Lecture 12 q uestion on leverage analysis

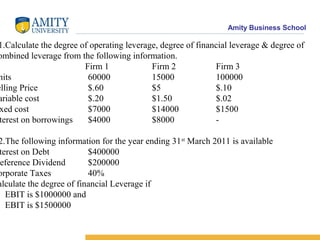

- 1. Amity Business School 1.Calculate the degree of operating leverage, degree of financial leverage & degree of ombined leverage from the following information. Firm 1 Firm 2 Firm 3 nits 60000 15000 100000 elling Price $.60 $5 $.10 ariable cost $.20 $1.50 $.02 xed cost $7000 $14000 $1500 terest on borrowings $4000 $8000 - 2.The following information for the year ending 31st March 2011 is available terest on Debt $400000 eference Dividend $200000 orporate Taxes 40% alculate the degree of financial Leverage if EBIT is $1000000 and EBIT is $1500000

- 2. Amity Business School Q3.Consider the following figures: Net Sales are Rs.16 Crores EBIT as a percentage of sales is 10% Corporate tax rate is 40% Capital employed : Equity shares @ of Rs.10 each is Rs 4 Crores 12% secured debenture @ of Rs 100 each Rs. 2 Crores You are required to calculate EPS & percentage change in EPS if EBIT increases by 10% Q4. Consider the following information of Pearson Ltd. Selling price per unit Rs.200 Variable cost per unit Rs.120 Fixed Cost Rs.2000000 Interest on Debt Rs.1200000 Tax rate 40% No of units produce 120000 Calculate the combine leverage & percentage change in EPS if sales are increased by 5%

- 3. Amity Business School Q5. ZOOP Ltd had the following Balance Sheet for the year ended 31st March 2011 Liabilities Assets Equity Capital (@Rs.10each) 1000000 Fixed Asset (net) 2500000 Reserve and Surplus 200000 Current Assets 1500000 15% debenture 2000000 Current Liabilities 800000 4000000 4000000 Additional information Fixed cost (excluding interest payment) Rs.800000 Variable operating cost ratio 80% Total Asset turnover ratio 3 Income tax 50% You are required to calculate i. EPS ii. OL iii. FL iv. Combined leverage.

- 4. Amity Business School Q6. The following are the operating result of a firm: Sales (units) 25000 Interest p.a. Rs.30000 Selling price unit Rs.24 Tax Rate 50% Variable cost Rs.16 per unit No. of equity shares 10000 Fixed Cost p.a. Rs.80000 Compute the followings: . Break even sales i. EBIT ii. EPS v. Operating Leverage v. Financial Leverage vi. Combined Leverage.

- 5. Amity Business School Q7. The following details of ABC ltd is available as on 31st March 2011. you are require to prepare the Income Statement of the company. Operating leverage 3 Financial leverage 2 Interest charge p.a. Rs.20 Lakhs Taxes 50% Variable cost as a percentage of sales is 60% Q8. You are a finance manager of Gel pen Ltd. The degree of operating leverage of Your company is 5. The degree of financial leverage is 3. Director of your company Has found that the degree of operating leverage & degree of financial leverage of your Nearest competitor INK pen Ltd are 6 & 4 respectively. In his opinion the Ink pen ltd Is better than that of Gel pen ltd. because of high value of degree of leverages. Do you agree to your managing Director? Justify.

- 6. Amity Business School . Q9.X corporation has estimated that for a new product its Break even point is 2000 units If the item is sold for Rs.14 per unit; the variable cost is Rs. 9 per unit. Calculate the Degree of operating leverage for sales volume of 2500 units and 3000 units. Q10. The capital structure of a company consists of ordinary share capital of Rs10,00,000 (shares of Rs 100 each) and Rs 10,00,000 of 10% debenture. The selling price is Rs 10 per unit; Variable costs amount to Rs 6 per unit and fixed Expenses amounted to Rs 2,00,000. The income tax is assumed to be 50%. The sales Level are expected to increase from 1,00,000 units to 1,20,000 units. You are required to calculate the degree of operating, financial leverage Q11. A firm’s sales, variable costs and fixed cost amount to Rs 75,00,000, Rs 42,00,000 And Rs 6,00,000 respectively. It has borrowed Rs. 45,00000 at 9% and its equity capital Totals Rs 55,00,000. What is firms ROI? Does it have favorable financial leverage Calculate operating, financial & combined leverage. If the sales drop to Rs. 50,00,000, what will be the new EBIT?

- 7. Amity Business School Q12. Following is the Balance sheet of Z ltd Liabilities Amount Assets Amount Equity Share Capital 60000 Fixed Asset 150,000 Retaining Earnings 20000 Current Assets 50000 10% long term debts 80000 Current Liabilities 40000 The company’s total Asset turnover ratio is 4, its fixed operating costs are Rs 1,00,000 And its variable operating cost is 40%. The income tax is 50%. Calculate the financial Leverage when face value of the share is Rs 10. also calculate the operating leverage.

- 8. Amity Business School Q13. Installed Capacity is 20,000 units, Actual Production and sales is 75% of installed Capacity, selling price per unit Rs 10, Fixed cost Rs 30,000, Total operating cost 80%. Calculate operating leverage Q14. From the following information calculate the percentage of change in EPS if Sales are increased by 5% EBIT Rs.1120 EBT Rs.320 Fixed Cost Rs.700 Q15. Calculate operating leverage, Financial Leverage & combine leverage under Situation 1 & 2 and financial plan A & B Installed capacity 2000 units Annual production and sales 50% of installed capacity Selling price per unit is Rs20: Variable cost per unit Rs.10 Fixed Cost: Situation 1 is 4000 & for Situation 2 is 5000 Capital Structure for Plan A is Equity Rs 5000 & Debt (cost 10%) is Rs.15000 for Plan B is Equity Rs.15000 & Debt (cost 10%) is Rs.5000

- 9. Amity Business School Q19. A firm has sales of Rs.10,00,000, Variable Cost of Rs. 7,00,000 and fixed costs of Rs. 2,00,000 and debt of Rs. 5,00,000 @ 10% rate of Interest. What are the operating Financial, and combined leverage? If the firm wants to double its earnings before Interest and tax, how much of a rise in sales would be needed on a percentage basis? Q20. Explain the significance of operating, financial & combined leverage in Managerial decision making with example. Q21.Income statement of Zenith ltd is given below. Calculate & interpret its degree of Operating leverages, degree of financial leverage and degree of combined leverage. Sale Rs.1050000 Variable Cost Rs. 767000 Fixed Cost Rs. 75000 EBIT Rs.208000 Interest Rs.110000 Taxes@ 30% Rs.29400 Net Income Rs.68600

- 10. Amity Business School Q22. If the combined leverage & operating leverage figures of a company are 2.5 & 1.25 respectively find the financial leverage & P/V ratio, given that equity Dividend per share is Rs.2, interest payable per year is Rs.1 lakhs, total fixed cost is 50,000 and sales Rs.10 lakhs