Contenu connexe

Similaire à PwC CECL Overview Placemat_Final

Similaire à PwC CECL Overview Placemat_Final (20)

PwC CECL Overview Placemat_Final

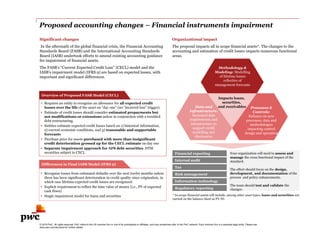

- 1. Proposed accounting changes – Financial instruments impairment

Significant changes

In the aftermath of the global financial crisis, the Financial Accounting

Standards Board (FASB) and the International Accounting Standards

Board (IASB) undertook efforts to amend existing accounting guidance

for impairment of financial assets.

The FASB’s “Current Expected Credit Loss” (CECL) model and the

IASB’s impairment model (IFRS 9) are based on expected losses, with

important and significant differences.

Organizational impact

The proposal impacts all in scope financial assets*. The changes to the

accounting and estimation of credit losses impacts numerous functional

areas.

• Requires an entity to recognize an allowance for all expected credit

losses over the life of the asset on “day one” (no “incurred loss” trigger).

• Estimate of credit losses should consider estimated prepayments but

not modifications or extensions unless in conjunction with a troubled

debt restructuring.

• Entities estimate expected credit losses based on 1) historical information,

2) current economic conditions, and 3) reasonable and supportable

forecasts

• Purchase price for assets purchased with more than insignificant

credit deterioration grossed up for the CECL estimate on day one

• Separate impairment approach for AFS debt securities. HTM

securities subject to CECL

Overview of Proposed FASB Model (CECL)

• Recognize losses from estimated defaults over the next twelve months unless

there has been significant deterioration in credit quality since origination, in

which case lifetime expected credit losses are recognized.

• Explicit requirement to reflect the time value of money (i.e., PV of expected

cash flows)

• Single impairment model for loans and securities

Differences in Final IASB Model (IFRS 9)

Your organization will need to assess and

manage the cross functional impact of the

standard.

The effort should focus on the design,

development, and documentation of the

process and policy enhancements.

The team should test and validate the

changes.Regulatory reporting

Tax

Information technology

Risk management

Financial reporting

Internal audit

* In-scope financial assets will include, among other asset types, loans and securities not

carried on the balance sheet as FV-NI.

Processes &

Controls:

Reliance on new

processes, data and

methodologies

impacting control

design and operation

Data and

Infrastructure:

Increased data

requirements and

infrastructure to

support credit

modelling and

disclosures

Methodology &

Modeling: Modelling

of lifetime losses

reflective of

management forecasts

Impacts loans,

securities,

and receivables

© 2016 PwC. All rights reserved. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see

www.pwc.com/structure for further details.

- 2. Proposed accounting changes – Financial instruments impairment

© 2016 PwC. All rights reserved. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see

www.pwc.com/structure for further details.

Key Provisions

CreditLossModelling • Moving from an “incurred loss”

estimate to a lifetime expected

credit loss estimate

• Modeling techniques

• Likely to increase the allowance requirement although the impact will vary depending on the life of the asset, existing loss emergence period estimates, and the timing

of estimated defaults

• Existing loss forecasting (including stress testing) models can be used, but will likely require some adaptation

• A range of modeling techniques are being considered – the final standard may increase the modeling complexity involved

• Incorporating reasonable and

supportable forecasts

• Use of different techniques for

the period beyond the point

where reasonable and

supportable forecasts are possible

• Modelling that incorporates forward-looking projections linked to specific macroeconomic drivers is complex requiring longer history of relatively stable

borrower/loan characteristic data and sufficiently robust default/loss observations

• May require greater reliance on vendor models and/or data, as many companies will not have sufficient internal data to develop macroeconomic models, particularly with

any level of granularity

• Requires consideration of what constitutes a “reasonable and supportable forecast”

• May involve different techniques to forecast beyond the near-term such as mean reversion of macroeconomic inputs to a loss forecast model, a long-term average loss rate,

etc.

AccountingandReporting

• Changes to the accounting model

for purchased credit impaired

assets and certain beneficial

interests

• Requires business rule definition of what constitutes “more than insignificant deterioration”

• Requires sourcing origination data for comparison to current credit characteristics

• Operational difference between acquired assets with and without deterioration (CECL day 1 through a balance sheet gross up versus CECL day 1 through earnings,

respectively)

• Updates to the “other-than-

temporary” (OTTI) impairment

model for securities

• Available-for-Sale Securities subject to a “modified” OTTI approach; credit recoveries are recorded through a reserve; elimination of OTTI “filters” for the extent

and duration of loss

• Held to maturity securities will be subject to CECL and will not follow the impairment model used for AFS debt securities

• Enhanced disclosure

requirements

• Expectation of significantly enhanced disclosure requirements to facilitate comparison by investors of portfolio credit quality indicators and management forecasts

underlying loss estimates

• Impact of CECL and IFRS 9

differences

• IFRS 9 operationally and methodologically more complex due to requirements to monitor a expected lifetime credit loss “trigger”; and the explicit requirement for

consideration of time value of money

• Likely to result in significantly different estimates for similar portfolios, increasing the complexity of controls and disclosures for joint filers

• Who in my organization should be engaged in planning and

assessing the impact of the proposed changes?

• How can we leverage existing processes and methodologies

developed for regulatory reporting purposes (i.e. stress

testing)?

• Do we understand the diversity in our portfolio and how our

various asset classes will be impacted?

• Do we understand the current state of data infrastructure and

technology supporting the ALLL and OTTI estimation process?

• What is the impact on our quarterly closing cycle if we change

OTTI filters?

• What data elements are required for new disclosures and are

those data elements readily accessible to

our organization?

• What are the appropriate internal parties responsible for testing and

validating models?

• Do we have adequate resources and expertise to design, develop, test, and

validate credit models?

• Should securities be modeled at a pool level or individual security level?

Testing and Validation Support

• What data requirements and enhanced qualitative information should be

considered for disclosures to key stakeholders regarding the impact of the

proposed changes?

• What systems and vendors do we rely upon for interest income recognition

processes?

• Are our existing systems and vendors capable of handling impairment

calculations under the new model?

• What would be the best method for developing and integrating the new

required disclosures into the existing financial reporting framework?

Readiness Assessments & Planning Design and Development

Key Considerations

Key Questions that Clients Should Consider

Securities Specialists

David Lukach

Partner

(646) 471 -3150

david.m.lukach@pwc.com

Frank Serravalli

Partner

(646) 742-7510

frank.serrvalli@pwc.com

Robert Kianos

Senior Manager

(973) 236-7854

robert.w.kianos@pwc.com

Chris Merchant

Partner

(202) 346-5050

chris.merchant@pwc.com

Jessica Pufahl

Director

(646) 574-2159

jessica.m.pufahl@pwc.com

Matt Keller

Manager

(646) 471-6742

matthew.h.keller@pwc.com

Please Contact

Loan/ALLL Specialists:

Mike Shearer

Managing Director

(646) 471-5035

michael.a.shearer@pwc.com

Ben Havird

Manager

(704) 344-4385

benjamin.havird@pwc.com