Tax Day Charts 2015

•

2 j'aime•630 vues

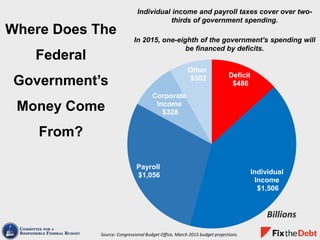

Individual income and payroll taxes cover over two-thirds of government spending. In 2015, one-eighth of the government’s spending will be financed by deficits. The top 20% of households pay almost 70% of the nation’s taxes, with the top 1% paying nearly a quarter. Tax expenditures have grown over time and now equal over a quarter of total government spending.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

This chartbook explains the 'doc fix' debate with illustrations and concise language.Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"Committee for a Responsible Federal Budget

Contenu connexe

Tendances

Tendances (18)

Oregon Economic and Revenue Forecast, September 2019

Oregon Economic and Revenue Forecast, September 2019

Progressive conservatives vs Liberal Government for Ontario

Progressive conservatives vs Liberal Government for Ontario

Progressive Conservatives vs Liberal Government for Ontario - April 2017

Progressive Conservatives vs Liberal Government for Ontario - April 2017

Session Seven: Twenty Years Of Tax Autonomy Across Levels Of Government Measu...

Session Seven: Twenty Years Of Tax Autonomy Across Levels Of Government Measu...

Oregon Economic and Revenue Forecast, September 2021

Oregon Economic and Revenue Forecast, September 2021

OpenSky Policy Institute - Funding Our Priorities 8.28.14

OpenSky Policy Institute - Funding Our Priorities 8.28.14

En vedette

This chartbook explains the 'doc fix' debate with illustrations and concise language.Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"Committee for a Responsible Federal Budget

Slides from June 30, 2016 Committee for a Responsible Federal Budget webinar on the June 2016 paper "Promises and Price Tags: A Fiscal Guide to the 2016 Election." Watch the video at http://www.crfb.org/events/watch-promises-and-price-tags-fiscal-guide-2016-election.CRFB Promises and Price Tags: A Fiscal Guide to the 2016 Election

CRFB Promises and Price Tags: A Fiscal Guide to the 2016 ElectionCommittee for a Responsible Federal Budget

A chartbook on the effects and implications of "repeal and replace" of the Affordable Care Act (ACA).Chartbook: Affordable Care Act "Repeal & Replace" Effects & Implications

Chartbook: Affordable Care Act "Repeal & Replace" Effects & ImplicationsCommittee for a Responsible Federal Budget

En vedette (8)

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"

Sustainable Growth Rate: The History and Future of Medicare "Doc Fixes"

CRFB Promises and Price Tags: A Fiscal Guide to the 2016 Election

CRFB Promises and Price Tags: A Fiscal Guide to the 2016 Election

Chartbook: Affordable Care Act "Repeal & Replace" Effects & Implications

Chartbook: Affordable Care Act "Repeal & Replace" Effects & Implications

Similaire à Tax Day Charts 2015

Similaire à Tax Day Charts 2015 (20)

Chartbook_From_Riches_to_Rags_Causes_of_Fiscal_Deterioration_Since_2001.pptx

Chartbook_From_Riches_to_Rags_Causes_of_Fiscal_Deterioration_Since_2001.pptx

The Great Rightward Shift: How Conservatism Shifted the Money to the 1%

The Great Rightward Shift: How Conservatism Shifted the Money to the 1%

CRFB webinar - Where Does the Next Phase of COVID Relief Stand - July 31, 2020

CRFB webinar - Where Does the Next Phase of COVID Relief Stand - July 31, 2020

2010 12-02incometaxchartbook-101202080453-phpapp01

2010 12-02incometaxchartbook-101202080453-phpapp01

What Are Taxes And Best Benefits of File Taxes Each Year? 2023 | CIO Women Ma...

What Are Taxes And Best Benefits of File Taxes Each Year? 2023 | CIO Women Ma...

Plus de Committee for a Responsible Federal Budget

Budgeting for the Next Generation: Children and the Federal BudgetBudgeting for the Next Generation: Children and the Federal Budget

Budgeting for the Next Generation: Children and the Federal BudgetCommittee for a Responsible Federal Budget

Playing By the (Budget) Rules: Understanding and Preventing Budget GimmicksPlaying By the (Budget) Rules: Understanding and Preventing Budget Gimmicks

Playing By the (Budget) Rules: Understanding and Preventing Budget GimmicksCommittee for a Responsible Federal Budget

Presentation with charts on the fiscal year 2018 budget proposal from President Donald Trump and the American Health Care Act to replace ObamacarePresident Trump's Fy 2018 "Skinny Budget" and the American Health Care Act

President Trump's Fy 2018 "Skinny Budget" and the American Health Care ActCommittee for a Responsible Federal Budget

A comprehensive fiscal analysis of the policies put forward by presidential candidates Donald Trump and Hillary Clinton. It shows how each would affect the federal budget and national debt. See more at http://crfb.org/.Promises and Price Tags: A Fiscal Guide to the 2016 Election

Promises and Price Tags: A Fiscal Guide to the 2016 ElectionCommittee for a Responsible Federal Budget

2015 Annual Report for the nonprofit, nonpartisan Committee for a Responsible Federal BudgetCommittee for a Responsible Federal Budget 2015 Annual Report

Committee for a Responsible Federal Budget 2015 Annual ReportCommittee for a Responsible Federal Budget

The next President will need to confront a number of budgetary challenges and will likely sign into law many federal tax and spending changes. Yet too often, election campaigns are about telling voters what they want to hear rather than what they need to know. To separate fiction from reality, the new Fiscal FactChecker series will monitor the 2016 Presidential campaign on an ongoing basis. To start with, we have identified 16 myths that may come up during the campaign.

Fiscal FactChecker: 16 Budget Myths to Watch Out for in the 2016 Campaign

Fiscal FactChecker: 16 Budget Myths to Watch Out for in the 2016 CampaignCommittee for a Responsible Federal Budget

Plus de Committee for a Responsible Federal Budget (20)

Promoting Economic Growth through Social Security Reform

Promoting Economic Growth through Social Security Reform

Budgeting for the Next Generation: Children and the Federal Budget

Budgeting for the Next Generation: Children and the Federal Budget

Playing By the (Budget) Rules: Understanding and Preventing Budget Gimmicks

Playing By the (Budget) Rules: Understanding and Preventing Budget Gimmicks

Everything You Should Know About Government Shutdowns

Everything You Should Know About Government Shutdowns

Marc Goldwein: The Return of Trillion Dollar Deficits

Marc Goldwein: The Return of Trillion Dollar Deficits

President Trump's Fy 2018 "Skinny Budget" and the American Health Care Act

President Trump's Fy 2018 "Skinny Budget" and the American Health Care Act

Promises and Price Tags: A Fiscal Guide to the 2016 Election

Promises and Price Tags: A Fiscal Guide to the 2016 Election

Committee for a Responsible Federal Budget 2015 Annual Report

Committee for a Responsible Federal Budget 2015 Annual Report

Fiscal FactChecker: 16 Budget Myths to Watch Out for in the 2016 Campaign

Fiscal FactChecker: 16 Budget Myths to Watch Out for in the 2016 Campaign

Dernier

Low Rate Call Girls Pune Vedika Call Now: 8250077686 Pune Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...Call Girls in Nagpur High Profile

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...dipikadinghjn ( Why You Choose Us? ) Escorts

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️9953056974 Low Rate Call Girls In Saket, Delhi NCR

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangements Near You

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9352852248

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 🌐 beautieservice.com 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9352852248

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S020524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9352852248

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...Call Girls in Nagpur High Profile

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...Call Girls in Nagpur High Profile

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Call Girls

Booking Now open +91- 9352852248

Why you Choose Us- +91- 9352852248

HOT⇄ 8005736733

Mr ashu ji

Call Mr ashu Ji +91- 9352852248

𝐇𝐨𝐭𝐞𝐥 𝐑𝐨𝐨𝐦𝐬 𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐑𝐚𝐭𝐞 𝐒𝐡𝐨𝐭𝐬/𝐇𝐨𝐮𝐫𝐲🆓 .█▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓

Hello Guys ! High Profiles young Beauties and Good Looking standard Profiles Available , Enquire Now if you are interested in Hifi Service and want to get connect with someone who can understand your needs.

Service offers you the most beautiful High Profile sexy independent female Escorts in genuine ✔✔✔ To enjoy with hot and sexy girls ✔✔✔$s07

★providing:-

• Models

• vip Models

• Russian Models

• Foreigner Models

• TV Actress and Celebrities

• Receptionist

• Air Hostess

• Call Center Working Girls/Women

• Hi-Tech Co. Girls/Women

• HousewifeCall Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...roshnidevijkn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Dernier (20)

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

Navi Mumbai Cooperetive Housewife Call Girls-9833754194-Natural Panvel Enjoye...

Navi Mumbai Cooperetive Housewife Call Girls-9833754194-Natural Panvel Enjoye...

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Enjoy Night⚡Call Girls Patel Nagar Delhi >༒8448380779 Escort Service

Enjoy Night⚡Call Girls Patel Nagar Delhi >༒8448380779 Escort Service

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

Tax Day Charts 2015

- 1. Individual income and payroll taxes cover over two- thirds of government spending. In 2015, one-eighth of the government’s spending will be financed by deficits. Where Does The Federal Government’s Money Come From? Source: Congressional Budget Office, March 2015 budget projections. Deficit $486 Individual Income $1,506 Payroll $1,056 Corporate Income $328 Other $302 Billions

- 2. Income Tax Rates 0% 5% 10% 15% 20% 25% 30% 35% 40% 0 $50k $100k $150k $200k $250k $300k $350k $400k $450k $500k Gross Income Marginal Rate Average Rate (Tax rates in 2014 for a married couple filing jointly)

- 3. Who Pays Federal Taxes? Source: Congressional Budget Office, “The Distribution of Household Income and Federal Taxes, 2011.” Bottom 20% 0.6% Second 20% 4% Middle 20% 9% Fourth 20% 18% 81st to 99th Percentiles 45% Top 1% 24% The top 20% of households pay almost 70% of the nation’s taxes. The top 1% is responsible for paying nearly a quarter. (Percentage of all federal taxes paid, by household income)

- 4. 10% 12% 14% 16% 18% 20% 22% 24% 26% 1990 1995 2000 2005 2010 2015 2020 2025 Revenues Don’t Cover Spending Source: Congressional Budget Office, March 2015 budget projections. Percent of the economy (GDP) Actual Projected 20.2%SPENDING AVERAGE 17.2%REVENUES AVERAGE Deficit

- 5. $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010 2014 2018 Tax Breaks Have Grown Over Time Actual Projected Source: U.S. Department of the Treasury, compiled by the National Priorities Project. Inflation-adjusted dollars Tax Reform Act of 1986 There is now twice as much money in “tax expenditures” – deductions, credits, and other tax breaks – as there was after Congress last overhauled the tax code in 1986.

- 6. Source: Congressional Budget Office, Joint Committee on Taxation Tax Expenditures: Another Kind of Spending Tax Expenditures aren’t part of the budget that Congress passes every year, but are similar to government spending programs. Think about it: $1,000 given out in Pell grants and $1,000 given out through education tax credits will both give $1,000 to students. If they were counted as a normal part of the budget, tax expenditures would be over a quarter of spending. Tax Expenditures 26% Social Security 18% Health Care 19% Defense 13% Non-Defense Discretionary 12% Interest 5% Other, 7%

- 7. High Earners Benefit Most From Tax Expenditures Most tax expenditures are regressive and provide a bigger benefit to the wealthy. The top 20% receives 50% of the benefit from the largest tax expenditures. Percent of “major” tax expenditures received 0% 10% 20% 30% 40% 50% 60% Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Highest Quintile Top 1% Source: Congressional Budget Office, “The Distribution of Major Tax Expenditures in the Individual Income Tax System.” Note: Graph shows ten “major” income tax expenditures as identified by Congressional Budget Office, which make up two-thirds of total tax expenditures by dollar amount.

- 8. Tax Expenditures Rival Spending Programs in Size *Spending represented by HUD Budget. Source: Office of Management and Budget, President’s Budget FY 2016; Joint Committee on Taxation **Spending represented by Pell Grants. Source: Joint Committee on Taxation *** Refundable credits include EITC and Child Tax Credit. Spending includes SSI,TANF, and Foster Care Assistance. Source: HHS, SSA $0 $20 $40 $60 $80 $100 $120 $140 Housing* Education** Income Support*** Tax Expenditures Program Spending Billions, FY2014

- 9. U.S. Has World’s Highest Corporate Tax Rate, but Only Average Collection The official U.S. corporate tax rate is the highest in the developed world, but the average rate paid after deductions and credits is more typical. Source: U.S. Department of the Treasury, “The President’s Framework for Business Tax Reform.” Data from Fiscal Year 2011. 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% United States UK Italy Canada Germany France MarginalCorporateTaxRate Statutory Rate Effective Rate

- 10. The Tax Reform Act of 2014 would have increased the size of the economy by between 0.1 percent and 1.6 percent by 2023. Tax Reform Promotes Economic Growth 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% MEG Model, Low Change In Employment MEG Model, High Change In Employment OLG Model Low Estimate High Estimate Source: Joint Committee on Taxation

- 11. Where Tax Dollars Went In 2014 Share of Each $100 Paid in Taxes Social Security $24.11 Health $23.72 Medicare $14.42 Medicaid $8.60 Other Health $0.69 Defense and Military Benefits $21.49 Interest $6.54 Civilian Federal Retirement $2.86 Transportation $2.62 Refundable Credits $2.45 Food Stamps $2.18 Education $1.84 Supplemental Security Income $1.54 Justice $1.44 Housing Assistance $1.36 Unemployment Insurance $1.26 Natural Resource Protection $1.03 Foreign Aid $1.00 Agriculture $0.70 Other $3.87 Total $100