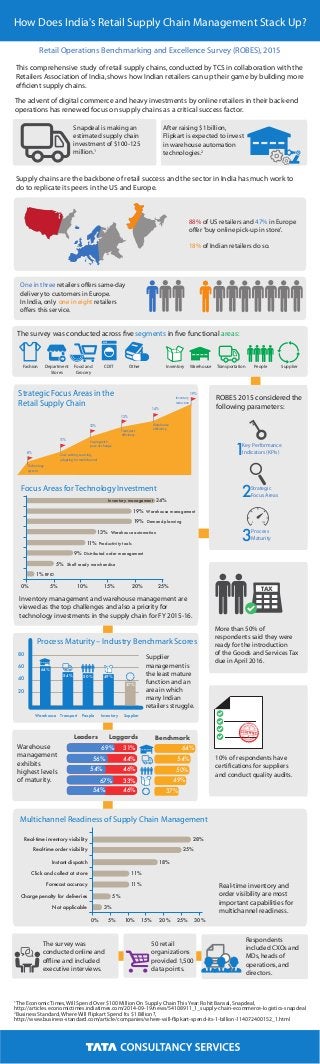

How Does India's Retail Supply Chain Management Stack Up?

- 1. 88% of US retailers and 47% in Europe offer 'buy online pick-up in store'. 18% of Indian retailers do so. One in three retailers offers same-day delivery to customers in Europe. In India,only one in eight retailers offers this service. The advent of digital commerce and heavy investments by online retailers in their back-end operations has renewed focus on supply chains as a critical success factor. Snapdeal is making an estimated supply chain investment of $100-125 million.1 After raising $1 billion, Flipkart is expected to invest in warehouse automation technologies.2 3%Not applicable 11% 0% 5% 10% 15% 20% 25% 30% Forecast accuracy 5%Charge penalty for deliveries 11%Click and collect at store 18%Instant dispatch 28%Real-time inventory visibility 25%Real-time order visibility Multichannel Readiness of Supply Chain Management Real-time inventory and order visibility are most important capabilities for multichannel readiness. Retail Operations Benchmarking and Excellence Survey (ROBES),2015 How Does India's Retail Supply Chain Management Stack Up? Supply chains are the backbone of retail success and the sector in India has much work to do to replicate its peers in the US and Europe. This comprehensive study of retail supply chains,conducted by TCS in collaboration with the Retailers Association of India,shows how Indian retailers can up their game by building more efficient supply chains. The survey was conducted across five segments in five functional areas: Inventory Warehouse Transportation People SupplierFashion Department Stores Food and Grocery CDIT Other 1 The Economic Times,Will Spend Over $100 Million On Supply Chain This Year:Rohit Bansal,Snapdeal, http://articles.economictimes.indiatimes.com/2014-09-19/news/54108911_1_supply-chain-ecommerce-logistics-snapdeal 2 Business Standard,Where Will Flipkart Spend Its $1 Billion?, http://www.business-standard.com/article/companies/where-will-flipkart-spend-its-1-billion-114072400152_1.html 10% of respondents have certifications for suppliers and conduct quality audits. More than 50% of respondents said they were ready for the introduction of the Goods and Services Tax due in April 2016. TAX ROBES 2015 considered the following parameters: 1 Process Maturity3 Key Performance Indicators (KPIs) Strategic Focus Areas2 0 100 Inventory management and warehouse management are viewed as the top challenges and also a priority for technology investments in the supply chain for FY 2015-16. 8% 11% 12% 13% 14% 19%Strategic Focus Areas in the Retail Supply Chain Technology system Cost-cutting,sourcing, adapting for multichannel Coping with pace of change Transport efficiency Warehouse efficiency Inventory reduction 0 Warehouse People InventorySupplier Leaders BenchmarkLaggards 64%31% 50%46%54% 54%44%56% 69% 49%33%67% 37%46%54% Warehouse management exhibits highest levels of maturity. Focus Areas for Technology Investment 0% 5% 10% 15% 20% 25% 5% Shelf ready merchandise 11% Productivity tools 1% RFID 9% Distributed order management 19% Demand planning 13% Warehouse automation 24%Inventory management 19% Warehouse management 20 40 60 80 64% Transport 54% 37% 50% 49% Process Maturity – Industry Benchmark Scores Supplier management is the least mature function and an area in which many Indian retailers struggle. Warehouse SupplierPeople Inventory The survey was conducted online and offline and included executive interviews. 50 retail organizations provided 1,500 data points. Respondents included CXOs and MDs,heads of operations,and directors.