Calm in Emerging Markets but Underlying Vulnerabilities Remain

•

1 j'aime•805 vues

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

The presentation was delivered during a seminar co-organized on September 29th, 2014 by CASE and IMF by dr. Emil Stavrev, a Deputy Division Chief at the Multilateral Surveillance Division of the IMF Research Department, which led the work on the 2014 Spillover Report.

See more on our webiste: http://www.case-research.eu/en/node/586892014 IMF Spillover Report, Emil Stavrev, IMF Research Department

2014 IMF Spillover Report, Emil Stavrev, IMF Research DepartmentCASE Center for Social and Economic Research

Contenu connexe

Tendances

The presentation was delivered during a seminar co-organized on September 29th, 2014 by CASE and IMF by dr. Emil Stavrev, a Deputy Division Chief at the Multilateral Surveillance Division of the IMF Research Department, which led the work on the 2014 Spillover Report.

See more on our webiste: http://www.case-research.eu/en/node/586892014 IMF Spillover Report, Emil Stavrev, IMF Research Department

2014 IMF Spillover Report, Emil Stavrev, IMF Research DepartmentCASE Center for Social and Economic Research

Tendances (20)

Policy Research Working Paper - The Experience with Macro-Prudential Policies...

Policy Research Working Paper - The Experience with Macro-Prudential Policies...

Causes and Consequences of the Asian Financial Crisis

Causes and Consequences of the Asian Financial Crisis

Recent macro developments in Rwanda and the world including europe

Recent macro developments in Rwanda and the world including europe

A Case Study Analysis on the Asian Financial Crisis of 1997 and Zapa Chemicals

A Case Study Analysis on the Asian Financial Crisis of 1997 and Zapa Chemicals

2014 IMF Spillover Report, Emil Stavrev, IMF Research Department

2014 IMF Spillover Report, Emil Stavrev, IMF Research Department

The-IMF-and-Pakistan-A-Road-to-Nowhere-Meekal-Aziz-Ahmed.pdf

The-IMF-and-Pakistan-A-Road-to-Nowhere-Meekal-Aziz-Ahmed.pdf

Causes of the 1997 South East Asian Financial Crises & its Impact on the Fina...

Causes of the 1997 South East Asian Financial Crises & its Impact on the Fina...

The Low Interest Rate Dilemma for Corporate Investors Presentation 5-12 CCA V...

The Low Interest Rate Dilemma for Corporate Investors Presentation 5-12 CCA V...

Similaire à Calm in Emerging Markets but Underlying Vulnerabilities Remain

This monthly briefing highlights that emerging economies face renewed financial turbulence, that US economy registered robust GDP growth in the fourth quarter of 2013 and that the last quarter of 2013 revealed a heterogeneous economic performance in the developing world.

For more information:

http://www.un.org/en/development/desa/policy/wesp/wesp_mb.shtml Monthly Briefing on the World Economic Situation and Prospects (WESP), No. 63

Monthly Briefing on the World Economic Situation and Prospects (WESP), No. 63Department of Economic and Social Affairs (UN DESA)

This monthly briefing highlights that financing conditions improve in euro area peripheral countries and in emerging economies, that the US economy bounces back after a difficult first quarter and that China’s first-quarter GDP growth is the slowest in two years.

For more information:

http://www.un.org/en/development/desa/policy/wesp/wesp_mb.shtml

Monthly Briefing on the World Economic Situation and Prospects (WESP), No. 66

Monthly Briefing on the World Economic Situation and Prospects (WESP), No. 66Department of Economic and Social Affairs (UN DESA)

Similaire à Calm in Emerging Markets but Underlying Vulnerabilities Remain (20)

Could the Emerging Market Slowdown Jeopardize the Global Recovery?

Could the Emerging Market Slowdown Jeopardize the Global Recovery?

Capital Flows into Emerging Markets to Remain Volatile in 2015

Capital Flows into Emerging Markets to Remain Volatile in 2015

Monthly Briefing on the World Economic Situation and Prospects (WESP), No. 63

Monthly Briefing on the World Economic Situation and Prospects (WESP), No. 63

Monthly Briefing on the World Economic Situation and Prospects (WESP), No. 66

Monthly Briefing on the World Economic Situation and Prospects (WESP), No. 66

A Requiem for Quantitative Easing in the United States

A Requiem for Quantitative Easing in the United States

Vunerabilidad de los mercados emergentes Octubre 2014

Vunerabilidad de los mercados emergentes Octubre 2014

Regional Economic Outlook: Middle East and Central Asia

Regional Economic Outlook: Middle East and Central Asia

Ukrainian banking sector in turmoil finald report aug 14

Ukrainian banking sector in turmoil finald report aug 14

Affect of us & european downturn on indian stock market

Affect of us & european downturn on indian stock market

To focus on the study of examine “U.S. financial crisis and its impact on Ind...

To focus on the study of examine “U.S. financial crisis and its impact on Ind...

Recent trends in the global ecenomy and the near term outlook

Recent trends in the global ecenomy and the near term outlook

Plus de QNB Group

Plus de QNB Group (20)

QNBFS Daily Technical Trader Qatar - November 14, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 14, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 06, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 06, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - October 25, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 25, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 11, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 11, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 04, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 04, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - September 28, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 28, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 24, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 24, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 19, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 19, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 07, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 07, 2023 التحليل الفني اليومي ...

Dernier

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S030524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Se...

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Se...Call Girls in Nagpur High Profile

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALLVIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...Call Girls in Nagpur High Profile

Low Rate Call Girls Pune Vedika Call Now: 8250077686 Pune Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...Call Girls in Nagpur High Profile

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Girls Waiting For You To Fuck

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...Call Girls in Nagpur High Profile

VIP Call Girl in Thane 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9VIP Call Girl in Thane 💧 9920725232 ( Call Me ) Get A New Crush Everyday With...

VIP Call Girl in Thane 💧 9920725232 ( Call Me ) Get A New Crush Everyday With...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...Call Girls in Nagpur High Profile

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-992072523VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex S...

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex S...Call Girls in Nagpur High Profile

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call Girls All India Service 🔥

Looking for Enjoy all Day(Akanksha) : ☎️ +91-7737669865

Today call girl service available 24X7*▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 CALL 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓 SERVICE ✅

⭐➡️HOT & SEXY MODELS // COLLEGE GIRLS

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

★ SAFE AND SECURE HIGH CLASS SERVICE AFFORDABLE RATE

★ 100% SATISFACTION,UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL 24x7 :: 3 * 5 *7 *Star Hotel Service .In Call & Out call SeRvIcEs :

★ A-Level (5 star escort) S040524N

★ Strip-tease

★ BBBJ (Bareback Blowjob)Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

100% SAFE AND SECURE 24 HOURS SERVICE AVAILABLE HOME AND HOTEL SERVICES

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-7737669865 👈

Our Best Areas:-

( Rohtak, Korba, Berhampur, Muzaffarpur, Mathura, Kollam, Avadi, Kadapa, Kamarhati, Sambalpur, Bilaspur, Shahjahanpur, Bijapur, Rampur, Shivamogga, Thrissur, Bardhaman, Kulti, Nizamabad, Tumkur, Khammam, Ozhukarai, Bihar Sharif, Panipat, Darbhanga, Bally, Karnal, Kirari Suleman Nagar, Barasat, Purnia, Satna, Mau, Sonipat, Farrukhabad, Sagar, Durg, Ratlam, Hapur, Arrah, Etawah, North Dumdum, Begusarai, Gandhidham, Baranagar, Tiruvottiyur, Puducherry, Thoothukudi, Rewa, Mirzapur, Raichur, Ramagundam, Katihar, Thanjavur, Bulandshahr, Uluberia, Murwara, Sambhal, Singrauli, Nadiad, Secunderabad, Naihati, Yamunanagar, Bidhan Nagar, Pallavaram, Munger, Panchkula, Burhanpur, Kharagpur, Dindigul, Hospet, Malda, Ongole, Deoghar, Chhapra, Haldia, Nandyal, Morena, Amroha, Madhyamgram, Bhiwani, Baharampur, Ambala, Morvi, Fatehpur, kutch, machilipatnam, mahisagar, malwa, manali, mansa, margao, mehsana, mizoram, modasa, moga, mohali, morbi, Mount Abu, muktsar, nainital, narmada, narsinghpur, Navsari, nawanshahr, neemuch, ooty, palanpur, panna, patan, pathankot, porbandar, prakasam, pushkar, raisen, rajpura, rishikesh, roorkee, sabarkantha, sangrur, sehore, seoni, shahdol, shajapur, sheopur, shivpuri, surendranagar, valsad, vapi, veraval, vidisha, Edappally, Ernakulam, Kottayam, Alappuzha, Chalakudy, Changanassery, Cherthala, Chittur Thathamangalam, Guruvayoor, Kanhangad, Kannur, Kasaragod, Kodungallur, Koyilandy, Malappuram, Nedumangad, Neyyattinkara, Palakkad, Paravur, Pathanamthitta, Peringathur, Perumbavoor, Taliparamba, Thiruvalla, Vaikom, Varkala, Chengannur, Munnar, Guruvayur, Kovalam, Thalassery, Ponnani, Punalur, Angamaly, Shornur, Ottapalam, Kalpetta, Kumarakom, Irinjalakuda, Muvattupuzha, Thekkady, Wayanad, Erattupetta, Kottakkal, Mananthavady, Ma( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...dipikadinghjn ( Why You Choose Us? ) Escorts

Dernier (20)

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Se...

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Se...

Diva-Thane European Call Girls Number-9833754194-Diva Busty Professional Call...

Diva-Thane European Call Girls Number-9833754194-Diva Busty Professional Call...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Pashan ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

VIP Call Girl in Thane 💧 9920725232 ( Call Me ) Get A New Crush Everyday With...

VIP Call Girl in Thane 💧 9920725232 ( Call Me ) Get A New Crush Everyday With...

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

Call Girls in New Friends Colony Delhi 💯 Call Us 🔝9205541914 🔝( Delhi) Escort...

Call Girls in New Friends Colony Delhi 💯 Call Us 🔝9205541914 🔝( Delhi) Escort...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex S...

Top Rated Pune Call Girls Shikrapur ⟟ 6297143586 ⟟ Call Me For Genuine Sex S...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

Calm in Emerging Markets but Underlying Vulnerabilities Remain

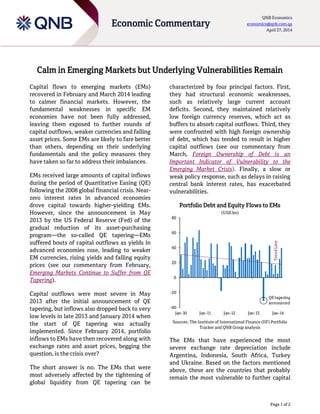

- 1. Page 1 of 2 Economic Commentary QNB Economics economics@qnb.com.qa April 27, 2014 Calm in Emerging Markets but Underlying Vulnerabilities Remain Capital flows to emerging markets (EMs) recovered in February and March 2014 leading to calmer financial markets. However, the fundamental weaknesses in specific EM economies have not been fully addressed, leaving them exposed to further rounds of capital outflows, weaker currencies and falling asset prices. Some EMs are likely to fare better than others, depending on their underlying fundamentals and the policy measures they have taken so far to address their imbalances. EMs received large amounts of capital inflows during the period of Quantitative Easing (QE) following the 2008 global financial crisis. Near- zero interest rates in advanced economies drove capital towards higher-yielding EMs. However, since the announcement in May 2013 by the US Federal Reserve (Fed) of the gradual reduction of its asset-purchasing program—the so-called QE tapering—EMs suffered bouts of capital outflows as yields in advanced economies rose, leading to weaker EM currencies, rising yields and falling equity prices (see our commentary from February, Emerging Markets Continue to Suffer from QE Tapering). Capital outflows were most severe in May 2013 after the initial announcement of QE tapering, but inflows also dropped back to very low levels in late 2013 and January 2014 when the start of QE tapering was actually implemented. Since February 2014, portfolio inflows to EMs have then recovered along with exchange rates and asset prices, begging the question, is the crisis over? The short answer is no. The EMs that were most adversely affected by the tightening of global liquidity from QE tapering can be characterized by four principal factors. First, they had structural economic weaknesses, such as relatively large current account deficits. Second, they maintained relatively low foreign currency reserves, which act as buffers to absorb capital outflows. Third, they were confronted with high foreign ownership of debt, which has tended to result in higher capital outflows (see our commentary from March, Foreign Ownership of Debt is an Important Indicator of Vulnerability to the Emerging Market Crisis). Finally, a slow or weak policy response, such as delays in raising central bank interest rates, has exacerbated vulnerabilities. Portfolio Debt and Equity Flows to EMs (USD bn) Sources: The Institute of International Finance (IIF) Portfolio Tracker and QNB Group analysis The EMs that have experienced the most severe exchange rate depreciation include Argentina, Indonesia, South Africa, Turkey and Ukraine. Based on the factors mentioned above, these are the countries that probably remain the most vulnerable to further capital -40 -20 0 20 40 60 80 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 TrendLine QEtapering announced

- 2. Page 2 of 2 Economic Commentary QNB Economics economics@qnb.com.qa April 27, 2014 flight. Each had a high current account deficit in 2013 (3.3% of GDP in Indonesia, 5.8% in South Africa, 7.9% in Turkey and 9.2% in Ukraine), with the exception of Argentina where foreign exchange restrictions kept the current account deficit near balance. They also had relatively low foreign exchange reserves at end-2013 (all below 14% of GDP compared to an average of 21% in the 16 vulnerable EMs we analyzed), limiting their capacity to defend their exchange rates against capital outflows. Furthermore, foreign ownership of debt is high (30.0% of total sovereign debt in Argentina, 55.5% in Indonesia, 35.8% in South Africa, 42.7% in Turkey and 46.4% in Ukraine). Central banks in Argentina, Indonesia, Turkey and Ukraine have responded. The Argentinian central bank was forced to raise interest rates dramatically (up 17 percentage points since May 2013) as FX reserves evaporated, forcing a devaluation of the Argentinian Peso in January 2014. In Indonesia, the policy rate has been increased by 150 basis points and Turkey’s repo rate has been increased by 450 basis points. The central bank in South Africa is pursuing an inflation-targeting mandate and the official interest rate has only been increased by 50 basis points so far. Ukraine’s central bank increased its policy rate by 300 basis points on April 15 to support the currency, which has weakened by over 30% since the end of February as its political crisis intensified. On the other hand, some EMs have avoided the worst of the crisis. Brazil has hiked rates 3.5% since May 2013, helping to support the currency despite a large current account deficit (3.6% of GDP) and moderate FX reserves (17.1% of GDP) at end-2013. In India, skillful central bank policies helped limit the weakness of the Indian Rupee through policies to curb imports and encourage exports. Low levels of foreign ownership of debt (only 6.3% of sovereign debt is foreign-owned at end- 2013) also helped insulate the Indian Rupee. Poland’s exchange rate has been surprisingly resilient to the crisis, partly due to a relatively small current account deficit (1.8% of GDP), moderate international reserves (18.9% of GDP) and a high share of debt held by foreigners (49.5% of sovereign debt). In summary, the fundamental vulnerabilities amongst selected EMs remain. QE tapering is expected to continue until late 2014 and is likely to put further pressure on capital flows to vulnerable EMs. Additional exchange rate weakness, higher interest rates, weak growth and financial market instability can therefore be expected. Based on the metrics that we have analyzed, the most vulnerable EMs appear to be Argentina, Indonesia, South Africa, Turkey and Ukraine. However, there is a second tier of EMs that have so far avoided the worst of the crisis but remain exposed, including Brazil, India and Poland. Further EM instability is likely in the months ahead. Contacts Joannes Mongardini Head of Economics Tel. (+974) 4453-4412 Rory Fyfe Senior Economist Tel. (+974) 4453-4643 Ehsan Khoman Economist Tel. (+974) 4453-4423 Hamda Al-Thani Economist Tel. (+974) 4453-4646 Ziad Daoud Economist Tel. (+974) 4453-4642 Disclaimer and Copyright Notice: QNB Group accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Where an opinion is expressed, unless otherwise provided, it is that of the analyst or author only. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. The report is distributed on a complimentary basis. It may not be reproduced in whole or in part without permission from QNB Group.