Income under head salaries

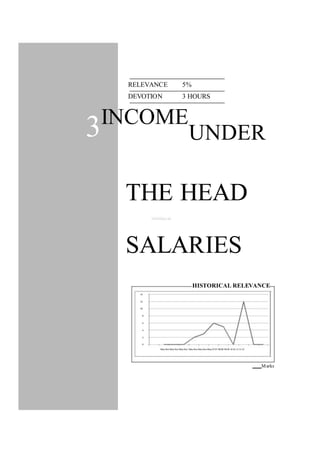

- 1. RELEVANCE 5% DEVOTION 3 HOURS 3INCOME UNDER THE HEAD SALARIES HISTORICAL RELEVANCE 14 12 10 8 6 4 2 0 May Nov May Nov May Nov May Nov May Nov May 07 07 08 08 09 09 10 10 11 11 12 Marks

- 2. Income under the Head Salaries Sectionwise Overview: Section Particulars Page No. 17(1) Definition of Salary 43 15 Charging section 43 Allowances 45 10(13A) House Rent Allowance 45 10(14) Notified/Specific Allowances 47 16(ii) Enter tainment allowance 49 10(6)/(7) Allowances exempt in the case of cer tain persons 50 Fully taxable allowances 51 Perquisites 52 17 Taxable in the hands of all employees 53 Taxable only for specific employees 53 Tax free perquisites 56 Valuation of perquisites 57 Rule 3 Accommodation provided by the employer 58 Fringe Benefits 63 Medical expenses 73 10(5) Leave Travel concession 77 Life Insurance/Deferred Annuity premium 79 Employee Stock Option Plan 79 17(3) Profits in lieu of salary 81 Retirement Benefits 82 10(10) Gratuity 82 10(10A) Pension 85 10(10AA) Leave Salary 86 10(10B) Retrenchment Compensation 89 10(10C) VRS Compensation 90 10(11) Contribution to Provident Fund 92 16 Deductions 93 89 read with Relief 95 Rule 21A(3)

- 3. INCOME from salaries is one of the simplest heads of taxation. The entire chapter is contained in Sec 15-17 together with relevant rules and exemptions. 3.1 Basics 3.1.1 Definition of the term Salary - Sec 17(1): Salary includes – • Wages • Annuity or pension • Gratuity • Any fees,commissions or perquisites • Profits in lieu of or in addition to salary • Advance salary • Encashment of unavailed leave • Interest earned in excess of 9.5% on the balance with a Recognised Provident Fund (W.r.e.f. 01.09.2010 vide Notification No.24/2011 dated 13.05.2011) • Amount transferred in excess of 12% of salary to Recognised Provident Fund • Profits in lieu of salary • Contribution by Central Government to the account of an employee towards a Pension scheme notified u/s 80CCD. 3.1.2 Charging Section- 15 The following incomes shall be charged to Income Tax under the head “Salaries” • Any salary due from an employer or a former employer in the previous year whether paid or not • Any salary paid or allowed to him in the previous year, by or on behalf of an employer or former employer, before it became due. • Any arrears of salary paid or allowed in the previous year by or on behalf of an employer or former employer, if not charged to tax in any earlier year. Inference: • Salary is charged to tax on due or receipt basis whicheveris earlier • Existence of an Employer-Employee relationship is a principal requirement for income to be considered as Salary • Where salary is received from more than one employer- salary from all employers are taxable • Salary from former, present or a prospective employer is charged to taxation. • Salary foregone shall be treated as application of income and charged to taxation on due or receipt basis whichever is earlier. • Employee‟s salary income shallinclude the value ofincome taxpaid by the employer. • Any voluntary payment made by the employer shall form par t of salary income.

- 4. • Salary and wages are not different for taxation purposes. • Advance salary is taxable on receipt while advance against salary is not salary income as it is in the nature of a loan from employer. • Tax Free Salary: Where an employer bears the tax liability of an employee, the employee has to include the taxpaid by the employer as par t of the total salary income. For example, if Mr X has negotiated a salary of Rs 60 lacs per annumnet of tax, with his employer and his employer has paid a total tax of Rs 15 lacs for and on behalf of Mr X, the total salary income of Mr X shall be Rs 75 lacs and not Rs 60 lacs. • However tax on non monetary perquisites paid by the employer is exempt u/s. 10(10CC). Tax paid by employer on salary of employee is exempt u/s 10(10CC) - DIT vs Sedco Forex International Drilling Inc [2012] 25 taxmann.com 238 (Uttarakhand) • Salary to a partner: Salary paid to a par tner of a firm is chargeable to tax u/s 28(v) i.e Profits and gains of business or profession since there is no employer – employee relationship between the firm and the par tner. • Salary taxed on due basis shall not be taxed again on receipt and vice-versa • Section 15 is not attracted in respect of remuneration received by an MLA, when provisions of section 15 are not attracted to remuneration received by him, section 17 cannot be attracted, in respect of reimbursement of medical expenses, as section 17 only extends definition of „salary‟ , by providing cer tain items mentioned therein, to be included in salary - [2008] 306 ITR 126 (RAJ.)CIT vs Shiv Charan Mathur. However in the case of Lalu Prasad vs CIT (2009) 316 ITR 186 (Patna) it was held that pay and allowances received by the Chief Minister of State or a Minister is salary. It cannot be taxed under the head income from other sources. • Surrender of Salary : Any surrender ofsalary by an employee to theCentralGovernment u/s 2of the Voluntary Surrender of Salaries (Exemption from Taxation) Act 1961 would be excluded from the total income of the employee.This benefit is available for both Government and Non Government employees. • Where the managing director is forced to refund a par t of his salary since it was in excess of the limits prescribed by the Companies Act 1956 – the same could not be held to be the assessee‟s income and therefore was not assessable to taxation – CIT vs Raghunath Murti (2009) 178 (Taxman) 144. 3.1.3 Place of Accrual- Sec 9(1) • Salary will be deemed to accrue or arise at the place where services are rendered. • If services are rendered in India but salary is received abroad, then income is deemed to accrue or arise in India. • If a person, after having served in India, settles abroad and receives pension abroad, such pension income shall be deemed to accrue or arise in India. • Leave salary paid abroad in respect of leave earned in India is deemed to accrue or arise in India. Exception: In the case of a Government employee, who is a citizen of India and renders service outside India, salary received shall be treated as income deemed to accrue or arise in India although services are rendered outside India. Example: Indian citizen working for Indian embassy at Dubai.

- 5. Study of the various provisions in computation of income under the head Salaries can be broadly classified as: - Allowances - Perquisites - Valuation of perquisites - Retirement benefits - Deductions 3.2 Allowances Allowances are monetary receipts from the employer towards meeting specific expenses- personal or official in nature. Allowances are of different types and are generally need and occupation based. Allowances are taxable components of salary income unless they are specifically provided as a deduction or exemption under the provisions of the Act. Allowances can be broadly classified as under: • House Rent Allowance: Sec 10(13A) • Notified/Specified allowances: Sec 10(14) • Entertainment allowance allowed as a deduction u/s 16(ii) • Allowances exempt in the case of certain persons • Fully taxable allowances. 3.2.1 House Rent Allowance (HRA)- Sec 10(13A) read with Rule 2A House rent allowance is provided to an employee to meet the cost of rental accommodation. Exemption under this section shall be the least of the following: • Actual HRA for the relevant period • Rent paid (-) 10% of Salary • 50% of Salary for the relevant period where accommodation is in a metro city and 40% of salary for Rest of India • Relevant period means the period during which the rented accommodation was occupied by the assessee during the previous year. Salary= Basic + Dearness Allowance (DA) forming part of salary forretirement benefits + Commission as a % of turnover • Salary is taken on due basis for the period during which the rented accommodation is occupied by the employee. • Salary of any other period is not to be included even though it may be received and taxed during the previous year. • Where the employee stays in his own accommodation or does not incur any expenditure towards accommodation, the entire HRA received shall be taxable. • Metro for this purpose shall mean Chennai, Mumbai, Kolkatta and Delhi. • Limits for HRA exemption are subject to salary, place of residence, rent and HRA received.

- 6. Where there is a change in any of these factors, HRA calculations should be broken into intervals of such change as explained below: Illustration 1 Mr Homie earns a monthly basic salary of Rs 10,000 (excl HRA) for the previous year. He also received an HRA of Rs 5000 pm. He pays a monthly rent of Rs 4000. Compute taxable HRA assuming: • He stays in Chennai • He stays in Chennai and his basic salary was Rs 5000 till July • He stays in Chennai. He stayed in his own house till July and his salary was revised from Rs 5000 to 10000 in December. You may assume that other components of salary remained constant in each of the above cases: Solution: Case 1:He stays in Chennai (Metro hence 50% of salary is taken for HRA)) Salary for HRA : 10,000*12 = 1,20,000 Actual HRA : 5,000*12 = 60,000 Rent Paid : 4,000*12 = 48,000 Exemption of HRA shall be least of the following: • Actual HRA for the relevant period : 60,000 • Rent paid (-) 10% of salary : 48,000 – 12,000= 36,000 • 50% of Salary : 60,000 Exempted HRA shall be Rs 36000 and taxable component shall be Rs 24000 (60000-36000). Case 2:Basic Salary was Rs 5000 till July Particulars Apr to July (4 months) Aug to Mar (8 months) Actual HRA 5,000*4 = 20,000 5,000*8 = 40,000 Rent paid (-) 10% salary 16,000 – 2,000 = 14,000 32,000 – 8,000 = 24,000 50% Salary (Note Below) 10,000 40,000 Exempted HRA(Least of the above) 10000 24,000 Note:Salary for relevant period 5,000*4 = 20,000 10,000*8 = 80,000 In this case HRA exemption shall be computed in two parts, since there is a change in one of the factors relevant for determining exempted HRA Actual HRA (5,000*12) = 60,000 Total HRA exempted (10,000+24,000) = 34,000 Taxable HRA = 26,000. Case 3:He stayed in his own house till July and his salary was revised from Rs 5000 to 10000 in December. In this case HRA exemption shall be computed in three parts since there are changes in two factors relevant for determining exempted HRA at different time frames:

- 7. Particulars Apr to July Aug to Nov Dec to Mar (4 months) (4 months) (4 months) Actual HRA 5,000*4 = 20,000 5,000*4 = 20,000 5,000*4 = 20,000 Rent paid (-) 10% Nil – as applicant 16,000 – 2,000 = 16,000 – 4,000 = salary stayed in his own house 14,000 12,000 50% Salary 10,000 10,000 20,000 Exempted HRA Nil 10,000 12,000 Salary for relevant 5,000*4 = 20,000 5,000*4 = 20,000 10,000*4 = 40,000 period Actual HRA : 5000*12 = 60,000 Exempted HRA : (10000+12000) = 22,000 Taxable HRA = 38,000 Note: Where an assessee stays in his residence for whole or part of the year, no exemption of HRA will be available during such period and the entire HRA is taxable. 3.2.2 Specified/Notified Allowances – Sec 10(14) read with Rule 2BB These allowances can be categorized into 2 types as under: • Those which are exempt to the extent of actual amount received or spent which ever is less • Those which are exempt to the extent of amount received or limits specified. Let‟s now look at each of these categories in detail: 3.2.2.a Allowances exempt to the extent of actual amount received or spent for the performance of duty, which ever is less Nature of Allowance Description Traveling Allowance Allowance granted to meet the cost of travel on tour or transfer of duty. Daily / Per Diem Allowance granted on tour or transfer to meet daily expenses on Allowance account of absence from normal place of duty Conveyance Allowance Allowance granted to meet the cost of conveyance for official purposes provided free conveyance is not given by the employer Helper Allowance Cost of helper engaged for official purposes Research / Academic Allowance granted for academic,research and training pursuits Allowance Uniform Allowance Expenditure incurred to meet the cost of purchase and maintenance of uniform X, an employee of a management consultancy firm was sent to UK in connection with a project of the firm‟s client for 2 months in the previous year. In addition to his salary, the firm paid per diem allowance for the period when he worked in UK to meet expenses on boarding and lodging. The employer did not deduct tax at source from such allowance. During the course of assessment of X under section 143(3), the Assessing Officer sent a notice to him asking him to explain why the per diem allowance received by him should not be charged to tax? X sought youradvice.

- 8. Solution:Per diem or Daily allowance is not taxable to the extent it is used forofficial purposes.Ifit is proved by MrXthat the amount was entirely spent forofficial purposes thesame shallnot taxable. Conversely ifthe amount spent is lowerthan the amount received,such excess shallbe regarded as taxable. The responseto the notice shallbe sent accordingly based on therelevantfacts ofthe case. 3.2.2. b Allowances exempt to the extent ofamount received or limits specified – Rule 2BB Nature of Allowance Amount Exempt: Lower ofActual amount received or limits given below Children Educational Allowance Rs 100 p.m per child upto a maximum of 2 children Hostel Expenditure Allowance Rs 300 p.m per child upto a maximum of 2 children Tribal Area /Scheduled Area /Agency Rs 200 p.m Area Transport Allowance - for commut- Rs 800 p.m for normal assessees and ing between office and residence Rs 1600 p.m for the blind and orthopaedically disabled. Counter insurgency Allowance – Rs 3900 p.m granted to the members of armed forces Underground Allowance Rs 800 p.m - Granted to an employee working in uncongenial, unnatural climate in underground mines. High altitude Allowance – granted to For altitude between 9000 ft and 15000 ft : Rs 1060 p.m employees of armed forces operating For altitude above 15000 ft : Rs 1600 p.m in high altitude Allowance to transport employees for Rs 10,000 p.m or 70% of such allowance whichever personal expenses during duty is less. Exemption is allowed provided the employee does not receive daily allowance. Island duty allowance- granted to Upto Rs 3,250 p.m employees of armed forces posted in the islands of Andaman and Nicobar and Lakshadweep group of islands Border Area Allowance to members Based on place of operation. Exemption varies from of armed forces Rs 200 p.m to Rs 1,300 p.m. Compensatory field area allowance Upto Rs 2,600 p.m in some cases. If this exemption is claimed, the same employee cannot claim any exemption in respect of border area allowance Compensatory modified field area Upto Rs 1,000 p.m in some cases. If this exemption allowance is claimed, the same employee cannot claim any exemption in respect of border area allowance Highly active field area allowance Upto Rs 4,200 p.m – granted to the members of armed forces Special Compensatory (Hill Areas) Al- Exemption varies from Rs 300 p.m to Rs 7,000 p.m lowances to members of armed forces

- 9. Actual amount spent is not relevant for the above mentioned allowances. For Example: Where an employeereceives transpor t allowance of Rs 1,000 p.mand his monthly travel expenditure for commuting between office and residence is Rs 500 still he would be eligible for an exemption of Rs 800 pm ie lower of limits specified and actual allowance. Illustration 2: Ascertain the taxability of the following allowances for Mr Kishore: • Travelling allowance of Rs 50,000, given for business travel to Mumbai- he however spent only Rs 35,000 for the purpose. • Transport allowance of Rs 1,200 p.m for commutation between residence and office. • Uniform allowance of Rs 25,000 was received however only 50% of the amount was spent for the purpose. • A fixed allowance of Rs 4,000 p.m was received towards meeting the educational and hostel expenditure of his 3 children studying in Ooty. He spends 3 times the amount received for the purpose. • During his travel to Kashmir, he received a fixed sum of Rs 500 per day for 20 days, for meeting his personal expenses. His actual expenditure was Rs 400 per day. Solution: Nature of Provision Tax implications Allowance Travelling Exempt to the extent spent Rs 15,000 (50k-35k) will be charged to Allowance or received whichever is less taxation. Transport Exempt @ Rs 800 p.m Rs 400 p.m (1,200-800) will be Allowance charged to taxation. Uniform Allowance Exempt to the extent spent Rs 12,500 (50% of 25k) will be or received whichever is less charged to taxation. Children‟s Educational Allowance Total Allowance (4,000*12) Rs 48,000 educational and exempt @ Rs 100 p.m* Less: Exemption hostel allowance Hostel Allowance exempt @ Educational Allowance Rs 2,400 Rs 300 p.m* (Rs 100p.m *2 children*12) *Subject to a maximum of 2 Hostel Allowance Rs 7,200 children (Rs 300p.m *2 children*12) Taxable Allowance Rs 38,400 Daily Allowance Exempt to the extent spent Rs 100 per day (Rs 500-400) for 20 or received whichever is less days ie Rs 2,000 will be charged to taxation. 3.2.3 Entertainment Allowance- Sec 16(ii) • This allowance is eligible for deduction u/s 16(ii). Hence the whole of the allowance received shall be added to salary and then claimed as a deduction u/s 16(ii). • Benefit of deduction is available only for Government employees.

- 10. • Actual amount spent shall not be relevant for the purpose of deduction. • Amount of deduction shall be the least of the following: ƒ Actual allowance received ƒ 20% of Basic ƒ Rs 5,000. Illustration 3: Mr Ramesh is a Government employee drawing a monthly salary as follows: - Basic: Rs 15,000 - DA Rs 7,500 - Entertainment allowance Rs 5,000 Compute his total taxable salary. Solution: Basic (15000*12) 1,80,000 DA (7500*12) 90,000 Entertainment Allowance (5,000*12) 60,000 Gross salary 3,30,000 Less Deduction u/s 16(2) WN I 5,000 Taxable Salary 3,25,000 Working note 1 Actual Entertainment Allowance 60,000 20% Basic 36,000 Specified Amount 5,000 Exempted Allowance 5,000 Note: Entertainment allowance is initially added to gross salary at full value and then allowed as a deduction u/s 16(ii). 3.2.4 Allowances which are exempt in the case of certain persons • Allowance to Government employees working abroad: Allowances to a citizen of India, being a Government employee and rendering services outside India – Sec 10(7). • Specified Allowances to High Court and Supreme Court Judges: ƒ According to Sec 22D(b) of the High Court Judges (Conditions of Service) Act, 1954, any allowance paid to a Judge of a High Court u/s 22A(2) of the said Act is not taxable. ƒ Sumptuary allowance paid to Judges of High Court and Supreme Court under the High Court Judges (Conditions of Service) Act, 1954 and Supreme Court Judges (Conditions of Service) Act,1958 respectively is not taxable. Compensatory allowance received by a Judge under Ar ticle 222(2) of the Constitution is not taxable since it is neither salary nor perquisite – Bishambar Dayal vs CIT (1976) 103 ITR 813(MP).

- 11. • Allowance to an employee of United Nations Organization (UNO) : Allowance paid by the UNO to its employees is not taxable by virtue of Sec 2 of the UN (Privileges and Immunities) Act, 1974. • Remuneration earned by foreign diplomats – Sec 10(6)(ii): Remuneration earned in their official capacity as an official or a member of staff in an embassy, high commission, legation, commission, consulate, trade representation of foreign state shall be exempt provided: ƒ Similar benefits are extended to Indian diplomats in the respective country. ƒ In the case of members of the staff, the exemption shall be available only if the following conditions are fulfilled: – They are subjects of the country represented and – They are not engaged in any business or profession or employment in India otherwise than as member of such staff. • Remuneration received from a foreign enterprise – Sec 10(6)(vi): Any remuneration received by an individual who is a foreign citizen as an employee of a foreign enterprise for services rendered by him during his stay in India shall be fully exempt provided: ƒ The foreign enterprise is not engaged in any business or trade in India ƒ His stay in India does not exceed in the aggregate a period of 90 days during the previous year ƒ Such remuneration is not liable to be deducted from the income of the employer chargeable under this Act. • Employee of a foreign ship – Sec 10(6)(viii): Any salary received by an employee of a foreign ship is fully exempt provided: ƒ The individual is a non resident foreign citizen ƒ His stay in India does not exceed 90 days • Employee of a foreign Government – Sec 10(6)(xi): Remuneration earned by an individual working with a foreign / Government shall be fully exempt provided: ƒ The remuneration is provided in connection with his training in India ƒ The training is given in an establishment or office owned by: i. The Government; or ii. Any company in which the entire paid-up share capital is held by the Central Government or State Government; or iii. Any company which is a subsidiary of a company referred to in item (ii); or iv. any corporation established by or under a Central, State or Provincial Act; or v. any registered society wholly financed by the Central Government or any State Government. 3.2.5 Allowances which are fully taxable: Any allowance not forming part of 3.2.1-3.2.4 classifications above shall be fully taxable. Few of such allowances are given below: • Dearness Allowance • City Compensatory Allowance

- 12. • Family Allowance • Fixed Medical Allowance • Bonus • Over Time Allowance • Lunch Allowance • Servant Allowance Students please note, if you come across a new allowance say special allowance or fitness allowance etc first ensure that it does not fall within the list given under 3.2.1 to 3.2.4. Once you are cer tain it is outside thefirst four categories simply consider theallowance to be fully taxable. 3.3 Perquisites Perquisites are generally non monetary benefits or facilities provided by an employer. According to Sec 17 (2), perquisite includes: Sec Perquisite 17(2)(i) Value of rent free accommodation. 17(2)(ii) Accommodation provided on concessional rent. 17(2)(iii) Value of any benefit or amenity provided to a specified employee. 17(2)(iv) Obligation of an employee met by the employer. 17(2)(v) Employers contribution to a fund other than: • Recognised Provident Fund • Approved Superannuation Fund • Deposit Linked Insurance Fund. to effect a life assurance or a contract of annuity. 17(2)(vi) ESOP/ESOS: Value of any specified security or sweat equity shares allotted or transferred, directly or indirectly, by the employer, or former employer, free of cost or at concessional rate to the assessee. 17(2)(vii) Contribution to an approved superannuation fund by the employer, to the extent it exceedsone lakh rupees. 17(2)(viii) the value of any other fringe benefit or amenity as may be prescribed. Specified Employee – Sec 17(2)(iii): An employee shallbe a Specified employee, if he falls into any ofthe following 3 categories: • Director of the company • Has Substantial Interest in the company • Income under the head Salaries, exclusive of all benefits and non monetary amenities exceeds Rs 50,000 p.a. Note: • Substantial interest u/s Sec 2(32) refers to Beneficial Ownership of not less than 20% in shares. • Carrying voting rights. • Not eligible for a fixed rate of dividend.

- 13. • Whetherhaving a right to par ticipate in profits or not. • Income under the head salaries for this purpose shall include salary received or due from one or more employers. • Such salary shall include taxable monetary payments like Basic, DA, Bonus, Commission, HRA etc but shall not include the value of any non-monetary benefits/perquisites. • Salary arrived above shall be reduced by enter tainment allowance – 16(ii) and professional tax on employment – 16(iii). • Tax paid by employer on behalf of employee is perquisite under section 17(2) and, therefore, not includible in salary under rule 3, for purpose of computing perquisite value of accommodation supplied by employer to employee – Isao Sakai vs JCIT [2011] 16 taxmann.com 332 (DELHI - ITAT). Classification ofperquisites: Incidence of taxation on perquisites varies, depending on nature of the benefit and type of employment. Perquisites can be broadly classified into: • Taxable in the hands of all employees • Taxable only for specified employees • Tax- Free perquisites. Let‟s now look into each of the above classification in detail. 3.3.1 Perquisites taxable in the case of all employees i. Rent free furnished or unfurnished accommodation ii. Accommodation provided by the employer on concessional rent iii. Obligation of the employee discharged by the employer iv. Employers contribution to a fund other than: • Recognised Provident Fund • Approved Superannuation Fund • Deposit Linked Insurance Fund To effect a life assurance or a contract of annuity. v. Value of shares or securities received free of cost or at concessional rate. vi. Value of any other benefit, amenity etc provided by the employer. vii. The amount of any contribution to an approved super annuation fund by the employer in respect of an assessee to the extent it exceeds Rs 1,00,000 3.3.2 Perquisites taxable only in the case of Specified employees These perquisites can be broadly classified as: • Employer providing gardener, sweeper,watchman etc. • Supply of gas, electricity and water for household • Free or concessional educational facility to any member of employee‟s household • U s e o f Motor Car • Personal or private journey provided free of cost or at concessional rate to an employee or a member of house hold.

- 14. Students please note in the case of perquisites mentioned above if the expenditure is incurred by the employee and reimbursed by the employer, value of such reimbursement shall be taxable in the hands of all employees whether they are specified or not. Such reimbursement is in the nature of an employee‟s obligation met by the employer. 3.3.2.a Provision by the employer of services of a gardener, watchman, sweeper or personal attendant – Rule 3(3): Actual salary paid by the employer to the sweeper, gardener etc shall be the value of taxable perquisite. Where the helpers have been employed by the employee and their salary is reimbursed by the employer, the entire reimbursement shall be taxable in the case of both specified and non specified employees- this transaction is similar to an obligation of the employee met by the employer. 3.3.2.b Supply ofgas electricity and water for household – Rule 3(4): Situation Value of perquisite Where supply is made from resources owned by the Actual manufacturing cost per unit shall employer without purchasing from outside agency be the value of taxable perquisite. In any other case Amount paid by the employer to the supplying agency. 3.3.2.c Free or concessional Educational facilities to any member ofemployee’s household Rule 3(5): Situation Value of perquisite Educational institution is owned and Cost of similar educational facility in or near locality maintained by the employer Note: In the case of education to employee’s children, value of this perquisite shall be nil,provided the cost ofWhere free education is allowed in any other institution by virtue of his being such education does not exceed Rs.1000 pm per child. in employment of that employer In any other case Amount of expenditure incurred by the employer. Member of Household shall include: • Spouse • Children and their spouses • Parents • Servants and dependants.

- 15. In the case of educational facilities provided to employee‟s children, the perquisite is exempt if the value of such facility does not exceed Rs 1000 pm per child. However if it exceeds Rs 1,000 p.m. per child, the entire amount is chargeable to tax. For example if the value of the perquisite is Rs 2,500 p.m. per child, the entire Rs 2,500 is chargeable to tax. The limit provided in this clause is not a blanket exemption however only a conditional exemption andshall not be applicable if the amount exceeds Rs 1,000 p.m. Value of any amount recovered from the employee on account of the perquisites shall be reduced from the value of taxable perquisite as given above. Where the cost of education for employee‟s child exceeds Rs 1000 per month per child the entire amount shall be considered as taxable perquisite. For the purpose of determining cost ofeducation,both direct andindirect costs shallbe taken into consideration. – CIT vs Director Delhi Public School [2011] 202 TAXMAN 318 (PUN. & HAR.) Note: The remaining perquisites namely motor car and transport benefits are discussed under valuation ofperquisites. Illustration 4 Mr Swaroop is working with X Ltd drawing a monthly basic of Rs 3,000. This apart he works part time with Y Ltd and receives a monthly remuneration of Rs 1,000. X Ltd has given him an Enfield Thunderbird Bike for the purpose of his official and personal travel. Fair market value of the bike is Rs 95,000. Swaroop received an annual bonus of Rs 2,000. Determine whether he is a specified employee or otherwise assuming: - He is not a director of X Ltd and Y Ltd - He has substantial interest in X Ltd - He is a director of Y Ltd - His annual bonus was Rs 4,000 instead of Rs 2,000. Solution: Annual monetary receipt of Mr Swaroop: Salary from X Ltd (3000*12) 36000 Salary from Y Ltd (1000*12) 12000 Annual Bonus 2000 Total Monetary Receipts 50000 Since annual monetary receipts do not exceed Rs 50,000, Mr Swaroop is not a specified employee based on income criteria. Note: Motorcycle given to employee is not a taxable perquisite. Moreover perquisites are not considered in determining whether the assessee is a specified employee or not. Situation Status in X Ltd Status in Y Ltd He is not a director of X Ltd and Y Ltd Not a specified employee Not a specified employee He has substantial interest in X Ltd specified employee Not a specified employee

- 16. He is a director of Y Ltd Not a specified employee specified employee His annual bonus was Rs 4,000 specified employee specified employee instead of Rs 2,000- His monetary receipts would now be Rs 52,000. Illustration 5 Mr Hitesh working for JP Morgan earns the following as his monthly pay: Basic : Rs 25,000 DA : Rs 15,000 Transport Allowance : Rs 1,500 Apart from the above, Hitesh is also provided with 2 housemaids for whom a monthly salary of Rs 2,000 each is paid. His entire domestic expenditure pertaining to gas and electricity was fully met by his employer. This expenditure amounted to Rs 5,000 p.m on an average. 2 of his children are given education in a school owned and maintained by his employer. Cost of similar education in the locality would cost a minimum of Rs 15,000 p.a per child. Solution: Basic (25,000*12) 3,00,000 Allowances DA (15,000*12) 1,80,000 Transport allowance (Note 1) (1,500*12) 18,000 Less Exempted allowance (800*12) 9,600 8,400 Perquisites Housemaid Note 2 (2,000*2*12) 48,000 Gas and electricity Note 2 (5,000*12) 60,000 Children's educational facility Note 2 (15,000*2) 30,000 Gross salary 6,26,400 Note: 1 Transport allowance is exempt @ Rs 800 p.m 2 Since Mr Hitesh is a specified employee (annual monetary receipts exceed Rs 50,000), benefits of housemaids, gas, electricity and educational facility are fully taxable. Value of taxable perquisite will be the cost of the facilities to the employer. 3 Assumed that Mr Hitesh was in employment for the entire previous year 3.3.3 Tax Free Perquisites – For all employees • Medical Facility or reimbursement: ƒ Discussed under taxation of medical benefits • Food and Beverages provided to an employee: ƒ Food or beverage provided in office or factory premises ƒ Provided through Non-Transferable vouchers usable only in eating joints • Recreational facilities provided to a group of employees (not restricted to a selected few)

- 17. • Loans to employees: ƒ Loan does not exceed Rs 20,000 ƒ Loan given for specified medical treatment. However no exemption is available if the loan for medical treatment has been reimbursed under any medical insurance scheme. • Perquisites provided outside India by Government to its employees, who are citizens of India, rendering services outside India – Sec 10(7) • Training expenditure on employees. • Rent free residence and conveyance facility provided to a judge of High Court or Supreme Court • Rent free furnished accommodation provided to officers of Parliament, Union Minister or Leader of Opposition. • Accommodation in a Remote area (explained under valuation of perquisites) • Educational facility for children where the facility, is owned by the employer or is provided by virtue of his employment and the value of such facility does not exceed Rs 1000 pm • Use of health clubs, sports facility etc provided by the employer if facilities are uniformly available to all employees. • Use by employee or any member of his household of laptops and computers owned or hired by the employer • Telephone expenses actually incurred. • Employers contribution to deferred annuity, pension and staff group scheme • Leave TravelConcession to the extent specified • Accident Insurance policy premium • Tax paid by the employer on the value of non monetary perquisites of the employee shall be exempt u/s 10(10CC). There shall be no tax liability on such tax paid on behalf of the employee as non monetary perquisite- RBF Rig Corpn vs ACIT – 2007 165 Taxman 101(Delhi). For example, if Mr Ram receives Rs 12 lacs as salary including non monetary benefits and his company pays a sum of Rs 50k as tax on non monetary perquisites on behalf of Mr Ram, the total taxable salary of Mr Ram shall be Rs 12 lacs only and not Rs 12.5 lacs (Rs 12 lacs plus Rs 50k). • Motor car provided to a non specified employee including the expenses incurred in this behalf on employee‟s car. • Amount given by employer to employee’schild as scholarship is exempt u/s 10(16). Notified perquisites paid both to serving Chairman and members of Union Public Service Commission 3.4 Valuation of Perquisites- Rule 3 (Notification no 94 dated 18-12-2009) Valuation is one of the most important topics of this chapter. You can expect comprehensive problems based on this topic. Perquisites, as we are aware, are non monetary benefits, however, income tax is a tax on financial rewards earned by an employee. To quantify non monetary benefits in monetary terms we have Rule 3 which provides for the rules of valuation. Following are the perquisites for which valuation norms have been specified vide Rule 3: i. Accommodation provided by the employer ii. Fringe Benefits taxable in the hands of the employee iii. Valuation of fringe benefits where the employer is not liable for fringe benefit tax iv. Medical Expenses

- 18. v. Leave TravelConcession vi. Life insurance premium/ deferred annuity etc paid by the employer vii. Employee Stock Option Plans (ESOP) Let us now look into each of the above perquisite in detail: 3.4.1 Accommodation provided by the employer- Rule 3(1) This category of perquisite can be studied as follows: A. Rent free or concessional accommodation B. Accommodation in a hotel C. Accommodation in a Site or Remote area D. Accommodation on transfer . 3.4.1.a Rent free accommodation or accommodation provided at concessional rates: • Accommodation provided to Government employees (employees of Union or State Government): Unfurnished Accommodation Furnished Accommodation License fee: License fee: Less: Rent recovered Add: 10% of the cost of assets Value of taxable perquisite Add: Actual hire charges Less: Rent recovered Value of taxable perquisite License fee shall be the value determined by the Government. Students please note, this value will be explicitly given in the question. In the case of any other employee: Type of Population of the city, as per 2001 census, where accommodation is provided Accommodation Exceeds 25 lacs Between 10 lacs and 25 lacs Upto 10 lacs Owned by employer 15% of salary 10% of salary 7.5% of salary Leased/rented by Actual lease/rent paid by the employer or 15% of salary- the employer Whichever is lower Meaning of Salary: Salary = Basic + DA taken for retirement benefits + Bonus + Commission + Fees + All Taxable Allowances + All Taxable Monetary Payments. However it excludes: • Employer‟s contribution to Provident Fund • Allowances exempt from Tax • Value of Perquisites. Note: Salary shall be computed on accrual basis for the period for which the accommodationis occupied by the employee.

- 19. - Where salary is received from more than one employer, salary from all the employers shall be taken into consideration even though the accommodation is provided by one of the employers. - Monetary payments which are in the nature of a perquisite shall not form par t of salary as all perquisites shall be excluded. - Salary formula/definition is common for all accommodation perquisites like hotel accommodation and accommodation on transfer. Where the accommodation is provided byCentralGovernment orState Government to an employee who is serving on deputation with any bodyorundertaking underthe controlofsuch Government: - The employer of such employee shall be deemed to be that body or under taking where the employee is serving on deputation,and - The value of perquisite of such an accommodation shall be computed as if such accommodation is owned by the employer. Inserted by notification no 94/2009 dated 18th December 2009. Where accommodation is provided by BSNL to Central Government employees on deputation to BSNL, which is a public sector company controlled by Central Government, it was held that for the purpose of computing perquisite value of housing accommodation, rules prescribed for employees of BSNL (non Government employees)shallhave to be considered – V.Surendranvs CBDT (2009)182 Taxman 211(Ker). Assessee's employer had incurred heavy expenses towards repairs and renovations of leased accommodation occupied by assessee. The Assessing Officer held that said expenditure was perquisite under section 17(2)(iv) since it was incurred to suit requirements of employee and it had nothing to do with performance of his duties. It was held that it is not permitted to deviate from prescribed method as stipulated in Rule 3 for computing value of rent free accommodation after renovation – Scott R. Bayman Vs CIT [2012] 24 taxmann.com 214 (Delhi) • The above value of perquisite shall be reduced by the amount of rent recovered from the employee. • Where the question is silent on whether the city has a population in excess of 10 lacs or otherwise, please make a suitable assumption and proceed with the solution. • Where furnished accommodation is provided by the employer, the following amounts shall be added to the value of perquisites computed above: • 10% of the cost of Furniture if owned by the employer • Actual hire charges if the furnishings are taken on lease by the employer. X is entitled to a salary of Rs. 25,000 per month He is given an option by his employer either to take house rent allowance (HRA) or a rent-free accommodation which is owned by the company The HRA amount payable is Rs.5.000 per month. The rent for the hired accommodation is Rs. 6,000 per month at new Delhi. Advice X whether it would be beneficial for him to avail HRA or rent free accommodation Give your advice on thebasis net take home cash benefits Solution: Computation of most favourable option for Mr X Particulars Rent free accommodation HRA Salary 3,00,000 3,00,000 Value of Taxable Perquisite (WN 1) 45,000 0 Taxable HRA (WN 2) 0 18,000 Total Taxable Salary 3,45,000 3,18,000 Tax Liability (WN 3) 17,000 14,210 Total Cash Received from the Employer

- 20. Particulars Rent Free Accommodation HRA Salary 3,00,000 3,00,000 HRA 0 60,000 Less Tax Liability 17,000 14,210 Net Take home pay 2,83,000 3,45,790 Less Rent Payable 72,000 Net Cash inflow 2,83,000 2,73,790 Based on the above computation, it is suggested that Mr X should opt for a rent free accommodation as the net cash inflow is higher in this option Working Note 1 - Value of Rent Free Accommodation Salary 3,00,000 Value of taxable perquisite @ 15% 45,000 Working Note 2: Computation of Taxable HRA Actual HRA 60,000 Rent Paid - 10% Salary 42,000 50% Salary 1,50,000 Exempted HRA (Least of the above) 42,000 Total HRA 60,000 Taxable HRA 18,000 Working Note 3: Computation of Tax Liability Tax Slab Rent Free Accommodation HRA First Rs 1,80,000 Nil Nil Balance @ 10% 16,500 13,800 Total Tax 16,500 13,800 Add Cess @ 3% 495 414 Total Tax liability (rounded off) 17,000 14,210 Illustration 6 Mr Sebin is working with Kotak Mahindra for the past 4 years. His monthly emoluments include the following: Basic : 25,000 DA (50% taken for retirement) : 10,000 Uniform Allowance : 5,000 This apart, Mr Sebin is also provided with accommodation at the company‟s own guest house at Chetpet (Chennai). The property is owned by the company and its fair rental value is Rs.60,000 p.a. The property is fully furnished with furniture costing Rs 5 lacs and with ACs taken on rent @ Rs 20,000 p.m. Entire Uniform Allowance was spent for the purpose. Compute taxable salary. Would your answer be different if the property was taken on lease by the company at the fair rental value?

- 21. Solution: Case 1: Property owned by the company Computation of Income under the head Salaries: Basic (25,000*12) 3,00,000 Allowances DA (10,000*12) 1,20,000 Uniform allowance (Note 1) Nil Perquisites Rent free furnished accommodation WN 1 3,44,000 Gross salary 7,64,000 Working Note 1 Computation ofrent free furnished accommodation Rent free un furnished accommodation (WN 1A) 54,000 Add Value of furnishings (WN 1B) 2,90,000 Value of Rent free furnished accommodation 3,44,000 Working Note 1 A Computation ofRent free un furnished accommodation Value of taxable perquisite = 15% of Salary (15% of Rs 3,60,000) = 54,000 Salary: Basic + DA (considered for retirement)+ Taxable monetary allowances and payments = 3,00,000+60,000 = 3,60,000 Working Note 1 B Computation ofvalue offurnishing Value of Furnishings : 10% of Actual cost of furniture + Actual hire charges : 10% of Rs 5 lacs + Rs 20,000*12 : 2,90,000 Note 1 Uniform allowance is exempt to the extent spent. 2 Its assumed that Chennai had a population in excess of 25 lacs as per 2001 census Case 2: Property is taken on lease by the company Working Note 2: Computation ofRent Free Furnished Accommodation Rent free unfurnished accommodation (WN 2A) 54,000 Value of furnishings (WN 1B) 2,90,000 (Same as Case 1) Value of rent free furnished accommodation 3,44,000 Working Note 2A: Computation ofRent Free Unfurnished Accommodation Value of taxable perquisite = 15% Salary or Actualrent whichever is less = Rs 54,000 or Rs 60,000 whichever is less = 54,000 Salary : Basic + DA (considered for retirement)+ Taxable monetary allowances and payments = 3,00,000+60,000 = 3,60,000 Since value of taxable perquisite is same,there would not be any change in gross salary.

- 22. 3.4.1.b Accommodation provided by the employer in a hotel (applicable for all employees): Value of perquisite shall be the least of the following: • 24% of salary paid or payable for the period during which the accommodation was provided, or • Actual hotel charges paid or payable. Exception: Hotel accommodation shall not be taxable if • Such accommodation is provided for a period not exceeding 15 days in aggregate, and • Such accommodation is provided on an employee‟s transfer from one place to another. Note 1: Where the hotelaccommodation is provided for more than 15 days, say 20 days, only the days in excess of 15 i.e. 5 days shall be charged to taxation on the above criteria. Where the hotel bill includes charges for services which are an integral par t of the accommodation, the entire value of the bill shall be considered as cost of accommodation. Howeverwhere such billalso includes separate charges forallied services like lunch, laundry etc, such expenses shall be considered separately based on valuation rules prescribed- Circular No 1/2010 dated 11-1-2010. Accommodation provided during business travelis not a taxable perquisite. Illustration 7 Mr. Nimish an employee of Citigroup has been transferred from Mumbai to Pune. Due to his transfer, Nimish was temporarily given accommodation in a hotel for a period of 20 days. He was placed in Hotel Grand Hyatt where his daily rental was Rs 10,000. Nimish was the Vice President of his company and is drawing a monthly Salary of Rs 1.50 lacs. Solution: Value of Taxable perquisite : Actual hire charges or 24% of salary (Whichever is less) in excess of 15 days for the relevant period : lower of Rs 50,000 or Rs 6,000(W.N.1) : Rs 6,000 Working note 1: Computation of salary for the relevant period Total Period of Stay 20 days Less Exempted Period 15 days Taxable period of Stay 5 days 24% Salary for the relevant period @ Rs 1.50 lacs p.m Rs 6,000 (Rs 1,50,000*5/30*24%) Actual Hire charges for 5 days @ Rs 10k per day Rs 50,000 Note: • Number of days in excess of 15 days only will be considered for valuation. • It‟s assumed that salary given is salary (as defined) for the purposes of valuation.

- 23. 3.4.1.c Accommodation provided at certain sites or in a remote area: Accommodation provided by the employer shall be tax free if such accommodation is provided to an employee working at either of the following: • Mining site • On shore oil exploration site • Project execution site • Dam site • Power generation site • Off shore site The above accommodation shall be exempt from taxation provided such accommodation is: ƒ Temporary in nature and having a plinth of not more than 800 sqft and located not less than 8 kms from local limits of any municipality or cantonment board, or ƒ Located in a remote area i.e an area located at least 40 kms away from a town having a population not exceeding 20,000. 3.4.1.d Accommodation provided at a new place of posting on transfer while retaining accommodation at the earlier place of work: • Where on transfer • An employee is provided with an accommodation at the new place of posting retaining the accommodation at his earlier place of work • For a period not exceeding 90 days • Value of taxable perquisite shall be only one such accommodation (accommodation with the lower value). • Beyond 90 days value of perquisite shall be for both such accommodations. 3.4.2 Valuation of Fringe Benefits Fringe Benefits for the purpose of valuation include: ƒ Interest free loans or concessional loans ƒ Use of movable assets ƒ Transfer of movable assets ƒ Other Fringe Benefits 3.4.2.a Interest free loans or loans at concessional interest - Rule 3(7)(i): The value of any benefit resulting from loans given to employees or any member of his household during the relevant previous year by the employer shall be a taxable perquisite. Value of taxable perquisite can be viewed under two circumstances namely: - Where there is principal repayment Sum of Maximum monthly * (Bench mark rate – Interest outstanding Value of Taxable outstanding balances recovered from employee) Perquisite ------------------------------------------------------------------------------------ 12 months

- 24. The above formula is applicable in cases where there is principal repayment of loan during the previous year. Bench mark is the rate charged by SBI on similar loans (Housing loan, car loan etc) as at the beginning of the previous year i.e on 1st of April of the relevant previous year. Any subsequent revision in rates by SBI will not have impact on tax calculations. STATE BANK OF INDIA : INTEREST RATES Interest Ratescharged by State BankofIndia as on 1st April, 2012 (applicable forAY 2013-14) on various loans in PersonalSegment advancesusedforthe purpose of computingperquisitevaluation are as under: HOME LOANS Upto Rs. 30 lakhs Above Rs.75 Rs.30 lakhs to Rs. 75 lakhs lakhs Interest rate during 1styear 10.75% 11% 10.00% EDUCATION LOANS Upto Rs. 4 Rs. 4 lakhs Above Rs 7.5 Concession for lakhs to Rs. 7.5 lakhs lakhs Girl Students SBI Student Loan 13.5% 13.25% 12% 0.50% Car Loan Two wheeler Loan Personal Loan 12% 18.25% 18.5%

- 25. - Where there is no principal repayment during the previous year: Value of taxable perquisite Loan Value * (Bench Mark rate – Interest recovered) * Number of months for which the loan was outstanding --------------------------------------------------------------------- 12 months • Member of household shall include: ƒ Spouse(s) ƒ Children and their spouses ƒ Parents ƒ Servants and dependants • Where the loan is given interest free by the employer, interest recovered will be taken as Nil for calculation and the entire Bench Mark rate will be considered for valuation of perquisites. • Value of perquisite shall not include interest on the following loans: ƒ Where the loan is given for medical treatment of specified diseases given under Rule 3A. However exemption is not applicable to so much of the loan as has been reimbursed to the employee under any medical insurance scheme ƒ Where the originalloan value does notexceed Rs 20,000 in aggregate • Where loan was granted by a bank to its employee at a rate lower than the bench mark rate of State Bank of India, such a loan would be regarded as a concessional loan and charged to taxation as a perquisite. The fact that the cost of funds for the bank was lower than the benchmark rate would be consideredforthe purpose ofperquisite valuation-All India Punjab National Bank Officer’s Association vs Chairman cum Managing Director,Punjab National Bank (2010)190 Taxman 221 (MP). Specified diseasesunder Rule 3Ashall mean: - cancer; - tuberculosis; - acquired immunity deficiency syndrome; - disease or ailment of the heart, blood, lymph glands, bone marrow, respiratory system, central nervous system, urinary system, liver, gall bladder, digestive system, endocrine glands or the skin, requiring surgical operation including ailment or disease of the organs specified, requiring medical treatment in a hospital for at least three continuous days;

- 26. - ailment or disease of the eye, ear,nose or throat, requiring surgical operation; - fracture in any part of the skeletal system or dislocation of vertebrae requiring surgical operation or orthopaedic treatment; - gynaecological or obstetric ailment or disease requiring surgical operation, caesarean operation or laperoscopic intervention; - gynaecological or obstetric ailment or disease requiring medical treatment in a hospital for at least three continuous days; - burn injuries requiring medical treatment in a hospital for at least three continuous days; - mental disorder - neurotic or psychotic - requiring medical treatment in a hospital for at least three continuous days; - drug addiction requiring medical treatment in a hospital for at least seven continuous days; - anaphylectic shocks including insulin shocks, drug reactions and other allergic manifestations requiring medical treatment in a hospital for at least three continuous days. X has taken an interest-free loan of Rs.10 lakh from his employer-company. The amount is utilized by him or purchasing a house on June 30, 2010. The house is self- occupied. As per the scheme of the company, loan would be recovered in 40 equal monthly installments recoverable immediately after the completion 18 month from the date of purchase. The SBI lending rate of similar loan on April 1, 2012 is 10.75 per cent. Calculate the perquisite value of such loan in the hands of X for the assessment year 2013-14. Is it possible to get deduction of perquisite value of interest under section 24(b)? Does it make any difference, if the house is given on rent? Solution: Last day of each month Maximum outstanding balance Rs. April 30,2011 10,00,000 May 31,2011 10,00,000 June 30,2011 10,00,000 July 31,2011 10,00,000 August 31,2011 10,00,000 September 30,2011 10,00,000 October 31,2011 10,00,000 November 30,2011 10,00,000 December 31,2011 10,00,000 January 31,2012 9,75,000 February 28,2012 9,50,000 March 31,2012 9,25,000 Sum of monthly outstanding 1,18,50,000 balances Value of perquisite = [Sum of maximum monthly outstanding balances * / 12 (benchmark rate-rate recovered)] = 11850000/12*10.75% = Rs 1,06,156.25

- 27. It is not possible to claim perquisite value of interest as deduction under section 24 since there is no interest payment being made to the employer. Also similar to sec 49(4) or 49(2AA), there is no deemed payment provision available fornotionalinterest benefit on loans which have beencharged u/s 17. If a closely held company gives a loan to an employee who holds at least 10% voting power, such loan is deemed as dividend u/s 2(22)(e) provided the conditions prescribed are fulfilled. Even in such a case,the perquisitevalue ofinterest free loan is chargeable to tax– CIT vs T.P.S.H Selva Saroja (2003) 131 Taxman 1 (Mad) Illustration 8 Mr Lokesh is working with ICICI as a Senior Sales manager drawing a monthly salary of Rs 45,000. On 1st of May, he took a housing loan from his employer for purchasing his house at a total cost of Rs 30 lacs. 50% of the cost was funded through loan @ 7% while the market rate (SBI rate) was @ 10.75%. Determine the value of taxable perquisite assuming: • There is no principal repayment • He repays a sum of Rs 15,000 at the end of every month towards principal. Solution: Case 1: No principal repayment Value of taxable perquisite Loan Value * (Bench Mark rate – Interest recovered) * Number of months for which the loan was outstanding ------------------------------------------------------------------------------------------------- 12 months : Rs 15lacs (10.75%-7%)*11months/12 months = Rs 51,563 Case 2: Monthly repayment ofRs 15,000 towards principal Sum of Maximum monthly * (Bench mark rate – Interest outstanding Value of Taxable balances recovered from employee) Perquisite -------------------------------------------------------------------------------- 12 months : Rs 15675000* (10.75%-7%)/12 months = Rs 48,984 Computation of maximum monthly outstanding balances: Month Maximum monthly outstanding balances May 15,00,000 June 14,85,000 July 14,70,000 August 14,55,000 September 14,40,000 October 14,25,000 November 14,10,000 December 13,95,000 January 13,80,000 February 13,65,000 March 13,50,000 Total 1,56,75,000

- 28. 3.4.2.b Use of movable Assets by an employee or a member of his household – Rule 3(7)(vii): Assets used Value of Taxable Perquisite Laptops and computers Nil Assets other than laptops, computers and 10% p.a of the actual cost if the asset is those specified in rules owned by the employer Or Actual rent paid or payable by the employer 1. Any amount recovered from the employee shall be reduced from the above value. 2. Motor cars shall be valued in accordance with Rule 3(2A). 3.4.2.c Transfer of any Movable Assets directly or indirectly to an employee or a member of his household – Rule 3(7)(viii): Value of Taxable Perquisite: Fair market value of asset less Amount recovered from the employees. Assets transferred Value of Taxable Perquisite Computers and Actual cost (-) 50% depreciation for each completed year of use under electronic items reducing balance method Less amount recovered from employee Motor car Actual cost (-) 20% depreciation for each completed year of use under reducing balance method Less amount recovered from employee Any other Asset Actual cost (-) 10% depreciation for each completed year of use under straight line method Less amount recovered from employee 3.4.2.d Other Fringe Benefits– Rule 3(7): Rule Benefit Situation Value of taxable perquisite Travelling, tour and Facility is maintained by the Value of similar facility 3(7(ii) accommodation expenses employer and is not uniformly offered by other of employee and his available to all employees agencies family reimbursed by Employee is on a official tour Actual expenditure employer other than leave and expenses are incurred for incurred for such travel concession specified any member of household member of household under Rule 2B accompanying him Official tour is extended to Actual cost of such vacation extended vacation In any other case Actual amount reimbursed

- 29. 3(7) Free food and non Tea and snacks provided during Nil (iii) alcoholic beverages working hours Free food and non alcoholic Nil beverages provided during working hours in: - Remote area - Off shore location Free food and non alcoholic Nil, if the value in either beverages provided during case does not exceed Rs working hours: 50 per meal - In office or business premises - Through non transferrable vouchers usable only at eating joints In any other case Actual amount incurred 3(7) Gift, voucher or token Where the aggregate value of Nil (iv) received such gifts, token or voucher is Caveat: below Rs 5000 per annum Students please note, if In any other case Actual value of such the value of gifts received gifts received in aggregate is Rs.5000 or more, the entire amount shall be considered as taxable perquisite. 3(7) Expenses on credit cards Where such expenses are wholly Nil- provided the (v) including add on cards. and exclusively for official conditions in Note Expenses for this purpose purposes below are fulfilled shall include membership In any other case Actual amount and annual fees. reimbursed/paid by the employer 3(7) Club membership and Where such expenses are wholly Nil- provided the (vi) expenses in a club and exclusively for official conditions in Note Where the employer purposes below are fulfilled has obtained corporate In any other case Actual amount membership of the club reimbursed/paid by the and the facility is enjoyed employer by the employee or any member of his household, the value of perquisite shall not include the initial fee paid for acquiring such corporate membership.

- 30. 3(6) Free or concessional journey Where employer is an Nil for employees and their airline or railways family where the employer is engaged in carriage of In any other case Value at which such facility is passengers or goods. provided to general public 3(7) Any other benefit, amenity, Arm‟s length price or fair market (ix) right, privilege or service value of such benefit or facility Note: - Conditions for claiming expenses as wholly official in nature: ƒ Complete details including the date and nature of the expenditure is maintained ƒ Employer should give a cer tificate to such effect. - Any amount recovered from employees shall be reduced from the value arrived above. - There shall be no perquisite for use of health club, spor ts and similar facilities provided uniformly to all employees. - Where the employer has obtained corporate membership in a club and the facility is enjoyed by the employee and his family, value of theinitial fee paid for membership shall not be considered as perquisite. No perquisite in case of expenses on telephone or mobile incurred for official purposes. If the company has provided money to an officer to purchase the club membership and if the subscription and the amount incurred by the officers for their personal benefit is reimbursed by the company, such amounts spent by theofficers of the company can not be considered as business promotion expenses in such event,that would fall undersection 17(2)(iv) – CIT vs Wipro Systems (2010) 325 ITR 234 (Kar). 3.4.3. Valuation of Motor Car as a Perquisite – Rule 3(2) – Taxable only for Specified Employees – As amended by notification no 94/2009 dated 18th December 2009. Car owned Maintenance Purpose of Engine capacity does Engine capacity or hired by: expenses met by the car not exceed 1.6 litres exceeds 1.6 litres Employer Official Nil – subject to relevant documents being maintained Employer Personal Actual maintenance expenses + Salary to Driver + 10% of the cost of the car Employer Partly official 1,800 p.m+ 900 p.m if 2400 p.m+ 900 p.m if Employer and partly driver is provided driver is provided 600 p.m+ 900 p.m if 900 p.m+ 900 p.m if Employee personal driver is provided driver is provided Employer Official Nil – subject to relevant documents being maintained Employee Partly official Actual expenditure Actual expenditure less Employer and partly less (1800 p.m+ (2400 p.m+ 900 p.m if 900 p.m if driver is personal driver is provided) provided)

- 31. A higher deduction in excess of Rs 1800/ 2400 can be claimed subject to maintenance of specified documents. Apart from motor car,if any other vehicle is provided by the employer, value of taxable perquisite shall be computed in the following manner Vehicle owned Maintenance Purpose of Value of taxable perquisite or hired by: expenses met by the vehicle Official Nil – subject to relevant documents being maintained Employer Employer Partly official Actual expenditure less Rs 900 p.m. A and partly higher deduction can be claimed subject personal to maintenance of relevant documents - Where more than one car is provided to an employee (otherwise than for exclusive official purposes): ƒ Consider one as being used for par tly official and par tly personal ƒ All other cars shallbe considered as ifthey are entirely used forpersonalpurposes - Specified documents to be maintained: o Employer shall maintain complete details of journey under taken for official purposes including: ƒ Date of journey ƒ Destination ƒ Mileage ƒ Expenditure incurred o Cer tificate from the employer to such effect. - The use of an official vehicle fromoffice to residence and vice versa shall not be regarded as a benefit to employees and hence exempt from taxation. - Conveyance facility providedto judges ofHigh Court and Supreme Court are exempt from taxation. Where a car is owned by the employee, maintenance is met by the employer and the car is used for personal purposes, expenses reimbursed shall be categorized as “obligation of an employee met by the employer” and shallhence be taxable forall categories ofemployees. Any amount recovered from an employee shall be reduced from the value of taxable perquisites. Illustration 9 Mr Arnab is working with Now News Channel as a Chief Editor drawing a monthly remuneration of Rs 2 lacs. Apart from salary Mr Arnab also received/used the following assets. Compute his total taxable salary income. • 2800 CC Audi A 4 car,worth Rs 65 lacs. • Sony VAIO laptop worth Rs 2 lacs. This lap top was used by him till 1st June after which it was sold to him for Rs 50,000. The laptop was purchased on 30th May last year.

- 32. • Teakwood sofa used at his own residence: worth Rs 1 lac. He also received a Bose Music System worth Rs 2 lacs for usage at his residence. • 2 Daikin Air conditioners taken on a consolidated monthly rent of Rs 15,000. • His kitchen was furnished with Modular cabinet fittings at an overall outlay of Rs 5 lacs. The entire expenditure was borne by the company and the asset is recorded in its books as part of fixed assets. • He acquired a Mercedes SLK for Rs 5 lacs. The car was used by the company for 2 years and was purchased for Rs 50 lacs. • His son was given an HP personal computer worth Rs 50,000 for personal use. • 2 watchmen on a monthly salary of Rs 5,000 each. Solution: Computation of Income under the head Salaries ofMr Arnab Base Salary (Rs 2 lacs*12) 24,00,000 Perquisites Motor Car WN 1 28,800 Use of Movable Assets WN 2 2,60,000 Transfer of Movable assets WN 3 27,50,000 Watchmen WN 4 1,20,000 Gross Salary 55,58,800 Note 1: Motor car & Watchman are taxable perquisites in the hands of specified employee. Working note 1 - Computation ofvalue oftaxable perquisite - Motor car Engine capacity of the car 2,800 cc Monthly value of taxable perquisite 2,400 Annual value of taxable perquisite 28,800 Note: It is assumed that the car is used for both official and personal purposes. Working Note 2- Use ofMovable Assets A Sony Laptop and HP computer used are not a taxable perquisites B Particulars Value of Asset Perquisite @ 10% on cost Teak Wood Sofa 1,00,000 10,000 Music System 2,00,000 20,000 Modular Kitchen Cabinet 5,00,000 50,000 Add Hire Charges for Air conditioners @ Rs 15,000 p.m 1,80,000 Value of taxable perquisite 2,60,000 Working Note 3- Transfer ofMovable Assets Asset Value of Perquisite Laptop (WN 3A) 50,000 Mercedes SLK (WN 3B) 27,00,000 Total value oftaxable perquisite 27,50,000

- 33. Working Note 3A - Transfer ofLaptop Purchase Price 2,00,000 Number of completed years of use 1 year Rate of Depreciation 50% written down value Total Depreciation 1,00,000 Written down Value 1,00,000 Less Amount Recovered from the employee 50,000 Value of Taxable perquisite 50,000 Working Note 3B - Transfer ofMercedes SLK Purchase Price 50,00,,000 Number of completed years of use 2 year Rate of Depreciation 20% written down value Depreciation 1st year (20% of 50,00,000) 10,00,000 2nd year Depreciation 8,00,000 (Rs 50 lacs - 1st year depreciation)*20% Total Depreciation 18,00,000 Written down Value 32,00,000 Less Amount Recovered from the employee 5,00,000 Value of Taxable perquisite 27,00,000 Working Note 4 - Provision ofWatchmen Total number of watchmen 2 Monthly salary paid for each 5,000 Total value of taxable perquisite 1,20,000 3.4.4 Medical Expenses- Proviso to Sec 17(2) Incidence of taxation on medical expenses incurred by the employer can be classified in to two categories as follows: • Medical treatment in India • Medical treatment outside India. Let‟s now look into these classifications in some detail: 3.4.4.a Medical Treatment in India: In the case of medical treatment expenses within India, the following expenses shall be treated as tax free perquisites: • Value of any medical treatment provided to an employee or a member of his family in any hospital maintained by the employer.

- 34. • Any sum incurred by the employee towards his medical treatment or that of any of his family members in any hospital, clinic or otherwise up to Rs 15,000 per annum. In other words, reimbursement of medical expenditure up to Rs 15,000 per annum is tax free. • In the following cases expenses incurred by the employer on the medical treatment of his employee and his family members shall be fully tax free: ƒ Actual expenditure incurred in any hospital maintained or approved by the Government or any local authority ƒ Expenditure incurred towards treatment of diseases prescribed under Rule 3A like cancer,AIDS,tuberculosis, treatment for drug addiction etc. • Health insurance premium paid by the employer under an approved health insurance scheme. • Reimbursement of health insurance premium paid under an approved insurance scheme for the benefit of employee and his family. 3.4.4.b Medical Treatment outside India: In the case of medical treatment expenses outside India, the following expenses shall be treated as tax free perquisites subject to the conditions prescribed: Expenditure Description /Situation Taxability Treatment Expenses on medical treatment provided to an Exempt to the extent Expenses employee or a member of his family outside permitted by Reserve India Bank of India (RBI) Accommodation Expenses on stay abroad of the employee or Exempt to the extent Expenses any member of his family together with one permitted by Reserve attendant in connection with such treatment Bank of India (RBI) Travel expenses of Where gross total income of the employee, Fully exempt the patient together before the inclusion such travel expenditure with an attendant as perquisite does not exceed Rs 2,00,000 In any other case Fully taxable • Family for the purposes ofmedical treatment shall mean: • Spouse • Children – may be dependant or independent/ married or unmarried • Parents, brothers and sisters who are wholly or mainly dependant on such employee • Any medical allowance shall be fully taxable. • Expenditure on medical treatment by the employer may be by way of payment or reimbursement – Circular No 603 dated 06-06-1991. From the following data, you are required to calculate the perquisite value of the expenditure on medical treatment, which is assessable in the hands of the employee of a company, inclusive of the conditions to be satisfied:

- 35. Rs. Gross total income Inclusive of salary 2,00,000 (1)Amount spent on treatment of the employee‟s wife in a hospital maintained by the employer 10,000 (2)Amount paid by the employer on treatment of the employee ‟s child in a hospital 5,000 (3)Medical insurance premium reimbursed by the employer on a policy Covering the employee, his wife and dependant parents. 8,000 (4)(a) Amount spent on medical treatment of the employee outside India 1,50,000 (b) Amount spent on travel and stay abroad 1,00,000 (5)Amount spent on travel and stay abroad of attendant 50,000 Solution: Situation (1) Amount spent on treatment of the employee‟s wife in a hospital maintained by the employer (2) Amount paid by the employer on treatment of the employee‟s child in a hospital (3) Medical insurance premium reimbursed by the employer on a policy covering the employee, his wife and dependant parents. (4 Amount spent onmedicaltreatment ofthe employee outside India (5) Amount spent on travel and stay abroad (6) Amount spent on travel and stay abroad of attendant Tax implication Not taxable Not taxable as it does not exceed Rs.15,000 Not taxable Not taxable (note) Not taxable (note) Not taxable (note) Note: It is assumed that the expenditure outside India is permitted by the Reserve Bank of India. Also applicants gross totalincome does not exceed Rs 2 lacs. Illustration 10 Mr Shenoy working for SDTV has a family which is, unfortunately, full of sick people. During the year he received the following medical benefits from his employer: • Reimbursement of medical expenses for treatment of his spouse: Rs 45,000. His spouse suffered from chronic tuberculosis. • His uncle (father‟s brother) was treated for renal failure at Apollo Hospital at a total outlay of Rs 25,000. The entire sum was reimbursed by the employer . • His father is an insulin dependant diabetic for whom a monthly sum of Rs 5,000 was incurred for treatment. This sum was also reimbursed by the company. His father is a retired service man drawing a monthly pension of Rs 1,500. • His second son suffered from brain tumor for which treatment was available only at the US. His son and his mother flew down to the US for the treatment and the total expenditure incurred is as follows: - Travel Rs 2 lacs - Treatment Rs 4 lacs (RBI limit Rs 5 lacs) - Stay Rs 2.55 lacs (RBI limit Rs 2.50 lacs)

- 36. • His sister who is unemployed – is suffering from Cancer. She was given treatment in a hospital owned by SDTV. Cost of similar treatment elsewhere is Rs 4 lacs. • His mother was treated in a Government hospital for arthritis and the entire cost of Rs 30,000 was borne by the employer. His mother is an IAS officer drawing 2 times his monthly salary. Discuss the taxability of the above perquisites assuming his salary income is: - Rs 1,00,000 - Rs 50,000 - Rs 95,000 Solution: Medical Benefit Tax Incidence Value of Taxable Perquisite Reimbursement of Fully exempt: Treatment for a specified disease Nil treatment expenses of spouse for Tuberculosis Reimbursement of Amount reimbursed will be fully taxable: Uncle Rs 25,000 expenditure incurred for is not a member of house hold for tax purposes his uncle Reimbursement of Exempt upto Rs 15,000 p.a while the balance is Rs 45,000 medical expenditure of fully taxable as a perquisite. (Rs 5,000*12 – father Note: It is assumed that his father is fully Rs15,000) dependant on Mr Shenoy. His pension is considered as insufficient for his survival. Treatment to Treatment for specified diseases to any member Nil unemployed sister of household is fully exempt. Note: Assumed that sister is fully dependant on Shenoy Treatment to mother Entire expenditure of Rs 30,000 is fully taxable Rs 30,000 as she is not dependant on the assessee. Treatment for son Foreign treatment and stay expenses are exempt Rs 5,000 abroad to the extent permitted by RBI. Treatment expenditure: Fully exempt Stay Expenses : Rs 5,000 (2.55 lacs -2.5 lacs) Value of Taxable perquisite excluding Foreign Travel Rs 1,05,000 Particulars Case 1 Case 2 Case 3 Salary Income apart from perquisites 1,00,000 50,000 95,000 Add Value of perquisite excluding foreign travel 1,05,000 1,05,000 1,05,000 Total 2,05,000 1,55,000 2,00,000 Add Foreign Travel Expenditure (Note) 2,00,000 Gross Salary 4,05,000 1,55,000 2,00,000 Taxability of Foreign Travel Expenditure for Medical Treatment

- 37. Note: Travel expenses of the patient together with one attendant are exempt provided gross total income of the employee, before the inclusion of such travel expenditure as perquisite, does not exceed Rs 2 lacs. Where gross totalincome exceeds Rs 2 lacs, the entire travel expenditure is fully taxable. X Ltd., manufacturer of drugs and pharma products provides the following information relating to payments made to its marketing manager during the previous year. • Salary @ Rs. 20,000 per month. • Motor-cycle purchased for Rs. 45,000 was given free of cost. The vehicle was used for 2 years by the company. • Conveyance allowance of Rs. 5,000 per month which was allowed to him. It is informed that the entire sum is towards office reimbursements which are eligible for full exemption u/s 10(14). as exempt under section 10(14). • Tickets wor th Rs. 4000 for a cricket match between India and England. • Reimbursement of medical expenses, incurred actually by him, of Rs. 17500. The company asks you to compute the amount of income chargeable to tax in the hands of marketing manager. Solution Computation of Taxable Salary Salary @ Rs 20,000 pm 2,40,000 Add MotorCycle given free ofcost Note 1 36000 Conveyance Allowance Note 2 NIL Tickets given free of cost Note 3 4,000 Reimbursement of Medical Expenses Note 4 2,500 Total Taxable Salary 2,82,500 Note 1 Since the motor cycle was given free of cost, the entire written down value i.e. Rs 45,000 less depreciation @ 10% per annum on straight line method being Rs 36,000, shall be regarded as value of taxable perquisite. 2 Conveyance allowance is exempt to the extent spent. It is assumed that the entire amount of Rs 5000 pm is spent by the employee. 3 Tickets given free of cost is regarded as an obligation of employee met by the employer. Hence fully taxable. Conversely if the same had been given as a gift- it would have been fully exempt since gifts upto Rs 5000 pa are not taxable. 4 Reimbursement of medical expenses is exempt upto Rs 15000 p.a. Hence the excess of Rs 2500 is chargeable to tax. 3.4.5. Leave Travel Concession- Sec 10(5) read with Rule 2B An employee is entitled to exemption under this section in respect of the value of travel concession or assistance received or due to him from his present/former employer, for himself and his family in connection with: • Travel to any place in India while on service • Travel to any place in India after retirement or termination of service.

- 38. The above exemption shall be subject to the following limits: Mode ofJourney Maximum Amount Exempt Air Economy air fare of the National Carrier of the shortest route to the destination Rail First class AC rail fare of the shortest route to the destination Where the places Where a recognised public Where no recognised public transport are not connected transport system exists: system exists: by rail 1st class or deluxe class fare on 1st class AC rail fare for the distance of such transport by the shortest journey by the shortest route as if the route journey had been performed by rail Frequency of claiming exemption: • Twice in a block of 4 years:Assessee can claim the benefit of exemption in respect of any 2 journeys in a block of 4 calendaryears. The4 calendar year blocks are given as follows: ƒ 1990-93 ƒ 1994-97 ƒ 1998-01 ƒ 2002-05 ƒ 2006-09 ƒ 2010-2013 • If the assessee has not availed the exemption of LTC in a par ticular block whether both or one of the journeys, he can claim the exemption in the1st journey in the calendar year immediately succeeding the end ofthe block.Assessee shallbe allowed exemption on two additionaljourneys in the block. • An employer is under no statutory obligation to collect evidence to show that its employees have actually utilized the amount paid towards leave travel concession or conveyance allowance. It is adequate compliance if the employer has received a declaration from the employee – CIT vs Larsen and Toubro Ltd (2009) 181 Taxman 71 (Supreme Court). • Family for this purpose includes: 1. Spouse 2. Children subject to a maximum of two children 3. Parents, brothers and sisters who are wholly or mainly dependant on the assessee • Where LTC is encashed without performing journey the entire amount received shall be taxable. • It is not necessary that family members should under take the journey along with the employee. • Exemption is available only in respect of Air/Rail/Road fare. Any boarding and lodging expenses shall not qualify for exemption. • Where a circular journey say Chennai – Hyderabad – Mumbai – Chennai is performed, the maximum exemption shall be for the shor test route between the place of origin (Chennai) and the far thest point reached (Mumbai). The restriction of two children shall not apply in the following circumstances: • Where the children were born prior to 1st of October 1998, or • In case of multiple bir ths after the first child i.e say twins after the 1st child in which case all the three children will be eligible for exemption u/s 10(5).