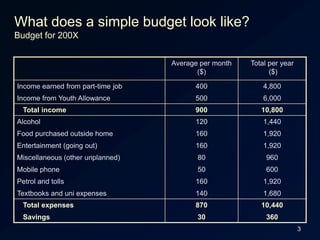

This document provides information about creating and maintaining a budget. It defines a budget as a plan for your money over the next year that includes income sources and expense categories. Having a budget gives you knowledge and power over your finances by identifying where your money is coming from and going. Challenges people face include being realistic about expenses and having flexibility, as the future is uncertain. The document recommends tracking income and expenses for two months before creating your first budget to improve accuracy. It then outlines tips for easy expense tracking including using software or receipts and reconciling cash amounts with recorded expenses.