861.4 569.7 501.6 1'146.3 314.0 144.3 940.7 685.4 663.4 480.4 CY+1 1'029.3 26'730.4 26'558.3 680.7 581.8 842.4 407.0 509.0 791.2 217.0 148.5 672.0 427.0 386.0 425.0 CY+2 1'050.3 27'411.1 27'461.6 741.3 621.8 912.0 407.0 523.0 796.1 221.0 170.7 648.0 437.0 391.0 509.3 EV/Total Revenue LFY - 6.9x - - - 6.8x - - - - 2.7x - - - 9.3x LTM - 6.9x - - - 7.0x - - - - 2.7x - - - 8.7x CY+1 - - - - 4.5x - - - - - - - - - 13.2x CY+2 - - - - 4.3x - - - - - - - - - 10.9x EBITDA LFY - 17'464.0 - - - 213.9 - - - - 66.4 - - - 236.2 LTM - 17'575.0 - - - 202.6 - - - - 64.7 - - - 250.0 CY+1 - - - - - - - - - - 65.3 - - - 267.2 CY+2 - - - - - - - - - - 80.5 - - - 324.7 EV/EBITDA LFY - 14.8x - - - 28.2x - - - - 5.8x - - - 17.6x LTM - 16.1x - - - 29.8x - - - - 5.9x - - - 16.6x CY+1 - - - - - - - - - - - - - - 20.9x CY+2 - - - - - - - - - - - - - - 17.1x EPS LFY 35.48 1.68 0.77 1.63 -0.52 1.76 0.38 27.28 -0.52 0.75 6.48 5.99 19.51 6.85 7.75 LTM 36.14 -0.75 0.84 1.04 -0.32 1.55 1.34 27.28 -2.21 2.07 6.33 7.37 19.79 7.90 8.46 CY+1 36.18 0.93 2.70 1.62 0.87 2.32 2.91 30.88 0.79 2.69 6.40 9.34 21.85 7.28 9.67 CY+2 36.66 1.21 3.11 1.83 1.09 2.68 3.60 31.97 0.93 4.51 7.69 7.75 22.48 6.84 11.69 P/E LFY 14.4x - 32.5x 26.0x - 21.3x 23.7x 14.7x - 38.8x 20.5x 13.4x 18.2x 11.1x 25.2x LTM 14.7x 15.3x 12.3x 26.0x - 20.6x 23.7x 14.7x - 38.8x 20.6x 14.0x 15.2x 14.4x 25.7x CY+1 14.4x 16.5x 10.1x 16.6x 18.6x 14.2x 10.9x 13.0x 14.9x 29.8x 20.2x 10.6x 16.5x 12.0x 22.1x CY+2 14.2x 12.6x 8.8x 14.8x 14.8x 12.3x 8.8x 12.5x 12.6x 17.8x 16.8x 12.8x 16.0x 12.8x 18.3x Revenue Growth 1 Year (2.3%) (8.5%) (10.3%) (2.3%) (15.8%) - (8.3%) (28.6%) 80.6% (7.7%) 8.1% (6.6%) (4.7%) (1.9%) 0.3% 5 Year (4.5%) (10.7%) 30.2% (5.5%) - (5.5%) (7.6%) (16.3%) 399.5% (13.5%) 10.2% (3.5%) (4.1%) (0.2%) 13.9% EBITDA Growth 1 Year - - - - - - - - - - 3.9% - - - (26.4%) 5 Year - (29.1%) - - - (9.9%) - - - - - - - - 7.6% EBITDA Margin LTM - 47.0% - - - 23.5% - - - - 44.9% - - - 52.0% CY+1 - - - - - - - - - - 44.0% - - - 62.9% CY+2 - - - - - - - - - - 47.2% - - - 63.7% Leverage/Coverage Ratios Total Debt / Equity % 322.4% 582.6% 927.6% 164.7% 0.8% 498.2% 119.7% 271.9% 128.7% 105.6% 0.7% 283.6% 364.2% 351.2% 0.0% Total Debt / Capital % 76.3% 84.2% 88.6% 61.5% 0.8% 83.3% 52.9% 73.1% 55.7% 50.8% 0.7% 71.4% 78.5% 77.8% 0.0% Total Debt / EBITDA - 18.434x - - - 34.709x - - - - 0.068x - - - 0.000x Net Debt / EBITDA - 9.520x - - - 23.855x - - - - -3.575x - - - -0.384x EBITDA / Int. Expense - - - - - - - - - - - - - - - Credit Ratings S&P LT Credit Rating AA A A A - A - - - A- - AA+ AA+ - - S&P LT Credit Rating Date 05.12.2011 29.11.2011 19.12.2008 17.12.2012 - 30.03.2009 - - - 24.02.2009 - 18.10.2001 12.09.2008 - - Moody's LT Credit Rating - A2 (P)A2 - - - - Aa1 - - - - - - - Moody's LT Credit Rating Date - 21.06.2012 21.06.2012 - - - - 02.12.2003 - - - - - - - Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |