Mf0012 & taxation management

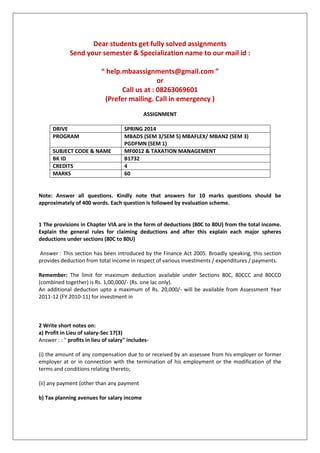

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency ) ASSIGNMENT DRIVE SPRING 2014 PROGRAM MBADS (SEM 3/SEM 5) MBAFLEX/ MBAN2 (SEM 3) PGDFMN (SEM 1) SUBJECT CODE & NAME MF0012 & TAXATION MANAGEMENT BK ID B1732 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. 1 The provisions in Chapter VIA are in the form of deductions (80C to 80U) from the total income. Explain the general rules for claiming deductions and after this explain each major spheres deductions under sections (80C to 80U) Answer : This section has been introduced by the Finance Act 2005. Broadly speaking, this section provides deduction from total income in respect of various investments / expenditures / payments. Remember: The limit for maximum deduction available under Sections 80C, 80CCC and 80CCD (combined together) is Rs. 1,00,000/- (Rs. one lac only). An additional deduction upto a maximum of Rs. 20,000/- will be available from Assessment Year 2011-12 (FY 2010-11) for investment in 2 Write short notes on: a) Profit in Lieu of salary-Sec 17(3) Answer : : " profits in lieu of salary" includes- (i) the amount of any compensation due to or received by an assessee from his employer or former employer at or in connection with the termination of his employment or the modification of the terms and conditions relating thereto; (ii) any payment (other than any payment b) Tax planning avenues for salary income

- 2. Answer : 1. Exemptions/reimbursements – Identify the reimbursements available from the company and take maximum advantage of the same. Normal expenses that one incurs could help save tax. Example- Telephone/fuel reimbursements, meal vouchers and company car. A person in lower tax slabs can reduce his tax liability to nil with exemptions alone. Some of The Popularly Known Exemptions/Reimbursements 3 There certain important things to know under Section 54ED. Explain all the important conditions in Section 54ED in Capital Gain. Mr. A acquired a plot of land on 15th June,1993 for Rs. 10,00,000 and sold it on 5th Jan,2010 for Rs.41,00,000. The expenses of transfer were Rs.1,00,000. Mr.A made the following investments on 4th Feb,2010 from the proceeds of the plot. a) Bonds of Rural Electrification Corporation redeemable after a period of three years Rs. 12,00,000. b) Deposits under Capital Gain Scheme for purchase of a residence house Rs.8,00,000 (he does not won any house). 4 Elaborate and write on the administrative mechanism envisaged in the DTC in Tax Management and also write on the assessment procedure. Answer : Tax policy forms an important component of India's fiscal policy. Apart from being an instrument of raising revenues, taxation laws play a key role in attaining larger fiscal objectives like, encouraging savings and investment, reducing inequalities of income and wealth, fostering balanced regional development, incentivising exports and small-scale industries, etc. However, in order to provide tax incentives for achieving vertical and horizontal equity and the above objectives, tax laws have been amended hundreds of times over the years, which has resulted in the tax laws becoming one of the most complex legislation in the country. In a fast globalizing world, where countries are 5 Service tax is a tax levied on services. List down the registration under service tax rules. Write down the procedure for registration and payment of service tax. Compute the taxable turnover and service tax liability for the year 2 of a new company in each of the following situations: Particulars Situation 1 Situation 2 Situation 3 Year 1 800000 800000 1100000 Year 2 800000 1100000 800000

- 3. Answer : Registration 2.1 Every person liable for paying the service tax shall make an application to the concerned Superintendent of Central Excise in Form ST-1 for registration within a period of thirty days from the date on which the service tax under section 66 of the Finance Act, 1994(32 of 1994) is levied: Provided that where a person commences the business of providing a taxable service after such service has been levied, he shall make an application for registration within a period of thirty days from the date of such commencement. (Refer 6 Capital structure is said to be optimum when the firm has selected a combination of equity and debt that minimizes the cost of capital. What are the major considerations in capital structure planning? Write about the dividend policy and factors affecting dividend decisions. Answer : There are three major considerations in capital structure planning, i.e. risk, cost of capital and control, which help the finance manager in determining the proportion in which he can raise funds from various sources. Although, three factors, i.e. risk, cost and control determines the capital structure of a particular business undertaking at a given point of time. The finance manager attempts to design the Capital Structure in such a manner that his risk and costs are the least and the control of the existing management is diluted to the least extent. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency )