ftb.ca.gov forms 09_587

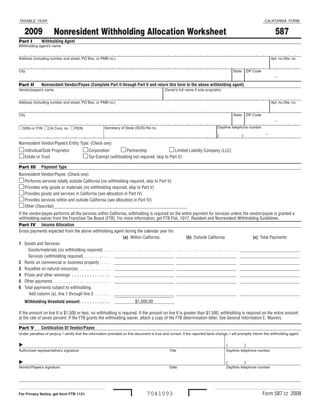

- 1. TAXABLE YEAR CALIFORNIA FORM 2009 587 Nonresident Withholding Allocation Worksheet Part I Withholding Agent Withholding agent’s name Address (including number and street, PO Box, or PMB no.) Apt. no./Ste. no. City State ZIP Code - Part II Nonresident Vendor/Payee (Complete Part II through Part V and return this form to the above withholding agent) Vendor/payee’s name Owner’s full name if sole proprietor Address (including number and street, PO Box, or PMB no.) Apt. no./Ste. no. City State ZIP Code - Daytime telephone number SSN or ITIN CA Corp. no. FEIN Secretary of State (SOS) file no. - ( ) Nonresident Vendor/Payee’s Entity Type: (Check one) Individual/Sole Proprietor Corporation Partnership Limited Liability Company (LLC) Estate or Trust Tax-Exempt (withholding not required, skip to Part V) Part III Payment Type Nonresident Vendor/Payee: (Check one) Performs services totally outside California (no withholding required, skip to Part V) Provides only goods or materials (no withholding required, skip to Part V) Provides goods and services in California (see allocation in Part IV) Provides services within and outside California (see allocation in Part IV) Other (Describe)____________________________________________________________ If the vendor/payee performs all the services within California, withholding is required on the entire payment for services unless the vendor/payee is granted a withholding waiver from the Franchise Tax Board (FTB) . For more information, get FTB Pub . 1017, Resident and Nonresident Withholding Guidelines . Part IV Income Allocation Gross payments expected from the above withholding agent during the calendar year for: (a) Within California (b) Outside California (c) Total Payments 1 Goods and Services: Goods/materials (no withholding required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ___________________________ Services (withholding required) . . . . . . . . . . . . ___________________________ ___________________________ ___________________________ 2 Rents on commercial or business property . . . . . ___________________________ ___________________________ ___________________________ 3 Royalties on natural resources . . . . . . . . . . . . . . . ___________________________ ___________________________ ___________________________ 4 Prizes and other winnings . . . . . . . . . . . . . . . ___________________________ ___________________________ ___________________________ 5 Other payments . . . . . . . . . . . . . . . . . . . . . . . . . . ___________________________ ___________________________ ___________________________ 6 Total payments subject to withholding . Add column (a), line 1 through line 5 . . . . . . . ___________________________ ___________________________ ___________________________ $1,500 .00 Withholding threshold amount: . . . . . . . . . . . ___________________________ If the amount on line 6 is $1,500 or less, no withholding is required . If the amount on line 6 is greater than $1,500, withholding is required on the entire amount at the rate of seven percent . If the FTB grants the withholding waiver, attach a copy of the FTB determination letter . See General Information E, Waivers . Part V Certification Of Vendor/Payee Under penalties of perjury, I certify that the information provided on this document is true and correct. If the reported facts change, I will promptly inform the withholding agent. ( ) Authorized representative’s signature Title Daytime telephone number ( ) Vendor/Payee’s signature Date Daytime telephone number Form 587 C2 2008 7041093 For Privacy Notice, get form FTB 1131.

- 2. Instructions for Form 587 Nonresident Withholding Allocation Worksheet References in these instructions are to the California Revenue and Taxation Code (R&TC). General Information to nonresidents of California for personal Payments not subject to withholding services performed in California and for include payments: Beginning January 1, 2008, domestic rents and royalties on property located in • To a resident of California or to a nonresidents may use Form 589, California . The withholding rate is seven corporation with a permanent place of Nonresident Request for Reduced percent unless the FTB grants a waiver . business in California . Withholding, to request the reduction in See General Information E, Waivers . • To a corporation qualified to do the standard seven percent withholding business in California . amount that is applicable to California C When to File This Form • To a partnership or LLC that has source payments made to nonresidents . a permanent place of business in The withholding agent requests that the Private Mail Box California . vendor/payee completes, signs, and Include the Private Mail Box (PMB) in the • For sale of goods . returns Form 587 when a contract is address field . Write “PMB” first, then the • For income from intangible personal entered into or before payment is made to box number . Example: 111 Main Street property, such as interest and the vendor/payee . PMB 123 . dividends, unless the property has Form 587 remains valid for the duration acquired a business situs in California . A Purpose of the contract (or term of payments), • For services performed outside of provided there is no material change Use Form 587, Nonresident Withholding California . in the facts . By signing Form 587, the Allocation Worksheet, to determine if • To a vendor/payee that is a tax-exempt vendor/payee agrees to promptly notify withholding is required on payments to organization under either California or the withholding agent of any changes in nonresidents . federal law . the facts . • Representing wages paid to employees . The vendor/payee completes, signs, and Wage withholding is administered returns Form 587 to the withholding D Withholding Requirements by the California Employment agent . The withholding agent relies on the Development Department (EDD) . For certification made by the vendor/payee Payments made to nonresident more information, contact your local to determine if withholding is required, vendors/payees (including individuals, EDD office . provided the completed and signed corporations, partnerships, LLCs, estates, • To reimburse a vendor/payee Form 587 is accepted in good faith . Retain and trusts) are subject to withholding . for expenses relating to services the completed Form 587 for your records, However, no withholding is required performed in California if the and provide a copy to the Franchise Tax if total payments of California source reimbursement is separately accounted Board (FTB) upon request . income to the vendor/payee during the for and not subject to federal calendar year are $1,500 or less . Do not use Form 587 if any of the Form 1099 reporting . Corporate following applies: If the California resident, qualified vendor/payees, for purposes of this corporation, LLC, or partnership is • Payment to a nonresident is only for exception, are treated as individual acting as an agent for the nonresident the purchase of goods . persons . vendor/payee, the payment is subject to • You sold California real estate . Use withholding if the nonresident vendor/ Form 593-C, Real Estate Withholding E Waivers payee does not meet any of the exceptions Certificate . on Form 590 . A nonresident vendor/payee may request • The vendor/payee is a resident of that withholding be waived . To apply California or is a non-grantor trust that Payments subject to withholding include for a withholding waiver, use Form 588, has at least one California resident the following: Nonresident Withholding Waiver Request . trustee . Use Form 590, Withholding • Payments for services performed in If the FTB has granted a waiver, you must Exemption Certificate . California by nonresidents . attach a copy of FTB’s determination letter • The vendor/payee is a corporation, • Payments made in connection with a to Form 587 . partnership, or limited liability California performance . company (LLC) that has a permanent • Rent paid to nonresidents if the rent is place of business in California or is F Requirement to File a paid in the course of the withholding qualified to do business in California . California Tax Return agent’s business . Use Form 590 . • Royalties paid to nonresidents for the A vendor’s/payee’s exemption • The payment is to an estate and the right to use natural resources located certification on Form 587, Form 590, decedent was a California resident . Use in California . or a determination letter from the FTB Form 590 . • Payments of prizes for contests waiving withholding does not eliminate entered in California . the requirement to file a California tax B Requirement • Distributions of California source return and pay the tax due . For return income to nonresident beneficiaries Revenue and Taxation Code (R&TC) filing requirements, see the instructions from an estate or trust . Section 18662 and the related regulations for Long or Short Form 540NR, California • Other payments of California source require withholding of income or Nonresident or Part-Year Resident Income income made to nonresidents . franchise tax on certain payments made Tax Return; Form 541, California Fiduciary Form 587 Instructions 2008 Page 1

- 3. Income Tax Return; Form 100, California In Person: Many libraries now have when part of the services are performed Corporation Franchise or Income internet access . A nominal fee may apply outside California, enter the amount paid Tax Return; or Form 100S, California to download, view, and print California for performing services within California S Corporation Franchise or Income forms and publications . Employees at in column (a) . Enter the amount paid Tax Return . libraries cannot provide tax information or for performing services while outside assistance . California in column (b) . Enter the total amount paid for services in column (c) . G Where to get Publications, Assistance for persons with disabilities If the vendor’s/payee’s trade, business, Forms, and Additional We comply with the Americans with or profession carried on in California Disabilities Act . Persons with hearing or Information is an integral part of a unitary business speech impairments call: By Internet: You can download, view, and carried on within and outside California, TTY/TDD . . . . . . . . . . . . . . 800 .822 .6268 print California tax forms and publications the amounts included on line 1 through Asistencia para personas from our website at ftb .ca .gov . line 5 should be computed by applying the discapacitadas . Nosotros estamos en vendor’s/payee’s California apportionment By Phone: To have publications or conformidad con el Acta de Americanos percentage (determined in accordance forms mailed to you, or to get additional Discapacitados . Personas con problemas with the provisions of the Uniform nonresident withholding information, auditivos pueden llamar al TTY/TDD Division of Income for Tax Purposes contact Withholding Services and 800 .822 .6268 . Act) to the payment amounts . For more Compliance at the address or automated information on apportionment, get telephone number below: Specific Instructions California Schedule R, Apportionment and WITHHOLDING SERVICES AND Allocation of Income . Part I – Withholding Agent COMPLIANCE MS F182 Withholding agent . If the amount FRANCHISE TAX BOARD The withholding agent must complete on line 6 is greater than $1,500, the PO BOX 942867 Part I before giving Form 587 to the withholding agent must withhold on all SACRAMENTO CA 94267-0651 vendor/payee . payments made to the vendor/payee until Telephone: 888 .792 .4900 Part II – Nonresident Vendor/Payee the entire amount on line 6 has been 916 .845 .4900 The vendor/payee must complete all withheld upon . If circumstances change (not toll-free) information in Part II including the FEIN, during the year (such as the total amount Fax: 916 .845 .9512 social security number, or individual of payments), which would change the taxpayer identification number, and entity amount on line 6, the vendor/payee must type . No withholding is required if the submit a new Form 587 to the withholding H To Get Publications, Forms, vendor/payee is a tax-exempt entity . Check agent reflecting those changes . The and Information Unrelated the tax-exempt box if the vendor/payee is withholding agent should evaluate the to Nonresident Withholding one of the following: need for a new Form 587 when a change in facts occurs . By Automated Phone Service: Use this • An entity that is exempt from tax under service to check the status of your refund, either California or federal law such as Part V – Certification of Vendor/Payee order California forms, obtain payment a church, pension, or profit-sharing Enter your name, title, and daytime and balance due information, and hear plan . telephone number, including area code . recorded answers to general questions . • An insurance company, IRA . Sign and date the form and return it to the This service is available 24 hours a day, • A federal, state, or local government withholding agent . 7 days a week, in English and Spanish . agency . From within the Tax-exempt vendors/payees do not need United States . . . . . . . . . . 800 .338 .0505 to complete Part III and Part IV, but must From outside the complete Part V . United States . . . . . . . . . . 916 .845 .6600 Part III – Payment Type (not toll-free) The nonresident vendor/payee must check Follow the recorded instructions . Have the box that identifies the type of payment paper and pencil handy to take notes . being received . By Internet: You can download, view, and No withholding is required when vendors/ print California tax forms and publications payees are residents or have a permanent from our website at ftb .ca .gov . place of business in California . By Mail: Allow two weeks to receive your Part IV – Income Allocation order . If you live outside of California, allow three weeks to receive your order . Use Part IV to identify payments that are Write to: subject to withholding . Only payments sourced within California are subject TAX FORMS REQUEST UNIT MS F284 to withholding . Services performed in FRANCHISE TAX BOARD California are sourced in California . In the PO BOX 307 case of payments for services performed RANCHO CORDOVA CA 95741-0307 Page 2 Form 587 Instructions 2008