Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (20)

Evolving Role of Captives Within the New Health Care Reform Reality

Evolving Role of Captives Within the New Health Care Reform Reality

Similaire à Stop Loss 101

Similaire à Stop Loss 101 (20)

Workers Comp Insurance in Safeguarding your Business.pptx

Workers Comp Insurance in Safeguarding your Business.pptx

Small BusinessThe Importance, Need and Why Business Insurance

Small BusinessThe Importance, Need and Why Business Insurance

FiNsure 360 Insurance For Start Up Investment Advisors/Financial Institutions

FiNsure 360 Insurance For Start Up Investment Advisors/Financial Institutions

Stop Loss 101

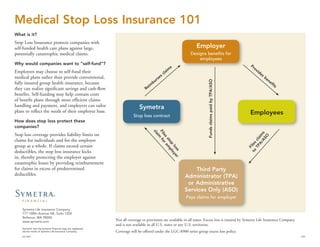

- 1. Symetra Life Insurance Company 777 108th Avenue NE, Suite 1200 Bellevue, WA 98004 www.symetra.com Symetra® and the Symetra Financial logo are registered service marks of Symetra Life Insurance Company. LGS-5943 4/07 What is it? Stop Loss Insurance protects companies with self-funded health care plans against large, potentially catastrophic medical claims. Why would companies want to “self-fund”? Employers may choose to self-fund their medical plans rather than provide conventional, fully insured group health insurance, because they can realize significant savings and cash-flow benefits. Self-funding may help contain costs of benefit plans through more efficient claims handling and payment, and employers can tailor plans to reflect the needs of their employee base. How does stop loss protect these companies? Stop loss coverage provides liability limits on claims for individuals and for the employer group as a whole. If claims exceed certain deductibles, the stop loss insurance kicks in, thereby protecting the employer against catastrophic losses by providing reimbursement for claims in excess of predetermined deductibles. Medical Stop Loss Insurance 101 Employees Symetra Stop loss contract Employer Designs benefits for employees Third Party Administrator (TPA) or Administrative Services Only (ASO) Pays claims for employer Reim burses claim s Provides benefits Files claim s to TPA/ASO Files stop loss claim forem ployer FundsclaimspaidbyTPA/ASO Not all coverage or provisions are available in all states. Excess loss is insured by Symetra Life Insurance Company and is not available in all U.S. states or any U.S. territories. Coverage will be offered under the LGC-8900 series group excess loss policy.